Escolar Documentos

Profissional Documentos

Cultura Documentos

Solutions To November 2011 Cost Accounting and Financail Mangement Paper

Enviado por

rk_rkaushikTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Solutions To November 2011 Cost Accounting and Financail Mangement Paper

Enviado por

rk_rkaushikDireitos autorais:

Formatos disponíveis

SOLUTIONS TO NOVEMBER 2011 COST ACCOUNTING AND FINANCAIL MANGEMENT PAPER

CMA N RAVEENDRANATH KAUSHIK

MA,MPhil,MBA,ACMA,PG Tax Laws e-mail kaushik@accountspoint.com www.cmakaushik.blogspot.com

Ans1(a)

Calculation of Break Even Point (BEP)

BEP = Sales (MS Ratio X Sales)/100

MS Ratio = Margin of Safety

It is given in the problem MS Ratio = 40% and Sales Rs 5,00,000 Substituting in the formula above BEP = 5,00,000 (40%*5,00,000)/100 BEP (Rs.) = Rs, 3,00,000 BEP (Units) = Rs 3,00,000/1000(w1) = 300 units Sales in units to earn a Profit of 10% on Sales Let us assume Sales to be X, then Profit is 10% of X Sales = (Fixed Cost + Desired Profit)/ PV Ratio Sales is X, Desired Profit = 10%of X or 0.1X Fixed Cost to be found out and PV Ratio = 50% Computation of Fixed Cost Sales X PV Ratio = Profit + Fixed Cost Fixed Cost = Sales X PV Ratio Profit Fixed Cost = Rs,5,00,000 X 50% - Rs1,00,000(w2) Fixed Cost = Rs 1,50,000

SOLUTIONS TO NOVEMBER 2011 COST ACCOUNTING AND FINANCAIL MANGEMENT PAPER

CMA N RAVEENDRANATH KAUSHIK

MA,MPhil,MBA,ACMA,PG Tax Laws e-mail kaushik@accountspoint.com www.cmakaushik.blogspot.com

Substituting the values in the below formula for calculating Sales Sales = (Fixed Cost + Desired Profit)/ PV Ratio X = (Rs1,50,000+0.1X)/ 50% Solving for X, X = Rs 3,75,000 So, Sales is Rs 3,75,000 at desired profit of 10% on Sales Sales(in Units) = Rs3,75,000/1000 = 375 Units

Workings W1 Selling Price Per Unit = Rs.50000/500 = Rs 1000/unit W2 Profit = Margin of Safety X PV Ratio Profit = (Rs 500000x40%) X 50% Profit = Rs 1,00,000

Ans1 (b)

1) Rowan Premium Plan Calculation of Total Wages Normal Wages Rs 1200 (Rs120X10) DA for 15 days Bonus Rs 450 (30X15) Rs 240 (24X10) --------------------Total Wages Rs. 1890

SOLUTIONS TO NOVEMBER 2011 COST ACCOUNTING AND FINANCAIL MANGEMENT PAPER

CMA N RAVEENDRANATH KAUSHIK

MA,MPhil,MBA,ACMA,PG Tax Laws e-mail kaushik@accountspoint.com www.cmakaushik.blogspot.com

Computation of Bonus Hours Bonus Hours = (120X30)/150 = 24 Hours

2) Emmersions Efficiency method .

Normal Wages DA

Rs 1200 Rs 450 (30X15)

Bonus = (Time Allowed /Time Taken) X 100 = 150/120X100 = 125% Rate of Bonus up to 100% = 20% of Normal Wages Rate of Bonus 101% to 125% = 25% of Normal Wages So, total bonus is 45% (20%+25%) of Normal Wages Which is Rs 1200X45% = Rs 540 Total Wages = Normal Wages+DA+Total Bonus = Rs1200+Rs450+Rs540 Total Wages = Rs 2,190

SOLUTIONS TO NOVEMBER 2011 COST ACCOUNTING AND FINANCAIL MANGEMENT PAPER

CMA N RAVEENDRANATH KAUSHIK

MA,MPhil,MBA,ACMA,PG Tax Laws e-mail kaushik@accountspoint.com www.cmakaushik.blogspot.com

Ans. 1 (C)

Evaluation of Credit Policy

1) Calculation of Net Profit After Tax Sales Increase Less : Cost of Sales Rs1,20,000 (Rs1,02,000) [ 85% ] --------------Rs 18,000 Less : Bad Debts loss (Rs 12,000) [ 10% on sales ] --------------Rs.6,000 Less : 30% Tax Rs 1,800 --------------Net Profit After Tax Rs 4,200 ----- 1 2) Opportunity Cost of Investment In Receivables Rs 5,100 40% on Rs12,750* 3) Net Loss ( 1 2 ) (Rs 900)

