Escolar Documentos

Profissional Documentos

Cultura Documentos

Sarfaesi Act

Enviado por

Hemavathy GunaseelanDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Sarfaesi Act

Enviado por

Hemavathy GunaseelanDireitos autorais:

Formatos disponíveis

What is the Sarfaesi Act?

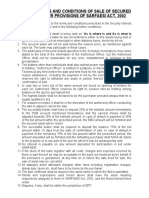

The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, allows banks and financial institutions to auction properties (residential and commercial) when borrowers fail to repay their loans. It enables banks to reduce their non-performing assets (NPAs) by adopting measures for recovery or reconstruction. When do properties fall under this Act? If a borrower defaults on repayment of his/her home loan for six months at stretch, banks give him/her a 60-day period to regularise the repayment, that is, start repaying. On failure to do so, banks declare the loan an NPA and auction it to recover the debt. How is the auction price decided? It depends on the market value of the property. Professional valuers determine the property value based on which banks fix a reserve or minimum bid price. The valuations tend to be on the conservative side as it is a distress sale. If the price fetched exceeds the banks dues, the excess amount is given to the borrower. Where can buyers get information about the auctions? Banks advertise such sales in at least one English and one regional newspaper, 30 days prior to the auction. Alternatively, you can look at websites like www.foreclosure.com. How can you bid? Interested bidders must submit their bids in a sealed envelope to the bank. Along with the bid, they must also deposit a certain percentage of the reserve price as earnest money deposit. This amount differs across banks and is refundable if one withdraws from the process or does not win. On the auction day, the sealed envelopes are opened in front of the bidders and the highest bid is announced. Bidders may or may not get another chance to revise their bids. If you win, you have to pay up to 25 per cent of your bid amount to confirm the purchase. The bank may allow you to pay the remaining in 10-15 days. You can apply for a loan for the same. What are the pros and cons of such buys? Typically, these properties are 20-30 per cent cheaper than the market price. Also, since the bank had previously lent against the property, there is clarity on property title. However, these properties are sold on an as-is basis. There may be pending dues or even litigations. These liabilities, unless checked carefully, can get transferred to you automatically. The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI) empowers Banks / Financial Institutions to recover their non-performing assets without the intervention of the Court. The Act provides three alternative methods for recovery of non-performing assets, namely: * Securitisation

* Asset Reconstruction * Enforcement of Security without the intervention of the Court The provisions of this Act are applicable only for NPA loans with outstanding above Rs. 1.00 lac. NPA loan accounts where the amount is less than 20% of the principal and interest are not eligible to be dealt with under this Act. Non-performing assets should be backed by securities charged to the Bank by way of hypothecation or mortgage or assignment. Security Interest by way of Lien, pledge, hire purchase and lease not liable for attachment under sec.60 of CPC, are not covered under this Act The Act empowers the Bank: * To issue demand notice to the defaulting borrower and guarantor, calling upon them to discharge their dues in full within 60 days from the date of the notice. * To give notice to any person who has acquired any of the secured assets from the borrower to surrender the same to the Bank. * To ask any debtor of the borrower to pay any sum due or becoming due to the borrower. * Any Security Interest created over Agricultural Land cannot be proceeded with. If on receipt of demand notice, the borrower makes any representation or raises any objection, Authorised Officer shall consider such representation or objection carefully and if he comes to the conclusion that such representation or objection is not acceptable or tenable, he shall communicate the reasons for non acceptance WITHIN ONE WEEK of receipt of such representation or objection. A borrower / guarantor aggrieved by the action of the Bank can file an appeal with DRT and then with DRAT, but not with any civil court. The borrower / guarantor has to deposit 50% of the dues before an appeal with DRAT. If the borrower fails to comply with the notice, the Bank may take recourse to one or more of the following measures: * Take possession of the security * Sale or lease or assign the right over the security * Manage the same or appoint any person to manage the same

Você também pode gostar

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsNo EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsNota: 5 de 5 estrelas5/5 (1)

- D. Co Increases, But Cu Decreases. Solution: As Cost of The Product Increases, The Lost Margin (Cu) Decreases. at TheDocumento5 páginasD. Co Increases, But Cu Decreases. Solution: As Cost of The Product Increases, The Lost Margin (Cu) Decreases. at TheAbhishek BatraAinda não há avaliações

