Escolar Documentos

Profissional Documentos

Cultura Documentos

Industry Analysis: Current Trends in The Industry

Enviado por

Ashish GutgutiaDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Industry Analysis: Current Trends in The Industry

Enviado por

Ashish GutgutiaDireitos autorais:

Formatos disponíveis

1.

Industry Analysis

Current trends in the industry:

The growth in the Indian Banking Industry has been more qualitative than quantitative and it is expected to remain the same in the coming years. Based on the projections made in the "India Vision 2020" prepared by the Planning Commission and the Draft 10th Plan, the report forecasts that the pace of expansion in the balance-sheets of banks is likely to decelerate. The total assets of all scheduled commercial banks by end-March 2010 is estimated at ` 40,90,000 crores. That will comprise about 65 per cent of GDP at current market prices as compared to 67 per cent in 2002-03. Bank assets are expected to grow at an annual composite rate of 13.4 per cent during the rest of the decade as against the growth rate of 16.7 per cent that existed between 1994-95 and 2002-03. It is expected that there will be large additions to the capital base and reserves on the liability side. The Indian Banking Industry can be categorized into non-scheduled banks and scheduled banks. Scheduled banks constitute of commercial banks and co-operative banks. There are about 67,000 branches of Scheduled banks spread across India. As far as the present scenario is concerned the Banking Industry in India is going through a transitional phase. The Public Sector Banks (PSBs), which are the base of the Banking sector in India account for more than 78 per cent of the total banking industry assets. Unfortunately they are burdened with excessive Non Performing assets (NPAs), massive manpower and lack of modern technology. On the other hand the Private Sector Banks are making tremendous progress. They are leaders in Internet banking, mobile banking, phone banking, ATMs. As far as foreign banks are concerned they are likely to succeed in the Indian Banking Industry.

Major players in the industry:

In the Indian Banking Industry, Major Private Sector banks are ICICI bank, HDFC bank, Axis bank etc. Major public sector banks are IDBI Bank, State Bank of India, Punjab National bank, Vijaya Bank, UCO Bank, Oriental Bank, Allahabad Bank etc. Major foreign banks are ANZ Grindlays Bank, ABN-AMRO Bank, American Express Bank Ltd, Citibank etc. Major Co-operative Banks are rural co-operative banks comprise State co-operative banks, district central cooperative banks, SCARDBs and PCARDBs. Competitors of banking industry:

Banking industry in India face competition from a wide range of financial intermediaries in the public and private sectors in the areas of financial inter-mediation and financial services (although the payments system is exclusively for banks). Such intermediaries form a diverse group in terms of size and nature of their activities, and play an important role in the financial system by not only competing with banks, but also complementing them in providing a wide range of financial services. Some of these intermediaries include Term-lending institutions, Non-banking financial companies, Insurance companies and Mutual funds Term-Lending Institutions Term lending institutions exist at both state and all-India levels. They provide term loans (i.e., loans with medium to long-term maturities) to various industries, service and infrastructure sectors for setting up new projects and for the expansion of existing facilities and thereby competes with banks. At the all-India level, these institutions are typically specialized, catering to the needs of specific sectors, which make them competitors to banks in those areas. These include Export Import Bank of India (EXIM Bank) Small Industries Development Bank of India (SIDBI) Tourism Finance Corporation of India Limited (TFCI) Power Finance Corporation Limited (PFCL)

At the state level, various State Financial Corporations (SFCs) have been set up to finance and promote small and medium-sized enterprises. There are also State Industrial Development Corporations (SIDCs), which provide finance primarily to medium-sized and large-sized enterprises. In addition to SFCs and SIDCs, the North Eastern Development Financial Institution Ltd. (NEDFI) has been set up to cater specifically to the needs of the north-eastern states. Non-Banking Finance Companies (NBFCs) India has many thousands of non-banking financial companies, predominantly from the private sector. NBFCs are required to register with RBI in terms of the Reserve Bank of India (Amendment) Act, 1997. The principal activities of NBFCs include equipment-leasing, hire purchase, loan and investment and asset finance. NBFCs have been competing with and complementing the services of commercial banks for a long time. All NBFCs together currently account for around nine percent of assets of the total financial system.

