Escolar Documentos

Profissional Documentos

Cultura Documentos

Byron Capital Research Report

Enviado por

Muhammad Saad HussainDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Byron Capital Research Report

Enviado por

Muhammad Saad HussainDireitos autorais:

Formatos disponíveis

Equity Research

July 11, 2011

Rating: SPECULATIVE BUY Target Price: $1.90

All figures in C$, unless otherwise noted. Recent Price: 52 Week Range: Shares O/S: Basic (MM) F.D. (MM) Market Cap (MM): Average Daily Vol. (3 mo.) Fiscal Year End: Cash (Est.) (MM): $1.00 $0.86 - $1.55 31.5 45.6 $31.5 86,500 Dec. 31 $3.0

(NGC TSXV) High-Yield of High-Value Battery Material

Initiating Coverage: We are initiating coverage on Northern Graphite Corp. (Northern Graphite), a company with 100% ownership of the Bissett Creek graphite deposit located less than 17 km from Highway 17 near Mattawa, Ontario. In the near term, the advanced project should deliver positive results from a pilot plant, a new resource estimate and a Bankable Feasibility Study (BFS) on its way to production by early 2013. Low Strip Ratio, Shallow Dip and Low Capex: The mineralization is covered by up to 10 metres of overburden and given the flat lying nature of the deposit (approximately 20%), the strip ratio will be less than one; roughly 0.66:1. With logging roads to the site, power and natural gas lines less than 17 km away and a simple flow sheet, capital costs for a 20,000 tonne per annum (tpa) plant is minimal at approximately $70 million. Upcoming Catalysts with Known Metallurgy and an Expanded Resource: Metallurgical work has been performed numerous times, in 1989 and confirmed in 2007, yielding a 95% recovery. A pilot plant test will be done in September of this year to confirm the easy flotation, but more importantly, we believe it will provide test material of its high value large flake, high carbon graphite content graphite for strategic investors. A BFS is expected shortly thereafter in November 2011, which will incorporate the pilot plant work and the new resource from a recent drill program. Can Easily Double Production: Northern Graphite can currently double production and still have a 20-year life of mine (LOM), and with the upcoming catalyst of incorporating May 2011 drill results into a new resource, Northern Graphite will easily extend the LOM over 20 years. This will help the company meet increased demand of its higher value graphite from the growth in lithium-ion batteries.

Northern Graphite Corp.

Company Description: Northern Graphite is a mine developer with its 100% owned asset, Bissett Creek, located in Maria Township right off the Trans-Canada highway and approximately 100 km east of North Bay. Northern Graphite plans on bringing the project to production by end of year 2012.

Jonathan Lee, MBA Battery Materials & Technologies 647.426.1674 jlee@byroncapitalmarkets.com Sandy Lam Associate 647.426.0287 slam@byroncapitalmarkets.com

Summary: With known metallurgy, infrastructure in place, a relatively low capex and a short time to production, risk is minimized for the Bissett Creek project that is expected to have $19.5 million per year in gross profit in 2013, with the potential to generate $39 million in gross profit by doubling production to meet demand from growing battery production. We are initiating coverage on Northern Graphite with a SPECULATIVE BUY rating and $1.90 target price based on 1.0x NAV using a 14% discount rate.

Please see end of this report for important disclosures

Northern Graphite Corp.

Graphite Overview

Graphite has long been an ugly and unloved material. Most of us are exposed to graphite only through the lead in the ubiquitous pencil, but industrial uses for graphite dominate this market. There are actually four forms of crystalline carbon; the most famous being diamond, but graphite is one of the four as well. Graphite has the advantage of being relatively chemically inert, while exhibiting the best electrical and thermal conductivity of all non-metallic solids. The graphite industry is approximately 1.1 million tonnes per year with about 75% of graphite being produced in China and the bulk of the remaining material sourced from North Korea, Brazil, Sri Lanka and Canada. Given the dominant market share of China and its implementation of a 20% export duty and a 17% value added tax, graphite prices have more than doubled in the past year for a range of different graphite grades and products. There are two sources of graphite. The first is mining graphite from deposits. This natural material has varying levels of quality/purity/size, ranging from lump (or vein) to amorphous to crystalline flake. However, contaminant loads can vary widely and this heavily influences the use of the material in some applications and its pricing; the carbon content of the graphite required for an application can range from 70% up to 99.9% or higher. The other source of graphite is to heat a feedstock such as petroleum coke to very high temperatures for days in a special furnace and create very pure synthetic graphite. Natural graphite finds uses in such areas as the making of refractories, as it can handle very hot materials such as molten metals. Refractories are best made from crystalline graphite, but new developments are increasing the use of amorphous graphite in this application. Steelmaking requires the addition of carbon to bring its level up to a desired point, which is called carbon raising. While graphite can be used to do this, so too can any other source of carbon that contains little in the way of other metal contaminants, including petroleum coke. Thus, the price for carbon raising materials is very low. Expanded graphite is graphite that has been acid treated to separate the sheets of carbon atoms that make up flake graphite and make it amenable for use as a high temperature seal or insulator. Amorphous or small flake graphite is used to make brake linings, although some new materials are taking market share from graphite. Foundry facings, the use of amorphous or small flake graphite to coat moulds for molten metal and make it easier to remove the poured part, is also a use for natural graphite, albeit a smaller one. Synthetic graphite is used to make electrodes that are used within arc furnaces, with the scrap from the manufacturing of these electrodes used as carbon raising material in the same steel plants. Synthetic graphite that is high in quality and purity is also used in the nuclear industry and to make carbon fibre products. In the past, synthetic graphite was also the only choice for battery manufacturers making anodes for both primary (disposable) and secondary (rechargeable) cells. However, various processes have been developed, including chemical and thermal treatments, to purify natural graphite to the point where it can be used as a battery anode. And with some other properties that natural graphite brings to the table and its cost advantage, it may well prove to be the performance and value leader in the battery market in the future. With the amount of graphite used in batteries approximately 10 times more than that of lithium, and the replacement of synthetic graphite with flake, we believe the growth of larger flake graphite is robust in the future. Thus, Northern Graphites ability to produce high carbon content, large flake graphite will enable the company to take advantage of lithium-ion battery demand growth.

Jonathan Lee, MBA 647.426.1674 jlee@byroncapitalmarkets.com

Page |2

Northern Graphite Corp.

