Escolar Documentos

Profissional Documentos

Cultura Documentos

HSBC Savings Account

Enviado por

Lavanya VitDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

HSBC Savings Account

Enviado por

Lavanya VitDireitos autorais:

Formatos disponíveis

HSBC Savings Account

Highlights

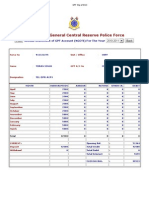

Bank Category Minimum AQB (Average Quarterly Balance) Interest Rate Card Offered

Main Features

HSBC Bank Regular Rs 25 4% ATM cum Debit Card

The HSBC Savings Account has no hidden costs: o You can automatically transfer extra savings from your savings account to a fixed deposit, through a standing instruction, to enable you to earn higher interest. o You are also eligible for a fee waiver on HSBC credit cards. o Introducing Card-to-Card Transfer facility - a funds transfer service that enables you to transfer money in an easy, fast, convenient and safe manner using the VISA MONEY TRANSFER service from VISA. o HSBC Demat Account services with waiver on account opening charges. o Keep track of your account with free quarterly account statements. o Free personalized chequebook. o Buy mutual fund products offered by select mutual fund houses. o Choose from a range of insurance products offered by Tata AIG. o Manage your account, make transactions, pay your bills and much more by taking advantage of HSBC's free Internet Banking facilities. International debit card: Use the international debit card to make purchases at 3,50,000 merchant establishments in India and at 26 million across the world. Withdraw cash from over 23,500 HSBC/Visa/Plus ATMs in India and from over 1 million VISA ATMs across the world. Credit card: Get an HSBC credit card that lets you access your Savings Account at HSBC ATMs worldwide. Perform banking transactions like cash withdrawals, balance inquiries and transfer of funds. You can also withdraw cash from your HSBC Current / Savings Account at any of our VISA / MasterCard ATMs worldwide. Special relationship discounts: Our HSBC customers (for 6 months or more) are entitled to a 0.5% discount on the upfront processing fee for Home loans and Personal/Professional loans and on the annual service charges for Asset Link.

Fees & charges Charges for non maintenance of minimum quarterly average balance ATM transaction at own bank Rs. 750 per quarter Account not operated for more than 2 years Rs. 150 per quarter Free

A total of 10 sale transactions per month (including Market Trade, Off Market Trade and Inter depository transactions) are free of cost for each Demat account. Each ISIN (International Security Identification Number) delivered in a Delivery Instruction Form (DIF), will be considered as a separate delivery transaction. If a single ISIN is delivered multiple times during the month, each delivery will constitute as a separate transaction. The charges will also be applicable to HSBC Premier customers. Cash withdrawal at ATMs in India Cash withdrawal at ATMs in outside India Debit Card Fees Balance inquiry at own bank Balance inquiry at Other banks Other bank VISA ATM cash withdrawals - Rs. 55 per withdrawal. In case of Debit Card plus 2 free transactions per month. Subsequent withdrawals will incur standard charge. Other bank VISA ATM cash withdrawals Rs. 120 per withdrawal HSBC Group ATM transactions (outside India) Rs. 120 per withdrawal Free (HSBC Premier only) Annual fee (except HSBC Premier) Rs. 150 (Rs. 400 in case of debit card Plus) Free balance enquiries (India) Rs. 15 per enquiry In case of Debit Card plus 2 free transactions per month. Subsequent enquires will incur standard charge. balance enquiries (outside India) Rs.15 per enquiry HSBC Group ATM transactions (outside India) Rs. 15 per enquiry Free (HSBC Premier only) Replacement of lost / damaged Debit card Rs. 100 Free (HSBC Premier only) Card Replacement Fee (outside India) Rs. 100 + international courier cost of Rs. 700 Statement of Accounts each quater (mailed to account holders) Free Duplicate Statements Rs. 150 per statement Free personalized chequebook Account closure in less than 6 months Rs. 500

Replacement of Debit Card

Statement/Duplicate Account Statement Cheque Books Closure of Account

Services & Features Overdraft Facility Reward Points Internet Banking Phone Banking Mobile Banking SMS Alerts No No Yes No No No

Documents

Your completed account opening form A passport-size photograph of yourself and all other accountholders, which must be signed across the front. One document each from the following two categories: Proof of individual's identity: o Passport o Voter's ID o Driving licence o Government ID card o Defence ID card o Photo ration card o Photo PAN card Proof of residence: o Passport o Telephone bill o Electricity bill o Ration card o Society outgoing bill

Life Insurance Policy

Notes: Please produce the original document for each photocopy submitted. Please fill the form in CAPITAL LETTERS. Please countersign any overwriting. Please avail of the nomination facility.