- Maceda LawDocumento6 páginasMaceda LawLemuel Angelo M. Eleccion100% (1)

- OTHM - PGD A & F - Assignment Brief - Investment AnalysisDocumento3 páginasOTHM - PGD A & F - Assignment Brief - Investment AnalysisIsurika PereraAinda não há avaliações

- Punjab Chemicals - Apr 2014Documento20 páginasPunjab Chemicals - Apr 2014Duby Rex100% (1)

- Sarfaesi Act - 2002Documento2 páginasSarfaesi Act - 2002Stan leeAinda não há avaliações

- Sarfaesi Act 2002Documento9 páginasSarfaesi Act 2002Deepak Mangal0% (1)

- Rights and ObligationsDocumento5 páginasRights and ObligationsAmace Placement KanchipuramAinda não há avaliações

- 9 Concepts Every Filipino Property Buyer Should Know: Buyers Rodel AmbasDocumento5 páginas9 Concepts Every Filipino Property Buyer Should Know: Buyers Rodel AmbasSarah WilliamsAinda não há avaliações

- Sarfaesi ActDocumento13 páginasSarfaesi Act..sravana karthik100% (5)

- Banking NotesDocumento3 páginasBanking NotesJomar UsmanAinda não há avaliações

- Export Bank GuaranteesDocumento3 páginasExport Bank GuaranteesJoytu DasAinda não há avaliações

- Bank GuaranteeDocumento2 páginasBank GuaranteeFaridul Alam100% (1)

- Emerging Mortgage Insurance Coverage Disputes: Mba Legal Issues/Regulatory Compliance ConferenceDocumento17 páginasEmerging Mortgage Insurance Coverage Disputes: Mba Legal Issues/Regulatory Compliance ConferenceCairo AnubissAinda não há avaliações

- Fixed DepositDocumento37 páginasFixed DepositMinal DalviAinda não há avaliações

- Bank Loan AgreementDocumento8 páginasBank Loan AgreementSiddhi LikhmaniAinda não há avaliações

- Bank Duties and RightsDocumento6 páginasBank Duties and RightsSthita Prajna Mohanty100% (1)

- Financial GuaranteeDocumento2 páginasFinancial Guaranteejeet_singh_deepAinda não há avaliações

- Sarfaesi Act, 2002Documento15 páginasSarfaesi Act, 2002abhishekbehal5012Ainda não há avaliações

- Definition and Classification of Banks Nature of Banking BusinessDocumento3 páginasDefinition and Classification of Banks Nature of Banking BusinesstiffanytunacaoAinda não há avaliações

- Republic Act No. 6552: Purchases?Documento5 páginasRepublic Act No. 6552: Purchases?Lylo BesaresAinda não há avaliações

- Loan DefaultDocumento5 páginasLoan DefaultUditi SinghAinda não há avaliações

- Truth in Lending Act (RA 3765)Documento3 páginasTruth in Lending Act (RA 3765)Joanna MAinda não há avaliações

- Research Topic 2 1. EMI Laws 2. Bank Laws Relating To Loan and Repayment 3. Rights of The Customer Taking Loan 4. Sarfaesi Act 5. MoratoriumDocumento18 páginasResearch Topic 2 1. EMI Laws 2. Bank Laws Relating To Loan and Repayment 3. Rights of The Customer Taking Loan 4. Sarfaesi Act 5. Moratoriumlakshya khandelwalAinda não há avaliações

- DownloadDocumento4 páginasDownloadVipin VishwakarmaAinda não há avaliações

- Defaults & Foreclosures QUESTIONSDocumento11 páginasDefaults & Foreclosures QUESTIONSPrince EG DltgAinda não há avaliações

- Processing and Operation of Cash Credit1 FinalDocumento42 páginasProcessing and Operation of Cash Credit1 Finalrajin_rammsteinAinda não há avaliações

- BANKING Terms-1Documento17 páginasBANKING Terms-1Monika Choudhary100% (1)

- CreditCard Sanction Letter 918217097145Documento4 páginasCreditCard Sanction Letter 918217097145Maha RajaAinda não há avaliações

