Escolar Documentos

Profissional Documentos

Cultura Documentos

Yes Bank: Performance Highlights

Enviado por

Angel BrokingDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Yes Bank: Performance Highlights

Enviado por

Angel BrokingDireitos autorais:

Formatos disponíveis

3QFY2012 Result Update | Banking

January 27, 2012

Yes Bank

Performance Highlights

Particulars (` cr) NII Pre-prov. profit PAT 3QFY12 428 399 254 2QFY12 386 386 235 % chg (qoq) 10.9 3.3 8.1 3QFY11 323 311 191 % chg (yoy) 32.3 28.1 32.9

ACCUMULATE

CMP Target Price Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Banking 11,482 1.4 341/231 3,28,788 10 17,234 5,092 YESB.BO YES@IN

`326 `367 12 Months

Source: Company, Angel Research

For 3QFY2012, Yes Bank reported a strong performance. Net profit grew by 32.9% yoy (8.1% qoq) to `254cr, above our estimate of `234cr. Profit growth was driven by healthy growth in operating income and lower-than-expected provisioning expenses. The robust traction in saving account deposits and maintenance of healthy asset quality profile were the key positive takeaways from the results. We maintain our Accumulate rating on the stock. Business growth picks up a bit, CASA traction strong and stable asset quality: The banks business growth picked up a bit during the quarter as compared to 2QFY2012. Advances grew by 15.3% yoy (4.9% qoq) and deposits grew by a rather healthy 19.5% yoy (6.5% qoq). CASA deposits accretion was robust at 22.2% qoq and 46.5% yoy. The bank had aggressively hiked the saving account interest rates immediately post the de-regulation which helped the bank in strengthening the weak link in its liability franchise. Saving account deposits growth was a robust 40% qoq and almost 100% on a yoy basis, consequently the CASA ratio improved by a substantial 162bp qoq to 12.6%. Reported NIM declined albeit by a marginal 10bp to 2.8%. The rise in cost of funds (30bp qoq) was only partly compensated by the 20bp qoq rise in yield on advances. The bank maintained its strong asset quality profile during the quarter as well, with gross NPA ratio declining by 10bp qoq to 0.2% and the net NPA ratio remaining stable sequentially at a marginal 0.04%. Provision coverage ratio (excluding technical write-offs) also remained stable sequentially at 80%.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 26.3 9.7 50.7 13.4

Abs. (%) Sensex Yes Bank

3m (0.3) 5.8

1yr (7.8) 22.9

3yr 91.4 457.7

Outlook and valuation: Yes Banks growth premium has reduced over time due

to execution challenges (now trading at 2.0x due to cyclical slowdown vs. five-year median of 2.5x). However, taking the challenges of building a retail deposit base head-on, the bank has more than doubled its branch network over the past 18 months to 331 branches and aggressively increased savings rate to 7% as a customer acquisition strategy. While it has fallen short of its retail expansion goals in the past and challenges remain significant, valuations at 2.0x FY2013E ABV in our view provide a reasonable upside from current levels. Hence, we maintain

our Accumulate recommendation on the stock with a target price of `367.

Key financials

Y/E March (` cr) NII % chg Net profit % chg NIM (%) EPS (`) P/E (x) P/ABV (x) RoA (%) RoE (%)

Source: Company, Angel Research

FY2010 788 54.1 478 57.2 2.8 14.1 23.2 3.6 1.6 20.3

FY2011 1,247 58.2 727 52.2 2.7 20.9 15.6 3.0 1.5 21.1

FY2012E 1,621 30.0 973 33.7 2.6 28.0 11.6 2.4 1.5 23.0

FY2013E 1,928 18.9 1,048 7.8 2.6 30.2 10.8 2.0 1.4 20.6

Vaibhav Agrawal

022 3935 7800 Ext: 6808 vaibhav.agrawal@angelbroking.com

Shrinivas Bhutda

022 3935 7800 Ext: 6845 shrinivas.bhutda@angelbroking.com

Varun Varma

022 3935 7800 Ext: 6847 varun.varma@angelbroking.com

Please refer to important disclosures at the end of this report

Yes Bank | 3QFY2012 Result Update

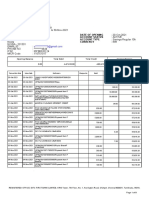

Exhibit 1: 3QFY2012 performance summary

Particulars (` cr) Interest earned - on Advances / Bills - on investments - on balance with RBI & others - on others Interest Expended Net Interest Income Other income - Financial markets - Financial advisory - Transaction banking - Retail and others Operating income Operating expenses - Employee expenses - Other Opex Pre-provision Profit Provisions & Contingencies PBT Provision for Tax PAT Effective Tax Rate (%)

Source: Company, Angel Research

3QFY12 2QFY12 % chg (qoq) 3QFY11 % chg (yoy) 1,684 1,173 506 5 1 1,256 428 211 48 81 64 19 639 240 122 118 399 22 376 122 254 32.5 1,439 1,032 398 4 5 1,053 386 214 41 98 61 14 600 214 110 104 386 38 348 113 235 32.5 17.1 13.7 27.1 17.6 (87.8) 19.3 10.9 (1.2) 17.8 (17.6) 4.9 30.8 6.6 12.4 10.7 14.1 3.3 (41.0) 8.2 8.3 8.1 4bp 1,126 818 299 7 2 803 323 162 41 54 50 17 485 174 90 83 311 25 286 95 191 33.2 49.5 43.4 69.0 (30.6) (72.2) 56.5 32.3 30.8 17.8 50.7 28.3 7.5 31.8 38.4 34.7 42.3 28.1 (10.4) 31.5 28.6 32.9 (73)bp

