Escolar Documentos

Profissional Documentos

Cultura Documentos

Contracts

Enviado por

mesher123Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Contracts

Enviado por

mesher123Direitos autorais:

Formatos disponíveis

CONTRACTS OUTLINE I. Applicable Law A. MS: Apply Article 2 to a sale of goods and common law to all other transactions.

1. Article 2 applies to a sale of goods (which are moveable, personal property). a. Real property is not covered by Article 2. b. Contracts for services are not covered by Article 2. c. In the case of a mixed contract, it is the more important purpose goods or services that dominates. If the services are an additional incentive to ensure the purchase of the goods, then it is a transaction of goods. B. NY: Apply Article 2 to a sale of goods, Article 2A to a lease of goods, and common law to all other transactions. 1. Under Article 2A, it does not matter whether it is a business or consumer lease. II. Definitions A. Contract: A contract is a legally enforceable agreement. 1. An express contract is created by the parties words (oral or written). 2. An implied contract is created by the parties conduct. B. Quasi-Contract: Protects against unjust enrichment when contract law yields an unfair result. This is a remedy of last resort. (always look for this!) 1. A party can recover the reasonable value of the benefit he conferred, not the contract price. C. Bi-Lateral Contract (flexible): Offer can be accepted in any reasonable way. D. Unilateral Contract (restrictive): Offers can be accepted only by performance. 1. This arises in 2 situations: a. Where an offer expressly says that can be accepted only by performance b. Where there is a reward, a contest or a prize III. Contract Formation A. Agreement Process 1. Offer a. Definition: A manifestation of an intention to be bound. b. Generally, advertisements are NOT offers. i. There must at least be a quantity term to be an offer. ii. Ex: Ad for ONE blue dress for $1 is an offer b/c it specifies quantity BUT: an ad for a breakfast special for $2.49 is not an offer b/c no quantity. c. Indefiniteness: i. See if there are any terms that are too indefinite to be enforced. ii. Open price terms are okay b/c the court will read in a reasonable price. iii. Requirements Contracts (Article 2) a. Quantity can be measured by the buyers needs or requirement (i.e., all of buyers requirements); you do not need a specific amount to be specified. 1. However, even if the buyer is ordering in good faith, the buyer cannot take the seller by surprise. Any increase in quantity cannot be way out of line with the buyers prior demands. 2. Termination of the Offer a. Lapse: An offer lapses after a stated term or a reasonable time has passed. b. Revocation: An offer terminates when the offeror revokes the offer.

i. General Rule: An offer can be revoked at any time before acceptance by: a. Direct Revocation: The offeror indicates directly to the offeree that he has changed his mind about the deal. b. Indirect Revocation: The offeror engages in conduct that indicates that hes changed his mind AND the offeree is aware of the conduct. ii. 4 Exceptions Where an Offer CANNOT Be Revoked: a. Option: An option is a promise to keep the offer open that is paid for. 1. A signed written promise not to revoke is NOT enforceable. 2. NY Distinction: A signed written promise not to revoke is enforceable, even without payment. b. Foreseeable Reliance Before Acceptance: 1. Reliance before acceptance is usually not foreseeable. The offeror usually expects the offeree to accept first and then rely. 2. However, an offer will be revocable where a subcontractor submits a bid to a contractor b/c the subcontractor knows that the contractor is going to rely on the offer before accepting the general contract. c. Starting to Perform a Unilateral Contract: 1. An offer may not be revoked after performance has begun. i. Mere preparation is not enough for this exception to apply. a. However, it may fall under foreseeable reliance exception. 2. NY Distinction: An offer can be revoked until performance has been completed. d. Firm Offer (Article 2) (fall back rule for option) 1. In a sale of goods, if a merchant promises in a signed writing to keep an offer open, the offer is irrevocable. (need all 3 elements!) i. Almost every businessperson is a merchant under Article 2. ii. Signed is broadly defined to include initials, letterhead, symbols. iii. Subject to a time limit. If the offer does not state a time period, then it will be firm for a reasonable time, not to exceed 3 months. iii. Timing: A revocation is effective only upon receipt. No mailbox rule. c. Rejection: An offer terminates when the offeree rejects it by making an inappropriate response. i. Counteroffer: Operates as a rejection, but mere bargaining does not. a. Ex: I will only pay $460,000 is a counteroffer and thus a rejection. b. A question is considered to be mere bargaining and not a rejection and thus the offeree can still accept the original offer. ii. Conditional Acceptance: Is NOT an acceptance at all. a. Ex: I accept the offer to appear in the film on condition that (or provided that/so long as/if) iii. Acceptance Varying Offer (Common law differs from Article 2!) a. Common Law: Acceptance must mirror offer (Mirror Image Rule) 1. No additional terms may be added. b. Sale of Goods (Article 2): Acceptance does not have to mirror offer. 1. Adding or changing a term does not prevent acceptance. 2. However, the offerees terms become part of the contract only if: i. Both parties are merchants; 2

ii. The term is not a material change; AND a. A material change is one that is likely to cause hardship or surprise for the offeror (such as a disclaimer). b. If the term is customary in industry, it is not a material change. c. Ex: Adding Saturday Delivery is not a material change. iii. The offeror does not object within a reasonable time. a. The offeror can keep out even a minor change (e.g., Saturday Delivery) by objecting to it within a reasonable time. d. Death of a Party Before Acceptance: i. Terminates a revocable offer. a. The offerees knowledge of the offerors death is irrelevant. ii. Does not terminate an irrevocable offer. 3. Acceptance of the Offer a. Language of the Offer Controls: i. If language of offer states only one method of performance, then performance is the exclusive means of acceptance. Indicated by only by language. ii. Otherwise, any reasonable manner of acceptance is permissible. Generally use the same means of communication to accept as was used for the offer. a. Ex: A promise to ship goods is good enough for acceptance. b. Starting Performance i. Bilateral Contract: a. Starting performance is acceptance of an offer to enter a bilateral contract AND carries with it an implied promise to finish the job. ii. Unilateral Contract: a. Starting performance is NOT acceptance of an offer to enter a unilateral contract; only completing performance is acceptance. b. Once the offeree starts performance, the offeror can no longer revoke. 1. NY Distinction: The offeror can still revoke until completion of performance. c. Improper Performance i. Common Law: Simultaneous acceptance AND breach a. Ex: Accepted offer to paint house white but paints it maroon. ii. Sale of Goods (Article 2): Simultaneous acceptance AND breach unless seller is sending the goods as an accommodation to buyer. a. Ex: If S tells B that he is sending nonconforming goods to accommodate B, then no acceptance and no breach. d. Offerees Silence is NOT acceptance. i. An offeror cannot single-handedly turn the offerees silence into acceptance. ii. Unsolicited merchandise is considered to be a gift. e. Timing of an Acceptance i. General Rule: Acceptance is effective when it is mailed. (Mailbox Rule) a. Even if acceptance letter gets lost in mail. Burden of loss is on the offeror. ii. Exceptions: a. Where offer provides otherwise (b/c Mailbox Rule is DEFAULT rule) b. Where the offer is irrevocable (b/c then the offeree does not need the protection of the Mailbox Rule)