Terms & Conditions

Show All Saving Accounts

Você também pode gostar

- ATM & Debit Card FeesDocumento1 páginaATM & Debit Card Feesfriend120873Ainda não há avaliações

- State Bank of IndiaDocumento48 páginasState Bank of Indiaanshukumar87Ainda não há avaliações

- CBI Debit Card Fee and ChargesDocumento1 páginaCBI Debit Card Fee and ChargesHari HariAinda não há avaliações

- Debits and CreditsDocumento11 páginasDebits and CreditsAlexandru BoceanAinda não há avaliações

- HBL ReportDocumento63 páginasHBL ReportShahid Mehmood100% (6)

- Bop ReportDocumento80 páginasBop ReportMudasser ALiAinda não há avaliações

- Career Objective: Srinivasa Rao - Gangadari Mobile: 9177604416Documento3 páginasCareer Objective: Srinivasa Rao - Gangadari Mobile: 9177604416soujanya2009Ainda não há avaliações

- Busn 258 Week 4 AssignmentDocumento3 páginasBusn 258 Week 4 AssignmentMark MinksAinda não há avaliações

- Account Balance SDocumento3 páginasAccount Balance SSaChibvuri JeremiahAinda não há avaliações

- VOC Analyst - G208009Documento3 páginasVOC Analyst - G208009UWTSSAinda não há avaliações

- Asst Manager - MIS AnalyticsDocumento2 páginasAsst Manager - MIS AnalyticsKetan VadorAinda não há avaliações

- Typical Duties of an Administrative Assistant Job DescriptionDocumento1 páginaTypical Duties of an Administrative Assistant Job Descriptionvishal9patel-63Ainda não há avaliações

- Akmal Resume BaruDocumento3 páginasAkmal Resume BaruSham ZaiAinda não há avaliações

- Sexual Harassment - Manini MishraDocumento2 páginasSexual Harassment - Manini MishraManini MishraAinda não há avaliações

- Alok Pritam Bio-Data PhD Statistics GraduateDocumento2 páginasAlok Pritam Bio-Data PhD Statistics GraduateAlok PritamAinda não há avaliações

- FaceDocumento1 páginaFaceTapasKumarDashAinda não há avaliações

- EmmahDocumento2 páginasEmmahapi-299191302Ainda não há avaliações

- Doing The Right Things, The Right Way A Reflection in Proverbs 15:9Documento1 páginaDoing The Right Things, The Right Way A Reflection in Proverbs 15:9Anonymous BvsEQ9YAinda não há avaliações

- Diesel Engine Damage Due To Misapplication or Misuse of Generating SetDocumento2 páginasDiesel Engine Damage Due To Misapplication or Misuse of Generating SetPavel ViorelAinda não há avaliações

- Js Bank ReportDocumento31 páginasJs Bank ReportBhao100% (3)

- Oracle Tuning Session LongopsDocumento2 páginasOracle Tuning Session LongopsshubhrobhattacharyaAinda não há avaliações

- The Park Place Economist Issues in Political EconomyDocumento2 páginasThe Park Place Economist Issues in Political EconomyamirahalimaAinda não há avaliações

- Study Report On Future Prospects of Debit and Credit CardsDocumento4 páginasStudy Report On Future Prospects of Debit and Credit CardsaishwaryaAinda não há avaliações

- CopyofbillcreatorDocumento2 páginasCopyofbillcreatorapi-336971323Ainda não há avaliações

- HDFC Bank Opening Savings Account Project ReportDocumento84 páginasHDFC Bank Opening Savings Account Project ReportCma Smrutiranjan Sahoo KintuAinda não há avaliações

- 129241credit Card Debit Authorization FormDocumento2 páginas129241credit Card Debit Authorization FormNurul Syazwana Abu BakarAinda não há avaliações

- AKODocumento2 páginasAKOLarah Jane BuisaAinda não há avaliações

- Comparing CASA Products of Top Indian BanksDocumento45 páginasComparing CASA Products of Top Indian Banksshrutigarg88@gmail,comAinda não há avaliações

- Michał Krajewski GR 3 Informatyka I EkonometriaDocumento2 páginasMichał Krajewski GR 3 Informatyka I Ekonometriamichk100Ainda não há avaliações

- Questions&Answers: Film Poster! That The Film Is Based On Some Sort of HolidayDocumento2 páginasQuestions&Answers: Film Poster! That The Film Is Based On Some Sort of Holidayapi-307784978Ainda não há avaliações

- Collecting Web DataDocumento3 páginasCollecting Web DataSoftlectSoftlectAinda não há avaliações

- United Bank LimitedDocumento78 páginasUnited Bank Limitedshani27100% (1)

