Escolar Documentos

Profissional Documentos

Cultura Documentos

India Post Conference Notes Day 1 Feb 12 EDEL

Enviado por

jayantsharma04Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

India Post Conference Notes Day 1 Feb 12 EDEL

Enviado por

jayantsharma04Direitos autorais:

Formatos disponíveis

7th & 8th February, 2012

The Trident, Bandra Kurla Complex, Mumbai

Post Conference Notes - Day 1

Preface

We present key takeaways from the day 1 of the Mumbai leg of Edelweiss India Conference 2012.

The event is aimed at bringing together over 70 corporates and facilitating over 2,000 one-on-one

meetings between investors and corporates.

The conference is being held in the backdrop of uncertain times, both in India as well as globally.

CY11 was one of the most challenging periods in recent times with the nascent global recovery

faltering on intensifying strains in the euro area and weakness elsewhere. Locally too, sentiments

took a beating as multiplicity of factors, ranging from government policy hurdles to the aggressive

monetary tightening, weighed down on macros. While sentiments have certainly improved since

the December lows, real economy indicators would need to be closely monitored to gauge the

extent of the recovery.

Overall, even as headwinds remain, investors are enthusiastic about India. The likely triggers in

the form of a possible reversal of the rate cycle, fiscal consolidation and traction in basic policy

decisions could provide big boost to investments in FY13. Our interactions with the companies

also point to a gradual recovery in demand. Within the consumer sector, our interactions

suggest that while the overall demand remains healthy, there is some pressure within the

discretionary space. With raw material prices beginning to soften, companies are confident of a

revival in margins. Further, rural markets are a key focus area and hence consumer companies

continue to invest in a robust rural distribution system. Meanwhile, real estate sector companies

are hopeful that as the interest cycle peaks out and policy reforms begin to kick in, risk perception

for the sector is likely to recede. While some concerns remain, a fall in interest rates is expected

to boost volume while recent initiatives to deleverage through asset sales may help spur cash

flows, leading to a reduction in debt levels, going forward. In metals, participants are hopeful of

an uptick in steel demand in FY13. While FY12 demand is expected at 4.5%-5.0%, (below the GDP

growth rate), FY13 could witness a higher demand growth in the range of 7%-8% (at least equal to

the GDP growth). Production cuts worldwide, especially in China (total of ~150mt annualized),

will support steel prices at current levels. Utility companies who attended the conference are

hopeful of speedy approvals from the government and are firmly on track in adding new capacities.

We hope this conference will provide investors with an ideal platform to interact with a crosssection of companies besides giving an insightful perspective on the likely trajectory of India's

growth and investment opportunities that come with it.

Team Edelweiss

Edelweiss

Securities Limited

Edelweiss Securities

Limited

Profile of Participating Companies

CONTENTS

Ajanta Pharma .............................................................................................................................................................................................. 4

Axis Bank ....................................................................................................................................................................................................... 6

Bajaj Electricals ............................................................................................................................................................................................ 8

Bhushan Steel ............................................................................................................................................................................................. 10

Cairn India ................................................................................................................................................................................................. 12

Cox & Kings ................................................................................................................................................................................................ 14

Dabur India ................................................................................................................................................................................................ 16

Deepak Fertilizers & Petrochemicals Corp ............................................................................................................................................. 18

Dish TV India .............................................................................................................................................................................................. 20

eClerx Services ........................................................................................................................................................................................... 22

Emami .......................................................................................................................................................................................................... 24

Gail .............................................................................................................................................................................................................. 26

Glenmark Pharmaceuticals ...................................................................................................................................................................... 28

Godrej Consumer Products ....................................................................................................................................................................... 30

Grasim Industries ...................................................................................................................................................................................... 32

Havells India .............................................................................................................................................................................................. 34

HDFC Bank .................................................................................................................................................................................................. 36

Hexaware Technologies ............................................................................................................................................................................ 38

Housing Development Finance Corp ........................................................................................................................................................ 40

ICICI Bank ................................................................................................................................................................................................... 42

IDBI Bank .................................................................................................................................................................................................... 44

Indoco Remedies ........................................................................................................................................................................................ 46

Info Edge India ........................................................................................................................................................................................... 48

Infrastructure Development Finance Co ................................................................................................................................................. 50

JSW Energy .................................................................................................................................................................................................. 52

JSW Steel ..................................................................................................................................................................................................... 54

Jyothy Laboratories ................................................................................................................................................................................... 56

Kajaria Ceramics ....................................................................................................................................................................................... 58

Edelweiss

Securities Limited

Edelweiss Securities

Limited

Profile of Participating Companies

KEC International ....................................................................................................................................................................................... 60

Kotak Mahindra Bank ................................................................................................................................................................................ 62

Larsen & Toubro ......................................................................................................................................................................................... 64

Manappuram Finance ............................................................................................................................................................................... 66

Oil & Natural Gas Corp ............................................................................................................................................................................. 68

Pantaloon Retail ........................................................................................................................................................................................ 70

Persistent Systems ..................................................................................................................................................................................... 72

Phoenix Mills ............................................................................................................................................................................................. 74

Power Finance Corporation ..................................................................................................................................................................... 76

PI Industries ............................................................................................................................................................................................... 78

Reliance Infrastructure ............................................................................................................................................................................. 80

Reliance Power ........................................................................................................................................................................................... 82

Shoppers Stop ............................................................................................................................................................................................ 84

Sun Pharmaceutical Industries ................................................................................................................................................................ 86

Tata Consultancy Services ........................................................................................................................................................................ 88

Titan Industries .......................................................................................................................................................................................... 90

Torrent Pharmaceuticals .......................................................................................................................................................................... 92

Yes Bank ...................................................................................................................................................................................................... 94

Zodiac Clothing .......................................................................................................................................................................................... 96

Zuari Industries ......................................................................................................................................................................................... 98

Edelweiss

Securities Limited

Edelweiss Securities

Limited

Company Profile

AJANTA PHARMA

Exciting play on specialty branded generics

India Equity Research

February 7, 2012

Pharmaceuticals

Key takeaways

EDELWEISS RATINGS

Focus on differentiated products drives above industry level growth: Ajantas focus

on differentiated products, through R&D capability, has led to above industry

level growth in its focus therapies including Cardio, Opthal and Dermatology. Its

derma portfolio, growing at 32%, has improved its ranking by four levels to 14th

during Dec 2011. Its entry into new segments including Ortho, ENT and Gastro will

drive higher growth over the next year. These segments comprise ~7% of current

domestic sales with portfolio of 16 products. Management expects to maintain

current growth momentum (~20%) in domestic market.

US market to accelerate growth: The key trigger for growth in exports (60% of total

sales) will be US where it plans to launch Levetiracetam and Risperdone over the

next two months. The products will be supplied from Aurangabad FDA approved

facility. Overall, Ajanta has 5-8 filings under approval in US. More importantly, US

will be a strategic focus market for Ajanta and will drive higher incremental

investment in future. Management has planned INR3bn investment into dedicated

manufacturing facility for the US market.

Targeting 1,300 registrations in key export markets: Ajanta has developed a robust

pipeline of ~1,300 product registrations (over existing similar base) which will

drive future growth in key branded generics markets (Asia, Africa and LATAM). This

pipeline of products will double the existing base business from these markets

over next three to four years and largely comprise niche products or segments

with less than three or four competitors.

Funding under AMFM programme not a concern: Ajantas presence in Africa (40%

of total exports) largely comprises sales under AMFM programme (INR750mn).

Management has confirmed that Bill Gate foundation support of USD200mn will

assure continued supply under the programme until FY14.

