Escolar Documentos

Profissional Documentos

Cultura Documentos

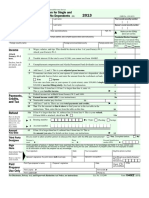

W4 Sheet

Enviado por

naru_vDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

W4 Sheet

Enviado por

naru_vDireitos autorais:

Formatos disponíveis

2011 Form W-4 *

Purpose. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes. Exemption from withholding. Read Section III of the UC W-4/DE 4 to see if you can claim exempt status. If exempt, complete only the UC W-4/DE 4, but do not complete Section I, Box 2; Section II, Boxes 2 or 3; or Section IV. Sign the form to validate it. Your exemption for 2011 expires February 16, 2012. See Pub. 505, Tax Withholding and Estimated Tax. Note: You cannot claim exemption from withholding if (a) your income exceeds $950 and includes more than $300 of unearned income (for example, interest and dividends) and (b) another person can claim you as a dependent on their tax return. Basic instructions. If you are not exempt, complete the Personal Allowances Worksheet below. The worksheets on pages 1 and 2 adjust your withholding allowances based on itemized deductions, certain credits, adjustments to income, or two-earner/multiple job situations. Complete all worksheets that apply. However, you

Department of the Treasury Internal Revenue Service

may claim fewer (or zero) allowances. For regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. Head of household. Generally, you may claim head of household filing status on your tax return only if you are unmarried and pay more than 50% of the costs of keeping up a home for yourself and your dependent(s) or other qualifying individuals. See line E below. Refer to Pub. 501, Exemptions, Standard Deduction, and Filing Information, for information. Tax credits. You can take projected tax credits into account in figuring your allowable number of withholding allowances. Credits for child or dependent care expenses and the child tax credit may be claimed using the Personal Allowances Worksheet below. See Pub. 919, How Do I Adjust My Tax Withholding, for information on converting your other credits into withholding allowances. Nonwage income. If you have a large amount of nonwage income, such as interest or dividends, consider making estimated tax payments using Form 1040-ES, Estimated Tax for Individuals. Otherwise, you may owe additional tax. If you have pension or annuity income, see Pub. 919 to find out if you should adjust your withholding on Form W-4 or W-4P. Two earners/Multiple jobs. If you have a working spouse or more than one job, figure the total number of allowances you are entitled to claim on all jobs using worksheets from only one Form W-4. Your withholding usually will be most accurate when all allowances are claimed on the Form W-4 for the highest paying job and zero allowances are claimed on the others. See Pub. 919 for details. Nonresident alien. If you are a nonresident alien, see the Instructions for Form 8233 before completing the UC Form W-4NR/DE 4. Check your withholding. After your Form W-4 takes effect, use Pub. 919 to see how the dollar amount you are having withheld compares to your projected total tax for 2011. See Pub. 919, especially if your earnings exceed $130,000 (Single) or $180,000 (Married). Recent name change? If your name on line 1 differs from that shown on your social security card, call 1-800-772-1213 to initiate a name change and obtain a social security card showing your correct name. Sign the UC W-4/DE 4. valid unless you sign it. The form is not

PERSONAL ALLOWANCES WORKSHEET (keep for your records) A B C D E F G

Enter 1 for yourself if no one else can claim you as a dependent Enter 1 if: You are single and have only one job; or You are married, have only one job, and your spouse does not work; or Your wages from a second job or your spouses wages (or the total of both) are $1,500 or less

A _________ B _________

Enter 1 for your spouse. But, you may choose to enter "-0-" if you are married and have either a working spouse or more than one job. (Entering -0-" may help you avoid having too little tax withheld.) Enter number of dependents (other than your spouse or yourself) you will claim on your tax return Enter 1 if you will file as head of household on your tax return (see conditions under Head of household above)

Enter 1 if you have at least $1,900 of child or dependent care expenses for which you plan to claim a credit (Note: Do not include child support payments. See Pub. 503, Child and Dependent Care Expenses, for details.) Child Tax Credit (including additional child tax credit). See Pub 972, Child Tax Credit, for more information. If your total income will be less than $61,000 ($90,000 if married), enter 2 for each eligible child; then less 1 if you have three or more eligible children. If your total income will be between $61,000 and $84,000 ($90,000 and $119,000 if married), enter 1 for each eligible child G _________ plus "1" additional if you have 6 or more eligible children Add lines A through G and enter total here. (Note: This may be different ------------------------------------------------------- H _________ from the number of exemptions you claim on your tax return.) For accuracy, complete all worksheets that apply. If you plan to itemize or claim adjustments to income and want to reduce your withholding, see the Deductions and Adjustments Worksheet on page 2. If you have more than one job or are married and you and your spouse both work and the combined earnings from all jobs exceed $40,000 ($10,000 if married), see the Two-Earners/Multiple Jobs Worksheet on page 2 to avoid having too little tax withheld. If neither of the above situations applies, stop here and enter the number from line H in Section I, Box 2, of the UC W-4/DE 4.