Right Off the Trans-Canada Highway

The Bissett Creek deposit is just 70 km east of Mattawa, Ontario. It is accessible by 17 km of well-maintained logging roads to the site, and the road is an easy turn off from Highway 17. The deposit is close enough to towns that the company does not have to construct a camp for its workforce. A natural gas pipeline and electric power also run along Highway 17, which Northern Graphite can tap into to run its operations. The location is an enviable one, as the company is costing three power scenarios to determine the most economic: 1) connect to the nearby natural gas pipeline; 2) connect to the closest substation; or 3) construct a new substation closer to the property. Low capital costs due to the deposits proximity to infrastructure will shorten the payback for the company and enhance shareholder value. Exhibit 1 Property Location

Source: Company reports

An initial resource and a scoping study were completed for the 100%-owned Bissett Creek deposit in 2010. The graphite deposit is hosted in weathered graphitic gneiss. The deposit is fairly flat, dipping approximately 5 to 20 degrees and is at surface with less than 10 metres of overburden. The thickness of the deposit is approximately 75 metres providing for an easy open pit operation. The flatness of the deposit at surface is shown in Exhibit 2. Industrial Minerals Inc. (Industrial Minerals) previously tried to start up a small operation but because the company used a flawed dry recovery process, it was unable to achieve continuous operation. Northern Graphite will take advantage of these characteristics of the deposit. We believe minimal overburden will lower capital costs for clearing the overburden and the shallow dip will maintain a low mining strip ratio, reducing operating costs over the long term.

More than Enough Resource

Jonathan Lee, MBA 647.426.1674 jlee@byroncapitalmarkets.com

Page |3

Northern Graphite Corp.

Exhibit 2 The Flat Lying Deposit

Source: Byron Capital Markets

SGS compiled a resource in 2010 using previous drill results, in the indicated and inferred category. The resource is sufficient for over 35 years of production at 20,000 tpa using a 1.5% graphitic carbon cut-off grade. The deposit is associated with larger flake material with all material expected, after processing, to remain at greater than 100 mesh size while being over 94% carbon concentrate. Exhibit 3 NI 43-101 Compliant Resource

Cutoff Grade (%C) 1.00% 1.50% 2.00% 2.50%

1

Ore (tonnes) 20,449 14,641 8779 4562

Indicated Graph CContained LECO (%) (000 tonnes C) 1.97% 403 2.24% 328 2.58% 226 2.88% 131

Contained (000 kg C) 402,843 327,958 226,498 131,386

Ore (tonnes) 26,232 18,027 10682 4621

Graph CLECO (%) 1.90% 2.21% 2.51% 2.89%

Inferred Contained (000 tonnes C) 498 398 268 134

Total: Contained Total Contained Mine Life (000 kg C) (000 tonnes C) (Years)1 498,408 901 21.40 398,397 726 17.25 268,118 495 11.75 133,547 265 6.29

Mine life based on expanded 40,000 tpa and 95% recovery

Source: Company reports, Byron Capital Markets Ltd.

Jonathan Lee, MBA 647.426.1674 jlee@byroncapitalmarkets.com

Page |4

Northern Graphite Corp.

Easily Expandable Resource

Recent drill results should result in a larger resource in the near future and will be an upcoming catalyst for the company. An increased resource will give the company the ability to increase production and generate cash faster. With indicated and inferred resources at 2.24% C and 2.21% C, respectively, the latest drill results averaged 2.36% C on a strike weighted basis, which should slightly increase the overall grade. More importantly, released drill results showed mineralization continues to the north and south as shown by the blue circles in Exhibit 4. Fifty of the 51 holes in the drill program intersected similar widths and similar grades, leading to a homogenous deposit. This should be incorporated in the upcoming BFS report (scheduled for November 2011) and easily let Northern Graphite expand beyond 19,000 tpa. Exhibit 4 Additional Drill Hole Locations

An inevitable added resource will let NGC double production while still maintaining a sufficient LOM

Source: Company reports

High Recovery of High Value Material in Simple Process

In the late 1980s Kilborn Engineering Ltd., KHD, Bacon Donaldson and Associates Ltd., and CESL performed metallurgical work on the deposit as part of a full feasibility study that was completed at the time. A simple grind and flotation process was achieved for the material. The same flotation recovery process was performed again by Systemes Geostat International Inc. in 2007. Graphite recovery was extremely high in the 95% range. Additionally, through the flotation and regrind process, a 93% carbon graphite concentrate was produced. Because of the minimal grinding to disassociate the gangue material from the carbon flakes, flake size remains intact throughout the process. From past testing, approximately 30% is in the +35 mesh size, 40% in -35+48 mesh size and 30% in the -48 mesh size. A smaller mesh size indicates a larger flake size. Additionally,

Jonathan Lee, MBA 647.426.1674 jlee@byroncapitalmarkets.com

Page |5

Northern Graphite Corp.

NGC has a simple flow sheet to have a high recovery yield while preserving the large flake nature of the graphite

after speaking with management, recent test results indicate that almost all material will be larger than +100 mesh. +48 mesh will sell at premium prices even relative to +100 mesh. Higher graphite content and larger size increase the products average selling price on a per tonne basis. Exhibit 5 - Simple Flow Schematic

Mine

Sag Mill

Float

Pebble Mill

Cleaner

Screen

Thickener

Ball Mill

Secondary Float

Secondary Cleaner

Dryer

Graphite Bins

Source: Company reports, Byron Capital Markets Ltd.

Comparable from a Private Company Going Upstream

Much like Northern Graphite, Magnesita Refratarios S.A. (Magnesita), a producer of a broad range of refractory materials, is developing its own graphite project near its production facilities in Bahia, Brazil to vertically integrate its operations. The locations of Magnesitas deposits are close to other graphite producing companies such as Nacional de Grafit and Grafite do Brasil. The company estimates producing 40,000 tpa of graphite; 30,800 tpa of which will be low-value graphite powder with the remainder being flake. Although lower grade, Bissett Creeks high-value flake grade is comparable to both of Magnesitas deposits. Additionally, we believe that Northern Graphites ability to achieve 95% grade while maintaining flake size is a key advantage. Exhibit 6 Comparable Deposit

Project Magnesita Projects: Pedra Azul/Cach. Pajeu Almenara Northern Graphite: 1 Bissett Creek

1

Geologic Resource (000 tonnes) 21,760 35,477 32,668

Carbon Content (%) 4.30% 5.18% 2.22%

+80 Mesh (Flake) 31.60% 46.56% 80.00%

+80 Mesh Flake Grade (%) 1.36% 2.41% 1.78%

+80 mesh percentage is an approximate value. From the Scoping Study, 70% is expected to be +48 mesh and all material will be +100 mesh Source: Magnesita Refratarios S.A., Northern Graphite Corp.

