Escolar Documentos

Profissional Documentos

Cultura Documentos

Baroda Ashray Form

Enviado por

Akhila ReddyDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Baroda Ashray Form

Enviado por

Akhila ReddyDireitos autorais:

Formatos disponíveis

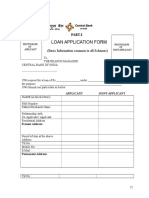

LOAN APPLICATION FORM FOR BARODA ASHRAY The Branch Manager, Bank of Baroda, _______________________ INSTRUCTIONS:

1. Please use BLOCK LETTERS 2. All details must be filled in. If not applicable, please write N.A. 3. Please put wherever applicable 4. Applicants should ensure this form is complete in all respects along with all relevant documents

I / We request you to grant me/us a loan facility under Baroda Ashray scheme for Rs.____________. To enable you to consider the proposal, I / We submit the following particulars:

Recent Photo of Main Applicant Recent Photo of Spouse (wherever applicable)

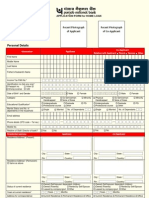

I. MAIN APPLICANTS PARTICULARS Name (Shri /Smt /Ms) Name of Father/Husband Date of Birth Nationality Gender Marital Status Female Married Male Unmarried (include Single, Divorced, Widowed)

Subject Property Address

Mailing Address, if different from Subject Property Address Years of Residence at Current Address Contact Nos. e-mail id, if any (H) (M)

Name of Spouse Date of Birth of Spouse Alternative Contact Person (Name, Address, Phone)

No. of Dependents

Voter ID No. Occupation Status

Income Tax PAN:

Passport No.

Driving License No.

Working Retired

Self-Employed Other

Office/Business Address with Contact Nos Current Official Designation No. of Years in Present Occupation Gross Annual Income

II. CO-APPLICANTS PARTICULARS (Applicable only where spouse is co owner of the property) Name (Shri /Smt /Ms ) Name of Father/Husband Date of Birth Nationality Contact Nos. e-mail id, if any Voter ID No. Occupation Status Income Tax PAN: Home : Mobile : : Passport No.

Driving License No.

Working Retired

Self-Employed Other

Office/Business Address with Contact Nos

Current Official Designation No. of Years in Present Occupation Gross Annual Income

III. FINANCIAL DETAILS

Outstanding Mortgage(s)

Please furnish details of all mortgages against the Residential Property to be mortgaged under reverse mortgage. In the event of the loan application being approved, it will be conditional that any existing mortgage must be redeemed in full. In case of more than one mortgage outstanding please provide details under Section VIII (Additional Information).

Lenders Name & Address

Loan Reference Number Outstanding Balance Monthly Payment Due date of repayment mortgage

of

existing

Is/Was the mortgage in arrears If YES, please give details

YES

NO

Main Applicant Applicant/Spouse NO - had a Court Judgement or any other YES Order for non-payment of a debt issued If YES, please give details against you - incurred mortgage, rent or loan arrears (including credit card) - been refused a mortgage or credit - been declared insolvent - entered into any arrangement with creditors or been party to a mortgage where the property has been taken into possession on either a voluntary or enforced basis? Order of discharge by the Insolvency Enclosed Court, if applicable Have you or your spouse ever IV. DETAILS OF ALL LEGAL HEIRS No. of legal Heirs Name and Addresses of legal heirs 1.

CoYES NO If YES, please give details

To follow

Relationship with Applicant(s)

Contact details

2.

3.