Housing-finance companies form a distinct sub-group of the NBFCs. As a result of some recent government incentives for investing in the housing sector, these companies business has grown substantially. Housing Development Finance Corporation Limited (HDFC), which is in the private sector and the Government-controlled Housing and Urban Development Corporation Limited (HUDCO) are the two premier housing-finance companies. HDFC & HUDCO are major players in the mortgage business, and provide stiff competition to commercial banks in the disbursal of housing loans.

Insurance Companies Insurance/reinsurance companies such as Life Insurance Corporation of India (LIC), General Insurance Corporation of India (GICI), and others provide substantial long-term financial assistance to the industrial and housing sectors and to that extent, are competitors of banks. LIC is the biggest player in this area. Mutual Funds Mutual funds offer competition to banks in the area of fund mobilization, in that they offer alternate routes of investment to households. Most mutual funds are standalone asset management companies. In addition, a number of banks, both in the private and public sectors have sponsored asset management companies to undertake mutual fund business. Banks have thus entered the asset management business, sometimes on their own and other times in joint venture with others. Location of banking industry on the Tangibility Spectrum:

2. Typical Service Offering

1. Accounts (Zero Balance Savings Account, Prime Savings Account, Corporate Salary Account, Women's Savings Account, Demat Account, Senior Citizen's Account, Defence Salary Account, Trust/NGO Savings Account & Pension Savings Account) 2. Deposits(Fixed Deposits, Recurring Deposits & Tax Saver Fixed Deposit) 3. Loans (Home Loan, Car Loan, Personal Loan, Loan Against Shares, Loan Against Property, Loan Against Security, Study Loan & Consumer Loan) 4. Cards (Credit Cards, Debit Cards & Prepaid Cards) 5. Investments (Online Trading, Mutual Funds, Demat Account) 6. Insurance(Life Insurance, Health Insurance, Personal Accident, Home, Critical Illness Motor Insurance, Jewellery Insurance, Travel Companion & Business Advantage) 7. Payment Transfers(Bill Pay, Electronic Clearing Service & Tax Payments) 8. Other Services(Locker, Online Shopping etc.)

A SELF SERVICE SERVICESCAPE The service is designed around a customer helping self with the service .The role of service employees is limited. Customer performs most of the activities, either on their own or with a little help from the provider. Examples are ATMs, cinema halls, gymnasium and self service restaurants etc.The service provider must plan the facility exclusively with the customer in mind. The facility design can attempt to position it for the desired market segment, by making the facility pleasing and appropriate to use for them. A gym layout and design and design (choice of equipment) conveys the segment of population that is targeted slimming enthusiasts, body shapers, sportspersons, business executives and housewives or the youth.

AN INTERPERSONAL SERVICESCAPE When a service encounter requires a close interaction between the customer and provider the servicescape must be facilitate this interaction. An interpersonal servicescape is appropriate. Hotels, hospitals, schools and banks are examples of this type of servicescapes, they must be designed to attract, satisfy and facilitate the activities of both conducive to the interaction between the two

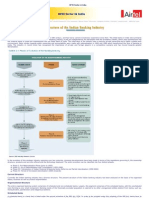

3. Service Blue Print

STRENGTH Indian banks have compared favourably on growth, asset quality and profitability with other regional banks over the last few years. The banking index has grown at a compounded annual rate of over 51 per cent since April 2001 as compared to a 27 percent growth in the market index for the same period. Policy makers have made some notable changes in policy and regulation to help strengthen the sector. These changes include strengthening prudential norms, enhancing the payments system and integrating regulations between commercial and co-operative banks. Bank lending has been a significant driver of GDP growth and employment. Extensive reach: the vast networking & growing number of branches & ATMs. Indian banking system has reached even to the remote corners of the country. The government's regular policy for Indian bank since 1969 has paid rich dividends with the nationalisation of 14 major private banks of India. In terms of quality of assets and capital adequacy, Indian banks are considered to have clean, strong and transparent balance sheets relative to other banks in comparable economies in its region.