C _________ D _________ E _________ F _________

* Use this sheet for FEDERAL instructions and worksheets.

Complete the UC W -4 / DE 4 as directed

OMB No. 1545-0010

Form W-4 (2010)

Page

Deductions and Adjustments Worksheet

Note: Use this worksheet only if you plan to itemize deductions, claim certain credits, or claim adjustments to income on your 2011 tax return. 1 Enter an estimate of your 2011 itemized deductions. These include qualifying home mortgage interest, ch aritable contributions, state and local taxes, medical expenses in excess of 7.5% of your income, and miscellaneous deductions. 1 2 Enter: $11,600 if married filing jointly or qualifying widow(er) $ 8,500 if head of household $ 5,800 if single or married filing separately ..... 2 $ $

3 Subtract line 2 from line 1. If zero or less, enter -0- 4 Enter an estimate of your 2011 adjustments to income and any additional standard deduction. ( Pub. 919 ). 5 Add lines 3 and 4 and enter the total. (Include any amount for credits from Worksheet 6 in Pub. 919) 6 Enter an estimate of your 2011 nonwage income (such as dividends or interest) 7 Subtract line 6 from line 5. If zero or less, enter -0- 8 Divide the amount on line 7 by $3,700 and enter the result here. Drop any fraction

3 4 5 6 7 8

$ $ $ $ $

9 Enter the number from the Personal Allowances Worksheet, line H, page 1 9 10 Add lines 8 and 9 and enter the total here. If you plan to use the Two-Earners/Multiple Jobs Worksheet, also enter this 10 total on line 1 below. Otherwise stop here and enter this total in Section 1, Box 2, of the UC W-4/DE4...................

Two-Earners/Multiple Jobs Worksheet (See Two earners/multiple jobs on page 1.)

Note: Use this worksheet only if the instructions under line H on page 1 direct you here. 1 Enter the number from line H, page 1 (or from line 10 above if you used the Deductions and Adjustments Worksheet) 2 Find the number in Table 1 below that applies to the LOWEST paying job and enter it here. However, if you are married filing jointly and wages from the highest paying job are $65,000 or less, do not enter more than 3. 3 If line 1 is more than or equal to line 2, subtract line 2 from line 1. Enter the result here (if zero, enter -0-) and in Section I, Box 2, of the UC W-4/DE 4. DO NOT use the rest of this worksheet Note: If line 1 is less than line 2, enter -0- in Section I, Box 2, of the UC W-4/DE 4. Complete lines 4-9 below to calculate the additional withholding amount necessary to avoid a year-end tax bill. 4 Enter the number from line 2 of this worksheet 4 5 Enter the number from line 1 of this worksheet 5 6 Subtract line 5 from line 4 7 8 9 Find the amount in Table 2 below that applies to the HIGHEST paying job and enter it here Multiply line 7 by line 6 and enter the result here. This is the additional annual withholding needed Divide line 8 by the number of months remaining in 2011. For example, divide by 26 if you are paid every two weeks and you complete this form in December 2010. Enter the result here and in Section IV, Box 1 of the UC W-4/DE 4. This is the additional amount to be withheld from each paycheck Table 1 Married Filing Jointly If wages from LOWEST Enter on paying job are line 2 above $0 $5,000 0 5,001 - 12,000 1 12,001 22,000 2 22,001 - 25,000 3 25,001 - 30,000 4 30,001 - 40,000 5 40,001 - 48,000 6 48,001 - 55,000 7 55,001 - 65,000 8 65,001 - 72,000 9 72,001 - 85,000 10 85,001 - 97,000 11 97,001 - 110,000 12 110,001 - 120,000 13 120,001 - 135,000 14 135,001 and over 15 All Others If wages from LOWEST Enter on paying job are line 2 above $0 - $8,000 0 8,001 - 15,000 1 15,001 - 25,000 2 25,001 - 30,000 3 30,001 - 40,000 4 40,001 - 50,000 5 50,001 - 65,000 6 65,001 - 80,000 7 80,001 - 95,000 8 95,001 - 120,000 9 120,001 and over 10 Table 2 Married Filing Jointly If wages from HIGHEST Enter on paying job are line 7 above $0 - $65,000 $560 65,001 - 125,000 930 125,001 - 185,000 1,040 185,001 - 335,000 1,220 335,001 and over 1,300 All Others If wages from HIGHEST Enter on paying job are line 7 above $0 - $35,000 $560 35,001 90,000 930 90,001 - 165,000 1,040 165,001 - 370,000 1,220 370,001 and over 1,300 1 2 3

