Escolar Documentos

Profissional Documentos

Cultura Documentos

General Interview Questions and Key Probation Officer Traits

Enviado por

Yaseer ArafathDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

General Interview Questions and Key Probation Officer Traits

Enviado por

Yaseer ArafathDireitos autorais:

Formatos disponíveis

Interview Questions - General 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21.

22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. Tell us what you know about our organization. With the many agencies our there, why do you want to work for us? How would you describe your work ethic? What kind of preparation did you do for this interview? Do you think that you are a leader? If yes, give us an example. How you ever spoken to a large group of people? How large? Tell us about it. What honors have you earned in your life? Why do you want to be a police officer/sheriffs officer/corrections officer/Special Agent/State Trooper/Parole Officer/Probation Officer/, etc. What have you done to prepare for this position? What skills do you have that would benefit our agency? What are your greatest strengths for this job? Limitations? What traits are needed by good law enforcement officers? What appeals most to you about entering law enforcement? In what ways would our agency benefit from hiring you? What do you offer that your competition for this position cannot? If hired, where do you see yourself in five years? Ten years? How would you rate your communication skills and what have you done to improve them? Which is more important to you, money or satisfaction? Define success. Everyone has prejudices. What are some of yours? Everyone has certain likes and dislikes. What kind of people do you like? Dislike? How are you in dealing with stressful situations? Give an example. If hired, describe what kind of officer you would be. Everyone has strengths and weaknesses. What are some of yours? What would you most like to accomplish if you had this job? Give us three examples of what would make you leave this job? What do you consider to be your greatest achievements to date? Explain. What kind of problems have people recently called on you to solve? Tell us what you have devised. What was your most difficult decision in the last six months? What made it difficult? Describe your most significant success & failure in the last two years. How would you describe your ability to deal with conflict? Explain. What is the largest difficulty you ever had with a supervisor? How did you resolve the conflict? Describe the best job you've ever had. Describe the best supervisor you've ever had. Which is more important: creativity or efficiency? Why? Are you good at delegating tasks? Explain. What books have you read in the past year? To what magazines do you subscribe? What are you top three television shows? To which newspapers do you subscribe? Growing up, who were some of your role models? Who are some of your influences today? What approach do you take in getting your people to accept your ideas or department goals? Do you feel you work more effectively on a one to one basis or in a group situation?

45. What kind of writing have you done? For a group? For an individual? 46. Have you ever had something you wrote published whether it be an editorial, article, or other writing? 47. How do I rate as an interviewer? What about the rest of the panel? Sample Probationary Officer Interview Questions: 48. Please state any three weakness and strengths of your candidature. 49. Why do you want to work with our bank? Do you want to join this bank from good salary and a lot of facilities? 50. As a probationary officer, explain the routine duties & job functions of this job position. 51. What do you know about our bank? Tell us about our bank logo. 52. How does our bank different from other competitors? What is the current condition of our bank in the market? 53. Explain the functions of a clerk, cashier and bank manager. 54. What do you think about your computation, analytical and decision making skills? How do these skills can benefit this financial institution? 55. Discuss the trait of a good probationary officer. What strategy do you follow to plan the official activities, conferences, field visits and supervisory programs? 56. Do you think that you can handle the courtroom procedures of our bank? 57. What is your method to prepare and submit the monthly, quarterly and annual statistical performance repost of bank staff? 58. How do you review the uploaded record shelves? How do you secure the sensitive data of high profile customer details? 59. What approach do you adopt to communicate with the department heads and divisional officer for taking some necessary legal assistance? Good Communication Skills, Nonjudgmentalness, and Good Listening Skills

Because a probation officer works with so many different types of personalities, he or she needs to have good communications skills. An officer needs to be able to talk with a parolee without judging or coming across as if he is. He needs to relate well to everyone. The probation officer will need to listen to the people in his care. He needs to be approachable so they feel comfortable coming to him when they need to.

Computer and Report-Writing Skills

The job of the probation officer involves overseeing a large amount of paperwork and files. She needs to know basic office and computer skills. She needs to gather information on each of her cases and organize the findings into a coherent report. The officer will need to keep track of where each probation case is in respect to court dates, paperwork needed and what each client needs to have accomplished by that date.