c. Where the offeror relies on a rejection that arrives before the prior-sent acceptance (i.e., where acceptance is sent first, but rejection arrives first) 1. The mailbox rule (acceptance valid when mailed) will still apply unless the offeror relies on the rejection. d. Where the rejection is sent first, it is a race. Whichever document gets their first is effective. B. Defenses Against Formation 1. Lack of Capacity a. Categories: Minors (under 18); intoxicated; mentally incompetent. i. NY Distinction: By statute, infants cannot void contracts in the following situations: life insurance contracts by those 14 or older; educational loans by those 16 or older; all contracts by 18 year olds; realty contracts related to the marital home; and contracts involving artistic or athletic services. ii. NY Distinction: An adjudicated incompetents contract is void, but an unadjudicated incompetents contract not voidable unless incompetent can restore other party to previous position. b. General Rule: An incapacitated defendant may disaffirm the contract if he wants to avoid it. i. We just care about the defendants capacity at the time of the agreement. ii. Implied Affirmation: If the defendant retains the benefit of the contract without complaint after gaining (or regaining) capacity, then the contract can be enforced against them as if they had expressly agreed to be bound. c. Exception: An incapacitated party is liable for necessaries (i.e., food, shelter, clothing, or medical care), but only on a quasi-contract basis. i. Thus, the incapacitated party is only required to pay the reasonable value of the necessaries, not the contract price. 2. Duress a. Economic pressure is more likely to be tested than threat of physical force. b. Economic Duress: i. The threat to break an existing contract; ii. The victim only agrees to second contract in order to get the deal done; AND iii. Where there is no reasonable alternative. 3. Misrepresentation/Nondisclosure of a Material Fact a. Even an honest misrepresentation can be a fatal flaw, as long as it is material. b. Ex: S tells B that house has no foundation problems. If S honestly believes house has no foundation problems but it does, B is not bound to the contract. 4. Ambiguity/Misunderstanding a. Occurs when the parties are on different wavelengths. b. If neither party knows or has reason to know about the different meanings, then there is no contract because of the misunderstanding (e.g., Peerless ship case). i. However, if one party knows or has reason to know of different meanings, then there will be a contract and the innocent partys meaning will govern. 5. Mistake a. Mutual Mistake about a Material Fact:

i. If there is a mutual mistake of a fact, the contract is NOT enforceable so long as the existence of the fact was central to the contract and a crucial aspect of the agreement. a. A mistake as to market value is generally not considered a material fact. b. Unilateral Mistake: i. One partys mistake is NOT a fatal flaw unless the other party knew or had reason to know about it. 6. Lack of Consideration a. Definition: Bargained-for legal detriment/benefit. b. You can bargain for a promise, performance, or even forbearance. i. Ex: I promise to sell dog in exchange for Bs promise to pay $400. ii. Ex: I promise to pay you $100 if you stop listening to recordings by NIN. c. Past Consideration is NOT consideration at all. You cannot bargain for something that has already been done. i. It does not matter whether the promise to pay past consideration is in writing. a. Ex: Paula promises to pay Simon $300 after Simon helped her move. This promise will not be enforceable b/c it is made after the fact. ii. NY Distinction: Past consideration is binding, if it is expressly stated in a signed writing, it can be proven, and it is signed by the promisor. d. Adequacy of Consideration: Does not matter how much consideration is paid as long as there is a bargain. e. Contract Modification (common law differs from Article 2!) i. Common Law: New consideration is required to modify a contract. Performing a pre-existing duty is not enough. (Pre-Existing Duty Rule) a. Ex: Ashlee cannot demand more money to play at a club right before the show b/c no consideration for the promise to pay extra money by owner. b. It does not matter whether the modification is in writing. 1. NY Distinction: No new consideration is needed if the modification is made in a signed writing. c. The preexisting duty rule cannot be used as a defense by a third party; it is only available to a party to the original contract. ii. Sale of Goods (Article 2): Consideration is not required to modify a contract, but you must show good faith. f. Partial Payment of a Debt: Depends on whether the debt is in dispute. i. If the debt is in dispute, then partial payment of the debt is consideration for promise to forgive balance. a. Ex: Visa does not have to honor promise to forgive $500 of $2500 debt if debtor pays $2000 b/c the debt was undisputed (i.e., it was already owed). ii. It does not matter whether the agreement re partial payment is in writing. iii. NY Distinction: No consideration is required if the promise to forgive is embodied in a signed writing. g. Time-Barred Debt: A written promise to pay a debt, collection of which is barred by the SOL, is enforceable even without consideration. i. Ex: Visa barred by SOL from enforcing debt. You write Visa a letter offering to pay debt. You must pay b/c the signed writing serves as a substitute for consideration. 5

h. Promissory Estoppel as a Substitute for Consideration: Foreseeable reliance may make a promise enforceable even without consideration! i. This will always be the second choice if there is no consideration found. 7. Public Policy a. Covenant Not-to-Compete: A court will invalidate or narrow a covenant not to compete that operates as a restraint of trade. i. Scope of the Covenant: Consider duration and geography a. The court will make a decision about whether the limits are reasonable in nature. The court balances the freedom of contract and restraint of trade. ii. Need for the Covenant: Consider uniqueness of services a. Ex: A covenant not to compete is probably enforceable against a Tavern on the Green chef but not against a bus boy. b. Exculpatory Clause: An exculpatory clause can eliminate liability for negligence, but not for gross negligence or intentional torts. IV. Statute of Frauds A. When a Writing is Required: Most oral contracts are enforceable; only certain kinds of contracts need a writing to be enforced (and thus come within the SOF). 1. Transfer of an Interest in Real Property: a. A sale of real property, a lease or easement, or other transfer of real property falls within the SOF. i. A contract to build a fence does not fall within the SOF. b. An agents authority concerning real property must be in writing under the equal dignities rule (= if the underlying transaction is within the SOF, then the agents act of performing the transaction must also be within the SOF). 2. Performance cannot be completed within ONE year. a. It does not matter whether performance actually takes more than one year; if full performance within a year is theoretically possible, then no writing is required. i. Specific tasks do not present a SOF problem b/c can task can theoretically be completed within one year. ii. A contract for lifetime employment does not require a writing. a. NY Distinction: Lifetime contracts do fall under the NY SOF. iii. Any contract (e.g., employment, etc.) for a specific time period in excess of one year falls within the SOF. b. Timing: The clock starts to run when the agreement is made, not when performance begins. Any contract that is not enforceable one year (plus 1) from the date when the agreement is made is subject to SOF. i. The duration of performance is irrelevant. It only matters how long between the agreement and the performance. ii. Ex: On 5/1/09, Enya orally agreed to perform on 12/31/10. Subject to SOF. 3. Sale of Goods for $500 or More (Article 2) a. Where we have a sale of goods for $500 or more, then Article 2 SOF applies. 4. Sale of Goods for $1000 or More (Article 2A) (NY ONLY) a. Where we have a lease of goods for $1000 or more, then Article 2A SOF applies. b. Total lease price controls here (e.g., $300/month for 1 year = $3600) 5. Suretyship: A suretyship is a promise to answer for the debt of another. a. Key Language: If A doesnt pay, I will.

