Escolar Documentos

Profissional Documentos

Cultura Documentos

BF - 307: Derivative Securities January 19, 2012 Homework Assignment 1 Suman Banerjee Instructions

Enviado por

samurai_87Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

BF - 307: Derivative Securities January 19, 2012 Homework Assignment 1 Suman Banerjee Instructions

Enviado por

samurai_87Direitos autorais:

Formatos disponíveis

BF_307: Derivative Securities Homework Assignment 1 Instructions

1 2 3 4

January 19, 2012 Suman Banerjee

This assignment is due on or before 4:00 PM, February 6, 2012. It needs to be physically delivered at S3-01C-89. Your answers should be typed and printed (no hand written assignment and no email submission allowed). Please make sure to write your full name and student ID on top of the assignment. This assignment is worth a total of 100 points (excluding bonus question).

Problem 1

Suppose that you enter into two short futures contracts to sell July silver for $10.20 per ounce on the New York Commodity Exchange. The size of the contract is 5,000 ounces. The initial margin is $4,000 per contract, and the maintenance margin is $3,000 per contract. i. (5 points) What change in the futures price will lead to a margin call? ii. (5 points) What happens if you do not meet the margin call? Problem 2 Suppose that you enter into two long futures contracts to buy July silver for $10.20 per ounce on the New York Commodity Exchange. The size of the contract is 5,000 ounces. The initial margin is $4,000 per contract, and the maintenance margin is $3,000 per contract. i. (5 points) What change in the futures price will lead to a margin call? ii. (5 points) What happens if you do not meet the margin call? Problem 3 A stock is expected to pay a dividend of $1 per share in 2 months and in 5 months. The stock price is $50, and the risk-free rate of interest is 8% per annum with continuous compounding for all maturities. An investor has just taken a short position in a 6-month forward contract on the stock. i. (5 points) What are the forward price and the initial value of the forward contract ii. (5 points) Three months later, the price of the stock is $48 and the risk-free rate of interest is still 8% per annum. What are the forward price and the value of the short position in the forward contract? Problem 4 A stock is expected to pay a dividend of $1 per share in 2 months and in 5 months. The stock price is $50, and the risk-free rate of interest is 8% per annum with continuous compounding for all maturities. An investor has just taken a long position in a 6-month forward contract on the stock. i. (5 points) What are the forward price and the initial value of the forward contract ii. (5 points) Three months later, the price of the stock is $52 and the risk-free rate of interest is still 8% per annum. What are the forward price and the value of the long position in the forward contract?

Problem 5 The current market price of T-bill maturing 110 days from now is 97.90 (out of par 100). The

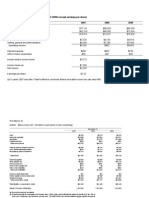

cash price for 90-day T-bill futures contract expiring 20 days from now is 98.30. A 20day Tbill futures contract is also traded in the market. i. (5 points) Compute the risk free rate that rules out arbitrage opportunities. ii. (5 points) Suppose that the 20-day T-bill rate is in fact 8%. Show how to set up transactions in T-bill contract and the futures contract that guaranteed to make an arbitrage profit. Problem 6 It is now October 2004. A company anticipates that it will purchase 10 million pounds of copper in each of February 2005, August 2005, February 2006, and August 2006. The company has decided to use the futures contracts traded in the COMEX division of the New York Mercantile Exchange to hedge its risk. One contract is for the delivery of 25,000 pounds of copper. The initial margin is $2,000 per contract and the maintenance margin is $1,500 per contract. The companys policy is to hedge 80% of its exposure. Contracts with maturities up to 13 months into the future are considered to have sufficient liquidity to meet the companys needs. Devise a hedging strategy for the company. Assume the market prices (in cents per pound) today and at future dates are as follows:

i.