Calm, Mature and Confident

The probation officer will need to remain calm in each situation he comes across. His clients will come from a variety of backgrounds, and he'll need to make them aware of his authority in a caring and compassionate manner. He needs to diffuse dangerous

situations if a parolee or person on probation gets out of hand. At times he'll need to refer the case back to court. He'll need to handle cases like that with maturity and confidence. Observant and Alert

Because each situation has the potential to become volatile, the probation officer needs to be aware of her surroundings and the mental state of the person she's working with. She'll need to watch for signs of substance abuse. She needs to be alert to assess threats and deal well with stress. She also needs to be aware of her surroundings and the people nearby. Others in a house or neighborhood could step in to cause a problem.

Integrity, Being a Team Player and Following Procedure

The probation officer needs to be above reproach. He needs to operate with integrity in all situations. He'll need to work well with officers of the court, co-workers and others in his office, and the people he represents when dealing with them in their homes or at court. He'll need to be diligent in following procedure in all situations, from court appearances to visits with his clients, and while working in his office Organized- I had 130 cases with no support staff. Effecient- Many deadlines Dedicated- Many of your "clients" will be scum Energized- Lots of long days Detail Oriented-

During an interview, I was asked what I thought the most valuable characteristics of a probation officer were. What is your opinion? They wanted five single wordshonesty -integrity -patience -good comm/writing skills -adaptability

federal Bank Limited (NSE: FEDERALBNK, BSE: 500469, LSE: FEDS) is a major Indian commercial bank in the private sector, headquartered at Aluva, Kochi, Kerala. As of December 31 2011 it has 832 branches spread across 24 states in India and 803 ATMsaround the country(across 108 metro centres, 224 urban centres, 384 semi-urban locations and 87 rural areas ).The bank is planning to expand its branch network to 1000 by march 2012.[1] History In the year 1931, Travancore Federal Bank was inaugurated at Vengal Varuttisseril atNedumpuram, near Tiruvalla, Kerala. The 14 founders included Sri Vengal Varuttisseril Oommen Varghese, his brothers Oommen Chacko, Oommen Kurian, Oommen George and also another person from Tiiruvalla, Kavumbhagam Mundapallil Lukose, and others. Oommen Varghese was the Chairman and Oommen Chacko the Manager. After it had functioned for nearly 10 years, the bank's day to day transaction had to be stopped due to the ill-health of the Manager. Understanding this situation, a lawyer from Perumbavoor named Sri K.P.Hormis and his acquaintances joined together, bought the bank and took over the management. In 1945, they moved the bank's registered office to Aluva and Hormis became the Managing Director. In 1947,the bank's name was shortened from Travancore Federal Bank to Federal Bank. [2]

In 1970, the bank became a Scheduled Commercial Bank. Recently, it opened a representative office in Dubai[3]. ]Acquisitions and Mergers In 1964, the bank embarked on a series of acquisitions that would substantially increase its size. It acquired the Chalakudy Public Bank in Chalakudy, the Cochin Union Bank in Thrissur, and the Alleppey Bank in Alappuzha. In 1965, it acquired the St.George Union Bank in Puthenpally. In 1968, it acquired the Marthandom Commercial Bank in Thiruvananthapuram. In 2006, Federal Bank acquired Ganesh Bank of Kurundwad after the Reserve Bank of India suspended the bank. Established in 1920, Ganesh Bank had its headquarters at Kurundwad, Maharashtra. The bank had a network of 32 branches and its operations were concentrated in Sangli and Kolhapur in Maharashatra and Belgaum in Karnataka. Prior to the merger, Federal Bank had 20 branches in Maharashtra. In March 2008, Federal Bank entered into a joint venture with IDBI Bank and Fortis Insurance International to form IDBI Fortis Life Insurance, of which Federal Bank owns 26 percent. The company ended the year with over 300 Cr in premiums as on 31 March 2009. On 24 August 2010, IDBI Fortis, rejuvenated as IDBI Federal Life Insurance with Aegas of Belgium.