i. Ex: Contract with A to paint As house for $10,000. B says If A doesnt pay, I will. B is a surety for A. ii. Ex: No contract with A to paint As house. B says If you paint As house, I will pay you $10,000. No suretyship here b/c B is the only one liable. b. Subject to SOF must have a writing. 6. Contract Modification: Must be in writing only if the contract as modified (not the original contract) is within the SOF. i. OR, the modified contract must independently satisfy SOF threshold. ii. Ex: Original K for $400. Modified K for $800. Modified K subject to SOF. iii. But if the contract is later reduced, no need for a writing as long as the contract modification is less than $500. b. Unless the original written contract prohibited oral modification. Then any modification would have to be in writing. Article 2 lets the parties create their own SOF and require a writing even if the Code does not require them to. i. Under common law, clauses that prohibit oral modification are not enforceable (so you can always modify a contract orally under common law, even if you have agreed not to). 7. Miscellaneous NY Provisions that REQUIRE a Writing: a. Assignment of an insurance policy b. A promise to pay a discharged debt c. An agreement to pay a finders fee or brokers commission, except an attorney, auctioneer, or real estate agent B. A Satisfactory Writing Depends on the NATURE of the Contract 1. Sale of Goods (Article 2): a. Must contain a quantity term AND be signed by the party to be charged with the breach of contract (i.e., the defendant). 2. Lease of Goods (Article 2A) (NY ONLY): a. Must state that its a lease, include the quantity, duration, and rental payments; and be signed by the defendant. 3. Any Other Contract: a. Must contain all material terms (who/what) and be signed by the defendant. i. The SOF can be a one-way street. C. Exceptions to SOF Defense (carved out where there is less chance of fraud) 1. Real Property a. Leases of 1 year or less: legislative exception to ensure that short-term leases are not invalidated by the SOF. b. Part Performance: i. Must have 2/3: some payment; improvement; possession. ii. Payment alone, even full payment, is not enough for part performance. 2. One-Year Prong: Full Performance Exception a. Where the contract has been fully performed, there is no need for a writing b/c the contract has been fully performed. i. Ex: Sesame Street orally agrees to employ Big Bird for 2 years for $50K. Big Bird works for 2 years, but SS wont pay. No need for a writing to satisfy SOF b/c Big Bird fully performed the contract.

b. Part performance is not enough to satisfy the full performance exception. Thus, a party cannot recover the full contract price, but may be able to recover in quasicontract for the reasonable value of the work he did. 3. Sale of Goods for $500 or more (Article 2) a. Goods Accepted or Paid for By Buyer i. This exception applies only to the goods accepted or paid for, not to the whole contract. ii. The seller does not need a writing to enforce the partial acceptance of goods and get paid for those goods (e.g., if 20 bats delivered, can only get paid for value of those 20 bats, not for the whole contract price). The seller still needs to be able to show that a contract was made. a. The seller may still have a SOF defense as to the goods not delivered. iii. However, if buyer paid for the entire contract, then no SOF defense for seller. b. Custom-Made Goods: i. If the seller has started to make them and they are not suitable for sale in the ordinary course of sellers business. c. Judicial Admission (e.g., in a deposition, in testimony, etc.) d. Merchants Confirmatory Memo: i. One party can use its own signed writing to satisfy the SOF against the other party if: a. Both parties are merchants; b. The writing claims a prior oral agreement and has a quantity; and c. The recipient doesnt object in writing within 10 days. 4. Suretyship: Main Purpose Exception a. If the suretys main purpose in making the promise was to benefit him, then no writing is required to satisfy SOF. b. NY Distinction: Does not have the main purpose exception. NY requires the promisor to come under an independent duty of payment irrespective of the liability of the principal. V. Contract Terms A. Parole Evidence Rule (PER): Keeps out evidence of a prior agreement (either oral or written) that contradicts a later writing. 1. A PER problem requires a writing as opposed to SOF which involves an oral K. 2. The PER assumes that a later writing is more reliable than what came before. 3. Exceptions [where evidence gets in]: a. To correct a clerical error (e.g, a typo) b. To establish a defense against formation i. Evidence that there was some flaw in the agreement always gets in. c. To interpret a vague or ambiguous term i. Courts give words their plain meaning. d. To supplement a partially-integrated writing (i.e., a final statement of the terms included, but not a complete statement of all terms agreed to) i. Evidence can be admitted to the writing if it does not appear to be complete on its face and the writing is silent on the topic of the term to be added. ii. However, a merger clause (This contract is limited to the terms herein) is evidence that the writing is complete and cannot be supplemented.

B.

C.

D.

E.

4. Subsequent Developments: The PER has nothing to do with what happens after an agreement is reduced to writing; thus, the evidence will always be allowed in. a. Ex: Can allow evidence that the manager stated that he will throw in the bridal suite for free after the contract is signed. Conduct: Can explain terms or fill in gaps 1. Course of Performance: What the parties did under this contract. a. This is the best evidence of what the parties intended. 2. Course of Dealing: What they did under prior contracts with each other. a. Course of dealing is more removed from this contract its about prior deals. 3. Usage of Trade: What others in the trade do in similar contracts. a. This is furthest removed from current contract its about how other people act. Sellers Warranties of Quality in a Sale of Goods (Article 2) 1. Express Warranties: A seller is liable for breach of an express warranty. a. What is an express warranty? i. Statements of fact, promises, descriptions of the goods, and the use of a sample or model are express warranties. ii. Opinion: An opinion is not an express warranty [look for general or subjective statements]. b. The express warranty must be a basis of the bargain: If the buyer could have relied on the express warranty, it was a basis of the bargain. 2. Implied Warranties (two different types) a. Implied Warranty of Merchantability i. Definition: The goods are fit for their ordinary purpose. ii. Triggering Fact: Seller is a special kind of merchant a merchant who deals in goods of the kind (he has a special knowledge about the particular goods involved in the contract). iii. Ex: Foot Locker gives an implied warranty of merchantability for the sale of running shoes but not as to the sale of delivery vans. b. Implied Warranty of Fitness for a Particular Purpose i. Definition: The goods are fit for the buyers particular purpose. ii. Triggering Facts: Buyer has a special purpose in mind; buyer is relying on seller to select suitable goods; and the seller knows it. a. Note: Seller does not have to be a merchant at all! iii. Ex: Shoe store breaches an implied warranty of fitness if they pick out the wrong kind of shoes for someone with an express purpose (i.e. job interview). However, they still give an implied warranty of merchantability for the shoes. Lessors Warranties in a Lease of Goods (Article 2A) (NY ONLY) 1. General Rule: Same warranties under Article 2A as under Article 2 a. EXCEPT for finance leases i. In this case, the implied warranty of merchantability is made by the manufacturer (i.e., Gateway for a computer) and not by the bank. Limitations on Warranty Liability in Sales and Leases of Goods 1. Disclaimers: A seller can disclaim implied, but not express, warranties. a. An express warranty will survive a disclaimer. A seller cannot make an express warranty and then subsequently disclaim it.