(10 points) What is the impact of the strategy you propose on the price the company pays for copper? ii. (5 points) What is the initial margin requirement in October 2004? Is the company subject to any margin calls? Problem 7 A bank offers a corporate client a choice between borrowing cash at 11% per annum and borrowing gold at 2% per annum. (If gold is borrowed, interest must be repaid in gold. Thus, 100 ounces borrowed today would require 102 ounces to be repaid in 1 year.) The risk-free interest rate is 9.25% per annum, and storage costs are 0.5% per annum. The interest rates on the two loans are expressed with annual compounding. The risk-free interest rate and storage costs are expressed with continuous compounding. i. (10 points) Discuss whether the rate of interest on the gold loan is too high or too low in relation to the rate of interest on the cash loan. Problem 8 A fund manager has a portfolio worth $50 million with a beta of 0.87. The manager is concerned about the performance of the market over the next 2 months and plans to use 3month futures contracts on the S&P 500 to hedge the risk. The current value of the index is 1250, one contract is on 250 times the index, the risk-free rate is 6% per annum, and the dividend yield on the index is 3% per annum. The current 3-month futures price is 1259. i. (5 points) What position should the fund manager take to eliminate all exposure to the market over the next 2 months? ii. (10 points) Calculate the effect of your strategy on the fund managers returns if the

level of the market in 2 months is 1,000, 1,300, and 1,400. Assume that the 1-month futures price is 0.25% higher than the index level in 2 months time.

Problem 9 You are in charge of the bond portfolio of Freeman Investments Inc. and have to buy $100 million of bonds on or after February 7, 2011 and on or before May 7, 2011. You are concerned that interest rate might fall between now (January 26, 2011) and May 7, 2011 and decide to use T-bond futures contract to set up the hedge. The current May 2011 T-bond futures are 95-04. On May 1, 2011 the average duration of the targeted bond portfolio will be 9.0 years. The cheapest to deliver T-bond futures contract expected to be 20 years, 8% coupon bond whose duration is 11.2 years at maturity of the futures contract. i. (5 points) Explain which risk you are exposed to if you do not set up the hedge. Separately consider the scenarios where interest rate rises and declines. ii. (5 points) Demonstrate the size and direction (short or long) of a position in May 2011 T-bond futures that would provide a hedge for the underlying bond portfolio.

Bonus Question (10 points) One of the key ideas from the discussion is that expectations about the appreciation of the underlying asset do not enter the futures pricing formula. Suppose that you meet someone (let's call him Joe) who really thinks that gold is going to appreciate over the next year. Joe thinks that the gold will go up in price by 50% over the next year. Since the current price of gold is $100 (and because he has not taken my class!), Joe is willing to enter into a futures contract with you at a fixed futures price of $150. That is, Joe is willing to buy (or sell) gold one year from today at $150. Further assume that the risk free rate of return is 10%, and that there are no carrying costs or other market frictions. The question is: How do you make money trading with Joe if there were no futures market?

Você também pode gostar

- Structured Financial Product A Complete Guide - 2020 EditionNo EverandStructured Financial Product A Complete Guide - 2020 EditionAinda não há avaliações

- Final Exam Solutions 2012 1 SpringDocumento123 páginasFinal Exam Solutions 2012 1 SpringBenny KhorAinda não há avaliações

- CLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketNo EverandCLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketAinda não há avaliações

- IFMDocumento55 páginasIFMSajalAgrawalAinda não há avaliações

- Strategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideNo EverandStrategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideAinda não há avaliações

- Interest Rate FuturesDocumento22 páginasInterest Rate FuturesHerojianbuAinda não há avaliações

- Chapter 18 - Derivatives and Risk ManagementDocumento85 páginasChapter 18 - Derivatives and Risk Managementliane_castañares0% (1)

- IFS International BankingDocumento39 páginasIFS International BankingVrinda GargAinda não há avaliações

- MAlongDocumento253 páginasMAlongerikchoisyAinda não há avaliações

- Accounting for Derivatives: Advanced Hedging under IFRSNo EverandAccounting for Derivatives: Advanced Hedging under IFRSAinda não há avaliações

- OPT SolutionDocumento52 páginasOPT SolutionbocfetAinda não há avaliações

- Credit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsNo EverandCredit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsAinda não há avaliações

- Case: Flash Memory, Inc. (4232)Documento1 páginaCase: Flash Memory, Inc. (4232)陳子奕Ainda não há avaliações

- AsdasdasdasdDocumento112 páginasAsdasdasdasdTan Wei ShengAinda não há avaliações

- ct12010 2013Documento144 páginasct12010 2013nigerianhacksAinda não há avaliações

- BE 351 Lecture 1 PDFDocumento52 páginasBE 351 Lecture 1 PDFBless Mwego100% (1)

- Stock Index Futures Contracts Analysis and ApplicationsDocumento63 páginasStock Index Futures Contracts Analysis and ApplicationsSidharth ChoudharyAinda não há avaliações

