Escolar Documentos

Profissional Documentos

Cultura Documentos

For Business Information, Annual Reports, Laws, Ordinances, Regulations and Articles

Enviado por

farisDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

For Business Information, Annual Reports, Laws, Ordinances, Regulations and Articles

Enviado por

farisDireitos autorais:

Formatos disponíveis

For business information, annual reports, laws, ordinances, regulations and articles.

Top of Form

Web

Bottom of Form

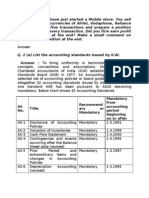

Paksearch.com

United Bank Limited Annual Report 2000 Auditors' Report to the Members We have audited the annexed balance sheet of UNITED BANK LIMITED as at December 31, 2000 and the related profit and loss account and the cash flow statement, together with the notes forming pert thereof for the year then ended, in which are incorporated the unaudited certified returns from the branches except for 43 branches which have been audited by us and 19 branches audited by auditors abroad and we state that we have obtained all the information and explanations which to the best of our knowledge and belief were necessary for the purposes of our audit and, after due verification thereof, found them satisfactory and, we report that: a) in our opinion, proper books of accounts have been kept by the Bank as required by Companies Ordinance, 1984, and the returns referred to above received from the branches have been found adequate for the purposes of our audit; b) in our opinion: (i) the balance sheet and profit and loss account together with the notes thereon have been drawn up in conformity with the Banking Companies Ordinance, 1962, and the Companies Ordinance, 1984, and are in agreement with the books of account and are further in accordance with accounting policies consistently applied except for the changes as explained in note 4 with which we concur, (ii) the expenditure incurred during the year was for the purposes of Bank's business; and

(iii) the business conducted, investments made and the expenditure incurred during the year were in accordance with the objects of the Bank and the transactions of the Bank which have come to our notice have been within the powers of the Bank; c) in our opinion and to the best of our information and according to the explanations given to us, the balance sheet, profit and loss account and the cash flow statement together with the notes forming part thereof give the information required by the Banking Companies Ordinance, 1962, and the Companies Ordinance 1984, in the manner so required and respectively give a true and fair view of the state of the Bank's affairs as at December 31, 2000 and its true balance of the profit and cash flows for the year then ended; d) in our opinion, Zakat deductible at source under the Zakat and Ushr Ordinance, 1980, was deducted by the Bank and deposited in the Central Zakat Fund established under section 7 of that Ordinance. Sd/EBRAHIM & CO. Chartered Accountants Karachi Dated: May 12, 2001 Balance Sheet as at December 31, 2000 Note ASSETS Cash and cash reserves Balances with other banks & money at calf Investments Advances - Performing - Non Performing net of provision Taxes recoverable Deferred taxation Operating fixed assets Other assets 5 6 7 8 8 9 9 10 11 2000 1999 (Rupees in thousand) 8,129,223 10,995,922 33,101,778 61,200,674 12,955,747 6,380,572 8,297,500 2,764,367 11,385,333

Sd/FORD, RHODES, ROBSON, MORRO

Chartered Accountan

11,657, 12,010, 44,953, 40,353, 21,361, 5,411,265 9,101, 2,811, 6,789 ----------------------------------155,211,116 154,450,

LIABILITIES Deposits and other accounts Borrowings from other banks, agents, etc. Bills payable Other liabilities Deferred liabilities

12 13 14 15

128,679,245 127,133, 4,859,758 7,329, 1,186,961 1,508, 10,387,683 9,427, 1,294,883 1,002, ----------------------------------146,408,530 146,400,

-----------------NET ASSETS ========== Represented by: Share capital Reserve fund and other reserves Accumulated losses Shareholders' equity Surplus/(deficit) on revaluation of securities Surplus on revaluation of fixed assets 16 17 22,481,680 4,087,899 (19,842,975) -----------------6,726,604 (103,409) 2,179,391 -----------------8,802,586 ==========

-----------------8,802,586 8,050, ========== 22,481,680 3,761,331 (20,376,649) -----------------5,866,362 -2,183,850 -----------------8,050,212 ========== 12,654,381 22,259,092

MEMORANDUM ITEMS Bills for collection Acceptances, endorsements & other obligations Contingent liabilities and commitments

18 19

9,228,

25,415,

The annexed notes form an integral part of these accounts Sd/Amar Zafar Khan President and Chief Executive Karachi Dated: May 12, 2001 Profit and Loss Account for the year ended December 31, 2000 Note Mark up / interest and discount and/or return earned Less: Cost / return on deposits, borrowings etc. 2000 10,416,460 (6,740,868) -----------------3,675,592 1,180,448 22,733 1999 (Rupees in thousand) 9,861,676 (7,508,557) -----------------235,311

Sd/Afaq Tiwana Director

Sd/Iftikhar A. Allawala Director

Fees, commissions and brokerage Dividend income

969,

18,

Other operating income

20

Total Income Administrative expenses Operating profit Provision against non performing assets/contingenc Profit before unusual items Unusual items Profit before taxation Taxation charge Profit after taxation Appropriation Transfer to statutory reserve Accumulated losses brought forward Accumulated losses carried forward

21

2,139, ----------------------------------3,497,037 3,126, ----------------------------------7,172,629 54,797 (5,159,130) (4,719,951) ----------------------------------2,013,499 759,776 (120,539) -----------------1,892,960 (247,463) -----------------(1,645,497) (978,405) -----------------667,092 (133,418) -----------------533,674 (20,376,649) -----------------(19,842,975) ========== (101,412) -----------------405,647 (20,782,296) -----------------(20,376,649) ========== (65,504) -----------------694,272 558,787 -----------------1,253,059 (746,000) ------------------

2,293,856

8.4

22 23 24 17

507,

The annexed notes form an integral part of these accounts Sd/Amar Zafar Khan President and Chief Executive Karachi Dated: May 12, 2001 Cash Flow Statement for the year ended December 31, 2000 2000 CASH FLOW FROM OPERATING ACTIVITIES Profit before taxation 1999 (Rupees in thousand) 1,253,059

Sd/Afaq Tiwana Director

Sd/Iftikhar A. Allawala Director

1,645,497

Less: Dividend income

(22,733) -----------------1,622,764

(18,417) -----------------1,234,642 177,093 (94,989) (640,317) (51,358) 12,363 (333,235) 103,540 -----------------(1,026,903) -----------------207,739 (11,596,534) (1,977,112) -----------------(13,573,646) 9,414,903 642,994 2,311,256 -----------------12,369,153 -----------------(996,754) (1,276,613) -----------------(2,273,367)

Adjustment for non-cash/other charges Depreciation 174,708 Provision for diminution/depreciation in the value of investment 617,206 Provision against non-performing advances 7,631,964 Profit on sales of banking (13,211) assets Provision for retirement benefits - (net) 292,586 Advances written-off (489,877) Provision - others (47,419) -----------------8,165,957 -----------------9,788,721 (Increase) in operating assets Advances (19,584,098) Other assets (4,548,586) -----------------(24,132,684) Increase / (decrease) in operating liabilities Deposits and other accounts 1,546,041 Bills payable (321,592) Other liabilities 1,152,248 -----------------2,376,697 -----------------Cash flow before tax (11,967,266) Income tax paid (1,143,712) -----------------Net cash flow used in operating activities (13,110,978) CASH FLOW FROM INVESTING ACTIVITIES Net sale of investments Dividend income Fixed capital expenditure Sale proceed of banking assets Net cash flow from investing activities CASH FLOW FROM FINANCING ACTIVITIES Borrowing from other banks Lease finance repaid Net cash flow used in /from financing

11,131,517 22,733 (114,185) 11,345 -----------------11,051,410

2,620,438 18,417 (210,696) 113,689 -----------------2,541,848

(2,469,402) (13,951) -----------------(2,483,353)

1,833,968 (10,594) -----------------1,823,374

activities (Decrease) / increase in cash and cash equivalents for the year Cash and cash equivalents at the beginning of the year Cash and cash equivalents at the end of the year Cash and cash equivalents Cash and cash reserves Balances with other banks & money at call -----------------(4,542,921) 23,668,066 -----------------19,125,145 ========== 8,129,223 10,995,922 -----------------2,091,855 21,576,211 -----------------23,668,066 ==========

11,657, 12,010, ----------------------------------19,125,145 23,668, ========== ==========

Sd/Amar Zafar Khan President and Chief Executive Karachi Dated: May 12, 2001

Sd/Afaq Tiwana Director

Sd/Iftikhar A. Allawala Director

Notes to the accounts for the year ended December 31, 2000 1. Status and Nature of Business United Bank Limited is incorporated in Pakistan and is engaged in commercial banking and related services The Bank operates 1371 (1999: 1398) branches in Pakistan and 19 (1999: 19) branches outside Pakistan. 2. Basis of presentation These financial statements have been prepared in accordance with the requirements of the State Bank of Pakistan (under the powers conferred upon it under the Banking Companies Ordinance, 1962) to conform with BPRD Circular No. 31 dated August 13, 1997. 3. Summary of Significant Accounting Policies 3.1 Historical Cost Convention These accounts have been prepared under the historical cost convention. 3.2 Staff Retirement Benefits The bank operates a funded pension scheme established in 1996. Contributions to the fund are based on actuarial advice. Provision for liability towards pension scheme has been recognized on the basis of actuarial advice in accordance with requirements of International Accounting Standards 19.