b. However, a seller can effectively disclaim implied warranties by use of magic words such as as is or with all faults as long as there is no other statement in contract about quality. i. If seller does not use one of the magic words to disclaim an implied warranty of merchantability or fitness, they can still disclaim implied warranties as long as they use the word merchantability in the disclaimer. 2. Limitation of Buyers Remedies a. General Rule: Seller can limit buyers remedies for breach of any warranty (express or implied) if the limitation is not unconscionable. b. Exception: Limiting buyers remedies for personal injury in the case of consumer goods is presumed to be unconscionable (prima facie). This exception operates as a kind of consumer protection clause. i. The seller can rebut this presumption, but is a very hard presumption to rebut. F. Risk of Loss (ROL) in Sales of Goods (Article 2) 1. Issue: When goods are damaged before the buyer gets the goods and neither the buyer nor the seller is to blame, who bears the risk of loss? a. If the seller bears ROL: Seller must provide new goods to buyer for no additional cost, or be liable for breach of contract. b. If the buyer bears ROL: Buyer must still pay the contract price! 2. Hierarchy: Look to the following things in the following order to determine ROL: a. Agreement: The agreement of the party controls. b. Breach: Breaching party bears ROL, even if the loss is unrelated to the breach. i. E.g., A seller can breach by shipping late and thus bear ROL. 3. Delivery by Common Carrier (e.g., UPS, Central Freight): a. ROL shifts to buyer when the seller completes its delivery obligations: i. Shipment Contract: Seller must get the goods to a common carrier, make delivery arrangements, and notify buyer. a. Often indicated by FOB [place or city that seller is located] b. Here, the buyer bears the risk of loss long before he gets the goods! ii. Destination Contract: Seller must get the goods to a specific definition (usually, where the buyer is located). a. Often indicated by FOB [any other place or city other than that of seller] 4. Non-Carrier Cases (e.g., buyer is to pick up or seller is to deliver the goods): a. If seller is merchant: Seller bears ROL until buyer takes possession of goods. i. Merchant: Deals in goods of the specific kind. b. If seller is not a merchant: Seller bears ROL until it tenders the goods (i.e., makes them available to buyer; tells buyer where/when to pick up goods) G. Risk of Loss in a Lease of Goods (Article 2A) (NY ONLY) 1. General Rule: The lessor bears the ROL, even though the goods are in the lessees possession when they are destroyed. 2. Exception: Finance Lease (bank buys from manufacturer and leases to lessee) a. The lessee bears the ROL. This is because NY loves banks! VI. Performance of the Contract A. Performance of Contracts for a Sale of Goods (Article 2) 1. Perfect Tender Rule: If the seller is not perfect, then the buyer may reject the goods.

10

2. Option to Cure: A seller who fails to make perfect tender may have an option to cure, which usually depends on whether the time for performance has expired. a. Where the time for performance has not expired: Seller has a right to cure. i. Seller must deliver perfectly conforming goods by the contract deadline. b. Where the time for performance has expired: Seller generally does not have an option to cure, UNLESS, based on their prior dealings, the buyer accepted nonconforming goods (e.g, for a 10% discount), so it is reasonable for the seller to believe that they will do it again. i. Here, look for facts that buyer had been flexible about taking nonconforming goods in the past. 3. Installment Sales Contracts a. Definition: Requires or authorizes delivery in separate installments. i. It does not matter what the seller actually does what matters is what the contract SAYS! b. The perfect tender rule does not apply, so its tougher for the buyer to reject. i. The buyer has the right to reject any installment only if there is a substantial impairment in the installment that cant be cured. ii. The buyer has the right to reject the entire contract only if a defect in an installment substantially impairs the value of the entire contract. a. Ex: Delivering 450 instead of 500 bagels on one day of a 2 month contract is NOT substantial impairment in either case so no right to reject. 4. Buyers Acceptance of the Goods a. Implied Acceptance: When buyer keeps goods without objecting after having the opportunity to inspect. i. Merely paying for goods is NOT an implied acceptance. Buyer must have the opportunity to inspect the goods first. ii. The buyer must inspect the goods within a reasonable time. To find an implied acceptance, look for a long period between the time the goods were delivered and the time that the buyer complains. b. Consequences of Acceptance (express or implied): i. After acceptance, it is too late for the buyer to reject. ii. BUT: a buyer who accepts non-conforming goods can still get damages for sellers breach. 5. Buyers Revocation of Acceptance of Goods a. General Rule: A buyer cannot revoke acceptance of goods. b. Exception: If a non-conformity substantially impairs the value of the goods AND was difficult to discover (i.e., if it was a latent defect). i. Ex: After two months of living in mobile home without incident, it rains for the first time. Buyer can revoke his acceptance of the mobile home as long as he does so within a reasonable time after discovery of defect. 6. Consequences of Rejection/Revocation of Acceptance a. Return goods to seller (at sellers expense); Refund; and Damages 7. Buyers Payment Obligation Under Article 2 a. A buyer may pay by check, but the seller doesnt have to take it. b. However, if the seller refuses the check, the buyer has a reasonable time to get cash, even if the deadline has passed.

11

i. Ex: B pays by check at 5:00p.m., which is the deadline for payment of the contract. S refuses to take the check. B is not in breach. B. Performance of Common Law Contracts: 1. Performance does not have to be perfect. Substantial performance is all that is required (i.e., a party cannot commit a material breach). 2. Ex: Hires Martha Stewart to decorate house. She finishes, except for one bathroom. This is good enough under the common law b/c it is substantial performance. 3. Ex: Martha quits after decorating only the foyer; this is a material breach. VII. Excuses for Non-Performance Based on Later Events A. Other Partys Breach: The other partys breach may provide an excuse for nonperformance. Whether it does depends on the nature of the contract. 1. Sale of Goods (Article 2): a. If the sellers performance is not perfect in every respect (Perfect Tender Rule), buyer has pretty much free reign and has 3 choices: i. Buyer may accept ALL of the goods. ii. Buyer may reject ALL of the goods. iii. Buyer may accept SOME of the goods but reject the rest. b. Regardless of what option buyer chooses, buyer can still get damages from seller. 2. Common Law Contracts: a. Damages: The injured party can recover damages for any breach of contract, whether the breach is material or not. i. If breach, injured party can get damages but must still pay contract price unless there is a material breach (i.e., lack of substantial performance). b. Excuse: But only a material breach provides an excuse. i. If material breach, can get damages but also excused from paying contract price. However, breaching party may still recover in quasi-contract for the reasonable value of the benefit conferred. ii. What is a material breach? a. The failure to perform on time is generally NOT a material breach unless time is of the essence. b. 30% performance is not material breach and thus no recovery for a lump sum contract price, but possible recovery in quasi-K. c. Divisible Contracts: i. Where payment is on a per unit basis, the breaching party can recover the contract price for any unit on which he has substantially performed. ii. Ex: Contract providing for payment of $9000 per cabana instead of $90,000 for all 10. If only decorates 3 cabanas, can recover $27,000 ($9000*3). B. Anticipatory Repudiation 1. Anticipatory repudiation must be unequivocal, not just an expression of doubt. a. Ex: After A starts to perform, I tell her that I am not going to pay for her. This is an anticipatory repudiation and A can stop working and sue me for damages. 2. Applies only if there are unperformed duties on both sides of a bilateral contract. 3. Anticipatory repudiation gives the nonrepudiating party 4 alternatives: a. Treat the contract as totally repudiated and sue immediately; b. Suspend his own performance and wait until the performance is due to sue; c. Treat the repudiation as an offer to rescind and treat contract as discharged; OR

