Escolar Documentos

Profissional Documentos

Cultura Documentos

Mexico, From Stabilized Development To Debt Crisis

Enviado por

Viktoria KlatskinDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Mexico, From Stabilized Development To Debt Crisis

Enviado por

Viktoria KlatskinDireitos autorais:

Formatos disponíveis

Mexico: From Stabilized Development to Debt Crisis

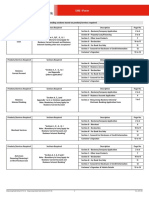

Background Information Mexican Revolution of 1910 Caused by unequal distribution of wealth Lower and Middle class revolted against 30-year Dictator Porfirio Daz Over 1 million people died DICTATORSHIP IN MEXICO ENDED Constitution of 1917 Government owns all land mineral deposits Foreign ownership of land = heavily restricted Government created minimum wage, maximum work hours, and union rights Emergence of Institutional Revolutionary Party (PRI) Changes in Economy After WWII, Mexico wanted to: Reduce dependence on raw material exports and manufactured goods imports They did this by: Increasing tariffs to protect newly emerging manufacturing sector Providing low-interest, long-term loans for manufacturing FDI increased fivefold from 1950-1970 because of high tariffs Countries like the US began investing directly into Mexico By 1972, more than half of the 300 largest manufacturing firms were controlled by foreigners Tight fiscal and monetary policy and a pegged exchange rate kept inflation low 1. What were the causes of debt crisis in Latin America in 1982? Underlying problems began to manifest in the mid-1960s Growth in Mexico began to slow During 1965-1970, the growth of agricultural production declined to only 1% per year, far below the population growth rate Exports of manufactured goods became stagnant Economy became more dependent on imported capital goods and intermediates Between 1965 and 1970, the current account deficit ballooned from $367 million to $946 million Mexican social landscape also changed Industrialization led to increased urbanization In 1950, 57% of the population lived in rural areas By 1970, only 41% of the population lived there In 1987, 70% of the population lived in cities, 35% in Mexico City alone Population grew at a rapid annual rate of 3.1% from 1965-1980, and 2.2% in the 1980s In the summer of 1968, a series of peaceful student demonstrations culminated in the armys massacre of hundreds of protesters PRIs (Institutional Revolutionary Party) use of outright repression resulted in a serious loss of legitimacy and precipitated greater opposition to the regime Presidents Luis Echeverria and Jose Lopez Portillo each attempted to restore trust in the PRI They tried to accommodate the growing and completing claims of different groups on national resources through aggressive expansionary fiscal policies

This led to: An increase in spending on healthcare and education A brief review of land reform Limited political space granted to independent unions and opposition parties Revenues did not grow to match the increasing government spending of the country Fiscal conservatism of previous administration was abandoned Fiscal and current account deficits began to appear Inflation rose to about 30% To finance the deficits, the Mexican government borrowed from abroad which increased Mexicos foreign indebtedness By August 1976, the situation in Mexico was unsustainable For the first time since 1954, the president was forced to devalue the peso To address the economic devaluation crisis, a standby loan agreement was reached between the Mexican authorities and the IMF Collapse February 1982, President Lopez Portillo forced to devalue peso Peso devalued again on August 15, 1982 Despite the devaluation, by June and July, capital was leaving the country up to $2 million to $400 million a day Mexican government announced that it could no longer meet interest payment on its foreign debt Mexico owed payments of $88 billion on debt which was double its liquid reserves, Mexico signed a deal with IMF

2. How did Mexico escape from the debt crisis? President Miguel de la Madrid reduced public spending, tried to stimulate exports, and foster economic growth However, trade deficit, high interest rates, and scarce credit were hurting recovery After 6 years of struggle, in 1988, inflation was under control, prices were stable, and fiscal and monetary policies were stable Even after increased stability, FDI did not improve In 1989, President Carlos Salinas de Gortari announced plan for economic growth and lowering debt The plan was to encourage private investment from citizens He lowered debt, lowered borrowing costs, and reformed the banking sector This all triggered growth and helped Mexico get out of the crisis 3. What triggered Mexicos pesos crisis in December 1994? Began in December 1994 The peso was devalued The exchange rate was switched from fixed rate to floating rate Causes High spending and large deficit and low oil prices Uncertainty about quality of credit extended by Mexican banks. Armed led rebellion caused investors to be wary of Mexicos stability

High Spending 1994 was the last year of the 6-year administration of Carlos Salinas de Gortari PRI tradition on an election year, launched a high spending splurge and a high deficit To finance the deficit, Salinas issued a type of debt instrument denominated in pesos but indexed to dollars Banking Concerns Mexico experienced lax banking or corrupt practices Some members of the Salinas family collected enormous illicit payoffs Rebellion The EZLN, was an insurgent rebellion, Zapatista Army of National Liberation They officially declared war on the government on January 1. The armed conflict ended two weeks later The grievances and petitions remained a concern, especially amongst investors Solution Mexico received loans totaling $50 Billion, $20 Billion coming from the US in 1994 By 1996, the economy was growing, and peaked at 7% growth in 1999 In 1997, Mexico repaid all US Treasury loans ahead of schedule