India has 88 scheduled commercial banks (SCBs) - 27 public sector banks (that is with the Government of India holding a stake)after merger of New Bank of India in Punjab National Bank in 1993, 29 private banks (these do not have government stake; they may be publicly listed and traded on stock exchanges) and 31 foreign banks. They have a combined network of over 53,000 branches and 17,000 ATMs. According to a report by ICRA Limited, a rating agency, the public sector banks hold over 75 percent of total assets of the banking industry, with the private and foreign banks holding 18.2% and 6.5% respectively. Foreign banks will have the opportunity to own up to 74 per cent of Indian private sector banks and 20 per cent of government owned banks. WEAKNESS PSBs need to fundamentally strengthen institutional skill levels especially in sales and marketing, service operations, risk management and the overall organizational performance ethic & strengthen human capital. Old private sector banks also have the need to fundamentally strengthen skill levels. The cost of intermediation remains high and bank penetration is limited to only a few customer segments and geographies. Structural weaknesses such as a fragmented industry structure, restrictions on capital availability and deployment, lack of institutional support infrastructure, restrictive labour laws, weak corporate governance and ineffective regulations beyond Scheduled Commercial Banks (SCBs), unless industry utilities and service bureaus. Refusal to dilute stake in PSU banks: The government has refused to dilute its stake in PSU banks below 51% thus choking the headroom available to these banks for raining equity capital. Impediments in sectoral reforms: Opposition from Left and resultant cautious approach from the North Block in terms of approving merger of PSU banks may hamper their growth prospects in the medium term. OPPORTUNITY The market is seeing discontinuous growth driven by new products and services that include opportunities in credit cards, consumer finance and wealth management on the retail side, and in fee-based income and investment banking on the wholesale banking side. These require new skills in sales & marketing, credit and operations. banks will no longer enjoy windfall treasury gains that the decade-long secular decline in interest rates provided. This will expose the weaker banks. With increased interest in India, competition from foreign banks will only intensify.

Given the demographic shifts resulting from changes in age profile and household income, consumers will increasingly demand enhanced institutional capabilities and service levels from banks. New private banks could reach the next level of their growth in the Indian banking sector by continuing to innovate and develop differentiated business models to profitably serve segments like the rural/low income and affluent/HNI segments; actively adopting acquisitions as a means to grow and reaching the next level of performance in their service platforms. Attracting, developing and retaining more leadership capacity Foreign banks committed to making a play in India will need to adopt alternative approaches to win the race for the customer and build a value-creating customer franchise in advance of regulations potentially opening up post 2009. At the same time, they should stay in the game for potential acquisition opportunities as and when they appear in the near term. Maintaining a fundamentally long-term value-creation mindset. reach in rural India for the private sector and foreign banks. With the growth in the Indian economy expected to be strong for quite some time especially in its services sector-the demand for banking services, especially retail banking, mortgages and investment services are expected to be strong. the Reserve Bank of India (RBI) has approved a proposal from the government to amend the Banking Regulation Act to permit banks to trade in commodities and commodity derivatives. Liberalisation of ECB norms: The government also liberalised the ECB norms to permit financial sector entities engaged in infrastructure funding to raise ECBs. This enabled banks and financial institutions, which were earlier not permitted to raise such funds, explore this route for raising cheaper funds in the overseas markets. Hybrid capital: In an attempt to relieve banks of their capital crunch, the RBI has allowed them to raise perpetual bonds and other hybrid capital securities to shore up their capital. If the new instruments find takers, it would help PSU banks, left with little headroom for raising equity. Significantly, FII and NRI investment limits in these securities have been fixed at 49%, compared to 20% foreign equity holding allowed in PSU banks. THREATS Threat of stability of the system: failure of some weak banks has often threatened the stability of the system. Rise in inflation figures which would lead to increase in interest rates. Increase in the number of foreign players would pose a threat to the PSB as well as the private players.