12

d. Ignore the repudiation and urge performance (but this urging of performance is not a waiver of the repudiation; nonrepudiating party may still sue for breach) 4. Repudiation may be retracted until the nonrepudiating party has accepted the repudiation or detrimentally relied on it. C. A Later Agreement 1. Rescission: An agreement to cancel the contract. a. In order for a rescission to be effective, each party must have some performance remaining. Otherwise there would be no consideration. 2. Modification: An agreement to replace an existing contract with a new one. a. Key Language: Now b. The modification takes effect immediately upon agreement. c. Ex: Agreement between A and B to discharge Bs debt to A if B promises to fix the clasp on As bag. If B does not fix the bag, A can only sue on the bag deal, but not on the debt. d. NY Distinction: No consideration is needed IF the modification is in writing and signed by the party to be charged, or by his agent. 3. Accord and Satisfaction: An accord is an agreement to accept performance in future satisfaction of an existing duty. Satisfaction is performance of the accord. a. Key Language: Then b. Ex: Same facts as above, except that agreement is that if B fixes the clasp on As bag, then A will discharge Bs debt to A. Now can sue on both debt and bag deal. 4. Novation: An agreement to substitute a new party for an existing one. a. Elements of Novation: 1) a previous valid contract; 2) an agreement among all parties, including the new party; 3) an immediate extinguishment of contractual duties as between original parties; and 4) a valid new contract. i. All original parties MUST consent to the new contract! Or else, no novation. ii. If all 4 of the elements are met, then the parties are not bound by the original contract and the new contract controls. b. Ex: Opie contracts to mow Helens lawn. Later, Opie, Goober and Helen agree that Goober will mow Helens lawn. If Goober does not do it, Helen may not sue Opie for breach of contract b/c Opie is excused by the novation and is off the hook. Helen may only proceed against Goober for breach of contract. D. Impossibility/Impracticability [sellers excuse] 1. A later unforeseen event that makes performance impossible (common law) OR impracticable (Article 2) (much harder/more expensive) may provide seller with an excuse for non-performance. a. Impossibility/impracticability rarely excuses seller on the MBE, especially if the grounds for this excuse are only an increase in the price for seller to perform. 2. Destruction of Something Necessary for Performance: a. Common Law: i. Destruction provides an excuse for non-performance b/c it makes the sellers performance impossible (e.g., a concert hall burns down before event). b. Sale of Goods (Article 2): Adopts the same general rule as the common law, but there are 2 trick questions to look out for: i. Unidentified Goods: Seller is excused only if the damaged/destroyed goods had been identified in the contract.

13

a. Identified in the contracts means that the goods were tagged or set aside for sale to this particular buyer. ii. Risk of Loss: A seller who bore ROL when goods were damaged or destroyed is excused by impracticability, but a buyer is not! a. If the ROL is still on seller when goods destroyed, excuse applies. b. If the ROL had been shifted to buyer before goods destroyed, no excuse and the buyer must perform the contract. 3. Death/Incapacity of Essential Person (not just any person) a. A contract is not discharged by the death or incapacity of the person who was to perform the services if the services are of a kind that can be delegated. i. Thus, if the contract was for personal services of a unique kind (e.g., the painting of a portrait by a famous artist), the death or incapacity of that person could make performance impossible, but if the services are not unique (e.g., the painting of a farmers barn), the death of incapacity of that person would not make performance impossible. 4. Supervening Government Regulation a. Duties may be discharged by supervening illegality of the subject matter (e.g., a subsequently enacted law rendering the contract subject matter illegal) E. Frustration of Purpose [buyers excuse] 1. A contract will be discharged for frustration of purpose where there is a supervening event that was not reasonably foreseeable at the time of entering into the contract which completely or almost completely destroys the purpose of the contract and the purpose was known and understood by both parties. F. Failure of an Express Condition (very important on MBE!) 1. Definition: Limits obligations created by other contractual language; it does not create an independent obligation. a. Look for words like if, as long as, when, provided that, on condition that, and unless. 2. Strict compliance with the express condition is required; if no strict compliance (almost is not good enough!), then the failure of the conditions occurrence gives the party who created the condition by contract a way out. a. Ex: Tori contracts to buy a house, provided that it appraises for at least $300K. House is appraised for $299,500. Tori has an excuse to break K if she wants it. 3. Satisfaction Clauses: Satisfaction is measured by a reasonable person (objective) standard UNLESS the contract deals with art or matters of personal taste. a. Ex: House painting contract judged by reasonable person standard; contract to paint a portrait judged by person who commissioned work. 4. Types of Express Conditions: a. Condition Precedent: condition must occur before performance is due (if) b. Condition Concurrent: obligation runs alongside the condition (as long as) c. Condition Subsequent: performance occurs first, then occurrence of the condition cuts it off (until) 5. Excusing the Occurrence of a Condition: Occurrence of a condition may be excused by the later action or inaction of the person who is protected by the condition [every condition protects someone]

14

a. Failure to Cooperate: A party who wrongfully prevents a condition from occurring will no longer be given the benefit of it. i. Ex: Condition of mortgage financing for house purchase. Buyer does not even apply for a mortgage or attempt to get one. No excuse. b. Waiver: Where the protected party voluntarily relinquishes the protection of the condition. i. A party may waive a condition by indicating that he will not insist on it. ii. However, such a waiver may be retracted at any time (e.g., as to future payments) unless the other party relies on the waiver and changes her position to her detriment. Upon such detrimental reliance, the waiving party is estopped from asserting the condition. VIII. Remedies A. Non-Monetary (In Rem) Remedies 1. Specific Performance a. Equitable remedy not generally available for breach of contract, but may be available if monetary damages are inadequate to compensate the injured party. b. Availability depends on nature of contract: i. Real Property: Specific performance is generally available because real property is considered to be unique (even if it is not really unique). ii. Sale of Goods (Article 2): Specific performance is available only if the goods are unique or there are other proper circumstances (e.g., an inability to buy substitute goods in the market). a. Works of art, antiques and custom-made goods are considered unique. iii. Service Contracts: Specific performance is not available in service contracts, but injunctive relief may be. a. Ex: Bar/Bri cannot get specific performance to compel prof to lecture, but can get an injunction to prevent him from lecturing for competitor. 2. Unpaid Sellers Right to Reclaim Goods (Article 2) a. General Rule: Not available under Article 2. b. Exception: If buyer was insolvent when it received the goods AND seller makes a demand within 10 days after buyer received the goods, seller may reclaim goods from buyer but cannot reclaim goods from a third party that buyer already sold the goods to. i. The clock starts to run when buyer received the goods, not when K was made. 3. Entrustment (Article 2): a. An owner who entrusts her goods to a merchant who deals in goods of the kind (i.e., a dealer) has no rights against a bona fide purchaser (BFP) of the goods. i. Theory: The owner assumed the risk when took the goods to a dealer to be repaired. Only cause of action is against the dealer for conversion. b. The fact pattern for entrustment on bar exam is always the same owner takes jewelry or car to be repaired by merchant who sells that particular kind of good. 4. Right to Request Assurance in a Sale of Goods (Article 2): a. A party with reasonable grounds for insecurity may request in writing adequate assurance that the other party will perform in accord with the contract.