Jonathan Lee, MBA 647.426.1674 jlee@byroncapitalmarkets.com

Page |6

Northern Graphite Corp.

Valuation

We estimate that the capital costs to build the mine will be $70 million with half of the capital costs being financed with debt at 10% for a duration of 10 years with the remaining $35 million through raised equity. Production will begin in 2013 at a rate of 19,000 tpa of graphite, with 70% sold at +48 mesh size at an average price of $2,200/tonne while the -48+100 mesh size graphite would be the remaining 30% being sold at $1,800/tonne graphite. On the cost side, we have taken operating costs to approximately $1,100/tonne graphite produced. This takes into consideration the simple flow sheet of mine, crush, grind, float and re-float while achieving 95% yield, which is inline with previous metallurgical work and should be confirmed again in September 2011. Additionally, we have taken into consideration the $20/tonne royalty on graphite produced. Given our expectation that graphite demand growth will continue, especially for larger flake graphite used in Li-ion batteries, and Northern Graphites ability to scale up the project, we expect the company to double production in 2016 to meet that surging demand, mainly from the automotive sector. We have used conservative pricing for Northern Graphites large flake 94% carbon content material (see Exhibit 10). By looking at Exhibit 9, you can see the sensitivity to graphite pricing. Thus, less conservative graphite pricing can dramatically increase the value of the project.

As a near-term mine developer, Northern Graphite can add value to the firm quickly by ramping up production and cash flow

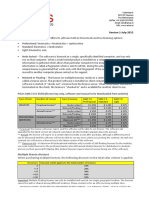

Exhibit 7 Discounted Cash Flow

2011 Fixed capital investments Capital costs: debt Principal paid Debt service (10%, 10 year) Net Income Royalties (2.5%) Depreciation Change in working capital Cash flow to NGC Discount rate Discounted cash flow NPV @ 14% Cash (est) Cash from warrants/options Shares outstanding (FD) Target price 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 ($70,000) ($30,000) $35,000 1 2 3 4 5 6 7 8 9 10 $0 ($2,196) ($2,416) ($2,657) ($2,923) ($3,215) ($3,537) ($3,891) ($4,280) ($4,708) ($5,178) $0 ($3,500) ($3,280) ($3,039) ($2,773) ($2,481) ($2,159) ($1,806) ($1,417) ($989) ($518) $3,054 $383 $5,707 $383 $9,091 $4 2022 2023

$0 $0

($1,723) ($19,684) $27 $27 $291

$7,890 $23,054 $22,431 $23,389 $24,225 $24,973 $25,657 $28,216 $383 $766 $766 $766 $766 $766 $766 $766 $7,218 $4 $5,731 $3,387 $4,551 $2 $3,613 $2 $2,869 $1 $2,278 $0 $1,809 ($0) $0 ($1)

$14,420 $11,449 $0 $3,494

($2,041) ($42,487) 14% ($2,041) ($37,269) $78,251 $3,000 $5,174 45,602 $1.90

$8,211 $11,753 ($18,201) $21,417 $22,677 $22,344 $22,048 $21,777 $21,522 $27,451 $274,506 $6,318 $7,933 ($10,777) $11,123 $10,331 $8,929 $7,729 $6,696 $5,805 $6,495 $56,976

Source: Byron Capital Markets Ltd.

Jonathan Lee, MBA 647.426.1674 jlee@byroncapitalmarkets.com

Page |7

Northern Graphite Corp.

Exhibit 8 Discount Rate Sensitivity

Discount Rate 16% 15% 14% 13% 12% 11% 10% 9% NPV $69,435 $77,495 $86,425 $96,330 $107,329 $119,556 $133,164 $148,328 Price/Sh $1.52 $1.70 $1.90 $2.11 $2.35 $2.62 $2.92 $3.25

Source: Byron Capital Markets Ltd.

Exhibit 9 Aggregate Graphite Price Sensitivity

Discount Rate 16% 15% 14% 13% 12% 11% 10% 9% Average Graphite Price/Tonne $3,000 $2,500 $2,120 $2,000 $3.63 $2.28 $1.52 $0.99 $3.98 $2.52 $1.70 $1.13 $4.37 $2.79 $1.90 $1.28 $4.80 $3.09 $2.11 $1.45 $5.28 $3.43 $2.35 $1.65 $5.82 $3.81 $2.62 $1.87 $6.42 $4.23 $2.92 $2.12 $7.09 $4.70 $3.25 $2.40

Source: Byron Capital Markets Ltd.

Exhibit 10 Current Graphite Pricing

Carbon Price Flake Content Range Size Mesh (%) (US$) Large +80 94-97 2,500 to 3,000 Medium +100-80 94-97 2,200 to 2,500 Medium +100-80 90 1,300 to 1,450 Medium +100-80 85-87 1,500 to 1,900 Fine -100 90 1,400 to 1,800

Source: Industrial Minerals Magazine, Roskill Industry Report, Northern Graphite Corp.

Jonathan Lee, MBA 647.426.1674 jlee@byroncapitalmarkets.com

Page |8

Northern Graphite Corp.

Conclusion

Northern Graphite is a late stage graphite mine developer that should have a producing mine by selling high-value graphite flakes in 2013 into the growing lithium-ion battery market. The company has begun the permitting process and given that the project flow sheet is simplistic and infrastructure is nearby, construction time should be about one year. We believe Bissett Creeks deposit size will also allow for Northern Graphite to more than double its production while maintaining over 20 years of resource. Low risk upcoming catalysts should keep investors excited about the company over the next six months. May 2011 results from step-out drilling indicate a significantly larger resource that will be released in a couple months followed by the BFS, which we expect to be released in November 2011. Also, pilot work is scheduled to be performed in September 2011 and given that the metallurgical work has been done twice, we foresee this as confirmation of past work. More importantly, it will provide Northern Graphite with material for strategic investors and/or off-take partners. Graphite prices have exploded over the past year, as China dominates the market with over 70% of market share and imposing a 20% export duty and a 17% value added tax on its graphite. Northern Graphites ability to come to market quickly and cheaply will allow the company to take advantage of the situation as well as continue to deliver continued news flow to the investor. We initiate coverage on Northern Graphite with a SPECULATIVE BUY rating and $1.90 target price based on 1.0x NAV using a 14% discount rate.

