Escolar Documentos

Profissional Documentos

Cultura Documentos

Introduction To Banking

Enviado por

Imtiyaz AlamTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Introduction To Banking

Enviado por

Imtiyaz AlamDireitos autorais:

Formatos disponíveis

Introduction to Banking Part I Basics, Savings, Current, CCOD, Remittance, Cash Version 1.

0 TATA Consultancy Services March 2002 Mumbai Introduction to Banking Part I Version 1.0 Tata Consultancy Services 1of 53

Confidential

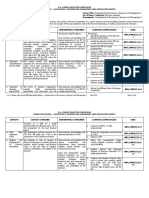

Table of Contents 1. ABOUT THIS DOCUMENT.......................................................... ............................................ 2 1.1 P URPOSE.................................................................... ....................................................2 1.2 O RGANISATION OF THIS D OCUMENT............................................. ....................................2 2. WHAT IS BANKING ? ........................................................... ..................................................3 2.1 INTRODUCTION................................................................ ................................................3 2.2 T HE BUSINESS OF BANKING ................................................... ..........................................3 2.3 R ELATIONSHIP BETWEEN A BANKER AND A C USTOMER ............................. .........................5 2.4 B ANKING SYSTEM IN INDIA................................................... ............................................6 3. ACCOUNTING CONCEPTS ......................................................... ........................................... 9 3.1 C OMPONENTS OF ACCOUNTING................................................... ....................................9 3.2 S YSTEMS OF ACCOUNTING...................................................... ......................................11 3.3 F IXED ASSETS.............................................................. .................................................16 3.4 C HART OF ACCOUNT........................................................... ..........................................17 3.5 S UMMARY.................................................................... .................................................21 4. SAVINGS ACCOUNT ............................................................. ............................................... 23 4.1 C ONCEPTS .................................................................. ..................................................23 4.2 P ROCESSING OF F INANCIAL T RANSACTIONS................................... ................................24 4.3 INTEREST CALCULATION....................................................... .........................................33 4.4 PPF A CCOUNT................................................................ ..............................................35 4.5 P ENSION ACCOUNT............................................................ ...........................................36 4.6 C OLLECTION OF GOVT. ACCOUNT................................................ ..................................36 4.7 D EFICIENCIES OF THE MANUAL SYSTEM......................................... .................................37 4.8 U NDERSTANDING THE ACCOUNTING ENTRIES ...................................... ...........................38 5. CURRENT ACCOUNT ............................................................. .............................................. 39

5.1 C ONCEPTS .................................................................. ..................................................39 5.2 P ROCESSING OF F INANCIAL T RANSACTIONS................................... ................................41 5.3 D EFICIENCIES / LIMITATIONS OF THE MANUAL SYSTEM ........................... ..........................41 6. CASH CREDIT/OVERDRAFT ACCOUNT ............................................... ............................. 42 6.1 C ONCEPTS .................................................................. ..................................................42 6.2 P ROCESSING OF F INANCIAL T RANSACTIONS................................... ................................44 6.3 INTEREST CALCULATION....................................................... .........................................45 6.4 D EFICIENCIES / LIMITATIONS OF THE MANUAL SYSTEM ........................... ..........................46 6.5 ALPM OPERATIONS ........................................................... ..........................................46 7. INLAND REMITTANCES........................................................... ............................................ 47 7.1 N EED FOR R EMITTANCE FACILITY ............................................ .......................................47 7.2 M ODES OF R EMITTANCE ..................................................... ...........................................47 7.3 R ECONCILIAITION OF ACCOUNTS BETWEEN BRANCHES ............................. .......................48 7.4 P ROCEDURE RELATED TO INLAND R EMITTANCES................................... ..........................48 7.5 D EFICIENCIES / HANDICAPS OF THE MANUAL O PERATIONS ....................... ........................51 8. CASH DEPARTMENT PROCEDURE ................................................... ................................ 52 8.1 INTRODUCTION................................................................ ..............................................52 8.2 O PERATION ON THE C URRENCY C HEST ......................................... .................................52 8.3 P ROCEDURE FOR OBTAINING CASH FROM THE C ASH O FFICER ...................... ...................52 8.4 R ECORD OF CASH T RANSACTIONS............................................... ..................................52 8.5 P ROCEDURE FOR TURNING IN AND BALANCING OF CASH............................. ......................53 8.6 C USTODY OF KEYS ........................................................... .............................................53 Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 2of 53 1. ABOUT THIS DOCUMENT 1.1 Purpose The objective of this document is to provide a basic understanding of the variou s operations in a bank / branch and familiarise the reader with the various banking terminology, the functions and operations performed by the various departments in a branch. The focus in on the manual processes preformed at a branch as this will help in understanding the operation s from a bankers perspective. Computerisation has changed the way in which some of these operations are performed today. However, once the reader has the understanding