-----

Decision : It is found that the estimated Profit after tax is less than the Opportunity Cost of Investment in Receivable, the proposal cannot be aceepted. Workings Calculation of Investment in Receivables = Cost of Sales/Receivable Turnover (times) = Rs1,02,000/8 = Rs 12,750 Receivable Turnover = 12 months/months of credit = 12/1.5 = 8times

SOLUTIONS TO NOVEMBER 2011 COST ACCOUNTING AND FINANCAIL MANGEMENT PAPER

CMA N RAVEENDRANATH KAUSHIK

MA,MPhil,MBA,ACMA,PG Tax Laws e-mail kaushik@accountspoint.com www.cmakaushik.blogspot.com

Ans 1 (d)

i) Calculation of Cost of Equity (Ke) Ke (after tax) = (DPS/MPS*100) + G DPS = Dividend Per Share MPS = Market Price Per Share G = Annual Growth Rate Given, DPS = 25% of Rs 4 = Re 1 MPS = Rs 40 and G= 8% Ke = (1/40X100) + 8 Ke 10.5% ii) Calculation of Cost of Debt (Kd) Kd (after tax) = (Interest/value of Debt) X100 (1-T) Interest = 10% of Rs2,00,000 =Rs20000 and 15% of Rs2.00.000 =Rs 30000 So, Interest = Rs 50,000 Value of Debt = Rs 4,00,000 and Taxrate =30% Kd = (50000/400000)X100(1-30%) Kd= 8.75% iii) Weighted Average Cost of Capital (WACC) Amount 1 6,00,000 4,00,000 Weights 2 0.6 0.4 Cost of Capital 3 .105 .0875 WACC (2X3) .063 .035

Equity Debt

WACC = .063+.035 = .098 = 9.8%

SOLUTIONS TO NOVEMBER 2011 COST ACCOUNTING AND FINANCAIL MANGEMENT PAPER

CMA N RAVEENDRANATH KAUSHIK

MA,MPhil,MBA,ACMA,PG Tax Laws e-mail kaushik@accountspoint.com www.cmakaushik.blogspot.com

Ans. 2 (a)

Absorbed Overhead = Actual Man days X Rate = Rs1,50,000 X50 = Rs 75,00,000 Under Absorption of Overheads = Actual Overheads Absorbed Overheads = Rs 79,00,000 Rs 75,00,000 = Rs 4,00,000 Defective Planning Rs 4,00,000 X 60% = Rs 2,40,000 Increase in Overhead Cost - Rs 4,00,000 X 40% = Rs 1.60,000 Treatment of Unabsorbed Overhead 1. Unabsorbed Overhead of Rs 2,40,000 due to Defective Planning is to be treated as abnormal loss and charged to Costing Profit and Loss Account. 2. Unabsorbed Overhead of Rs 1,60,000 due to Increase in Overhead Cost is to charged based on Supplementary Rate. Working of Supplementary Rate = Rs 1,60,000 / (30000+5000+50% 10000) = Rs 4/unit Unabsorbed overheads as below Cost of Sales Account = 30000unitsXRs4 = Rs 1,20,000 Finished Stock Account = 5000 units X Rs4= Rs 20,000 WIP Account = 5000 units X Rs4 = Rs 20,000

SOLUTIONS TO NOVEMBER 2011 COST ACCOUNTING AND FINANCAIL MANGEMENT PAPER

CMA N RAVEENDRANATH KAUSHIK

MA,MPhil,MBA,ACMA,PG Tax Laws e-mail kaushik@accountspoint.com www.cmakaushik.blogspot.com

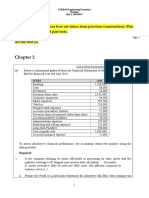

Ans. 2 (b)

i) Quick Ratio = Liquid Asset / Current Liabilities Liquid Asset = Current Asset Stock- Prepaid Expenses = Rs 30,50,000-Rs 21,60,000-Rs 10,000 = Rs 8,80,000 Quick Ratio = Rs 8,80,000/10,00,000 = .88 ii) Debt Equity Ratio = Long term debt / Shareholders Fund = Rs 16,00,000/ (Rs 20,00,000+ Rs 8,00,000) Debt Equity Ratio = .57 iii) Return on Capital Employed (ROCE) ROCE = (PBIT / Capital Employed) X100 = (Rs12,00,000/Rs 44,00,000) X 100 = 27.27% iv) Average Collection Period = (Sundry Debtors / Credit Sales) X 360 = (Rs 4,00,000 / Rs 32,00,000)X360 = 45 days