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Chap 7 SolutionsDocumento8 páginasChap 7 SolutionsMiftahudin MiftahudinAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- How To Secure A Bank Account From Levy 1Documento5 páginasHow To Secure A Bank Account From Levy 1api-374440897% (124)

- Pamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoDocumento5 páginasPamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoLyca SorianoAinda não há avaliações

- Project of Merger Acquisition SANJAYDocumento65 páginasProject of Merger Acquisition SANJAYmangundesanju77% (74)

- BCG Growth-Share MatrixDocumento3 páginasBCG Growth-Share Matrixabhishek kunalAinda não há avaliações

- 1 Alfino Borrowed Money From Yakutsk and Agreed in WritingDocumento1 página1 Alfino Borrowed Money From Yakutsk and Agreed in Writingjoanne bajetaAinda não há avaliações

- Cash Flow Statement 2016-2020Documento8 páginasCash Flow Statement 2016-2020yip manAinda não há avaliações

- HLB SME 1form (Original)Documento14 páginasHLB SME 1form (Original)Mandy ChanAinda não há avaliações

- Fauji Fertilizer Company LimitedDocumento16 páginasFauji Fertilizer Company Limitedkhan izharAinda não há avaliações

- CAF2-Intorduction To Economics and Finance - QuestionbankDocumento188 páginasCAF2-Intorduction To Economics and Finance - Questionbankrambo100% (1)

- BPI Philippine High Dividend Equity Fund - November 2023 v2Documento3 páginasBPI Philippine High Dividend Equity Fund - November 2023 v2Gabrielle De VeraAinda não há avaliações

- Teknik AkersonDocumento60 páginasTeknik Akerson060098401Ainda não há avaliações

- TENANCY AGREEMENT Pasar SegarDocumento4 páginasTENANCY AGREEMENT Pasar SegarFade ChannelAinda não há avaliações

- ICICI Pru Signature Online BrochureDocumento30 páginasICICI Pru Signature Online Brochuremyhomemitv2uAinda não há avaliações

- Salary Slip-Format 547Documento2 páginasSalary Slip-Format 547dinescAinda não há avaliações

- Ernst & Young Islamic Funds & Investments Report 2011Documento50 páginasErnst & Young Islamic Funds & Investments Report 2011The_Banker100% (1)

- DigiKhata PDFDocumento2 páginasDigiKhata PDFtufailnazir Muhammad tufailAinda não há avaliações

- Export ProcedureDocumento19 páginasExport ProcedureDenis SamuelAinda não há avaliações

- Guidelines Baseline 4 - Without TTDocumento297 páginasGuidelines Baseline 4 - Without TTdarin.vasilevAinda não há avaliações

- Practice Set Quasi Reorganization - QUESTIONNAIREDocumento2 páginasPractice Set Quasi Reorganization - QUESTIONNAIREJERICO RAMOSAinda não há avaliações

- Berkshire's Corporate Performance vs. The S&P 500Documento23 páginasBerkshire's Corporate Performance vs. The S&P 500FirstpostAinda não há avaliações

- Notes in Tax On IndividualsDocumento4 páginasNotes in Tax On IndividualsPaula BatulanAinda não há avaliações

- Ap COSTSDocumento4 páginasAp COSTSferAinda não há avaliações

- British Lyceum ChallanDocumento1 páginaBritish Lyceum ChallanKamran JalilAinda não há avaliações

- Skanray Technologies Pvt. LTD: Company ProfileDocumento33 páginasSkanray Technologies Pvt. LTD: Company ProfileMars NaspekovAinda não há avaliações

- BSP M-2020-016 PDFDocumento9 páginasBSP M-2020-016 PDFRaine Buenaventura-EleazarAinda não há avaliações

- Economics A-Z Terms Beginning With A - The EconomistDocumento6 páginasEconomics A-Z Terms Beginning With A - The EconomistYoussef AbidAinda não há avaliações

- PT Nagai Plastic Indonesia Feb 2015 - 06072015 Draft6jul15Documento41 páginasPT Nagai Plastic Indonesia Feb 2015 - 06072015 Draft6jul15nogoenogoe yahoo.co.idAinda não há avaliações

- My Cash: Balance TotalDocumento9 páginasMy Cash: Balance TotalDahlan MuksinAinda não há avaliações

- Am Mutual Master Prospectus 2010Documento281 páginasAm Mutual Master Prospectus 2010easyunittrustAinda não há avaliações