Growth guidance: Management is confident of delivering 21% growth in FY12 and

aims to achieve long term target sales of INR 10 bn (from INR 5 bn).

Key risks

ROCE may dip due to upcoming investments. Increase in API costs could impact

margins in exports business.

Absolute Rating

NOT RATED

MARKET DATA (R : AJPH.BO, B: AJP IN)

CMP

: INR 391

Target Price

: NA

52-week range (INR)

: 421 / 175

Share in issue (mn)

: 11.7

M cap (INR bn/USD mn)

: 5 / 94

Avg. Daily Vol. BSE/NSE (000) : 85.4

Share Holding Pattern (%)

Promoters*

: 68.9

MFs, FIs & Banks

0.0

FIIs

0.0

Others

: 31.1

* Promoters pledged shares

(% of share in issue)

4.7

Relative Performance (%)

Sensex

Stock

Stock over

Sensex

1 month

11.7

32.2

20.5

3 months

0.8

14.6

13.9

12 months

(1.8)

99,7

101.5

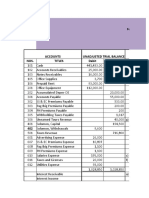

Financials

Year to March

FY08

FY09

FY10

FY11

Revenues (INR mn)

Rev. growth (%)

EBITDA (INR mn)

Net profit (INR mn)

Share outstanding (mn)

EPS (INR)

EPS growth (%)

Diluted P/E (x)

EV/EBITDA (x)

ROE (%)

3,092

19.9

514

225

12

18.9

53.6

20.5

12.3

17.6

3,492

12.9

651

254

12

21.6

13.8

18.2

10.8

17.4

4,077

16.8

771

340

12

28.8

33.6

13.6

8.7

19.9

5,049

23.8

963

507

12

43.0

49.4

9.1

6.6

24.5

Edelweiss Research is also available on www.edelresearch.com,

Bloomberg EDEL <GO>, Thomson First Call, Reuters and Factset.

Manoj Garg

+91-22-6623 3302

manoj.garg@edelcap.com

Perin Ail

+91-22-6620 3032

perin.ali@edelcap.com

Edelweiss Securities Limited

Post Conference Notes - Day 1

Financial Statements

Balance sheet

Income statement

Year to March

(INR mn)

FY08

FY09

FY10

FY11

Income from operations

3,092

Direct costs

1,402

Employee costs

305

R&D

Other expenses

872

Total operating expenses

2,578

EBITDA

514

Depreciation and amortisation 7 9

EBIT

435

Interest expenses

161

Other income

15

Profit before tax

289

Provision for tax

69

Core profit

220

Extraordinary items

(6)

Profit after tax

226

Adjusted net profit

225

EPS (INR) basic

18.9

Diluted equity shares (mn)

12

Tax rate (%)

23.7

3,492

1,271

427

4,077

1,455

542

5,049

1,729

637

1,144

2,841

651

142

509

236

25

298

44

254

0

254

254

21.6

12

14.7

1,308

3,306

771

207

564

202

25

388

48

340

0

340

340

28.8

12

12.3

1,719

4,085

963

247

716

178

28

566

59

507

0

507

507

43.0

12

10.3

FY09

FY10

FY11

81.4

4.1

6.7

18.6

7.3

81.1

5.1

4.9

18.9

8.3

80.9

4.9

3.5

19.1

10.0

Common size metrics as % of net revenues

Year to March

FY08

Operating expenses

Depreciation and Amortization

Interest expenditure

EBITDA margins

Adj. Net profit margins

Growth metrics (%)

Year to March

Revenues

EBITDA

PBT

Net profit

EPS

Cash flow statement

Year to March

Net profit

Depreciation

Gross cash flow

Less:Changes in WC

Operating cash flow

Less: Capex

Free cash flow

83.4

2.5

5.2

16.6

7.3

FY08

FY09

FY10

FY11

19.9

29.4

49.0

53.6

53.6

12.9

26.7

3.2

13.1

13.8

16.8

18.6

30.0

33.6

33.6

23.8

24.9

46.0

49.4

49.4

FY08

FY09

FY10

(INR mn)

FY11

225

79

303

(113)

191

(237)

(46)

254

142

396

(50)

346

(509)

(163)

340

207

547

404

951

(501)

450

507

247

755

93

848

(405)

443

(INR mn)

As on 31st March

FY08

FY09

FY10

FY11

118

1,231

1,349

1,735

3

3,087

1,018

239

85

928

868

58

375

2,228

426

512

1,716

29

3,087

262

118

1,453

1,571

2,502

0

4,073

1,383

552

85

1,039

1,001

81

452

2,573

455

513

2,060

(6)

4,073

345

118

1,731

1,849

2,280

0

4,129

1,685

470

85

1,196

967

148

400

2,712

693

769

1,942

(53)

4,129

350

118

2,170

2,288

1,906

0

4,195

1,842

470

85

1,131

1,040

148

506

2,825

809

918

1,907

(109)

4,195

356

FY08

FY09

FY10

FY11

ROAE (%) (on adjusted profits) 17.6

ROACE (%)

16.5

Inventory days

213.0

Debtors days

91.7

Payable days

94.2

Cash conversion cycle

210.4

Current ratio

4.4

Debt/EBITDA

3.4

Debt/equity

1.3

17.4

14.5

282.5

97.7

126.5

253.6

5.0

3.8

1.6

19.9

14.2

280.3

88.1

144.0

224.4

3.5

3.0

1.2

24.5

17.8

245.7

72.6

158.6

159.6

3.1

2.0

0.8

FY08

FY09

FY10

FY11

19.0

53.6

25.3

20.5

1.5

2.0

12.3

21.5

13.1

33.6

18.2

1.1

2.0

10.8

28.8

33.6

46.4

13.6

1.1

1.7

8.7

43.0

49.4

64.0

9.1

1.1

1.3

6.6

Equity capital

Reserves & surplus

Shareholders funds

Borrowings

Minority Interest

Sources of funds

Net block

Capital Work in Progress

Investments and goodwill

Inventories

Sundry debtors

Cash and equivalents

Other current assets

Total current assets

Sundry creditors

Total CL & provisions

Net current assets

Net deferred tax

Uses of funds

Adjusted BV per share (INR)

Ratios

Year to March

Valuation parameters

Year to March

Diluted EPS (INR)

Y-o-Y growth (%)

CEPS

Diluted P/E (x)

Price/BV (x)

EV/Sales (x)

EV/EBITDA (X)

Edelweiss

Securities Limited

Edelweiss Securities

Limited

Company Profile

AXIS BANK

Buoyant growth

India Equity Research

February 7, 2012

Banking and Financial Services

Key takeaways

EDELWEISS 4D RATINGS

Major discussion has been around its infra and non-fund based exposure.

Management indicated that government seems to be warming up to take some

affirmative action in power sector particularly on the SEB front and fuel linkage

issue. On non-fund based exposure it reiterated that as a lead syndicator it issues

bank guarantees/LCs on behalf of consortium banks with back-to-back

arrangements.

With respect to priority sector lending requirement, it highlighted that this time

agri loan proportion will be similar to FY11 (against its guidance of inching it up

by 25-30bps every year) and it will have to resort to RIDF investments.

Proposes to open 250 branches in the next 12 months (including RBIs requirement

for Tier 5 and 6 cities).