Jonathan Lee, MBA 647.426.1674 jlee@byroncapitalmarkets.com

Page |9

Northern Graphite Corp.

Appendix 1 Income Statement

Exhibit 11 Income Statement

Saleable (C kg, 000) C Price ($/kg) +48 mesh, 95% C Price ($/kg) +100 mesh, 95% Average realized graphite price Revenue (C kg, 000) Mining costs (000) Crushing costs (000) Processing cost (000) COGS COGS/tonne graphite Gross profit Mineral exploration General and administrative Stock-based compensation Expenses EBITDA Debt service (10%, 10 year) Depreciation EBT Tax expense (27%) Net income Royalties (2.5%) EPS Deficit, beginning of period Deficit, end of period Source: Byron Capital Markets 2011 0 $2.20 $1.80 $0 $0 $0 $0 $0 $0 $1,000 $640 $83 $1,723 ($1,723) $0 $0 ($1,723) $0 ($1,723) $27 ($0.04) ($1,750) ($3,498) ($5,248) 2012 0 $2.20 $1.80 $0 $0 $0 $0 $0 $0 $1,020 $653 $91 $1,764 ($1,764) $3,500 $14,420 ($19,684) $0 ($19,684) $27 ($0.43) ($19,711) ($5,248) ($24,959) 2013 19,152 $2.20 $1.80 $2.12 $40,602 $7,470 $1,494 $12,150 $21,114 $1.102 $19,488 $918 $686 $100 $1,704 $17,784 $3,280 $11,449 $3,054 $0 $3,054 $383 $0.07 $2,671 ($24,959) ($22,288) 2014 19,152 $2.20 $1.80 $2.12 $40,602 $7,470 $1,494 $12,150 $21,114 $1.102 $19,488 $826 $720 $105 $1,651 $17,837 $3,039 $9,091 $5,707 $0 $5,707 $383 $0.13 $5,324 ($22,288) ($16,963) 2015 19,152 $2.20 $1.80 $2.12 $40,602 $7,470 $1,494 $12,150 $21,114 $1.102 $19,488 $744 $756 $107 $1,607 $17,881 $2,773 $7,218 $7,890 $0 $7,890 $383 $0.17 $7,507 ($16,963) ($9,456) 2016 38,304 $2.20 $1.80 $2.12 $81,204 $14,940 $2,988 $24,300 $42,228 $1.102 $38,976 $669 $794 $105 $1,568 $37,408 $2,481 $5,731 $29,196 $6,143 $23,054 $766 $0.64 $22,288 ($9,456) $12,831 2017 38,304 $2.20 $1.80 $2.12 $81,204 $14,940 $2,988 $24,300 $42,228 $1.102 $38,976 $602 $833 $103 $1,539 $37,438 $2,159 $4,551 $30,728 $8,297 $22,431 $766 $0.68 $21,665 $12,831 $34,496 2018 38,304 $2.20 $1.80 $2.12 $81,204 $14,940 $2,988 $24,300 $42,228 $1.102 $38,976 $542 $875 $101 $1,518 $37,458 $1,806 $3,613 $32,040 $8,651 $23,389 $766 $0.71 $22,623 $34,496 $57,119

Jonathan Lee, MBA 647.426.1674 jlee@byroncapitalmarkets.com

P a g e | 10

Northern Graphite Corp.

Appendix 2 Management and Directors

Gregory Bowes, President, CEO and Director Mr. Bowes has over 25 years of experience in the resource and engineering industries. He holds an MBA from Queens University and an Honours B.Sc., Geology degree from the University of Waterloo. Mr. Bowes was Senior Vice President of Orezone Gold Corporation (Orezone Gold) (Feb/09 - Oct/09); Vice President, Corporate Development of its predecessor, Orezone Resources Inc. (Orezone Resources) (Jan/04 - Sept/05) and Chief Financial Officer (Oct/05 - Mar/07 and Apr/08 - Feb/09). From December 2006 until April 2008, Mr. Bowes served as President, CEO and a director of San Anton Resource Corporation. Mr. Bowes is a director of Industrial Minerals. Donald K.D. Baxter, President Mr. Baxter has a degree in Mining Engineering from Queens University (1987). For the past five years, he has been President of Ontario Graphite Limited, which is attempting to bring the Kearney graphite property, a past producing mine located near Huntsville, Ontario, back into production. Mr. Baxter was Mine Superintendent and Chief Mine Engineer at Kearney between 1990 and 1995. Prior to 1990, Mr. Baxter was involved in mine engineering and operations with INCO Ltd. and Noranda Minerals Inc. Stephen Thompson, Chief Financial Officer Mr. Thompson holds a Bachelor of Commerce (honours) degree from Queens University (1991) and is a Chartered Accountant, as well as a Certified Public Accountant (Illinois) with more than 20 years of experience in accounting and finance. For the past three years, he has provided financial management and leadership services to a number of small Ottawa-based companies. He was previously Vice President, Finance of Espial Group Inc.; Vice President, Finance of Hydro Ottawa Limited; and Vice President Controller of Accelio Corporation. Iain Scarr, Director Mr. Scarr is founder and principal of IMEX Consulting, which provides business development, mining and marketing services to the industrial minerals industry. Mr. Scarr spent 30 years with Rio Tinto Exploration and was most recently Commercial Director and Vice President, Exploration of the Industrial Minerals division. He holds a B.Sc. in Earth Sciences from California State Polytechnic University and MBA from Marshall School of Business at the University of Southern California. Mr. Scarr is currently Vice President, Development of Lithium One Inc. Ron Little, Director Mr. Little is the President, CEO and a director of Orezone Gold. Mr. Little has more than 20 years of senior level experience in mineral exploration, mine development, mine operations and capital markets. He spent the past 15 years focused on African projects, where he was responsible for over $1.2 billion of transactions with the predecessor company Orezone Resources. Mr. Little has held directorships with other public and private companies and held senior operating positions in both major and junior gold producing companies.

Jonathan Lee, MBA 647.426.1674 jlee@byroncapitalmarkets.com

P a g e | 11

Northern Graphite Corp.