Exhibit 2: 3QFY2012 Actual vs. estimates

Particulars (` cr) Net interest income Other income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Company, Angel Research

Actual 428 211 639 240 399 22 376 122 254

Estimates 409 201 610 227 383 38 346 112 234

Var. (%) 4.5 5.1 4.7 5.7 4.1 (40.5) 8.9 9.1 8.8

January 27, 2012

Yes Bank | 3QFY2012 Result Update

Exhibit 3: 3QFY2012 performance analysis

Particulars Balance sheet Advances (` cr) Deposits (` cr) Credit-to-Deposit Ratio (%) CASA deposits (` cr) CASA ratio (%) CAR (%) Tier 1 CAR (%) Profitability Ratios (%) Yield on advances Cost of funds Reported NIM Cost-to-income ratio Asset quality Gross NPAs (` cr) Gross NPAs (%) Net NPAs (` cr) Net NPAs (%) Provision Coverage Ratio (%)

Source: Company, Angel Research

3QFY12 2QFY12 % chg (qoq) 3QFY11 % chg (yoy) 35,868 46,929 76.4 5,914 12.6 16.1 9.2 12.4 8.9 2.8 37.6 72 0.2 14 0.04 80.0 34,194 44,076 77.6 4,839 11.0 16.0 9.4 12.2 8.6 2.9 35.6 69 0.3 14 0.04 80.2 4.9 6.5 (115)bp 22.2 162bp 12bp (20)bp 20bp 30bp (10)bp 194bp 4.7 (10)bp 5.6 0bp (18)bp 31,112 39,453 78.9 4,037 10.2 18.2 10.4 10.0 7.1 2.8 35.8 73 0.2 17 0.1 76.1 15.3 18.9 (243)bp 46.5 237bp (212)bp (120)bp 240bp 180bp 0bp 178bp (1.1) (3)bp (17.1) (2)bp 387bp

Strong traction in CASA deposits

The banks business growth picked up a bit during the quarter as compared to 2QFY2012. Advances grew by 15.3% yoy (4.9% qoq) and deposits grew by a rather healthy 6.5% qoq (19.5% yoy). Share of loans from corporate and institutional banking increased by 2% qoq to 63% during the quarter.

Exhibit 4: Business momentum picks up a bit

3QFY11 80.0 60.0 40.0 20.0 4QFY11 1QFY12 2QFY12 3QFY12

Exhibit 5: Share of branch banking improving

Corp. and Insti. Banking Commercial Banking Branch Banking 100 10 12 12 15 15 80 22 23 24 21 24 60 40 68 65 63 61 63

66.3

54.8

26.1

12.7

79.0

71.4

44.1

10.2

15.3

18.9

20 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12

Advances yoy growth (%)

Source: Company, Angel Research

Deposits yoy growth (%)

Source: Company, Angel Research

CASA deposits accretion was robust at 22.2% qoq and 46.5% yoy. The bank had aggressively hiked the saving account interest rates immediately post the deregulation which helped the bank in strengthening the weak link in its liability franchise. Saving account deposits growth was a robust 40% qoq and almost 100% on a yoy basis. Consequently, the CASA ratio improved by a substantial 162bp qoq and 237bp yoy to 12.6%. The share of non-wholesale (CASA and

January 27, 2012

Yes Bank | 3QFY2012 Result Update

branch banking deposits) has now risen to 31% of total deposits, thereby reducing the banks dependence on higher costing bulk corporate deposits. During the quarter, the bank opened 26 branches (taking the network size to 331 branches) and recruited ~300 new employees.

Exhibit 6: CASA deposits growth picks up strongly...

(%) 105.0 81.1 70.0 68.6 49.8 35.0 19.7 46.5

Exhibit 7: ...leading to a 1.6% qoq jump in CASA ratio

(%) 14.0 12.0 10.2 10.0 8.0 6.0 10.3 10.9 11.0

12.6

3QFY11 4QFY11 1QFY12 2QFY12 3QFY12

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

Source: Company, Angel Research

Source: Company, Angel Research

NIM declines marginally on higher cost of funds

Reported NIM declined albeit by a marginal 10bp to 2.8%. The rise in cost of funds (of 30bp qoq) was only partly compensated by the 20bp qoq rise in yield on advances, leading to the decline in NIMs. The management indicated an impact of ~4-5bo on the NIM due to the hike in saving account rates post the deregulation. The bank had hiked its base rate by 25bp post the review of Monetary Policy by the RBI in October, which aided in increasing the yield on advances.

Exhibit 8: Rise in cost of deposits by 30bp qoq...

(%) 9.0 8.0 7.1 7.0 6.0 5.0 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 7.8 8.5 8.6 8.9

Exhibit 9: ...leads to a 10bp qoq decline in NIM

(%) 3.0 2.8 2.8 2.8

2.9 2.8

2.8

2.6

2.4 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12

Source: Company, Angel Research

Source: Company, Angel Research

Non-interest income growth remains strong

The banks non-interest income grew strongly by 30.8% yoy to `212cr (marginal decline of 1.2% on a sequential basis). Non-interest income stood at a healthy 1.3% (annualised) of the average total assets for 3QFY2012.