The bank also operates a non-funded gratuity schema for those employees who have not opted for the pension scheme. Provisions are made annually to cover the obligations. The bank has also established a contributory staff provident fund and contributions are made in accordance with the terms of the scheme. The bank provides for compensated absences on the basis of actuarial advice in accordance with requirements of International Accounting Standard 19. The hank provides post-retirement medical to eligible retired employees. Provision is made annually to meet the cost of such medical benefit. Actuarial liability is amortized over a period of 5 years. The hank also operates a contributory benevolent fund. Provision is made annually to meet the cost of bank's obligation. Actuarial deficit is amortized over a period of 5 years. 3.3 Taxation Current Provision for taxation is based on the taxable income for the year. Deferred The bank accounts for deferred taxation on major timing differences using the liability method in respect of those timing differences, which may reverse in the foreseeable future. Deferred tax debits are, however, recognized only if there is reasonable expectation of realization of the amount. 3.4 Advances Amounts are stated net of provisions against non-performing advances. Provisions for domestic advances are made at the end of the year in accordance with the requirements of prudential regulations issued by the State Bank of Pakistan and charged to profit and loss account. Provision pertaining to overseas advances are made to meet the requirements of monetary agencies and regulatory authorities. 3.5 Investments These am stated at acquisition cost, net of adjustments and provisions. Adjustments relate to amortisation of premium over the period of maturity. Provisions are made wherever considered necessary to cover the decline in market value as at the balance sheet date, determined on an aggregate portfolio basis. In respect of domestic portfolio, all securities bald by the bank are classified as investment securities. Securities, where the intention and ability is to hold are stated at amortized cost less provision for permanent diminution in value, if any, with the exception of securities where ready quotes are available on Reuters Page (PKRV) or Stock Exchanges, from this year, in accordance with requirements of BSD circular if 20 dated August 04, 2000 issued by State Bank of Pakistan. Securities for which ready quotes are available on Reuters Page (PKRV) or Stock Exchanges are valued at market value and the resulting surplus/deficit is kept in a separate account and is shown below the shareholder's equity in the balance

sheet. Gains and losses arising on disposals are taken to profit and loss account. The bank also enters into transactions of repos and reverse repos at contracted rates for a specified period of time. These are recorded as under: Sale under repurchase obligations: The securities are deleted from the books and the charges arising from the differential in sale and repurchase value are accrued on a pro-rata basis and recorded as expense. Upon repurchase the securities are reinstated at their deleted values. Purchase under resale obligations: The securities are booked at the contracted purchase price and the differential of the contracted price and resale price is amortised over the period of their contract and recorded as income. 3.6 Operating Fixed Assets Fixed assets are stated at cost or valuation less accumulated depreciation. Depredation is computed over the estimated useful lives of the related assets at varying rates and methods depending on the nature of the assets and the country of operation. Profit and less on disposal is taken to income currently Assets held under finance leases are stated at cost less depreciation. The outstanding obligations under the lease agreements are shown as a liability net of finance charges allocable to future periods. The financial charges on finance leases are allocated to accounting periods in a manner so as to provide a constant periodic rate of charge on the outstanding liability. Depreciation is charged at the rates specified in the relevant note. 3.7 Deferred Cost Deferred costs am amortised over a period of five years. 3.8 Provision against Contingencies Provisions required against guarantees, letters of credit relating to non-performing customers is provided for in the accounts. 3.9 Revenue Recognition Mark-up/return on loans/advances and investments is recognised on an accrual basis, except in case of leans/advances classified under the prudential regulations. The return on classified advances is taken to income account on realization. Fees, commission and brokerage income is recognized when earned. Dividend income is recognized on an accrual basis on the basis of declaration of dividend up to the year end. 3.10 Foreign Currencies Assets, liabilities, income and expenses of overseas branches, investments in subsidiaries & joint venture,

other foreign currency balances and forward exchange contracts are translated into rupees at the applicable rate of exchange prevailing at the balance sheet date or where appropriate, at contractual rates. Foreign currency transactions during the year are converted into Pakistan rupees applying the exchange rate at the date of respective transactions. Gains and losses on translation are included in income currently. 3.11 Overseas Branches Investments in overseas branches are accounted as foreign entities as per the requirements of International Accounting Standard No. 21. Consequent, gains and losses on translation of carrying value of investments are taken to equity and shown as Exchange Reserve. 4. REASONS AND EFFECTS OF CHANGES IN ACCOUNTING POLICIES 4.1 Investments The State Bank of Pakistan through BSD Circular No. 20 dated August 04, 2000 has directed all banks to revalue their security holdings on the basis of market value and any surplus/deficit arising on such revaluation should not be taken to profit and loss account except when actually realized and instead should be kept in a separate account called 'Surplus / deficit on revaluation of securities'. Consequently, effective this year the Bank has changed its accounting policy for valuation of its investment in marketable securities which are now stated at their market values as referred to in Note: 3.5 above. Further, the surplus/deficit on revaluation has been shown below shareholders' equity in the balance sheet. Had this policy not been changed the profit before taxation for the current year would have been lower by Rs. 103,409 thousand and there would have been no surplus/deficit on revaluation of securities. 4.2 Deferred Liabilities Effective this year, the bank has decided to provide for post retirement medical benefits and contributory benevolent fund based on actuarial advice to comply with the requirements of International Accounting Standard 19. Actuarial liability is amortised over a period of 5 years. Had this policy not been changed the profit before taxation for the current year would have been higher by Rs. 245 million and accumulated losses would be lower by this account. 4.3 Provision against Contingencies Effective this year, the bank has decided to make provision against guarantees, letters of credit relating to non-performing customers to comply with Core principles Methodology for Effective Banking Supervision. Had this policy not been changed the profit before taxation for the current year would have been higher by Rs. 229 million and accumulated losses would be lower by this amount 2000 5. CASH AND CASH RESERVES AS AT DECEMBER 31, 1999 (Rupees in thousand)

In hand - local currency - foreign currencies With State Bank of Pakistan in: - Special deposit account - Current account With other central banks With National Bank of Pakistan in: - Current account -----------------========== 6. BALANCES WITH OTHER BANKS & MONEY AT CALL Outside Pakistan - Deposit account - Current account - Money at Call and Short Notice ------------------

2,548,950 507,412 875,713 300,893 2,673,808 1,222,447

2,398, 917,

3, 5,347, 1,857,

1,132, -----------------8,129,223 11,657, ==========

9,388,748 1,093,458 513,716

9,206, 1,391,

1,412,

-----------------10,995,922 12,010, ========== ========== 7. INVESTMENTS (at cost less provision) Dealing Securities Federal Government Securities: - Federal Investment Bonds - Treasury Bills Fully paid-up ordinary shares: ------------------ listed companies ========== Investment Securities Debentures, Bonds, Participation Term Certificates and Term Finance Certificates Federal and Provincial Government Securities: - Treasury Bills - Foreign Currency Bonds - Federal Investment Bonds - Foreign Securities - Provincial Government Securities - CDC Saarc Fund (Overseas) - Central Government Securities 5,848,321

3,050,000 2,578,181 220,140

2,488, 91,

136,

-----------------2,716, ==========

11,640,637 7,092,715 3,884,847 2,399,003 1,618,388 312,593 164,584 157,700

14,266,

17,923, 3,240, 4,052, 1,388,

312,

105,

226,

-----------------Investments in subsidiary companies Fully paid-up ordinary shares: - listed companies - unlisted companies Stock of National Prize Bonds ------------------

-----------------15,629,830 27,249, 374,845 338, 649,828 465,712 46,684

733, 265, 218,

Less: Provision for diminution in value of investments Less: Provision for diminution in marketable securities charged to profit and loss account in prior years (224,053) Less: Difference between carrying and market value as at December 31, 2000 taken to surplus / (deficit) on revaluation of securities in accordance with SBP's BSD Circular No. 20 dated August 4, (103,409) 2000 Less: Amortisation of premium on investments (156,393) -----------------33,101,778 ========== 7.1 Investments include following which have been placed on non-performing status; - shares of unlisted companies - debentures, participation term certificates and term finance certificates (includes Rs. 708 million guaranteed by the Government 1999: Rs. 3,458 million) Less: Provision for diminution in value of investment

-----------------28,807,536 43,071, ========== ========== 34,655,857 45,787,374 (1,070,224) (476,000) (222,767)

-(134,697) -----------------44,953,910 ==========

129,835

--

1,891,002 2,020,837 (1,070,224) -----------------950,613 ==========

4,458,872 4,438,872 (476,000) -----------------3,962,872 ==========

7.2 Investments of net book value of Rs. 117 million (Gross Rs. 312 million) are likely to be transferred to the Corporate and Industrial Restructuring Corporation as more fully discussed in note: 8.2 (a) 7.3 As at December 31, 2000 market value of quoted investments was Rs. 10,441 million (1999: Rs. 18,662 million) and value of un-quoted investments was Rs. 22,888 million (1999: Rs. 26,292 million). 7.4 investments include Rs. 329 million (1999: 329 million) held by the State Bank of Pakistan and National

Bank of Pakistan against demand loan and TT/DD discounting facilities sanctioned to the Bank. 8. ADVANCES 8.1 Advances (Performing) Loans, cash credits, overdrafts, etc: - In Pakistan - Outside Pakistan Bills discounted and purchased (excluding Government Treasury Bills) - Payable in Pakistan - Payable outside Pakistan 48,642,483 6,221,619

298,837, 4,074, ----------------------------------54,864,102 33,958, 878,415 5,458,157

466, 5,928, ----------------------------------6,336,572 6,394, ----------------------------------61,200,674 40,353, ========== ========== 52,340,183 8,860,491

Particulars of advances In local currency In foreign currencies

33,914, 6,438, ----------------------------------61,200,674 40,353, ========== ==========