- Problem Set 2: rh+0.2 H RH 0.2 H 0 TDocumento7 páginasProblem Set 2: rh+0.2 H RH 0.2 H 0 TYeet BoyAinda não há avaliações

- International Finance Tutorial 3 Answer-HafeezDocumento5 páginasInternational Finance Tutorial 3 Answer-HafeezMohd Hafeez NizamAinda não há avaliações

- Problem SetDocumento105 páginasProblem SetYodaking Matt100% (1)

- frm指定教材 risk management & derivativesDocumento1.192 páginasfrm指定教材 risk management & derivativeszeno490Ainda não há avaliações

- e 51 F 8 F 8 B 4 A 32 Ea 4Documento159 páginase 51 F 8 F 8 B 4 A 32 Ea 4Shawn Kou100% (5)

- Time SeriesDocumento819 páginasTime Seriescristian_masterAinda não há avaliações

- Exercise C4Documento6 páginasExercise C4Bruno Estanque ViegasAinda não há avaliações

- Chapter 13 AnswersDocumento5 páginasChapter 13 Answersvandung19Ainda não há avaliações

- Arbitrage in India Past Present and FutureDocumento28 páginasArbitrage in India Past Present and FuturekinshuksAinda não há avaliações

- Contango vs. Normal BackwardationDocumento2 páginasContango vs. Normal BackwardationmksscribdAinda não há avaliações

- Bond ValuationDocumento52 páginasBond ValuationDevi MuthiahAinda não há avaliações

- 001 2018 4 b-1Documento165 páginas001 2018 4 b-1vusiAinda não há avaliações

- HW FINS3635 2018 1 1Documento9 páginasHW FINS3635 2018 1 1Roger GuoAinda não há avaliações

- Exercise Problems - 485 Fixed Income 2021Documento18 páginasExercise Problems - 485 Fixed Income 2021Nguyen hong LinhAinda não há avaliações

- Binomial TreeDocumento4 páginasBinomial TreeCharlie GreyAinda não há avaliações

- Practice Final Exam Solution PDFDocumento18 páginasPractice Final Exam Solution PDFAdnan AliAinda não há avaliações

- Forward Rate AgreementDocumento8 páginasForward Rate AgreementNaveen BhatiaAinda não há avaliações

- Combinepdf PDFDocumento65 páginasCombinepdf PDFCam SpaAinda não há avaliações

- Principal Protected Investments: Structured Investments Solution SeriesDocumento8 páginasPrincipal Protected Investments: Structured Investments Solution SeriessonystdAinda não há avaliações

- Stock ValuvationDocumento30 páginasStock ValuvationmsumanraoAinda não há avaliações

- Types of SwapsDocumento25 páginasTypes of SwapsBinal JasaniAinda não há avaliações

- Swaps: Problem 7.1Documento4 páginasSwaps: Problem 7.1Hana LeeAinda não há avaliações

- Act7 2Documento4 páginasAct7 2Helen B. EvansAinda não há avaliações

- 2.3 Fra and Swap ExercisesDocumento5 páginas2.3 Fra and Swap ExercisesrandomcuriAinda não há avaliações

- ENG 111 Final SolutionsDocumento12 páginasENG 111 Final SolutionsDerek EstrellaAinda não há avaliações

- Global Investments PPT PresentationDocumento48 páginasGlobal Investments PPT Presentationgilli1trAinda não há avaliações

- FuturesDocumento102 páginasFuturesSon LamAinda não há avaliações

- Review Session: Preparation For Midterm ExamDocumento4 páginasReview Session: Preparation For Midterm ExammariaAinda não há avaliações

- Flash Memory Inc Student Spreadsheet SupplementDocumento5 páginasFlash Memory Inc Student Spreadsheet Supplementjamn1979Ainda não há avaliações

- Policy Statement: Statement of Your Financial ObjectivesDocumento5 páginasPolicy Statement: Statement of Your Financial Objectivesavi dotto100% (1)

- Question Bank 2 - SEP2019Documento6 páginasQuestion Bank 2 - SEP2019Nhlanhla ZuluAinda não há avaliações

- International FinanceDocumento181 páginasInternational FinanceadhishsirAinda não há avaliações

- Mid Term Report FingameDocumento6 páginasMid Term Report FingameShine NagpalAinda não há avaliações