]Sponsorships Federal Bank,will be the principal sponsor of Kochi Tuskers Kerala .[4] The tickets for KTK's home matches will be sold through Federal bank branches and their website

Savings Bank Current Accounts Loans Deposits Debit-Cards Funds Transfer Inward Remittance Online Bill Collection Bank Guarantee Cash Management Demat Accounts Federal Pure Gold Gilt Accounts Mutual Fund Safe Deposit Lockers ASBA Visa Bill Payment MasterCard SecureCode Verified by Visa Online Tax Payment Mobile Banking- FedMobile Internet Banking-FedNet

Board of Directors

Mr. Shyam Srinivasan Mr P C Cyriac IAS ( Retd) Mr Suresh Kumar Prof. Abraham Koshy Dr T C Nair Dr. M.Y. Khan Mr P C John

Managing Director & CEO Chairman of the Board Director Director Director Director Director

Mr. Nilesh Shivji Vikamsey Director Key Management Personnel :

Mr. Shyam Srinivasan Mr P C John Mr Abraham Chacko Mr T S Jagadeesan Mr Girish Kumar Ganapathy

Managing Director & CEO Executive Director Executive Director Chief General Manager Company Secretary

123456 Mr Shyam Srinivasan Managing Director & CEO Shri. Shyam Srinivasan has taken charge as the Managing Director & CEO of the Bank with effect from 23rd September 2010. He joined Federal Bank after having worked with leading multinational banks in India and overseas across Middle East, India and South East Asia, where he has gained significant experience in retail lending, wealth management and SME banking. Before joining Federal Bank, Shyam Srinivasan was with Standard Chartered Bank, the largest foreign bank in India, where he was responsible for strategy, development and management of the Bank's Consumer Banking Business spread across a large network of branches in India employing over 6,000 people.

Prior to that, he was Country Head of Standard Chartered Bank's Consumer franchise in Malaysia where he focused on broad-basing the revenue streams and delivered significant increase in profitability while developing a strong team of local professionals. Shri. Shyam Srinivasan is an alumnus of the Indian Institute of Management, Kolkata and Regional Engineering College, Tiruchirapally. He has completed a Leadership Development Program from the London Business School and has served on the Global Executive Forum (the top 100 executives) of Standard Chartered Bank from 2004 to 2010.. Web Awards The WebAwards is the premier annual website award competition that names the best Web sites in 96 industries while setting the standard of excellence for all website development.Federal Bank has won Webawards for the "Bank Standard of Excellence (2010)" declared by the Web Marketing Association on 15th Sept 2010 for its content rich, innovative and ease of use corporate website. The recognition came for its recently released corporate website from the Web Marketing Association. Federal Bank Corporate website outscored the Industry Average as well as the WebAward Average (take me to Webaward page) The IDRBT award The Banking Technology Excellence Award for the year 2010-11 in the category IT for Internal Effectiveness among small banks was conferred on Federal Bank by the IDRBT, at a function held in Hyderabad. The Institute for Development & Research in Banking Technology [IDRBT] was established by the Reserve Bank of India in 1996 as an Autonomous Centre for Development and Research in Banking Technology. Excellence Award The Excellence Award for Second Best Bank among Traditional Private Sector Banks in Kerala - constituted by the State Forum for Bankers Clubs Kerala. The Bank also received all three Excellence Awards for Best Branches and the award for the Best Branch Managers among Traditional Private Sector Banks in Kerala. The Great Mind Challenge award Federal Bank has won the Great Mind Challenge award for implementing the most innovative solution for business. This award is being introduced by IBM for the first time in India for business development initiatives. Federal Bank is the first Bank in India to receive the award. The solution is being used by the Bank primarily for international remittances. NRI customers can remit money to their account in Federal Bank or to other Banks in the quickest possible time. The award winning software was developed and implemented within a record time of four months. This facility is extensively being used by more than 40 Foreign Banks and Exchange Houses. An NRI customer can even remit money to India by logging to the internet banking facility of Foreign Banks. This is yet another unique feature being enabled by the solution. Economic Times Intelligence Group Survey The Economic Times Intelligence Group has conducted a comparison of Indian Banks (ET Investors Guide dated 23.11.2009) on various parameters. Federal Bank has been ranked Number One in Efficiency and in Financial Strength when compared to other Indian Banks. Efficiency was calculated on the basis of Net Interest Margin, Business per Employee and Return on Assets. Financial Strength was calculated on the basis of Capital Adequacy Ratio and Non performing assets. January 2006: Federal Bank becomes the first traditional bank to successfully issue GDR. While the issue of 18 million Global Depository Receipts realised $71.46 million, the green shoe option of 2 million GDR was also fully subscribed, bringing in a total of $80 million to the bank. The