Jay Chmelauskas, Director Mr. Chmelauskas is President of Western Lithium Corp. and was previously the President and CEO of China Gold International Resources Corp. Ltd. (formerly Jinshan Gold Mines), where he successfully managed and led the company during all phases of the commissioning of one of Chinas largest open pit gold mines. Mr. Chmelauskas has considerable experience in the exploration, development and mining industry, including a large Placer Dome Inc. gold mine, and business analyst position with chemical manufacturer Methanex Corporation. Mr. Chmelauskas has a Bachelor of Applied Science in Geological Engineering from the University of British Columbia and a Master of Business Administration from Queens University. Donald Christie, Director Mr. Christie is a Chartered Accountant and currently a Partner and Chief Financial Officer with Alexander Capital Group (Alexander Capital). He is a director of Alpha One Corporation, a capital pool company. Prior to his involvement with Alexander Capital, Mr. Christie co-founded Ollerhead Christie & Company Ltd. (Ollerhead Christie), a privately held Toronto investment banking firm which sourced, structured and syndicated debt private placements and provided financial advisory services to a client base comprised primarily of colleges, universities, schools boards and provincial government agencies. Prior to founding Ollerhead Christie, Mr. Christie served as Vice President and a director of Newcourt Capital Inc. (Newcourt), formerly the corporate finance subsidiary of then publicly-traded Newcourt Credit Group, which subsequently combined with the CIT Group, Inc. While at Newcourt, Mr. Christie was involved in the structuring and syndication of over $1.5 billion of transactions. Mr. Christie holds a B.Comm degree from Queens University. K. Sethu Raman, Director Dr. Raman is an independent mining consultant with over 35 years of international experience in all phases of exploration and development and has held senior executive positions in several public mining companies. He spent 13 years with Campbell Chibougamau Mines Ltd. and Royex Gold Group of companies (now Barrick Gold Corp.) in various management positions including Vice President (1980 - 86) where he played a key role in the discovery and development in six operating gold mines and major acquisitions including Hemlo Gold Mine and Nickel Plate Gold Mine. From 1986 to 2004, Dr. Raman was President and CEO of Holmer Gold Mines Limited, which discovered and developed the Timmins West Gold deposit. On December 31, 2004, Lake Shore Gold Corp. acquired all of the issued and outstanding shares of Holmer. Dr. Raman holds a Ph.D (1970) in geology from Carleton University, Ottawa and a UNESCO Post-Graduate Diploma (1965) from University of Vienna, Austria. John S. Rogers, Senior Project Advisor Mr. Rogers was a formerly Manager of Nanisivik and Detour Lake Mines and Director of Operations, Saudi Arabian Mining Company. George Hawley, Technical Advisor Mr. Hawley has 40 years of experience in Industrial Minerals in research, process and product development, market analysis and development.

Jonathan Lee, MBA 647.426.1674 jlee@byroncapitalmarkets.com

P a g e | 12

Northern Graphite Corp.

Notes

Jonathan Lee, MBA 647.426.1674 jlee@byroncapitalmarkets.com

P a g e | 13

Northern Graphite Corp.

Notes

Jonathan Lee, MBA 647.426.1674 jlee@byroncapitalmarkets.com

P a g e | 14

Northern Graphite Corp.

IMPORTANT DISCLOSURES Analyst's Certification All of the views expressed in this report accurately reflect the personal views of the responsible analyst(s) about any and all of the subject securities or issuers. No part of the compensation of the responsible analyst(s) named herein is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the responsible analyst(s) in this report. The particulars contained herein were obtained from sources which we believe to be reliable but are not guaranteed by us and may be incomplete. Byron Capital Markets Ltd. (Byron) is a Member of IIROC and CIPF. Byron compensates its research analysts from a variety of sources. The research department is a cost centre and is funded by the business activities of Byron including institutional equity sales and trading, retail sales and investment banking. Since the revenues from these businesses vary, the funds for research compensation vary. No one business line has greater influence than any other for research analyst compensation. Dissemination of Research Byron endeavours to make all reasonable efforts to provide research simultaneously to all eligible clients. Byron equity research is distributed electronically via email and is posted on our proprietary website to ensure eligible clients receive coverage initiations and ratings changes, targets and opinions in a timely manner. Additional distribution may be done by the sales personnel via email, fax or regular mail. Clients may also receive our research via a third party. Company Specific Disclosures: 1 The research analyst(s) and/or associates who prepared our original research report have viewed the material operations of this company. 2 Their travel expenses were not reimbursed by this company, its employees or affiliates. 3 The research analyst(s) and/or associates who prepared this report (or their household members) hold an equity position in Industrial Minerals Inc., which holds 9,750,000 shares of Northern Graphite Corporation. Investment Rating Criteria STRONG BUY The security represents extremely compelling value and is expected to appreciate significantly from the current price over the next 12-18 month time horizon. The security represents attractive value and is expected to appreciate significantly from the current price over the next 12-18 month time horizon. The security is considered a BUY but in the analysts opinion possesses certain operational and/or financial risks that may be higher than average. The security represents fair value and no material appreciation is expected over the next 12-18 month time horizon. The security represents poor value and is expected to depreciate over the next 12-18 month time horizon.

BUY

SPECULATIVE BUY

HOLD

SELL

Other Disclosures This report has been approved by Byron for distribution in Canada for the use of Byrons clients. Clients wishing to effect transactions in any security discussed should do so through a qualified Byron salesperson, registered in their jurisdiction. Informational Reports From time to time, Byron will issue reports that are for information purposes only, and will not include investment ratings. These reports will be clearly labeled as appropriate.

Jonathan Lee, MBA 647.426.1674 jlee@byroncapitalmarkets.com

P a g e | 15

Northern Graphite Corp.

