Escolar Documentos

Profissional Documentos

Cultura Documentos

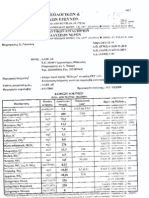

OIKOI ΠΙΣΤΟΛΗΠΤΙΚΗΣ ΑΞΙΟΛΟΓΗΣΗΣ: ΕΚΚΡΕΜΕΙΣ ΔΙΚΕΣ 2011

Enviado por

Dr. KIRIAKOS TOBRAS - ΤΟΜΠΡΑΣTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

OIKOI ΠΙΣΤΟΛΗΠΤΙΚΗΣ ΑΞΙΟΛΟΓΗΣΗΣ: ΕΚΚΡΕΜΕΙΣ ΔΙΚΕΣ 2011

Enviado por

Dr. KIRIAKOS TOBRAS - ΤΟΜΠΡΑΣDireitos autorais:

Formatos disponíveis

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

U.S. SEC may recommend S&P lawsuit

The Associated Press Posted: Sep 26, 2011 9:25 AM ET

The U.S. Securities and Exchange Commission is considering suing Standard & Poor's over its rating of a 2007 collateralized debt offering Jonathan Ernst/Reuters

The staff of the U.S. Securities and Exchange Commission is considering recommending civil legal action against the Standard & Poor's debt ratings agency over its rating of a 2007 collateralized debt offering. Collateralized debt obligations, also known as CDOs, are securities tied to multiple underlying mortgage loans. The CDO generally gains value if borrowers repay. But if borrowers default, CDO investors lose money. Soured CDO's have been blamed for making the 2008 financial crisis worse. Ratings agencies have been accused of being lax in rating CDOs. The SEC staff said it may recommend that the commission seek civil money penalties, disgorgement of fees or other actions.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

S&P has been under fire for its recent downgrade of U.S. debt, as well as several bad calls it made leading up to the financial crisis and economic meltdown that began in 2008. The unit's president stepped down last month. McGraw-Hill Cos., which owns S&P, said Monday that it received a Wells Notice from the SEC's staff on Thursday. In issuing Wells notices, the SEC enforcement staff gives companies the chance to make the case why charges are unwarranted. That means a formal decision by SEC commissioners to file charges may not occur. S&P said it has been co-operating with the commission and plans to continue co-operating on the matter. The news comes two weeks after McGraw-Hill announced that it plans to split up into two public companies with one focused on education and the other centred on markets, featuring the Standard & Poor's unit. The decision had been expected, as investors have pushed the New York company to boost the company's stock price, which has dropped by more than 40 per cent since 2006. McGraw-Hill Education will be the new company focused on education services and digital learning, while McGraw-Hill Markets will retain S&P and J.D. Power and Associates, a market research company. It also includes S&P Capital IQ, a provider of data, research, benchmarks and analytics and Platts, a provider of information and indices in energy, petrochemicals and metals. McGraw-Hill was founded by James H. McGraw in 1888 when he purchased the company's first publication, The American Journal of Railway Appliances. Since then, the company has provided technical and trade publications, as well as information and analysis on global markets.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI Banks and Finance

S&P under threat of lawsuit over CDOs

US regulators have stepped up their investigation into the role played by Standard & Poor's in the financial crisis, the ratings agency has warned.

The SEC is targeting a collateralised debt obligation (CDO) called 'Delphinus CDO 2007-1' that S&P rated. Photo: EPA

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

S&P Parent McGraw-Hill, Moodys Tumble on Lawsuit (Update1)

By Pierre Paulden - September 3, 2009 16:49 EDT

Sept. 3 (Bloomberg) -- McGraw-Hill Cos., the owner of Standard & Poors, dropped the most in nine months and Moodys Corp. also fell after a U.S. judge refused to dismiss a lawsuit against the rating companies. U.S. District Judge Shira Scheindlin in New York rejected yesterday the firms arguments that investors cant sue over deceptive ratings of private-placement notes because those opinions are protected by free-speech rights. The decision forces S&P, Moodys and Morgan Stanley, which was also sued, to respond to fraud charges in a classaction by investors claiming the raters hid the risks of securities linked to subprime mortgages. Defaults on the debt ignited a credit crisis that has led to more than $1.6 trillion in writedowns and losses since the start of 2007. The fate of the major rating companies may be determined by the courts rather than Congress or regulators, said Jerome Fons, a New York-based consultant and former Moodys managing director for credit policy who left the firm in August 2007. There are so many suits outstanding, if they lost a major case all bets are off. The floodgates will be open. McGraw-Hill tumbled $3.30, or 10 percent, to $29.01 in New York Stock Exchange composite trading, its steepest decline since Dec. 1. Moodys declined $1.84, or 7.1 percent, to $24.26. Earlier the two stocks fell as much as 12 percent. Senators Criticism

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Moodys and S&P, both based in New York, have been criticized by investors and lawmakers including Senate Banking Committee Chairman Christopher Dodd, who has said the companies wrongly assigned top credit rankings to U.S. subprime-mortgage bonds just before that market collapsed in 2007. The companies have fought lawsuits by arguing that the letter grades they assign to bonds to predict the risk of default are opinions protected by the First Amendment of the Constitution. The ruling has struck a note of fear into people, Edward Atorino, an analyst at Benchmark Co. in New York, said in an interview. It could be a very serious problem. The reaction of the market tells you it came out of left field. McGraw-Hill and Moodys shares have outperformed the market this year as bond issuance has picked up faster than people anticipated, Atorino said. McGraw-Hill rose 25 percent this year, while Moodys gained 21 percent and the S&P 500 Index increased 11 percent. Following Advice The ruling may affect Fitch Ratings and other credit rankings firms that have made similar arguments after investors lost money following their advice on subprime and other asset- backed investments. The courts ruling was posted on the judges docket after U.S. markets closed yesterday. Its the first major ruling upholding fraud allegations against an arranger and the rating agencies on the instruments that are at the heart of the financial crisis, said Patrick Daniels, a lawyer at Coughlin Stoia Geller Rudman Robbins LLP, the San Diego-based securities litigation firm that represented investors in the case.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

In previous cases, Daniels said, the ratings companies would hide behind First Amendment protection, saying they were merely reporting their opinion. Scheindlin said in her ruling that the First Amendment of the U.S. Constitution doesnt provide a defense in the case because the rating firms comments were distributed privately to a select group of investors and not to the general public. Enough Facts Without ruling on the merits of the lawsuit, the judge said opinions by the ratings companies may be the basis for a lawsuit if the speaker does not genuinely and reasonably believe it or if it is without basis in fact. She said there are enough facts alleged against the two rating companies and Morgan Stanley, the sixth-biggest U.S. bank by assets, for the lawsuit to go forward with evidence gathering needed for any trial. According to Daniels, Scheindlin rejected the First Amendment claim because the rating firms opinions are an essential component of private-placement transactions in which securities are sold directly to institutional or private investors without a public offering. The case concerns notes issued by Cheyne Finance Plc, a socalled structured investment vehicle that collapsed in 2007. It received the highest credit ratings ever given to capital notes, according to the ruling. SIVs issued short-term debt to fund purchases of higher-yielding long-term notes and failed when credit dried up amid the financial crisis. Investor Claims

