Escolar Documentos

Profissional Documentos

Cultura Documentos

Types of Banks in India

Enviado por

CAJaideepDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Types of Banks in India

Enviado por

CAJaideepDireitos autorais:

Formatos disponíveis

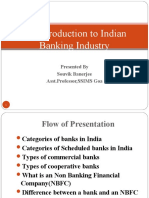

TYPES OF BANKS AND BANKING ACTIVITIES

Reserve Bank of India In India the central banking authority is the Reserve Bank of India. It is also referred to as the Apex Bank. It functions under an Act called The Reserve Bank of India Act, 1934. All the banks and other financial institutions operating in India come under the monitoring and control of RBI. RBI controls the banking sector in India through an Act called The Banking Regulations Act 1949. In the past, when there were very few banks, RBI used to include all the scheduled banks in its schedule. Nowadays, when the number of banks has gone up substantially, RBI has to change the schedule every now and then, hence irrespective of whether a bank finds its name in the schedule to the RBI Act or not, its schedule status can be found out from its banking licence. A Bank that is not a scheduled bank is referred to as non scheduled bank even in it is having banking licence. Scheduled And Non-Scheduled Banks

Scheduled Banks in India constitute those banks which have been included in the Second Schedule of Reserve Bank of India(RBI) Act, 1934. RBI in turn includes only those banks in this schedule which satisfy the criteria laid down vide section 42 (6) (a) of the Act. Non-scheduled bank in India means a banking company as defined in clause (c) of section 5 of the Banking Regulation Act, 1949 (10 of 1949), which is not a scheduled bank.

The difference lies in the type of banking activities that a bank can carry out in India. In the case of a scheduled bank, it is licensed by the RBI to carry on extensive banking operations including foreign exchange operations, whereas, a non-scheduled bank can carry out only limited operations. There are a number of factors considered by RBI to declare a bank as a scheduled bank, like the amount of share capital, type of banking activities that the bank is permitted to carry out etc. Commercial And Co-operative Banks Commercial banks are by far the most widespread banking institutions in India. They provide major products and services in India. A commercial bank is run on commercial lines, for profits of the organization. A co-operative bank on the other hand is run for the benefit of a group of members of the co-operative body. A co-operative bank distributes only a very small portion of its profit as dividend, retaining a major portion of it in business. All the nationalized banks in India and almost all the private sector banks are commercial scheduled banks. There are a large number of private sector co-operative banks and most of them are non-scheduled banks. In the public sector also, within a state, starting from the State capital, there are State Co-operative Banks and District Central Co-operative Banks at the District level. Under the District Central Co-operative Bank, there are Co-operative Societies.

At present, In India, the banks can be bifurcated into following categories. Public Sector Banks or Nationalized Banks, which are commercial and scheduled Examples: State Bank of India, Bank of India etc. Public Sector Banks, which are co-operative and non-scheduled - These are state owned banks like the Maharashtra State Co-operative Bank, Junnar Co-operative Society etc. Private Sector Banks, which are commercial and scheduled - These could be foreign banks, as well as Indian Banks. Foreign Banks- CITI Bank, Standard Chartered Bank etc. Indian Banks - Bank of Rajasthan Limited, Vyasa Bank Limited etc. Private Sector Banks, which are co-operative and scheduled - These are large cooperative sector banks but which are scheduled banks. Examples: Saraswat Cooperative Bank Limited, Cosmos Co-operative Bank Limited etc. Private Sector Banks, which are co-operative and non-scheduled - These are small co-operative banks but which are non-scheduled. Examples: Local co-operative banks which operate within a town or a city. Example: Mahesh Sahakari Bank Limited. Regional Rural Banks - These are state owned. These banks have been established with a view to developing the rural economy by providing, for the purpose of development of agriculture, trade, commerce, industry and other productive activities in the rural areas, credit and other facilities, particularly to the small and marginal farmers, agricultural labourers and artisans and small entrepreneurs Gramin Banks - that are also state owned. They operate at still smaller level than RRBs and serve at villages level. Foreign banks - These banks have Head Office outside India and branch in India, Besides, the Reserve Bank of India (hereinafter referred to as RBI) acts as the central bank of the country. RBI is responsible for development and supervision of the constituents of the Indian financial system (which comprises banks and non-banking financial institutions) as well as for determining, in conjunction with the central Government, the monetary and credit policies. They are also controlled by RBI.