of the manual procedures, it will be easy for him/her to map it on to the automated pro cesses. This document is a part of the training material for fresh entrants into the ban king group. Also, the persons responsible for the implementation of Banking solutions could also u se this as a reference material. It is recommended that the reading is taken up in the order specified. 1.2 Organisation of this Document This document is organized based on the various functions performed at the branc h. It also provides a very basic tutorial on the accounting concepts as is applicable to th e banking industry. This document is organised in three parts for sake of convenience. It is advisable for beginners to read this document in the order it has been presented. Part I What is Banking Accounting Concepts Savings Account Current Account Cash Credit / Overdraft Accounts Inland Remittances Cash Department Procedures Part II Time Deposits Loans Bills Letter of Credit Guarantees Part III Introduction to Foreign Exchange Exports Imports Foreign Remittances Forward contracts This is the first part (Part I) of the Introduction to Banking. Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 3of 53 2. WHAT IS BANKING ? 2.1 Introduction Banking is defined as Accepting of deposits of money from public for the purpose of Lending or Investment, repayable on demand or otherwise and withdrawable by cheque, draf t, or otherwise A banking company must perform both of the essential functions accepting of deposits lending or investing the deposits and such a company is called a Bank. Alternately, an institution (person or body, corporate or otherwise) cannot be a bank if it does not - Take deposit accounts Take current accounts Issue and pay cheques Collect cheques crossed and uncrossed for his customers If the purpose of accepting of deposits is not to lend or invest, then the busin

ess will not be called as a banking business. 2.2 The Business of Banking When the bank accepts deposits, it pays interest on the deposit to the customer. When the bank lends money, it charges interest on the money lent to the customer. Also, t he bank provides certain services to its customers for a fee. Thus, the business of a bank is based on this principle of The difference in interest received on the amount lent and the interest paid on the deposits collected. This difference between interest earned and paid is also called Spre ad. Income received by means of fees for the services rendered In very simple terms, the business model of a bank can be summarised as follows -Profit = ( IR I P ) (O C + O E ) + F I Where, I R - Interest Received on Advances I P - Interest Paid on Deposits O C - Operating Costs O E - Operating Expenses F I - Fee based Income 2.2.1 Deposits When a bank accepts money from the public, it is called as a Deposit. Accepting deposits of money from the public is one of the essential functions of a bank. Deposits are one of the basic resources for the banking industry. The relationship between a banker and a customer is established with the opening of an account by the customer with a deposit of mon ey. Deposits can be classified as -! Demand Deposits ! Time Deposits Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 4of 53 2.2.1.1 Demand Deposit As the name suggests, these deposits are repayable on Demand. The customer can d emand the deposit back from the bank at his discretion and the bank has to oblige. Examples Savings account, Current Account. We shall look at the details of this later in the document. 2.2.1.2 Time Deposits In this type of deposits, the bank and the customer enter into a contract over t

