Escolar Documentos

Profissional Documentos

Cultura Documentos

S3046CV

Enviado por

Governor Chris ChristieDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

S3046CV

Enviado por

Governor Chris ChristieDireitos autorais:

Formatos disponíveis

January 9, 2012

SENATE BILL NO. 3046

To the Senate: Pursuant to Article V, Section I, Paragraph 14 of the New Jersey Constitution, I am returning Senate Bill No. 3046 with my recommendations for reconsideration. This bill would require the State to provide recipients of unemployment insurance (UI) benefits, State tax refunds and State employee compensation with an option to receive payments in the form of a paper check. Specifically, the bill mandates

that the Department of Labor and Workforce Development provide UI claimants with written notice of benefit payment options which shall include prepaid debit card, direct deposit and

paper check. paper

In addition, the bill requires the State to issue to State employees, including employees of

paychecks

State authorities and institutions of higher education, when so requested by the employee. Finally, the bill provides that the

Director of the Division of Taxation shall provide a taxpayer due a refund of any State tax payment the option of receiving the refund in the form of a paper check. While I recognize that the sponsors would like to provide recipients choice of of State of benefits, payment, I refunds am and payments by the with a

form that

troubled with my

bills

provisions

directly

conflict

Administrations

efforts to streamline State government operations and save the taxpayers money. From the outset, my Administration has

diligently worked to reduce costs to the taxpayer created by vestigial and bureaucratic impediments to programmatic

efficiencies.

For instance, in March of 2010 I created the

New Jersey Privatization Task Force to evaluate the delivery of government services at the State level and to recommend

reform measures to rein in spending on State programs.

In its

May 31, 2010 report, the Task Force noted that the State could realize significant cost savings by eliminating or reducing the practice of physically producing and distributing paper checks for payroll and other payments, including UI payments. Notably, in 2010 the Department of Labor and Workforce Development implemented a debit card program for UI benefits that has completely eliminated paper check payments and has already saved the taxpayers millions debit of dollars. program has More been

importantly,

the

Departments

card

lauded by experts as extremely consumer friendly.

In fact, the

National Consumer Law Center concluded in a recent report that New Jersey has one of the best UC prepaid cards, with multiple free ways to access cash, including some out-of-network ATM withdrawals, free account information, and no penalty fees. By requiring a paper check option for UI benefits payments, this legislation would undermine the Departments efforts to maximize cost savings and beneficiary convenience through its successful debit card program. In addition of to having and an adverse impact upon debit the card

Department

Labor

Workforce

Developments

program, if approved in its current form this legislation will likely impede future efforts to pursue cost savings to payroll and tax refund operations. discourage the State Specifically, the legislation might exploring the feasibility of

from

eliminating paper checks for these payments in the future and might hinder future efforts to achieve less costly, but equally effective alternatives. In recognition of the foregoing, I recommend that the bill be revised to codify the Department of Labor and Workforce

Developments continue efficient taxpayer. that to

successful serve our

debit UI

card

program in

so

that

we

can and the

claimants the

an

effective savings to

manner

and

maximize

programs

In addition, I recommend that the bills provisions paper check options for State employee

mandate

compensation and State tax refunds be eliminated so that we can preserve our flexibility to explore future cost saving measures for these payments. Accordingly, I herewith return Senate Bill No. 3046 and recommend that it be amended as follows: Page 2, Title, Line 2: Page 2, Title, Line 3: Page 2, Section 1, Lines 8-17: Page 2, Section 2, Line 19: Page 2, Section 2, Line 22: Delete Title 52 Revised Statutes, of the

Delete and Title 54 of the Revised Statutes Delete in their entirety Delete 2. and insert 1. After benefits, delete written notice of benefit payment options, which shall and insert payment either in the form of deposit into a benefit debit card account as prescribed or approved by the division or payment by direct deposit into the claimants personal account in a financial institution. Unless the claimant affirmatively indicates to the division a choice of payment by direct deposit into the claimants personal account in a financial institution, the division shall make payment of benefits to the claimant by deposit into a benefit debit card account prescribed or approved by the division. In no case shall payment be made by way of a paper check or other negotiable instrument other than as permitted by this section. Delete in their entirety After option delete at any time. The written

Page 2, Section 2, Lines 23-26: Page 2, Section 2, Line 28:

notice, and insert at a time and in a manner prescribed by the division through regulation. Page 2, Section 2, Lines 29-39: Page 2, Section 3, Lines 41-44: Page 2, Section 4, Line 46: Delete in their entirety Delete in their entirety Delete 4. and insert 2.