V. REVERSE MORTGAGE LOAN REQUIREMENTS Amount of Loan Required Period of the Loan Disbursement Loan Purpose Interest Rate Option Mode of Payment Fixed Monthly Floating Quarterly Half-Yearly

Annual Initial Lump sum required and

Line of Credit

Lump-sum

Rs.__________________________ Periodic Cash required Rs.__________________________ Do you want to have the applicable YES fees/charges that do not have to be paid at the outset of this loan application added to the Reverse Mortgage Loan? DETAILS OF BANK ACCOUNT

(To be nominated by the borrower(s) to receive the loan disbursement s)

NO

Name of the Bank and Address

Bank Account Number Name(s) of the Account Holders

VI. SUBJECT PROPERTY DETAILS ( against the security of which Reverse Mortgage Loan is sought to be availed) Address of the property

Type of Property

House Bungalow Flat Other (Please specify_________________) Is the property being used wholly for YES NO residential purposes If NO, please specify details ______________________________________ Please indicate the Tenure of the Freehold Leasehold property If Leasehold, please indicate _______________ years Remaining Term _____________________________________ Name of the Lessor YES NO Permission of the Lessor for mortgage, if required Type of Construction Brick Mortar/Cement Stone Timber frame Other (Please specify _________________) Age of the property in years Name(s) of all the Registered Owners of the Property

Mode of Acquisition of the property by the Applicant(s) Does the owner of the Property include any person other than the borrower and his/her spouse Is the property adequately insured YES against losses/damage caused by fire, flood and such other risks, as is usual for

NO

residential property? Please provide details.

_______________________________________ VII. TENANTS/OTHER OCCUPANTS

Is any part of the property let or tenanted?

YES

NO

Other Occupants Please provide details of person(s) who is/are not a loan applicant(s) (besides the spouse) but will be living in the property during the life of the Applicant/Spouse of the Applicant. Name(s) of other occupants Relationship with borrowers(s)

VIII. ADDITIONAL INFORMATION

IX. DECLARATION I/We declare that all the particulars and information given in this loan application form are true, correct and that they shall form the basis of any loan that Bank of Baroda may decide to sanction to me/us. I/We have no insolvency proceedings/legal proceedings against me/us nor have I/We even been adjudicated insolvent. I/We confirm that the said residential property which is used as my/our permanent primary residence is self-acquired, self-occupied and not let out/tenanted and there is no third party interest. I/We also accept that the property will not be let out or no third party interest will be created without Bank of Barodas prior written consent. I/We confirm that I/we do not have more than one surviving legal spouse. I/We acknowledge that the loan requested pursuant to this application will be secured by a mortgage of the property in such form and manner as may be required by the Lender and I/We agree that the loan will not be used for any illegal or prohibited purpose or use. I/We agree that where a periodic loan disbursement has been requested such disbursements will be credited to the bank account nominated by me/us in Section V. I/We accept that the written consent of all the loan applicants will be required to change the above nominated Bank Account. I/ We agree that Bank of Baroda may take up such references and enquiries in respect of this application, as it may deem necessary. I/We undertake to inform Bank of Baroda regarding any change in my/our occupation/ employment. I/We understand that I/We have read the brochure/ terms and conditions of the Reverse Mortgage Loan Scheme of Bank of Baroda and understood the contents. I/We hereby agree to be bound by these terms and conditions. I/We further agree that

my/our loan shall be governed by the rules of Bank of Baroda which may be in force from time to time. A draft of the loan agreement of Bank of Baroda to be executed by me/us has been received and understood by me/us and I/We agree to execute the loan documents as per the terms of sanction of the proposed loan. I/We also confirm to abide by the same. By signing this application form, I/We agree that any person interested now or in the future in the loan and the mortgage may rely upon the truth and accuracy of the information contained in this application and any supporting documentation, information or security. Signature of Applicant Date Signature of Co-Applicant Date

Você também pode gostar

- Top Up Loan Application PDFDocumento4 páginasTop Up Loan Application PDFashutosh arya75% (8)

- One Account Application Form - FNBDocumento7 páginasOne Account Application Form - FNBjsinnAinda não há avaliações

- LJHooker 2014 Tenancy Application 2014Documento4 páginasLJHooker 2014 Tenancy Application 2014vk_ramsAinda não há avaliações

- Personal Loan Application FormDocumento1 páginaPersonal Loan Application FormDomingo RamilAinda não há avaliações

- Home Loan Application FormDocumento4 páginasHome Loan Application FormSudeep ChatterjeeAinda não há avaliações

- Bank of IndiaDocumento4 páginasBank of Indiavivek75% (8)

