Escolar Documentos

Profissional Documentos

Cultura Documentos

New Microsoft Word Document

Enviado por

Anurag KhandelwalDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

New Microsoft Word Document

Enviado por

Anurag KhandelwalDireitos autorais:

Formatos disponíveis

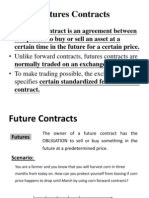

Commodity futures have commodities as underlying assets. Futures on commodities help mitigate price risk.

Trading in forward and futures on commodities is not new. It has been in vogue for more than 100 years. BenefitFutures on commodities due to its possible use as a speculative product are often thought as unwarranted and as a disservice to society. Futures contracts on commodities result in price discovery, reducing seasonal price variations, efficient dissemination of information, reduced cost of credit, and more efficient physical markets. Commodity future and economyThe usual tools of containing the volatility in the commodity prices like buffer stocks, controlled and phased release of commodities, minimum support price etc have either failed or have proved too expensive for the economy. Commodity futures trading in developing country can contribute a lot to the stability of fiscal management, increasing the effectiveness of price protection at national level and improving the efficiency of social programmes Stability to Governments Revenue Government budget, developmental expenditure, and position of balance of payment are crucially dependent upon prices of commodities. Volatility in commodity prices causes volatility in budgetary provisions and governments developmental expenditure. Therefore at national level there is a need to reduce the volatility. Eliminating Minimum Support Price and Subsidy

Commodity futures trading helps smooth out the variability in governments revenue and transfers the price risk management from government to private participants. Commodity and financial futureFutures contracts on commodities differ significantly from those on financial assets in terms of quality specifications and delivery mechanism.The consumption value makes valuation of futures contracts on commodities difficult. Quality of underlying asset is immaterial in case of financial products, whereas there is ample scope of controversy over quality in case of commodity futures. Commodity futures are governed by seasons and perishable nature of the underlying asset. Commodities (the agricultural products) is confined to the harvesting period while the consumption is uniform throughout the year.

Long and Short PositionsWhen one holds the underlying asset he is said to be long on the asset. For example a jeweller holding gold or silver is long on the asset. The one who requires the asset in future is said to be short. For example a tea exporter needs stock of tea to execute the pending orders is short on tea.

Similarly in the futures market if one buys a futures contract he is said to be long, and if one sells the futures contract he is said to be short. Hedging principleTo execute a hedge following steps are taken:One who is long on the asset, goes short on the futures market, and the one who is short on underlying goes long in the futures market. At an appropriate time one can neutralise the position in the futures market, i.e. go long on futures if one was originally short and go short on futures if one was originally long, and receive/pay the difference of prices.

Sell or buy the underlying asset in the physical market at prevailing price Short hedgeWhen one has long position in the asset he needs to take a short position in futures to hedge. It is referred as short hedge. For example, a sugar mill would go short on the futures contract on sugar to hedge against the fall in price. If prices fall the short position in futures would yield profit compensating for the loss due to reduced realized value of sugar in the spot market. Long hedgeWhen one has short position in the asset he needs to take a long position in futures to hedge. It is referred as long hedge. For example, an importer of oil would go long on the futures contract on oil to hedge against the rise in price. If prices indeed rise the long position in futures would yield profit compensating for the loss due to increased price of oil in the spot market. Fututure hedge-Except by coincidence futures hedge is imperfect. The gains/losses in the futures do not exactly offset the loss/gains in the physical position because: the exposure in the underlying and futures market is not on the identical asset of same quality, the value of exposure in the underlying and the futures are not same because futures contract have fixed size. the time of maturity of the futures contract is not same as the time of exposure in the physical position because maturities of futures contract are specific. Speculation with commmdoty hedge futureFutures can be used for speculation if the estimate of future spot price is different than the futures price.