SOLUTIONS TO NOVEMBER 2011 COST ACCOUNTING AND FINANCAIL MANGEMENT PAPER

CMA N RAVEENDRANATH KAUSHIK

MA,MPhil,MBA,ACMA,PG Tax Laws e-mail kaushik@accountspoint.com www.cmakaushik.blogspot.com

Ans. 3 (a)

i) Statement of Equivalent Production

PARTICULARS Production Units completed Closing WIP Normal Loss 8% ** Total Less : Abnormal Loss Total

UNITS 1,58,000 18,000 15,200 1,91,200 1,200 1,90,000

MATERIAL (Units) 1 , 58 , 000 18,000 1, 76, 000 1, 200 1, 74, 000

LABOUR (Units) 1, 58, 000 12,600* 1, 70, 600 1, 200 1, 69, 400

* Working for Closing WIP of Labour 70% of 18000 = 12,600 units ** Working for Normal Loss = 8% of 190000units (1.82,000+8,000) = 15,200

ii) PARTICULARS WIP Opening Balance Materials Added Expenses Total Less Scrap Realised (Sale of Normal Loss items) Net Cost 1 Equivalent Units 2 Cost Per Unit ( 1 / 2) Rs / Unit

Cost Statement MATERIAL 63,900 7,56,900 8,20,800 1,21,600 LABOUR 10,800 3,28,000 3,38,800 (Amount in Rs.) OVERHEAD 5,400 1,64,000 1,69,400

6,99,000 1,74,800 4

3,38,800 1,69,400 2

1,69,400 1,69,400 1

So, Total Cost Per Unit = (Cost/ unit of Material+Labour+Overhead) = (Rs4+Rs3+Re1) = Rs7

SOLUTIONS TO NOVEMBER 2011 COST ACCOUNTING AND FINANCAIL MANGEMENT PAPER

CMA N RAVEENDRANATH KAUSHIK

MA,MPhil,MBA,ACMA,PG Tax Laws e-mail kaushik@accountspoint.com www.cmakaushik.blogspot.com

Ans. 3(b)

Total Assets = Rs 48,00,000 Total Assets Turnover Ratio = 2.5 Total Sales = Rs 48,00,000X 2.5 = Rs1,20,000 Computation of PAT Sales Less VC Rs 1,20,00,000 Rs 72,00,000 ************ Contribution Rs 48,00,000 Less Fixed Cost Rs 28,00,000 ************ Profit before Interest Rs. 20,00,000 Less Interest (15%) Rs 4,20,000 ************ PBT Rs. 15,80,000 Less Taxt 30% Rs. 4,74,000 ************ Profit After Tax (PAT) Rs. 11,06,000

Earning Per Share (EPS) = Profit available Equity Share Holders (PAT) ************************************** Number of Equity Shares Outstanding = 11,06,000 / 1,00,000 = Rs. 11.06

Degree of Combined Leverage = Contribution / PBT = Rs 48,00,000 / Rs15,80,000 = 3.04

SOLUTIONS TO NOVEMBER 2011 COST ACCOUNTING AND FINANCAIL MANGEMENT PAPER

CMA N RAVEENDRANATH KAUSHIK

MA,MPhil,MBA,ACMA,PG Tax Laws e-mail kaushik@accountspoint.com www.cmakaushik.blogspot.com

Ans. 4 (a)

Workings of Operating Cycle

Rawmaterial Period = Average Stock of Rawmaterial ie Opening+Closing)/2 -------------------------------------Daily Consumption of Rawmaterial = (1,80,000+2,00,000)/2 ---------------------------- = 63.33 Days 10,80,000/360

Conversion Period = Average WIP / Daily Average Production Cost = (60000+100000)/2 ----------------------- = 18.7 Days 1540000/360

Finished Goods Period = Average Finished Goods / Average cost of goods sold = (2,60,000 + 3,00,000)/2 ------------------------------ = 67.19 Days 15,00,000/360 Debtors Collection Period = Average Debtors / Daily Average Sales = (150000+200000)/2 ------------------------- = 31.5 Days 20,00,000 / 360 Creditors Payment Period = Average Creditors / Daily Average Pruchases = (2,00,000+2,40,000)/2 ----------------------------- = 72 Days 11,00,000/360 OPERATING CYCLE = Raw Material + WIP+Finished Goods+Debtors Creditors = 63.33+18.7+67.19+31.5-72 = 108.72 days