Advances include an amount of Rs. 4,780 million which is recoverable from Pakistan Steel Mills Corporation (PASMIC). Until last year, the amount was being shown under investments in public sector companies. The liabilities of PASMIC towards various financial institutions are being restructured as loans by the Government of Pakistan (GOP) in May, 2000 as outlined in the letter No. 3640/Secy(I&P) dated May 24, 2000 issued by the Secretary, Ministry of Industries and Production. The Ministry of Finance has also given its concurrence to the above rescheduling through letter No. F.I (1) CF-III/2000474 dated May 30, 2000. As a consequence, income amounting to Rs. 1,253 million has been recognized in the accounts out of which Rs. 1,062 million pertaining to prior years is reflected in Note: 22. 8.2 Advances (Nonperforming) Loans, cash credits, overdrafts, etc: - In Pakistan - Outside Pakistan Interest on stuck up and doubtful advances

23,736,882 20,757,480 -----------------44,494,362 (10,777,779) -----------------33,716,583

24,665,097 19,832,544 -----------------44,497,641 (10,443,543) -----------------34,054,098

Bills discounted and purchased (excluding Government Treasury Bills) - Payable in Pakistan - Payable Outside Pakistan

1,896, 2,433, ----------------------------------4,348,813 4,330, ----------------------------------38,065,396 38,364, (25,109,649) -----------------12,955,747 ========== 7,597,857 5,357,890 (17,023,168) -----------------21,381,247 ==========

1,900,638 2,448,175

General & Specific provision for nonperforming advances (Note: 8.3)

Particulars of advances In local currency In foreign currencies

15,438, 5,923, ----------------------------------12,955,747 21,361, ========== ==========

Advances include Rs. 38,065 million having Net Book Value (NBV) of Rs. 12,956 million (1999: Rs. 38,384 million having NBV of Rs 21,381 million) which have been placed on non-performing status. These include: (a) Advances having NBV of Rs. 3,106 million (Gross Rs. 12,562 million) are likely to be transferred to the Corporate and Industrial Restructuring Corporation (CIRC) at forced sale values of the mortgaged assets not exceeding the net book value of advances. The ClRC has been formed by the Government of Pakistan with a view to rehabilitate the national economy by acquiring, restructuring, disposition etc. of non-performing assets of banks and financial institutions. UBL's transfer of such loans to CIRC is expected to be concluded by June 2001. (b) Advances having NBV of Rs. 3,223 million (Gross Rs. 5,681 million) though restructured & performing are included in NPLs. Of these advances balances amounting to NBV Rs. 133 million were restructured during the year (Gross Rs. 360 million) but have remained on non-performing status following the BPRD Circular Letter No. 2 dated January 29, 2000, which requires monitoring of performance for atleast one year before any upgradation is considered. (c) Advances below Rs. 1 million (NBV Nil; Gross Rs. 800 million), agricultural loans (NBV Rs. 70 million; Gross Rs. 650 million) and yellow cab advances (NBV Rs. 90 million; Gross Rs. 3,537 million) have been outsourced for collection purely on a success fee basis. (d) Loans/advances amounting to NBV of Rs. 265 million (Gross Rs. 314 million) guaranteed by Federal Government, against which no provision has been made against principal in accordance with Prudential Regulations. (e) Loans/advances amounting to NBV of Rs. 34 million (Gross Rs. 50 million) guaranteed by the

Provincial Governments against which no provision has been made against principal as per BSD circular letter No. 5 dated March 29, 2001. 8.3 Particulars of provision against non-performing advances Specific General 2000 (Rupees in thousand) Opening balance Exchange adjustments Charge for the year (Note: 8.4) Transfer Amounts written off Reversals Closing balance Provision against: Advances to banks Advances to others 16,904,874 118,294 928,080 1,528 7,750,793 28,166 (43,316) 56,102 (489,577) (300) (119,169) (27,826) ------------------ -----------------24,931,685 177,964 ========== ========== 17,023,168 929,608 7,778,959 14,786 (489,877) (146,995) -----------------25,109,649 ========== -25,109,649 -----------------25,109,549 ========== TOTAL 1999 18,865,635 (192,915) 56,953 (476,000) (333,235) (897,270) -----------------17,023,168 ========== -17,023,168 -----------------17,023,168 ==========

The Bank bas strengthened its credit controls and reporting procedures during the year. The Bank has also undertaken extensive verification of the non-performing loans and has revised estimation procedures relating to provisions. In consequence, calculations of provision including amounts related to prior years have been rectified. Additionally, Prudential Regulations relating to non-performing loans and provisioning were modified during the year by State Bank of Pakistan. The provision arising from these factors amounting to Rs. 8,081 million including provision against non performing investment amounting to Rs. 477 million has been charged in the accounts and shown under Note: 22. 8.4 Provisions have been charged as under: Provision against non-performing Unusual items assets/ contingencies Provision against advances - specific Provision against advances - general Provision against investments Provision against contingencies

Total

146,581 7,604,212 7,750,793 28,166 -28,166 ------------------ ----------------------------------174,747 7,604,212 7,778, 117,224 477,000 594,224 229,000 -229,000

Others Total 2000 Total 1999

(400,432) -----------------120,539 ========== 65,504 ==========

------------------8,081,212 ========== (897,270) ========== 2000

(400,432) -----------------8,201,751 ========== (831,766) ==========

AS AT DECEMBER 31, 1999 (Rupees In thousand)

8.5 Classification of advances by security Debts considered good in respect of which the Bank is fully secured Debts considered good for which the Bank holds on security other than the debtors' personal security Debts considered good secured by the personal liabilities of one or more parties in addition to the personal security of the debtors Debts considered doubtful or bad not provided for

57,515,237 7,250,446 9,390,738 ------------------74,156,421 ==========

45,211,364 7,195,500 9,307,546 ------------------61,714,410 ==========

8.6 Certain Debts due by directors, executives, associated undertakings and subsidiary companies Balance outstanding as at Dec. 31, 2000 Maximum total amount of advances including temporary advances granted during the year

Debts due by directors or executives of the Bank or any of them either severally or jointly with any other persons Debts due by companies or firms in which the directors of the Bank are interested as directors, partners or in the case of private companies, as members Debts due by subsidiary companies, controlled firms, managed modarabas and other associated undertakings

39,896 703,879 ---

42,

901,

8.7 Amounts written-off during the year In terms of sub-section (3) of section 33A of the Banking Companies Ordinance, 1962, the statement in respect of written-off loans or any other financial relief of five hundred thousand rupees or above allowed to a person(s) during the year ended December 31, 2000 is given at Annexure-1.

2000 9. TAXES RECOVERABLE AND DEFERRED TAXATION Taxes recoverable - net of provision (Note: 9.1) Deferred taxation (Note 9.2)

AS AT DECEMBER 31, 1999 (Rupees in thousand)

6,380,572 8,297,500

5,411,

9,101,

9.1 Based on the understanding reached with tax authorities the pending assessments of the bank and long outstanding issues that cover assessments date back to last 20 years are expected to be finalised by June 30, 2001. The significant outstanding issues relate to interest suspense, un-realised exchange gain, disallowance of borrowing cost and addition out of profit and loss account. 9.2 This represents the balance amount of deferred tax asset recognised in 1998. Based on the understanding reached with tax authorities, the tax losses carded forward are estimated at around Rs. 18,409 million, which would lapse in 2004 and deferred tax at current rate on the losses would amount to Rs. 10,677 million. The amount of deferred tax carded forward would be fully utilised by the year 2004 against current projected results. 10. OPERATING FIXED ASSETS Cost/Valuation (Deletions)/ Adjustments -8,490 44,653 (2,120) -----------------51,023 (7,494) -----------------43,529 ========== (62,331) ========== As at Dec. 31, 2000 --

Particulars Owned Land - leasehold Buildings on leasehold land Furniture, fixture and office equipment Vehicles Sub-Total Assets held under finance lease: Vehicles TOTAL 2000 TOTAL 1999

As at Jan. 01, 2000 938,861 1,795,094 1,441,827 164,582 -----------------4,338,364 40,649 -----------------4,379,213 ========== 4,218,340 ========== Rate % -As at Jan. 01, 2000 --

Additions/ Accretion -10,334 103,554 7,791 -----------------121,679 15,505 -----------------137,184 ========== 223,204 ========== Depreciation Charge for the year --

Particulars Owned Land - leasehold

Buildings on leasehold land Furniture, fixture and office equipm Vehicles

5 10-20 20

271,114 1,118,360 162,424 ------------------ -----------------1,551,898 15,337 ------------------ -----------------1,567,235 ========== ========== 1,390,142 ========== ==========

65,513 77,014 2,409

362,

1,245,

Sub-Total Assets held under finance lease: Vehicles 20 TOTAL 2000 TOTAL 1999

167, -----------------164,936 1,774, 9,772 174,708

20,

-----------------1,795, ========== 177,093 1,567, ==========

10.1 Revaluation of domestic properties The Bank has revalued its land and buildings as at December 31, 1998 based on report submitted by M/s. Engineering and Management Consultants-Engineers, Architects, Planners and Evaluators. 10.2 Details of disposal of fixed assets having book value above Rs. 100 thousand Description Cost/ Revaluation Book value 4,939 Sale Proceed Mode of Disposal 5,300Through Advertisement 2000 Purchaser Name and Address Tarranum Fishan Karachi

Bungalow # 23/11, 22nd Street, Phase V, 5,909 DHA, Karachi

AS AT DECEMBER 31, 1999 (Rupees in thousand) -5,632,552 -39,838 194,043 117,462 805,433 11,385,333

11. OTHER ASSETS Receivable from Government of Pakistan (Note: 22.1) 7,200,000 Income / mark-up accrued on advances and investments, commission & brokerage on shares and other income receivable 3,163,481 Deferred cost (Note: 11.1) 368,000 Haj refund 241,495 Stationery and stamps on hand 156,225 Advance deposits, advance rent and 113,040 prepayments Others (including suspense account Rs. 19 make, 1999 Rs. 39 148,092 million.) -----------------==========

-----------------6,789, ==========

11.1 Deferred cost pertains to staff voluntary separation scheme and is amortised over a period of five years in line with the technical release number 28 issued by the Institute of Chartered Accountants of Pakistan.