January 27, 2012

Yes Bank | 3QFY2012 Result Update

Exhibit 10: Overall fee income growth remains healthy at 30.8% yoy

Particulars (` cr) Financial markets Financial advisory Transaction banking Retail and others Other income

Source: Company, Angel Research

3QFY12 2QFY12 % chg (qoq) 3QFY11 % chg (yoy) 48 81 64 19 212 41 98 61 14 214 17.8 (17.6) 4.9 30.8 (1.2) 41 54 50 17 162 17.8 50.7 28.3 7.5 30.8

Strong asset quality

The bank maintained its strong asset quality profile during the quarter as well, with gross NPA ratio declining by 10bp qoq to 0.2% and the net NPA ratio remaining stable sequentially at a marginal 0.04%. Provision coverage ratio (excluding technical write-offs) also remained stable sequentially at 80%. Restructured advances were largely the same on a sequential basis at ~`176cr. Management indicated that the exposure to troubled carrier Kingfisher Airlines was at `62cr and the exposure was outside the consortium and has been adequately secured.

Exhibit 11: Asset quality still amongst the best in industry

Gross NPA (` cr, LHS) 100 80 60 40 20 73 17 3QFY11 81 9 56 3 69 14 2QFY12 72 14 3QFY12 76 89 80 80 Net NPA (` cr, LHS) 95 NPA coverage % (RHS) 100 90 80 70 60 50

4QFY11

1QFY12

Source: Company, Angel Research

Operating costs rise a bit on higher headcount

Cost-to-income ratio though increased by ~200bp qoq remained healthy at 37.6%. The bank recruited ~300 employees in 3QFY2012, leading to a 34.7% yoy increase in staff expenses for 3QFY2012. Going forward, the management plans to contain the cost-to-income ratio at 40%. Considering the robust branch expansion plans and continued recruitment of employees, we have factored in operating expenses to grow by 34% and 30% for FY2012 and FY2013, respectively.

January 27, 2012

Yes Bank | 3QFY2012 Result Update

Exhibit 12: Branch expansion gaining traction

350 300 250 200 150 100 50 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 185 214 255 305 331

Exhibit 13: Opex ratios improve on a yoy basis

Opex to avg assets (%, RHS) 40.0 37.4 37.5 35.0 32.5 30.0 1.3 1.3 1.3 1.4 1.5 35.8 34.8

35.6 37.6

Cost-to-income ratio (%) 1.6

1.4

1.2

1.0

3QFY11 4QFY11 1QFY12 2QFY12 3QFY12

Source: Company, Angel Research

Source: Company, Angel Research

Capital adequacy continues to be strong

The banks capital adequacy ratio (CAR) continued to be strong at 16.1%, with tier-I ratio at 9.2%. The tier-I CAR including the 3QFY2012 PAT stood at 9.7% which was higher than tier-I CAR as of 2QFY2012, the improvement was on the back of rise in share of rated advances.

Exhibit 14: Capital adequacy remains healthy

20.0 18.2 Tier-I CAR (%) 16.5 15.0 7.8 Tier-II CAR (%) 16.2 16.0 16.1

6.8

6.6

6.6

6.9

10.0

5.0

10.4

9.7

9.6

9.4

9.2

3QFY11 4QFY11 1QFY12 2QFY12 3QFY12

Source: Company, Angel Research

January 27, 2012

Yes Bank | 3QFY2012 Result Update

Investment arguments

A-list management and ability to raise capital

Yes Bank has an A-list top management team, which brings to the table rich experience from the best banks in India, including Bank of America, ABN AMRO, Citibank, ICICI Bank, Rabo India and HDFC Bank. The banks performance also benefits from managements ability to raise equity capital (at increasing, book-accretive premiums).

Strong asset quality

The bank has maintained strong asset quality in spite of growing at a fast clip over the past few years (gross and net NPA ratios at just 0.2% and 0.04%, respectively), which has been aided by the smaller size of its balance sheet so far. The banks

provision coverage ratio even without inclusion of technical write-offs remained healthy at 80% in 3QFY2012.The bank has also been astute in

managing its growth rate and asset-liability durations in-line with the changing external environment.

Investment concerns

Medium-term downside risks to RoAs

The banks credit market share has steadily increased on the back of a robust credit CAGR of 53.9% over FY2008-11, which at 0.9% represents an increasingly meaningful market share. The bank has so far managed to source loans with relatively above-average profitability, keeping its NIM above 2.7% since FY2009, in spite of just 12.6% CASA ratio. Going forward though, as the size of the balance sheet increases, we believe RoA compression remains a risk to the bank. Having said that the recent deregulation of saving account interest rates and the consequent strong accretion of SA deposits for Yes Bank is likely to aid in maintaining the margins.

Execution risks in retail expansion plans

The bank has expanded its network at a fairly rapid pace from 67 branches in FY2008 to 331 branches as of 3QFY2012. Management is planning to add 30-40 branches every quarter going forward, with new branches directed towards improving its retail franchise. In our view though, considering the experience of the past several quarters, the inherent challenges of building a retail franchise are substantial despite managements high pedigree.

Outlook and valuation

Yes Banks growth as well as managements track record has been excellent, so far. However, as the banks balance sheet size continues to increase, it remains to be seen whether it can continue to source as profitable lending opportunities as its current loan portfolio. On the liabilities side, building a savings deposit franchise involves execution risks. However the recent deregulation of SA rates is likely to aid to a great extent in building the franchise. Yes Banks growth premium has reduced over time due to execution challenges (now trading at 2.0x due to cyclical slowdown vs. five-year median of 2.5x).