SOLUTIONS TO NOVEMBER 2011 COST ACCOUNTING AND FINANCAIL MANGEMENT PAPER

CMA N RAVEENDRANATH KAUSHIK

MA,MPhil,MBA,ACMA,PG Tax Laws e-mail kaushik@accountspoint.com www.cmakaushik.blogspot.com

Calculation of Working Capital

Cost of Production Add Administrative and Selling Expeneses Rs 15,00,000 (W1)

Rs 2,50,000 *********** Operating Expenses Rs 17,50,000

Working Capital Required = Operating Expenses / Number of Operating Cycle in a Year Number of Operating Cyle = Total Operating Cycle / 360 days in a year = 3.3 times So, Working Capital Required = Rs17,50,000/ 3.3 = Rs 5,28,541

Workings W 1 computation of Cost of Production Opening Stock of WIP Opening Stock of Finished Goods Add: Raw Material Consumed Rs 10,80,000 Wages Rs 3,00,000 Expenses Rs 2,00,000 ---------------Less : Closing Stock of WIP Closing Stock of Finished Goods Cost of Production Rs 60000 Rs 2,60,000

Rs.15,80,000 (Rs. 1,00,000) (Rs. 3,00,000) ----------------Rs 15,00,000

SOLUTIONS TO NOVEMBER 2011 COST ACCOUNTING AND FINANCAIL MANGEMENT PAPER

CMA N RAVEENDRANATH KAUSHIK

MA,MPhil,MBA,ACMA,PG Tax Laws e-mail kaushik@accountspoint.com www.cmakaushik.blogspot.com

Ans. 4 (b)

LEDGER ACCOUNTS Dr. Cr.

Stores Ledger Control Account

Particulars To Balance B/d To Cost Ledger Control a/c To WIP control a/c Amount (Rs.) 9, 000 48,000 24,000 Particulars By WIP Control A/c By Production Overhead control a/c By Costing Profit and Loss a/c (Stock ) By Balance C/d (balancing figure) Amount (Rs.) 48,000 6,000 1,800 25,200

81,000

81,000

Dr.

Cr.

Direct Wages Control Account

Particulars To Cost Ledger Control a/c Amount (Rs.) 21,000 Particulars By WIP Control A/c (Direct Wages) By Costing Profit and Loss a/c (balancing figure) Amount (Rs.) 18,000 3,000 21,000

21,000

Dr.

Cr.

WIP Control Account

Particulars To balance b/d To Stores Ledger Control a/c To Direct Wages Control a/c To Production OH control a/c Amount (Rs.) 18,000 48,000 18,000 72,000 1,56,000 Particulars By Stores Ledger Control A/c By Finished Stock control a/c (balancing figure) By Balance c/d Amount (Rs.) 24,000 1,20,000 12,000 1,56,000

SOLUTIONS TO NOVEMBER 2011 COST ACCOUNTING AND FINANCAIL MANGEMENT PAPER

CMA N RAVEENDRANATH KAUSHIK

MA,MPhil,MBA,ACMA,PG Tax Laws e-mail kaushik@accountspoint.com www.cmakaushik.blogspot.com

Dr.

Cr.

Production Overhead Control Account

Particulars To Stores Ledger Control a/c To Cost Ledger Control a/c Amount (Rs.) 6,000 75,000 Particulars By WIP Control A/c (Overheads) By Costing Profit and Loss a/c (balancing figure) Amount (Rs.) 72,000 9,000

81,000

81,000

Dr.

Cr.

Costing Profit and Loss Account

Particulars To Cost of Sales a/c To Direct Wages control a/c To OH control a/c To Stores Ledger control a/c Amount (Rs.) 1,20,000 3,000 9,000 18,000 1,33,800 * Rs 1,20000 * 10% Particulars By Cost Ledger control a/c * By Cost Ledger control a/c (balancing figure - Loss) Amount (Rs.) 1,32,000 1,800

1,33,800

SOLUTIONS TO NOVEMBER 2011 COST ACCOUNTING AND FINANCAIL MANGEMENT PAPER

CMA N RAVEENDRANATH KAUSHIK

MA,MPhil,MBA,ACMA,PG Tax Laws e-mail kaushik@accountspoint.com www.cmakaushik.blogspot.com

Ans. 6 (a) Working of annual saving in cash

Machine X Savings Wages Scrap realization Savings Less : Cash Outflow Materials Supervision Maintenance Annual Cash Saving Less Depreciation * Rs 30,000 -------------Rs 45,000 Rs 13,500 ------------Rs 31,500 Rs 30,000 ------------Rs 61,500 Rs 40,000 ---------------Rs 60,000 Rs. 18,000 -------------Rs 42,000 Rs.40,000 -------------Rs 82,000 Rs 90,000 Rs 10,000 -------------Rs 1,00,000 Machine Y Rs 1,20,000 Rs 15,000 -------------Rs 1,35,000