Você também pode gostar

- Regional Rural Banks of India: Evolution, Performance and ManagementNo EverandRegional Rural Banks of India: Evolution, Performance and ManagementAinda não há avaliações

- Banking India: Accepting Deposits for the Purpose of LendingNo EverandBanking India: Accepting Deposits for the Purpose of LendingAinda não há avaliações

- Banking Structure in IndiaDocumento5 páginasBanking Structure in IndiaCharu Saxena16Ainda não há avaliações

- Indian Banking StructureDocumento5 páginasIndian Banking StructurevivekAinda não há avaliações

- Co Opeartive BankingDocumento3 páginasCo Opeartive Bankingjyotz777Ainda não há avaliações

- Types of Banks IndiaDocumento3 páginasTypes of Banks India17-075 Upgna PatelAinda não há avaliações

- Comparative Analysis of Commercial Bank (Icici and Idbi Bank)Documento27 páginasComparative Analysis of Commercial Bank (Icici and Idbi Bank)GUDDUAinda não há avaliações

- Banking System in India or The Indian Banking System Can Be Segregated Into Three Distinct PhasesDocumento9 páginasBanking System in India or The Indian Banking System Can Be Segregated Into Three Distinct PhasesmayurAinda não há avaliações

- Concept of BankingDocumento36 páginasConcept of BankingDhaval B MasalawalaAinda não há avaliações

- Banking Practice Unit 1Documento13 páginasBanking Practice Unit 1Nandhini VirgoAinda não há avaliações

- Structure of The Indian Banking System Sem IDocumento2 páginasStructure of The Indian Banking System Sem IAshitosh ChavanAinda não há avaliações

- 4 Banking LawDocumento85 páginas4 Banking LawRamesh BuridiAinda não há avaliações

- Banking Overview: Historical PerspectiveDocumento6 páginasBanking Overview: Historical PerspectiveSatish VarmaAinda não há avaliações

- BankingDocumento74 páginasBankingAbhishek DubeyAinda não há avaliações

- Banking Structure in IndiaDocumento31 páginasBanking Structure in IndiaRishabhShuklaAinda não há avaliações

- Name: Swaraj Mahadev Golekar Class: BBA SY Finance Semester: III Subject: Banking and Finance Roll No: 13Documento32 páginasName: Swaraj Mahadev Golekar Class: BBA SY Finance Semester: III Subject: Banking and Finance Roll No: 13Swaraj GolekarAinda não há avaliações

- Structure of Indian Banking System: by - K Mallikarjuna RaoDocumento53 páginasStructure of Indian Banking System: by - K Mallikarjuna Raosubba raoAinda não há avaliações

- Schedule Banks Are Those Which Are Included in The Second Schedule of Banking Regulation Act 1965Documento25 páginasSchedule Banks Are Those Which Are Included in The Second Schedule of Banking Regulation Act 1965Moncy Idicula MathaiAinda não há avaliações

- 0 Ashay% PDFDocumento55 páginas0 Ashay% PDFAshay AgrawalAinda não há avaliações

- Comparative Analysis of Commercial Bank (Icici and Idbi Bank)Documento31 páginasComparative Analysis of Commercial Bank (Icici and Idbi Bank)GUDDUAinda não há avaliações

- Banking Management Additional NotesDocumento118 páginasBanking Management Additional NotesLokesh ChAinda não há avaliações

- Banking Structure in IndiaDocumento13 páginasBanking Structure in IndiaharshAinda não há avaliações

- Banking Structure in IndiaDocumento9 páginasBanking Structure in IndiaDhanu BhardwajAinda não há avaliações

- Banking Law Reserach PaperDocumento23 páginasBanking Law Reserach Papersarayu alluAinda não há avaliações

- Banking Practical 1 InformationDocumento4 páginasBanking Practical 1 InformationMadhur AbhyankarAinda não há avaliações

- Type of Banks: Different Types of Banks in India & Their FunctionsDocumento15 páginasType of Banks: Different Types of Banks in India & Their FunctionscecilAinda não há avaliações

- 01 Indian Banking SystemDocumento11 páginas01 Indian Banking SystemAmir AhmedAinda não há avaliações