he amount of money to be deposited, the duration and the interest rate applicable. Here, the money is repaid to the customer as per the contracted date. However, there are provisions available for the customer to take his money back without fulfilling the contract, in which ca se, there will be a monetary penalty levied. Examples Term Deposits, Recurring deposits, etc. We shall look at the details of this later in the document. 2.2.2 Advances Banks mobilise deposits for the purpose of lending and investment in order to ea rn profits from such operations. Funds are lent at an interest that will obviously be higher tha n the interest paid by the bank on deposits. Advance is another term used for lending of funds. Advances can be broadly classified as -! Loans ! Overdrafts 2.2.2.1 Loans It is a disbursal of an amount towards a specific purpose for a pre-determined p eriod and is normally repaid in pre-determined installments. Interest is charged by the bank on the amount lent to the customer. Interest charged could be simple or compound, based on dai ly or monthly balance, depending on agreed terms. Examples Housing loan, Vehicle loan, Loan for household items, etc. 2.2.2.2 Overdrafts This is a facility, where a limit in terms of amount is defined for a customer a ccount. The customer can withdraw the amount upto a maximum of the specified limit as and wh en he needs and can repay it by means of deposits in his account. Interest is charged on the amount overdrawn and for the period of its actual utilisation. Advances can either be secured of unsecured. 2.2.2.3 Secured Advances These are advances given to customers against some security such as Shares, Prop erty, etc. 2.2.2.4 Unsecured Advances These are advances given to customers without any security. These are essentiall y short-term arrangements based on the customers standing or reputation Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 5of 53 2.2.3 Resources (Funds) Management Of all the resources of the bank, deposits form the most important part since ba nking functions essentially consist of accepting deposits and lending the deposits for productiv e purposes. Deposits have a high cost as the bank has to meet in turn its obligations to th e depositors. This apart, the bank has to carry a certain amount of liquidity to meet its day -to-day obligations. Keeping idle cash may mean forfeiting the opportunity to earn inter est. It is therefore, imperative that the costly resources are employed in such a way as to

yield maximum return to the bank. Bank deposits do not convert themselves into resource unless they are available to the bank for effective deployment. Branches advise their deposits figures to their contro lling authority on a weekly basis. These are collated and made available to the Central Office. It is only when the Central Office is able to plan for the investment of such deposits in time o n the basis of the weekly statements, can these deposits be termed as real resources of the bank. 2.2.3.1 Cash Reserve Ratio (CRR) One of the statutory obligations of the bank is to maintain a prescribed percent age of its Demand and Time deposits in the form of Cash with RBI. The current prescribed pe rcentage is 7% and this keeps varying. Every scheduled bank maintains this amount as a Curre nt Account with RBI and all inter-bank transactions are routed through this account. Hence, the balance in this account will be fluctuating. RBI will consider the average balance maintain ed by the bank over the last 15 days for monitoring the CRR. The bank does not receive any interest on the CRR maintained by them with RBI. 2.2.3.2 Statutory Liquidity Reserve (SLR) The bank has to utilise a part of its resource to comply with yet another requir ement namely the SLR. A specified percentage of the banks total Demand and Time liabilities h ave to be maintained by way of investments in approved securities, cash in hand, gold or e xcess balance with the RBI over the CRR. The maximum percentage that RBI can specify i s 40%. Currently the SLR percentage is 25%. The objective of this is to force the banks to keep a significant proportion of their deposits in liquid assets. These statutory requirements are also tools in the hand of the Government to reg ulate money supply in the economy. Resources are available for lending purposes, after CRR and SLR requirements are met. Even out of the remaining balance, certain percentages are specified for advances tow ards priority sectors. 2.3 Relationship between a Banker and a Customer A person from whom the bank has accepted money or to whom bank has lent money is termed as a Customer of the bank. In very loose terms, the relationship between a bank and a customer is established by means of an Account. Relationship of a Debtor and Creditor (Banker as Debtor) When a customer deposits money with a bank, he lends it to the banker. Thus, the depositor becomes the creditor and the banker a debtor. Relationship of a Creditor and Debtor When a bank lends money to a customer, the banker becomes the creditor and the c ustomer a debtor. Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential

6of 53 Banker as a Trustee The bank can act as a trustee for customers money, where they perform certain fun ctions for the benefit of some other person called the beneficiary. Banker as an Agent In some cases the banker acts as an agent for a customer, where he buys or sells securities on behalf of his customer, collects cheques on his behalf and makes payments of various dues, like payment of insurance premium. Banker as a Consultant Some banks have separate departments to give consultancy to their customers in a reas of payment of taxes, making investments, etc. Banker as a Bailee Bankers also provide service of safe custody to their customers, where they act not only as a trustees but also as bankers. In this capacity the customer deposits valuables w ith the bank for safe custody. Hence in case of a loss, Banker is liable as a bailee and the cust omer is a bailor. Lessor and Lessee (Banker as a Lessor) The banker provides Safe Deposit Lockers to its customers on lease for depositin g their valuables. Here the banker is the Lessor and the customer is the Lessee. 2.4 Banking System in India 2.4.1 Evolution The Indian Govt. established three Presidency banks in India - Bank of Calcutta (Bank of Bengal) - 1806/1809 Bank of Bombay - 1840 Bank of Madras - 1843 These three Presidency banks were subsequently amalgamated into the Imperial Ban k of India in 1921 which is now State Bank of India. The Imperial Bank of India was allowed to hold Government Funds and to manage pu blic debt and clearing houses, till the establishment of the Reserve Bank of India in 1935 . The State Bank of India Act was passed in 1955 and the function of the Imperial Bank was taken over by the newly constituted State Bank of India. Towards the end of 19 th century and the beginning of 20 th century, some joint stock banks came on the scene. Some of these banks were Allahabad Bank Ltd. Punjab National Bank Ltd., Bank of India Ltd., Canara Bank Ltd., Indian Bank Ltd., Bank of Baroda Ltd . These banks along with the other major banks were nationalised in 1969 and 1980. 2.4.2 Reserve Bank of India (RBI) RBI started functioning as the central bank of the country from 1935 onwards. Or iginally RBI was established as a private sector bank with its capital contributed by shareho lders. Shortly after its establishment, RBI took over the function of currency issue from the G ovt. of India and the power to control credit of the country.

Introduction to Banking Part I Version 1.0 Confidential 7of 53 Thus RBI is the Central bank of the country and performs the traditional functio ns of a central bank and a variety of development and promotional functions. RBI is also respons ible for granting permission for setting up of new banks or branches. 2.4.2.1 Role of RBI Some of the important functions of RBI are -Issue and Regulation of Currency It is the sole authority for issue of currency in the country. It issues and regulates the issue of currency and ensures that the coun try has adequate supply of currency for the smooth functioning of the economy. Maintain Currency Chests The currency notes have to be equitably distributed in all parts of the country. For this purpose, RBI has made adequate administrative arrangeme nts by opening offices of its issue department in important cities. Banker to the Central and State Governments All money belonging to Govt. of Indi a are kept with RBI. It looks after the current financial transactions of the Govt. an d also manages the public debt of the Govt. Bankers Bank All commercial banks keep and maintain their accounts with RBI Regulation of Bank Credit RBI exercises its control over the volume of credit ge nerated by commercial banks in the economy in order to control the inflationary tendencies. Custodian of Foreign Exchange Reserves It acts as the custodian of foreign excha nge reserves of the country and focuses on building up the necessary level of foreig n exchange reserves that is essential for interaction with foreign trade and commerce. Maintaining the external value of the currency It has the responsibility of main taining the external value of the Indian rupee. The foreign exchange market has been de-regu lated and the market forces determine the exchange rate. However, RBI intervenes under exc eptional circumstances if the rupee starts sliding. Control of Economy As the banks have to maintain around 30 - 35 % of the Demand and time liabilitie s with RBI by way of CRR and SLR, RBI plays a role in controlling the countrys economy. Also RB I keeps changing the CRR and SLR percentages depending on the movement of the economy. Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 8of 53 2.4.3 Banking Structure in India Reserve Bank of India Dev. Fin. Inst. Banks IFCI IDBI SIDBI ICICI IRBI NABARD NHB EXIM State Lvl. Tata Consultancy Services