12. DEPOSITS AND OTHER ACCOUNTS Fixed deposits Savings deposits Current accounts Sundry deposits Margin deposits Deposits and other accounts of banks

38,151, 47,419, 30,871, 2,000, 808, 7,881, ----------------------------------128,679,245 127,133, ========== ==========

38,473,267 61,170,088 24,790,679 1,743,315 876,690 1,625,206

12.1 Particulars of deposits and other accounts In local currency -Cheap deposits (Note: 12.2) -Other deposits

58,283, 37,280, ----------------------------------98,528,561 95,563, 7,763,248 22,387,436

64,476,238 34,052,323

In foreign currencies - Cheap deposits (Note 12.2) - Other deposits

6,432, 25,137, ----------------------------------30,150,684 31,569, ----------------------------------128,679,245 127,133, ========== ==========

12.2 Cheap deposits represent current, savings, 7 days notice and cash management accounts. 13. BORROWINGS FROM OTHER BANKS, AGENTS ETC. In Pakistan Outside Pakistan 4,796,638 63,120

7,074, 254, ----------------------------------4,659,758 7,329, ========== ========== 4,796,638 63,120

13.1 Particulars of borrowings from other Banks, agents etc. In Local currency In foreign currencies

7,074, 254, ----------------------------------4,659,756 7,329, ========== ==========

13.2 Un-secured Loans from banks and other financial institutions Loans from subsidiary companies, managed modarabas

33,822

16,288

and associated undertakings Loans from directors (including chief executive) of the Bank Loans from State Bank of Pakistan: -Export finance -Locally manufactured machinery Money at call / Interbank borrowings

--3,763,987 323,829 -----------------4,087,816

33,735 --

4,123,

1,101,

-----------------5,224, 738,120 2,054, ----------------------------------4,859,758 7,329, ========== ==========

13.3 These loans carry mark up at rates ranging from 5.21% to 14.25% per annum. 14. OTHER LIABILITIES Profit payable on PLS deposits and other accounts Branch adjustment account Accrued expenses Provision for non-funded advances Interest on foreign currency deposits Mark-up/Interest on loans/borrowings Payable under severence scheme Income received in advance Others Liabilities against assets subjects to finance leases (Note: 14.1)

6,024,083 2,673,745 958,340 229,000 167,586 102,016 93,565 -112,860 26,488 ------------------180,662 43,141 147,892

5,183,

2,520, 1,038,

177, 108, 24,

-----------------10,387,683 9,427, ========== ========== 14.1 Liabilities against Assets subject to finance leases These represent finance leases entered into with leasing companies for vehicles. The rate of interest used as the discounting factor are ranging from 17% to 19% (1999: 19% to 20%) per annum. There is no financial restriction in the lease agreement. The amount of future minimum lease payments together with the present value of the minimum lease payments and the periods during which they will become due are, as follows: Year ending Dec. 31, 2000 Minimum Present value Lease of Payments Payments -16,797 8,244 -14,081 7,096 Minimum Lease payments 15,993 10,746 2,347 Dec. 31, 1999 Present value of payments 12,994 9,684 2,256

December, 2000 December, 2001 December, 2002

December, 2003 Less: Financial charges allocated to future periods

5,669 5,311 ------------------ -----------------30,710 26,488 (4,152) ------------------- -----------------26,488 26,488 ========== ==========

------------------29,086 (4,152) -----------------24,934 ==========

------------------24,934 ------------------24,934 ==========

At the end of period the ownership of assets shall transfer to the Bank on payment of residual value. The cost of operating and maintaining the leased assets is borne by the Bank. These are secured by demand promissory notes and security deposits. 2000 15. DEFERRED LIABILITIES (Note: 15.1) Medical/benevolent fund Gratuity Provision for pension and compensated absences 246,000 424,527 625,356 -----------------1,294,883 ========== AS AT DECEMBER 31, 1999 (Rupees In thousand) -436,941 565,356 -----------------1,002,297 ==========

15.1 The actuarial valuation of various schemes has produced the following results as at December 31,2000: Retirement Schemes Pension Scheme (Funded) Gratuity (Non-funded) Benevolent Fund (Funded) Acturial results

Surplus- Rs. 208 million Total liabilities Rs. 393 million fully provided in the accounts Deficit of Rs. 63 million being amortised over 5 years w.e.f December 31, 2000 Medical Scheme (Un-funded) Actuarial liabilities Rs. 1,163 million being amortised Over 5 years w.e.f. December 31, 2000 16. SHARE CAPITAL Authorized 2,500,000,000 ordinary shares of Rs. 10/= each ========== Issued, subscribed and paid up: Ordinary shares of Rs. 10/= each: 2000 1999 22,403,784

25,000,000

25,000, ==========

2,240,378,400 2,240,378,400Issued for cash

22,403,

Issued for consideration other tha 6,783,600 6,783,600Issued as bonus shares ---------------------------------2,248,168,000 2,248,168,000 ========== ========== 1,006,000 1,006,000

10,060 67,836 -----------------22,481,680 ========== ------------------

10,

67,

22,481, ==========

16.1 Capital Adequacy To further strengthen the capital adequacy ratio (CAR) of the Bank, the Government of Pakistan has Committed to provide a sub-ordinated loan in the sum of Rs. 1 billion during the year 2001. 17. RESERVE FUND AND OTHER RESERVES Statutory Exchange 2000 (Rupees in thousand) Balance at the beginning of 2,214,412 1,546,919 year Transfer from profit and loss 133,418 -accou Exchange difference on net investment in foreign branches defined as "foreign entities." -193,156 ------------------ -----------------2,347,830 1,740,089 ========== ========== 3,761,331 133,418 3,831,817 101,412 AS AT DECEMBER 31, 1999

193,150 -----------------4,087,899 ========== 2000

(171,898) -----------------3,761,331 ==========

AS AT DECEMBER 31, 1999 (Rupees in thousand) 1,077,567 11,576,694

18. BILLS FOR COLLECTION Payable in Pakistan Payable outside Pakistan

1,017, 8,211, ----------------------------------12,654,381 9,228, ========== ==========

19. CONTINGENT LIABILITIES AND COMMITMENTS 19.1 Contingencies 19.1.1 Money for which the Bank is contingently liable: a) Contingent liability in respect of guarantees given on behalf

of directors or officers or any of them (severally or jointly) with any other person, subsidiaries & associated undertakings b) Contingent liability in respect of guarantees given favouring: i) Government ii) Banking companies and other financial institutions iii) Others

--

--

914, 3,631, 3,929, ----------------------------------8,088,295 8,475,

469,336 3,922,201 3,696,758

Provision has been made for liability of Rs. 229 million in respect of guarantees / LCs to non-performing customers. The provision is reported under the head of "Other liabilities". 19.1.2 Claims against the Bank not acknowledged as debts 7,028,537

6,079,

19.1.3 The tax department has raised tax demands relating to various items aggregating Rs. 5,858 million including demands in respect of interest suspense on classified advances recorded under Prudential Regulations of the State Bank of Pakistan which has been taxed and is currently disputed in appeals. In the matter of interest suspense the Bank has flied reference applications, before the Honourable High Court of Sindh which have been heard, and a decision is awaited. 19.1.4 There are additional tax demands of Rs. 37 million pertaining to overseas operations of the bank. The Bank has flied appeals with respective tax authorities and believe that such liability will not arise. 2000 19.2 Commitments 19.2.1 Commitments in respect of forward exchange contracts - Sale - Purchase 5,110,566 2,574,099 AS AT DECEMBER 31, 1999 (Rupees in thousand)

1,951, 2,093,

19.2.2The commitments for land and buildings under operating leases relating to overseas operations amounts to Rs. 69 million as follows. Within one year In the second to fifth year Over five years

19.2.3 Other commitments in respect of 'Repo' transactions.

17,455-45,310-6,693-----------------------------------69,458-========== ========== 6,595,688 2,415,

FOR THE YEAR ENDED DECEMBER 31, 2000 1999 (Rupees in thousand) 20. OTHER OPERATING INCOME Income from dealing in foreign currencies, brokerage etc. Incidental charges and other operational income Income from subsidiaries Income from disposal of banking assets Others -----------------========== 21. ADMINISTRATIVE EXPENSES Personnel cost Salaries, allowances etc. Staff retirement benefits Security guard expenses Medical expenses Premises cost Rent, taxes, insurance, electricity etc. Depreciation - Premises Repairs - Premises -----------------693,477 Other operating cost Non-executive directors' fees and allowances Legal and professional charges Office running expenses Communications Repairs and maintenance Financial charges on leased assets Stationery and printing Advertisement and publicity New product cost Auditors' remuneration (Note: 21.1) Depreciation Entertainment Vehicle expenses Subscriptions Donations Travelling Cartage, freight and 14 168,884 89,757 96,532 40,904 5,218 86,235 19,058 42,190 33,552 91,454 25,056 51,987 19,071 -34,816 26,205 1,560,344 651,691 727 13,211 67,883

1,907,

117,

6, 51, 56,

-----------------2,293,856 2,139, ==========

2,625, 306, 98, 163, ----------------------------------3,325,610 3,193, 587,180 83,254 23,043 ------------------

2,639,252 419,553 109,664 157,141

515, 81, 10,

606,

70, 67, 78, 28, 6, 82, 17, 33, 29, 95, 24, 43, 17,

39, 25,

conveyance Computer, expenses VAT paid-overseas Cleaning expenses Training and seminar Cash transportation charges Miscellaneous ----------------------------------========== 21.1 Auditors remuneration Ford, Rhodes, Robson, Morrow 2000 1999 2000 Audit fee Fee for audit of EPZ branch Special certifications and sundry advisory services Out of pocket expenses 175 -3,869 794 150 -2,351 709 175 27 3,759 772 4,733 ==========

115,555 30,373 14,232 8,924 48,400 91,526 -----------------1,140,043

108, 14, 11, 4, 46, 74,

920, -----------------5,159,130 4,719, ==========

Ebrahim & Co. 1999 Rupees in thousand 150 22 2,355 670 -----------------3,197 ==========

------------------ ------------------ -----------------4,838 3,210 ========== ==========

In addition to the above Rs. 24 million (1999: Rs. 24 million) have been paid by other overseas branches to various audit firms in respect of audit assignments conducted in those countries. 21.2 Increase in special certification and sundry advisory services is attributable to increase in fees of "Special Assignment on Advances" and other special assignment on "Core Principles Methodology for Effective Banking Supervision" and a special review of "Human Resource Management" carried out during 2000.