Absolute Rating

BUY

Rating Relative to Sector

Outperformer

Risk Rating Relative to Sector Medium

Sector Relative to Market

Equalweight

MARKET DATA (R : AXBK.BO, B: AXSB IN)

CMP

: INR 1,114

Target Price

: INR 1,372

52-week range (INR)

: 1,460 / 784

Share in issue (mn)

: 412.6

M cap (INR bn/USD mn)

: 460 / 9,151

Avg. Daily Vol. BSE/NSE (000) : 2,171.0

Will gradually increase share of retail in the overall loan portfolio. Will further

build branch based origination capabilities for retail loans. In retail, secured

loans will continue to be a growth driver. On the corporate side, growth will be

primarily working capital related and draw-downs from past sanctions.

Expects credit cost to be around 80bps. No chunky or lumpy restructuring pipeline.

INR70mn of restructured has slipped into NPL in Q3FY12.

Margins are higher than the guided range and should normalize to 3.25-3.5%.

Share Holding Pattern (%)

Promoters*

: 37.5

MFs, FIs & Banks

FIIs

: 31.4

Others

: 24.4

* Promoters pledged shares

(% of share in issue)

6.7

Nil

Investment conclusion

Led by a healthy NIM and fee income performance coupled with a benign asset

quality (against consensus expectation), we anticipate ~21% earnings CAGR over

FY12 14E. The banks strategy of moderating the pace of loan growth is already

reflecting in more formidable retail franchise and consistently higher RoA of 1.6%.

Key risks

Change in management may affect the pace of growth and profitability in the near

term. Deterioration of macro environment can result in higher slippages and slow

down business growth.

PRICE Performance (%)

Stock

Nifty

EW BFSI

Index

15.8

1 month

27.7

9.6

3 months

(4.5)

0.3

3.9

12 months

(16.5)

(7.1)

(6.2)

Financials

Year to March

Net revenues (INR mn)

Net rev growth (%)

Net profit (INR mn)

Shares outstanding (mn)

Diluted EPS (INR)

EPS growth (%)

Diluted P/E (x)

Price to adj. book (x)

ROAE (%)

FY10

FY11

FY12E

FY13E

89,509

36.0

25,143

405

62.1

23.1

17.9

2.9

19.1

111,951

25.1

33,880

411

82.5

33.0

13.5

2.4

19.3

136,267

21.7

41,874

411

102.0

23.6

10.9

2.1

20.2

163,502

20.0

49,564

411

120.7

18.4

9.2

1.8

20.3

Edelweiss Research is also available on www.edelresearch.com,

Bloomberg EDEL <GO>, Thomson First Call, Reuters and Factset.

Nilesh Parikh

+91-22- 4063 5470

nilesh.parikh@edelcap.com

Kunal Shah

+91-22- 4040 7579

kunal.shah@edelcap.com

Suruchi Chaudhary

+91-22-6623 3316

suruchi.chaudhary@edelcap.com

Edelweiss Securities Limited

Post Conference Notes - Day 1

Financial Statements

Balance sheet

Income statement

Year to March

(INR mn)

FY10

FY11

FY12E

FY13E

Interest income

116,380

Interest expenses

66,335

Net interest income

50,045

Non interest income

39,465

- Fee & forex income

30,333

- Misc. income

2,030

- Investment profits

7,102

Net revenues

89,509

Operating expense

37,097

- Employee exp

12,558

- Other opex

24,539

Preprovision profit

52,412

Provisions

13,916

- Loan loss provisions

13,570

- Investment depreciation

(222)

- Other provisions

568

PBT

38,496

Taxes

13,353

PAT

25,143

Diluted EPS

62.1

DPS

12.0

Payout ratio (%)

22.6

151,548

85,918

65,630

46,321

39,210

3,518

3,593

111,951

47,794

16,139

31,655

64,157

12,832

9,551

993

2,288

51,325

17,445

33,880

82.5

14.0

19.8

209,366

128,731

80,635

55,632

49,629

3,253

2,750

136,267

59,605

23,378

36,227

76,662

14,626

13,576

800

250

62,036

20,162

41,874

102.0

17.0

18.4

243,666

149,947

93,719

69,782

62,542

3,741

3,500

163,502

69,057

27,626

41,432

94,444

21,016

20,266

500

250

73,429

23,865

49,564

120.7

20.0

18.3

Growth metrics (%)

Year to March

FY10

FY11

FY12E

FY13E

NII growth

Fees growth

Opex growth

PPOP growth

PPP growth

Provisions growth

PAT growth

35.8

19.7

29.8

31.5

40.7

48.1

38.5

31.1

29.3

28.8

33.7

22.4

(29.6)

34.8

22.9

26.6

24.7

22.0

19.5

42.1

23.6

16.2

26.0

15.9

23.0

23.2

49.3

18.4

Operating ratios (%)

Year to March

FY10

FY11

FY12E

FY13E

8.6

6.7

7.3

3.1

4.4

0.0

5.9

2.9

41.4

34.7

8.4

6.5

7.4

3.2

4.4

4.5

6.4

2.9

42.7

34.0

9.5

6.8

8.0

3.07

5.2

5.1

6.8

2.8

43.7

32.5

9.1

6.6

7.6

2.94

5.0

4.9

6.5

2.7

42.2

32.5

Yield on advances

Yield on investments

Yield on assets

Net interest margins

Cost of funds

Cost of deposits

Cost of borrowings

Spread

Cost-income

Tax rate

(INR mn)

As on 31st March

FY10

Liabilities

Equity capital

Reserves

Net worth

Sub bonds/pref cap

Deposits

Borrowings

Other liabilities

Total

Assets

Loans

Investments

Gilts

Others

Cash & equi

Fixed assets

Other assets

Total

Balance sheet ratios (%)

Credit growth

Deposit growth

EA growth

SLR ratio

C-D ratio

Low-cost deposits

Gross NPA ratio

Net NPA ratio

Provision coverage

Incremental slippage

Net NPA / Equity

Capital adequacy

- Tier 1

Book value

FY11

FY12E

FY13E

4,052

4,106

4,106

4,106

156,393

185,883

220,065

260,581

160,444

189,988

224,171

264,686

71,558

69,932

71,932

73,932

1,413,002 1,892,378 2,287,450 2,696,121

100,137

192,746

297,053

421,212

61,335

82,089

84,013

94,259

1,806,477 2,427,134 2,964,619 3,550,211

1,043,431 1,424,078 1,708,894 2,050,673

341,959

441,979

599,605

692,048

217,789

277,937

345,041

428,920

152,064

214,087

243,375

302,469

12,224

22,732

22,019

20,996

39,009

46,321

45,686

55,105

1,806,477 2,427,134 2,964,619 3,550,211

ROA decomposition (%)

Year to March

Net interest income/Assets

Fees/Assets

Investment profits/Assets

Net revenues/Assets

Operating expense/Assets

Provisions/Assets

Taxes/Assets

Total costs/Assets

ROA

Equity/Assets

ROAE

Valuation parameters

Year to March

Diluted EPS (INR)

EPS growth (%)

Book value per share (INR)

Adj. book value/share (INR)

Diluted P/E (x)

Price/ BV (x)

Price/ ABV (x)

Dividend yield (%)

23.7

20.4

22.8

22.6

83.6

46.7

1.1

0.4

68.2

1.9

2.6

15.8

11.2

396.0

35.8

33.9

34.3

21.2

84.9

41.1

1.0

0.3

74.3

1.2

2.2

17.9

13.2

462.8

20.6

20.9

22.9

23.2

84.7

39.5

1.1

0.5

61.0

1.5

3.7

16.9

13.0

546.0

20.6

17.9

19.9

22.2

86.6

39.7

1.3

0.5

65.2

1.7

4.0

16.2

12.8

644.7

FY10

FY11

FY12E

FY13E

3.1

2.0

0.4

5.6

(2.3)

