Escolar Documentos

Profissional Documentos

Cultura Documentos

Ib

Enviado por

Jyotsna WadhwaDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ib

Enviado por

Jyotsna WadhwaDireitos autorais:

Formatos disponíveis

INTRO Latvia: Latvija), officially the Republic of Latvia (Latvian: Latvijas Republika), is a country in the Baltic region of Northern

Europe. It is bordered to the north by Estonia (border length 343 km), to the south by Lithuania (588 km), to the east by the Russian Federation (276 km), and to the southeast by Belarus (141 km). Across the Baltic Sea to the west lies Sweden. The territory of Latvia covers 64,589 km2 (24,938 sq mi) and it has temperate. Located on the eastern shore of the Baltic Sea, Latvia lies on the East European Plain. However, its vegetation is much different than the rest of the plain and shares many similarities with the boreal biome. It consists of fertile, low-lying plains, largely covered by forest, mostly pines, the highest point being the

ECONOMY OF LATVIA Latvia is a member of the World Trade Organization (1999) and the European Union (2004). Since the year 2000 Latvia has had one of the highest (GDP) growth rates in Europe However, the chiefly consumption-driven growth in Latvia resulted in the collapse of the Latvian GDP in late 2008 and early 2009, exacerbated by the global economic crisis and shortage of credit. Latvian economy fell 18% in the first three months of 2009, the biggest fall in the European Union. According to Eurostat data, Latvian PPS GDP per capita stood at 56 per cent of the EU average in 2008.

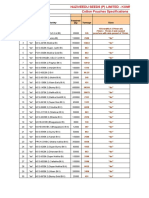

TRADE

Latest scenario has proven the earlier assumptions that the fast growing economy was heading for implosion of the economic, because it was driven mainly by growth of domestic consumption, financed by a serious increase of private debt, as well as a negative foreign trade balance. The prices of real estate, which were at some points appreciating at approximately 5% a month, were long perceived to be too high for the economy, which mainly produces low-value goods and raw materials. Latvia plans to introduce the Euro as the country's currency but, due to the inflation being above EMU's guidelines, the government's official target is

now January 1, 2012. However in October 2007, with inflation above 11%, the head of the National Bank of Latvia suggested that 2013 may be a more realistic date. Privatization in Latvia is almost complete. Virtually all of the previously state-owned small and medium companies have been successfully privatized, leaving only a small number of politically sensitive large state companies. Latvian privatization efforts have led to the development of a dynamic and prosperous private sector, which accounted for nearly 68% of GDP in 2000. Foreign investment in Latvia is still modest compared with the levels in north-central Europe. A law expanding the scope for selling land, including to foreigners, was passed in 1997. Representing 10.2% of Latvia's total foreign direct investment, American companies invested $127 million in 1999. In the same year, the United States exported $58.2 million of goods and services to Latvia and imported $87.9 million. Eager to join Western economic institutions like the World Trade Organization, OECD, and the European Union, Latvia signed a Europe Agreement with the EU in 1995with a 4-year transition period. Latvia and the United States have signed treaties on investment, trade, and intellectual property protection and avoidance of double taxation.

Market Challenges

There are few market challenges in Latvia. However, due to the country's small size, if a company is considering doing business only in Latvia, local labeling requirements could prove costly relative to the potential customer base. Many companies focus on Latvia as a part of the broader EU market. Because the market is small, it is sometimes quickly saturated, and it can be difficult to keep business secrets. American products face strong competition in the Latvian market from EU countries and the Commonwealth of Independent States (CIS). Due to historical trade relations, companies from Scandinavian countries and Germany approach the Latvian market with greater confidence. Government bureaucracy and corruption are seen by the U.S. government as the main impediments to

U.S. trade and investment in Latvia. Some concerns exist regarding the protection of intellectual property, but recent legislative changes promise to give law enforcement additional tools to address these issues.