FOR THE YEAR ENDED DECEMBER 31, 2000 1999 (Rupees in thousand) 22. UNUSUAL ITEMS Exceptional provision against non-performing advances and investments (Note: 8.4) Medical / benevolent fund - yearly amortisation of liabilities Staff compensation / severence scheme /actuarial shortfall in compensated absences Product launch expenses on prize schemes

8,081,212 245,000 184,035 --

(897,270) -671,023 81,227

shelved Interest income for prior years Sale of collection rights (Note: 22.1)

(1,062,784) (7,200,000) -----------------247,463 ==========

(413,767) ------------------(558,787) ==========

22.1 The bank has entered into an arrangement with the Government of Pakistan (GOP), whereby the GOP is assisting the collection of specified long overdue and substantial loans. The bank's claim as at December 31, 2000 substantially exceeds the net book value of these loans. In consideration for the GOP assistance, with respect to collection effort, the bank and GOP have reached an arrangement, under which, the GOP has effectively acquired a beneficial right to a substantial part of collection proceeds on these loans. In consideration for this the GOP has agreed to pay Rs. 7.2 billion, irrevocably, within the year 2001. This transaction has been endorsed by the State Bank of Pakistan. 23. TAXATION CHARGE Year 2000 Current tax Prior year tax Deferred taxation Overseas Azad Kashmir Domestic Rupees in thousand --(750,000) -----------------(750,000) ========== Domestic -(95,000) -----------------(95,000) ========== Total (129,246) (45,159) (804,000) -----------------(978,4o5) ========== Total (286,000) (460,000) -----------------(746,000) ==========

(29,187) (100,059) (45,159) -(54,000) ------------------- -----------------(128,346) (100,059) ========== ========== Overseas Azad Kashmir

Year 1999 Current tax Deferred taxation - domestic

(133,678) (152,322) (365,000) ------------------- -----------------(498,678) (152,322) ========== ==========

24. PROFIT AFTER TAXATION Year 2000 Profit before tax Taxation charge-current - prior years - deferred* Overseas Azad Kashmir Domestic Rupees in thousand 1,261,029 --(750,000) -----------------(750,000) -----------------Total 1,645,497 (129,246) (45,159) (804,000) -----------------(978,405) ------------------

220,167 154,301 (29,187) (100,059) (45,159) -(54,000) ------------------- -----------------(128,346) (100,089) ------------------ ------------------

Profit after tax Effective tax rate Year 1999 Profit before tax Taxation charge - current - deferred* Total Profit after tax Effective tax rate

91,821 54,242 ========== ========== 58%61% ========== ========== Overseas Azad Kashmir

511,029 ========== 59% ========== Domestic 136,454 -(95,000) -----------------(95,000) -----------------41,454 ========== 70% ==========

667,092 ========== 59% ========== Total 1,253,059 (286,000) (460,000) -----------------(746,000) -----------------507,059 ========== 60% ==========

861,795 254,810 (133,678) (152,322) (365,000) ------------------- -----------------(498,678) (152,322) ------------------ -----------------363,117 102,488 ========== ========== 58% 60% ========== ==========

The overseas amount has been computed as a balancing item to maintain the effective tax rate at 58%. 25. REMUNERATION OF DIRECTORS AND EXECUTIVES The aggregate amount charged in the accounts for remuneration, including all benefits to the Chief Executive, Directors and Executives of the Bank is as follows: 2000 Fees Managerial remuneration Retirement benefits Rent Travelling Utilities Medical Re-imbursement of children educat Vehicle running, maintenance and -2,100 831 900 -160 -203 164 Chief Executive 1999 -2,100 -1,090 1,280 415 37 343 151 2000 14 --------Director 1999 Rupees in thousand 15 -------423 -----------------438 ========== 6 ==========

------------------ ------------------ -----------------4,358 ========== 1 ========== 5,416 ========== 1 ========== 14 ========== 6 ==========

Number of persons

In addition to the above the Chief Executive has been provided with a fully maintained car. The Executives are also provided with free use of Bank's maintained cars. 26. MATURITIES OF ASSETS AND LIABILITIES Up to one month Over one month to one year Rupees In thousand -Over one year to five years

Total ASSETS Cash and Cash Reserves Balance with other Banks & money Investments Advances-Performing -Non Performing net of provision Taxes recoverable Deferred taxation Operating fixed assets Other assets

8,129,223 10,995,922 33,101,778 61,200,674

8,129,223

--9,490,344 10,646,620 12,955,747 -8,297,500 663,448 276,000 -----------------42,329,659 ========== 32,489,932

9,947,7011,048,221 3,079,64511,171,296 10,272,12326,202,737 -6,380,572 -165,862 7,771,183 -----------------52,739,871 ==========

12,955,747-6,380,572-8,297,500-2,764,367-11,385,3333,338,150 ------------------ -----------------155,211,11634,766,842 ========== ========== 128,679,245

LIABILITIES Deposits and other accounts * Borrowings from other banks, agents etc. Bills payable Other liabilities Deferred liabilities

17,800,829

70,799,

4,859,758738,120 4,087,816 33,822 1,186,961949,569 237,392 -10,387,6836,293,685 1,067,097 124,156 1,294,883--------------------- ------------------ ----------------------------------146,408,530 25,782,203 37,882,237 70,957, ========== ========== ========== ========== 8,802,586 8,984,639 ========== 14,857,634(28,627,730) ========== ========== ==========

NET BALANCE

Shareholders' equity 6,726,604 Surplus / (deficit) on revaluation of securities (103,409) Surplus on revaluation of fixed 2,179,391 ass ------------------

8,802,586 ========== Current and savings deposits do not have any contractual maturity, therefore, current deposits and savings accounts have been classified between all four maturities. Further, it has been assumed that on a going concern basis, these deposits are not expected to fall below the current year's level. 27. SEGMENT ANALYSIS 27.1 Geographic segment Profit before taxation Pakistan Domestic Operations Karachi Export Processing Zone 1,425,330 (18,105) Total assets employed 112,936,075 5,086,606 Bills for collection Rupees in thousand 4,579,064 (18,134) Bills for collection

9,264,

49,

------------------ ------------------ -----------------1,407,225 118,022,681 4,560,930 ------------------ ------------------ -----------------Overseas Europe United States of America Middle East

-----------------9,334, ------------------

TOTAL

124,933 3,804,484 763,426 174, 26,072 1,478,588 26,072 27, 87,267 31,905,363 3,452,158 3,117, ------------------ ------------------ ----------------------------------238,272 37,188,435 4,241,656 3,319, ------------------ ------------------ ----------------------------------1,645,497 155,211,116 8,802,586 12,654, ========== ========== ========== ==========

27.2 Segment by class of business Deposits Rupees in thousand Percentage Rupees in thousand 1.5 6.1 0.722,819,672 0.1948,859 0.3729,382 0.31,047,018 0.6310,245 0.5533,676 8,316 3,679,351 1,064,739 7,192,346 Advances Percentage

Chemicals and pharmaceuticals 1,959,198 Agribusiness 7,816,438 Textile 877,345 Cement 131,092 Sugar 403,806 Shoes and leather garments 306,367 Automobile and transportation 788,811 Financial 673,123 Insurance 1,389,322 1.1 Transportation 291,364 0.2

Electronics and electric appliances Production and transmission of en Basic metal industry Others Less: Provision for bad debts Less: Interest suspense account

786,005 1,822,818

0.6 1.4

657,558 1,045,521 4,779,618 65,227,548 (25,109,649) (10,777,779) -----------------74,158,421 ==========

0.9 1.4 6.4 88.0 (33.9) (14.5) -----------------==========

--111,433,558 86.6 ---------------------- -----------------128,679,245 100.0 ========== ==========

10

27.3 Segment by sector Deposits Rupees in thousand Public/Government Private Percentage Rupees in thousand Advances Percentage

11,297,790 8.8 20,655,549 117,351,455 91.2 53,500,872 ------------------ ------------------ ----------------------------------128,679,245 100.0 74,156,421 ========== ========== ========== ========== AS AT DECEMBER 31, 2000 DOMESTIC OVERSEAS 2,996,806 10,544,578 4,780,333 61,200,674 12,955,747 6,380,572 8,297,500 2,764,367 11,385,333 -----------------155,211,116 (Rs. in thousand) TOTAL

2 7

10

27.4 Balance Sheets

ASSETS Cash and cash reserves Balances with other banks & money at call Investments Advances - Performing - Non Performing net of provision Taxes recoverable Deferred taxation Operating fixed assets Other assets

5,132,417 451,344 28,321,445 52,340,183 8,860,491 7,597,857 6,377,456 8,297,500 2,636,618 11,075,695 -----------------122,230,515 103,576,798 4,796,638 1,003,076 2,770,701 5,357,890 3,116 -127,749 309,638 -----------------32,980,601 25,102,447 63,120 163,885 7,616,982