- Apply for Debit Card for Savings, Current & Minor AccountsDocumento2 páginasApply for Debit Card for Savings, Current & Minor AccountsDeep Chh100% (1)

- Tests Mechanical Devices and Registration SamplingDocumento3 páginasTests Mechanical Devices and Registration SamplingJocel D. MendozaAinda não há avaliações

- Exhibit-D14 (Close Out Report)Documento3 páginasExhibit-D14 (Close Out Report)charlessimoAinda não há avaliações

- Image ProcessingDocumento3 páginasImage ProcessingesuncakAinda não há avaliações

- ITC AssignmentDocumento1 páginaITC AssignmentHiraAinda não há avaliações

- 580 Report TemplateDocumento2 páginas580 Report TemplatengyncloudAinda não há avaliações

- How Islam is Growing Stronger Despite 9/11 AttacksDocumento1 páginaHow Islam is Growing Stronger Despite 9/11 AttacksksahunkAinda não há avaliações

- No Politics Is The Biggest PoliticsDocumento2 páginasNo Politics Is The Biggest PoliticsSantosh Kumar MamgainAinda não há avaliações

- Should We Follow The Majority or The MinorityDocumento3 páginasShould We Follow The Majority or The MinorityShadab AnjumAinda não há avaliações

- Quantitative and QualitativeDocumento1 páginaQuantitative and QualitativeMuralis MuralisAinda não há avaliações

- Topic 7 Exercise 1 Read The Extract of "The Unicorn in The Garden" by James Thurbar and Answer The Questions That FollowDocumento3 páginasTopic 7 Exercise 1 Read The Extract of "The Unicorn in The Garden" by James Thurbar and Answer The Questions That Follownseir_alAinda não há avaliações

- Micro The Me - One of These DaysDocumento2 páginasMicro The Me - One of These DaysRegi SimpsonAinda não há avaliações

- Paul Casquejo - RespondentDocumento1 páginaPaul Casquejo - RespondentPaul Gabriel CasquejoAinda não há avaliações

- Being Led by Your Own Liahona Scripture Study Rebecca ZimmerDocumento1 páginaBeing Led by Your Own Liahona Scripture Study Rebecca Zimmerapi-285869153Ainda não há avaliações

- The Runaway AnsarsDocumento3 páginasThe Runaway AnsarszchoudhuryAinda não há avaliações

- Practice of The Remembrance of GodDocumento2 páginasPractice of The Remembrance of Godapi-19795286Ainda não há avaliações

- 10 Things Every Worship Team Member Must RememberDocumento1 página10 Things Every Worship Team Member Must Remembertoyi kamiAinda não há avaliações

- Saving The Last Drop: by Jerahpapasin (Abj)Documento2 páginasSaving The Last Drop: by Jerahpapasin (Abj)Jerah Morado PapasinAinda não há avaliações

- Texture Tiles - WriteupDocumento2 páginasTexture Tiles - WriteupmishaAinda não há avaliações

- Thesis ContentDocumento2 páginasThesis ContentJulie Ann QuicayAinda não há avaliações

- Debit Card Application Form For Burgundy Savings Account PDFDocumento2 páginasDebit Card Application Form For Burgundy Savings Account PDFSiva Naga Prasad TadipartiAinda não há avaliações

- NotesDocumento3 páginasNotesAyesha MahmoodAinda não há avaliações

- Driver (1976), You Might Find Trouble With The Police. But If Your Skin Color Is Black, There Is ADocumento2 páginasDriver (1976), You Might Find Trouble With The Police. But If Your Skin Color Is Black, There Is Aapi-298580735Ainda não há avaliações

- The Five Conditions For Lasting RelationshipsDocumento2 páginasThe Five Conditions For Lasting Relationshipsapi-85444408Ainda não há avaliações

- Valid Cases 10 Cases With Missing Value(s) 0Documento2 páginasValid Cases 10 Cases With Missing Value(s) 0Antonio TablizoAinda não há avaliações

- 1 2Documento80 páginas1 2Amrita GhartiAinda não há avaliações

- HSBC BankDocumento40 páginasHSBC BankPrasanjeet PoddarAinda não há avaliações

- SAVE MONEY WITH BANK SAVINGS ACCOUNTSDocumento11 páginasSAVE MONEY WITH BANK SAVINGS ACCOUNTSপ্রিয়াঙ্কুর ধরAinda não há avaliações

- CASES IN LOCAL and REAL PROPERTY TAXATIONDocumento3 páginasCASES IN LOCAL and REAL PROPERTY TAXATIONTreblif AdarojemAinda não há avaliações

- DDT Use Raises Ethical IssuesDocumento15 páginasDDT Use Raises Ethical IssuesNajihah JaffarAinda não há avaliações