Respectfully, /s/ Chris Christie Governor [seal]

Attest: /s/ Kevin M. ODowd Deputy Chief Counsel to the Governor

Você também pode gostar

- RECO Outage ReportDocumento1 páginaRECO Outage ReportGovernor Chris ChristieAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Facts Behind MSNBC's False ClaimsDocumento3 páginasThe Facts Behind MSNBC's False ClaimsGovernor Chris ChristieAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- PSEG Outage ReportDocumento10 páginasPSEG Outage ReportGovernor Chris ChristieAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Facts On Hoboken's Sandy Recovery AidDocumento3 páginasThe Facts On Hoboken's Sandy Recovery AidGovernor Chris ChristieAinda não há avaliações

- JCP&L Outage ReportDocumento5 páginasJCP&L Outage ReportGovernor Chris Christie50% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Elements of A Plan For The Creation of A Structure To Better Promote Tourism in The State of New JerseyDocumento22 páginasElements of A Plan For The Creation of A Structure To Better Promote Tourism in The State of New JerseyGovernor Chris ChristieAinda não há avaliações

- Building The Jersey ComebackDocumento4 páginasBuilding The Jersey ComebackGovernor Chris ChristieAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Betting On Atlantic CityDocumento3 páginasBetting On Atlantic CityGovernor Chris ChristieAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- EO-90: Governor Chris Christie Orders Flags Lowered To Half-Staff in Honor of Congressman Donald M. PayneDocumento3 páginasEO-90: Governor Chris Christie Orders Flags Lowered To Half-Staff in Honor of Congressman Donald M. PayneGovernor Chris ChristieAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- ACE Outage ReportDocumento1 páginaACE Outage ReportGovernor Chris ChristieAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Governor Christies FY 2013 Budget Makes Education A Key PriorityDocumento3 páginasGovernor Christies FY 2013 Budget Makes Education A Key PriorityGovernor Chris ChristieAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Supremely QualifiedDocumento3 páginasSupremely QualifiedGovernor Chris ChristieAinda não há avaliações

- Trenton Two StepDocumento1 páginaTrenton Two StepGovernor Chris ChristieAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Governor's FY 2013 Budget SummaryDocumento150 páginasThe Governor's FY 2013 Budget SummaryGovernor Chris ChristieAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- EO-89: Governor Christie Creates The Education Funding Task ForceDocumento5 páginasEO-89: Governor Christie Creates The Education Funding Task ForceGovernor Chris ChristieAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Tax Relief For All New JerseyansDocumento2 páginasTax Relief For All New JerseyansGovernor Chris ChristieAinda não há avaliações

- Governor Chris Christie Designates Week of January 22rd, 2012 School Choice Week in New JerseyDocumento1 páginaGovernor Chris Christie Designates Week of January 22rd, 2012 School Choice Week in New JerseyGovernor Chris ChristieAinda não há avaliações

- List of Medal RecipientsDocumento1 páginaList of Medal RecipientsGovernor Chris ChristieAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- EO-87: Governor Chris Christie Orders Flags Lowered To Half-Staff in Recognition of New Jersey Native Whitney HoustonDocumento2 páginasEO-87: Governor Chris Christie Orders Flags Lowered To Half-Staff in Recognition of New Jersey Native Whitney HoustonGovernor Chris ChristieAinda não há avaliações

- EO-88: Governor Chris Christie Orders Flags Lowered To Half-Staff in Honor of Fallen Military ServicemanDocumento3 páginasEO-88: Governor Chris Christie Orders Flags Lowered To Half-Staff in Honor of Fallen Military ServicemanGovernor Chris ChristieAinda não há avaliações

- Governor Christie Conditionally Vetoes Senate Bill 1Documento6 páginasGovernor Christie Conditionally Vetoes Senate Bill 1Governor Chris ChristieAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- UMDNJ Advisory Committee Final ReportDocumento57 páginasUMDNJ Advisory Committee Final ReportGovernor Chris ChristieAinda não há avaliações

- Assembly Bill No. 3920 (Second Reprint) StatementDocumento3 páginasAssembly Bill No. 3920 (Second Reprint) StatementGovernor Chris ChristieAinda não há avaliações

- Home Field Advantage: Part 2Documento2 páginasHome Field Advantage: Part 2Governor Chris ChristieAinda não há avaliações

- Red Tape Review Commission Issues Report Detailing Strategies To Cut Red Tape For Businesses and Non-Profits Throughout New JerseyDocumento41 páginasRed Tape Review Commission Issues Report Detailing Strategies To Cut Red Tape For Businesses and Non-Profits Throughout New JerseyGovernor Chris ChristieAinda não há avaliações

- EO-86: Governor Chris Christie Orders Flags Lowered To Half-Staff in Honor of Fallen Military ServicemanDocumento2 páginasEO-86: Governor Chris Christie Orders Flags Lowered To Half-Staff in Honor of Fallen Military ServicemanGovernor Chris ChristieAinda não há avaliações

- Governor'S Statement Upon Signing Assembly Bill No. 3138 (Third Reprint)Documento1 páginaGovernor'S Statement Upon Signing Assembly Bill No. 3138 (Third Reprint)Governor Chris ChristieAinda não há avaliações

- Tax Relief For All New JerseyansDocumento2 páginasTax Relief For All New JerseyansGovernor Chris ChristieAinda não há avaliações

- New Jersey's Fiscal Health: Then vs. NowDocumento2 páginasNew Jersey's Fiscal Health: Then vs. NowGovernor Chris ChristieAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Bid Doc DPTC Set Ind759Documento36 páginasBid Doc DPTC Set Ind759rafikul123Ainda não há avaliações