8,129, 10,995, 33,101,

LIABILITIES Deposits and other accounts Borrowings from other banks, agents, etc. Bills payable Other liabilities

128,679, 4,859, 1,186, 10,387,

Deferred liabilities

NET ASSETS Represented by: Share capital Reserve fund and other reserves Accumulated losses

1,280,716 -----------------113,427,929 -----------------8,802,586 ==========

14,167 -----------------32,980,601 ------------------========== -----------------------------------------========== 3,569,533 4,418,081

1,294, -----------------146,408, -----------------8,802, ========== 22,481,680 4,087,899 (19,842,975) -----------------6,726,604 (103,409) 2,179,391 -----------------8,802,586 ==========

22,481,680 4,087,899 (19,842,975) -----------------Shareholder's equity 6,726,604 Surplus / (deficit) on revaluation of securities (103,409) Surplus on revaluation of fixed assets 2,179,391 -----------------8,802,586 ========== MEMORANDUM ITEMS Bills for collection Acceptances, endorsements & other obligations 27.5 Profit and Loss Accounts

9,264,848 17,641,011

12,654,

22,259,

FOR THE YEAR ENDED DECEMBER 31, 2000 DOMESTIC Mark up/Interest and discount and/or return earned 8,572,881 Less: Cost/return on deposits, borrowings etc. (5,722,756) -----------------2,850,125 -----------------Fees, commissions and 680,444 brokerage Dividend income 22,733 Other operating income 2,068,199 -----------------2,771,376 -----------------Total income 5,621,501 Administrative expenses (4,045,433) -----------------1,576,068 Operating profit Provision against non OVERSEAS 1,843,579 (1,018,112) -----------------825,467 -----------------500,004 -225,657 -----------------725,661 -----------------1,551,128 (1,113,697) -----------------437,431 (Rs. in thousand) TOTAL 10,416,460 (6,740,868) -----------------3,675,592 -----------------1,180,448 22,733 2,293,856 -----------------3,497,037 -----------------7,172,629 (5,159,130) -----------------2,013,499

performing assets / contingencies Profit before unusual items Unusual items Profit before taxation

(114,585) -----------------1,461,483 (35,153) -----------------1,425,330 ==========

(5,954) -----------------431,477 (211,310) -----------------220,167 ==========

(120,539) -----------------1,892,960 (247,463) -----------------1,645,497 ==========

28. CURRENCY BREAKDOWN OF ASSETS AND LIABILITIES Assets Rupees in thousand Pakistan Rupee US Dollar Pound Sterling Deutsche Mark Japanese Yen Other European Currencies Other Currencies Percentage Rupees in thousand Liabilities Percentage

116,095,529 74.8 104,016,153 16,275,850 10.5 19,264,348 3,543,041 2.3 3,542,363 12,797 0.0 57,045 7,114 0.0 873 408,591 0.3 588 18,868,194 12.1 19,527,160 ------------------ ------------------ ----------------------------------155,211,116 100.0 146,408,530 ========== ========== ========== ========== 2000 1999 (Rupees in thousand)

7 1

10

29. TRANSACTIONS WITH ASSOCIATED UNDERTAKINGS i) Advances given during the year ii) Advances repaid during the year iii) Deposits (at year end) iv) Mark-up/interest expensed v) Mark-up/Interest earned vi) Others - legal expenses

298,320 100,000 41,256 17 4,978 870 97,391 177,430 154,912 29,928 --

1,508,

30. MERGER OF THE UK BUSINESS WITH NATIONAL BANK OF PAKISTAN Negotiations are currently in progress with regard to a possible merger of the UK branch network of the bank with the UK branch network of National Bank of Pakistan (NBP) but no substantive agreements have been signed. Both the banks have signed Heads of Agreement declaring the intention of such a merger. Discussions are currently in progress with the Financial Services Authority (FSA) in the United Kingdom and detailed submissions to them were made at the end of April, 2001. The businesses are expected to merge following receipt of the appropriate authorisation from the FSA. A joint venture company (JVC) has bean formed which will take over the businesses of the two banks in UK. It is anticipated that shareholding in the JVC will be held 55% by United Bank Limited and 45% by

NBP. 31. GENERAL Figures have been rounded off to the nearest thousand. rupees. Corresponding figures have been re-arranged wherever necessary for the purpose of comparison. Sd/Amar Zafar Khan President and Chief Executive Karachi Dated: May 12, 2001 STATEMENT UNDER SECTION 237 (1)(e) OF THE COMPANIES ORDINANCE, 1984 United Executors and Trustees Company Limited a) Extent of the interest of United Bank Limited (holding Company) in the equity of its subsidiaries at the end of last financial period of the subsidiaries. b) The net aggregate amount of profits/(losses) of the subsidiary company so far as these concern members of the holdings company that has not been dealt with in the accounts of the holding company for the year ended Dec 31, 2000. For the current financial period of the (1,091) subsidiary. For the previous periods but subsequent of the acquisition of controlling interest by the holding company. 4,515 c) The net aggregate amount of profits/(losses) of the subsidiary company so far as these have been dealt with or provision made for losses in the accounts of holding company for the year ended December 31, 2000. For the current financial year of the subsidiary. For pervious year but subsequent to the acquisition of controlling interest by the holding company d) Audited financial statements of subsidiaries For the year ended June 30, 2000 is For the year ended December 31, 2000 100%

Sd/Afaq Tiwana Director

Sd/Iftikhar A. Allawala Director

(Rupees in thousand United Bank Limited (Zurich)

10

20,468 4,039

attached Sd/Amar Zafar Khan President and Chief Executive Karachi Dated: May 12, 2001 STATEMENT UNDER SECTION 237 (8) OF THE COMPANIES ORDINANCE, 1984

is attached

Sd/Afaq Tiwana Director

Sd/Iftikhar A. Allawala Director

United Executors and Trustees Company Limited a) Change in the holding company's interest in the subsidiary between the end of the financial year of the subsidiary and the end of the holding company financial year b) Details of material changes which have occurred between the end of the financial year of the subsidiary and the end of the holding company's financial year in respect of: - The subsidiary's fixed assets - The investments - The monies lent by it and - The monies borrowed by it for any purpose other - than that of meeting current liabilities. Sd/Amar Zafar Khan President and Chief Executive Karachi Dated: May 12, 2001 ANNEXURE-I

--

--

-----

Sd/Afaq Tiwana Director

Sd/Iftikhar A. Allawala Director

LOANS/ADVANCES/FINANCES FACILITIES/MARK-UP OR OTHER DUES WRITTEN-OFF AND OTHER FINANCIAL RELIEFS PROVIDED THROUGH RESCHEDULING OR RESTRUCTURING RS. 0.5 MILLION OR MORE DURING THE YEAR ENDED 2000 Sr. No. Name and address of the borrower Name of individuals/ partners/directors N.I.C. Number (where available)

1.

M/s. Quil Tex. Pvt. Ltd. Mr. Mian Muhammad Ehsan Amin Town, Kashmir Road, Mrs. Abida Ehsan Faisala M/s. Royal Flying Coach, 6-Tipu Block, New Garden Town Lahore Mr. Muhammad Khalid Malik Mr. Muhammad Tariq Malik Mr. Saqib Malik Mrs. Mubarika Sultan

244-92-393162 244-60-278940 270-42-262537 274-44-155669 270-60-373707 270-23-262455 ---

2.

3. 4.

M/s. Al-Rabia Trading Corp. Mr. Muhammad Ashraf Faisal M/s. Haji Textiles Factory, Mr. Haji Qadiruddin P-450, Madina Street, Sammundri Road, Faisalabad. M/s. Rachana Industries Mr. Ch. Muhammad Nawaz Sammundri Road, Faisalabad. M/s. Umer Hayat Sial Group. Mrs. Rifat Sial i) Sial Cotton Ginner & Oil Mrs. Somaira Sial Mills Garh Mr. Nadir Hayat Moharaja ii) Indus Ginners & Millers Mr. Umer Hayat Sial (Late) Mouza Hafafizabad Mianwali iii) Umer Hayat Sial M/s. A. K. Brothers Textile PAK (P 4th Floor Sadiq Plaza Katachery Bazar Faisalabad. 2) 4/6 Haseeb Shaheel Colony, Fais Mr. Rana Abdul Khaliq Mr. Ausaf Khaliq Mr Wasif Khalid Mr. Aftab Khalid

5. 6.

244-87-287774 -----

7.

-244-58-353376 244-85-353381 --

8.

M/s. Piracha Poultry Farms. Mr. Sh. Mohd. Sibtain Near Bricks Kiln Niazian, Qutubuddin Paracha Amar Siddhu, Lahore. M/s Malik Canvas Ind Opposite Angoori Cinema Link Road, Jhang. M/s. Muhammad Iqbal Krishan Nagar Kasur Mr. Abdul Ghani Malik Mr. Abdul Qayum Mr. Abdul Karim Mrs. Nawab Begum Mr. Muhammad Iqbal

--------602-89-479844

9.

10. 11. 12.

M/s. Inayat Dairy Farm Mr. Inayatur Rehman Maira Tangi The. & Distt. Charsadda M/s. Dost Mohammad Mr. Haji Juma Khan Raisani Street Sheldra Quetta C/o. Qadri Coach Service, Jinnah Road, Quetta. M/s. Abdul Hameed Mr. Haji Juma Khan House No. 9-13/116-45 Baloch Colony Stewart Road Quetta. M/s. Abdul Hameed Mr. Haji Juma Khan House No. 9-13/116-45 Baloch Colony Stewart Road Quetta M/s. Abdul Zahir, C/o. Qadri Coach Services, Jinnah Road, Quetta. Mr Haji Juma Khan

13.