- IGL, General Banking Law (Riguera Lec)Documento12 páginasIGL, General Banking Law (Riguera Lec)Ivan LeeAinda não há avaliações

- Annexure General TCDocumento2 páginasAnnexure General TCVikrant Green lotusAinda não há avaliações

- Maceda Law Realty Installment Buyer Protection Act: Own House CondominiumDocumento4 páginasMaceda Law Realty Installment Buyer Protection Act: Own House CondominiumsherwinAinda não há avaliações

- Banker and CustomerDocumento4 páginasBanker and CustomerLloyd J. PereiraAinda não há avaliações

- Do's and Don't While Creating Different Types ofDocumento28 páginasDo's and Don't While Creating Different Types ofAnit BiswasAinda não há avaliações

- Bank Guarantee TypesDocumento4 páginasBank Guarantee TypesecpsaradhiAinda não há avaliações

- BankingDocumento9 páginasBankingIshaanKapoorAinda não há avaliações

- Truth in Lending ActDocumento31 páginasTruth in Lending ActArann Pilande100% (1)

- Questionnaire On Sarfaesi ActDocumento5 páginasQuestionnaire On Sarfaesi ActVinod Kumar AgarwalAinda não há avaliações

- Retail Banking AdvancesDocumento38 páginasRetail Banking AdvancesShruti SrivastavaAinda não há avaliações

- Reverse Mortgage in IDBI BANKDocumento66 páginasReverse Mortgage in IDBI BANKMohmmad SameemAinda não há avaliações

- Banker Customer RLTNDocumento15 páginasBanker Customer RLTNpriyabrat.77Ainda não há avaliações

- PayDay Loan Terms N C 2Documento8 páginasPayDay Loan Terms N C 2igwe christianAinda não há avaliações

- Banking and Marketing TermsDocumento17 páginasBanking and Marketing TermsVigya JindalAinda não há avaliações

- Legal Aspects of BusinessDocumento5 páginasLegal Aspects of BusinessMaxson MirandaAinda não há avaliações

- Contract 159303 PDFDocumento4 páginasContract 159303 PDFNoelAinda não há avaliações

- Banking LawsDocumento33 páginasBanking LawsliboaninoAinda não há avaliações

- Note On SarfaesiDocumento4 páginasNote On SarfaesiPritha SrikumarAinda não há avaliações

- Chapter VIIIDocumento39 páginasChapter VIIIBenedict Jarilla VillarealAinda não há avaliações

- Banking TermsDocumento20 páginasBanking Termsdeepakgarg1Ainda não há avaliações

- Republic Act No. 6552: 1. How Do I Know If This Law Would Truly Protect My Rights in Real Estate Installment Purchases?Documento5 páginasRepublic Act No. 6552: 1. How Do I Know If This Law Would Truly Protect My Rights in Real Estate Installment Purchases?Lucy HeartfiliaAinda não há avaliações

- Sarfaesi Act 2002Documento4 páginasSarfaesi Act 2002Prashant ChaudharyAinda não há avaliações

- Chit FundsDocumento5 páginasChit FundsscribdbodasAinda não há avaliações

- SARFAESI Act, 2002: How It Works?Documento4 páginasSARFAESI Act, 2002: How It Works?Kriti KhareAinda não há avaliações

- Personal Loans May 2021Documento17 páginasPersonal Loans May 2021rdebnath004Ainda não há avaliações

- Sta. Lucia Land, Inc. - PDS GroupDocumento9 páginasSta. Lucia Land, Inc. - PDS GroupKai SanchezAinda não há avaliações

- SecuritisationDocumento32 páginasSecuritisationAmit SinghAinda não há avaliações

- Upeso: Loan AgreementDocumento3 páginasUpeso: Loan AgreementMonaliza BelamideAinda não há avaliações

- Bank Guarantee (Law Project)Documento4 páginasBank Guarantee (Law Project)starifAinda não há avaliações

- Philippine Deposit Insurance Corporation (Pdic) :: Pdic Act (Ra 3591, As Amended)Documento2 páginasPhilippine Deposit Insurance Corporation (Pdic) :: Pdic Act (Ra 3591, As Amended)Arvin John MasuelaAinda não há avaliações