- YTM at Time of Issuance (At Par)Documento8 páginasYTM at Time of Issuance (At Par)tech& GamingAinda não há avaliações

- Empirical Studies in FinanceDocumento8 páginasEmpirical Studies in FinanceAhmedMalikAinda não há avaliações

- M 2012 Dec PDFDocumento18 páginasM 2012 Dec PDFMoses LukAinda não há avaliações

- Option Valuation and Dividend Payments F-1523Documento11 páginasOption Valuation and Dividend Payments F-1523Nguyen Quoc TuAinda não há avaliações

- Topic 3 Introduction To The Valuation of Fixed Income InstrumentsDocumento80 páginasTopic 3 Introduction To The Valuation of Fixed Income InstrumentsMingyanAinda não há avaliações

- Derivatives Individual AssignmentDocumento24 páginasDerivatives Individual AssignmentCarine TeeAinda não há avaliações

- Econ 132 Problems For Chapter 1-3, and 5Documento5 páginasEcon 132 Problems For Chapter 1-3, and 5jononfireAinda não há avaliações

- 10 Pages Directors' Summary - by CA Harsh GuptaDocumento10 páginas10 Pages Directors' Summary - by CA Harsh Guptagovarthan1976Ainda não há avaliações

- Lecture Session 9 - Forecasting Exchange RatesDocumento10 páginasLecture Session 9 - Forecasting Exchange Ratesapi-19974928Ainda não há avaliações

- Test Your Knowledge: QuestionsDocumento5 páginasTest Your Knowledge: QuestionsRITZ BROWNAinda não há avaliações

- 6Documento2 páginas6Min Hsuan HsianAinda não há avaliações

- Importance or Advantages of Insurance To SocietyDocumento11 páginasImportance or Advantages of Insurance To SocietyPooja TripathiAinda não há avaliações

- Quiz 4 SolutionDocumento5 páginasQuiz 4 SolutionSam LindersonAinda não há avaliações

- Coursepack Basic AccountingDocumento61 páginasCoursepack Basic Accountingdeepak singhalAinda não há avaliações

- E - Portfolio Assignment MacroDocumento8 páginasE - Portfolio Assignment Macroapi-316969642Ainda não há avaliações

- Conceptual Framework and Accounting StandardsDocumento11 páginasConceptual Framework and Accounting StandardsAngela TalastasAinda não há avaliações

- Senior Mortgage Loan Processor in NYC Resume Yocheved KraussDocumento2 páginasSenior Mortgage Loan Processor in NYC Resume Yocheved KraussYochevedKraussAinda não há avaliações

- L1 - JN - Financial Statement Analysis 2024 V1Documento66 páginasL1 - JN - Financial Statement Analysis 2024 V1niketshah75oAinda não há avaliações

- CCAF Africa and Middle East Alternative Finance Report 2017Documento64 páginasCCAF Africa and Middle East Alternative Finance Report 2017CrowdfundInsiderAinda não há avaliações

- Bankers Trust Company v. Transamerica Title Insurance Company, 594 F.2d 231, 10th Cir. (1979)Documento9 páginasBankers Trust Company v. Transamerica Title Insurance Company, 594 F.2d 231, 10th Cir. (1979)Scribd Government DocsAinda não há avaliações

- GST Invoice: SL No. 1 2.000 KG. 2 2.000 KGDocumento2 páginasGST Invoice: SL No. 1 2.000 KG. 2 2.000 KGDNYANESHWAR PAWARAinda não há avaliações

- Gbpaud m5 OLDocumento3 páginasGbpaud m5 OLArifAinda não há avaliações

- Technical Analysis OscillatorsDocumento18 páginasTechnical Analysis Oscillatorsbrijeshagra100% (1)

- Lesson 1 - Intro To LiabilitiesDocumento21 páginasLesson 1 - Intro To LiabilitiesGrace Joy MarcelinoAinda não há avaliações

- Annotated 3.1 Q3 PPT Adjusting Entries Accruals and DeferralsDocumento36 páginasAnnotated 3.1 Q3 PPT Adjusting Entries Accruals and DeferralsenzobarnaoAinda não há avaliações

- Hire Purchase Excel TemplateDocumento6 páginasHire Purchase Excel TemplateShreeamar SinghAinda não há avaliações