January 27, 2012

Yes Bank | 3QFY2012 Result Update

However, taking the challenges of building a retail deposit base head-on, the bank has more than doubled its branch network over the past 18 months to 331 branches and aggressively increased savings rate to 7% as a customer acquisition strategy. While it has fallen short of its retail expansion goals in the past and challenges remain significant, valuations at 2.0x FY2013E ABV in our view provide a reasonable upside of ~12% from current levels. Hence, we maintain our

Accumulate recommendation on the stock with a target price of `367. Exhibit 15: Key assumptions

Particulars (%) Credit growth Deposit growth CASA ratio NIMs Other income growth Growth in staff expenses Growth in other expenses Slippages

Source: Angel Research

Earlier estimates FY2012 18.0 18.0 11.7 2.5 26.5 28.5 28.5 0.3 FY2013 19.0 21.0 13.2 2.5 19.0 30.0 30.0 0.5

Revised estimates FY2012 16.0 16.0 12.1 2.6 30.6 34.0 34.0 0.2 FY2013 19.0 21.0 13.8 2.6 18.3 30.0 30.0 0.4

Exhibit 16: Change in estimates

Particulars (` cr) NII Non-interest income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Angel Research

Earlier estimates

1,579 789 2,368 874 1,494 117 1,377 447 930

FY2012 FY2013 Revised Revised Earlier Var. (%) Var. (%) estimates estimates estimates

1,621 814 2,435 911 1,524 84 1,440 467 973 2.7 3.2 2.8 4.3 2.0 (28.1) 4.6 4.6 4.6 1,861 939 2,800 1,136 1,664 172 1,492 484 1,008 1,928 962 2,891 1,184 1,706 155 1,551 503 1,048 3.6 2.5 3.3 4.3 2.5 (9.8) 4.0 4.0 4.0

January 27, 2012

Yes Bank | 3QFY2012 Result Update

Exhibit 17: P/ABV band

500 400 300 200 100 0 Price (`) 1x 1.5x 2x 2.5x 3x

Dec-05

Aug-07

Mar-07

Dec-10

Apr-09

Jul-05

Oct-06

Jul-10

Oct-11

Nov-08

May-06

Source: Company, Angel Research

Exhibit 18: Recommendation summary

Company AxisBk FedBk HDFCBk ICICIBk* SIB YesBk AllBk AndhBk BOB BOI BOM CanBk CentBk CorpBk DenaBk IDBI# IndBk IOB J&KBk OBC PNB SBI* SynBk UcoBk UnionBk UtdBk VijBk Reco. Buy Neutral Accumulate Buy Neutral Accumulate Neutral Neutral Buy Neutral Accumulate Accumulate Neutral Accumulate Accumulate Accumulate Neutral Accumulate Neutral Neutral Accumulate Buy Accumulate Neutral Neutral Accumulate Neutral CMP (`) 1,076 403 484 888 23 326 157 103 760 353 49 464 86 414 68 101 218 88 799 258 971 2,043 96 68 215 64 55 Tgt. price (`) 1,361 516 1,061 367 907 53 510 450 72 107 94 1,059 2,359 106 70 Upside (%) 26.5 6.8 19.5 12.4 19.4 10.0 9.9 8.6 6.9 6.7 5.9 9.0 15.5 10.6 10.0 FY2013E P/ABV (x) 1.74 1.1 3.28 1.6 1.1 2.0 0.7 0.8 1.0 1.2 0.7 1.0 0.7 0.7 0.5 0.7 0.9 0.6 0.8 0.7 1.1 1.7 0.6 0.8 0.9 0.6 0.8 FY2013E Tgt P/ABV (x) 2.2 3.5 2.0 2.3 1.3 0.8 1.1 0.8 0.5 0.7 0.6 1.2 1.9 0.7 0.7 FY2013E P/E (x) 9.3 8.7 16.9 14.0 6.8 10.8 4.4 5.0 5.8 7.7 4.9 5.9 5.4 4.5 3.5 5.0 5.2 4.4 4.8 5.8 6.0 9.9 4.1 4.4 5.5 4.4 5.8

#

FY2011-13E EPS CAGR (%) 18.2 16.2 30.4 19.2 13.5 20.1 9.6 (4.8) 9.8 0.1 26.3 (7.0) (24.3) (1.8) 2.4 9.9 3.8 7.1 14.9 (7.4) 7.3 26.0 13.7 10.9 (0.3) 4.3 4.1

FY2013E RoA (%) 1.5 1.2 1.8 1.3 0.9 1.4 0.9 0.8 1.1 0.6 0.7 0.8 0.4 0.8 0.8 0.7 1.2 0.5 1.4 0.7 1.0 0.8 0.7 0.6 0.7 0.6 0.5

May-11

FY2013E RoE (%) 20.2 13.2 21.0 14.4 17.5 20.6 17.6 14.6 19.3 13.3 16.9 15.8 11.4 15.5 14.9 13.4 18.4 13.0 18.6 11.1 19.7 17.9 16.5 15.4 15.4 12.1 11.6

Source: Company, Angel Research; Note:*Target multiples=SOTP Target Price/ABV (including subsidiaries), Without adjusting for SASF