15

i. However, an insecure party cannot use this provision to rewrite the contract or to demand a particular kind of assurance. What is adequate depends on the facts and circumstances of the case. a. Ex: Sale on credit. S learns the B is missing payments to other suppliers. S cannot demand that B pay cash. S can request assurance of quality of products to be delivered under contract. b. If the seller does not provide adequate assurances to the buyer, then the buyer can treat this failure as an anticipatory repudiation and can stop performance under the contract and sue for breach. B. Monetary Remedies (Damages) (most common contract remedy) 1. Punitive Damages: Not awarded for breach of contract b/c the purpose of contract damages is to compensate, not punish. a. Exam Tip: Dont think of good guys or bad guys in contract law. 2. Liquidated Damages: Upheld if damages were difficult to estimate and are a reasonable forecast of probable damages, but L/D cannot operate as a penalty. a. Look for liquidated damages clauses that provide a flexible, graduated per diem structure (such as $100/day). Common in construction contracts. i. A lump sum liquidated damages clauses are probably not valid. b. If L/D clause is struck down, injured party still gets actual damages. c. NY Distinction: In a real estate contract, seller is entitled to keep down payment if the buyer backs out of the deal. 3. Expectation Damages: Put an injured party in as good as a position as full performance to insure that the injured party gets the benefit of the bargain a. This is the GENERAL RULE. b. Common Law Damages: i. The injured party is entitled to the difference between the contract prices if the contracting party breaches before performance has started and they need to find someone else to do the work. ii. If performance has started, the injured party may also recover reliance damages, which is the money that they already incurred to perform (such as buying paint, etc.) and their expected profit. c. Sale of Goods Damages (Article 2): Expectation i. Buyers Damages (3 options!): a. Cover Damages: cover price MINUS contract price if buyer covers in good faith [usual measure] 1. It is okay that the buyer paid more than the original contract price as long as the buyer uses good faith in finding a substitute. b. Market Damages: market price MINUS contract price if the buyer doesnt cover in good faith OR doesnt cover at all 1. The buyer cannot get better goods; they must get comparable goods. 2. It is okay if the buyer does not buy replacement goods at all; they will still recover the market price minus the contract price c. Loss in Value: value as promised MINUS value delivered if the buyer keeps non-conforming goods

16

1. The fact that the buyer made a good deal to get an expensive rug for cheap does not mean that the buyer gets less money if the good turns out to not be as valuable (can even make a profit!) ii. Sellers Damages (4 options!): a. Resale Damages: contract price MINUS resale price if the seller resells in good faith [usual measure] 1. However, the seller is not entitled to profit. The max that they can get is the original contract price. b. Market Damages: contract price MINUS market price if seller does not resell in good faith OR does not resell at all. 1. The seller does not have to resell the car to get market damages. c. Lost Profit: If the seller is a lost volume dealer who sells cars out of its regular inventory 1. The seller may not get any resale damages, but may get damages for lost profits on the original contract b/c if that contract had been performed they would have made 2 profits instead of the 1 actually made b/c of the resale. i. This is the typical situation on the MBE A dealer resells the same goods for the same price. The dealer does not get $0 damages, but gets the profit that they would have made on the initial sale! d. Contract Price: If the seller cant resell the goods. 1. Ex: Custom made goods 2. Here, the buyer must pay the full contract price, even if he breaches, and gets to keep the goods (even if didnt want them). 4. Incidental Damages: a. Cost of transporting/caring for goods AFTER breach and arranging a substitute transaction. i. Examples: storage costs; advertising costs. b. Available to both buyer and seller. 5. Consequential Damages: a. Damages that are special to this plaintiff AND were reasonably foreseeable to the breaching party at the time of the contract. i. Not available to the seller under Article 2. ii. The seller must have knowledge of the possible damage to the P in the case of a breach or delay of the contracts performance. a. Ex: Miller contracts with UPS to ship a broken mill shaft back to manufacturer. UPS delays in shipment. Miller does not have another shaft. Miller cannot recover for the $20K loss in profit that resulted form them having to shut down the mill for 9 extra days b/c UPS did not know that the shipment contained Millers only shaft. 6. Avoidable Damages: a. An injured party cannot recover damages he could have avoided (mitigated) with reasonable effort. b. Ex: Employee fired. She makes $900/week. Her former employer alleges that she can get a comparable job paying $800/week. Assuming that statement is true, her damages would be $100/week even if she doesnt take the comparable job.

17

IX. Third-Party Problems A. Third Party Beneficiaries 1. Definition: Two people enter a contract intending to benefit a third party. 2. Vocabulary: a. Third Party Beneficiary (TPB): A person who is not a party to the contract, but has rights under the contract because it was intended to benefit him. i. These rights vest once he learns of the contract AND relies ON IT. b. Promisor: The party who promises to perform for the TPB c. Promisee: The party who secures the promise. d. Intended Beneficiary: The person the contracting parties intend to benefit (usually named in contract). An incidental beneficiary just happens to benefit from the contract. Only an intended beneficiary has legal rights. e. Donee Beneficiary: A TPB who receives a gift of performance from the promisee is a donee beneficiary (typical). i. If the promisee owes a debt to TPB, the TPB is a creditor beneficiary (rare). 3. Rescission and Modification a. General Rule: The promisor and promisee can rescind or modify the contract until the rights of the TPB have vested. b. Exception: Contrary language in the contract controls. i. Ex: If the contract lets the promisee change beneficiaries, then the contract controls and the promisee can change beneficiaries at any time, even after the TPBs rights have vested. 4. Rights of a Third-Party Beneficiary a. Against the Promisor i. An intended beneficiary can sue the promisor even though there is no privity of contract between them. ii. However, if the promisee cannot recover from the promisor because the promisee committed a material breach, the intended beneficiary cannot recover either. b. Against the Promisee i. The intended beneficiary can only recover damages from the promisee if he was a creditor beneficiary. Otherwise, the intended beneficiary has no rights against the promisee b/c promisee was just making him a gift of performance. 5. Rights of the Promisee Against the Promisor a. The promisee can recover damages from the promisor for a breach of contract just as he could for any other contract, even if the intended beneficiary is a donee beneficiary (though damages would be small in this case). B. Delegation of Duties 1. General Rule: Contractual duties may be delegated without the consent of the person to whom performance is owed (the obligee). 2. Exceptions (2 of these!): a. Contract Language Controls i. If the contract expressly prohibits delegation, then duty cannot be delegated. ii. If the contract prohibits assignment, then the duty still cannot be delegated because no assignment = no delegation. b. Special Skill or Reputation

18

i. If performance of the duties involve a special skill or reputation, they cannot be delegated, even if the person delegating believes that the other person is comparable. ii. Ex: Letterman cannot delegate his duties to host the 2010 Academy Awards to Robin William even if Robin is funnier, better known, etc. 3. Rights of the Obligee a. Against the Delegating Party i. The delegating party remains liable on the contract to the obligee. a. This is different from a novation, excuses the original party and lets off the hook on the contract to the obligee. b. Against the Delegate i. The obligee can only sue the delegate on the contract if the delegate got consideration from the delegating party for completing the task. If he did, then he becomes liable on the contract. C. Assignment of Rights 1. Definition: Two people make a contract. Later, one (assignor) transfers his rights to a third party (assignee). The party who owes the duty is the obligor. a. An assignment of rights transfers only rights [usual case]. An assignment of an entire contract transfers both rights and obligations. 2. Triggering Fact: In an assignment, 2 parties enter a contract and a third party (the assignee) appears later on. a. To contrast, in 3d party beneficiary situation, all 3 parties are present from outset. 3. Requirements: a. You must have language of present assignment for an assignment to be valid: I assign OR I hereby assign b. Gift assignments are valid. However, a lack of consideration will affect revocability. i. NY Distinction: A gift assignment is irrevocable if in writing and signed by the assignor. 4. Restrictions on Assignment: a. Contract Language Controls! i. Key: Distinguish between clauses that prohibits assignment form one that completely invalidates assignment. a. If the clause prohibits assignment, then the assignor will be liable to obligor for breach of contract, but the assignment itself is valid. b. If the clause completely invalidates assignment (i.e., all assignments under this contract are void), then the assignment is not effective at all. b. The assignment cannot substantially change the duties of the obligor. i. One can always assign the right to payment b/c its just as easy to write a check to one party as it is to write it to another. a. Ex: Batman can assign his right to payment to Robin. ii. The obligor cannot assign the assignors services to another location b/c that would substantially change the assignors duties. a. Ex: GC cannot assign its right to Batmans services to Metropolis. iii. Requirements contracts are assignable as long as the assignees requirements are not out of line with the assignors.