- Delhi Public School Mid-Term Exam for Class 5 Students Covering English, Math, ScienceDocumento20 páginasDelhi Public School Mid-Term Exam for Class 5 Students Covering English, Math, ScienceFaaz MohammadAinda não há avaliações

- JPM The Audacity of BitcoinDocumento8 páginasJPM The Audacity of BitcoinZerohedge100% (3)

- Grammar Rules - Self-Study - Comparative and Superlative AdjectivesDocumento4 páginasGrammar Rules - Self-Study - Comparative and Superlative AdjectivesTatiana OliveiraAinda não há avaliações

- Regional Director: Command GroupDocumento3 páginasRegional Director: Command GroupMae Anthonette B. CachoAinda não há avaliações

- MOWILEX Balinese Woodcarving A Heritage To Treasure LatestDocumento85 páginasMOWILEX Balinese Woodcarving A Heritage To Treasure LatestBayus WalistyoajiAinda não há avaliações

- New Jersey V Tlo Research PaperDocumento8 páginasNew Jersey V Tlo Research Paperfvg7vpte100% (1)

- Coming From Battle To Face A War The Lynching of Black Soldiers in The World War I EraDocumento251 páginasComing From Battle To Face A War The Lynching of Black Soldiers in The World War I Eralobosolitariobe278Ainda não há avaliações

- GT Letters - Notes and Practice QuestionDocumento14 páginasGT Letters - Notes and Practice Questionओली एण्ड एसोसिएट्स बुटवलAinda não há avaliações

- Omoluabi Perspectives To Value and Chara PDFDocumento11 páginasOmoluabi Perspectives To Value and Chara PDFJuan Daniel Botero JaramilloAinda não há avaliações

- Case Study 2, Domino?s Sizzles With Pizza TrackerDocumento3 páginasCase Study 2, Domino?s Sizzles With Pizza TrackerAman GoelAinda não há avaliações

- Humility Bible StudyDocumento5 páginasHumility Bible Studyprfsc13Ainda não há avaliações

- The Paradox ChurchDocumento15 páginasThe Paradox ChurchThe Paradox Church - Ft. WorthAinda não há avaliações

- Intestate of Luther Young v. Dr. Jose BucoyDocumento2 páginasIntestate of Luther Young v. Dr. Jose BucoybearzhugAinda não há avaliações

- TAX-402 (Other Percentage Taxes - Part 2)Documento5 páginasTAX-402 (Other Percentage Taxes - Part 2)lyndon delfinAinda não há avaliações

- Research TitleDocumento5 páginasResearch TitleAthena HasinAinda não há avaliações

- Pedagogy of Teaching HistoryDocumento8 páginasPedagogy of Teaching HistoryLalit KumarAinda não há avaliações

- Understanding Plane and Solid FiguresDocumento9 páginasUnderstanding Plane and Solid FiguresCoronia Mermaly Lamsen100% (2)

- Lecture-1 An Introduction To Indian PhilosophyDocumento14 páginasLecture-1 An Introduction To Indian PhilosophySravan Kumar Reddy100% (1)

- O&M Manager Seeks New Career OpportunityDocumento7 páginasO&M Manager Seeks New Career Opportunitybruno devinckAinda não há avaliações

- 3 Macondray - Co. - Inc. - v. - Sellner20170131-898-N79m2kDocumento8 páginas3 Macondray - Co. - Inc. - v. - Sellner20170131-898-N79m2kKobe Lawrence VeneracionAinda não há avaliações

- Annual GPF Statement for NGO TORA N SINGHDocumento1 páginaAnnual GPF Statement for NGO TORA N SINGHNishan Singh Cheema56% (9)

- Bangla Book "Gibat" P2Documento34 páginasBangla Book "Gibat" P2Banda Calcecian100% (3)

- Biswajit Ghosh Offer Letter63791Documento3 páginasBiswajit Ghosh Offer Letter63791Dipa PaulAinda não há avaliações

- Weekly Mass Toolbox Talk - 23rd Feb' 20Documento3 páginasWeekly Mass Toolbox Talk - 23rd Feb' 20AnwarulAinda não há avaliações

- DefenseDocumento18 páginasDefenseRicardo DelacruzAinda não há avaliações

- 0025 Voters - List. Bay, Laguna - Brgy Calo - Precint.0051bDocumento3 páginas0025 Voters - List. Bay, Laguna - Brgy Calo - Precint.0051bIwai MotoAinda não há avaliações

- Excerpt of "The Song Machine" by John Seabrook.Documento9 páginasExcerpt of "The Song Machine" by John Seabrook.OnPointRadioAinda não há avaliações

- iOS E PDFDocumento1 páginaiOS E PDFMateo 19alAinda não há avaliações