GDR, each representing an underlying equity share, were priced at $3.97 each working out to approximately Rs.175 per share. The issue was subscribed by major banks and Financial Institutions across the globe.

February 2006: Federal Bank wins two prestigious awards for BEST USE OF IT IN RETAIL BANKING & BEST PAYMENTS INITATIVE from IBA and TFCI. This is the second consecutive time that the Bank has won the award for best use of IT in Retail Banking. More details available here

September 2006: 1. Amalgamation of Ganesh Bank of Kurundwad with Federal Bank 2. Banks Total No. of Branches crossed 500

November 2006: Bank entered into Life Insurance Joint Venture with IDBI & FORTIS

January 2007: Bank won the award under category Best Clearing & Settlement System in the Banking Technology Awards 2006 instituted by IBA, Infosys & TFCI

Mar 2007: A full fledged Data Center was set up by the Bank

June 2007: Bank formed a Centralized Processing Centre for centralizing the account opening process to make it quick and efficient.

September 2007:All branches/offices of the Bank were migrated to Centralised Banking Solution (CBS), Finacle

January 2008: 1. Successfully completed 1:1 Rights Issue 2. Opened first overseas Representative Office at Abu Dhabi, UAE.

March 2008: 1. Banks Total No. of Branches crossed 600 2. The Asian Banker, together with the Technology Advisory Council of The Asian Banker Summit, has affirmed Federal Bank as sole recipient of the Best Core Banking Project Award 2007

September 2008: Bank started providing Online Stock Trading facility to the customers in association with M/s Geojit Financial Services

January 2009: Bank won the award under category 'Best Customer Relationship Achievement' in the Banking Technology awards 2008 instituted by IBA, Infosys & TFCI for the outstanding achievements in technology infusion and dissemination. The Bank was winning IBA-TFCI awards for the fourth time

March 2009: 1. Total Business of the Bank crossed Rs.50,000/- Crores 2. Bank becomes BASEL-II compliant

August 2009: 1. Bank has taken an important step in customer Service by dedicating 24 X 7 Contact Center to the customers. Started offering NEFT/RTGS facility through Internet Banking. Bank started offering Telebanking facility through a Toll-free number 2. Launched three new variants of Visa Debit Cards Platinum, Gold and Shopn Save

January 2010: Launched Point Of Sale (POS) Terminal Business

June 2010: Federal Bank became part of National Financial Switch ATM Network the largest ATM network in India

July 2010: 1. Total number of branches crossed 700 2. Launched Debit Cards in association with MasterCard 3. Received the Finanacial Express-Indias Best Banks Award 2009-10

August 2010: From 24.08.2010, the joint venture IDBI FORTIS renamed as IDBI FEDERAL

September 2010: 1. Mr. Shyam Srinivasan has taken charge as 8th MD &CEO of Federal Bank 2. Federal Bank had the rare privilege to become the official partner to the one day international cricket match between India & Australia

December 2010: Ms. Suma Varma, Regional Director ,RBI, Kerala & Lakshwadeep inaugurated the Banks financial inclusion product FEDJYOTHI and released FEDJYOTHI smart cards at Alapuzha on 18th December 2010

February 2011: Federal Reach, the in house publication from the Bank received the Kerala Management

Association Excellence Award for the Best Corporate Magazine published /received during the calendar year 2010