Você também pode gostar

- Banking India: Accepting Deposits for the Purpose of LendingNo EverandBanking India: Accepting Deposits for the Purpose of LendingAinda não há avaliações

- AXIS ProjectDocumento59 páginasAXIS ProjectSalim KhanAinda não há avaliações

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Ainda não há avaliações

- Project Vijaya Bank FinalDocumento62 páginasProject Vijaya Bank FinalNalina Gs G100% (1)

- Marketing of Consumer Financial Products: Insights From Service MarketingNo EverandMarketing of Consumer Financial Products: Insights From Service MarketingAinda não há avaliações

- Introduction of Banking SystemDocumento10 páginasIntroduction of Banking SystemMasy1210% (1)

- Regional Rural Banks of India: Evolution, Performance and ManagementNo EverandRegional Rural Banks of India: Evolution, Performance and ManagementAinda não há avaliações

- Project Ameer Draft For PrintDocumento124 páginasProject Ameer Draft For PrintameerashnaAinda não há avaliações

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume III: Thematic Chapter—Fintech Loans to Tricycle Drivers in the PhilippinesNo EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume III: Thematic Chapter—Fintech Loans to Tricycle Drivers in the PhilippinesAinda não há avaliações

- Yes Bank Mainstreaming Development Into Indian BankingDocumento20 páginasYes Bank Mainstreaming Development Into Indian Bankinggauarv_singh13Ainda não há avaliações

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsAinda não há avaliações

- A Project Report On Comparison Between HDFC Bank Amp ICICI BankDocumento45 páginasA Project Report On Comparison Between HDFC Bank Amp ICICI Bankillusionofsoul_51347Ainda não há avaliações

- Guidance Note on State-Owned Enterprise Reform for Nonsovereign and One ADB ProjectsNo EverandGuidance Note on State-Owned Enterprise Reform for Nonsovereign and One ADB ProjectsAinda não há avaliações

- Vijaya Bank and Dena Bank Being Merged Into The Bank of BarodaDocumento3 páginasVijaya Bank and Dena Bank Being Merged Into The Bank of BarodaJerin VargheseAinda não há avaliações

- BfsiDocumento9 páginasBfsiMohd ImtiazAinda não há avaliações

- Banking System in IndiaDocumento9 páginasBanking System in IndiaBhavesh LimaniAinda não há avaliações

- ICICI Go Global Case PDFDocumento15 páginasICICI Go Global Case PDFSAGAR BALAGARAinda não há avaliações

- Credit Appraisal ProjectDocumento109 páginasCredit Appraisal ProjectAshwath KodaguAinda não há avaliações

- Venkey HDFC Bank 111Documento86 páginasVenkey HDFC Bank 111Uday GowdaAinda não há avaliações

- Economy Banking System in IndiaDocumento21 páginasEconomy Banking System in Indiakrishan palAinda não há avaliações

- Banking SectorDocumento12 páginasBanking SectorVijay RaghunathanAinda não há avaliações

- Scope of The Bank ManagementDocumento5 páginasScope of The Bank ManagementHari PrasadAinda não há avaliações

- PROJECT Regarding Consumer AwarenessDocumento34 páginasPROJECT Regarding Consumer AwarenessNavjot Mangat44% (9)

- Introduction To Banking IndustryDocumento35 páginasIntroduction To Banking IndustrySindhuja SridharAinda não há avaliações

- E-Internship Report 1Documento13 páginasE-Internship Report 1Avani TomarAinda não há avaliações

- Service Sector BankingDocumento63 páginasService Sector BankingsayliAinda não há avaliações

- Introduction To Banking Sector & SbiDocumento107 páginasIntroduction To Banking Sector & SbiTanushreeAinda não há avaliações

- Abhishek BFSIDocumento11 páginasAbhishek BFSIabhishekAinda não há avaliações

- History of Banking IndustryDocumento66 páginasHistory of Banking IndustryJissy ShravanAinda não há avaliações

- Credit Appraisal in Sbi Bank Project6 ReportDocumento106 páginasCredit Appraisal in Sbi Bank Project6 ReportVenu S100% (1)

- Introduction To Banking Sector & SbiDocumento106 páginasIntroduction To Banking Sector & Sbiaparajitha lalasaAinda não há avaliações

- JK Bank Project ReportDocumento74 páginasJK Bank Project ReportSurbhi Nargotra43% (7)

- Abn-Ambro Bank Final 2007Documento60 páginasAbn-Ambro Bank Final 2007Ajay PawarAinda não há avaliações