- How to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersNo EverandHow to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersNota: 3 de 5 estrelas3/5 (1)

- The Autobiography of William Henry DonnerDocumento166 páginasThe Autobiography of William Henry DonnerBen DencklaAinda não há avaliações

- 2014 Afr Goccs Volume IDocumento479 páginas2014 Afr Goccs Volume IRomel TorresAinda não há avaliações

- The Branch Manager, Bank of Baroda,: Loan Application Form For Baroda AshrayDocumento6 páginasThe Branch Manager, Bank of Baroda,: Loan Application Form For Baroda AshrayNitin BhatnagarAinda não há avaliações

- Rudra Singh - 98 - Tyco - Edp - Exp 7Documento14 páginasRudra Singh - 98 - Tyco - Edp - Exp 7tanmay ghoraiAinda não há avaliações

- Loan Application Template PDFDocumento5 páginasLoan Application Template PDFaslan firstAinda não há avaliações

- Bank of Maharashtra FormDocumento5 páginasBank of Maharashtra FormSujay KamuniAinda não há avaliações

- APPLN Part IDocumento5 páginasAPPLN Part IAakash GargAinda não há avaliações

- BDO PersonalLoanAKAppliFormDocumento4 páginasBDO PersonalLoanAKAppliFormAirMan ManiagoAinda não há avaliações

- Home Loan Application FormDocumento2 páginasHome Loan Application Formanon_300020848Ainda não há avaliações

- Sample Dsa Application FormDocumento4 páginasSample Dsa Application FormANUJ KUMAR100% (2)

- Home Loan Application FormDocumento2 páginasHome Loan Application FormrazafarhaAinda não há avaliações

- 2 - DSA Application FormDocumento4 páginas2 - DSA Application FormRishi SoniAinda não há avaliações

- Housing Loan - Mega BankDocumento7 páginasHousing Loan - Mega Banksshres4Ainda não há avaliações

- Neral Format: Photo (Affix For Each Applic Ant)Documento6 páginasNeral Format: Photo (Affix For Each Applic Ant)Noorul AmeenAinda não há avaliações

- BANCO DE ORO (BDO) Home Loan Application Form - Individual (May2015)Documento2 páginasBANCO DE ORO (BDO) Home Loan Application Form - Individual (May2015)Morgan PalmaAinda não há avaliações

- DownloadDocumento27 páginasDownloadoneoceannetwork3Ainda não há avaliações

- ISA FormDocumento2 páginasISA FormAkram SayeedAinda não há avaliações

- App FormDocumento3 páginasApp Formanurag655Ainda não há avaliações

- (For Office Use Only) : Instruction For Filling This FormDocumento6 páginas(For Office Use Only) : Instruction For Filling This Formspatel1972Ainda não há avaliações

- E VisaDocumento3 páginasE Visazahoorunisa20Ainda não há avaliações

- Description: Tags: FP0705AttFAppPNoteStandardDocumento18 páginasDescription: Tags: FP0705AttFAppPNoteStandardanon-23498Ainda não há avaliações

- Rental Application: Contact Numbers: Applicant 1 Applicant 2Documento4 páginasRental Application: Contact Numbers: Applicant 1 Applicant 2robferg1Ainda não há avaliações

- SHL Application Form Revised Version97Documento3 páginasSHL Application Form Revised Version97Neil Matthew P. DianAinda não há avaliações

- Application Form PNB 1166 Upto 1 Crore MsmeDocumento7 páginasApplication Form PNB 1166 Upto 1 Crore MsmeChristopher GarrettAinda não há avaliações

- Car Loan Application Form NRIDocumento4 páginasCar Loan Application Form NRIPardeep MalikAinda não há avaliações

- DBS Varying Terms of MortgageDocumento1 páginaDBS Varying Terms of Mortgagericky_sporeAinda não há avaliações

- Icici FormDocumento2 páginasIcici Formpalash_monAinda não há avaliações

- AL Form Individual Revised MAY - Fillable BdoDocumento2 páginasAL Form Individual Revised MAY - Fillable BdoAnonymous BjaA0IiY100% (1)