Fin. Inst. Comm. Banks Reg. Rural Banks Land Dvlp. Banks Co-op. Banks Public Sector Pvt. Sector State Bank Group Nationalized Bank SBI Associated Banks of SBI Indian Banks Foreign Banks State Co-op. Banks Central District Co-op. Banks Primary Credit Societies Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 9of 53 3. ACCOUNTING CONCEPTS 3.1 Components of Accounting Accounting is the process of recording the monetary transactions of business ent ities. An account is an element in the accounting system that is used to classify and s ummarize money measurements of business activity. The accounting involves recording, clas sifying and summarizing of past events and transactions of financial nature. Every account w ill be classified as an Asset or a Liability. 3.1.1 Assets Assets are things of value owned by the bank. In other words Assets of a bank ar e what others owe the bank. For example, when Bank gives a loan to a customer, the customer owes money to th e bank. The loan disbursed to a customer is to be repaid by the customer. Thus Loan adva nced by the bank will be an asset for the bank. Other examples of Assets will be the premise s owned by the bank, Cash at the bank/branch, Interest to be received, etc. Assets can be classified as : 3.1.1.1 Fixed Assets These are assets like land, buildings, vehicles, furniture which are used for bu siness operations over a relatively long period of time. These Assets are not consumed in the course of operations within an accounting period. 3.1.1.2 Current Assets These are assets, which are usually converted into cash within the accounting pe riod. In other words, these assets can be converted into cash quickly. 3.1.2 Liability Liabilities are amounts or balances that a Bank owes others. For example, the claim of the depositors constitutes the liability of the bank. The money

deposited by a customer in the Savings account can be withdrawn by him at his di scretion. Thus from the point of view of the branch, the money deposited in a Savings Bank Account is a liability to be paid on demand i.e. Demand Liability. All customer deposit acc ounts with the bank are Liability accounts. Liabilities may be classified as : 3.1.2.1 Long-Term These are liabilities that may be repayable beyond a one-year horizon. 3.1.2.2 Current Liability Current Liabilities are all those accounts and claims on the bank which have to be settled within a relatively short period of time, normally within a year. Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 10of 53 3.1.2.3 Contingent Liability A contingent liability is a possible future liability (are those which do not ex ist at that particular time but which may arise in future), which may arise as a result of past circums tances or actions a possible future event. Examples are payment against Letter of Credit, invocation of Guarantee, etc. 3.1.3 Fundamental Accounting Equation Total Assets = Total Liabilities This means that at any given point of time what is owned by the bank will be equ al to what is owed by the bank. 3.1.4 Business Entity Concept The legal entity of a Bank is distinct from the entity of its owners (shareholde rs). Similarly, the accounting entity of a bank is also distinct from its owners (shareholders). Thu s when the shareholders bring in capital into the bank, the bank in turn is deemed to owe t he capital back to the shareholders. This concept is called as the Business Entity Concept. Illustration 1 In order to understand this equation clearly, let us consider a new branch, whic h is about to start operations. The Head Office (HO) shall provide the finance for acquiring t he premises, furnitures, fixtures etc., as well as the initial capital to start banking operat ions. Stage I : Let us assume that the HO contributes Rs. 50,00,000/- of which, Rs. 25,00,000/- is used towards acquiring the premises, Rs. 10,00,000/- is used towards acquiring the furnitures/fixtures Rs. 15,00,000/- is held by the branch in cash. The financial position of the branch at this stage will be as shown below : Liabilities Assets Head Office 50,00,000.00 Premises 25,00,000.00 Furniture & Fixtures 10,00,000.00 Cash 15,00,000.00 Total 50,00,000.00 50,00,000.00 Table 1 Financial Position at the beginning of 1st day of operation The branch owes Rs. 50,00,000 back to its Head Office. Hence it is shown in the Liabilities