March 2011: The first Gram Jeevan Branch at Thuruthy Vengoor West was inaugurated by Shri. P. C. Cyriac, Chairman, Board of Directors

April 2011: Shri. P. C. Cyriac appointed as part time chairman of the Board of Federal Bank

May 2011: 1. Bank felt its presence in the state of Jammu by opening its 1st branch in the state 2. Mr. Abraham Chacko joined the Bank as Executive Director

June 2011: The Bank launched an instant online remittance solution to the visa debit card holders across the country, in association with Visa, the first Bank in India to do so Bank rate:Bank rate is the rate at which RBI lends money to other banks or financial institutions or commercial banks. If bank rate is increased by RBI, then all banks will also hike their own lending rates such as deposit rates and prime lending rates etc.......Bank rate is also known as the discount rate and it is the oldest instrument of monetary policy. The bank rate policy seeks to affect both the cost and availability of credit. CRR:CRR is a bank regulation that sets the minimum reserves each bank must hold to customer deposits and notes. Banks in India are required to hold a certain proportion of their deposits in the form of cash. However, actually banks don't hold these as cash with themselves, but deposit such case with RBI, which is considered as equivalent to holding cash with themselves. These reserves are designed to satisfy withdrawal demands, and would normally be in the form of authorized currency stored in a bank vault or with RBI. The reserve ratio is sometimes used as a tool in the monetary policy, influencing the country's economy, borrowing and interest rates. CRR is also known as cash asset ratio or liquidity ratio. The RBI is empowered to vary CRR between 3% and 20% respectively. SLR:-

Every bank is required to maintain at the close of business every day, a minimum proportion of their net demand and time liabilities as liquid assets in the form of cash, gold or approved securities. This percentage is fixed by RBI. The maximum and minimum limits for the SLR are 40% and 25% respectively. Repo Rate:It is also called as repurchase rate. It is the rate at which RBI lends short term money to the banks. When the banks have any shortage of funds they can borrow it from RBI. A reduction in the repo rate will halp banks to get money at a cheaper rate. When the repo rate increases, borrowing from RBI becomes expensive. Reverse Repo rate:Reverse repo rate is the rate at which RBI borrows money from banks. When liquidity or cash floating is excess in banks, RBI sucks it out by reverse repo by lending securities and taking out money from banks.

Você também pode gostar

- Interview QuestionsDocumento4 páginasInterview QuestionsTop 100Ainda não há avaliações

- Behavioural InterviewsDocumento5 páginasBehavioural InterviewsAndreea CandreaAinda não há avaliações

- Behavioural/Competency-based Interviews: (Reference Copy Available at VUW Careers Resource Library)Documento5 páginasBehavioural/Competency-based Interviews: (Reference Copy Available at VUW Careers Resource Library)Asfandyar AliAinda não há avaliações

- Hrm-Module 2Documento5 páginasHrm-Module 2Frany IlardeAinda não há avaliações

- Effective Interviewing Skills:: A Self-Help GuideDocumento29 páginasEffective Interviewing Skills:: A Self-Help GuiderajshakerandroAinda não há avaliações

- DEPED Bookkeeper Duties GuideDocumento5 páginasDEPED Bookkeeper Duties GuideMai Mai100% (1)

- MBA Employability Skills and Interview TipsDocumento6 páginasMBA Employability Skills and Interview TipsAswin PrabhakarAinda não há avaliações

- Journal explores career interests and goals through self-reflectionDocumento8 páginasJournal explores career interests and goals through self-reflectionRuslan MagamedovAinda não há avaliações

- IIM Lucknow PI Kit 2023Documento194 páginasIIM Lucknow PI Kit 2023T D Harish Ragavendra100% (1)

- Role-Play in Building Self-AwarenessDocumento22 páginasRole-Play in Building Self-Awarenessapi-280504764100% (2)

- Guide to Ace Your Job Interview with PreparationDocumento50 páginasGuide to Ace Your Job Interview with PreparationKelly KellyAinda não há avaliações

- Pio InterviewDocumento4 páginasPio InterviewLotte Conde AntipuestoAinda não há avaliações

