Escolar Documentos

Profissional Documentos

Cultura Documentos

About Loan Process

Enviado por

Prasad SailDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

About Loan Process

Enviado por

Prasad SailDireitos autorais:

Formatos disponíveis

Hi, I have taken Home & top-up loan from ICICI bank with floating ROI.

RBI reduced the Repo rate & so nationalized banks also reduced the FRR/PLR (SBI's home loan interest rate 8% to 8.5%). But private banks like ICICI are not reducing it proportionately (for me currently ICICI's Home loan Interest rate is 13%, for top-up it is 14.75% & FRR/PLR is 13.75%). But while increasing FRR / PLR, they are always ahead of nationalized banks. Four-Five yrs before, when I approached the ICICI bank for home loan, Interest rate of ICICI (In May 2004, FRR/PLR of ICICI was 7.75% & with -0.75% variance with FRR/PLR, I got the loan at 7.00% ROI) & Nationalized bank was almost same (Nationalised banks were charging around 7.50% interest rate). Now the difference between ROI in Nationalized banks & ICICI is around 5% (13% - 8%). [The effect of the difference in ROI of Home Loans between nationalized & ICICI bank for Rs. 10,00,000/- loan & the tenure of 20 yrs is Rs. 3,500/- per month .] Currently, Bank rates of ICICI bank are different, for new / existing customers. So without reducing FRR/PLR, they are reducing interest rate for new customers (just to attract new customers) by giving more variance in FRR/PLR with ROI. So they are charging ROI of 13% for existing customers & around 9.75 for new customers. Not sure, whether this is cheating of existing customers as per consumer laws / RBI regulations. I taken floating interest rate option, under the impression that "Floating Interest Rate" means the FRR/PLR is directly proportional with the RBI Repo rate. ICICI, increases the FRR/PLR, immediately after increase in REPO, but while reducing they are reluctant (just to fill their pockets with the difference between FRR/PLR & Repo). Then what is meaning of "Floating Interest Rate"? I think, it's cheating with the customers. We, as a consumer, understand, if there is * minor dis-proportion of FRR/PLR of banks with RBI Repo Rate and

* minor difference of Interest rates in Nationalized & Private bank. But when there is huge difference, we, as a consumer or as a common man, become helpless. We feel that private banks like ICICI are cheating us. And when there is recession and people have fear of job loss this is very frustrating. Transfer of loans to some other bank is one solution on this problem, but an expensive one. For transfer, ICICI will charge 2% on the outstanding principle, plus applicable service tax @12.36% on the foreclosure

charges. Then processing fees (0.5%) of the new bank is new burdon, though which is acceptable. Since loan transfer is Prepayment of the loan (by taking loan from other bank). Not only for loan transfer but even for Prepayment, ICICI charge 2% on outstanding Amount. Not sure, whether charges on Full Payment / Prepayment has any legal ground, because as per my knowledge, SBI is not chanring anything for Pre-payment (But I am not sure). In this way, ICICI has blocked all the roads of customers (loan transfer is expensive, staying with ICICI is also expensive). Note: Last week, ICICI came up with scheme for existing customers to reduce the interest rate (making variance with FRR/PLR to 4%) by paying 0.5% of outstanding amount & some other fees. By this scheme now status of existing customer for home loan will be changed to new customer & he will get new home loan account number. So bank is treating existing customer as a new customer, by charging some amount. Just to reduce EMI burdon of my home loan- though unwillingly- I opted for it, which may get effect in next month. But scheme is not for top-up loan. So still having very high ROI for top-up loan. Though I am not happy, in paying for such Home-Loan scheme, to reduce the ROI; since RBI reduced the Repo and ICICI is supposed to transfer that benefit to existing customer (having floating rate option)without delay & without such extra payment schemes (where existing customers will be converted to new customer). RBI / Central Government are the governing bodies, but they may not have any control on this. As a common man, confused with the situation. Don't know who can help us. There is always hope from Consumer Court, but not sure, if this issue can be discussed in consumer court. I have taken insurance on my both the loans from ICICI for security purpose. Even I don't know now my new customer status in case of Home Loan, will nullify the insurance coverage for my home loan.