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

The rating companies worked directly with Morgan Stanley to structure the notes, and their own compensation was based on the notes receiving the desired ratings, according to the order. The ratings companies were paid more than three times their normal fees, the judge said. The value of the notes collapsed during the worst economic slump in decades, making repayment of the debt impossible as it came due, according to the ruling. The notes were liquidated at discounted prices, leaving investors with a fraction of their investment or with notes that were worthless, according to the opinion. The investors sued based on fraud, negligence and contract claims to recover their losses. Morgan Stanley, as the arranger and placement agent for the notes, distributed documents to investors that included Moodys and S&Ps ratings, according to the ruling. Plaintiffs These ratings, or opinions, are too deeply embedded throughout our financial structure, saidGene Phillips, a director at PF2 Securities Evaluations Inc., an advisory firm in New York. We cannot continue to so heavily base our financial regulatory framework on ratings, especially if theyre purely opinions without ramifications for being wrong, said Phillips. The lawsuit was filed by Abu Dhabi Commercial Bank, based in the United Arab Emirates, and Washingtons King County, which includes Seattle. The plaintiffs, seeking classaction status, filed the complaint on behalf of themselves and other investors. Scheindlin dismissed all claims against Bank of New York Mellon Corp. Edward Sweeney, a spokesman for S&P in New York, said the company is pleased that Scheindlin dismissed all but one of 11 claims in the suit.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

We are confident that we will prevail on the remaining claim, Sweeney said. Jennifer Sala, a Morgan Stanley spokeswoman, declined to comment. We Are Confident We are pleased that the court dismissed all but one of the claims against Moodys, said Michael Adler, a spokesman for Moodys in New York. We are confident that the remaining claim will be dismissed once the court has been presented with facts, not just plaintiff allegations. In July, the California Public Employees Retirement System, the largest U.S. public pension fund, sued Moodys, S&P and Fitch in state court in San Francisco for $1 billion in losses over wildly inaccurate risk assessments. The companies face a similar lawsuit, filed in federal court in Sacramento, California, over bond ratings. The case is Abu Dhabi Commercial Bank and King County, Washington v. Morgan Stanley, 08-7508, U.S. District Court, Southern District of New York (Manhattan). To contact the reporter on this story: Pierre Paulden in New York at ppaulden@bloomberg.net. To contact the editor responsible for this story: Alan Goldstein at agoldstein5@bloomberg.net.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

S&P Sued by Ex-Ratings Manager for Targeting Women in Job Cuts

By Elliot Blair Smith - March 23, 2009 00:01 EDT

March 23 (Bloomberg) -- Rosario Buendia, a former managing director in Standard & Poors structured-finance ratings group, says in a lawsuit that McGraw-Hill Cos. discriminated against women in reorganizing the bondrating subsidiarys leadership. Since credit markets collapsed in August 2007, S&P has replaced at least five female executives with men, according to the complaint filed on March 6 in New York State Supreme Court. The dismissals allegedly came as the parent company announced four rounds of job cuts at S&P eliminating 512 positions. McGraw-Hill favored male employees and discriminated against women, according to Buendias complaint, which says she was paid considerably less than her male counterparts, despite her exemplary performance. Buendia seeks $5 million in compensatory damages and a $15 million punitive award. Financial institutions are cutting jobs as they reel from $1.3 trillion of subprime mortgage-related writedowns and losses. The economic contraction disguises the growing trend by companies of using job reductions to cover up the discriminatory treatment of women, minorities and older workers, says New York labor attorney Douglas Wigdor. McGraw-Hill, based in New York, says Buendias lawsuit is unfounded.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

As a company recognized for treating employees fairly and valuing the contributions of its workforce, we believe this suit to be without merit and will defend against it vigorously, company spokesman Frank Briamonte said in a statement. S&P Executive Vice President Vickie Tillman remains in the No. 2 job at the McGraw-Hill subsidiary, overseeing its ratings business and reporting to current President Deven Sharma. Structured Finance Joanne Rose, the former head of structured finance, was reassigned in January 2008 to a new job as executive managing director for risk and quality policy, the company announced at the time. Structured securities are pools of debt, including subprime loans made to the least creditworthy borrowers. While S&P doesnt report employment by gender, female executives who have been replaced include former company President Kathleen Corbet, a head of human resources and the general counsel for ratings, according to Buendias complaint. At least three other female managing directors in S&Ps structured-finance business have had their company phone numbers disconnected, and a switchboard operator said the women were no longer listed. McGraw-Hill wouldnt comment on their status. Buendia, 43, and attorney Matthew Schatz of the Schwartz & Perry LLP law firm in New York declined to comment when reached by telephone. Pay Study The female executive team that once led S&Ps ratings business was an exception in an industry where women occupy about 8 percent of the best-paid jobs at financial

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

companies with more than $1 billion in assets, according to a study for Bloomberg by Equilar Inc., a Redwood Shores, California-based pay consultant. Equilar prepared the analysis, based on the 2008 proxy filings of publicly held corporations, for this story. The median annual compensation for the best-paid women was 30 percent less than the $797,774 for men, Equilar reported. While the financial services industry has cut 292,000 jobs since peak employment in December 2006, women still account for their traditional share of almost two out of three industry positions, according to the federal Bureau of Labor Statistics. Women managers are losing jobs disproportionately, according to attorney Wigdor, who says he is litigating gender- based claims against New York-based Citigroup Inc. and a U.S. unit of Tokyo-based Mitsubishi UFJ Financial Group Ltd. Citigroup Jobs Women formerly held about 10 percent of the managerial jobs in Citigroups public finance business and have borne about 45 percent of the units job cuts since November, Wigdor says. Citigroup spokeswoman Danielle Romero-Apsilos says the reduction was done fairly and lawfully and was based on legitimate business reasons unrelated to gender. Citigroup doesnt disclose the gender makeup of its workforce and hasnt quantified the job cuts publicly, Romero-Apsilos says. Peter Walker, an attorney at the Seyfarth Shaw LLP law firm in New York, who represents Mitsubishis Bank of Tokyo unit, said he had no comment on Wigdors genderdiscrimination claim.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Buendias lawsuit against McGraw-Hill says that she was unlawfully terminated on Aug. 11 from her job overseeing S&Ps global business of rating asset-backed securities, which are investment pools of home mortgages, equity lines and credit card debt. Buendia and two other female executives lost their jobs in the structured-finance unit that day, along with a male executive who subsequently was rehired, the lawsuit states. S&P Profit Falls Ratings on structured investments were the largest source of the bond-analysis firms profit and revenue growth for most of this decade, according to McGraw-Hill financial statements. Last year, as credit markets slowed, S&Ps operating profit fell 22 percent to $1.1 billion on a 13 percent drop in revenue. S&Ps largest competitor, New York-based Moodys Corp., reduced its U.S. head count by 45 jobs last year, or 2.1 percent, according to the companys annual financial report. S&P and Moodys contributed to credit market losses because they produced flawed ratings, according to congressional testimony and a Securities and Exchange Commission report. The gender-discrimination lawsuit is Rosario Buendia vs. The McGraw-Hill Cos., Supreme Court of the State of New York, County of New York, Docket No. 103197/2009. To contact the reporter on this story: Elliot Blair Smith in Washington, D.C., atesmith29@bloomberg.net To contact the editor responsible for this story: Robert L. Simison in Washington atrsimison@bloomberg.net

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Bloomberg

Moodys, Fitch, S&P Must Face New Mexico Securities Lawsuit

October 03, 2011, 7:01 PM EDT

By Edvard Pettersson

(Updates with comment by Moodys in eighth paragraph.) Oct. 3 (Bloomberg) -- Moodys Corp., Fitch Inc. and Standard & Poors must face claims in a lawsuit brought by investors in mortgage-backed securities that they violated New Mexico securities law. U.S. District Judge James O. Browning in Albuquerque, New Mexico, in a Sept. 30 order denied the rating companies request to dismiss the claim against them. The judge didnt provide his reasons for the ruling, saying he will issue a detailed opinion later. The plaintiffs, led by the Maryland-National Capital Park & Planning Commission Employees Retirement and the Midwest Operating Engineers Pension Trust Fund, filed an amended complaint in December 2010, seeking to represent other investors in $5 billion of Thornburg Mortgage Home Loans Inc. mortgage- backed securities. The investors allege that the rating companies gave the securities false and misleading AAA or Aaa ratings. In a Feb. 11 request to dismiss the claim, lawyers for the rating companies said every court has rejected efforts to hold them liable under federal securities law. The plaintiffs claim under New Mexico law was a blatant attempt to avoid the parade of recent decisions that have rightly