6 7 8 $ $

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. The Internal Revenue Code requires this information under sections 3402(f)(2)(A) and 6109 and their regulations. Failure to provide a properly completed form will result in your being treated as a single person who claims no withholding allowances; providing fraudulent information may also subject you to penalties. Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation, to cities, states, and the District of Columbia for use in administering their tax laws, and using it in the National Directory of New Hires. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103. The average time and expenses required to complete and file this form will vary depending on individual circumstances. For estimated averages, see the instructions for your income tax return. If you have suggestions for making this form simpler, we would be happy to hear from you. See the instructions for your income tax return.

Você também pode gostar

- Webcam For AdultDocumento2 páginasWebcam For AdultDixieojmwwAinda não há avaliações

- Form W-4 (2013) : Employee's Withholding Allowance CertificateDocumento2 páginasForm W-4 (2013) : Employee's Withholding Allowance Certificateapi-20374706Ainda não há avaliações

- Withholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)Documento4 páginasWithholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)ts0m3Ainda não há avaliações

- Tax Form 2016Documento2 páginasTax Form 2016Sharkman1234566100% (1)

- Payroll Setup ChecklistDocumento4 páginasPayroll Setup ChecklistcaliechAinda não há avaliações

- F1040ez PDFDocumento2 páginasF1040ez PDFjc75aAinda não há avaliações

- Beta 1040 EzDocumento2 páginasBeta 1040 EzLeonard RosentholAinda não há avaliações

- US Internal Revenue Service: fw4p - 2001Documento4 páginasUS Internal Revenue Service: fw4p - 2001IRSAinda não há avaliações

- Monica L Lindo Tax FormDocumento2 páginasMonica L Lindo Tax Formapi-299234513Ainda não há avaliações

- US Internal Revenue Service: fw4 - 2002Documento2 páginasUS Internal Revenue Service: fw4 - 2002IRSAinda não há avaliações

- US Internal Revenue Service: fw4p - 1995Documento3 páginasUS Internal Revenue Service: fw4p - 1995IRSAinda não há avaliações

- Attention:: Order Information Returns and Employer Returns OnlineDocumento6 páginasAttention:: Order Information Returns and Employer Returns Onlinepdizypdizy0% (1)

- US Internal Revenue Service: fw4 - 2000Documento2 páginasUS Internal Revenue Service: fw4 - 2000IRSAinda não há avaliações

- US Internal Revenue Service: fw4p - 2000Documento4 páginasUS Internal Revenue Service: fw4p - 2000IRSAinda não há avaliações

- Income Tax Return For Single and Joint Filers With No DependentsDocumento2 páginasIncome Tax Return For Single and Joint Filers With No DependentsmarahmaneAinda não há avaliações

- US Internal Revenue Service: fw4s07 AccessibleDocumento2 páginasUS Internal Revenue Service: fw4s07 AccessibleIRSAinda não há avaliações

- US Internal Revenue Service: fw4p07 AccessibleDocumento4 páginasUS Internal Revenue Service: fw4p07 AccessibleIRSAinda não há avaliações

- US Internal Revenue Service: fw4p - 1994Documento3 páginasUS Internal Revenue Service: fw4p - 1994IRSAinda não há avaliações

- US Internal Revenue Service: fw4 - 1998Documento2 páginasUS Internal Revenue Service: fw4 - 1998IRSAinda não há avaliações

- F1040ez 2008Documento2 páginasF1040ez 2008jonathandeauxAinda não há avaliações

- US Internal Revenue Service: fw4p - 1993Documento3 páginasUS Internal Revenue Service: fw4p - 1993IRSAinda não há avaliações

- fw4 PDFDocumento2 páginasfw4 PDFbikash PrajapatiAinda não há avaliações

- US Internal Revenue Service: fw4p - 2003Documento4 páginasUS Internal Revenue Service: fw4p - 2003IRSAinda não há avaliações