- BankingDocumento8 páginasBankingDivya NathAinda não há avaliações

- Dena BNK Project FinalDocumento82 páginasDena BNK Project FinalNirmal MudaliyarAinda não há avaliações

- Jayesh BlackbookDocumento16 páginasJayesh BlackbookJayesh GuptaAinda não há avaliações

- A Study On Recent Trends of Banking Sector in India: M.Sujatha, N.V Haritha, P. Sai SreejaDocumento8 páginasA Study On Recent Trends of Banking Sector in India: M.Sujatha, N.V Haritha, P. Sai Sreejasomprakash giriAinda não há avaliações

- Indian BankingDocumento4 páginasIndian Bankingrahul vatsyayanAinda não há avaliações

- Performance AppraisalDocumento49 páginasPerformance Appraisalparthsavani750Ainda não há avaliações

- A Project Report On Comparison Between HDFC Bank Amp Icici BankDocumento75 páginasA Project Report On Comparison Between HDFC Bank Amp Icici BankSAHIL AGNIHOTRIAinda não há avaliações

- HDFC BankDocumento50 páginasHDFC BankNikhil TyagiAinda não há avaliações

- IndexDocumento15 páginasIndexJagdish BambhaniyaAinda não há avaliações

- Fundamental Analysis of Banking SectorsDocumento63 páginasFundamental Analysis of Banking SectorsDeepak Kashyap75% (4)

- Introduction of Banking IndustryDocumento15 páginasIntroduction of Banking IndustryArchana Mishra100% (1)

- CITIBANKDocumento28 páginasCITIBANKAnirudh SinghAinda não há avaliações

- Banking Is A Vital System For Developing Economy For The NationDocumento13 páginasBanking Is A Vital System For Developing Economy For The NationVinit SinghAinda não há avaliações

- Chapter 2Documento18 páginasChapter 2ShivuPannurAinda não há avaliações

- BFSI Sector in IndiaDocumento3 páginasBFSI Sector in IndiaKenneth GallowayAinda não há avaliações

- Banking SectorDocumento77 páginasBanking Sectormhdtariq22544100% (1)

- Banking - Banking Sector in IndiaDocumento65 páginasBanking - Banking Sector in Indiapraveen_rautela100% (1)

- A Project On Banking SectorDocumento81 páginasA Project On Banking SectorAkbar SinghAinda não há avaliações

- Idbi Bank ING Vyasa Bank SBIDocumento16 páginasIdbi Bank ING Vyasa Bank SBINEON29Ainda não há avaliações

- A STUDY OF SERVICE PROVIDER BY PRIVATE SECTOR BANK AND PUBLIC SECTOR BANK A BankDocumento86 páginasA STUDY OF SERVICE PROVIDER BY PRIVATE SECTOR BANK AND PUBLIC SECTOR BANK A BankShahzad SaifAinda não há avaliações

- Structure of Management in The Banking SectorDocumento16 páginasStructure of Management in The Banking Sectoranimesh RanjanAinda não há avaliações

- BankDocumento9 páginasBankakashgulati007Ainda não há avaliações

- Service Sector: BankingDocumento62 páginasService Sector: Bankingsteffszone100% (4)

- Recent Trends in BankingDocumento16 páginasRecent Trends in BankingManisha S. BhattAinda não há avaliações

- UTI BankDocumento69 páginasUTI BankSnehal RunwalAinda não há avaliações

- 7 P's of Private Sector BankDocumento21 páginas7 P's of Private Sector BankMinal DalviAinda não há avaliações

- Ashish Udawant Summer ProjectDocumento48 páginasAshish Udawant Summer ProjectAshishAinda não há avaliações

- IP Pump DataSheet CNLDocumento2 páginasIP Pump DataSheet CNLAmit ChourasiaAinda não há avaliações

- People of The Philippines Vs BasmayorDocumento2 páginasPeople of The Philippines Vs BasmayorjbandAinda não há avaliações

- James Tager Retirement AnnouncementDocumento2 páginasJames Tager Retirement AnnouncementNEWS CENTER MaineAinda não há avaliações

- Tin Industry in MalayaDocumento27 páginasTin Industry in MalayaHijrah Hassan100% (1)