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

held that issuing credit ratings is not the same thing as selling or underwriting securities, according to the filing by the companies. Partial Wins Browning also granted and denied in part motions to dismiss by the underwriters and other defendants. Moodys believes the lawsuit is without merit and remains confident the claims against it will ultimately dismissed, Michael Adler, a spokesman for the New York-based company, said in a phone interview. Ed Sweeney, a spokesman for Standard & Poors in New York, had no immediate comment on the ruling. Sandro Scenga, a spokesman for Fitch, didnt immediately return a call to his office seeking comment. A federal judge in Columbus, Ohio, on Sept. 27 threw out a case against the three companies alleging their ratings of mortgagebacked securities were faulty and caused five Ohio public employee pension funds to buy money-losing investments. U.S. District Judge James L. Graham agreed with the firms that the ratings were predictive opinions. Without specific allegations that the ratings services intended to defraud investors, the companies couldnt be held liable, he said. The case is Genesee County Employees Retirement System v. Thornburg Mortgage Securities Trust 2006-3, U.S. District Court, District of New Mexico (Albuquerque). --Editors: Peter Blumberg, Fred Strasser To contact the reporter on this story: Edvard Pettersson in Los Angeles at epettersson@bloomberg.net To contact the editor responsible for this story: Michael Hytha at mhytha@bloomberg.net

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

UPDATE 1-S&P, Moody's must defend "Rhinebridge" lawsuit-judge

Tue Apr 27, 2010 4:02pm EDT

* Investment vehicle created by German bank IKB

* Agencies accused of wrongly assigning top ratings * S&P and Moody's both expect to prevail (Adds S&P and Moody's expect to prevail; more quotes from judge's opinion) By Grant McCool NEW YORK, April 27 (Reuters) - Ratings agencies Standard & Poor's and Moody's Corp (MCO.N) must defend themselves against a lawsuit over a structured investment vehicle created by Germany's IKB Deutsche Industriebank AG (IKBG.DE), according to a court ruling made public on Tuesday. Spokesmen for the ratings agencies said they were confident S&P and Moody's would prevail in the lawsuit, which was filed last October in Manhattan federal court by King County in Washington state. The lawsuit made some of the most specific claims against rating agencies as they were scrutinized for their role in creating volatile markets. The SIV known as Rhinebridge was wound down in August 2008 in an auction that saw investors recover 55 percent of their $1.1 billion investment. In an opinion dated on Monday, U.S. District Judge Shira Scheindlin denied a joint motion by McGraw-Hill Cos Inc (MHP.N) unit S&P and Moody's to dismiss the lawsuit. The county, which manages cash for more than 100 public agencies, accused the rating agencies of wrongly assigning top

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

scores to Rhinebridge before its notes were sold to investors in June 2007. Iowa Student Loan Liquidity Corporation later joined the lawsuit. "Plaintiffs have adequately pleaded that misleading ratings and the eventual corrective disclosure proximately caused plaintiffs' losses," the opinion said. She wrote that the top ratings concealed the risk that Rhinebridge comprised billions of dollar of toxic assets and thus was likely to default. Her opinion also noted that she was "uncertain whether plaintiffs will be able to ultimately prove that any portion of their losses were caused by the defendants' conduct as opposed to the credit crisis." SIVs typically raised short-term debt to invest in longer-term, higher-yielding securities. They multiplied before the credit crisis, but many were wiped out by the global liquidity squeeze starting in 2007 that dried up funding. "We are confident that when the Court considers more than the plaintiffs' baseless allegations -- which it was required to accept as true at this preliminary stage of the cases -- it will be apparent that the facts and applicable law do not support the claim, and we will prevail," said McGraw-Hill spokesman Frank Briamonte. Moody's "continues to believe the lawsuit is without merit and remains confident the claim will be dismissed once the court is presented with the full facts," spokesman Anthony Mirenda said. The judge wrote that issues raised by co-defendants Fitch ratings agency, IKB and one of its officers would be addressed at a later date. Fitch is owned by France's Fimalac SA (LBCP.PA). The case is King County, Washington v IKB Deutsche Industriebank AG et al, U.S. District Court for the Southern District of New York, No. 09-8387. (Reporting by Grant McCool; editing by Gerald E. McCormick, Andre Grenon and Robert MacMillan)

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Legg Mason Batterymarch S&P 500 Index Fund Investor Lawsuit

February 23, 2011 Investment news in San Diego,California, United States of America

Investors filed a lawsuit on behalf of all investors who purchased or redeemed also shares in Legg Mason Batterymarch S&P 500 Index Fund mutual funds that was part of the Smith Barney family of funds

FOR IMMEDIATE RELEASE San Diego, California, United States of America(Free-PressRelease.com) February 23, 2011 -- Lawsuit also on behalf of all investors who purchased or redeemed shares in Legg Mason Batterymarch S&P 500 Index Fund mutual funds with the ticker symbol MUTF: (SBSDX) that was part of the Smith Barney family of funds from September 11, 2000 through May 31, 2005. If you purchased shares Legg Mason Batterymarch S&P 500 Index Fund mutual funds with the ticker symbol (MUTF:SBSDX)from September 11, 2000 through May 31, 2005, you have certain options and there are strict and short deadlines running. Those SBSDX fund holders should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554. According to the complaint filed in the United States District Court for the Southern District of New York the plaintiffs, who invested in the Smith Barney Capital Preservation Fund, the Citistreet Large Company Stock Fund, and the Smith Barney Large Cap Growth And Value Fund allege also on behalf of all investors who purchased or redeemed SBSDX shares from

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

September 11, 2000 through May 31, 2005, that Smith Barney Asset Management LLC allegedly made false and misleading statements and omissions relating to a contract for transfer agent services. The plaintiffs filed the lawsuit on behalf of investors in 105 mutual funds, Legg Mason Batterymarch S&P 500 Index Fund is one of those funds. The plaintiff claims that Smith Barney Fund Management LLC contracted a transfer agent to handle administrative work for their funds. Then Smith Barney Asset Management LLC decided to bring the work in-house because it was cheaper, but the original transfer agent offered a tremendous discount to remain the primary servicer. Smith Barney Asset Management LLC accepted the discounted services and never passed on the administrative savings to the fund shareholders, so the plaintiff. The plaintiff claims that fund managers have fiduciary responsibilities to the shareholder and must place shareholder interest above their own. On January 25, 2011, the Court of Appeals sustained most of the claims, but the judges held that the present plaintiffs lacked standing to represent investors in most of the 105 funds, including Legg Mason Batterymarch S&P 500 Index Fund. According to a law firm investors in Legg Mason Batterymarch S&P 500 Index Fund must step forward if this fund is to be included in this litigation. If someone who bought shares in Legg Mason Batterymarch S&P 500 Index Fund mutual funds with the ticker symbol SBSDX from September 11, 2000 through May 31, 2005 does not step forward, the plaintiffs may have no standing in this fund and, thus, investors in the Legg Mason Batterymarch S&P 500 Index Fund will likely not be included in the litigation, so the law firm. Those who purchased shares in Legg Mason Batterymarch S&P 500 Index Fund mutual funds with the ticker symbol (MUTF: SBSDX) from September 11, 2000 through May 31, 2005, have certain options and there are strict and short deadlines running. Those SBSDX investors in the Legg Mason Batterymarch S&P 500 Index Fund mutual fund should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Shareholders Foundation, Inc. Trevor Allen 3111 Camino Del Rio North - Suite 423 92108 San Diego Phone: +1-(858)-779-1554 Fax: +1-(858)-605-5739 mail@shareholdersfoundation.com www.ShareholdersFoundation.com