January 27, 2012

Mar-12

Sep-09

Feb-10

Jan-08

Jun-08

Yes Bank | 3QFY2012 Result Update

Income statement

Y/E March (` cr) Net Interest Income - YoY Growth (%) Other Income - YoY Growth (%) Operating Income - YoY Growth (%) Operating Expenses - YoY Growth (%) Pre - Provision Profit - YoY Growth (%) Prov. & Cont. - YoY Growth (%) Profit Before Tax - YoY Growth (%) Prov. for Taxation - as a % of PBT PAT - YoY Growth (%) FY07 171 94.6 201 101.1 372 98.0 194 124.7 179 75.4 35 101.3 144 49 34.3 94 FY08 331 92.9 361 79.7 691 85.8 341 76.3 350 96.0 44 24.9 306 106 34.7 200 FY09 511 54.6 435 20.6 946 36.9 419 22.7 528 50.7 62 41.6 466 52.0 162 34.8 304 51.9 FY10 788 54.1 576 32.3 1,363 44.1 500 19.5 863 63.6 137 121.6 726 55.9 249 34.2 478 57.2 FY11 1,247 58.2 623 8.3 1,870 37.2 680 35.9 1,190 37.9 98 (28.2) 1,092 50.3 365 33.4 727 52.2 FY12E 1,621 30.0 814 30.6 2,435 30.2 911 34.0 1,524 28.0 84 (14.1) 1,440 31.8 467 32.4 973 33.7 FY13E 1,928 18.9 962 18.3 2,891 18.7 1,184 30.0 1,706 12.0 155 83.9 1,551 7.8 503 32.4 1,048 7.8

70.1 113.3

70.4 111.9

Balance sheet

Y/E March (` cr) Share Capital Reserves & Surplus Deposits - Growth (%) Borrowings Tier 2 Capital Other Liab. & Prov. Total Liabilities Cash Balances Bank Balances Investments Advances - Growth (%) Fixed Assets Other Assets Total Assets - Growth (%) FY07 280 507 8,220 182.5 867 479 750 11,103 390 903 3,073 6,290 161.3 71 377 11,103 166.7 FY08 296 1,023 13,273 61.5 986 728 677 16,982 959 668 5,094 9,430 49.9 101 730 16,982 52.9 FY09 297 1,327 16,169 21.8 2,189 1,513 1,405 22,901 1,278 645 7,117 12,403 31.5 131 1,327 22,901 34.8 FY10 340 2,750 26,799 65.7 2,564 2,185 1,745 36,383 1,995 678 10,210 22,193 78.9 115 1,191 36,383 58.9 FY11 347 3,447 45,939 71.4 3,333 3,358 2,583 59,007 3,076 420 18,829 34,364 54.8 132 2,186 59,007 62.2 FY12E 347 4,298 53,289 16.0 5,743 3,895 2,912 70,485 3,464 1,410 22,985 39,862 16.0 153 2,611 70,485 19.5 FY13E 347 5,185 64,480 21.0 6,013 4,635 3,458 84,119 4,191 1,682 27,516 47,436 19.0 178 3,116 84,119 19.3

January 27, 2012

10

Yes Bank | 3QFY2012 Result Update

Ratio analysis

Y/E March Profitability ratios (%) NIMs Cost to Income Ratio RoA RoE B/S ratios (%) CASA Ratio Credit/Deposit Ratio CAR - Tier I Asset Quality (%) Gross NPAs Net NPAs Slippages Loan Loss Prov. /Avg. Assets Provision Coverage Per Share Data (`) EPS ABVPS (75% cover.) DPS Valuation Ratios PER (x) P/ABVPS (x) Dividend Yield DuPont Analysis NII (-) Prov. Exp. Adj. NII Treasury Int. Sens. Inc. Other Inc. Op. Inc. Opex PBT Taxes RoA Leverage RoE 2.2 0.5 1.8 0.1 1.9 2.5 4.4 2.5 1.9 0.6 1.2 11.2 13.9 2.4 0.3 2.0 0.4 2.5 2.1 4.6 2.4 2.2 0.8 1.4 13.3 19.0 2.6 0.3 2.3 0.7 3.0 1.4 4.4 2.1 2.3 0.8 1.5 13.6 20.6 2.7 0.5 2.2 0.3 2.5 1.6 4.1 1.7 2.5 0.8 1.6 12.6 20.3 2.6 0.2 2.4 (0.1) 2.3 1.4 3.7 1.4 2.3 0.8 1.5 13.9 21.1 2.5 0.1 2.4 0.0 2.4 1.2 3.6 1.4 2.2 0.7 1.5 15.3 23.0 2.5 0.2 2.3 0.0 2.3 1.2 3.5 1.5 2.0 0.7 1.4 15.2 20.6 96.7 11.6 48.2 7.3 31.9 6.0 23.2 3.6 0.5 15.6 3.0 0.8 11.6 2.4 0.9 10.8 2.0 1.2 3.4 28.1 6.8 44.6 10.2 53.9 14.1 1.5 20.9 2.5 28.0 3.0 30.2 4.0 91.0 109.3 133.8 159.4 0.1 0.0 0.2 0.0 80.0 0.7 0.4 0.9 0.3 48.5 0.3 0.1 0.9 0.3 78.4 0.2 0.0 0.2 0.1 88.6 0.2 0.0 0.2 0.1 88.6 0.2 0.0 0.4 0.2 88.5 5.8 76.5 13.6 8.2 8.5 71.0 13.6 8.5 8.7 76.7 16.6 9.5 10.5 82.8 20.6 12.9 10.3 74.8 16.5 9.7 12.1 74.8 16.6 9.9 13.8 73.6 16.6 9.9 2.3 52.0 1.2 13.9 2.5 49.4 1.4 19.0 2.7 44.2 1.5 20.6 2.8 36.7 1.6 20.3 2.7 36.3 1.5 21.1 2.6 37.4 1.5 23.0 2.6 41.0 1.4 20.6 FY07 FY08 FY09 FY10 FY11 FY12E FY13E