side. Stage II : Let us assume that the operations performed on the first day of operation are as follows : A customer opens Savings A/C with an initial deposit of Rs. 2000/-Anot her customer is given a loan in cash of Rs. 10000/-. The financial position of the branch at this stage will be as shown below : Liabilities Assets Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 11of 53 Head Office 50,00,000.00 Premises 25,00,000.00 Furniture & Fixtures 10,00,000.00 Cash 14,92000.00 Savings Accounts 2,000.00 Loans 10,000.00 Total 50,02,000.00 50,02,000.00 Table 2 Financial Position at the end of 1st day of operation This position has been achieved after taking into effect the two transactions me ntioned above. The transaction for the Savings Account will have the following effect : - The liability under Savings Accounts will go up by Rs. 2000. - The Cash balance will go up by Rs. 2000. The transaction for the Loan Disbursement will have the following effect : The Loans advanced will go up by Rs. 10000 The Cash balance will reduce by Rs. 10000 Thus the net effect will be as follows : Head Office = 5000000/-Premises = 2500000/-Furnitur es & Fixtures = 1000000/-Savings Account = 0 + 2000 = 2000 Loans = 0 + 10000 = 10000 Cash = 1500000 + 2000 - 10000 = 1492000.00 One can see from the above illustration that, all the assets of the bank branch are due to be paid back either to the depositors or to the HO (owner of the branch) thus estab lishing the fundamental equation of accounting. We noticed in the above example that every transaction involved two entries. The deposit into the Savings A/C increases the Liability in the Savings A/C by Rs. 2000 and also increases the Cash balance by Rs. 2000. Similarly the disbursement of the loan of Rs. 10000 in creased the Loans Advanced by Rs. 10000 and decreased the Cash balance by Rs. 10000. This fo rm of accounting is referred to as the Double Entry System. 3.2 Systems of Accounting 3.2.1 Types of account There are three types of accounts: Personal Account It deals with accounts of individuals like account holders, dep ositors, etc. It shows the balance due to these individuals or due from these individuals on a particular date Real Account It represents assets like Cash, Premises, Furniture & fixtures, lan d, etc. As on a particular date, this account shows the worth of the asset. Nominal Account It consists of different types of expenses or incomes or profit or loss. These accounts shows the amount of income earned or expense incurred for a parti cular period. Examples are interest to be paid to depositors, interest received on loa

ns/advances, commission received, etc. Introduction to Banking Part I Version 1.0 Tata Consultancy Services 12of 53 3.2.2 Double Entry System The basic attributes of an account are title of the account, opening balance, cl osing balance and the transaction in the account. Every business transaction will have an impa ct on one or more accounts and will effect the balance of the accounts. Every business transa ction will have two effects and this system of recording both the accounting effects is kno wn as Double Entry System of Book Keeping. The two effects of a business transaction are know n as Debit and Credit. Debit Represents Outflow of Resources ! Expenses : For example - Salaries, Rent for the premises, Interest Paid, etc. ! Assets : For example - Land, Building, Cash, etc. (Outflow of resources resul t in increase of Assets) All those who owe money to the bank : For example - Debtors, Customers who have taken a loan from the bank Credit Represents Inflow of Resources ! Income : For example - Interest received, Commission received, etc. ! Liabilities : For example - Deposit Accounts, Savings Account, etc. (Inflow o f resources result in the increase of Liability) All those whom the bank owes money : For example Saving account holders, Deposi t Account holders, etc. Whether an Account is to be debited or credited is decided by the rules indicate d in the following tables : Personal Accounts Real Accounts Nominal Accounts Debit The receiver What comes in All expenses and losses Credit The giver What goes out All incomes and gains Assets Liabilities Income Expenses Increase in Debit Credit Credit Debit Decrease in Credit Debit Debit Credit Balances Debit Credit Credit Debit Example The example below will emphasise the concepts explained above regarding the acco unts, transactions and the effect of a transaction on various accounts. Business Transaction : Mr. Shah Deposits Rs. 2000 in his Savings Account Accounts Impacted : Mr. Shahs Savings Account, Cash Account Transactions : 1) Debit Cash Account (Real Account) 2) Credit Shahs Savings Account (Personal Account) Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 13of 53 Next we will discuss the concept of natural sign associated with the GL accounts. The natural Confidential