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

SBSDX Investor Lawsuit in connection with Citi S&P 500 Index D Investment

Investors filed a lawsuit on behalf of all investors who purchased or redeemed also SBSDX shares in Citi S&P 500 Index D from September 11, 2000 through May 31, 2005 - Citi S&P 500 Index D investors should contact the Shareholders Foundation at mail@shareholdersfoundation.com

Lawsuit also on behalf of all investors who purchased or redeemed SBSDX shares in the Citi S&P 500 Index D with the ticker symbol MUTF: (SBSDX) that was part of the Smith Barney family of funds from September 11, 2000 through May 31, 2005. If you purchased SBSDX shares of the mutual fund Citi S&P 500 Index D from September 11, 2000 through May 31, 2005, you have certain options and there are strict and short deadlines running. Those SBSDX fund holders should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554. According to the complaint filed in the United States District Court for the Southern District of New York the plaintiffs, who invested in the Smith Barney Capital Preservation Fund, the Citistreet Large Company Stock Fund, and the Smith Barney Large Cap Growth And Value Fund allege also on behalf of all investors who purchased or redeemed SBSDX shares from September 11, 2000 through May 31, 2005, that Smith Barney Asset Management LLC allegedly made false and misleading statements and omissions relating to a contract for transfer agent services. The plaintiffs filed the lawsuit on behalf of investors in 105 mutual funds, the Citi S&P 500 Index D (renamed into Legg Mason Batterymarch S&P 500 Index Fund) is one of those funds. The plaintiff claims that Smith Barney Fund Management LLC contracted a transfer agent to handle administrative work for their funds. Then Smith Barney Asset Management LLC decided to bring the work in-house because it was cheaper, but the original transfer agent offered a tremendous discount to remain the primary servicer. Smith Barney Asset Management LLC accepted the discounted services and never passed on the administrative savings to the fund shareholders, so the plaintiff.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI The plaintiff claims that fund managers have fiduciary responsibilities to the shareholder and must place shareholder interest above their own. On January 25, 2011, the Court of Appeals sustained most of the claims, but the judges held that the present plaintiffs lacked standing to represent investors in most of the 105 funds, including the Citi S&P 500 Index D (MUFT:SBSDX).

According to a law firm investors in Citi S&P 500 Index D must step forward if this fund is to be included in this litigation. If someone who bought shares in Citi S&P 500 Index D mutual funds with the ticker symbol SBSDX from September 11, 2000 through May 31, 2005 does not step forward, the plaintiffs may have no standing in this fund and, thus, investors in the Citi S&P 500 Index D will likely not be included in the litigation, so the law firm. Those who purchased MUFT:SBSDX shares in the mutual fund Citi S&P 500 Index D from September 11, 2000 through May 31, 2005, have certain options and there are strict and short deadlines running. Those SBSDX investors in the Citi S&P 500 Index D mutual fund should contact the Shareholders Foundation atmail@shareholdersfoundation.com or call +1(858) 779 - 1554. Shareholders Foundation, Inc. Trevor Allen 3111 Camino Del Rio North - Suite 423 92108 San Diego Phone: +1-(858-779-1554 Fax: +1-(858-605-5739

mail@shareholdersfoundation.com

www.ShareholdersFoundation.com ____________________________________________________ _________________________________ The Shareholders Foundation, Inc. is a professional portfolio legal monitoring service and an investor advocacy group. We do research related to shareholder issues and inform investors of securities class actions, settlements, judgments, and other legal related news to the stock / financial market. At Shareholders Foundation, Inc. we are in contact with a large number of shareholders. We believe that together we can combine the interests of many investors, and use the size of our interest as leverage against the giant corporations. We offer help, support, and assistance for every shareholder. We help investors find answers to their questions and equitable solutions to their

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI problems. The Shareholders Foundation, Inc. is not a law firm. The information is provided as a public service. It is not intended as legal advice and should not be relied upon.

Court to allow lawsuit against Moody's, S&P to proceed

Sep 3, 2009 11:38 AM | about stocks: MCO, MHP

0

Two of my favorite companies to hate, Standard & Poors and Moody's, are under pressure today after a judge ruled that a lawsuit against the firms may proceed. Unfortunately, the judge dismissed 10 out 11 claims. Shares of the two companies are selling off today, as they should be. Just last night I listened to a big fixed-income manager tout his firm's in-house ratings research, and how it identified problem credits months (even years) ahead of the "big 3" ratings agencies -->> yet another reason that these firms and their flawed/negligent ratings are becoming more useless by the day. Sept. 3 (Bloomberg) -- A U.S. judge refused to dismiss a lawsuit against Moodys Investors Service Inc. and Standard & Poors, rejecting arguments that investors cant sue over deceptive ratings of private-placement notes because those opinions are protected by free-speech rights. I'd buy the "free speech" argument if the firms weren't a protected monopoly thanks to the government limiting competition. Without ruling on the merits of the lawsuit, the judge said opinions by the ratings companies may be the basis for a lawsuit if the speaker does not genuinely and reasonably believe it or if it is without basis in fact. She said there are enough facts alleged against the two agencies and Morgan Stanley, the sixth-biggest U.S. bank by assets, for the lawsuit to go forward with evidence gathering needed for any trial. As for whether the agencies believe in their ratings, here's

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

their own thoughts on the matter, from a 2007 text message between S&P officials: Official #1: Btw (by the way) that deal is ridiculous. Official #2: I know right...model def (definitely) does not capture half the risk. Official #1: We should not be rating it. Official #2: We rate every deal. It could be structured by cows and we would rate it. The fact that these guys are inept shouldn't be reason enough for a lawsuit --it's that they're peddling a product that they have no confidence in that is the issue. Here's some more detail from my May post Demise of the ratings agencies? (Wishful thinking but...): Almost 2 years ago, Robert Rodriguez of First Pacific Advisors scared the pants off anyone listening to a lecture of his. I've pasted his associates' questions put to a Fitch official, regarding the models behind Fitch's ratings on Mortgage-Backed Securities. Fitch admits that their models would "start to break down" if home prices flattened out, and if housing prices went DOWN (crazy thought at the time), their model would "break down completely." Incredible. "We were on the March 22 call with Fitch regarding the sub-prime securitization markets difficulties. In their talk, they were highly confident regarding their models and their ratings. My associate asked several questions. What are the key drivers of your rating model? They responded, FICO scores and home price appreciation (HPA) of low single digit (LSD) or mid single digit (MSD), as HPA has been for the past 50 years. My associate then asked, What if HPA was flat for an extended period of time? They responded that their model would start to break down. He then asked, What if HPA were to decline 1% to 2% for an extended period of time? They responded that their models would break down completely. He then asked, With 2% depreciation, how far up the ratings scale would it harm? They responded that it might go as high as the AA or AAA tranches." If any firms in the credit debacle deserve to be sued out of existence, it's the ratings agencies. I'll finish with a quote from money manager David Einhorn on the agencies:

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

"If your product is a stamp of approval where your highest rating is a curse to those that receive it, and is shunned by those who are supposed to use it, you have problems." "The truth is that nobody I know buys or uses Moody's credit ratings because they believe in the brand. They use it because it is part of a government created oligopoly and, often, because they are required to by law. As a classic oligopolist, Moody's earns exceedingly high margins while paying only the needed lip service to product quality. The real value of Moody's lies in its ability to cow the authorities into preserving its status." Stocks: MCO, MHP

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Fitch settles lawsuit, but Calpers will streamline case against Moodys and S&P