19

a. Ex: GC can assign its contract to buy all of its kryptonite needs for 2010 from a particular distributor to Metropolis. 5. Assignees Rights Against the Obligor a. An assignee can sue the obligor if he is not paid for the assignors work. i. This is precisely what an assignment is designed to do. b. However, if the assignor fails to perform the services, the assignee cannot collect form the obligor. i. The assignee steps into the assignors shoes and only has the rights that the assignor would have had. c. If the obligor was unaware of the assignment, payment to the assignor is permissible and the obligor is not liable to the assignee. i. Ex: GC did not know about Batman-Robin assignment so makes June payment to Batman. GC is not liable to Robin. 6. Multiple Assignments a. Gratuitous (Gift) Assignments: i. Gift assignments are fragile very easy to revoke. ii. The last gratuitous assignee in time prevails over earlier gratuitous assignees b/c a later gift assignment revokes an earlier ones. b. Assignments for Consideration: i. General Rule: The first assignee for consideration prevails over all subsequent assignees because an assignment for consideration is much more durable than a gratuitous assignment. ii. Exception: A later assignee for consideration prevails IF he does not know of the earlier assignments AND is the first to get payment from or a judgment against the obligor. a. Must have BOTH requirements. Being the first to notify the obligor is not enough; must also be first to receive payment or judgment from obligor. b. NY Distinction: The assignment of a construction contract or money due thereunder is not valid until filed. Thus, a subsequent assignee in good faith, who filed first, prevails over a party who failed to file. c. Bar Exam Tip: If you encounter multiple assignments in a question, you should analyze each assignment in the order it was made to see if that particular assignment was valid.

20

Você também pode gostar

- Jason Contracts OutlineDocumento26 páginasJason Contracts Outlinethekaybomb100% (1)

- Contracts Outline: 3 Months. After Firmness (Irrevocability) Expires, Offer BecomesDocumento12 páginasContracts Outline: 3 Months. After Firmness (Irrevocability) Expires, Offer BecomesAVAinda não há avaliações

- Bar Essays Contracts Short Review Outline PDFDocumento7 páginasBar Essays Contracts Short Review Outline PDFno contractAinda não há avaliações

- Contracts and SalesDocumento26 páginasContracts and SalesSean Williams100% (1)

- Contracts Outline - CO - Kaal - Spring 2010Documento9 páginasContracts Outline - CO - Kaal - Spring 2010Chris OdomAinda não há avaliações

- Contracts FULL Outline For MBEDocumento12 páginasContracts FULL Outline For MBEMegan KelbermanAinda não há avaliações

- Contracts 1 & 2 OutlineDocumento13 páginasContracts 1 & 2 OutlineYa YAAinda não há avaliações

- CA Bar: Contracts (2009)Documento20 páginasCA Bar: Contracts (2009)The LawbraryAinda não há avaliações

- Contract OutlineDocumento17 páginasContract Outlineaasquared1Ainda não há avaliações

- Contracts Outline KarDocumento22 páginasContracts Outline KarchenyijingAinda não há avaliações

- CDocumento11 páginasCAlexAinda não há avaliações

- Contracts OutlineDocumento12 páginasContracts OutlineFernanda Rodriguez TorresAinda não há avaliações

- Contracts OutlineDocumento12 páginasContracts Outlineericachavez83% (18)

- Contracts Outline Fall 2005: Is There An Agreement For A Promise?Documento38 páginasContracts Outline Fall 2005: Is There An Agreement For A Promise?leed2727Ainda não há avaliações

- Contracts and Sales - Final Review OutlineDocumento66 páginasContracts and Sales - Final Review OutlineAlyssaAinda não há avaliações

- Master Contracts OutlineDocumento13 páginasMaster Contracts OutlineJustin RoxasAinda não há avaliações

- Hand Out ContratosDocumento7 páginasHand Out ContratosjorgeAinda não há avaliações

- Exam Tip 2Documento40 páginasExam Tip 2nicole100% (1)

- Emanuel OutlineDocumento15 páginasEmanuel OutlineThomas DuffyAinda não há avaliações

- Bar Exam Outlines ContractsDocumento17 páginasBar Exam Outlines Contractsklm103Ainda não há avaliações

- Contracts Essay OutlineDocumento11 páginasContracts Essay Outlineisgigles157100% (14)

- Contracts OutlineDocumento29 páginasContracts OutlineJoeDellera75% (4)

- Contracts Master Essay OutlineDocumento9 páginasContracts Master Essay Outlinekutekath27100% (5)

- Business Law Chap. TwoDocumento74 páginasBusiness Law Chap. TwoSamiya MaxamuudAinda não há avaliações

- Contracts: Kabil Developments Corp. v. Mignot (Helicopters Promised)Documento62 páginasContracts: Kabil Developments Corp. v. Mignot (Helicopters Promised)Orlando Aaron VelasquezAinda não há avaliações

- Contract NotesDocumento17 páginasContract NotesNazz BossladyAinda não há avaliações

- Chapter 02 Contract Act 1872 1229869798371959 1Documento7 páginasChapter 02 Contract Act 1872 1229869798371959 1Hari Krishnan AvAinda não há avaliações

- Are Contracts: Contracts I. What Is A Contract? Is There An Agreement?Documento38 páginasAre Contracts: Contracts I. What Is A Contract? Is There An Agreement?JoeDelleraAinda não há avaliações

- Lopez Contracts OutlineDocumento65 páginasLopez Contracts Outlinewil lopezAinda não há avaliações

- Contracts I - Wilmarth - Fall 2001-1-3Documento31 páginasContracts I - Wilmarth - Fall 2001-1-3champion_egy325Ainda não há avaliações

- Formation of A ContractDocumento30 páginasFormation of A ContractMayi PennylAinda não há avaliações

- ACCA F4 MALAYSIA Variant Contract ActDocumento22 páginasACCA F4 MALAYSIA Variant Contract Actjacinta_chongAinda não há avaliações

- Bar Prep - Outline - Contracts - ShortDocumento13 páginasBar Prep - Outline - Contracts - ShortAnonymous Cbr8Vr2SX100% (1)

- Contracts Final OutlineDocumento19 páginasContracts Final OutlineCatherine Merrill100% (1)

- Applicable Law? Formation: I. Agreement RequirementDocumento32 páginasApplicable Law? Formation: I. Agreement RequirementeccegeorgeAinda não há avaliações

- Explain Contract Act, 1872 and State The Essentials To A ContractDocumento29 páginasExplain Contract Act, 1872 and State The Essentials To A ContractPRINCESS PlayZAinda não há avaliações

- Contracts Full OutlineDocumento25 páginasContracts Full OutlineAnnie Weikel YiAinda não há avaliações

- Contracts II Final OutlineDocumento24 páginasContracts II Final Outlinepmariano_5Ainda não há avaliações