(Rs 6,000) (Rs 12,000) (Rs 7,000) -------------Rs 75,000

(Rs. 8,000) (Rs. 16,000) (Rs. 11,000) --------------Rs . 1,00,000

Less Tax 30%

Add : Depteciation Annual Cash Inflow Average Rate of Return Method

Machine X ARR = Average Annual Savings ------------------------------X100 Average Investment 31,500 -----------X100 75,000

Machine Y 42,000 ---------X100 1,20,000

Machine X to be chosen

42%

35%

SOLUTIONS TO NOVEMBER 2011 COST ACCOUNTING AND FINANCAIL MANGEMENT PAPER

CMA N RAVEENDRANATH KAUSHIK

MA,MPhil,MBA,ACMA,PG Tax Laws e-mail kaushik@accountspoint.com www.cmakaushik.blogspot.com

Present Value Index Method

PV = Annual Cash InflowX PV factor Machine X = Rs 61,500 X 3.79 = Rs 2,33,085 (5 years) Machine Y = Rs 82,000 X 4.354 = Rs 3.57,028 (6 years) Machine X PV Index = Present Value / Investment 2,33,085 -----------1,50,000 = 1.55 MACHINE X IS PREFERRED Machine Y 3,57,028 -----------2,40,000 = 1.47

Ans. 6 (b)

Calculation of Material Cost Variance MCV = Actual Production (on standard) Material Usage = 48000*10*10 Rs 5,25,000 = Rs 45000 (Unfavorable) Calculation of Labour Cost Variance LCV = Actual production (on standard) - Labour Paid = 48000*6*5.50- Rs 1,55,000 = Rs. 3,400 Favorable

SOLUTIONS TO NOVEMBER 2011 COST ACCOUNTING AND FINANCAIL MANGEMENT PAPER

CMA N RAVEENDRANATH KAUSHIK

MA,MPhil,MBA,ACMA,PG Tax Laws e-mail kaushik@accountspoint.com www.cmakaushik.blogspot.com

Calculation of Fixed Overhead Cost Variance FOCV = Fixed Overhead (at standard) Actual Fixed cost = 48000*Rs90 Rs 4,70,000 = Rs 38,000 (Unfavorable) Fixed Over head Rate = 30000labour hours/6hours = 5000units Fixed Overhead rate = Fixed OH cost/Units = Rs 4,50,000/5000 = Rs 90

Calculation of Variable Overhead Cost Variance

VOCV= Variable OH (at standard) Actual OH = (48000X6X10) 2,93,000 = Rs 5000 (Unfavorable)

Você também pode gostar

- Paper: Cost Accounting and Financial Management: Raveendranath Kaushik & Associates Cost AccountantDocumento13 páginasPaper: Cost Accounting and Financial Management: Raveendranath Kaushik & Associates Cost Accountantrk_rkaushikAinda não há avaliações

- Pravinn Mahajan CA Ipcc Cost & FM Nov 2011 SolutionDocumento15 páginasPravinn Mahajan CA Ipcc Cost & FM Nov 2011 SolutionPravinn_MahajanAinda não há avaliações

- IPCC Cost Accounting Financial Management Guideline Answer Nov 2015 ExamDocumento12 páginasIPCC Cost Accounting Financial Management Guideline Answer Nov 2015 ExamSushant Saxena100% (1)

- Assignment Acct.Documento9 páginasAssignment Acct.Dagmawit NegussieAinda não há avaliações

- FMA Assg 1Documento8 páginasFMA Assg 1Dagmawit NegussieAinda não há avaliações

- Final Solution Winter 2017Documento27 páginasFinal Solution Winter 2017sunkenAinda não há avaliações

- ADL 56 Cost & Managerial AccountingDocumento23 páginasADL 56 Cost & Managerial AccountingAshish Rampal0% (1)

- FM Solved PapersDocumento83 páginasFM Solved PapersAjabba87% (15)

- CA IPCC Costing Guideline Answers May 2015 PDFDocumento20 páginasCA IPCC Costing Guideline Answers May 2015 PDFanupAinda não há avaliações

- DepreciationDocumento18 páginasDepreciationAhmad Hafiz100% (1)

- Suggested SolutionsDocumento7 páginasSuggested SolutionsSunder ChaudharyAinda não há avaliações

- Module-5 Valuation Concepts (EVA, MVA)Documento19 páginasModule-5 Valuation Concepts (EVA, MVA)vinit PatidarAinda não há avaliações