SAN FRANCISCO: Fitch Ratings settled a lawsuit in which the largest US public pension fund alleged that Fitch and other credit ratings agencies assigned unreasonably high ratings to special investment vehicles, according to a court document filed on Friday. The California Public Employees' Retirement System (Calpers) sued Fitch, Moody's and Standard & Poor's (S&P) in July 2009, alleging that inaccurate ratings caused US$1bil of losses. Fitch will make no payment under the settlement, Fitch spokesman Daniel Noonan said in an e-mail on Monday. Calpers spokesman Wayne Davis declined to comment on the terms of the settlement but said it will streamline the case against Moody's and Standard & Poor's. Calpers can still fully recover its damages if it prevails against Moody's or S&P, Davis said in an e-mail. Michael Adler, a Moody's spokesman, said the company continued to believe the lawsuit was without merit and that Calpers' claims would be dismissed.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

We are pleased that the plaintiff has finally begun to focus on the lack of evidence supporting its claims in this case, Adler said. S&P spokeswoman Catherine Mathis said a previous court ruling established that ratings of SIVs were protected speech. Thus Calpers must demonstrate at an upcoming hearing a probability of success on its merits, Mathis said, and S&P will urge the court to find that Calpers has failed to do so. Calpers' lawsuit focuses on structured investment vehicles, which are complex packages of loans and debt, including subprime mortgages and collateralised debt obligations, that banks assemble and then sell to investors. The pension fund contended that it bought US$1.3bil of debt issued byCheyne Finance LLC, Sigma Finance and Stanfield Victoria Funding LLC, which were SIVs that had received tripleA ratings. Calpers said these ratings were inflated and that it suffered heavy losses starting in 2007 when the investments collapsed in value as credit tightened. Fitch is pleased with the resolution of this case and the disposition reached with Calpers, Noonan said. Reuters

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Credit Rating Agencies Fending Off Lawsuits from Subprime Meltdown

July 15, 2008

Battered by critics who blame them for helping to foment the U.S. subprime mortgage meltdown, credit raters are now trying to fend off lawsuits including fraud claims brought by their own shareholders. Many financial companies, including banks and lenders, have been sued following the housing market bust; but the cases against ratings agencies may be among the most closely watched. Thats because the three biggest agencies Moodys Corp , McGraw-Hill Cos Incs Standard & Poors division and Fitch Ratings, part of Fimalac SA have drawn fire from some politicians and investors for awarding top marks to subprimelinked securities that later disintegrated. Theyve also been criticized as being too close to issuers who foot the bill for their ratings. Based on how prior cases have played out, the plaintiffs could face an uphill battle in court and ratings firms say they will vigorously defend themselves against the lawsuits. Plaintiffs lawyers, though, say that their claims are strong and that a government report unveiled this week finding serious shortcomings at the raters could bolster their cases.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

No one has really crossed the threshold to try to hold the rating agencies accountable for their faulty ratings, said Christopher Keller, a lawyer at law firm Labaton Sucharow LLP, who represents some of the plaintiffs in a shareholder case against Moodys. Without their complicity in this process (of rating mortgagebacked debt pools), most of these securities would never have come to market, he said. The agencies have agreed to institute some reforms. Last month the three top agencies struck a pact with New Yorks attorney general to change how they charge fees for reviewing mortgagebacked securities. A separate probe by Connecticuts attorney general is ongoing. Rating agencies have found themselves in court before. When they were sued by Enron investors for allegedly being too slow to downgrade the energy traders debt, a federal judge dismissed the claims, saying the ratings analysts deserved the same kinds of First Amendment protections that shield journalists because their work was in essence opinion and not a guarantee. Under a barrage of criticism in Washington, the raters also argued that they, too, were victims of the Enron fraud, saying they werent told the truth about the companys finances. In another case, Orange County, California sued S&P for $2 billion after poor investments triggered its 1994 bankruptcy.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

S&P settled the case for $140,000 but admitted no wrongdoing. The $140,000 represented a partial refund of the ratings fees paid by the county. Each of the three leading raters is a defendant in at least one new lawsuit brought by investors seeking to hold them liable for the ratings on mortgage-related securities. That suit was brought by a union fund on behalf of investors in several mortgage loan trusts that issued bonds that fell sharply. Also, Moodys, S&P and Fitch all face purported class-action cases in U.S. District Court in Manhattan that contend they deceived their own shareholders and applied lax ratings criteria to keep lucrative fee revenue going, The claims revolve around representations made directly by the senior insiders of these companies to the market, said Darren Robbins, a lawyer at law firm Coughlin Stoia Geller Rudman & Robbins LLP, which has sued S&P and Fitch. Fitchs parent has called a shareholder lawsuit filed by the Indiana Laborers Pension Fund totally without merit and said it would fully and vigorously defend against it. McGraw-Hill said the various suits against S&P are completely without merit and it will be moving to dismiss each of them. A Moodys representative did not immediately respond to a phone message seeking comment.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

The lawsuits are still in the early stages. Court trials which are highly unusual in class-actions, because most are ultimately dismissed or settled could be years away. Meanwhile, the plaintiffs want to get their hands on documents cited in a U.S. Securities and Exchange Commission report this week that uncovered poor disclosure and conflicts-of-interest practices. The report cited e-mails suggesting that the raters knew that collateralized debt obligations (CDOs) pools of debt linked to subprime mortgages were headed for problems. The SEC report did not identify the specific agencies or individuals who wrote the documents. It would likely be up to the courts overseeing the lawsuits to determine whether plaintiffs should get access to more details. One e-mail from an agency analyst said that her firms ratings model did not capture half of one deals risk, but that it could be structured by cows and we would rate it. In another e-mail, a ratings agency manager called the CDO market a monster and said: Lets hope we are all wealthy and retired by the time this house of cards falters. Plaintiffs lawyer Keller said he and his colleagues would certainly love to know the origin of that e-mail as they press their claims. He said the SEC report really gives a window into what was going on.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

(Reporting by Martha Graybow, editing by Gerald E. McCormick, Leslie Gevirtz)

Moodys, S&P Sued by Connecticut AG Over Debt Ratings

By editor Mar 10, 2010, 2:55 PM Author's Website

Connecticut Attorney General Richard Blumenthal sued rating agencies Moodys Investors Service (MCO) and Standard & Poors on Wednesday, over ratings the agencies issued on investments backed by subprime loans. According to Mr. Blumenthals lawsuits, filed in state court in Connecticut, both agencies used deceptive and misleading tactics an knowingly assigned tainted ratings to these complex and risky investments that pushed the country into recession. DJ: Moodys and S&P violated public trustresulting in many investors purchasing securities that contained far more risk than anticipated and that have ultimately proven to be nearly worthless, Blumenthal said in a statement. Mr. Blumenthal, who called the lawsuit the first of its kind against ratings agencies, added that Moodys and S&P were swayed by lucrative fees received for rating the debt. Many of the investments were given triple-A ratings during the peak of the housing bubble. In a statement, Michael Adler, a Moodys spokesman, said, The state attorney generals suit is without merit and we are confident we will prevail once we have an opportunity to present the facts of the case. Blumenthal is seeking penalties and fines against both agencies that could reach into the hundreds of millions of dollars.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Connecticut has two lawsuits pending against debt rating agencies