- Study MaterialDocumento42 páginasStudy MaterialLion Naresh PradhanAinda não há avaliações

- Structure of Banking System in IndiaDocumento34 páginasStructure of Banking System in IndiaAyushi SinghAinda não há avaliações

- Commercial Banking in IndiaDocumento15 páginasCommercial Banking in Indiabipinpanickar57Ainda não há avaliações

- Banking Services Unit IDocumento11 páginasBanking Services Unit IKrishna KumarAinda não há avaliações

- Classification of Banking System Final 52Documento7 páginasClassification of Banking System Final 52sonam1991Ainda não há avaliações

- Banking System in IndiaDocumento3 páginasBanking System in Indiahello707Ainda não há avaliações

- Chapter 2. Lecture 2.1 Kinds of Banks and Its FunctionsDocumento7 páginasChapter 2. Lecture 2.1 Kinds of Banks and Its FunctionsvibhuAinda não há avaliações

- Structure of BanksDocumento15 páginasStructure of BanksAmogh AroraAinda não há avaliações

- Structure of The Indian Banking Industry: Commercial BanksDocumento2 páginasStructure of The Indian Banking Industry: Commercial BanksMayank AhujaAinda não há avaliações

- Banking StructureDocumento3 páginasBanking StructureMayank AhujaAinda não há avaliações

- Regulatory Bodies of India (Rbi and Sebi) : Report By-D. Sravani Sheetal PrachiDocumento23 páginasRegulatory Bodies of India (Rbi and Sebi) : Report By-D. Sravani Sheetal PrachiSravy DAinda não há avaliações

- Indian Banking Sector-An IntroductionDocumento16 páginasIndian Banking Sector-An Introductionbando007Ainda não há avaliações

- 04 - Chapter 1Documento27 páginas04 - Chapter 1shantishree04Ainda não há avaliações

- Types of BanksDocumento5 páginasTypes of BanksAsif AliAinda não há avaliações

- Banks in India PDFDocumento2 páginasBanks in India PDFAnonymous HEhAAiAinda não há avaliações

- Comparitive Analysis of Public Sector and Private Sectors Banks PDFDocumento67 páginasComparitive Analysis of Public Sector and Private Sectors Banks PDFAnonymous y3E7ia100% (1)

- Banking System in India: 12 Types of BanksDocumento7 páginasBanking System in India: 12 Types of Banksप्रॉजेक्टपैराडायसAinda não há avaliações

- Structure of Commercial Banks in IndiaDocumento11 páginasStructure of Commercial Banks in IndiaVijayalakshmi100% (2)

- Banking SectorDocumento3 páginasBanking SectorVishal KhatriAinda não há avaliações

- Performance of Indian Banking SystemDocumento40 páginasPerformance of Indian Banking Systemnikhil mudhirajAinda não há avaliações

- Banking Structure in India PDFDocumento12 páginasBanking Structure in India PDFShantanu PorelAinda não há avaliações

- Banking & Financial Institutions in India: Historical BackgroundDocumento6 páginasBanking & Financial Institutions in India: Historical BackgroundRUPA GOELAinda não há avaliações

- Types of BankingDocumento10 páginasTypes of BankingJinu SajiAinda não há avaliações

- Banking System in IndiaDocumento33 páginasBanking System in Indiadevinder07Ainda não há avaliações

- Banking IndustryDocumento77 páginasBanking Industryprashant mhatreAinda não há avaliações

- Economics ProjectDocumento15 páginasEconomics ProjectAniket taywadeAinda não há avaliações

- Indian Financial SystemDocumento2 páginasIndian Financial SystemAkash PawarAinda não há avaliações

- Unit - 1Documento93 páginasUnit - 1Suji MbaAinda não há avaliações

- Types of Banks in India & Role of RBIDocumento32 páginasTypes of Banks in India & Role of RBINIYATI BAGWEAinda não há avaliações

- Banking Industry 1Documento11 páginasBanking Industry 1Sohini KarAinda não há avaliações

- A Practical Approach to the Study of Indian Capital MarketsNo EverandA Practical Approach to the Study of Indian Capital MarketsAinda não há avaliações

- 3108 13 06 FinancialResponsibility GN SEDocumento9 páginas3108 13 06 FinancialResponsibility GN SENEEVE SHETHAinda não há avaliações