- Nbpi Inc ApplicationDocumento2 páginasNbpi Inc Applicationapi-273354666Ainda não há avaliações

- UTITSL US64 Redemption FormDocumento2 páginasUTITSL US64 Redemption FormJayashree SivaramanAinda não há avaliações

- Personal Loan AgreementDocumento10 páginasPersonal Loan AgreementchandanAinda não há avaliações

- Rental Application Form For Residential Premises: Applicant 1 Details of First Person Applying To Rent The PremisesDocumento6 páginasRental Application Form For Residential Premises: Applicant 1 Details of First Person Applying To Rent The PremisesNyasha SvondoAinda não há avaliações

- LN TBond FormDocumento90 páginasLN TBond FormboargzcrAinda não há avaliações

- Indian Overseas Bank ..BranchDocumento6 páginasIndian Overseas Bank ..Branchanwarali1975Ainda não há avaliações

- SPL Application Form PDFDocumento9 páginasSPL Application Form PDFAdnan MunirAinda não há avaliações

- Credit Card Application Form: Residential DetailsDocumento3 páginasCredit Card Application Form: Residential DetailsShashi ShekharAinda não há avaliações

- Business Loan Application FormDocumento12 páginasBusiness Loan Application FormsyediliyassikandarAinda não há avaliações

- Failure To Provide Bank Account Details May Result in A Delay in Your RefundDocumento2 páginasFailure To Provide Bank Account Details May Result in A Delay in Your RefundTerry Lollback100% (2)

- Ental Pplication: (If Less Than Three Years Ago)Documento2 páginasEntal Pplication: (If Less Than Three Years Ago)Brandon WeberAinda não há avaliações

- Application Form - Reduce Monthly Repayment Amount PDFDocumento2 páginasApplication Form - Reduce Monthly Repayment Amount PDFasdsaAinda não há avaliações

- Request For Change of Existing Resident Account To Nro AccountDocumento4 páginasRequest For Change of Existing Resident Account To Nro Accountviraj duaAinda não há avaliações

- Non Face To Face Form With AMB Declaration PDFDocumento10 páginasNon Face To Face Form With AMB Declaration PDFrohit.godhani9724Ainda não há avaliações

- CORADocumento3 páginasCORANaveenAinda não há avaliações

- Michigan Rental Application FormDocumento2 páginasMichigan Rental Application FormvadarsuperstarAinda não há avaliações

- Application FormDocumento4 páginasApplication FormChe Airell MiqailAinda não há avaliações

- Borang Baru 1jun2015Documento26 páginasBorang Baru 1jun2015Azlin MohdAinda não há avaliações

- Apr.12 - 871 App Nri FormDocumento10 páginasApr.12 - 871 App Nri FormsnkrmAinda não há avaliações

- 21-2012 PNB 1054 - Ann I - Application-Cum-Appraisal-Cum-Sanction For Housing LoanDocumento9 páginas21-2012 PNB 1054 - Ann I - Application-Cum-Appraisal-Cum-Sanction For Housing Loanrisk_j2546Ainda não há avaliações

- HSBC Add-On Credit Card Application: Primary Credit Cardholder DetailsDocumento2 páginasHSBC Add-On Credit Card Application: Primary Credit Cardholder DetailsPrabudh BansalAinda não há avaliações

- Application For Auto LoanDocumento6 páginasApplication For Auto Loanbanduat83Ainda não há avaliações

- Deed of Assignment - 102018Documento5 páginasDeed of Assignment - 102018Kawaii YoshinoAinda não há avaliações

- Loan Application Form: Part-I Cent VidyarthiDocumento8 páginasLoan Application Form: Part-I Cent VidyarthiSandeep ChowdhuryAinda não há avaliações

- Request Form (Request For Modification and Affidavit)Documento3 páginasRequest Form (Request For Modification and Affidavit)eagles39100% (1)

- UMLDocumento38 páginasUMLMuthu100% (4)

- Color Names Supported by All BrowsersDocumento5 páginasColor Names Supported by All BrowsersAkhila ReddyAinda não há avaliações