626-87-162487

14.

626-87-162487

15.

616-90-160403

16. 17. 18. 19. 20.

M/s. Kauda Assa, Mr. Khuda Assa Village Sur-Bunder Tehsil Gwadar Quetta. M/s. Khalid Ahmed Hoth Main Bazar Turbat. M/s. Jamil & Bros. Main Bazar Turbat. Mr. Khalid Ahmed Hoth M. Jamil

-632-46-025101 633-41-059644 ----

M/s. Tribal Corp. (Pvt.) Ltd. Mr. Azam Khan Karam Khan Road, Quetta M/s. Abdul Qayoom, Mr. Abdul Qayoom Abdul Qadeer, House No. Mr. Abdul Qadeer A/615, Bali Khana Road, Hyderabad.

21.

M/s. Ghulam Mustafa Mr. Abdul Qadeer Ghulam Murtaza & Co. Mr. Abdul Qayoom House No. A/641/1, Bail Khana Road, Hyderabad. M/s. Talib Ali Co. New Town, Mirpurkhas M/s. Mussdiq Autos, Qazi Baba Street, Sukha Talab, Suk Late Talib Ali Khawaja (Partner) Late Anwer Ali Khowaja (Partner) Mr. Syad Anwar Hussain Mr. Shah Bukhari

---

22.

--409-90-159034 -409-36-109287 439-44-047628 --

23.

24. 25. 26.

M/s. Nafees Stationery Mart, Mr. Fida-e-Muhammad Qureshi Shahi Bazar, Sukkur. M/s. Kishin Chand, Mr. Ladknal Hindu Mohalla, P.O. Piryaloi M/s. Rafique Muhammad Mr. Rafique Muhammad Shah Shah Rice Mills, Madegi Dist. Shikarpur. M/s. Progressive Motel (Pvt) Mr. Ejaz Jeffary Ltd. 16-Abid Majid Road, Mr. Wagas Khan Lahore Mr. Forzar Wagas Mst. Imtiaz Begum M/s. Muhammad Iqbal, Mohallah Muslimabad, Gujrat. Mr. Muhammad Iqbal

27.

----224-37-065848

28.

29.

M/s. Naqi & Suns, Mr. Syed Ibrar Hussain Naqvi Commercial Centre, Settle Lite Town, Rawalpindi. M/s. Rahim Karim Mr. Abdul Rehman Enterprises, Jallain Manzoor Water Rd., Multan. M/s. Wadood Industries, Multan. Mr. Kh. M.A. Wadood

211-24-082866

30.

514-37-031945

31. 32.

322-26-015253 514-35-010528 517-40-912361 517-33-193694 227-47-070839

M/s. Shahnawaz Limited, Mr. Mahmood Nawaz Westwharf P.O. Box # 4766, Mr. Mehmood Naeem Karachi. Mr. C.M. Khalid Mr. Muneer Nawaz

Mr. Mehmood Ahmed Mr. Muhammad Rafiq Mr. Ishaq Adil Mr. Feroz Ahmed 33. M/s. Rehana Raza, 1-6-B-11, 28th Street, Phase-V, D.H.S. Karachi. M/s. Eximp International, S.T. 2/3, Sector 15-A/5, Bufer Zone, North Karachi. M/s. Abdul Khaliq & Co. 2071/A, PIB Colony, Karachi. Mst. Rehana Raza

517-38-144666 517-90-438759 517-41-217880 517-38-204631 --

34.

Mr. S. Mehboob Shah

--

35.

Mr. Abdul Khaliq

--

36.

M/s. Frasun International, Mr. A.H. Faqoorui A/c. at Vault Branch Karachi. M/s. Farsina Industries (Pvt) Mr. Ahmed Ally Memon Ltd., Bungalow No. JM-1/88, Mr. Riaz Haider Memon Old No. 10, Dayaram Mr. Fayyaz Ahmed Memon Giddumal Road, Parsi Colony Mr. Shahid Bakhtair Karachi. Mr. Ashraf Bukhtiar M/s. Khurshid Twisting A-130, Block10, Gulshan-e-Iqbal, Karachi. Mrs. Khurshid Begum

514-32-092590

37.

-------

38.

39.

M/s. Rehman & Rehman, Mr. Azizur Rehman Off: L-17, Block-21, Mr. Abdul Rehman F.B. Area, Karachi. Res: E-4, Block-7 Gulshan-e-Iqbal, Karachi. M/s. Classic Interior Shop No. 2 Falcon Centre, Clifton, Karachi. Mr. Agha Khurshid Ahmed Mrs. Ayisha Hassan

518-88-227519

40.

--

41.

M/s. A. Majid A. Malik Mr. Abdul Majid Room No. 616, Qamar Mr. Abdul Majid & Sakina Bai House, M.A. Jinnah Road, Karachi. M/s. International --

--

42.

--

Commercial Age Room No. 616, Qamar House, M.A. Jinnah Road, Karachi. 43. M/s. Zakaria Impex, Mr. Zikar Room No. 616, Qamar House, M.A. Jinnah Road, Karachi. M/s. Sakina Mrs. Sakina Bai Bai, Room No. 616, Qamar house, M.A. Jinnah Road, Karachi M/s. Rashida Bai, Room No. 616, Qamar House, M.A. Jinnah Road, Karachi Mrs. Rashida Bai --

44.

--

45.

--

46.

M/s. Moosa Siddiq & Bros., Mr. Moosa Siddiq Room No. 616, Qamar House, M.A. Jinnah Road, Karachi. M/s. Pakistan Packages, 984, PIB Colony, Karachi. M/s. Firdous Trading Corporation, Serai Road, Karachi. Mr. S. Atiq Ahmed Mr. Rashid Ahmed Mr. M. Suleman (Deceased) Mr. Nisar Ahmed (Deceased) Mr. M. Saleem (Deceased) Mr. Bashir Ahmed Mr. Fazal Rehman Mr. Hasan Ali Chatoor Mr. Kassam Ali Chatoor

--

47.

502-36-605096

48.

--------

49.

M/s. Superior Steel Mills, 213 UniPlaza, I.I. Chundrigar Road, Karachi. M/s. Golden Pickers, 213 UniPlaza, I.I. Chundrigar Road, Karachi. M/s. Aina Bearing,

50.

Mr. Hasan Ali Chatoor Mr. Kassam Ali Chatoor

---

51.

Mr. Hasan Ali Chatoor

--

M-9 Manzoor Square, Plaza Quarters, Karachi. 52.

Mr. Kassam Ali Chatoor

----517-35-061851 ------

M/s. Zaibtun Textile Mills, Mr. Haji Haroon A/8, SITE, Manghopir Road, Mr. Haji Zakaria Karachi. Mr. Muhammad Jawed M/s. H.A. Fashion Wear (Pvt.) Ltd. 14-C 21ST, Street, Phase I, DHA, Karachi. M/s. Construction Engineering, 245, Block-6, PECHS, Karachi. Mr. Hasan Muhammad Saif Mr. Muhammad Moosa Mr. Faisal Jamal Ayoob Mr. Saeed Mirza Mr. Tanveer Mirza Mr. Saghir A. Khan

Top of Form

53.

54.

Web

Bottom of Form

Paksearch.com

Home | About Us | Contact | Information Resources

Você também pode gostar

- 1999 Annual Report of BAFDocumento16 páginas1999 Annual Report of BAFMahmood KhanAinda não há avaliações

- Bank of Tokyo Mitshubhishi LTD 2009Documento46 páginasBank of Tokyo Mitshubhishi LTD 2009Mahmood KhanAinda não há avaliações

- Bank of Tokyo LTD 2010Documento45 páginasBank of Tokyo LTD 2010Mahmood KhanAinda não há avaliações

- Upload A Document Search Documents Explore Sign Up Log In: Top of Form Bottom of FormDocumento45 páginasUpload A Document Search Documents Explore Sign Up Log In: Top of Form Bottom of FormGopi NathAinda não há avaliações

- Final Accounts 2005Documento44 páginasFinal Accounts 2005Mahmood KhanAinda não há avaliações

- Agrani Bank 2010Documento78 páginasAgrani Bank 2010Shara Binte Hamid100% (1)

- Financial Statements 2008Documento39 páginasFinancial Statements 2008Farjana Ul Hoque MoushumiAinda não há avaliações

- Deloitte & Touche Associated Accountants Bakr Abulkhair & Company Member of Bdo International P.O. Box 442 P.O. Box 60930 Jeddah 21411 Riyadh 11555 Saudi Arabia Saudi ArabiaDocumento27 páginasDeloitte & Touche Associated Accountants Bakr Abulkhair & Company Member of Bdo International P.O. Box 442 P.O. Box 60930 Jeddah 21411 Riyadh 11555 Saudi Arabia Saudi Arabiahussain200055Ainda não há avaliações

- Aknight Quarter Report-Sept 2012Documento8 páginasAknight Quarter Report-Sept 2012James WarrenAinda não há avaliações

- Financial Statement2012Documento56 páginasFinancial Statement2012Khalid FirozAinda não há avaliações

- 3 JBCMLDocumento42 páginas3 JBCMLArman Hossain WarsiAinda não há avaliações

- 2010Documento51 páginas2010Mahmood KhanAinda não há avaliações

- ConsolidatedReport08 (BAHL)Documento87 páginasConsolidatedReport08 (BAHL)Muhammad UsmanAinda não há avaliações

- ZTBL 2008Documento62 páginasZTBL 2008Mahmood KhanAinda não há avaliações

- 4.JBSL AccountsDocumento8 páginas4.JBSL AccountsArman Hossain WarsiAinda não há avaliações