- Unit 8Documento10 páginasUnit 8Syarlon FadliAinda não há avaliações

- Int TipsDocumento6 páginasInt TipsDevipriya BalaramanAinda não há avaliações

- Master Key For Effective Job InterviewsDocumento7 páginasMaster Key For Effective Job InterviewsChandramowleeswaran MuthusubramanianAinda não há avaliações

- Effective Interviewing Skills:: A Self-Help GuideDocumento29 páginasEffective Interviewing Skills:: A Self-Help Guideaqas_khanAinda não há avaliações

- Q&A - 300+ Finance Interview Questions Leverage Academy ForumDocumento21 páginasQ&A - 300+ Finance Interview Questions Leverage Academy Forumsaw4321Ainda não há avaliações

- MR Q&aDocumento17 páginasMR Q&aJustluk YouAinda não há avaliações

- Morale QuestionsDocumento16 páginasMorale Questionssisakara100% (1)

- Iim Lucknow - Pi KitDocumento176 páginasIim Lucknow - Pi Kitkumbhare100% (1)

- Competency & Biographical Interviews - What Is The Difference?Documento4 páginasCompetency & Biographical Interviews - What Is The Difference?AlexAinda não há avaliações

- Interview QuestionsDocumento10 páginasInterview QuestionsWajeed MohamadAinda não há avaliações

- Final Report MGT-351Documento24 páginasFinal Report MGT-351Tanvir Hossain SunnyAinda não há avaliações

- 50 Practice Interview QuestionsDocumento8 páginas50 Practice Interview QuestionsromarcambriAinda não há avaliações

- Communicating Confidence Inside and Out: How to Build Confidence, Be Assertive and Succeed!No EverandCommunicating Confidence Inside and Out: How to Build Confidence, Be Assertive and Succeed!Ainda não há avaliações

- 53 HR Interview Questions and Answers Asked FrequentlyDocumento42 páginas53 HR Interview Questions and Answers Asked Frequentlyymt1123Ainda não há avaliações

- PI KIT 2024 Ignicion MentorshipDocumento176 páginasPI KIT 2024 Ignicion MentorshipNIRAJ KUMAR YADAVAinda não há avaliações

- IBPS, RRB PO Interview Capsule by AffairsCloud PDFDocumento57 páginasIBPS, RRB PO Interview Capsule by AffairsCloud PDFRanjit Angomjambam100% (11)

- Top 20 Business Analyst Interview QuestionsDocumento4 páginasTop 20 Business Analyst Interview QuestionsAnurag MalhotraAinda não há avaliações

- Interview QuestionsDocumento17 páginasInterview QuestionsHope Eamiguel DoronAinda não há avaliações

- Kellogg Consulting Club How To Succeed To The Personal InterviewDocumento8 páginasKellogg Consulting Club How To Succeed To The Personal InterviewKaya ToastAinda não há avaliações

- IIM BG WAT-PI KitDocumento39 páginasIIM BG WAT-PI KitPrakul AsthanaAinda não há avaliações

- Boardroom Strategies for Financial InstitutionsNo EverandBoardroom Strategies for Financial InstitutionsAinda não há avaliações

- HR Questions InterviewDocumento54 páginasHR Questions InterviewAlice AliceAinda não há avaliações

- MBA - I SEM Human Resource Management-MB0027 3 Credits SetDocumento13 páginasMBA - I SEM Human Resource Management-MB0027 3 Credits Setpradeepsoni80Ainda não há avaliações

- Interview PreparationDocumento4 páginasInterview Preparationapi-26189934Ainda não há avaliações

- Appreciative InquiryDocumento8 páginasAppreciative InquiryAlbert Palada Orcine JrAinda não há avaliações

- Win the Job with Proven Interview SkillsDocumento41 páginasWin the Job with Proven Interview SkillsPradeep NagireddiAinda não há avaliações

- BSBLDR501 Assignment Task OneDocumento6 páginasBSBLDR501 Assignment Task Oneann engman67% (6)

- CBI Interview GuideDocumento33 páginasCBI Interview GuideRashid Magorwa100% (2)