Market Opportunities

The Latvian economy is based on service industries including transportation, information technology, and financial services. At the same time the construction industry plays an important role, as do wood and forestry products, food processing, metalworking, and light industries (e.g., textiles). Tourism is growing rapidly. Latvia has a flat corporate income tax rate of 15%. The country is well connected by approximately 80 direct flights to all major European cities as well as a weekly direct flight to New York and by plenty of connecting flights. From 2007-2013 the Latvian Government will administer approximately $6.6 billion of EU structural funds. Available incentives for investment are: grants for high tech high value added and large scale investments; grants for training of employees; grants for development of new products and technologies; special depreciation rates for new equipment purchased. At the same time Latvia has generous allowances for write-offs of investments in technological equipment. On January 1, 2011, the Latvian government implemented corporate income tax allowances for large investments of 5 million lats (approximately 10 million USD) or more. Tax allowances will be available to tax payers that have invested in supported priority sectors and the size of the allowance volume will depend on the volume of the investments. The European Bank for Reconstruction and Development (EBRD) operates in Latvia out of its regional office in Vilnius, Lithuania. Latvia qualifies for U.S. Export Import Bank (ExIm)-financed projects. Good opportunities exist for expanding trade exist in various sectors, including energy; computer and telecommunications services and equipment; forestry, farming and woodworking equipment; transportation (including aircraft); and agricultural products. Latvias increased competitiveness, spurred by its handling of the financial crisis, has increased potential for investments in both the manufacturing and services sectors.

Market Entry Strategy

Market entry strategy varies from industry to industry and should be considered in the context of the U.S. companys overall approach toward the EU. Business agents are commonly used. Businesses, and especially small and medium-sized enterprises (SMEs), wishing to enter the market should contact the Embassy for guidance and may wish to consider a visit to Latvia. Import Tariffs

Latvian Integrated Tariff Management System: http://itvs.vid.gov.lv/itms/ There are no specific import tariffs for US goods set by Latvia. All import policy and tariffs are under the mandate of the EU. Customs duties are payable in the country of entry in the EU, where imported goods are cleared for intra-community circulation.

Prohibited and Restricted Imports

The Integrated Tariff of the European Communities (TARIC) is designed to show various rules applying to specific products being imported into the customs territory of the EU or, in some cases, when exported from it. To determine if a product is prohibited or subject to restriction, check the TARIC for that product for the following codes: CITES Convention on International Trade of Endangered Species PROHI Import Suspension RSTR Import Restriction

Foreign-Trade Zones/Free Ports

There are four free trade areas in Latvia: free ports are established in the Riga and Ventspils ports, and special economic zones (SEZ) are created in Liepaja, a port city in western Latvia, and Rezekne, the center of an eastern Latvian region which borders Russia. The IMF objects to free trade zones on the grounds that they distort competition and create tax collection problems. Somewhat different rules apply to each of the four zones. In general, the two free ports provide for exemptions from indirect taxes, including customs duties, VAT and excise tax. The SEZs offer additional incentives, such as 80-100 percent reduction of corporate income taxes and real estate taxes. To qualify for tax relief and other benefits, companies must receive permits and sign agreements with the appropriate authorities: the Riga and the Ventspils Port Authorities, for the relevant free port; the Liepaja SEZ Administration; or the Rezekne SEZ Administration

LATVIA Economy Globalization: 76.14 100 Gross domestic product: 29700 (PPP) per capita: 13,000 USD World 9,300 Currency LVL (ISO= LVL) Population: 2,274,735 Unemployment: 8.80% Km2= 64,589.00 LATVIA Doing Business Economy - Freedom = 66,6 Business= 73,8 trade= 85,8 Government 58,5 Currency= 71,1 Investment= 70 Finance= 60 Copyright= 55 Corruption= 48 Labor= 61,6 100 Best Corruption= 5 10 Transparency

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Student Management System - Full DocumentDocumento46 páginasStudent Management System - Full DocumentI NoAinda não há avaliações

- What Can Tesla Learn From Better Place's FailureDocumento54 páginasWhat Can Tesla Learn From Better Place's Failuremail2jose_alex4293Ainda não há avaliações

- List of Notified Bodies Under Directive - 93-42 EEC Medical DevicesDocumento332 páginasList of Notified Bodies Under Directive - 93-42 EEC Medical DevicesJamal MohamedAinda não há avaliações

- Julian BanzonDocumento10 páginasJulian BanzonEhra Madriaga100% (1)

- Referensi PUR - Urethane Surface coating-BlockedISO (Baxenden) - 20160802 PDFDocumento6 páginasReferensi PUR - Urethane Surface coating-BlockedISO (Baxenden) - 20160802 PDFFahmi Januar AnugrahAinda não há avaliações