To speculate on the prices of commodities one has to do one of the following:If a trader expects a price fall he simply has to sell a futures contract today and buy it later; If a trader anticipates a rise in prices he simply has to buy the futures today and sell later;

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Financial Institutions 11Documento13 páginasFinancial Institutions 11Afshan ShehzadiAinda não há avaliações

- New Zealand 2009 Financial Knowledge SurveyDocumento11 páginasNew Zealand 2009 Financial Knowledge SurveywmhuthnanceAinda não há avaliações

- Pefindo'S Corporate Default and Rating Transition Study (1996 - 2010)Documento21 páginasPefindo'S Corporate Default and Rating Transition Study (1996 - 2010)Theo VladimirAinda não há avaliações

- Form 16 Part BDocumento4 páginasForm 16 Part BDharmendraAinda não há avaliações

- Silabus Cgc. FixDocumento5 páginasSilabus Cgc. FixTeguh PurnamaAinda não há avaliações

- Project On Partnership Accounting PDFDocumento17 páginasProject On Partnership Accounting PDFManish ChouhanAinda não há avaliações

- Topic2 Part1Documento16 páginasTopic2 Part1Abdul MoezAinda não há avaliações

- Futures ContractsDocumento14 páginasFutures ContractsSantosh More0% (1)

- Selection Among AlternativesDocumento24 páginasSelection Among AlternativesDave DespabiladerasAinda não há avaliações

- Chapter 15: Risk and Information: - Describing Risky Outcome - Basic ToolsDocumento38 páginasChapter 15: Risk and Information: - Describing Risky Outcome - Basic ToolsrheaAinda não há avaliações

- KPMG - IFRS vs. US GAAP - RD CostsDocumento8 páginasKPMG - IFRS vs. US GAAP - RD CoststomasslrsAinda não há avaliações

- Employment Income TaxDocumento20 páginasEmployment Income TaxBizu AtnafuAinda não há avaliações

- Nova Chemical CorporationDocumento28 páginasNova Chemical Corporationrzannat94100% (2)

- Real Estate AppraiserDocumento2 páginasReal Estate Appraiserapi-77241843Ainda não há avaliações

- Symmetry Hedge Fund Survey 2010-11 FinalDocumento7 páginasSymmetry Hedge Fund Survey 2010-11 FinalhlbeckleyAinda não há avaliações

- Maksājuma Uzdevums NR.: (Valūtas Maksājumiem)Documento1 páginaMaksājuma Uzdevums NR.: (Valūtas Maksājumiem)Sergejs UrbanovičsAinda não há avaliações

- Chapter 7Documento46 páginasChapter 7Awrangzeb AwrangAinda não há avaliações

- Oracle ERP, EBS: M Mursaleen BhuiyanDocumento68 páginasOracle ERP, EBS: M Mursaleen BhuiyanMohammad Shaniaz IslamAinda não há avaliações

- CFAS Quiz Questions AddedDocumento2 páginasCFAS Quiz Questions AddedSaeym SegoviaAinda não há avaliações

- CSEC POA June 2012 P1 PDFDocumento12 páginasCSEC POA June 2012 P1 PDFjunior subhanAinda não há avaliações

- Deutsche Finan ExcelDocumento6 páginasDeutsche Finan ExcelAnonymous VVSLkDOAC1Ainda não há avaliações

- CH 07Documento3 páginasCH 07ghsoub777Ainda não há avaliações

- Principles of Macro Economics Part 4Documento6 páginasPrinciples of Macro Economics Part 4Duaa WajidAinda não há avaliações

- Coromandel International Ltd. 2008-09Documento90 páginasCoromandel International Ltd. 2008-09samknight2009100% (1)

- Birla Sun Life InsuranceDocumento17 páginasBirla Sun Life InsuranceKenen BhandhaviAinda não há avaliações

- Principles of Income and Business TaxationDocumento3 páginasPrinciples of Income and Business TaxationQueen ValleAinda não há avaliações

- PDFDocumento1 páginaPDFKRUNAL ParmarAinda não há avaliações

- Blue Chip CompanyDocumento12 páginasBlue Chip CompanyMuralis MuralisAinda não há avaliações

- Analysis of Financial Performance of SbiDocumento5 páginasAnalysis of Financial Performance of SbiMAYANK GOYALAinda não há avaliações

- The Accounting Process: Name: Date: Professor: Section: Score: QuizDocumento6 páginasThe Accounting Process: Name: Date: Professor: Section: Score: QuizAllyna Jane Enriquez100% (1)