January 27, 2012

11

Yes Bank | 3QFY2012 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Yes Bank No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

January 27, 2012

12

Você também pode gostar

- Westpac Feb4Documento2 páginasWestpac Feb4რაქსშ საჰა100% (1)

- Pce Part B Set CDocumento13 páginasPce Part B Set Czara100% (1)

- FINAL Examination - Applied Auditing 1 SY 2017-2018: College of Accounting EducationDocumento17 páginasFINAL Examination - Applied Auditing 1 SY 2017-2018: College of Accounting EducationAiron Keith Along100% (1)

- Wells Fargo Credit Reporting CodesDocumento4 páginasWells Fargo Credit Reporting CodesGoodStuff140% (1)

- Axis Bank Result UpdatedDocumento13 páginasAxis Bank Result UpdatedAngel BrokingAinda não há avaliações

- Yes Bank: Performance HighlightsDocumento12 páginasYes Bank: Performance HighlightsAngel BrokingAinda não há avaliações

- Axis Bank: Performance HighlightsDocumento13 páginasAxis Bank: Performance HighlightsAngel BrokingAinda não há avaliações

- Dena Bank Result UpdatedDocumento11 páginasDena Bank Result UpdatedAngel BrokingAinda não há avaliações

- Bank of BarodaDocumento12 páginasBank of BarodaAngel BrokingAinda não há avaliações

- IDBI Bank: Performance HighlightsDocumento13 páginasIDBI Bank: Performance HighlightsAngel BrokingAinda não há avaliações

- Bank of Baroda, 7th February, 2013Documento12 páginasBank of Baroda, 7th February, 2013Angel BrokingAinda não há avaliações

- Canara Bank Result UpdatedDocumento11 páginasCanara Bank Result UpdatedAngel BrokingAinda não há avaliações

- ICICI Bank Result UpdatedDocumento16 páginasICICI Bank Result UpdatedAngel BrokingAinda não há avaliações

- UCO Bank: Performance HighlightsDocumento11 páginasUCO Bank: Performance HighlightsAngel BrokingAinda não há avaliações

- Vijaya Bank, 1Q FY 2014Documento11 páginasVijaya Bank, 1Q FY 2014Angel BrokingAinda não há avaliações

- Axis Bank: Performance HighlightsDocumento13 páginasAxis Bank: Performance HighlightsAngel BrokingAinda não há avaliações

- Axis Bank: Performance HighlightsDocumento13 páginasAxis Bank: Performance HighlightsAngel BrokingAinda não há avaliações

- Dena Bank: AccumulateDocumento11 páginasDena Bank: AccumulateAngel BrokingAinda não há avaliações

- South Indian Bank Result UpdatedDocumento13 páginasSouth Indian Bank Result UpdatedAngel BrokingAinda não há avaliações

- Jammu and Kashmir Bank: Performance HighlightsDocumento10 páginasJammu and Kashmir Bank: Performance HighlightsAngel BrokingAinda não há avaliações

- IDBI Bank Result UpdatedDocumento13 páginasIDBI Bank Result UpdatedAngel BrokingAinda não há avaliações

- Oriental Bank of Commerce: Performance HighlightsDocumento11 páginasOriental Bank of Commerce: Performance HighlightsAngel BrokingAinda não há avaliações

- Allahabad Bank Result UpdatedDocumento11 páginasAllahabad Bank Result UpdatedAngel BrokingAinda não há avaliações

- ICICI Bank Result UpdatedDocumento15 páginasICICI Bank Result UpdatedAngel BrokingAinda não há avaliações

- IDBI Bank: Performance HighlightsDocumento13 páginasIDBI Bank: Performance HighlightsAngel BrokingAinda não há avaliações

- Bank of Baroda Result UpdatedDocumento12 páginasBank of Baroda Result UpdatedAngel BrokingAinda não há avaliações

- UCO Bank: Performance HighlightsDocumento11 páginasUCO Bank: Performance HighlightsAngel BrokingAinda não há avaliações

- HDFC Bank Result UpdatedDocumento13 páginasHDFC Bank Result UpdatedAngel BrokingAinda não há avaliações

- ICICI Bank Result UpdatedDocumento15 páginasICICI Bank Result UpdatedAngel BrokingAinda não há avaliações

- Jammu and Kashmir Bank Result UpdatedDocumento10 páginasJammu and Kashmir Bank Result UpdatedAngel BrokingAinda não há avaliações

- Dena Bank Result UpdatedDocumento10 páginasDena Bank Result UpdatedAngel BrokingAinda não há avaliações

- Bank of India Result UpdatedDocumento12 páginasBank of India Result UpdatedAngel BrokingAinda não há avaliações

- Corporation Bank Result UpdatedDocumento11 páginasCorporation Bank Result UpdatedAngel BrokingAinda não há avaliações

- Bank of Baroda, 1Q FY 2014Documento12 páginasBank of Baroda, 1Q FY 2014Angel BrokingAinda não há avaliações

- State Bank of India: Performance HighlightsDocumento14 páginasState Bank of India: Performance HighlightsAngel BrokingAinda não há avaliações