Brian Lockhart, Staff Writer Published 05:10 p.m., Saturday, August 13, 2011

Killers on the wing in Stratford

The nation may just be learning about the power wielded by credit rating agencies, but Connecticut officials have been scrutinizing Standard and Poor's and its two major rivals in the bond market for a few years. "The United States losing its AAA bond rating for the first time focused the federal government, Congresspeople and senators on the power that rating agencies hold over government," Jim Finley, head of the Connecticut Conference of Municipalities, said about the recent S&P downgrade of the nation's debt outlook. The state has two lawsuits pending against S&P, Fitch and Moody's, the trio of rating titans. The suits were filed by Democratic Attorney General-turned-U.S. Sen. Richard Blumenthal. Although the cases are moving forward, current Attorney General George Jepsen has recused himself from direct involvement because his previous law firm represented S&P. While some lawmakers, political pundits and economic gurus spent the past week questioning S&P's credibility, Blumenthal Friday said he has long harbored doubts about the fairness, independence and functionality of the bond rating system. "I only wish the courts moved more quickly and more effectively, because the story that we tell in these lawsuits, obviously, has powerful meaning for our present economic moment," Blumenthal said.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Blumenthal, with CCM's support, in 2008 brought S&P, Fitch and Moody's to court, alleging they intentionally assigned lower credit ratings to bonds issued by public entities, forcing cities and towns to pay higher interest rates or purchase bond insurance. Moody's and Fitch, which is partly owned by the Hearst Corp., owner of Hearst Connecticut Newspapers, have since made some changes. An S&P spokesman was unable to comment Friday. Last year, prior to his election to Senate, Blumenthal targeted S&P and Moody's for allegedly violating the Connecticut Unfair Trade Practices Act. He claimed the agencies portrayed themselves as objective, but steered insurance companies, mutual, hedge and pension funds to certain investment vehicles based on personal interest. The two agencies at the time said Blumenthal's case lacked merit and they expected to prevail. Alan Schankel, director of fixed income research for Philadelphiabased Janney Montgomery Scott financial services, said the ratings agencies arose around 1900, focusing on railroad bonds and eventually moving on to municipal debt. Schankel said while smaller ratings agencies exist, "I think it's probably true these three (S&P, Fitch, Moody's) basically control the market." It is no secret that local and state officials jump through hoops to try and maintain higher bond ratings granted by S&P, Fitch and Moody's. "It comes down to interest costs," said Schankel. In other words, the better the rating, the less taxpayer dollars are spent on interest governments pay when they borrow to fund bigticket projects. "It's also psychological. Bragging rights," said Schankel, who added he thought the agencies do a "reasonably good job" on their municipal bond ratings. "The U.S. downgrade -- it's doubtful it's

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

cost the U.S. much in interest, but it sure was a black mark and embarrassment." On Thursday, Bridgeport Mayor Bill Finch, a Democrat who is facing a tough primary battle, proudly announced Fitch had displayed its confidence in the state's largest city by reaffirming Bridgeport's "A" bond rating. In contrast, Fitch's decision in 2010 to remove the "+" from Connecticut's AA+ rating had gubernatorial candidates pointing fingers at incumbent lawmakers and positioning themselves as the most qualified to stabilize the state's finances. Finley said municipalities believe they are unfairly held captive by the current bond rating system. "There's a sense of powerlessness over the fact you essentially have a monopoly from these agencies in giving a thumbs up or down or in the middle to a community," he said. "They sort of have this ability to unilaterally wield power that has a dramatic impact over every American in the U.S." Officials in Westport and Fairfield, both of which enjoy AAA ratings from Moody's, expressed dismay and bafflement when the rating company downgraded their longer-term outlook from stable to negative. Blumenthal hoped the current focus in Washington on S&P would help shake up the playing field and lead to an increase in the number of rating agencies. State Sen. Andrew Roraback, R-Goshen, a member of the Connecticut Bond Commission, said the rating companies may not be perfect, but are needed. "They keep us honest," he said. "Nobody likes to hear the unvarnished truth because they take a dispassionate look at reality. Politicians tend to sugarcoat things. There needs to be somebody in the world that tells it like it is."

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Staff Writer Brian Lockhart can be reached at brian.lockhart@scni.com

BUSINESS - BRIEFS

Anschutz Corp. lawsuit against Deutsche Bank, S&P allowed to advance.

The Denver Post POSTED: 03/29/2011 01:00:00 AM MDT

Deutsche Bank Securities Inc. and Standard & Poor's must face claims in a lawsuit brought by Denver-based Anschutz Corp. seeking damages over its purchase of auction-rate securities, a judge ruled. U.S. District Judge Susan Illston in San Francisco on Sunday refused to throw out Anschutz's claims of market manipulation and fraud against Deutsche Bank and negligent misrepresentation against S&P, according to a ruling.

Read more:Anschutz Corp. lawsuit against Deutsche Bank, S&P allowed to advance. - The Denver Posthttp://www.denverpost.com/business/ci_17721388#ixzz1ZoMsxItW Read The Denver Post's Terms of Use of its content: http://www.denverpost.com/termsofuse

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

S&P, Moody's, Fitch Lose Bid to Toss Calpers Lawsuit Claiming Negligence

By Karen Gullo - May 5, 2010 3:38 AM GMT+0300

Standard & Poors, Moodys Investors Service and Fitch Ratings must face the California Public Employees Retirement Systems lawsuit claiming their faulty risk assessments on structured investment vehicles caused $1 billion in losses. A state court judge in San Francisco rejected the companies requests to dismiss Calpers claims of negligent misrepresentation, Brad Pacheco, a spokesman for Calpers, the largest U.S. pension fund, said today in a phone interview. Judge Richard Kramer, in an April 30 ruling, tossed out a claim of negligent interference and said Calpers could renew that claim later, Pacheco said. Calpers sued the three major bond-rating companies for $1 billion in losses it said were caused by wildly inaccurate risk assessments. They used methods to analyze mediumterm notes and commercial paper that were seriously flawed in conception and incompetently applied, Calpers said in its lawsuit filed July 9. The companies all gave their highest ratings to Cheyne Finance Ltd., Stanfield Victoria Funding LLC and Sigma

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Finance Inc., prompting Calpers to invest in them in 2006, the fund said in its complaint. The structured investment vehicles collapsed in 2007 and 2008, defaulting on payments to Calpers, the pension fund said. The underlying assets of the three firms, Calpers said, consisted primarily of risky subprime mortgages.

Manhattan Lawsuits

Moodys, S&P and Fitch face similar lawsuits by institutional investors in federal court in Manhattan. The companies have denied wrongdoing. We are pleased that the judge granted our motion to dismiss the claim of negligent interference with prospective economic advantage, Frank Briamonte, a spokesman at McGraw- Hill Cos., the parent company of Standard & Poors, said in an e-mail. We are confident that when the court considers more than the plaintiffs baseless allegations -- which it was required to accept as true at this preliminary stage of the case -- it will be apparent that the facts and applicable law do not support the claim and we will prevail, he said. David Weinfurter, a spokesman at Fitch, said in an e-mail that the company believes the Calpers claim is fully without merit and we will continue to defend it to the fullest extent. Fitch is planning to appeal the judges decision, he said. Michael Adler, a Moodys Corp. spokesman, said in an email that the company was pleased by the dismissal of one claim. We continue to believe the case is without merit, and we are confident that the remaining claim will be dismissed once the court is presented with the facts in the case, he said. Calpers, with $211.1 billion in assets, manages retirement benefits for more than 1.6 million California public employees, retirees and their dependents.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

The case is California Public Employees Retirement Systems v. Moodys Corp., 09-490241, Superior Court of California, County of San Francisco. To contact the reporters on this story: Karen Gullo in San Francisco at kgullo@bloomberg.net.

ISE Files Suit To List Dow Jones, S&P Options

By Lindsay Fortado

Law360, New York (November 03, 2006, 12:00 AM ET) -The International Securities Exchange is continuing its fight to compete with the Chicago Board Options Exchange, filing a lawsuit alleging that it should be able to list the Dow Jones Industrial Average and Standard & Poors 500 index options without a license. Both indexes have denied the ISE a license, the lawsuit alleges. The suit, filed on Thursday in the Southern District of New York against Dow Jones and S&P, seeks to end the exclusive listing of certain index options. Currently, the CBOE holds licensing agreements...