- Kinds of Sentences - Positives.Documento20 páginasKinds of Sentences - Positives.Vamsi KrishnaAinda não há avaliações

- University of Rajasthan Admit CardDocumento2 páginasUniversity of Rajasthan Admit CardKishan SharmaAinda não há avaliações

- G O Ms NoDocumento2 páginasG O Ms NoMuralidhar MogalicherlaAinda não há avaliações

- Maximo Application Suite (MAS) Level 2 - Application Performance Management (APM)Documento13 páginasMaximo Application Suite (MAS) Level 2 - Application Performance Management (APM)ikastamobebeAinda não há avaliações

- Consent Form - Jan 2022Documento2 páginasConsent Form - Jan 2022Akmal HaziqAinda não há avaliações

- Financial and Management Accounting Sample Exam Questions: MBA ProgrammeDocumento16 páginasFinancial and Management Accounting Sample Exam Questions: MBA ProgrammeFidoAinda não há avaliações

- Restaurant Training Manuals: Bus ManualDocumento15 páginasRestaurant Training Manuals: Bus ManualKehinde Ajijedidun100% (1)

- Pointers For FinalsDocumento28 páginasPointers For FinalsReyan RohAinda não há avaliações

- X7 User Manual With ConnectionDocumento15 páginasX7 User Manual With Connectionanup nathAinda não há avaliações

- Laws of Tanzania Chapter The LawsDocumento9 páginasLaws of Tanzania Chapter The LawsSTEVEN TULA100% (7)

- Succession: ElementsDocumento33 páginasSuccession: ElementsDave A ValcarcelAinda não há avaliações

- Republic V Tanyag-San JoseDocumento14 páginasRepublic V Tanyag-San Joseyannie11Ainda não há avaliações

- Mahabharata of KrishnaDocumento4 páginasMahabharata of KrishnanoonskieAinda não há avaliações

- Cost-Effective Sustainable Design & ConstructionDocumento6 páginasCost-Effective Sustainable Design & ConstructionKeith Parker100% (2)

- Ocr Vietnam CourseworkDocumento5 páginasOcr Vietnam Courseworkiyldyzadf100% (2)

- ENTREPRENEURSHIP QuizDocumento2 páginasENTREPRENEURSHIP QuizLeona Alicpala100% (2)

- Chapter 11 Summary: Cultural Influence On Consumer BehaviourDocumento1 páginaChapter 11 Summary: Cultural Influence On Consumer BehaviourdebojyotiAinda não há avaliações

- Laffitte 2nd Retrial Motion DeniedDocumento6 páginasLaffitte 2nd Retrial Motion DeniedJoseph Erickson100% (1)

- Golden Rule of InterpretationDocumento8 páginasGolden Rule of InterpretationPawanpreet SinghAinda não há avaliações

- Upstream Pre B1 Unit Test 9Documento3 páginasUpstream Pre B1 Unit Test 9Biljana NestorovskaAinda não há avaliações

- Essays On Hinduism-PDF 04Documento54 páginasEssays On Hinduism-PDF 04YaaroAinda não há avaliações

- Judicial Process - AssignmentDocumento16 páginasJudicial Process - AssignmentApoorva Kulkarni SharmaAinda não há avaliações

- Iphone 11 Imagine PDFDocumento2 páginasIphone 11 Imagine PDFJonassy SumaïliAinda não há avaliações

- Sales Philippine Law (Articles 1458 - 1510)Documento17 páginasSales Philippine Law (Articles 1458 - 1510)Ellen Glae Daquipil100% (4)

- Project Proposal - Tanya BhatnagarDocumento9 páginasProject Proposal - Tanya BhatnagarTanya BhatnagarAinda não há avaliações

- The Macabre Motifs in MacbethDocumento4 páginasThe Macabre Motifs in MacbethJIA QIAOAinda não há avaliações

- Reading the Constitution: Why I Chose Pragmatism, not TextualismNo EverandReading the Constitution: Why I Chose Pragmatism, not TextualismAinda não há avaliações