- Business Law CH#2 Offer and AcceptanceDocumento4 páginasBusiness Law CH#2 Offer and Acceptancegonkillua430Ainda não há avaliações

- Law of ContractDocumento8 páginasLaw of ContractShadman Sakib Fahim 1831736030Ainda não há avaliações

- Contracts Duke Spring 2005 SalzmanDocumento24 páginasContracts Duke Spring 2005 Salzmantinytim123Ainda não há avaliações

- Contract Law (1) Notes For LLB - HonsDocumento22 páginasContract Law (1) Notes For LLB - HonsemanAinda não há avaliações

- Contract in Class Notes Week 11Documento11 páginasContract in Class Notes Week 11georger717Ainda não há avaliações

- Essential Elements of A Valid ContractDocumento13 páginasEssential Elements of A Valid ContractCarol MemsAinda não há avaliações

- Offer - Case NotesDocumento7 páginasOffer - Case NotesSania LopesAinda não há avaliações

- Contract Remedies-Mid TermDocumento11 páginasContract Remedies-Mid TermtragicallyohioAinda não há avaliações

- Barbri - UCCDocumento16 páginasBarbri - UCCsfaris07Ainda não há avaliações

- A Contract For The Sale of Goods May Be Made in Any Manner Sufficient To Show Agreement.Documento20 páginasA Contract For The Sale of Goods May Be Made in Any Manner Sufficient To Show Agreement.Stacy OliveiraAinda não há avaliações

- Contracts Approach and Mini OutlineDocumento12 páginasContracts Approach and Mini Outlinechristensen_a_gAinda não há avaliações

- Contracts - Ucc - Full Year - Professor McketrickDocumento23 páginasContracts - Ucc - Full Year - Professor McketricktravisbortzAinda não há avaliações

- CH 12 (3) - Contracts and Sales - Introduction and FormationDocumento8 páginasCH 12 (3) - Contracts and Sales - Introduction and FormationMaria ForkAinda não há avaliações

- Intro To Contract Law: 1. What Is A Contract?Documento24 páginasIntro To Contract Law: 1. What Is A Contract?misterbabyAinda não há avaliações

- Contract Law OutlineDocumento17 páginasContract Law OutlineErin Kitchens Wong100% (1)

- Contracts Essay OutlineDocumento12 páginasContracts Essay OutlineGeneTeam100% (6)

- Contract Essay OutlineDocumento11 páginasContract Essay OutlineKevin100% (4)

- Contracts Outline General IntroductionDocumento12 páginasContracts Outline General IntroductionCheck MateAinda não há avaliações

- Cape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyNo EverandCape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyAinda não há avaliações

- 2022 HO 12 - Civil Law - PropertyDocumento12 páginas2022 HO 12 - Civil Law - PropertyMichael James Madrid MalinginAinda não há avaliações

- Vigilantism AffirmativeDocumento8 páginasVigilantism AffirmativejzofferAinda não há avaliações

- LEGAL FORMS - Class Compilation (LLB3 630-830)Documento290 páginasLEGAL FORMS - Class Compilation (LLB3 630-830)Ja CinthAinda não há avaliações

- Material On Law of Evidence: Unit-Ii By-Ghalib Nashter B.A.LL.B (Hons) - VI SemesterDocumento15 páginasMaterial On Law of Evidence: Unit-Ii By-Ghalib Nashter B.A.LL.B (Hons) - VI SemesterMithunAinda não há avaliações

- DPWH Complaint 2021 - Final V2Documento3 páginasDPWH Complaint 2021 - Final V2ZENA TriniAinda não há avaliações

- Filipino Grievances Against Governor WoodDocumento16 páginasFilipino Grievances Against Governor WoodShiraishi80% (5)

- Traders Royal Bank V Cuison Lumber Co PDFDocumento5 páginasTraders Royal Bank V Cuison Lumber Co PDFMonica Soria0% (1)

- Dy Vs People, GR 189081, (Aug. 10, 2016)Documento4 páginasDy Vs People, GR 189081, (Aug. 10, 2016)Lu CasAinda não há avaliações

- Womens Legal and Human Rights BureauDocumento7 páginasWomens Legal and Human Rights Bureauabc cbaAinda não há avaliações

- 74 Ls 541Documento6 páginas74 Ls 541Manoel NascimentoAinda não há avaliações

- 18.10.2019 Gad - RT - 2323Documento2 páginas18.10.2019 Gad - RT - 2323Ravi Kundeti100% (2)

- (214335206 - 1) - Moore v. Hackensack BOE - ComplaintDocumento14 páginas(214335206 - 1) - Moore v. Hackensack BOE - ComplaintTAPinto HackensackAinda não há avaliações

- Jimenez Vs SoronganDocumento2 páginasJimenez Vs SoronganEAAinda não há avaliações

- LOG-2-6-WAREHOUSE-TEMPLATE-Warehouse Rental Contract-RCRCS PDFDocumento3 páginasLOG-2-6-WAREHOUSE-TEMPLATE-Warehouse Rental Contract-RCRCS PDFG Vishwanath ReddyAinda não há avaliações

- Reviewer in Credit Transactions-CompleteDocumento61 páginasReviewer in Credit Transactions-CompleteDiane Althea Valera Pena91% (11)

- Liga AOM CollectionsDocumento6 páginasLiga AOM CollectionsJonson PalmaresAinda não há avaliações

- Notes For CivicsDocumento2 páginasNotes For CivicsHannah LougheedAinda não há avaliações

- Rules of Court 139BDocumento3 páginasRules of Court 139BScrib LawAinda não há avaliações

- DoD Hemp MemoDocumento2 páginasDoD Hemp MemoMarijuana MomentAinda não há avaliações

- BBA IInd Year Company LawDocumento75 páginasBBA IInd Year Company LawKanishk GoyalAinda não há avaliações

- AttyDeVera Syllabus 2019Documento6 páginasAttyDeVera Syllabus 2019Raffy MarianoAinda não há avaliações

- Najera V NajeraDocumento3 páginasNajera V NajeraMaya TolentinoAinda não há avaliações

- City of Taguig v. City of Makati March 8 2017Documento3 páginasCity of Taguig v. City of Makati March 8 2017Gela Bea BarriosAinda não há avaliações

- BLACKBURN BOBBIN COMPANY, LIMITED v. T. W. ADocumento4 páginasBLACKBURN BOBBIN COMPANY, LIMITED v. T. W. AAbel KiraboAinda não há avaliações

- O'Neal v. Thompson, 10th Cir. (2002)Documento9 páginasO'Neal v. Thompson, 10th Cir. (2002)Scribd Government DocsAinda não há avaliações

- Allenbaugh ComplaintDocumento4 páginasAllenbaugh ComplaintEricAinda não há avaliações

- Cruz Consti FullDocumento504 páginasCruz Consti FullCMLAinda não há avaliações

- Delivery Booking Order Template in Excel Format1Documento6 páginasDelivery Booking Order Template in Excel Format1Leydi Grandez RíosAinda não há avaliações

- BSNL Cda Rules 2006 PDFDocumento63 páginasBSNL Cda Rules 2006 PDFSitikantha JenaAinda não há avaliações

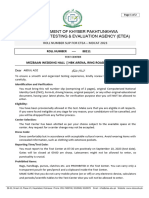

- WrittenTestRollNumberSlip AspxDocumento2 páginasWrittenTestRollNumberSlip AspxAbdul Aziz AfridiAinda não há avaliações