- WiproDocumento2 páginasWiproshreya singhAinda não há avaliações

- Test PDFDocumento3 páginasTest PDFkazim4ualiAinda não há avaliações

- Stripe's Guide To Payment MethodsDocumento33 páginasStripe's Guide To Payment MethodsYogesh Gutta100% (1)

- Financial Services Offered by BankDocumento52 páginasFinancial Services Offered by BankIshan Vyas100% (2)

- Credit Cards SO APIDocumento524 páginasCredit Cards SO APIfirepenAinda não há avaliações

- PBill August'23Documento9 páginasPBill August'23ajdubeyAinda não há avaliações

- Final Revision in General Schedule of Fees and Charges W e F 1st May 2022Documento2 páginasFinal Revision in General Schedule of Fees and Charges W e F 1st May 2022AbhiAinda não há avaliações

- SA20210817Documento4 páginasSA20210817charlene maeAinda não há avaliações

- Bank Account Statement Jan-Jul 2019Documento4 páginasBank Account Statement Jan-Jul 2019sanathoi rajkumariAinda não há avaliações

- Capitec Statement NewDocumento4 páginasCapitec Statement NewCindyAinda não há avaliações

- S 6 Uo J5 KP 47 FH NireDocumento5 páginasS 6 Uo J5 KP 47 FH NirePraveen ChunaraAinda não há avaliações

- Non Resident Account: Tax InvoiceDocumento2 páginasNon Resident Account: Tax InvoiceEmanuelsön Caverä BreezÿAinda não há avaliações

- Miscellaneous Banking ActivitiesDocumento20 páginasMiscellaneous Banking ActivitiessaktipadhiAinda não há avaliações

- SmartHRMS User Manual V2Documento126 páginasSmartHRMS User Manual V2avelogic100% (2)

- Warehouse UK Bill FormatDocumento6 páginasWarehouse UK Bill FormatKuka KukaAinda não há avaliações

- FloraBank User ManualDocumento113 páginasFloraBank User Manualkash50% (2)

- State Bank of India savings account statement for Mr. Rachaprolu AtchaiahDocumento12 páginasState Bank of India savings account statement for Mr. Rachaprolu AtchaiahRajesh pvkAinda não há avaliações

- Online Payment System Using Steganography and Visual Cryptography PDFDocumento5 páginasOnline Payment System Using Steganography and Visual Cryptography PDFanandhu kaleshAinda não há avaliações

- Nsebp PDFDocumento187 páginasNsebp PDFWilmer HernandezAinda não há avaliações

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento5 páginasStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSurya PrakashAinda não há avaliações

- RB NotesDocumento35 páginasRB NotesmyokhinewinAinda não há avaliações

- UBL Annual Report 2009Documento272 páginasUBL Annual Report 2009Malik Anees NawazishAinda não há avaliações

- U2.Reading Practice - True False Not Given Extra 1 - Attempt ReviewDocumento4 páginasU2.Reading Practice - True False Not Given Extra 1 - Attempt ReviewNgan Lam100% (1)

- Operative Accounts Deposit Accounts Loan Accounts All AccountsDocumento2 páginasOperative Accounts Deposit Accounts Loan Accounts All AccountsGamer JiAinda não há avaliações

- 53RD Personal Bank StatementDocumento3 páginas53RD Personal Bank StatementKelvin Dominic50% (2)

- Impact of E-Banking on Customer Satisfaction in Sri Lankan BanksDocumento27 páginasImpact of E-Banking on Customer Satisfaction in Sri Lankan BanksKhristine Dela CruzAinda não há avaliações

- TOTAISDocumento55 páginasTOTAISJim Reeves100% (1)

- Axa China Bank ADA Enrollment Form PDFDocumento1 páginaAxa China Bank ADA Enrollment Form PDFAna A OverlyAinda não há avaliações

- Plastic Card ADV Crypto WorldDocumento2 páginasPlastic Card ADV Crypto WorldHenry Vargas GamboaAinda não há avaliações

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesNo EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesAinda não há avaliações

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteNo EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteNota: 4.5 de 5 estrelas4.5/5 (16)

- Reading the Constitution: Why I Chose Pragmatism, not TextualismNo EverandReading the Constitution: Why I Chose Pragmatism, not TextualismAinda não há avaliações

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpNo EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpNota: 4.5 de 5 estrelas4.5/5 (11)

- You Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherNo EverandYou Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherAinda não há avaliações

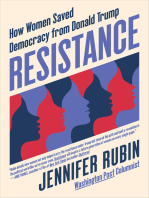

- Resistance: How Women Saved Democracy from Donald TrumpNo EverandResistance: How Women Saved Democracy from Donald TrumpAinda não há avaliações

- Witch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryNo EverandWitch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryNota: 4 de 5 estrelas4/5 (6)

- The Courage to Be Free: Florida's Blueprint for America's RevivalNo EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalAinda não há avaliações