I know this is not the personal problem but for all ICICI customers. But any solution on this?

base 10.75% Baroda Home Loan to Individuals / NRIs / PIOs (W.E.F 01.08.2011) Fixed Rate option Floating Rate option Repayment Period Up to Rs. 30 Lacs Above Rs. 30 Lacs 75 Lacs and above Not Available

and below Rs. 75 Lacs Upto 5 years Over 5 years & up to 15 years 0.50% above Base Rate 0.75% above Base Rate 1.25% above Base Rate 1.50% above Base Rate 1.75% above Base Rate Base Rate + 1.50% Base Rate +1.75% Base Rate +2.00%

Over 15 years & up to 1.00% above Base 25 yrs Rate

Concession of 0.25 % in interest rate available upto 31.12.2011 during Retail Loan Festival Campaign on Home Loan

=10.75+.75-.25 =11.25

AXIS BANK SUPER RATE OF INTEREST 11.75%

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Analyzing Business TransactionsDocumento33 páginasAnalyzing Business Transactionsabdulw_40Ainda não há avaliações

- SME Bank v. de Guzman - G.R. No. 184517Documento2 páginasSME Bank v. de Guzman - G.R. No. 184517Nica Cielo B. LibunaoAinda não há avaliações

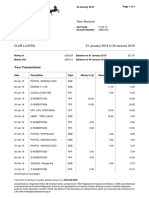

- 2019 January StatementDocumento3 páginas2019 January StatementDeclan Robertson33% (3)

- A Study of Investment Pattern of A Common Man A Literature ReviewDocumento4 páginasA Study of Investment Pattern of A Common Man A Literature ReviewEditor IJTSRDAinda não há avaliações

- Risk and Return Analysis of Three Bank Nifty StocksDocumento75 páginasRisk and Return Analysis of Three Bank Nifty StocksSangeethaAinda não há avaliações

- Understanding The Digital Economy Challenges For NDocumento5 páginasUnderstanding The Digital Economy Challenges For NВукашин Б ВасићAinda não há avaliações

- Final Sip Mba Project PDFDocumento87 páginasFinal Sip Mba Project PDFRinkesh Modi93% (14)

- GK About BanksDocumento3 páginasGK About BanksSanket VasaniAinda não há avaliações

- EOC13Documento28 páginasEOC13jl123123Ainda não há avaliações

- The Next Normal - DMCInsights May - 2021Documento41 páginasThe Next Normal - DMCInsights May - 2021Rama SubramanianAinda não há avaliações

- Sacco Societies Act 2008Documento139 páginasSacco Societies Act 2008James GikingoAinda não há avaliações

- Igcse Accounting Cash Book & Petty Cash Book: Prepared by D. El-HossDocumento42 páginasIgcse Accounting Cash Book & Petty Cash Book: Prepared by D. El-HossArvind Harrah100% (1)

- Future Wealth Gain PDFDocumento23 páginasFuture Wealth Gain PDFviswanathbobby8Ainda não há avaliações

- Financing CycleDocumento4 páginasFinancing CycleYzah CariagaAinda não há avaliações

- Funds Transfers - OverviewDocumento7 páginasFunds Transfers - OverviewCajita FelizAinda não há avaliações

- IF You Want To Purchase This and Any Other Then:-Contact Us atDocumento50 páginasIF You Want To Purchase This and Any Other Then:-Contact Us atJolina AynganAinda não há avaliações

- Ch02-Cash Inflow OutFlowDocumento45 páginasCh02-Cash Inflow OutFlowismat arteeAinda não há avaliações

- CHFS QuestionnaireDocumento102 páginasCHFS QuestionnaireNameAinda não há avaliações

- Series 63 NotesDocumento8 páginasSeries 63 Notesleo2331100% (2)

- Working Capital ManagementDocumento78 páginasWorking Capital ManagementPriya GowdaAinda não há avaliações

- Credit Limit Application Form PDFDocumento3 páginasCredit Limit Application Form PDFSaptavarnaa Sdn BhdAinda não há avaliações

- LIST OF IGNOU MBA Marketing Project TopicsbbDocumento2 páginasLIST OF IGNOU MBA Marketing Project TopicsbbSivaji VarkalaAinda não há avaliações

- BoA's $2B Benefits from Six SigmaDocumento7 páginasBoA's $2B Benefits from Six SigmaAzuati MahmudAinda não há avaliações

- Reference Book On Staff MattersDocumento910 páginasReference Book On Staff Matterssiddharthdatta89% (9)

- Bank of The Philippine Island V MendozaDocumento1 páginaBank of The Philippine Island V MendozaKya CabsAinda não há avaliações

- Aashi Gupta (FE1702) - Prakhar Sikka (FE1730)Documento12 páginasAashi Gupta (FE1702) - Prakhar Sikka (FE1730)Suprabha GambhirAinda não há avaliações

- Delayed: Intermediaries, They CollecDocumento16 páginasDelayed: Intermediaries, They CollecNadeesha UdayanganiAinda não há avaliações

- Remote Deposit Capture Project Part 1: Project Integration ManagementDocumento7 páginasRemote Deposit Capture Project Part 1: Project Integration ManagementManasa KarumuriAinda não há avaliações

- Statement June and JulyDocumento2 páginasStatement June and JulyGregory Scarpa SnrAinda não há avaliações

- RonishPokhrel BSBOPS502 Assessment TasksDocumento26 páginasRonishPokhrel BSBOPS502 Assessment Tasksronish pokrel100% (2)