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Standard & Poor's and Moody's Dodge Another Lawsuit

04/13/2010BY: BRITTANY DUNN

In another win for Standard & Poors (S&P) and Moodys Corp., a New York federal judge dismissed a lawsuit claiming the companies defrauded investors who relied on their ratings before buying $63 billion of investment-grade mortgage-backed securities, Bloomberg recently reported. According to Bloomberg, the claims against S&P and Moodys were part of a lawsuit filed by institutional investors against various banks and rating companies accused of making untrue statements and omissions in registrations statements and prospectuses for 84 offerings sold as safe. S&P and Moodys werent the only companies to dodge the bullet. Complaints against Credit-Based Asset Servicing &

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Securitization LLC (C-Bass), First Franklin Financial Corp., and Merrill Lynch Mortgage Lending Inc. were also thrown out in a two-page order by U.S. District Judge Jed Rakoff. The basis for the dismissals was not immediately made clear, but an explanation of the reasoning is expected in a written opinion by the judge. C-Bass attorney Jamie Wareham of Paul Hastings Janofsky & Walker LLP told Bloomberg, The likely reason to come from Judge Rakoffs opinion will be important to many defendants in financial crisis litigation. The disclosures were adequate, and the market knew of the risks associated with subprime products. This isnt the first lawsuit investors have filed against S&P and Moodys. And it isnt the first one to be dismissed either. As DSNews.com reported, in January, a judge dismissed a lawsuit against S&P and Moodys brought by investors who claimed the two ratings agencies defrauded them on nearly $100 billion in mortgage-backed securities (MBS) issued back in 2007 by the now-defunct Lehman Brothers Holdings, Inc. In addition, on March 29, the two companies, along with Fitch Ratings, won dismissal of a negligence and fraud lawsuit by two California investors who lost money on highly-rated bonds, Bloomberg said.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

S&P Affirms JDN Realty Corp. Rtgs; Otlk Revsd to Stb.

Business Editors NEW YORK--(BUSINESS WIRE)--Standard & Poor's Jan. 25, 2002-- Standard & Poor's today affirmed its double-'B'-minus corporate credit rating on JDN Realty Corp., as well as the ratings on $235 million of senior notes and $75 million of preferred stock. In addition, Standard & Poor's revised its outlook on JDN Realty Corp. to stable from negative. The outlook revision acknowledges the settlement of a class action lawsuit, a strengthened management team, and the quality and continued stability of the company's core portfolio. The company's primary credit weaknesses remain weaker coverage measures, limited financial flexibility, and higher levels of short-term debt. Shortly after the February 2000 announcement regarding previously undisclosed compensation arrangements, JDN was faced with turnover of the senior management team, a technical default on the company's unsecured line of credit, and an uncertain contingent liability related to shareholder lawsuits. Since that time, the appointments of an interim CEO and CFO were made permanent. Additionally, a seasoned shopping center developer was named CEO and President of JDN Development Co. This new team set out to improve relationships with existing tenants and bankers, while proving the viability of its revised growth strategy.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Standard & Poor's recognizes that some progress has been made toward these goals. The most visible of which was the $46 million settlement of a class action lawsuit that had represented a potentially large contingent liability. The settlement, which was made in the form of cash and common stock, was expensed in the second quarter of 2001. It could take a while longer, though, for the company's modified business model to prove viable. The new management team has shifted its development focus from predominantly Wal-Mart and Lowe's anchored centers to grocery-anchored shopping centers. If successful, this new model would further diversify JDN's tenant base and enhance the company's cash flow stability. Atlanta, Ga.-based JDN is a fully integrated REIT that develops and manages shopping centers anchored by value-oriented retailers. Today, the company owns 102 centers totaling 11.1 million square feet. The properties are relatively new and well occupied by generally high-quality anchor tenants on long-term leases. Five of the six largest tenants, led by Lowes Cos. Inc. (single-'A') and Wal-Mart Stores Inc. (double-'A'), are investment-grade tenants that contribute 31% of JDN's base rental income. Kmart Corp. ('D') contributes less than 3% of rental income. All five Kmart locations are currently operating and paying rent. In addition to the relatively strong credit quality of most of these retailers, lease expirations are very stable, with an average of only about 4% of base rents expiring annually over the next ten years. JDN's financial profile continues to be impacted by a higher cost of capital as well as additional costs consisting primarily of legal expenses related to the shareholder lawsuit. While leverage remains moderate at 55% on a book value basis, coverage measures are weak at 2.1 times (x) debt service and 1.8x fixed charges (as of Sept. 30, 2001). These measures are low, particularly given JDN's development and refinancing needs over the next two years, and the variable rate nature of 42% of JDN's debt. JDN does have sufficient capacity to fund the remaining portion of its existing development commitments, primarily through construction loans and expected asset sales proceeds. However, financial flexibility and the company's ability to implement its revised business plan, remains limited, since a significant portion of JDN's portfolio is pledged to secured lenders. As a result, Standard & Poor's views the unsecured noteholder as being in a subordinate position, which warrants a distinction between the corporate credit rating and the ratings on the unsecured notes.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

OUTLOOK: STABLE The stable outlook acknowledges the progress the new management team has made toward improving tenant and lender relationships and eliminating much uncertainty surrounding shareholder lawsuits. As JDN's developments come on-line and begin to contribute to earnings, debt protection measures should gradually improve. Standard & Poor's will consider improvement to the rating and/or outlook upon the company's demonstration of its ability to appropriately fund and execute its stated business plan.

Calpers settles suit with Fitch, not Moody's or S&P

Monday, August 29, 2011 3:21 p.m. CDT

SAN FRANCISCO (Reuters) - Fitch Ratings settled a lawsuit in which the largest U.S. public pension fund alleged that Fitch and other credit ratings agencies assigned unreasonably high ratings to special investment vehicles, according to a court document filed on Friday. The California Public Employees' Retirement System (Calpers) sued Fitch, Moody's and Standard & Poor's in July 2009, alleging that inaccurate ratings caused $1 billion of losses. Fitch will make no payment under the settlement, Fitch spokesman Daniel Noonan said in an email on Monday. Calpers spokesman Wayne Davis declined to comment on the terms of the settlement but said it will streamline the case against Moody's and Standard & Poor's. "Calpers can still fully recover its damages if it prevails against Moody's or S&P," Davis said in an email.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Michael Adler, a Moody's spokesman, said the company continues to believe the lawsuit is without merit and that Calpers' claims will be dismissed. "We are pleased that the plaintiff has finally begun to focus on the lack of evidence supporting its claims in this case," Adler said. S&P spokeswoman Catherine Mathis said a previous court ruling established that ratings of SIVs are protected speech. Thus Calpers must demonstrate at an upcoming hearing a probability of success on its merits, Mathis said, and S&P will urge the court to find that Calpers has failed to do so. Calpers' lawsuit focuses on structured investment vehicles, which are complex packages of loans and debt, including subprime mortgages and collateralized debt obligations, that banks assemble and then sell to investors. The pension fund contended that it bought $1.3 billion of debt issued by Cheyne Finance LLC, Sigma Finance Inc and Stanfield Victoria Funding LLC, which were SIVs that had received "triple-A" ratings. Calpers said these ratings were inflated and that it suffered heavy losses starting in 2007 when the investments collapsed in value as credit tightened. "Fitch is pleased with the resolution of this case and the disposition reached with Calpers," Noonan said. S&P is a unit of McGraw-Hill Cos and Fitch is a unit of France's Fimalac SA .