sign associated with the different GL account types and transactions are as list ed below : LIABILITY + ASSET -All the Liability accounts have positive balance and all the Asset accounts have negative balance. A Debits transaction is negative and a Credit transaction is positive. When there is a debit transaction in an Asset account, the absolute balance incr eases by the amount of the transaction. When there is a credit transaction in an Asset Accoun t the absolute balance decreases by the amount of the transaction. When there is a Credit transaction in an Liability account, the absolute balance increases by the amount of the transaction. When there is a debit transaction in a Liability Account the absolute balance decreases by the amount of the transaction. 3.2.3 Books of Accounts in a Bank In accounting, every transaction creates a source document, which is any written or printed evidence of a business transaction that describes the essential facts of the tra nsaction. Examples are cheques, withdrawal slips, deposit slips, document created by the b anker. These are referred to as vouchers. 3.2.3.1 Voucher Before a transaction is recorded or entered in books of account, it is written d own on a form (usually pre-printed on banks stationery) known as a voucher form, and when this form is filled in and completed it is known as a voucher. This form, even though filled in eith er by customer or banks internal staff, does not become a voucher till it is authorised (signed) by the banks authorised personnel. Generally, a voucher is first prepared by a clerk or a customer, checked by a se nior person and then the transactions are entered in appropriate books. The vouchers, being loose forms, are usually distributed among different persons for various purposes such as making entries in different books, writing intimations of trans actions for the parties concerned, checking the entries in books etc. A cheque issued by a custo mer or paying-in slip deposited along with cash become a voucher after it has been pass ed and entered into books of account of the bank. Vouchers also help as valuable records of transactions, and as such banks carefu lly preserve them for many years. There are three types of Vouchers Debit Vouchers Credit Vouchers Transfer Voucher 3.2.3.2 Transactions In banking scenario, the transactions are categorized as Cash, Clearing and Tran sfer. Cash transaction When one of the accounts affected in a business transaction is Cash, it is referred to as a Cash transaction.

Introduction to Banking Part I Version 1.0 Confidential 14of 53 For example, let us consider a business transaction : Vinod deposits Rs. 2000.00 in his Savings account. The accounting transactions for the above is Cr. Savings a/c. of Vinod and Dr. C ash a/c. by Rs. 2000. This transaction in entirety, comprising the Debit and Credit is treat ed as a Cash transaction. Clearing transaction When one of the accounts affected in a business transactio n relates to Clearing or Service branch account, it is referred to as a Clearing transacti on. It involves transaction between two banks. For example, let us consider a business transaction : Paresh deposits a Cheque o f Rs. 5000.00 of Indian Bank in his Savings account, which is maintained at Dena bank. The accounting transactions for the above at Dena bank is - Dr. Outward clearing by Rs. 5000.00 - Cr. Saving Bank a/c. of Paresh by Rs. 5000.00. This transaction in entirety, comprising the Debit and Credit is treated as a Cl earing transaction. Transfer Transactions When the accounts effected in a business transaction are i nternal to the bank, it is referred to as the Transfer transaction. For example, Interest is credited to a Savings account or transfer of funds from one savings account to another in the same bank (could be across different branches). Consider the business transaction : Interest of Rs. 20 is credited to Shahs Term Deposit Account. The accounting transactions for this : - Dr. Interest A/c by Rs. 20 - Cr. Shahs Term Deposit A/c. by Rs. 20. 3.2.3.3 Day book/Cash Book Since for every business transaction debit and credit entry has to match, at the end of the business day bank needs to confirm the same. This is achieved by summarizing the debits and credits transactions grouping under cash, clearing and transfer heads for th e various GL heads. These summarised transactions under the GL heads are then posted to the respecti ve GL accounts at the end of the day. The day book at the end of the day (2 nd February 2002) for the transactions given in the examples above under Cash, Clearing and Transfer is : Debit Credit Total Clrng. Trfr. Cash GL Head Cash Trfr. Clrng. Total Savings 2000.00 5000.00 7000.00 Deposit 20.00 20.00 20.00 20.00 Interest 2000.00 2000.00 Cash 5000.00 5000.00 HO-A/c Tata Consultancy Services