Company Directory

Campbell Becher Geoff Clarke, MBA, LL.B., LL.M. Dale Sampson Gillian Wong-Hinds, CGA Robert Orviss, CFA Derrick Chiu Brad Freelan John Rak Chris Hobbs, CA Greg Borsk, CA Jamie Grundman Steve Lambros, MD Elisa Chio Mary Stuart Russell Mills Marco Beretta Guy Gordon, CFA, MBA Jon Hykawy, PhD, MBA Shawn Morgan Al P. Nagaraj, M.S., MBA Byron Berry, M.A., CFA Jeff Wu, CFA Brian Szeto, M.A., CFA Jonathan Lee, MBA Merril W. McHenry, CFA Omid Ameri Sandy Lam Trading Desk Nick Stajduhar Jonathan Samahin, CFA Tom Chudnovsky David Kemp Cyrus Osena Graham Farrell Kariv Oretsky Nick Perkell Mike Gardner Charles Pollock Charlie Mitchell Taylor Davison Patsy Fernandes Kathy Sherban Joe Ladeira Ali Mohammad Elisabeth Wightwick Dorothy Dudek Sandra Stefanescu Victoria Williston Jen Levy Sandra Day Zarina Belcher Chief Executive Officer President and Chief Operating Officer Chief Compliance Officer Chief Financial Officer

EXECUTIVE

647.426.1657 416.867.8882 416.867.1569 416.867.8883 campbell@byroncapitalmarkets.com gclarke@byroncapitalmarkets.com dsampson@byroncapitalmarkets.com gwh@byroncapitalmarkets.com rorviss@byroncapitalmarkets.com derrick@byroncapitalmarkets.com bfreelan@byroncapitalmarkets.com jrak@byroncapitalmarkets.com chobbs@byroncapitalmarkets.com gborsk@byroncapitalmarkets.com jgrundman@byroncapitalmarkets.com slambros@byroncapitalmarkets.com elisa@byroncapitalmarkets.com mstuart@byroncapitalmarkets.com rmills@byroncapitalmarkets.com mberetta@byroncapitalmarkets.com guy@byroncapitalmarkets.com jhykawy@byroncapitalmarkets.com smorgan@byroncapitalmarkets.com anagaraj@byroncapitalmarkets.com bberry@byroncapitalmarkets.com jwu@byroncapitalmarkets.com bszeto@byroncapitalmarkets.com jlee@byroncapitalmarkets.com mmchenry@byroncapitalmarkets.com oameri@byroncapitalmarkets.com slam@byroncapitalmarkets.com

INVESTMENT BANKING

Managing Director Managing Director, Head of Equity Capital Markets Vice President, Investment Banking Vice President, Investment Banking Co-Head, Mergers and Acquisitions Co-Head, Mergers and Acquisitions Analyst, Investment Banking Associate Associate Associate Associate Associate, Syndication 647.426.1668 647.426.1662 416.867.3144 604.697.2456 647.426.0467 647.426.0466 647.426.0469 647.426.1659 647.426.0288 604.616.5311 647.426.0290

RESEARCH

647.426.0289 647.426.1672 647.426.1656 647.426.0473 647.426.0291 416.867.1623 604.697.2455 647.426.1673 647.426.1674 647.426.1660 416.867.3984 416.867.2375

Managing Director, Head of Research, Oil & Gas Analyst Head of Global Research, Clean Tech and Materials Analyst Managing Editor & Production Coordinator Special Situations Analyst Strategist Mining Analyst Mining Analyst Battery Materials and Technologies Analyst Mining and Metals Analyst Associate Associate

SALES & TRADING

(main telephone line) Vice President, Head of Institutional Sales Vice President, Head of Global Trading Vice President, Institutional Sales Managing Director, Institutional Trading Vice President, Head of Business Development Institutional Sales & Trading Institutional Sales Institutional Trading Head of Proprietary Trading Proprietary Trader Proprietary Trader Equity Trader Associate, Sales and Trading Sr. Vice President, Operations and Administration Vice President, Compliance Controller / Regulatory Accountant Executive Assistant Executive Assistant Compliance Officer Administrative Assistant Associate, Operations and Administration Office Manager Vancouver Office Manager Toronto 647.426.1670 647.426.1664 647.426.1670 647.426.1665 647.426.1666 647.426.1675 647.426.1667 647.426.1658 647.426.1671 416.867.8880 416.967.8880 416.469.9609 416.867.8880 416.867.2375 416.867.1650 647.426.1660 416.364.2678 416.867.8881 647.426.0471 641.426.0470 416.867.9800 416.867.9064 604.697.2540 647.426.1660 nick@byroncapitalmarkets.com jsamahin@byroncapitalmarkets.com tom@byroncapitalmarkets.com dkemp@byroncapitalmarkets.com cosena@byroncapitalmarkets.com gfarrell@byroncapitalmarkets.com koretsky@byroncapitalmarkets.com nperkell@byroncapitalmarkets.com michaelgardner@byroncapitalmarkets.com cpollock@byroncapitalmarkets.com cmitchell@byroncapitalmarkets.com tdavison@byroncapitalmarkets.com pfernandes@byroncapitalmarkets.com ksherban@byroncapitalmarkets.com jladeira@byroncapitalmarkets.com amohammad@byroncapitalmarkets.com ewightwick@byroncapitalmarkets.com ddudek@byroncapitalmarkets.com sstefanescu@byroncapitalmarkets.com vwilliston@byroncapitalmarkets.com jlevy@byroncapitalmarkets.com sday@byroncapitalmarkets.com zbelcher@byroncapitalmarkets.com

FINANCE, ADMINISTRATION AND OPERATIONS

TORONTO VANCOUVER 4 KING STREET WEST, SUITE 1100 1075 WEST GEORGIA STREET, SUITE 1330 TORONTO, ON M5H 1B6 VANCOUVER, BC V6E 3C9

Jonathan Lee, MBA 647.426.1674 jlee@byroncapitalmarkets.com

P a g e | 16

Você também pode gostar

- Alternative Materials for One Cent CoinageNo EverandAlternative Materials for One Cent CoinageAinda não há avaliações

- Facts About Graphite As A Strategic MineralDocumento3 páginasFacts About Graphite As A Strategic MineralRichard J MowatAinda não há avaliações

- A Look at The Lithium Clay Projects - Trabajo Rec Reservas Litio Arcillas y MetalurgiaDocumento10 páginasA Look at The Lithium Clay Projects - Trabajo Rec Reservas Litio Arcillas y Metalurgiaigor colladoAinda não há avaliações

- Graphite High Tech Supply Sharpens Up Nov 00Documento12 páginasGraphite High Tech Supply Sharpens Up Nov 00Familoni LayoAinda não há avaliações

- Informe - 468 - 18-11-2022bDocumento44 páginasInforme - 468 - 18-11-2022bMadahi Katherine Garcia MedranoAinda não há avaliações