(0.9)

(0.8)

(4.0)

1.6

8.2

19.1

3.2

2.1

0.2

5.4

(2.3)

(0.6)

(0.8)

(3.8)

1.6

8.5

19.3

3.1

2.0

0.1

5.2

(2.3)

(0.6)

(0.8)

(3.6)

1.6

7.9

20.2

2.9

2.1

0.1

5.1

(2.2)

(0.7)

(0.7)

(3.6)

1.6

7.7

20.3

FY10

FY11

FY12E

FY13E

62.1

23.1

396.0

388.8

17.9

2.8

2.9

1.1

82.5

33.0

462.8

455.8

13.5

2.4

2.4

1.3

102.0

23.6

546.0

531.7

10.9

2.0

2.1

1.5

120.7

18.4

644.7

626.8

9.2

1.7

1.8

1.8

Edelweiss

Securities Limited

Edelweiss Securities

Limited

Company Profile

BAJAJ ELECTRICALS

Domestic consumer play

India Equity Research

February 7, 2012

Engineering and Capital Goods

Key takeaways

EDELWEISS 4D RATINGS

Management reiterated its view on not splitting the consumer business and

engineering and projects business, given the synergies.

Absolute Rating

BUY

Rating Relative to Sector

Outperformer

The company indicated that there is no slowdown in the consumer business and

estimates growth at 20-25%. Moderate growth in fans and luminaries at 10-15%.

Risk Rating Relative to Sector Medium

Sector Relative to Market

Underweight

The company is not too worried of the competition as the market itself is expanding.

MARKET DATA (R : BJEL.BO, B: BJE IN)

After sales service is the key differentiator given Bajaj Electricals provides with

two years warranty.

CMP

: INR 170

Target Price

: INR 240

Investment conclusion

52-week range (INR)

: 296 / 132

Share in issue (mn)

: 99.6

M cap (INR bn/USD mn)

: 17 / 336

With its consumer-facing business growing steadily, the company is now more

focused on its E&P division. By virtue of tie ups with global majors like Morphy

Richards (UK) and Nardi (Italy), the company competes with premium players like

Philips and Kenstar, and has been able to create a niche in the premium segment.

Its products like mixers, irons, OTG, water heaters and room coolers are leading

products in their respective product ranges. The companys distribution reach is

far wider than its competitors, and is efficiently managed in terms of logistics and

supply chain. BJE outsources most of its manufacturing. It has long-term relations

with its vendors, dating back several decades, and has exclusive arrangements

with 70% vendors. With such a set up in place, the company is able to focus on its

core competencies, i.e., marketing and distribution.

Avg. Daily Vol. BSE/NSE (000) : 133.5

Share Holding Pattern (%)

Promoters*

: 65.6

MFs, FIs & Banks

9.4

FIIs

6.9

Others

: 18.1

* Promoters pledged shares

(% of share in issue)

Nil

Key risks

Overdependence on vendors or vendor buy out.

PRICE Performance (%)

Stock

Intense competition in the consumer durable segment can squeeze margins.

Increase in prices of key raw materials such as steel and zinc can hamper margins

of the E&P division.

Nifty

EW Capital

Goods Index

16.1

1 month

20.8

9.6

3 months

(15.1)

0.3

(7.1)

12 months

(24.4)

(7.1)

(25.5)

Financials

Year to March

Revenues (INR mn)

Rev. growth (%)

EBITDA (INR mn)

Net profit (INR mn)

Share outstanding (mn)

EPS (INR)

EPS growth (%)

Diluted P/E (x)

EV/EBITDA (x)

ROE (%)

FY10

FY11

FY12E

FY13E

22,286

26.2

2,499

1,221

98

12.5

21.0

13.5

6.8

33.0

27,408

23.0

2,598

1,488

99

15.1

20.2

11.2

6.5

26.9

31,778

15.9

2,475

1,291

99

13.1

(13.2)

12.9

7.3

19.6

38,350

20.7

3,451

1,895

99

19.2

46.8

8.8

5.3

24.1

Edelweiss Research is also available on www.edelresearch.com,

Bloomberg EDEL <GO>, Thomson First Call, Reuters and Factset.

Rahul Gajare

+91-22- 4063 5561

rahul.gajare@edelcap.com

Amit Mahawar

+91-22- 4040 7451

amit.mahawar@edelcap.com

Swarnim Maheshwari

+91-22- 4040 7418

swarnim.maheshwari@edelcap.com

Edelweiss Securities Limited

Post Conference Notes - Day 1

Financial Statements

Balance sheet

Income statement

Year to March

(INR mn)

FY10

FY11

FY12E

FY13E

Income from operations

22,286

Direct costs

16,524

Employee costs

972

Other expenses

2,292

Total operating expenses

19,787

EBITDA

2,499

Depreciation & amortisation

157

EBIT

2,342

Interest expenses

314

Other income

29

Profit before tax

2,057

Provision for tax

835

Core profit

1,221

Extraordinary items

(50)

Profit after tax

1,171

PAT after minority interest

1,171

Adjusted net profit

1,171

EPS (INR) basic

12.5

Diluted equity shares (mn)

98

Dividend payout (%)

22.4

Tax rate (%)

40.6

27,408

20,729

1,224

2,856

24,810

2,598

126

2,472

291

57

2,239

751

1,488

(50)

1,438

1,438

1,438

15.1

99

21.8

33.5

32,853

24,806

1,438

3,646

29,891

2,963

135

2,828

466

55

2,416

834

1,583

1,583

1,583

1,583

16.0

99

20.5

34.5

38,848

29,063

1,660

4,349

35,072

3,776

149

3,627

521

54

3,161

1,106

2,055

2,055

2,055

2,055

20.8

99

15.8

35.0

FY11

FY12E

FY13E

90.5

0.5

1.1

9.5

5.4

91.0

0.4

1.4

9.0

4.8

90.3

0.4

1.3

9.7

5.3

Common size metrics as % of net revenues

Year to March

FY10

Operating expenses

88.8

Depreciation and Amortization 0.7

Interest expenditure

1.4

EBITDA margins

11.2

Net profit margins

5.5

Growth metrics (%)

Year to March

Revenues

EBITDA

PBT

Net profit

EPS

Cash flow statement

Year to March

Net profit

Depreciation

Deferred tax

Others

Gross cash flow

Less:Changes in WC

Operating cash flow

Less: Capex

Free cash flow

FY10

FY11

FY12E

FY13E

26.2

36.1

46.8

36.6

21.0

23.0

3.9

8.9

21.8

20.2

19.9

14.1

7.9

6.4

6.4

18.2

27.4

30.8

29.8

29.8

FY10

FY11

FY12E

(INR mn)

FY13E

1,221

157

(5)

243

1,616

1,564

52

395

(343)

1,488

126

(20)

260

1,853

828

1,025

627

398

1,583

135

466

2,184

2,237

(53)

200

(253)

2,055

149

521

2,724

1,726

998

250

748

(INR mn)

As on 31st March

FY10

FY11

FY12E

FY13E

Equity capital

195

Reserves & surplus

4,749

Shareholders funds

4,944

Secured loans

684

Borrowings

1,518

Sources of funds

6,462

Gross block

1,700

Depreciation

683

Net block

1,016

Capital work in progress

1

Total fixed assets

1,017

Investments

366

Inventories

2,094

Sundry debtors

7,507

Cash and equivalents

612

Loand & Advances

1,777

Total current assets

11,990

Sundry creditors and others 6,273

Provisions

643

Total CL & provisions

6,916

Net current assets

5,074

Net deferred tax

5

Uses of funds

6,462

Adjusted BV per share (INR)