- AB Bank Limited & Its SubsidiariesDocumento110 páginasAB Bank Limited & Its SubsidiariesMd Ridwan Siddiquee WadudAinda não há avaliações

- Unit 7Documento29 páginasUnit 7FantayAinda não há avaliações

- Bank StatementDocumento38 páginasBank StatementPardeep KumarAinda não há avaliações

- 2015-Annual-Report of AB Bank LimitedDocumento120 páginas2015-Annual-Report of AB Bank LimitedMd Ridwan Siddiquee WadudAinda não há avaliações

- 2014-Annual-Report of AB Bank LimitedDocumento112 páginas2014-Annual-Report of AB Bank LimitedMd Ridwan Siddiquee WadudAinda não há avaliações

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Documento32 páginas4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiAinda não há avaliações

- Business Information Report: ReferenceDocumento7 páginasBusiness Information Report: ReferenceAlina AlinaAinda não há avaliações

- National Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Documento36 páginasNational Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Ghulam AkbarAinda não há avaliações

- AFS HardwareDocumento32 páginasAFS HardwareThabiso MojakisaneAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- PTCL Accounts 2009 (Parent)Documento48 páginasPTCL Accounts 2009 (Parent)Najam U SaharAinda não há avaliações

- Financial StatementDocumento115 páginasFinancial Statementammar123Ainda não há avaliações

- Auditors' Report To The MembersDocumento59 páginasAuditors' Report To The MembersAleem BayarAinda não há avaliações

- Annual Report 2 0 0 1 - 2 0 0 2: Relaxo Footwears LimitedDocumento51 páginasAnnual Report 2 0 0 1 - 2 0 0 2: Relaxo Footwears LimitedSeerat JangdaAinda não há avaliações

- Balance SheetDocumento24 páginasBalance SheetBhagwan BachaiAinda não há avaliações

- Advanced - Yr 2022 Audited AccountsDocumento22 páginasAdvanced - Yr 2022 Audited AccountswolekniceAinda não há avaliações

- Annual Report 2010 70 89Documento1 páginaAnnual Report 2010 70 89Manik SahaAinda não há avaliações

- 2012-Annual-Report AB BankDocumento112 páginas2012-Annual-Report AB BankWasik Abdullah MomitAinda não há avaliações

- HBL 2005Documento46 páginasHBL 2005Momna AmjadAinda não há avaliações

- Oman Oil Balance SheetDocumento27 páginasOman Oil Balance Sheeta.hasan670100% (1)

- Consolidated2010 FinalDocumento79 páginasConsolidated2010 FinalHammna AshrafAinda não há avaliações

- Islami Bank Bangladesh Limited: Annual Report 2015Documento143 páginasIslami Bank Bangladesh Limited: Annual Report 2015MD. ISRAFIL PALASHAinda não há avaliações

- Annual Report 2021-22 PDFDocumento179 páginasAnnual Report 2021-22 PDFMohnish KhianiAinda não há avaliações

- Executive Summary: Highlights of Financial OperationsDocumento12 páginasExecutive Summary: Highlights of Financial OperationsJaniceAinda não há avaliações

- Philippine Deposit Insurance Corporation Executive Summary 2011Documento4 páginasPhilippine Deposit Insurance Corporation Executive Summary 2011Rosela Mae BaracaoAinda não há avaliações

- Auditors Report Financial StatementsDocumento57 páginasAuditors Report Financial StatementsSaif Muhammad FahadAinda não há avaliações

- Glosario de FinanzasDocumento9 páginasGlosario de FinanzasRaúl VargasAinda não há avaliações

- 5 FinDocumento35 páginas5 FinMansour HamjaAinda não há avaliações

- Example On General Fund AdmasDocumento8 páginasExample On General Fund Admasmiadjafar463Ainda não há avaliações

- Sample PaperDocumento28 páginasSample PaperSantanu KararAinda não há avaliações

- Recommend Ary or Mandatory Mandatory From Accounting Period Beginning On or AfterDocumento7 páginasRecommend Ary or Mandatory Mandatory From Accounting Period Beginning On or AfterdnbiswasAinda não há avaliações

- Consolidated Financial StatementsDocumento78 páginasConsolidated Financial StatementsAbid HussainAinda não há avaliações

- Cash Flow StatementDocumento3 páginasCash Flow StatementAvinash ThomasAinda não há avaliações

- Accounting Activities and Financial Statements: ACCT 100Documento46 páginasAccounting Activities and Financial Statements: ACCT 100gulafshanAinda não há avaliações

- Financial Statements For The Year 2016Documento128 páginasFinancial Statements For The Year 2016taijulshadinAinda não há avaliações

- Audited Consolidated Financial StatementDocumento42 páginasAudited Consolidated Financial StatementAbigail EjiroAinda não há avaliações

- Land Transportation Office Executive Summary 2012Documento13 páginasLand Transportation Office Executive Summary 2012lymieng Star limoicoAinda não há avaliações

- Balance Sheet2006Documento50 páginasBalance Sheet2006malikzai777Ainda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- 2020 China Glaze Bangladesh Limited - AFSDocumento46 páginas2020 China Glaze Bangladesh Limited - AFSMD. Rezwanul HaqueAinda não há avaliações

- 3 Years Audited Account 200Documento51 páginas3 Years Audited Account 200Raymond SmithAinda não há avaliações

- RBI Balance SheetDocumento10 páginasRBI Balance SheetporuterAinda não há avaliações

- Annual Budget Statement EnglishDocumento54 páginasAnnual Budget Statement EnglishSunny BanyAinda não há avaliações

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryNo EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Credit Union Revenues World Summary: Market Values & Financials by CountryNo EverandCredit Union Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Research Paper On Recruitment and Selection in 1122Documento10 páginasResearch Paper On Recruitment and Selection in 1122faris67% (6)

- Research Paper On Recruitment and Selection in 1122Documento10 páginasResearch Paper On Recruitment and Selection in 1122faris67% (6)

- Agro Value Chain Analysis and DevelopmentDocumento83 páginasAgro Value Chain Analysis and DevelopmentfarisAinda não há avaliações

- 4.4 - Game TheoryDocumento9 páginas4.4 - Game TheoryfarisAinda não há avaliações

- Introduction To Logic - Practice Exam For Unit/Exam 1: A. Validity and Soundness C. TranslationsDocumento1 páginaIntroduction To Logic - Practice Exam For Unit/Exam 1: A. Validity and Soundness C. TranslationsfarisAinda não há avaliações

- Irational?: Apple Is An Iconic Brand. Now It Is A Totemic Investment, TooDocumento4 páginasIrational?: Apple Is An Iconic Brand. Now It Is A Totemic Investment, ToofarisAinda não há avaliações

- Ethical Business ActivitiesDocumento5 páginasEthical Business ActivitiesfarisAinda não há avaliações

- Lecture - Interest Rate SwapDocumento26 páginasLecture - Interest Rate SwapKamran AbdullahAinda não há avaliações

- FeasibilityDocumento23 páginasFeasibilityNimona BultumAinda não há avaliações

- Maf253 GP Ia No6 QDocumento2 páginasMaf253 GP Ia No6 QNik Syarizal Nik MahadhirAinda não há avaliações

- Literature ReviewDocumento4 páginasLiterature ReviewRenjitha DevAinda não há avaliações

- IIA Company Analysis Project E-Commerce IndustryDocumento44 páginasIIA Company Analysis Project E-Commerce IndustryAngira VermaAinda não há avaliações

- RWJ Chapter 1 - EUDocumento17 páginasRWJ Chapter 1 - EULokkhi BowAinda não há avaliações

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Documento6 páginasPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)Mary Jo Lariz OcliasoAinda não há avaliações

- Financial Econometrics IntroductionDocumento13 páginasFinancial Econometrics IntroductionPrabath Suranaga MorawakageAinda não há avaliações

- Review: Merchandise Company Periodic Vs Perpetual Inventory SystemDocumento8 páginasReview: Merchandise Company Periodic Vs Perpetual Inventory SystemNabila Nur IzzaAinda não há avaliações

- Law 1.2Documento7 páginasLaw 1.2CharlesAinda não há avaliações

- BOI Procedure NotesDocumento2 páginasBOI Procedure NotesSheilaAinda não há avaliações

- The Green Register - Spring 2011Documento11 páginasThe Green Register - Spring 2011EcoBudAinda não há avaliações

- AES Case PresentationDocumento13 páginasAES Case PresentationClaire Marie Thomas67% (3)

- FICO Cutover ChecklistDocumento2 páginasFICO Cutover Checklistsaurabh.rai83Ainda não há avaliações

- Sir Win ExercisesDocumento21 páginasSir Win ExercisesAbigail RososAinda não há avaliações

- Domestic: For Immediate AssistanceDocumento3 páginasDomestic: For Immediate AssistanceVinod KumarAinda não há avaliações

- Vitthal Mandir Audit ReportDocumento4 páginasVitthal Mandir Audit ReportHindu Janajagruti SamitiAinda não há avaliações

- Portfolio's KPIs Calculations TemplateDocumento7 páginasPortfolio's KPIs Calculations TemplateGARVIT GoyalAinda não há avaliações

- Incoming International Wire InstructionsDocumento2 páginasIncoming International Wire InstructionsMiki Vs Mari PurocorazonAinda não há avaliações

- 140.national Investment and Development Corp. vs. AquinoDocumento18 páginas140.national Investment and Development Corp. vs. Aquinovince005Ainda não há avaliações

- NCERT Class 12 Accountancy Part 2Documento329 páginasNCERT Class 12 Accountancy Part 2KishorVedpathak100% (2)

- Hkcee Economics - 8 National Income - P.1Documento9 páginasHkcee Economics - 8 National Income - P.1peter wongAinda não há avaliações