- Compensation Canadian 5th Edition by Milkovich Newman and Yap ISBN Test BankDocumento13 páginasCompensation Canadian 5th Edition by Milkovich Newman and Yap ISBN Test Bankmichael100% (23)

- CashTOa JPDocumento11 páginasCashTOa JPDarwin LopezAinda não há avaliações

- Faks Borang Pemindahan Baki: Langkah 1Documento1 páginaFaks Borang Pemindahan Baki: Langkah 1Mazlan AmingAinda não há avaliações

- Case Study-ABAKADA CompanyDocumento3 páginasCase Study-ABAKADA CompanyDawn Juliana Aran100% (1)

- DK Goel Solutions For Class 11 Accountancy Chapter 11 Books of Original Entry - Cash BookDocumento51 páginasDK Goel Solutions For Class 11 Accountancy Chapter 11 Books of Original Entry - Cash BookjigyasuAinda não há avaliações

- Auditing The Investing and Financing Cycles PDFDocumento6 páginasAuditing The Investing and Financing Cycles PDFGlenn TaduranAinda não há avaliações

- DCM Shriram BS 2022Documento202 páginasDCM Shriram BS 2022Puneet367Ainda não há avaliações

- Lanbank vs. FastechDocumento14 páginasLanbank vs. FastechDANICA ECHAGUEAinda não há avaliações

- 2 Economics MAY 2019 AnswersDocumento10 páginas2 Economics MAY 2019 AnswersLala AlalAinda não há avaliações

- Eun 9e International Financial Management PPT CH06 AccessibleDocumento31 páginasEun 9e International Financial Management PPT CH06 AccessibleDao Dang Khoa FUG CTAinda não há avaliações

- Solved Jim and Andrea Kerslake Want To Open A Restaurant inDocumento1 páginaSolved Jim and Andrea Kerslake Want To Open A Restaurant inAnbu jaromiaAinda não há avaliações

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNo EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNota: 5 de 5 estrelas5/5 (6)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNo Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNota: 4.5 de 5 estrelas4.5/5 (3)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNo EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNota: 4.5 de 5 estrelas4.5/5 (8)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNo EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNota: 4.5 de 5 estrelas4.5/5 (17)

- Finance Basics (HBR 20-Minute Manager Series)No EverandFinance Basics (HBR 20-Minute Manager Series)Nota: 4.5 de 5 estrelas4.5/5 (32)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 4.5 de 5 estrelas4.5/5 (14)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetNo EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetNota: 5 de 5 estrelas5/5 (2)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelAinda não há avaliações

- Ready, Set, Growth hack:: A beginners guide to growth hacking successNo EverandReady, Set, Growth hack:: A beginners guide to growth hacking successNota: 4.5 de 5 estrelas4.5/5 (93)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNota: 4.5 de 5 estrelas4.5/5 (32)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamAinda não há avaliações

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNo EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNota: 4.5 de 5 estrelas4.5/5 (79)

- Financial Risk Management: A Simple IntroductionNo EverandFinancial Risk Management: A Simple IntroductionNota: 4.5 de 5 estrelas4.5/5 (7)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistNo EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistNota: 4 de 5 estrelas4/5 (32)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)No EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Nota: 4.5 de 5 estrelas4.5/5 (4)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNo EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNota: 4.5 de 5 estrelas4.5/5 (73)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsNo EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsNota: 5 de 5 estrelas5/5 (1)

- Joy of Agility: How to Solve Problems and Succeed SoonerNo EverandJoy of Agility: How to Solve Problems and Succeed SoonerNota: 4 de 5 estrelas4/5 (1)

- Value: The Four Cornerstones of Corporate FinanceNo EverandValue: The Four Cornerstones of Corporate FinanceNota: 4.5 de 5 estrelas4.5/5 (18)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionNo EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionNota: 5 de 5 estrelas5/5 (1)

- Creating Shareholder Value: A Guide For Managers And InvestorsNo EverandCreating Shareholder Value: A Guide For Managers And InvestorsNota: 4.5 de 5 estrelas4.5/5 (8)

- How to Measure Anything: Finding the Value of Intangibles in BusinessNo EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessNota: 3.5 de 5 estrelas3.5/5 (4)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNo EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNota: 4.5 de 5 estrelas4.5/5 (34)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityNo EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityNota: 4.5 de 5 estrelas4.5/5 (4)