- Will Cheap Asian HPAL Save The EV Industry From Its Looming SuccessDocumento10 páginasWill Cheap Asian HPAL Save The EV Industry From Its Looming SuccessDartwin ShuAinda não há avaliações

- Electric VehiclesDocumento10 páginasElectric Vehiclescarolyncolaco10Ainda não há avaliações

- PVFeedstockCost 5YearOutlookDocumento8 páginasPVFeedstockCost 5YearOutlookthanhlinh9191Ainda não há avaliações

- ArticleDocumento3 páginasArticlesuresh_mohite1524Ainda não há avaliações

- 0909 PDFDocumento3 páginas0909 PDFCris CristyAinda não há avaliações

- Galaxy Resources ReportDocumento28 páginasGalaxy Resources Reportokeydokey01Ainda não há avaliações

- Getting Graphite Prices RightDocumento5 páginasGetting Graphite Prices RightMochammad AdamAinda não há avaliações

- Concern Over Battery Grade Graphite SuppliesDocumento2 páginasConcern Over Battery Grade Graphite SuppliesRichard J MowatAinda não há avaliações

- Coal Part 2 MaterialsDocumento17 páginasCoal Part 2 MaterialsNs1503Ainda não há avaliações

- Clariant Shuts Two North American Masterbatch Sites, Mulls Production Plant in RussiaDocumento2 páginasClariant Shuts Two North American Masterbatch Sites, Mulls Production Plant in RussiaGavoutha BisnisAinda não há avaliações

- Carbon Products - A Major ConcernDocumento3 páginasCarbon Products - A Major ConcernjaydiiphajraAinda não há avaliações

- Silicon Carbide Carborundum MarketDocumento9 páginasSilicon Carbide Carborundum MarketEugênia PheganAinda não há avaliações

- Business Plan MagnetiteDocumento45 páginasBusiness Plan MagnetiteJuliano ConstanteAinda não há avaliações

- 854 Neometals Commences Lithium Battery Recycling Pilot PlantDocumento7 páginas854 Neometals Commences Lithium Battery Recycling Pilot PlantGalih TaqwatomoAinda não há avaliações

- Graphite OutlookDocumento21 páginasGraphite OutlookMasna PrudhviAinda não há avaliações

- First Analysis Lithium Update June 2014Documento31 páginasFirst Analysis Lithium Update June 2014odiegarfield100% (1)

- Building On The Strength of Our People and Our Portfolio: 2011 Annual ReportDocumento160 páginasBuilding On The Strength of Our People and Our Portfolio: 2011 Annual ReportmtzakovAinda não há avaliações

- Top Ten GTL Projects of The WorldDocumento8 páginasTop Ten GTL Projects of The Worldhimadri.banerji60Ainda não há avaliações

- Carbon BlackDocumento11 páginasCarbon BlackYEHAinda não há avaliações

- Tata Steel Stock AnalysisDocumento50 páginasTata Steel Stock AnalysisAmitabh VatsyaAinda não há avaliações

- Downstream IGO Nickel Sulfate PDFDocumento7 páginasDownstream IGO Nickel Sulfate PDFRyan E NugrohoAinda não há avaliações

- Final Project ReportDocumento15 páginasFinal Project ReportRishi Mehta100% (1)

- Lithium Sediments: Jindalee Resources Limited (ASX:JRL)Documento21 páginasLithium Sediments: Jindalee Resources Limited (ASX:JRL)nuseAinda não há avaliações

- Coal Quality Improvement Technology Brief-EngDocumento10 páginasCoal Quality Improvement Technology Brief-EngRiko C PribadiAinda não há avaliações

- Recycling of PGM Secures The Supplies of Key Industry SectorsDocumento12 páginasRecycling of PGM Secures The Supplies of Key Industry Sectorsapi-94537271Ainda não há avaliações

- Raphite: by Rustu S. KalyoncuDocumento11 páginasRaphite: by Rustu S. KalyoncudimasAinda não há avaliações

- Lithium Stocks in 2021Documento11 páginasLithium Stocks in 2021FrankAinda não há avaliações

- ITC June 2022 Paper 3 Question 1 IntellectDocumento5 páginasITC June 2022 Paper 3 Question 1 Intellectdjbongz777Ainda não há avaliações

- Pmegp Flyash Bricks Project Report 4-24 PDFDocumento16 páginasPmegp Flyash Bricks Project Report 4-24 PDFRaj Shrama100% (2)

- Vertical Shaft Calcination Process DescriptionDocumento5 páginasVertical Shaft Calcination Process DescriptionP.S.J.Sarma0% (1)

- Raphite: by Rustu S. KalyoncuDocumento7 páginasRaphite: by Rustu S. KalyoncuJaideep RajeAinda não há avaliações

- Steel Industry Research PaperDocumento4 páginasSteel Industry Research Papers0l1nawymym3100% (1)

- GPM Quadruples Plant Recovery Using Albion Process: Breaking NewsDocumento6 páginasGPM Quadruples Plant Recovery Using Albion Process: Breaking NewsravibelavadiAinda não há avaliações

- American Chemical CorporationDocumento9 páginasAmerican Chemical CorporationKishor Chindam100% (11)

- An Introduction To Geopolymer Concrete: Indian Concrete Journal November 2011Documento5 páginasAn Introduction To Geopolymer Concrete: Indian Concrete Journal November 2011m g vidyashree CivilAinda não há avaliações

- Graphite Outlook 2020Documento14 páginasGraphite Outlook 2020Mochammad AdamAinda não há avaliações

- CBF & Pultrusion Basalt Composite Materials Production Project in ArmeniaDocumento16 páginasCBF & Pultrusion Basalt Composite Materials Production Project in ArmeniaAnonymous LhmiGjOAinda não há avaliações

- North of 60 Mining News - The Mining Newspaper For Alaska and Canada's NorthDocumento4 páginasNorth of 60 Mining News - The Mining Newspaper For Alaska and Canada's NorthAndrewAinda não há avaliações

- Parry Pasricha Rain IndustriesDocumento25 páginasParry Pasricha Rain IndustriesKunal Desai100% (1)

- Powder Metallurgy at Automotive Parts Plant: Energy EfficiencyDocumento4 páginasPowder Metallurgy at Automotive Parts Plant: Energy Efficiencypandeydeepak88Ainda não há avaliações

- F18 ARS Annual Report 2018 Final EYDocumento59 páginasF18 ARS Annual Report 2018 Final EYRendy SentosaAinda não há avaliações