32

198

5,913

6,111

483

1,165

7,275

2,302

769

1,533

1,533

366

2,946

10,654

481

1,668

15,749

9,661

731

10,392

5,357

20

7,276

52

198

7,172

7,370

1,483

2,165

9,534

2,502

904

1,598

1,598

366

3,874

13,290

438

1,834

19,435

11,561

324

11,885

7,550

20

9,534

78

198

8,902

9,100

1,683

2,365

11,465

2,752

1,052

1,699

1,699

366

4,419

15,705

541

2,018

22,682

12,979

324

13,303

9,379

20

11,465

109

FY10

FY11

FY12E

FY13E

33.0

45.1

43

107

127

23

1.7

0.6

7.4

22.7

0.3

26.9

38.1

44

121

140

25

1.5

0.4

8.5

21.5

0.2

23.5

35.3

50

133

156

27

1.6

0.7

6.1

21.0

0.3

25.0

35.9

52

136

154

34

1.7

0.6

7.0

23.6

0.3

FY10

FY11

FY12E

FY13E

12.4

39.8

13.8

13.5

6.6

0.8

6.8

15.0

21.1

16.2

11.2

5.4

0.6

6.5

13.0

(13.2)

14.3

12.9

4.7

0.6

7.3

19.2

46.8

20.5

8.8

3.8

0.5

5.3

Ratios

Year to March

ROAE (%) (on adjusted profits)

ROACE (%)

Inventory days

Debtors days

Payable days

Cash conversion cycle

Current ratio

Debt/EBITDA

Interest coverage

Fixed assets t/o (x)

Debt/equity

Valuation parameters

Year to March

Diluted EPS (INR)

Y-o-Y growth (%)

CEPS

Diluted P/E (x)

Price/BV (x)

EV/Sales (x)

EV/EBITDA (X)

Edelweiss

Securities Limited

Edelweiss Securities

Limited

Company Profile

BHUSHAN STEEL

In expansion mode

India Equity Research

February 7, 2012

Metals & Mining

Key takeaways

EDELWEISS 4D RATINGS

Phase III 2.9mtpa expansion on track for completion by October 2012

Absolute Rating

HOLD

Rating Relative to Sector

Performer

Bhushan Steel reiterated completion of 2.9mtpa (crude steel) steel expansion by

October 2012. H2FY13E to post volumes of ~0.8mt from this expansion (our

assumption is nil). FY13 and FY14 HRC production guidance is 2.35mt and 3.7mt,

respectively

Targeting FY13 EBITDA of INR 40 bn, a ~33% YoY growth

Risk Rating Relative to Sector Medium

Sector Relative to Market

Underweight

MARKET DATA (R : BSSL.BO, B: BHUS IN)

The company guided for FY13 EBITDA of INR40bn (against our INR28.5bn estimate)

led by volume growth from Phase III expansion. By FY15E, EBITDA expected to grow

further to INR60bn led by HRC volumes rising to 4mt.

Adding downstream capacity of ~2.6mtpa over next three years

CMP

: INR 358

Target Price

: INR 382

52-week range (INR)

: 530 / 296

Share in issue (mn)

: 212.4

M cap (INR bn/USD mn)

: 76 / 1,514

Bhushan Steel has already completed 0.5mtpa ERW pipe plant at Khopoli. CR mill

of 0.35mtpa capacity is expected in Orissa in April 2013 while high-end CR mill of

1.8mtpa capacity is likely to be launched for completion in FY15.

Avg. Daily Vol. BSE/NSE (000) : 439.6

Captive mine commencement ~2 years away

Share Holding Pattern (%)

The company has been allotted iron ore and thermal coal mines with reserves of

70mt and 325mt, respectively, but with the slow approval process would take 1824 months to commence. For the thermal coal mine, land acquisition process has

commenced.

Promoters*

: 69.9

MFs, FIs & Banks

0.8

FIIs

1.8

Others

: 27.5

* Promoters pledged shares

(% of share in issue)

: 19.7

Investment conclusion

The expected ramp up of the 2.3mtpa steel capacity will drive volumes over the

next two years and enable BSL to further strengthen its position in the auto and

white goods sectors. The backward integration facility right up to the metallic

stage will give a fillip to EBITDA margin as dependence on external HR will be

eliminated. Moreover, the pure play exposure to the auto/ white goods industry

places BSL in a competitive position compared to peers.

PRICE Performance (%)

1 month

3 months

Key risks

12 months

Delay in ramping up of capacities.

Stock

Nifty

EW Metals

and Mining

Index

10.9

9.6

17.3

7.4

0.3

3.1

(14.7)

(7.1)

(10.5)

Lack of captive raw material.

Financials

Year to March

Revenues (INR mn)

Rev. growth (%)

EBITDA (INR mn)

Net profit (INR mn)

Share outstanding (mn)

EPS (INR)

EPS growth (%)

Diluted P/E (x)

EV/EBITDA (x)

ROE (%)

FY10

FY11

FY12E

FY13E

56,404

13.8

14,527

8,458

212

39.8

100.8

9.0

12.7

26.5

70,005

24.1

20,304

10,051

212

47.3

18.8

7.6

11.8

20.5

96,188

37.4

28,430

9,437

212

44.4

(6.1)

8.1

9.2

15.0

96,754

0.6

28,546

8,812

212

41.5

(6.6)

8.6

9.9

12.3

Edelweiss Research is also available on www.edelresearch.com,

Bloomberg EDEL <GO>, Thomson First Call, Reuters and Factset.

Prasad Baji

+91-22-4040 7415

prasad.baji@edelcap.com

Navin Sahadeo

+91-22-6623 3473

navin.sahadeo@edelcap.com

Edelweiss Securities Limited

Post Conference Notes - Day 1

Financial Statements

Balance sheet

Income statement

Year to March

(INR mn)

FY10

FY11

FY12E

FY13E

Net revenue

56,404

Accretion to stock

(2,955)

Raw material costs

38,576

Purchase of goods

64

Employee expenses

1,409

Power & fuel

2,150

SGA & other expenses

2,632

Total operating expenses

41,876

EBITDA

14,527

Depreciation & amortisation 2,091

EBIT

12,436

Interest expenses

2,100

Other income

1,178

Profit before tax

11,514

Provision for tax

3,056

Core profit

8,458

Profit after tax

8,458

Profit after minority interest 8,458

Basic shares outstanding (mn) 212.4

Basic EPS

39.8

Diluted shares (mn)

212.4

Diluted EPS

39.8

Dividend per share (INR)

0.5

Dividend payout (%)

1.3

Tax rate

26.5

70,005

(4,718)

42,769

2,221

5,220

4,208

49,701

20,304

2,778

17,525

4,464

695

13,756

3,706

10,051

10,051

10,051

212.4

47.3

212.4

47.3

0.5

1.1

26.9

86,166

40,236

2,244

6,235

11,637

60,351

25,815

6,202

19,612

9,294

650

10,968

2,961

8,007

8,007

8,007

212.4

37.7

212.4

37.7

0.7

1.9

27.0

90,133

42,631

2,266

6,583

12,213

63,693

26,440

6,437

20,003

10,290

715

10,428

2,816

7,613

7,613

7,613

212.4

35.8

212.4

35.8

0.7

2.0

27.0

Common size metrics as % of net revenues

Year to March

FY10

Operating expenses

Depreciation

Interest expenditure

EBITDA margins

Net profit margins

Growth metrics (%)

Year to March

Revenues

EBITDA.