- Corp Acc UNIT IIIDocumento22 páginasCorp Acc UNIT IIIesebenazer2003Ainda não há avaliações

- From Dream to Deal: Navigating Creative Financing in Real Estate for the Beginning InvestorNo EverandFrom Dream to Deal: Navigating Creative Financing in Real Estate for the Beginning InvestorAinda não há avaliações

- Uber Case StudyDocumento16 páginasUber Case StudyHaren ShylakAinda não há avaliações

- Practice Questions # 4 Internal Control and Cash With AnswersDocumento9 páginasPractice Questions # 4 Internal Control and Cash With AnswersIzzahIkramIllahiAinda não há avaliações

- Business Cycles (BBA BI)Documento19 páginasBusiness Cycles (BBA BI)Yograj PandeyaAinda não há avaliações

- Robert Half Salary Guide 2012Documento9 páginasRobert Half Salary Guide 2012cesarthemillennialAinda não há avaliações

- Chapter 5Documento20 páginasChapter 5Clyette Anne Flores Borja100% (1)

- Lecture18 Safeway CaseDocumento13 páginasLecture18 Safeway Casegoot11Ainda não há avaliações

- PPCDocumento27 páginasPPCPRAMATHESH PANDEY100% (1)

- Assignment 3Documento6 páginasAssignment 3salebanAinda não há avaliações

- Basin Water Allocation Planning PDFDocumento144 páginasBasin Water Allocation Planning PDFrendy firmansyahAinda não há avaliações

- Liquidity Adjustment FacilityDocumento1 páginaLiquidity Adjustment FacilityPrernaSharma100% (1)

- Ian Marcouse - Marie Brewer - Andrew Hammond - AQA Business Studies For AS - Revision Guide-Hodder Education (2010)Documento127 páginasIan Marcouse - Marie Brewer - Andrew Hammond - AQA Business Studies For AS - Revision Guide-Hodder Education (2010)Talisson BonfimAinda não há avaliações

- Demand TheoryDocumento10 páginasDemand TheoryVinod KumarAinda não há avaliações

- 15 LasherIM Ch15Documento14 páginas15 LasherIM Ch15advaniamrita67% (3)

- Goldaman Facebook Deal - WhartonDocumento4 páginasGoldaman Facebook Deal - WhartonRafael CarlosAinda não há avaliações

- Justdial SWOTDocumento2 páginasJustdial SWOTweedemboy9393Ainda não há avaliações

- 9 Most Common Hirevue QuestionsDocumento10 páginas9 Most Common Hirevue QuestionsShuyuan JiaAinda não há avaliações

- Money in The Nation's EconomyDocumento18 páginasMoney in The Nation's EconomyAnne Gatchalian67% (3)

- Sector Analysis of BFSI - Axis BankDocumento11 páginasSector Analysis of BFSI - Axis BankAbhishek Kumawat (PGDM 18-20)Ainda não há avaliações

- BSA 1 13 Group 4 - Exercises 6 1 and 6 2Documento10 páginasBSA 1 13 Group 4 - Exercises 6 1 and 6 2vomawew647Ainda não há avaliações

- Latur Water Supply ProjectDocumento14 páginasLatur Water Supply ProjectMehul TankAinda não há avaliações

- Cotton IndustryDocumento18 páginasCotton IndustrySakhamuri Ram'sAinda não há avaliações

- SAP New GL # 1 Overview of New GL Document Splitting Process PDFDocumento8 páginasSAP New GL # 1 Overview of New GL Document Splitting Process PDFspani92100% (1)

- Carter CleaningDocumento1 páginaCarter CleaningYe GaungAinda não há avaliações

- Problem 29.2Documento2 páginasProblem 29.2Arian AmuraoAinda não há avaliações

- WG O1 Culinarian Cookware Case SubmissionDocumento7 páginasWG O1 Culinarian Cookware Case SubmissionAnand JanardhananAinda não há avaliações

- Mary Michelle R. MayladDocumento3 páginasMary Michelle R. Mayladmichie_rm26Ainda não há avaliações

- Profitability RatiosDocumento4 páginasProfitability RatiosDorcas YanoAinda não há avaliações