- Highlighting HTML Web Page Links 1) : HTML Layouts - Using TablesDocumento5 páginasHighlighting HTML Web Page Links 1) : HTML Layouts - Using TablesAkhila ReddyAinda não há avaliações

- Microcontrolle 8051 AssemblyDocumento40 páginasMicrocontrolle 8051 AssemblyNaveedAinda não há avaliações

- BS en 287Documento7 páginasBS en 287Chris Thomas0% (1)

- Chapter Twenty: Managing Credit Risk OnDocumento21 páginasChapter Twenty: Managing Credit Risk OnSagheer MuhammadAinda não há avaliações

- Affidavit (Mortgagee Bank) DHSUDDocumento2 páginasAffidavit (Mortgagee Bank) DHSUDRodrigo MartinAinda não há avaliações

- MGT520 Assignment 2 Solution Fall 2020Documento4 páginasMGT520 Assignment 2 Solution Fall 2020rickyrickstar4Ainda não há avaliações

- Methods of Payment in Export ImportDocumento10 páginasMethods of Payment in Export Importkaran singlaAinda não há avaliações

- Working Capital Management NOTESDocumento10 páginasWorking Capital Management NOTESvalentine mutungaAinda não há avaliações

- Capital StructureDocumento75 páginasCapital StructureSantosh ChhetriAinda não há avaliações

- MFRS Glossary in Bahasa Malaysia - July2015Documento66 páginasMFRS Glossary in Bahasa Malaysia - July2015Muhammad Yunus KamilAinda não há avaliações

- M27 For Jan 2021Documento4 páginasM27 For Jan 2021kittu_sivaAinda não há avaliações

- ShimmerDocumento4 páginasShimmerkeshavbansal114Ainda não há avaliações

- Module 10 Assign#10Documento4 páginasModule 10 Assign#10Marjurie QuinceAinda não há avaliações

- Application Form Account Opening18042022034606Documento4 páginasApplication Form Account Opening18042022034606dawokel726Ainda não há avaliações

- CitiBank ApplicationDocumento15 páginasCitiBank ApplicationJordan P HunterAinda não há avaliações

- FTC Disclosure ExampleDocumento12 páginasFTC Disclosure ExampleReden Oriola100% (1)

- Module10 1Documento22 páginasModule10 1Colleen Mae San DiegoAinda não há avaliações

- Role and Importance of Capital Market in IndiaDocumento9 páginasRole and Importance of Capital Market in IndiaMukul Babbar50% (4)

- Tanzania Mortgage Market Update 30 June 2021Documento6 páginasTanzania Mortgage Market Update 30 June 2021Arden Muhumuza KitomariAinda não há avaliações

- Multiple Choice and AnswerDocumento63 páginasMultiple Choice and AnswerJubaida Alam 203-22-694100% (2)

- FM1, CH01-EditedDocumento17 páginasFM1, CH01-Editedsamuel kebedeAinda não há avaliações

- FAQsDocumento34 páginasFAQsFredPahssenAinda não há avaliações

- Types of Letter of CreditDocumento3 páginasTypes of Letter of Creditmd. Billal HosenAinda não há avaliações

- Form 4 Paper 1 2020 Batch Term 3 19.3.21Documento10 páginasForm 4 Paper 1 2020 Batch Term 3 19.3.21Aejaz MohamedAinda não há avaliações

- 0ANNUALREPORT24CEDEDocumento264 páginas0ANNUALREPORT24CEDERao TvaraAinda não há avaliações

- Law Mock QDocumento12 páginasLaw Mock QRanjitha GovindaiahAinda não há avaliações

- PDI 111 Mar24Documento40 páginasPDI 111 Mar24xen101Ainda não há avaliações

- Amortization ScheduleDocumento8 páginasAmortization ScheduleCamoColtonAinda não há avaliações

- TNC Grab Deals MerchantDocumento2 páginasTNC Grab Deals MerchantRuchita JainAinda não há avaliações

- Ujjivan Annual Report FY 17 18 PDFDocumento340 páginasUjjivan Annual Report FY 17 18 PDFkabilanAinda não há avaliações