- Internship Report On A Study of The Masterbranding of Dove: Urmee Rahman SilveeDocumento45 páginasInternship Report On A Study of The Masterbranding of Dove: Urmee Rahman SilveeVIRAL DOSHIAinda não há avaliações

- Lunch Hour Meetings: Kiwanis Mission:: - Officers & Directors, 2018-2019Documento2 páginasLunch Hour Meetings: Kiwanis Mission:: - Officers & Directors, 2018-2019Kiwanis Club of WaycrossAinda não há avaliações

- Analysis of Pipe FlowDocumento14 páginasAnalysis of Pipe FlowRizwan FaridAinda não há avaliações

- Baixar Livro Draw With Jazza Creating Characters de Josiah Broo PDFDocumento5 páginasBaixar Livro Draw With Jazza Creating Characters de Josiah Broo PDFCarlos Mendoza25% (4)

- 2U6 S4HANA1909 Set-Up EN XXDocumento10 páginas2U6 S4HANA1909 Set-Up EN XXGerson Antonio MocelimAinda não há avaliações

- Judicial Review of Legislative ActionDocumento14 páginasJudicial Review of Legislative ActionAnushka SinghAinda não há avaliações

- Not Just Another Winter Festival: Rabbi Reuven BrandDocumento4 páginasNot Just Another Winter Festival: Rabbi Reuven Brandoutdash2Ainda não há avaliações

- Knowledge, Attitude and Practice of Non-Allied Health Sciences Students of Southwestern University Phinma During The Covid-19 PandemicDocumento81 páginasKnowledge, Attitude and Practice of Non-Allied Health Sciences Students of Southwestern University Phinma During The Covid-19 Pandemicgeorgemayhew1030Ainda não há avaliações

- PDF - Unpacking LRC and LIC Calculations For PC InsurersDocumento14 páginasPDF - Unpacking LRC and LIC Calculations For PC Insurersnod32_1206Ainda não há avaliações

- G.R. No. 186450Documento6 páginasG.R. No. 186450Jose Gonzalo SaldajenoAinda não há avaliações

- College PrepDocumento2 páginasCollege Prepapi-322377992Ainda não há avaliações

- Filipino Chicken Cordon BleuDocumento7 páginasFilipino Chicken Cordon BleuHazel Castro Valentin-VillamorAinda não há avaliações

- Statement 876xxxx299 19052022 113832Documento2 páginasStatement 876xxxx299 19052022 113832vndurgararao angatiAinda não há avaliações

- Solution Document For Link LoadBalancerDocumento10 páginasSolution Document For Link LoadBalanceraralAinda não há avaliações

- Seven Seas of CommunicationDocumento2 páginasSeven Seas of Communicationraaaj500501Ainda não há avaliações

- Robot 190 & 1110 Op - ManualsDocumento112 páginasRobot 190 & 1110 Op - ManualsSergeyAinda não há avaliações

- Bimetallic ZN and HF On Silica Catalysts For The Conversion of Ethanol To 1,3-ButadieneDocumento10 páginasBimetallic ZN and HF On Silica Catalysts For The Conversion of Ethanol To 1,3-ButadieneTalitha AdhyaksantiAinda não há avaliações

- Problem Based LearningDocumento23 páginasProblem Based Learningapi-645777752Ainda não há avaliações

- Did Angels Have WingsDocumento14 páginasDid Angels Have WingsArnaldo Esteves HofileñaAinda não há avaliações

- WIKADocumento10 páginasWIKAPatnubay B TiamsonAinda não há avaliações

- Latvian Adjectives+Documento6 páginasLatvian Adjectives+sherin PeckalAinda não há avaliações

- 1907 EMarketer GEN XDocumento16 páginas1907 EMarketer GEN XRodolfo CampaAinda não há avaliações

- Sycip v. CA (Sufficient Funds With The Drawee Bank)Documento15 páginasSycip v. CA (Sufficient Funds With The Drawee Bank)Arnold BagalanteAinda não há avaliações

- Cotton Pouches SpecificationsDocumento2 páginasCotton Pouches SpecificationspunnareddytAinda não há avaliações

- Quizo Yupanqui StoryDocumento8 páginasQuizo Yupanqui StoryrickfrombrooklynAinda não há avaliações