- Us W-2 2015 PDFDocumento7 páginasUs W-2 2015 PDFkevsAinda não há avaliações

- TDON1Documento2 páginasTDON1Fevzi OzdemirAinda não há avaliações

- 2012 Ontario Tax FormDocumento2 páginas2012 Ontario Tax FormHassan MhAinda não há avaliações

- US Internal Revenue Service: fw4p - 2002Documento4 páginasUS Internal Revenue Service: fw4p - 2002IRSAinda não há avaliações

- Withholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)Documento4 páginasWithholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)quylowAinda não há avaliações

- US Internal Revenue Service: fw4s 06Documento2 páginasUS Internal Revenue Service: fw4s 06IRSAinda não há avaliações

- US Internal Revenue Service: fw4 - 1994Documento2 páginasUS Internal Revenue Service: fw4 - 1994IRSAinda não há avaliações

- Withholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)Documento4 páginasWithholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)imimranAinda não há avaliações

- Form 1040-ES (NR) : U.S. Estimated Tax For Nonresident Alien IndividualsDocumento9 páginasForm 1040-ES (NR) : U.S. Estimated Tax For Nonresident Alien IndividualsBrokerAAinda não há avaliações

- US Internal Revenue Service: fw4 - 1997Documento2 páginasUS Internal Revenue Service: fw4 - 1997IRSAinda não há avaliações

- Instructions For Form 1099-G: Future DevelopmentsDocumento2 páginasInstructions For Form 1099-G: Future DevelopmentsDunk7Ainda não há avaliações

- Publication 590 Appendix C, Individual Retirement Arrangements (IRAs)Documento10 páginasPublication 590 Appendix C, Individual Retirement Arrangements (IRAs)Michael TaylorAinda não há avaliações

- Shit PDFDocumento2 páginasShit PDFlysprr0% (1)

- Form W-4 (2009) : Employee's Withholding Allowance CertificateDocumento1 páginaForm W-4 (2009) : Employee's Withholding Allowance Certificateezra242Ainda não há avaliações

- US Internal Revenue Service: fw4 - 1993Documento2 páginasUS Internal Revenue Service: fw4 - 1993IRSAinda não há avaliações

- Certain Government Payments: 4. Federal Income Tax WithheldDocumento2 páginasCertain Government Payments: 4. Federal Income Tax WithheldWhisnu Wardhana0% (1)

- US Internal Revenue Service: fw4p 06Documento4 páginasUS Internal Revenue Service: fw4p 06IRSAinda não há avaliações

- F1040es 2018Documento18 páginasF1040es 2018diversified1Ainda não há avaliações

- Notice To Employee Instructions For Employee: (Continued From The Back of Copy B.)Documento1 páginaNotice To Employee Instructions For Employee: (Continued From The Back of Copy B.)redditor1276Ainda não há avaliações

- fw418510 0Documento2 páginasfw418510 0ezra242100% (2)

- Copy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Documento4 páginasCopy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Andy BipesAinda não há avaliações

- Withholding Certificate For Pension or Annuity Payments: Personal Allowances WorksheetDocumento4 páginasWithholding Certificate For Pension or Annuity Payments: Personal Allowances WorksheetIRSAinda não há avaliações

- PDF W2Documento1 páginaPDF W2John LittlefairAinda não há avaliações

- Individuals: Tax Return ForDocumento12 páginasIndividuals: Tax Return FormoocowchickenAinda não há avaliações

- File by Mail Instructions For Your Federal Amended Tax ReturnDocumento14 páginasFile by Mail Instructions For Your Federal Amended Tax ReturnRyan MayleAinda não há avaliações

- Notice To Employee Instructions For Employee: WWW - SSA.govDocumento1 páginaNotice To Employee Instructions For Employee: WWW - SSA.govPiyush AgrawalAinda não há avaliações

- fw46707 0Documento2 páginasfw46707 0ezra242Ainda não há avaliações

- FW 4Documento2 páginasFW 4Ana MartinezAinda não há avaliações

- 2012 Federal ReturnDocumento1 página2012 Federal Return24male86Ainda não há avaliações

- 1040 Exam Prep: Module II - Basic Tax ConceptsNo Everand1040 Exam Prep: Module II - Basic Tax ConceptsNota: 1.5 de 5 estrelas1.5/5 (2)

- Surviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesNo EverandSurviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesAinda não há avaliações

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryAinda não há avaliações

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsNo Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsAinda não há avaliações

- Income Tax Basic Definitions and TermsDocumento13 páginasIncome Tax Basic Definitions and TermsshivamAinda não há avaliações