- Interviewing SkillsDocumento26 páginasInterviewing Skillsanishchattha194mAinda não há avaliações

- Câu hỏi phỏng vấnDocumento5 páginasCâu hỏi phỏng vấnThanh KiềuAinda não há avaliações

- Business CommunicationDocumento87 páginasBusiness CommunicationAyushi BiswasAinda não há avaliações

- Guide to Ace Your Next InterviewDocumento9 páginasGuide to Ace Your Next InterviewThanh Nhan NguyenAinda não há avaliações

- Interview Questions.Documento39 páginasInterview Questions.sagar meshramAinda não há avaliações

- Why Did You Choose This CareerDocumento18 páginasWhy Did You Choose This CareerGeethjvbAinda não há avaliações

- IIM UdaipurDocumento60 páginasIIM UdaipurrohithashreeAinda não há avaliações

- Kellogg Guide To PIDocumento8 páginasKellogg Guide To PISiddharth ModiAinda não há avaliações

- Theory ZDocumento6 páginasTheory ZNuzhat RezaAinda não há avaliações

- Bank of America Helps Build Strong Communities by Creating Opportunities For People - Including Customers, Shareholders and Associates - To Fulfill Theirdreams.Documento3 páginasBank of America Helps Build Strong Communities by Creating Opportunities For People - Including Customers, Shareholders and Associates - To Fulfill Theirdreams.bcm85Ainda não há avaliações

- Financial Ombudsman Cover LetterDocumento5 páginasFinancial Ombudsman Cover Letterf60pk9dc100% (2)

- Barclay Simpson - Competency Based InterviewsDocumento5 páginasBarclay Simpson - Competency Based InterviewsShehzad Khattak100% (1)

- HR Tutorial: PrerequisiteDocumento17 páginasHR Tutorial: Prerequisitesahibullah zalandAinda não há avaliações

- Career Counselling PDFDocumento104 páginasCareer Counselling PDFshalini jainAinda não há avaliações

- Training Manual On Interviewing SkillsDocumento28 páginasTraining Manual On Interviewing SkillsHassam BashirAinda não há avaliações

- Presentation For Viva - Charulata ShindeDocumento47 páginasPresentation For Viva - Charulata ShindeCharulata ShindeAinda não há avaliações

- Business Strategy Understand What It Takes To Be Successful In BusinessNo EverandBusiness Strategy Understand What It Takes To Be Successful In BusinessAinda não há avaliações

- A Project Report On Brand AwarnessDocumento47 páginasA Project Report On Brand AwarnessYaseer ArafathAinda não há avaliações

- A Study On Mutual Funds in IndiaDocumento40 páginasA Study On Mutual Funds in IndiaYaseer ArafathAinda não há avaliações

- Fin InterviewDocumento3 páginasFin InterviewYaseer ArafathAinda não há avaliações

- IIMB Laterals Placements 2012 - Dev Factory ShortlistDocumento1 páginaIIMB Laterals Placements 2012 - Dev Factory ShortlistYaseer ArafathAinda não há avaliações

- Human resource management goals and activities explainedDocumento1 páginaHuman resource management goals and activities explainedYaseer ArafathAinda não há avaliações

- Yardstick International College Department of Accounting and FinanceDocumento39 páginasYardstick International College Department of Accounting and Financetsegaw kebedeAinda não há avaliações

- Financial model assumptions and key statements for opening a tea cafe in IndiaDocumento3 páginasFinancial model assumptions and key statements for opening a tea cafe in IndiaYASHASVI SHARMAAinda não há avaliações

- Credit Ratings Provide Insight Into Financial StrengthDocumento6 páginasCredit Ratings Provide Insight Into Financial StrengthvishAinda não há avaliações

- Standard Chartered p3 2010 Final PublishedDocumento52 páginasStandard Chartered p3 2010 Final PublishedlmferlaAinda não há avaliações

- TVM Class QuestionsDocumento1 páginaTVM Class QuestionskartikAinda não há avaliações