- Cost - and - Management - Accounting June 23 - Assignment AnswersDocumento5 páginasCost - and - Management - Accounting June 23 - Assignment AnswersKhushiAinda não há avaliações

- Wef2012 Pilot MAFDocumento9 páginasWef2012 Pilot MAFdileepank14Ainda não há avaliações

- P1 May 2010 Answers + Brief GuideDocumento12 páginasP1 May 2010 Answers + Brief GuidemavkaziAinda não há avaliações

- DAIBB MA Math Solutions 290315Documento11 páginasDAIBB MA Math Solutions 290315arman_277276271Ainda não há avaliações

- Solution AccountDocumento12 páginasSolution Accountbikaspatra89Ainda não há avaliações

- Ch8 LongDocumento14 páginasCh8 LongratikdayalAinda não há avaliações

- Marginal CostingDocumento10 páginasMarginal Costinganon_672065362Ainda não há avaliações

- Answer To MTP - Intermediate - Syllabus 2012 - Dec2014 - Set 1Documento16 páginasAnswer To MTP - Intermediate - Syllabus 2012 - Dec2014 - Set 1Crizhae OconAinda não há avaliações

- Bmmf5103 861024465000 Managerial Finance - RedoDocumento14 páginasBmmf5103 861024465000 Managerial Finance - Redomicu_san100% (1)

- Cost-Volume-Profit Relationships 2Documento57 páginasCost-Volume-Profit Relationships 2Princess Jay NacorAinda não há avaliações

- Cost and Management AccountingDocumento9 páginasCost and Management AccountingFlora ChauhanAinda não há avaliações

- Cost and Management Accounting June 2023Documento8 páginasCost and Management Accounting June 2023Shalaka YadavAinda não há avaliações

- Corporate FinanceDocumento7 páginasCorporate FinanceNeev JoganiAinda não há avaliações

- Fundamental of AccountingDocumento147 páginasFundamental of AccountingLakshman Rao0% (1)

- Activity Based CostingDocumento49 páginasActivity Based CostingEdson EdwardAinda não há avaliações

- CVP BEP Analysis. Assignments, (In Class) : RequiredDocumento3 páginasCVP BEP Analysis. Assignments, (In Class) : Requiredmuhammed shadAinda não há avaliações

- Assignment 2Documento8 páginasAssignment 2chandu1113100% (2)

- Engineering Economics RevisionDocumento43 páginasEngineering Economics RevisionDanial IzzatAinda não há avaliações

- FinMan A2Documento7 páginasFinMan A2bugzmioAinda não há avaliações

- MANACC - NotesW - Answers - BEP - The Master BudgetDocumento6 páginasMANACC - NotesW - Answers - BEP - The Master Budgetldeguzman210000000953Ainda não há avaliações

- MTP Soln 1Documento14 páginasMTP Soln 1Anonymous 8wg4eowIdzAinda não há avaliações

- Financial Management - Notes NumericalsDocumento6 páginasFinancial Management - Notes NumericalsSandeep SahadeokarAinda não há avaliações

- Numerical Problems PDFDocumento31 páginasNumerical Problems PDFciljokmoncyAinda não há avaliações

- COEB442 - Sem - 2 - 2015-2016 RevisionDocumento37 páginasCOEB442 - Sem - 2 - 2015-2016 RevisionNirmal ChandraAinda não há avaliações

- CA FINAL SFM Solution Nov2011Documento15 páginasCA FINAL SFM Solution Nov2011Pravinn_MahajanAinda não há avaliações

- 29 Problems and Solution CostingDocumento70 páginas29 Problems and Solution CostingNavin Joshi70% (10)

- BMAC5203 Assignment Jan 2015 (Amended)Documento6 páginasBMAC5203 Assignment Jan 2015 (Amended)Robert WilliamsAinda não há avaliações

- Economic AnalysisDocumento10 páginasEconomic AnalysismanueltsibiaAinda não há avaliações

- Responsibility Accounting and Transfer PricingDocumento26 páginasResponsibility Accounting and Transfer PricingfoglaabhishekAinda não há avaliações

- Answer To PTP - Intermediate - Syllabus 2012 - Jun2014 - Set 2Documento16 páginasAnswer To PTP - Intermediate - Syllabus 2012 - Jun2014 - Set 2ankitshah21Ainda não há avaliações

- ULO A Analyze Act1Documento5 páginasULO A Analyze Act1Marian B TersonaAinda não há avaliações

- Cost and Management AccountingDocumento12 páginasCost and Management Accountingrishabhsharma.p22Ainda não há avaliações

- Final Managerial 2013 SolutionDocumento6 páginasFinal Managerial 2013 SolutionRanim HfaidhiaAinda não há avaliações