- Assignment ACFI2080 Corporate FinanceDocumento11 páginasAssignment ACFI2080 Corporate FinanceArif KamalAinda não há avaliações

- Bir Ruling No. Dac168 519-08Documento12 páginasBir Ruling No. Dac168 519-08Jasreel DomasingAinda não há avaliações

- Maksi Perbanas IAS 19 Income Taxes-1Documento102 páginasMaksi Perbanas IAS 19 Income Taxes-1Vi Trio100% (1)

- Syllabus - Commercial and Taxation LawDocumento13 páginasSyllabus - Commercial and Taxation LawDiane JulianAinda não há avaliações

- Batch 16 2nd Preboard (TOA)Documento12 páginasBatch 16 2nd Preboard (TOA)Patrick Walters50% (2)

- FORM16 CLTDocumento4 páginasFORM16 CLTrajeevAinda não há avaliações

- AFAR - Partnership OperationsDocumento3 páginasAFAR - Partnership OperationsCleofe Mae Piñero AseñasAinda não há avaliações

- 1 ULO 1 To 3 Week 1 To 3 SHE Activities (AK)Documento10 páginas1 ULO 1 To 3 Week 1 To 3 SHE Activities (AK)Margaux Phoenix KimilatAinda não há avaliações

- Taxation For DevelopmentDocumento23 páginasTaxation For DevelopmentHRDS Region 3Ainda não há avaliações

- Income Tax Calculator For Financial Year 2011 12Documento18 páginasIncome Tax Calculator For Financial Year 2011 12Karan GulatiAinda não há avaliações

- Form PDF 457810310271221Documento6 páginasForm PDF 457810310271221Pankaj GuptaAinda não há avaliações

- One Liner Case Laws by BB May-20 PDFDocumento15 páginasOne Liner Case Laws by BB May-20 PDFnaga jaganAinda não há avaliações

- Tax Credits and Calculation of Tax: What Is Income Tax?Documento59 páginasTax Credits and Calculation of Tax: What Is Income Tax?Moilah MuringisiAinda não há avaliações

- 56212rtpfinaloldnov19 p7Documento52 páginas56212rtpfinaloldnov19 p7naveen kumarAinda não há avaliações

- Cir V Pascor Realty & Dev'T Corp Et. Al. GR No. 128315, June 29, 1999Documento8 páginasCir V Pascor Realty & Dev'T Corp Et. Al. GR No. 128315, June 29, 1999Cristy Yaun-CabagnotAinda não há avaliações

- Form No. 25Documento5 páginasForm No. 25Amit BhatiAinda não há avaliações

- SMC 2021 Budget FinalDocumento39 páginasSMC 2021 Budget Finalprassna_kamat1573Ainda não há avaliações

- Tax2 Bar Qs CompiledDocumento10 páginasTax2 Bar Qs CompiledDaisyKeith VinesAinda não há avaliações

- PIC MicroprojectDocumento19 páginasPIC MicroprojectDevdas JadhavAinda não há avaliações

- Income Taxation Reviewer : With TRAIN Law UpdatesDocumento25 páginasIncome Taxation Reviewer : With TRAIN Law UpdatesTristanMaglinaoCanta75% (4)

- Income Tax Law PracticeH Final Bajaj Maam V Unit PDFDocumento38 páginasIncome Tax Law PracticeH Final Bajaj Maam V Unit PDFShubham JainAinda não há avaliações

- Form 16 2019 20Documento4 páginasForm 16 2019 20Kishan SinghAinda não há avaliações

- Reconciliation of Cost and Financial Account: By: Arun Sonu Jha Rahul Neeraj NitinDocumento21 páginasReconciliation of Cost and Financial Account: By: Arun Sonu Jha Rahul Neeraj NitinPushpendra GautamAinda não há avaliações

- Income Form Other Sources-9Documento10 páginasIncome Form Other Sources-9s4sahith50% (2)

- Taxation Law Bar QuestionsDocumento54 páginasTaxation Law Bar QuestionsAnthony RoblesAinda não há avaliações

- CIR vs. Filinvest Dev't Corp.Documento2 páginasCIR vs. Filinvest Dev't Corp.Direct LukeAinda não há avaliações

- Chapter 7Documento7 páginasChapter 7张心怡Ainda não há avaliações

- DeductionsDocumento4 páginasDeductionsDianna RabadonAinda não há avaliações

- Taxation Case DigestsDocumento8 páginasTaxation Case DigestsJane Sudario100% (1)