- Federal Bank: Performance HighlightsDocumento11 páginasFederal Bank: Performance HighlightsAngel BrokingAinda não há avaliações

- Dena Bank, 1Q FY 2014Documento11 páginasDena Bank, 1Q FY 2014Angel BrokingAinda não há avaliações

- IDBI Bank Result UpdatedDocumento13 páginasIDBI Bank Result UpdatedAngel BrokingAinda não há avaliações

- Bank of India Result UpdatedDocumento12 páginasBank of India Result UpdatedAngel BrokingAinda não há avaliações

- Allahabad Bank Result UpdatedDocumento11 páginasAllahabad Bank Result UpdatedAngel BrokingAinda não há avaliações

- United Bank of India Result UpdatedDocumento12 páginasUnited Bank of India Result UpdatedAngel BrokingAinda não há avaliações

- State Bank of IndiaDocumento16 páginasState Bank of IndiaAngel BrokingAinda não há avaliações

- Syndicate Bank Result UpdatedDocumento11 páginasSyndicate Bank Result UpdatedAngel BrokingAinda não há avaliações

- Allahabad Bank, 1Q FY 2014Documento11 páginasAllahabad Bank, 1Q FY 2014Angel BrokingAinda não há avaliações

- Bank of Maharashtra: Performance HighlightsDocumento11 páginasBank of Maharashtra: Performance HighlightsAngel BrokingAinda não há avaliações

- Oriental Bank, 1Q FY 2014Documento11 páginasOriental Bank, 1Q FY 2014Angel BrokingAinda não há avaliações

- Axis Bank Result UpdatedDocumento13 páginasAxis Bank Result UpdatedAngel BrokingAinda não há avaliações

- Union Bank of India: Performance HighlightsDocumento11 páginasUnion Bank of India: Performance HighlightsAngel BrokingAinda não há avaliações

- Punjab National Bank Result UpdatedDocumento12 páginasPunjab National Bank Result UpdatedAngel BrokingAinda não há avaliações

- Andhra Bank: Performance HighlightsDocumento11 páginasAndhra Bank: Performance HighlightsAngel BrokingAinda não há avaliações

- UCO Bank: Performance HighlightsDocumento11 páginasUCO Bank: Performance HighlightsAngel BrokingAinda não há avaliações

- South Indian BankDocumento11 páginasSouth Indian BankAngel BrokingAinda não há avaliações

- Corporation Bank 4Q FY 2013Documento11 páginasCorporation Bank 4Q FY 2013Angel BrokingAinda não há avaliações

- Axis Bank: Performance HighlightsDocumento13 páginasAxis Bank: Performance HighlightsRahul JagdaleAinda não há avaliações

- Syndicate Bank, 1Q FY 2014Documento11 páginasSyndicate Bank, 1Q FY 2014Angel BrokingAinda não há avaliações

- Canara Bank, 1Q FY 2014Documento11 páginasCanara Bank, 1Q FY 2014Angel BrokingAinda não há avaliações

- Federal Bank, 1Q FY 2014Documento11 páginasFederal Bank, 1Q FY 2014Angel BrokingAinda não há avaliações

- Union Bank of India Result UpdatedDocumento11 páginasUnion Bank of India Result UpdatedAngel BrokingAinda não há avaliações

- South Indian Bank Result UpdatedDocumento12 páginasSouth Indian Bank Result UpdatedAngel BrokingAinda não há avaliações

- Andhra Bank: Performance HighlightsDocumento10 páginasAndhra Bank: Performance HighlightsAngel BrokingAinda não há avaliações

- Indian Overseas BankDocumento11 páginasIndian Overseas BankAngel BrokingAinda não há avaliações

- Federal Bank: Performance HighlightsDocumento11 páginasFederal Bank: Performance HighlightsAngel BrokingAinda não há avaliações

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioAinda não há avaliações

- Economic Indicators for East Asia: Input–Output TablesNo EverandEconomic Indicators for East Asia: Input–Output TablesAinda não há avaliações

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocumento4 páginasRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingAinda não há avaliações

- Daily Metals and Energy Report September 16 2013Documento6 páginasDaily Metals and Energy Report September 16 2013Angel BrokingAinda não há avaliações

- Oilseeds and Edible Oil UpdateDocumento9 páginasOilseeds and Edible Oil UpdateAngel BrokingAinda não há avaliações

- WPIInflation August2013Documento5 páginasWPIInflation August2013Angel BrokingAinda não há avaliações

- International Commodities Evening Update September 16 2013Documento3 páginasInternational Commodities Evening Update September 16 2013Angel BrokingAinda não há avaliações

- Daily Agri Report September 16 2013Documento9 páginasDaily Agri Report September 16 2013Angel BrokingAinda não há avaliações

- Daily Agri Tech Report September 16 2013Documento2 páginasDaily Agri Tech Report September 16 2013Angel BrokingAinda não há avaliações

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocumento6 páginasTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingAinda não há avaliações

- Daily Agri Tech Report September 14 2013Documento2 páginasDaily Agri Tech Report September 14 2013Angel BrokingAinda não há avaliações

- Currency Daily Report September 16 2013Documento4 páginasCurrency Daily Report September 16 2013Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Documento4 páginasDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingAinda não há avaliações

- Market Outlook: Dealer's DiaryDocumento13 páginasMarket Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Derivatives Report 8th JanDocumento3 páginasDerivatives Report 8th JanAngel BrokingAinda não há avaliações