- Summary: Surrounded by Idiots: The Four Types of Human Behavior and How to Effectively Communicate with Each in Business (and in Life) by Thomas Erikson: Key Takeaways, Summary & AnalysisNo EverandSummary: Surrounded by Idiots: The Four Types of Human Behavior and How to Effectively Communicate with Each in Business (and in Life) by Thomas Erikson: Key Takeaways, Summary & AnalysisNota: 4 de 5 estrelas4/5 (2)

- Perversion of Justice: The Jeffrey Epstein StoryNo EverandPerversion of Justice: The Jeffrey Epstein StoryNota: 4.5 de 5 estrelas4.5/5 (10)

- For the Thrill of It: Leopold, Loeb, and the Murder That Shocked Jazz Age ChicagoNo EverandFor the Thrill of It: Leopold, Loeb, and the Murder That Shocked Jazz Age ChicagoNota: 4 de 5 estrelas4/5 (97)

- Insider's Guide To Your First Year Of Law School: A Student-to-Student Handbook from a Law School SurvivorNo EverandInsider's Guide To Your First Year Of Law School: A Student-to-Student Handbook from a Law School SurvivorNota: 3.5 de 5 estrelas3.5/5 (3)

- Hunting Whitey: The Inside Story of the Capture & Killing of America's Most Wanted Crime BossNo EverandHunting Whitey: The Inside Story of the Capture & Killing of America's Most Wanted Crime BossNota: 3.5 de 5 estrelas3.5/5 (6)

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesNo EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesAinda não há avaliações

- Learning to Disagree: The Surprising Path to Navigating Differences with Empathy and RespectNo EverandLearning to Disagree: The Surprising Path to Navigating Differences with Empathy and RespectAinda não há avaliações

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingNo EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingNota: 4.5 de 5 estrelas4.5/5 (97)

- Conviction: The Untold Story of Putting Jodi Arias Behind BarsNo EverandConviction: The Untold Story of Putting Jodi Arias Behind BarsNota: 4.5 de 5 estrelas4.5/5 (16)

- All You Need to Know About the Music Business: 11th EditionNo EverandAll You Need to Know About the Music Business: 11th EditionAinda não há avaliações

- Get Outta Jail Free Card “Jim Crow’s last stand at perpetuating slavery” Non-Unanimous Jury Verdicts & Voter SuppressionNo EverandGet Outta Jail Free Card “Jim Crow’s last stand at perpetuating slavery” Non-Unanimous Jury Verdicts & Voter SuppressionNota: 5 de 5 estrelas5/5 (1)

- The Law of the Land: The Evolution of Our Legal SystemNo EverandThe Law of the Land: The Evolution of Our Legal SystemNota: 4.5 de 5 estrelas4.5/5 (11)

- The Myth of Equality: Uncovering the Roots of Injustice and PrivilegeNo EverandThe Myth of Equality: Uncovering the Roots of Injustice and PrivilegeNota: 4.5 de 5 estrelas4.5/5 (17)

- Reasonable Doubts: The O.J. Simpson Case and the Criminal Justice SystemNo EverandReasonable Doubts: The O.J. Simpson Case and the Criminal Justice SystemNota: 4 de 5 estrelas4/5 (25)

- All You Need to Know About the Music Business: Eleventh EditionNo EverandAll You Need to Know About the Music Business: Eleventh EditionAinda não há avaliações

- The Dark Net: Inside the Digital UnderworldNo EverandThe Dark Net: Inside the Digital UnderworldNota: 3.5 de 5 estrelas3.5/5 (104)

- The Edge of Innocence: The Trial of Casper BennettNo EverandThe Edge of Innocence: The Trial of Casper BennettNota: 4.5 de 5 estrelas4.5/5 (3)

- Chokepoint Capitalism: How Big Tech and Big Content Captured Creative Labor Markets and How We'll Win Them BackNo EverandChokepoint Capitalism: How Big Tech and Big Content Captured Creative Labor Markets and How We'll Win Them BackNota: 5 de 5 estrelas5/5 (20)

- The Private Diary of an O.J. Juror: Behind the Scenes of the Trial of the CenturyNo EverandThe Private Diary of an O.J. Juror: Behind the Scenes of the Trial of the CenturyNota: 5 de 5 estrelas5/5 (1)