PBT

Net profit

EPS

Cash flow statement

Year to March

Net profit

Add:Non cash charge

Others

Gross cash flow

Less: Changes in W. C.

Operating cash flow

Less: Capex

Free cash flow

FY11

FY12E

FY13E

74.2

3.7

3.7

25.8

15.0

71.0

4.0

6.4

29.0

14.4

70.0

7.2

10.8

30.0

9.3

70.7

7.1

11.4

29.3

8.4

FY10

FY11

FY12E

FY13E

13.8

41.1

105.3

100.8

100.8

24.1

39.8

19.5

18.8

18.8

23.1

27.1

(20.3)

(20.3)

(20.3)

4.6

2.4

(4.9)

(4.9)

(4.9)

FY10

FY11

FY12E

(INR mn)

FY13E

9,653

2,091

1,755

13,500

9,529

3,970

29,042

(25,072)

11,037

2,778

4,942

18,758

8,251

10,507

56,460

(45,953)

8,007

6,202

8,644

22,853

(10,504)

33,358

35,000

(1,642)

7,613

6,437

9,575

23,624

283

23,341

35,000

(11,659)

11

(INR mn)

As on 31st March

FY10

FY11

FY12E

FY13E

Equity capital- Voting shares

425

Preference share capital

367

Reserves & surplus

39,125

Shareholders funds

39,917

Secured loans

106,101

Unsecured loans

7,940

Borrowings

114,041

Deferred tax liability

3,295

Sources of funds

157,253

Gross block

36,859

Depreciation

16,066

Net block

20,793

CWIP

111,093

Total fixed assets

131,886

Investments

3,700

Loans and advances

9,534

Inventories

19,627

Sundry debtors

7,339

Cash and equivalents

1,202

Total current assets

37,702

Sundry creditors and others 15,671

Provisions

365

Total CL & provisions

16,036

Net current assets

21,666

Uses of funds

157,253

BV per share (INR)

188

425

687

57,853

58,964

150,659

15,267

165,926

6,983

231,874

144,244

18,581

125,663

73,932

199,595

2,777

13,307

31,684

4,835

351

50,177

20,192

484

20,676

29,501

231,874

278

425

687

65,684

66,796

183,859

4,275

188,134

6,983

261,913

144,244

24,784

119,460

108,932

228,393

3,610

13,307

22,047

4,721

11,264

51,339

20,945

484

21,429

29,910

261,913

315

425

687

73,121

74,233

203,359

4,275

207,634

6,983

288,850

155,137

31,220

123,917

133,039

256,956

3,610

13,307

23,360

4,939

9,355

50,960

22,192

484

22,676

28,284

288,850

350

FY10

FY11

FY12E

FY13E

26.5

9.6

163

44

150

57

7.9

2.4

2.9

2.9

20.5

9.2

304

25

172

85

8.2

2.4

2.8

2.8

12.9

8.0

200

20

187

25

7.3

2.4

2.8

2.8

10.9

7.4

200

20

185

25

7.9

2.2

2.8

2.8

Valuation parameters

Year to March

FY10

FY11

FY12E

FY13E

EPS (INR)

Y-o-Y growth (%)

CEPS (INR)

P/E (x)

Price/BV(x)

Market cap/Sales (x)

EV/Sales (x)

EV/EBITDA (x)

Dividend yield (%)

39.8

100.8

49.7

9.0

1.9

1.3

3.3

12.7

0.1

47.3

18.8

60.4

7.6

1.3

1.1

3.4

11.8

0.1

44.4

(6.1)

73.6

8.1

1.1

0.8

2.7

9.2

0.2

41.5

(6.6)

71.8

8.6

1.0

0.8

2.9

9.9

0.2

Ratios

Year to March

ROAE (%)

ROACE (%)

Inventory (days)

Debtors (days)

Payable (days)

Cash conversion cycle (days)

Debt/EBITDA

Current ratio

Debt/ Equity

Adjusted debt/Equity

Edelweiss

Securities Limited

Edelweiss Securities

Limited

Company Profile

CAIRN INDIA

CY13 exit production guidance at 210-240 kbpd

India Equity Research

February 7, 2012

Oil, Gas and Services

Key takeaways

EDELWEISS 4D RATINGS

CY13 exit crude oil prodn. at 210-240kbpd; pipeline not a bottleneck

Absolute Rating

HOLD

Rating Relative to Sector

Performer

Crude oil production is likely to increase to 210-240kbpd, (150+kbpd - Mangala,

40+kbpd Bhagyam, 20+kbpd Aishwarya) by CY13 end. Pipeline capacity is not

a bottleneck for increasing the production as the same can be managed by

increasing the number of pumping stations (required approvals), which require

less time and capex.

Risk Rating Relative to Sector Medium

Sector Relative to Market

Overweight

MARKET DATA (R : CAIL.BO, B: CAIR IN)

Dividend seems near, but only after consolidation; better Q4 pricing

Cairn holds cash of USD1.4bn and will be generating ~USD1bn of FCF in FY13. It is

in final stages DGH approval for consolidation of its foreign subsidiaries. Only

after the same will it announce the dividend. Q4FY12 pricing will be better due to

better fuel oil cracks.

CMP

: INR 366

Target Price

: INR 342

52-week range (INR)

: 372 / 250

Share in issue (mn)

: 1,903.0

M cap (INR bn/USD mn)

: 697 / 13,863

Avg. Daily Vol. BSE/NSE (000) : 3,877.0

FY13E net capex at USD800mn; triggers exist

FY13 capex guidance of USD800mn (net), of which 70% for MBA development and

balance for Rajasthan exploration. Sri Lanka exploration capex at USD200mn

(USD150mn spent till date). Triggers to watch out areMangala approval for 150

kbpd, Aishwarya FDP approval, FDP submission and approval for Bhagyam and

Aishwarya fields.

Investment conclusion

We have a negative view on crude on the back of weakening demand and rising

supply from Libya and US and estimate FY13 Brent at USD95/bbl.

Key risks

Fall in crude prices or a higher discount to Brent. Delay in getting approvals to

ramp up Mangala. Utilization of excess cash.

Share Holding Pattern (%)

Promoters*

: 59.0

MFs, FIs & Banks

8.2

FIIs

6.2

Others

: 26.5

* Promoters pledged shares

(% of share in issue)

Nil

PRICE Performance (%)

Stock

Nifty

EW O &G

Index

1 month

8.9

9.6

8.0

3 months

18.5

0.3

(1.1)

12 months

5.0

(7.1)

(5.8)

Financials

Year to March

Net Revenues(INR Mn)

EBITDA (INR Mn)

Net profit (INR Mn)

EPS (INR)

P/E (x)

EV/EBITDA (x)

ROAE (%)

FY10

FY11

FY12E

FY13E

16,230

9,805

10,511

5.5

66.5

71.6

3.2

102,779

84,117

63,344

33.2

11.0

7.9

17.1

155,252

109,136

87,114

45.8

8.0

5.9

19.9

168,367

112,244

89,498

47.0

7.8

5.3

17.5

Edelweiss Research is also available on www.edelresearch.com,

Bloomberg EDEL <GO>, Thomson First Call, Reuters and Factset.