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

The case is California Public Employees' Retirement Systems v. Moody's Corp et al, Superior Court of California, San Francisco County, No. 09-490241. (Reporting by Dan Levine; Editing by Robert MacMillan and Steve Orlofsky)

Cincinnati Bell lawsuit can proceed

Business Courier Date: Wednesday, September 21, 2011, 10:18am EDT - Last Modified: Wednesday, September 21, 2011, 11:27am EDT

A judge has decided a lawsuit filed againstCincinnati Bell Inc. executives and the companys board of directors can continue. Timothy Black, U.S. District Judge for the Southern District of Ohio, denied Tuesday the defendants motion to dismiss. Black said in his 12-page ruling that the plaintiff has made adequate pleadings that the Cincinnati Bell Board is not entitled to business judgement protection for its 2010 pay hikes. A spokeswoman for Cincinnati Bell could not be immediately reached for comment. NECA-IBEW Pension Fund, a Cincinnati Bell (NYSE: CBB) shareholder since 2003, filed the lawsuit derivatively on behalf of Cincinnati Bell in U.S. District Court for the Southern District of Ohio July 5 against the companys board of directors and top executives. Named in the suit are Jack Cassidy,

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

president and CEO; Gary Wojtaszek, CFO; Christopher Wilson, vice president, general counsel and secretary; and Bells compensation consultant, Towers Watson & Co. The lawsuit is seeking to make executives return the pay increases and implement internal controls preventing excessive compensation to the companys top executives. The defendants filed a motion to dismiss the lawsuit on July 29. The lawsuit came two months after shareholders voted against Bells executive compensation plan. Two-thirds of voting Cincinnati Bell shareholders rejected the companys compensation for its CEO and executives for 2010, according to the lawsuit. The vote on executive compensation is part of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. The lawsuit claims giving executives pay raises of as much as 80 percent hurt the company at a time when net income declined more than 68 percent.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Abu Dhabi Bank Sues Credit Suisse, S&P Over Deal Friday, 26 November 2010

Abu Dhabi Commercial Bank said Thursday it is suing Credit Suisse and credit rating agency Standard & Poor's, alleging it was misled over a 2007 investment that went sour. The case is the second filed by the Abu Dhabi governmentcontrolled bank in New York involving complex financial instruments known as structured investment vehicles that fell prey to the credit squeeze brought on by the subprime mortgage crisis in the U.S. ADCB alleges that Credit Suisse failed to disclose conflicts of interest and provided misleading information when packaging and selling the investment vehicle, which went by the name Farmington. The bank says it was pressured to invest in the deal in 2007 to protect its stake in an earlier, similar investment known as Stanfield Victoria that was coming under pressure at the time. As part of the agreement, ADCB claims it was required to enter into another transaction known as a credit default swap designed to protect Credit Suisse's exposure to the Farmington deal, which it believed "carried minimal risk."

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Structured investment vehicles were set up to borrow money by issuing short-term securities at a low interest rate. They would lend that money by purchasing long-term securities at higher interest. Investors were able to profit from the difference, as were issuing banks that charged fees to structure them. ADCB is suing S&P because it alleges the rating house made inaccurate assessments tied to the Farmington investment by assigning ratings to underlying assets that were "investment-grade," suggesting they were relatively safe. Ala'a Eraiqat, ADCB's chief executive said the lawsuit aims to protect the bank from potential losses, but he doesn't expect it to have a major effect on the company's earnings. "For the benefit of all our key stakeholders, it is appropriate to take action against parties who we believe misled ADCB," he said in a statement outlining the lawsuit. "On close examination, the investment was sold to the bank in an unacceptable manner." Representatives for Credit Suisse and S&P declined to comment. ADCB is pursuing a separate suit involving structured investment vehicles against Morgan Stanley, S&P, and another rating agency, Moody's Investors Service. That case, a class-action suit filed in 2008, seeks damages resulting from the collapse of an SIV known as Cheyne that was backed by U.S. mortgages and other securities.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Rajaratnam, SocGen, Blackstone, S&P, AT&T in Court News

October 04, 2011, 6:41 AM EDT

By Elizabeth Amon

(Adds Rajaratnam in top section, Moodys in Lawsuits and Exxon in Trials.) Oct. 4 (Bloomberg) -- Raj Rajaratnam, the hedge fund manager convicted of directing a massive insider-trading ring, opposed a government request to unseal data about his medical condition, claiming it would only fuel a media feeding frenzy. The public has no right to the information submitted to the court in a bid for leniency, Rajaratnams lawyers, led by John Dowd, argued in papers filed in Manhattan federal court yesterday. Rajaratnam is to be sentenced by U.S. District Judge Richard Holwell Oct. 13 The idea that Mr. Rajaratnams interest in keeping his medical conditions private must yield to the publics prurient interest in such intimate details is absurd, the lawyers wrote. No defendant should be forced to choose between providing the court with medical information relevant to sentencing and making himself the subject to a salacious and morbid media feeding frenzy.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

Rajaratnam, 54, was convicted in May on all 14 criminal counts against him. Prosecutors said he gained $63.8 million by trading with inside information in 11 stocks, including Goldman Sachs Group Inc., Intel Corp., Google Inc., ATI Technologies Inc. and Clearwire Corp. The government is urging Holwell to give Rajaratnam, the cofounder of Galleon Group LLC, 19 1/2 to 24 1/2 years in prison. Rajaratnams lawyers, calling the governments proposal grotesquely severe, asked for a sentence substantially below that. Ellen Davis, a spokeswoman for U.S. Attorney Preet Bharara, declined to comment on the court filing. The case is U.S. v. Rajaratnam, 1:09-cr-01184, U.S. District Court, Southern District of New York (Manhattan). For more, click here. On The Docket Kerviel Appeal on SocGen Trading Verdict Scheduled for June Jerome Kerviels appeal of a three-year jail sentence and order to repay Societe Generale SAs 4.9 billion-euro ($6.5 billion) trading loss was scheduled for June 2012. A Paris appeals court yesterday set the appeal hearings to run from June 4 to June 28. Kerviel didnt attend yesterdays session. While Kerviel said during the trial that his activities were probably not part of his mandate, his lawyer Olivier Metzner said yesterday that he is appealing all three guilty counts -breach of trust, forging documents and computer hacking. Kerviel, 34, was held solely responsible for the loss in the 2010 verdict. The judges rejected his arguments that his superiors at the bank, Frances second largest, knew he had trades that exceeded his limits and that it was the banks decision to unwind

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI

the bets over three days of falling markets in 2008 that caused such a large loss. Kerviel was crushed by the verdict, he said after the decision. Metzner criticized the ruling, saying the bank should have reduced the loss it claimed because of a 1.7 billion-euro deferred tax credit it received. The 4.9 billion-euro figure was the difference between the 6.38 billion euros the bank lost unwinding the positions and Kerviels 2007 trading profit of 1.47 billion euros. Societe Generale said after the ruling it had learned its lessons from the episode and improved its risk controls. A spokeswoman for the bank declined to comment on the appeal yesterday. Premier League Risks Blow to BSkyB TV-Rights at EUs Top Court English soccers Premier League and European governing body UEFA risk losing part of their revenue from exclusive television rights sold to broadcasters such as British Sky Broadcasting Group Plc in a ruling by the European Unions highest court today. The EU Court of Justice in Luxembourg is set to decide whether the Premier Leagues exclusive regional contracts to televise its soccer matches are lawful. An adviser to the court in a nonbinding opinion in February said they are not. The Premier League is home to some of Europes most successful clubs including Manchester United and Liverpool. The league started a three-year 1.8 billion-pound ($2.8 billion) U.K. television contract in August 2010, and receives a further 1.4 billion pounds from the sale of international broadcast rights. The biggest fallout is probably for the Premier League, Daniel Geey, a lawyer at Field Fisher Waterhouse LLP in London. Their 1.8 billion-pounds contract, of which theyre in the second year of three, could potentially be deemed illegal and have to be renegotiated.

Dr. KIRIAKOS TOBRAS * 2011

: RATING AGENCIES : PENDING CHARGES AGENZIE DEL RATING : CARICHI GIUDIZIARI PENDENTI