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocumento1 páginaPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingAinda não há avaliações

- Metal and Energy Tech Report Sept 13Documento2 páginasMetal and Energy Tech Report Sept 13Angel BrokingAinda não há avaliações

- Currency Daily Report September 13 2013Documento4 páginasCurrency Daily Report September 13 2013Angel BrokingAinda não há avaliações

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocumento4 páginasJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingAinda não há avaliações

- Market Outlook: Dealer's DiaryDocumento12 páginasMarket Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Daily Agri Tech Report September 12 2013Documento2 páginasDaily Agri Tech Report September 12 2013Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Documento4 páginasDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Currency Daily Report September 12 2013Documento4 páginasCurrency Daily Report September 12 2013Angel BrokingAinda não há avaliações

- Market Outlook: Dealer's DiaryDocumento13 páginasMarket Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Daily Metals and Energy Report September 12 2013Documento6 páginasDaily Metals and Energy Report September 12 2013Angel BrokingAinda não há avaliações

- Metal and Energy Tech Report Sept 12Documento2 páginasMetal and Energy Tech Report Sept 12Angel BrokingAinda não há avaliações

- Daily Agri Report September 12 2013Documento9 páginasDaily Agri Report September 12 2013Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Documento4 páginasDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingAinda não há avaliações

- Soal Tes Tertulis DKMS LawyersDocumento2 páginasSoal Tes Tertulis DKMS LawyersFerlianto Dwi PutraAinda não há avaliações

- 中英文对照版财务报表及专业名词Documento6 páginas中英文对照版财务报表及专业名词sandywhgAinda não há avaliações

- 2023-10-28 Sub Prime Mortgage Crisis V0.02amDocumento13 páginas2023-10-28 Sub Prime Mortgage Crisis V0.02amb23036Ainda não há avaliações

- 40 - Financial Statements - TheoryDocumento9 páginas40 - Financial Statements - TheoryクロードAinda não há avaliações

- PA2 X ESP HW9 G1 Revanza TrivianDocumento9 páginasPA2 X ESP HW9 G1 Revanza TrivianRevan KonglomeratAinda não há avaliações

- Risk Management in Punjab National BankDocumento76 páginasRisk Management in Punjab National BankAshis SahooAinda não há avaliações

- Ratio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of PakistanDocumento17 páginasRatio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of Pakistanshurahbeel75% (4)

- Exchange Rate MechnismDocumento16 páginasExchange Rate MechnismojasvitaAinda não há avaliações

- Notice: Casualty and Nonperformance Certificates: Landmark Freight, Inc., Et Al.Documento2 páginasNotice: Casualty and Nonperformance Certificates: Landmark Freight, Inc., Et Al.Justia.comAinda não há avaliações

- AF205 Assignment 2 - Navneet Nischal Chand - S11157889Documento3 páginasAF205 Assignment 2 - Navneet Nischal Chand - S11157889Shayal ChandAinda não há avaliações

- Objectives of The StudyDocumento51 páginasObjectives of The StudyMmp AbacusAinda não há avaliações

- MBBsavings - 158118 107625 - 2016 12 31Documento7 páginasMBBsavings - 158118 107625 - 2016 12 31Zahar ZekAinda não há avaliações

- Guideline On Classification of NPL and Provision For Substandard, Bad and Doubtful Debts (BNM-GP3)Documento20 páginasGuideline On Classification of NPL and Provision For Substandard, Bad and Doubtful Debts (BNM-GP3)Shaa DidiAinda não há avaliações

- Cluster University Jammu Fee ChallanDocumento2 páginasCluster University Jammu Fee ChallanHayderi GMAinda não há avaliações

- Liquidity RatiosDocumento2 páginasLiquidity Ratiosabrar mahir SahilAinda não há avaliações

- IDFCFIRSTBankstatement 10078387878 130042647Documento8 páginasIDFCFIRSTBankstatement 10078387878 130042647Nikhil Visa ServicesAinda não há avaliações

- Intacct3: Assignment Item #1: (JG Company)Documento5 páginasIntacct3: Assignment Item #1: (JG Company)Kristen StewartAinda não há avaliações

- Banking Ass - KPMG Study - Bank MarginsDocumento58 páginasBanking Ass - KPMG Study - Bank MarginscommercestudentAinda não há avaliações

- Flash Note: China / Hong KongDocumento8 páginasFlash Note: China / Hong KongAshokAinda não há avaliações

- The Repo MarketDocumento16 páginasThe Repo MarketmeetozaAinda não há avaliações

- ECGCDocumento22 páginasECGCchandran0567Ainda não há avaliações

- Testimonial 9 (11.5.16)Documento69 páginasTestimonial 9 (11.5.16)LeninAinda não há avaliações

- The Doctrine of Merger 2002Documento4 páginasThe Doctrine of Merger 2002mptacly9152100% (2)

- Unit 14 Money Creation and Central Banking: 14.0 ObjectivesDocumento14 páginasUnit 14 Money Creation and Central Banking: 14.0 ObjectivesSaima JanAinda não há avaliações

- Exam 2 Practice Problems AnswersDocumento6 páginasExam 2 Practice Problems Answersoizys131Ainda não há avaliações

- IND AS - 40 - INVESTMENT PROPERTY RevisionDocumento8 páginasIND AS - 40 - INVESTMENT PROPERTY RevisionAmrit NeupaneAinda não há avaliações