Niraj Mansingka, CFA

+91 22 6623 3315

niraj.mansingka@edelcap.com

Edelweiss Securities Limited

Post Conference Notes - Day 1

Financial Statements

Balance sheet

Income statement

Year to March

(INR mn)

FY10

FY11

FY12E

FY13E

Net revenues

16,230

Increase/decrease in stocks (366)

Statutory levies

1,466

Lifting costs

2,782

Production expenses

4,248

Employee expenses

1,441

Other expenses

1,102

Total expenses

6,791

EBITDAX

9,805

Recouped costs

3,570

EBIT

6,235

Financing costs

148

Other income

4,077

Profit before tax

10,163

Current tax

2,216

Deferred tax

(1,087)

Other taxes

(1,477)

Total tax

(348)

Core profit

10,511

Extraordi./ prior period items

0

Profit after tax

10,511

Profit after minority int.

10,511

Basic shares (mn)

1,897

EPS - basic (INR)

5.5

Diluted shares (mn)

1,911

EPS - diluted (INR)

5.5

CEPS

6.9

DPS

-

102,779

(264)

9,820

5,350

15,170

1,409

2,346

18,925

84,117

13,596

70,521

2,909

1,288

68,900

15,611

(11,214)

1,159

5,556

63,344

0

63,344

63,344

1,902

33.3

1,908

33.2

34.6

-

164,113

0

39,894

5,358

45,252

1,442

2,416

49,111

115,002

16,453

98,549

2,603

2,771

98,717

19,281

(12,371)

0

6,910

91,807

(9,600)

82,207

82,207

1,903

48.3

1,903

48.3

50.4

4.3

161,790

0

44,865

5,885

50,751

1,495

2,489

54,734

107,056

17,622

89,434

2,055

4,475

91,854

17,940

(11,511)

0

6,430

85,424

0

85,424

85,424

1,903

44.9

1,903

44.9

48.1

6.7

FY11

FY12E

FY13E

14.8

2.3

81.8

13.2

2.8

61.6

27.6

1.5

70.1

10.0

1.6

50.1

31.4

1.5

66.2

10.9

1.3

52.8

Common size metrics as % of net revenues

Year to March

FY10

Direct costs

Other expenses

EBITDA margins

Depreciation & amortisation

Interest

Net profit margin

Growth metrics (%)

Year to March

26.2

6.8

60.4

22.0

0.9

64.8

FY10

FY11

FY12E

FY13E

Revenues

EBITDA

PBT

Net profit

EPS

13.3

7.8

2.9

30.8

31.0

533.3

757.9

577.9

502.6

503.8

59.7

36.7

43.3

44.9

45.3

(1.4)

(6.9)

(7.0)

(7.0)

(7.0)

Cash flow statement

Year to March

FY10

FY11

FY12E

(INR mn)

FY13E

Net profit

10,511

Add: Depreciation

3,570

Add: Deferred tax

(1,087)

Add: Others

(3,881)

Gross Cash flow

9,114

Less: Changes in wor. capital 8,357

Opertaing cash flow

757

Less: Capex

31,122

Free Cash flow

(30,365)

63,344

13,596

(11,214)

1,545

67,271

5,861

61,410

32,791

28,619

82,207

16,453

(12,371)

(2,225)

84,064

20,216

63,848

29,527

34,320

85,424

17,622

(11,511)

(5,450)

86,086

6,483

79,603

21,490

58,113

13

(INR mn)

As on 31st March

Total equity capital

Stock option outstanding

Reserves & surplus

Shareholder's equity (A)

Minority interest (B)

Secured loans

Unsecured loans

Total debt (C)

Deferred tax liability (D)

Sources of funds (A+B+C+D)

Gross fixed assets

Depreciation

Net fixed assets

Capital WIP

Total fixed assets (A)

Investments (B)

Inventories

Accounts receivable

Cash and cash equivalents

Loans and advances

Other current assets

Current assets (C)

Current liabilities

Provisions

Current lia. & provis. (D)

Net current assets (E)

Miscellaneous exp. (F)

Uses of funds (A+B+E+F)

Book value per share

FY10

FY11

FY12E

FY13E

18,970

464

319,250

338,683

19,019

555

383,358

402,932

19,027

0

458,490

477,516

19,027

0

531,100

550,127

34,007

0

34,007

4,453

377,144

261,791

2,335

259,457

91,635

351,092

17,124

2,909

3,067

9,294

8,318

145

23,734

9,869

4,937

14,806

8,928

0

377,144

169

13,282

13,500

26,782

5,612

435,326

346,398

13,120

333,278

39,819

373,097

10,944

3,277

14,829

44,847

16,269

386

79,608

12,638

16,628

29,266

50,343

943

435,326

202

10,000

1

10,001

(6,759)

480,759

370,812

28,073

342,739

44,933

387,671

12,000

4,103

22,976

55,376

32,823

821

116,098

13,129

21,881

35,010

81,087

0

480,759

241

5,000

1

5,001

(18,269)

536,858

387,182

44,196

342,986

50,053

393,039

12,000

4,045

22,651

99,625

40,448

809

167,577

12,943

22,815

35,758

131,819

0

536,858

279

FY10

FY11

FY12E

FY13E

1.7

3.2

2.8

1.6

65

222

(105)

0.1

3.5

0.1

18.0

17.1

15.6

2.7

12

45

(1)

0.1

0.3

0.1

22.1

20.9

20.0

3.3

9

29

22

0.0

0.1

0.0

18.0

16.6

16.8

4.7

9

29

31

0.0

0.0

0.0

FY10

FY11

FY12E

FY13E

5.5

31.0

6.9

66.5

2.2

43.3

71.6

0.0

33.2

503.8

34.6

11.0

1.8

6.5

7.9

0.0

45.8

37.9

47.8

8.0

1.5

4.1

5.9

1.1

47.0

2.7

50.3

7.8

1.3

3.5

5.3

1.9

Ratios

Year to March

ROACE

ROAE (%)

ROA

Current ratio

Inventory (days)

Payables (days)

Cash conversion cycle (days)

Debt-equity (x)

Debt/EBITDA

Adjusted debt/equity

Valuation parameters

Year to March

Diluted EPS (INR)

Y-o-Y growth (%)

CEPS (INR)

Diluted P/E (x)

P/BV (x)

EV/Sales (x)

EV/EBITDA (x)

Dividend yield(%)

Edelweiss

Securities Limited

Edelweiss Securities

Limited

Company Profile

COX & KINGS

All eyes on HBR

India Equity Research

February 7, 2012

Hotels

Key takeaways

EDELWEISS RATINGS

Cox and Kings (CNK) expects synergies in business as combined group buying

(~INR65bn) will improve overall margins going forward.

Absolute Rating

HOLD

Investment Characteristics

Growth

Holiday Breaks (HBR) is in talks with public schools to start providing educational

tours facility at subsidized rates in UK. Current facilities of government are facing

budget cuts. Currently, HBRs educational centers are running at just 30% capacity

utilization.

CNK has the option to purchase the balance 50% stake of Menninger at EUR4050mn. The final pricing will be dependent on a formula based on various factors

such as sales achieved, PAT etc. Purchase could be executed during FY13-14.

The company may look for equity dilution to reduce the leverage (~INR33bn post

acquisition) as one of the options.

From the short-term perspective the companys goal is proper integration. From

the medium-term perspective the aim is to drive synergies, margins and reduce

leverage. Its long-term aim is to introduce HBR educational products in India.

MARKET DATA (R : COKI.BO, B: COXK IN)

CMP

: INR 185

Target Price

: INR 248

52-week range (INR)

: 248 / 152

Share in issue (mn)

: 136.5

M cap (INR bn/USD mn)

: 25 / 504

Avg. Daily Vol. BSE/NSE (000) : 471.2

Share Holding Pattern (%)

Promoters*

: 58.7

MFs, FIs & Banks

Post acquisition of HBR, we believe working capital will turn negative in FY13 as

operations in UK are mostly retail based. CNK is looking for synergies from HBR in

terms of better purchasing power capacity, wider geographical reach and more

product offerings. Consistent innovation and the companys inorganic growth

strategy have provided CNK with higher growth rate.