- Compound Interest Example ProblemsDocumento2 páginasCompound Interest Example ProblemsMicah Aila MallariAinda não há avaliações

- Accounting Question Petty CashDocumento2 páginasAccounting Question Petty Cashelsana philipAinda não há avaliações

- This Study Resource Was: Fraud in Banking SectorDocumento6 páginasThis Study Resource Was: Fraud in Banking SectorMeena BhagatAinda não há avaliações

- Http://202.83.164.226/complaint - Attachments//2019 11 08 07 47 20 1573181240 5457837 5dc4d738aff255.3935adb9d1b58f8c PDFDocumento2 páginasHttp://202.83.164.226/complaint - Attachments//2019 11 08 07 47 20 1573181240 5457837 5dc4d738aff255.3935adb9d1b58f8c PDFNaveed KhanAinda não há avaliações

- Ashok Pay SlipDocumento7 páginasAshok Pay SlipVivek WagheAinda não há avaliações

- A Study On Credit Management at District CoDocumento86 páginasA Study On Credit Management at District CoIMAM JAVOOR100% (2)

- LECTURE NO 4 5Cs and 7Ps of CreditDocumento5 páginasLECTURE NO 4 5Cs and 7Ps of CreditJessica Miller79% (14)

- Card Cancellation DisclaimerDocumento1 páginaCard Cancellation Disclaimerambermikaela.siAinda não há avaliações

- A Comparative Study of Non-Performing Assets of Canara Bank & Icici BankDocumento42 páginasA Comparative Study of Non-Performing Assets of Canara Bank & Icici BankASWATHYAinda não há avaliações

- Commerce Project 3rd YearDocumento31 páginasCommerce Project 3rd YearJatin Arora72% (122)

- Mathematics in Financial Risk ManagementDocumento10 páginasMathematics in Financial Risk ManagementJamel GriffinAinda não há avaliações

- Estmt - 2022 04 29Documento12 páginasEstmt - 2022 04 29Laura MCG100% (1)

- Task 3.9-Steps On Bank ReconDocumento8 páginasTask 3.9-Steps On Bank ReconRayAinda não há avaliações

- Training NotesDocumento7 páginasTraining NotesMuaz AzizAinda não há avaliações

- SBI01 MAR 2022 To 21 NOV 2022Documento12 páginasSBI01 MAR 2022 To 21 NOV 2022Fascino WhiteAinda não há avaliações

- Demand Draft Cancellation Form: D D MM Y Y Y YDocumento1 páginaDemand Draft Cancellation Form: D D MM Y Y Y YMohan TamilAinda não há avaliações

- Personal FinanceDocumento2 páginasPersonal FinanceMonica ValentinaAinda não há avaliações

- Complete List of Indian Banks and Their Heads - CMDs - CEOs - Gr8AmbitionZ PDFDocumento8 páginasComplete List of Indian Banks and Their Heads - CMDs - CEOs - Gr8AmbitionZ PDFNageswara ReddyAinda não há avaliações

- Disbursement Voucher: Appendix 32Documento7 páginasDisbursement Voucher: Appendix 32Samiracomputerstation Kuya MarvsAinda não há avaliações

- Accion Camel Financial Assessment Instrument For Microfinance2264Documento20 páginasAccion Camel Financial Assessment Instrument For Microfinance2264khafagy100% (1)

- Assignment No-3Documento9 páginasAssignment No-3Ronit gawade100% (1)

- Scottish Power - Ocean WharfDocumento3 páginasScottish Power - Ocean Wharfvic2clarionAinda não há avaliações

- Gerald Canton Palma: Statement of AccountDocumento4 páginasGerald Canton Palma: Statement of AccountGerald PalmaAinda não há avaliações

- Merchant Banking FinalDocumento20 páginasMerchant Banking FinalMiral PatelAinda não há avaliações

- Liability Products: Personal Banking Segment of SBIDocumento4 páginasLiability Products: Personal Banking Segment of SBIapu20090% (2)

- ch18 PDFDocumento34 páginasch18 PDFLê Chấn PhongAinda não há avaliações

- 01 Time Value of Money AKDocumento4 páginas01 Time Value of Money AKXandra Faye MendozaAinda não há avaliações

- S Poddar and Co ProfileDocumento35 páginasS Poddar and Co ProfileasassasaaAinda não há avaliações