- Ratio AnalysisDocumento2 páginasRatio Analysisswapnil choubeyAinda não há avaliações

- CMA April - 14 Exam Question SolutionDocumento55 páginasCMA April - 14 Exam Question Solutionkhandakeralihossain50% (2)

- CheatSheet 3FF3Documento1 páginaCheatSheet 3FF3Muntaha Rahman MayazAinda não há avaliações

- UNIT 3 Tutorial Q & ADocumento14 páginasUNIT 3 Tutorial Q & AAlicia AbsolamAinda não há avaliações

- FM Eco Full Test 1 Unscheduled Nov 2023 Solution 1691563701Documento34 páginasFM Eco Full Test 1 Unscheduled Nov 2023 Solution 1691563701Srushti AgarwalAinda não há avaliações

- Assigment Management AccountingDocumento7 páginasAssigment Management Accountingpuiyan0314Ainda não há avaliações

- Cpa Review School of The Philippines: Management Advisory Services AGE OFDocumento9 páginasCpa Review School of The Philippines: Management Advisory Services AGE OFJohn Carlo CruzAinda não há avaliações

- CVP AnalysisDocumento41 páginasCVP AnalysisAbdulyunus Amir100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsAinda não há avaliações

- CPA Review Notes 2019 - BEC (Business Environment Concepts)No EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Nota: 4 de 5 estrelas4/5 (9)

- Rural Livestock AdministrationNo EverandRural Livestock AdministrationAinda não há avaliações

- Business Metrics and Tools; Reference for Professionals and StudentsNo EverandBusiness Metrics and Tools; Reference for Professionals and StudentsAinda não há avaliações

- Macauro: Internet Banking-Benefits and ChallengesDocumento5 páginasMacauro: Internet Banking-Benefits and Challengesrk_rkaushikAinda não há avaliações

- Newsletter August2016Documento5 páginasNewsletter August2016rk_rkaushikAinda não há avaliações

- Governance and Social Responsibility Models in Ancient IndiaDocumento13 páginasGovernance and Social Responsibility Models in Ancient Indiark_rkaushik100% (1)

- Newsletter October 2016Documento5 páginasNewsletter October 2016rk_rkaushikAinda não há avaliações

- Macauro: Tourism in India: Innovation and DevelopmentDocumento5 páginasMacauro: Tourism in India: Innovation and Developmentrk_rkaushikAinda não há avaliações

- Newsletter Jan 2016Documento5 páginasNewsletter Jan 2016rk_rkaushikAinda não há avaliações

- Macauro: Emerging Trends in Banking - Challenges and OpportunitiesDocumento4 páginasMacauro: Emerging Trends in Banking - Challenges and Opportunitiesrk_rkaushikAinda não há avaliações

- Revised Schedule VI 28feb2011Documento23 páginasRevised Schedule VI 28feb2011Thameem Ul AnsariAinda não há avaliações

- Macauro: Consumer Awareness & Attitude Towards Green MarketingDocumento6 páginasMacauro: Consumer Awareness & Attitude Towards Green Marketingrk_rkaushikAinda não há avaliações

- Macauro: Agricultural Business Awareness To Farmers and IndiansDocumento4 páginasMacauro: Agricultural Business Awareness To Farmers and Indiansrk_rkaushikAinda não há avaliações

- Full Lengthpaper PESITDocumento9 páginasFull Lengthpaper PESITrk_rkaushikAinda não há avaliações

- CSR - Role of AuditorsDocumento7 páginasCSR - Role of Auditorsrk_rkaushikAinda não há avaliações

- ICWAI Inter Direct Tax Solved June 2011Documento15 páginasICWAI Inter Direct Tax Solved June 2011rk_rkaushikAinda não há avaliações

- The Indian Tax Scenario - Part 1Documento5 páginasThe Indian Tax Scenario - Part 1rk_rkaushikAinda não há avaliações

- Central Sales TaxDocumento1 páginaCentral Sales TaxÑîtîƞ ĢágâƞAinda não há avaliações

- (Year) : Amendments Vide Finance Act, 2010 On "Direct Tax"Documento16 páginas(Year) : Amendments Vide Finance Act, 2010 On "Direct Tax"peyala_sudhirAinda não há avaliações

- Central Excise ActDocumento6 páginasCentral Excise ActRakesh BhagatAinda não há avaliações

- Transfer PricingDocumento82 páginasTransfer Pricingrk_rkaushik100% (1)

- Eco-Agri Tourism - Emerging Business OpportunityDocumento10 páginasEco-Agri Tourism - Emerging Business Opportunityrk_rkaushikAinda não há avaliações