FIIs

: 21.3

Others

: 13.9

* Promoters pledged shares

(% of share in issue)

Key risks

PRICE Performance (%)

Investment conclusion

CNKs inability to drive volumes could lower its bargaining power with business

partners, deployment of further working capital in subsidiaries and other group

companies, unforeseen events like war or disease.

BSE Midcap

Index

Stock

6.2

Nil

Stock over

Index

1 month

15.0

10.4

(4.6)

3 months

(4.0)

(20.4)

(16.4)

12 months

(10.2)

(14.7)

(4.5)

Financials

Year to March

FY10

FY11

FY12E

FY13E

Revenues (INR mn)

Growth (%)

EBIDTA (INR mn)

Net profit (INR mn)

Share outstanding (mn)

EPS (INR)

EPS growth (%)

Diluted P/E (x)

ROAE (%)

3,992

39.1

1,864

1,064

126

8.4

26.8

22.1

20.7

4,967

24.4

2,301

1,175

137

8.5

1.4

21.8

11.7

17,145

245.1

1,122

(1,711)

137

(12.6)

(248.8)

NA

(15.4)

43,555

154.0

7,508

2,779

137

20.2

NA

9.2

24.2

Edelweiss Research is also available on www.edelresearch.com,

Bloomberg EDEL <GO>, Thomson First Call, Reuters and Factset.

Manish Sarawagi

+91 22 4040 7575

manish.sarawagi@edelcap.com

Manav Vijay

+91 22 4063 5413

manav.vijay@edelcap.com

Edelweiss Securities Limited

Post Conference Notes - Day 1

Financial Statements

Balance sheet

Income statement

(INR mn)

Year to March

FY10

FY11

FY12E

FY13E

Income from operations

3,992

Employee cost

994

Advertisement expenditure

357

Other expenditure

776

Total operating expenses

2,127

EBITDA

1,864

Depreciation and amortisation 151

EBIT

1,714

Interest expenses

270

Other income

137

Profit before tax

1,581

Provision for tax

517

Core profit

1,064

Extraordinary items

284

Profit after tax

1,348

Less: Minority interests

(10)

PAT after minority interest

1,338

EPS (INR) basic

8.4

Diluted equity shares (mn)

126

Dividend payout (%)

5.5

Tax rate (%)

28

4,967

1,296

423

948

2,667

2,301

186

2,115

544

230

1,801

626

1,175

130

1,305

(15)

1,290

8

137

6.2

32

17,145

2,868

1,291

11,863

16,022

1,122

938

185

1,467

335

(948)

763

(1,711)

0

(1,711)

(15)

(1,726)

(13)

137

NA

33

43,555

6,414

3,106

26,527

36,047

7,508

1,532

5,976

2,615

395

3,755

976

2,779

0

2,779

(15)

2,764

20

137

5.7

26

FY11

FY12E

FY13E

53.7

3.7

11.0

46.3

23.7

93.5

5.5

8.6

6.5

(10.0)

82.8

3.5

6.0

17.2

6.4

Common size metrics as % of net revenues

Year to March

FY10

Operating expenses

Depreciation and Amortization

Interest expenditure

EBITDA margins

Net profit margins

Growth metrics (%)

Year to March

Revenues

EBITDA

PBT

Net profit

EPS

Cash flow statement

Year to March

Net profit

Depreciation

Others

Gross cash flow

Less:Changes in WC

Operating cash flow

Less: Capex

Free cash flow

53.3

3.8

6.8

46.7

26.7

FY10

FY11

FY12E

FY13E

39.1

53.7

60.9

67.9

26.8

24.4

23.4

13.9

10.4

1.4

245.1

(51.2)

(152.6)

(245.6)

(248.8)

154.0

568.9

NA

NA

NA

FY10

FY11

FY12E

(INR mn)

FY13E

1,865

151

(87)

1,345

833

512

312

201

1,931

186

188

1,765

815

950

883

67

(948)

938

1,179

406

(9,145)

9,552

17,160

(7,608)

3,755

1,532

2,268

6,579

(1,984)

8,562

300

8,262

15

(INR mn)

As on 31st March

FY10

FY11

FY12E

FY13E

Equity capital

629

Reserves & surplus

7,472

Shareholders funds

8,101

Secured loans

2,946

Unsecured loans

2,097

Borrowings

5,043

Deferrex tax (net)

48

Sources of funds

13,192

Gross block

1,337

Depreciation

615

Net block

722

Capital work in progress

204

Investments

2,584

Inventories

83

Sundry debtors

3,021

Cash and equivalents

3,747

Other current assets

2,715

Total current assets

9,565

Sundry creditors and others 1,769

Provisions

344

Total CL & provisions

2,113

Net current assets

7,452

Net deferred tax

55

Uses of funds

13,192

Adjusted BV per share (INR)

64

683

11,396

12,079

5,443

3,000

8,443

91

20,613

1,841

819

1,021

641

2,112

86

4,142

9,613

3,826

17,667

2,681

350

3,031

14,636

28

20,613

88

683

9,522

10,204

31,693

3,000

34,693

91

44,989

19,001

1,757

17,243

641

3,112

282

5,167

852

4,826

11,127

14,047

350

14,397

(3,270)

28

44,989

75

683

12,137

12,819

27,693

3,000

30,693

91

43,604

19,301

3,289

16,011

641

4,112

716

5,966

1,687

6,326

14,696

18,764

350

19,114

(4,418)

28

43,604

94

FY10

FY11

FY12E

FY13E

ROAE (%) (on adjusted profits) 20.7

ROACE (%)

21.4

Inventory days

5.4

Debtors days

244.3

Payable days

309.3

Cash conversion cycle

(59.6)

Current ratio

4.5

Debt/EBITDA

2.7

Interest coverage

6.4

Fixed assets t/o (x)

5.5

Debt/equity

0.6

11.7

14.5

6.2

263.2

304.6

(35.2)

5.8

3.7

3.9

4.9

0.7

(15.4)

0.6

4

99

191

(87.5)

0.8

31

0.1

1.0

3.4

24.2

14.7

4

47

166

(115.3)

0.8

4

2.3

2.7

2.4

FY10

FY11

FY12E

FY13E

8.4

26.8

9.7

22.1

2.9

5.5

11.8

10.1

0.5

8.5

1.4

10.0

21.8

2.1

4.4

9.6

22.5

0.5

(12.6)

(248.8)

(5.7)

NA

2.5

3.3

49.9

3.4

1.1

20.2

NA

31.6

9.2

2.0

1.2

6.7

Ratios

Year to March

Valuation parameters

Year to March

Diluted EPS (INR)

Y-o-Y growth (%)

CEPS (INR)

Diluted P/E (x)

Price/BV(x)

EV/Sales (x)

EV/EBITDA (x)

EV/EBITDA (x)+1 yr forward

Dividend yield (%)

Edelweiss

Securities Limited

Edelweiss Securities

Limited

1.1

Company Profile

DABUR INDIA

The health and wellness expert

India Equity Research

February 7, 2012

Consumer Goods

Key takeaways

EDELWEISS 4D RATINGS

Dabur India (Dabur) posted ~8% YoY volume growth in domestic business in Q3FY12.

Management expects volume growth to be sustained at high single digit in coming

quarters. The company believes that margins have bottomed out. It expects margins

to improve 100bps per quarter for the next 2 3 quarters despite maintaining ad

spends at ~13-14% of sales.