- 1&2 Meaning and Definition of AccountingDocumento73 páginas1&2 Meaning and Definition of AccountingPrasad BhanageAinda não há avaliações

- Ax2009 Enus Finii 08Documento24 páginasAx2009 Enus Finii 08Timer AngelAinda não há avaliações

- Principal and Agent: Joseph E. StiglitzDocumento13 páginasPrincipal and Agent: Joseph E. StiglitzRamiro EnriquezAinda não há avaliações

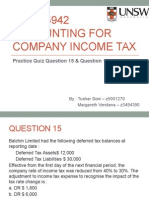

- ACCT5942 Week4 PresentationDocumento13 páginasACCT5942 Week4 PresentationDuongPhamAinda não há avaliações

- Chapter 18 Government GrantsDocumento6 páginasChapter 18 Government Grantsalexandra rausaAinda não há avaliações

- MFD Exam 500 QusDocumento40 páginasMFD Exam 500 QusArvindKumarAinda não há avaliações

- Regulatory framework derivatives IndiaDocumento2 páginasRegulatory framework derivatives IndiasvtashaAinda não há avaliações

- 11 Sample Papers Accountancy 2Documento10 páginas11 Sample Papers Accountancy 2AvcelAinda não há avaliações

- Pairs Trading Cointegration ApproachDocumento82 páginasPairs Trading Cointegration Approachalexa_sherpyAinda não há avaliações

- Audit Planning and Materiality: Concept Checks P. 209Documento37 páginasAudit Planning and Materiality: Concept Checks P. 209hsingting yuAinda não há avaliações

- 300 - PEI - Jun 2019 - DigiDocumento24 páginas300 - PEI - Jun 2019 - Digimick ryanAinda não há avaliações

- Authority To Sell FORMDocumento2 páginasAuthority To Sell FORMSuzi Garcia-RufinoAinda não há avaliações

- Credit Rating Agencies PDFDocumento17 páginasCredit Rating Agencies PDFAkash SinghAinda não há avaliações

- Pertinent Laws in Urban DesignDocumento31 páginasPertinent Laws in Urban DesignAnamarie C. CamasinAinda não há avaliações

- Management Accounting NotesDocumento9 páginasManagement Accounting NoteskamdicaAinda não há avaliações

- Impact of Merger On Financial Performance of Nepalese Commercial BankDocumento4 páginasImpact of Merger On Financial Performance of Nepalese Commercial BankShrestha Photo studioAinda não há avaliações

- Additional Issues in Accounting For Corporations: Accounting Principles, Eighth EditionDocumento36 páginasAdditional Issues in Accounting For Corporations: Accounting Principles, Eighth EditionAiiny Nurul 'sinepot'Ainda não há avaliações

- Analyze Profitability Ratios of Digi and MaxisDocumento5 páginasAnalyze Profitability Ratios of Digi and MaxisMuhammad KharusaniAinda não há avaliações

- Sosialisasi Asuransi Kesehatan Karyawan PT Arcadis IndonesiaDocumento38 páginasSosialisasi Asuransi Kesehatan Karyawan PT Arcadis IndonesiaZahra ArsahAinda não há avaliações

- Detailed StatementDocumento2 páginasDetailed Statementnisha.yusuf.infAinda não há avaliações

- Final Thesis MA Tigist TesfayeDocumento51 páginasFinal Thesis MA Tigist Tesfayekiya felelkeAinda não há avaliações

- Hudson Law of Finance 2e 2013 Syndicated Loans ch.33Documento16 páginasHudson Law of Finance 2e 2013 Syndicated Loans ch.33tracy.jiang0908Ainda não há avaliações

- 123 PDFDocumento3 páginas123 PDFraggerloungeAinda não há avaliações

- Praktek Akuntansi PD UD Buana (Kevin Jonathan)Documento67 páginasPraktek Akuntansi PD UD Buana (Kevin Jonathan)kevin jonathanAinda não há avaliações

- Financial Markets Exam - Key Terms, Concepts, and InstitutionsDocumento1 páginaFinancial Markets Exam - Key Terms, Concepts, and InstitutionsNishad AlamAinda não há avaliações