- Arun LamsalDocumento50 páginasArun LamsalSmith TiwariAinda não há avaliações

- Accounts - Module 6 Provisions of The Companies Act 1956Documento15 páginasAccounts - Module 6 Provisions of The Companies Act 19569986212378Ainda não há avaliações

- Test Bank For Advanced Accounting 7th by JeterDocumento15 páginasTest Bank For Advanced Accounting 7th by Jeteracetize.maleyl.hprj100% (50)

- IFP From ScotiaDocumento11 páginasIFP From ScotiaForexliveAinda não há avaliações

- STI Education Systems Holdings Inc.: (Amount in Philippine Pesos)Documento20 páginasSTI Education Systems Holdings Inc.: (Amount in Philippine Pesos)chenlyAinda não há avaliações

- Sicav Annual Report Final Audited and Signed 2021Documento465 páginasSicav Annual Report Final Audited and Signed 2021sirinekadhi7Ainda não há avaliações

- Chapter 08 Unregulated CorpDocumento15 páginasChapter 08 Unregulated Corpmehrabshawn50% (2)

- Aud Quiz No.3Documento3 páginasAud Quiz No.3Clarice GonzalesAinda não há avaliações

- Al Khidmat Foundation Pakistan Audit & Compliance DepartmentDocumento2 páginasAl Khidmat Foundation Pakistan Audit & Compliance DepartmentFarooq Maqbool100% (1)

- AF0101 - Assignment 2 (Part 3) S2 2023Documento3 páginasAF0101 - Assignment 2 (Part 3) S2 2023Doreen RovesiAinda não há avaliações

- Assignment - SolutionDocumento15 páginasAssignment - SolutionWang Hon YuenAinda não há avaliações

- Lai Final PT Bk-2016 Final OkDocumento75 páginasLai Final PT Bk-2016 Final Okdeborah rumateAinda não há avaliações

- Intro S4HANA Using Global Bike Exercises FI GUI en v3.3Documento6 páginasIntro S4HANA Using Global Bike Exercises FI GUI en v3.3Tuệ Nguyễn Ngọc GiaAinda não há avaliações

- Cash Flow and Financial Planning: Learning GoalsDocumento69 páginasCash Flow and Financial Planning: Learning GoalsJully GonzalesAinda não há avaliações

- Ugbs Accounting For Investment in Associate and Joint VentureDocumento30 páginasUgbs Accounting For Investment in Associate and Joint VentureStudy GirlAinda não há avaliações

- Financial Analysis ProjectDocumento11 páginasFinancial Analysis ProjectCharles TulipAinda não há avaliações

- Exercise No.3 (Acctg 7) - TanDocumento2 páginasExercise No.3 (Acctg 7) - TanFaith Reyna TanAinda não há avaliações

- Afm 1Documento20 páginasAfm 1antrikshaagrawalAinda não há avaliações

- EY Engineering and Construction Internal Audit Benchmarking StudyDocumento44 páginasEY Engineering and Construction Internal Audit Benchmarking StudyNaveen BansalAinda não há avaliações

- MC200912013 GSFM7514Documento6 páginasMC200912013 GSFM7514Yaga KanggaAinda não há avaliações

- Objectives of AuditDocumento11 páginasObjectives of AuditpoojaAinda não há avaliações

- FABM2 Q2 Mod10Documento16 páginasFABM2 Q2 Mod10Fretty Mae AbuboAinda não há avaliações

- Garcia'S Data Encoders Trial Balance MAY Account Title Debit CreditDocumento4 páginasGarcia'S Data Encoders Trial Balance MAY Account Title Debit CreditChristel TacordaAinda não há avaliações

- SearchDocumento3 páginasSearchMelwin jay mabanagAinda não há avaliações

- 8215 Almagtome 2019 E R1Documento21 páginas8215 Almagtome 2019 E R1Gabriela LFAinda não há avaliações

- Journal Entries ServiceDocumento4 páginasJournal Entries ServiceJasmine ActaAinda não há avaliações

- BUS707 Assessment 3 Structured Literature Review - Aasi - EditedDocumento9 páginasBUS707 Assessment 3 Structured Literature Review - Aasi - EditedFarheen AhmedAinda não há avaliações

- Module 6 - Operating SegmentsDocumento3 páginasModule 6 - Operating SegmentsChristine Joyce BascoAinda não há avaliações

- P3 2A AnswerDocumento2 páginasP3 2A AnswerMinh NhậtAinda não há avaliações

- Candidate Guide To Practical ExperienceDocumento45 páginasCandidate Guide To Practical ExperiencekautiAinda não há avaliações