- 19-Grange Overview (1.36 MB) - 27 Mar 06Documento3 páginas19-Grange Overview (1.36 MB) - 27 Mar 06basilmabrookvAinda não há avaliações

- Atrum Coal Investment Fact Sheet February 2012Documento3 páginasAtrum Coal Investment Fact Sheet February 2012mekarsari retnoAinda não há avaliações

- Icheme Wcce 05 LNG Versus GTLDocumento11 páginasIcheme Wcce 05 LNG Versus GTLtj_kejAinda não há avaliações

- Graphite SummaryDocumento11 páginasGraphite SummaryFamiloni LayoAinda não há avaliações

- Cost Reduction in Polysilicon Manufacturing For PhotovoltaicsDocumento25 páginasCost Reduction in Polysilicon Manufacturing For PhotovoltaicsMohamed Farag MostafaAinda não há avaliações

- AAC Sample Prject Profile-CompleteDocumento19 páginasAAC Sample Prject Profile-Completettpatel91Ainda não há avaliações

- QT8 FlyAsh Bricks Project Report May-2014 PDFDocumento15 páginasQT8 FlyAsh Bricks Project Report May-2014 PDFesha108Ainda não há avaliações

- Case Studies in Open Pit Design Using Lerchs-Grossman Pit OptimizationDocumento8 páginasCase Studies in Open Pit Design Using Lerchs-Grossman Pit OptimizationTerry ChongAinda não há avaliações

- GeopolymerDocumento5 páginasGeopolymerjahremade jahremadeAinda não há avaliações

- 08-02-25 Geovic BrochureDocumento2 páginas08-02-25 Geovic Brochureaeid101Ainda não há avaliações

- 9 STG Gas To Liquids GTLDocumento6 páginas9 STG Gas To Liquids GTLDiego Bascope MaidaAinda não há avaliações

- Byron Capital TSX.V:AVC Initiation ReportDocumento16 páginasByron Capital TSX.V:AVC Initiation ReportRichard J MowatAinda não há avaliações

- Finance Sample MidtermDocumento21 páginasFinance Sample MidtermbillyAinda não há avaliações

- Preguntas Nivel 2Documento33 páginasPreguntas Nivel 2Luis AEAinda não há avaliações

- ECW2141 AssignmentDocumento4 páginasECW2141 AssignmentpeterAinda não há avaliações

- DipIFR 2009 Dec QDocumento19 páginasDipIFR 2009 Dec QSaed AliAinda não há avaliações

- Exchange Rate DeterminationDocumento22 páginasExchange Rate Determinationrajarjun100% (1)

- FitchDocumento9 páginasFitchTiso Blackstar Group100% (1)

- Problem Solving Percentage Change in Currency RatesDocumento24 páginasProblem Solving Percentage Change in Currency RatesAbdallah ClAinda não há avaliações

- Barter Barron in BusinessDocumento26 páginasBarter Barron in BusinessLeon Van Tubbergh100% (1)

- New Microsoft Word DocumentDocumento17 páginasNew Microsoft Word Documentmahesh_zorrick8907Ainda não há avaliações

- Asking To See A Product DialoguesDocumento13 páginasAsking To See A Product DialoguesIuliana RasaneanuAinda não há avaliações

- (2016-S1) - FINS3616 - Tutorial Slides - Week 02 - Introduction + FX Bas...Documento53 páginas(2016-S1) - FINS3616 - Tutorial Slides - Week 02 - Introduction + FX Bas...itoki229Ainda não há avaliações

- SAM 7.0 PricingDocumento2 páginasSAM 7.0 PricingFabianAinda não há avaliações

- Hedging With Foreign Currency Futures at Transcend IncDocumento5 páginasHedging With Foreign Currency Futures at Transcend IncYuyun Purwita SariAinda não há avaliações

- Global Business Environment Strategy D1Documento11 páginasGlobal Business Environment Strategy D1DAVIDAinda não há avaliações

- IFM10e TB 13Documento10 páginasIFM10e TB 13k59.2014310091Ainda não há avaliações

- NullDocumento22 páginasNullapi-28191758100% (1)

- CS-Euro Strategy 11may12Documento36 páginasCS-Euro Strategy 11may12Stathis MetsovitisAinda não há avaliações

- Liquidity Management: Corporate Financial Management 3e Emery Finnerty StoweDocumento52 páginasLiquidity Management: Corporate Financial Management 3e Emery Finnerty StoweMichelle GoAinda não há avaliações

- Restore Classic Cars Business PlanDocumento33 páginasRestore Classic Cars Business PlanCristianbraicu0% (1)

- Ltcma Full ReportDocumento130 páginasLtcma Full ReportclaytonAinda não há avaliações

- Chap 008Documento23 páginasChap 008Qasih IzyanAinda não há avaliações

- Numerical Test Tutorial SHL Style Sample PDFDocumento18 páginasNumerical Test Tutorial SHL Style Sample PDFBob100% (1)

- FX Rates Sheet Treasury & Capital Markets Group: Ready Transaction Rates Indicative FBP RatesDocumento1 páginaFX Rates Sheet Treasury & Capital Markets Group: Ready Transaction Rates Indicative FBP RatesUmair AhmedAinda não há avaliações

- Mcdonalds Swot AnalysisDocumento18 páginasMcdonalds Swot AnalysisSimo El KettaniAinda não há avaliações

- Annual Report 2010 1Documento329 páginasAnnual Report 2010 1congsang099970Ainda não há avaliações

- Shity PaperDocumento2 páginasShity PaperCarina MerceaAinda não há avaliações

- Fund5e Chap05 PbmsDocumento44 páginasFund5e Chap05 PbmsLêViệtPhươngAinda não há avaliações

- Intro To FX SlidesDocumento81 páginasIntro To FX Slidessbrownv100% (1)

- Alibaba Numbers Could Be Fake, Bronte Capital Hedge Fund Manager Says - FortuneDocumento18 páginasAlibaba Numbers Could Be Fake, Bronte Capital Hedge Fund Manager Says - Fortunebhaskar.jain20021814Ainda não há avaliações

- 038-Palting vs. San Jose Petroleum Inc. 18 Scra 924 (1966)Documento10 páginas038-Palting vs. San Jose Petroleum Inc. 18 Scra 924 (1966)wewAinda não há avaliações