(Clearing) 7020.00 5000.00 20.00 2000.00 Total 2000.00 20.00 5000.00 7020.00 3.2.3.4 General Ledger Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 15of 53 The General Ledger is a ledger / book maintained by the branch for maintaining t he all GL accounts. The General Ledger is updated on a daily basis to record the transacti ons for the GL accounts affected during the day. The General Ledger would show for each of the accounts the opening balance , the consolidated transactions and also the closing balance for the day. The General Ledger for the affected accounts at the end of the day (2 nd February 2002) is : GL Head : Savings (Liability A/c.) Date Debit Credit Balance 01-02-2002 100,000.00 02-02-2002 7000.00 107000.00 GL Head : Deposits (Liability A/c.) Date Debit Credit Balance 01-02-2002 50,000.00 02-02-2002 20.00 50,020.00 GL Head : Interest Payable (Liability A/c.) Date Debit Credit Balance 01-02-2002 1000.00 02-02-2002 20.00 980.00 GL Head : Cash (Asset A/c.) Date Debit Credit Balance 01-02-2002 -1,40,000.00 02-02-2002 2000.00 -1,42,000.00 GL Head : HO A/c (Clearing) (Asset A/c.) Date Debit Credit Balance 01-02-2002 -11,000.00 02-02-2002 5000.00 -16,000.00 3.2.3.5 Trial Balance Since the individual transactions have been matched to ensure that Total Debits = Total Credits, it is also essential to confirm that the Total Assets = Total Liabilities. This is achieved by creating a statement called Trial Balance. The trial balance for 2 nd February 2002 is : Liability Asset GL Head Balance GL Head Balance Savings 1,07,000.00 Cash 1,42,000.00 Deposits 50,020.00 HO-A/c. (Clearing) 16,000.00 Interest Payable 980.00 1,58,000.00 1,58,000.00 3.2.3.6 Balance Sheet Balance sheet is a statement, which reflects the financial position of the bank as on a particular date. The trail balance forms the basis for the preparation of the ba lance sheet. Apart from the Assets and Liabilities in the Trial balance as of a date, the ban k/branch will

need to pass certain adjustment entries in order to arrive at the balance sheet thereby reflecting the exact position of Assets and Liabilities as of a particular date. For example, the interest payable account as appearing in the Trial balance is R s. 980.00. While preparing a balance sheet based on this trial balance, an entry will have to be passed Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 16of 53 debiting the interest payable by the interest amount that is due to be paid on t he savings account till that date and crediting the individual Saving A/c. For reasons like this, the balance sheet is typically prepared on the closing date (half year ends, Years). Now, with the advent of Computerisation of the branch operations, it is possible to arrive at a balance sheet as of any day. 3.2.3.7 Profit and Loss Statement There are certain Accounts which will be classified as either Income or Expense head. Income All kinds of earnings of a bank are termed as income. For example, Interest earn ed on Loans, Commissions, exchange margins, etc. would form part of the Income of the bank. Expense All expenditure incurred by the bank are termed as expenses. For example, Items like interest paid to the depositors, depreciation on furniture, salaries, sundry expenses, et c. would form part of the Expense of the bank. The natural sign associated with the Income and Expense account are as listed be low : Income + Expense -All the Income accounts have positive balance and all the Expense accounts have negative balance. The P/L statement (also referred to as the Income and Expense Statement) is a st atement that lists of all Income and Expense heads. The difference between Income and Expense accounts determines the Profit or Loss of the bank. The excess of income over expense is the profit and excess of expense over the income is the loss. Again, the Profit or Loss can be classified under Liability or Assets. Bank owes the profit to the shareholders and hence is classified as a Liability. Loss is classified as an Asset. This figure of Profit or Loss is taken into the Balance Sheet / Trial balance un der the P/L GL account head. 3.3 Fixed Assets Fixed assets are what a bank owns for the purpose of business like land, buildin gs, furniture, etc. and are normally not available for sale. They are essentially of a permanen t nature and are in constant use to carry on the business. 3.3.1 Depreciation All fixed assets except land, do get used up in business over a long period of tim

e. This fact is reflected through the process of charging depreciation on the fixed assets, s o that each year the fixed assets are shown at a lesser value in the balance sheet than what they were shown at in the balance sheet of the previous year. When an Asset other the conventional fixed assets are written-off over a period of time, the process is known as amortization rather than depreciation. Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 17of 53 Depreciation is the accounting process adopted for the gradual conversion of ass et costs into expense. The basis of depreciation is quite simple. It is the diminution in value caused by the inevitable wear and tear through constant use. It thus becomes essential for the bank to se t aside each year sums of money for the eventual replacement of aging and inefficient assets. There has to be a charge for depreciation each year against profits. The annual depreciation charge is shown in the Profit and Loss account as an item of expenditure representing the cost of using the fixed assets during the year. It is not an actual outgo of cash. There are two basic commonly used method by companies to compute their annual depreciation : 3.3.1.1 Straight-Line Method In this method, a certain fixed percentage of the original cost of assets is wri tten off each year. The depreciation percentage depends on the type of asset and is decided based on the assumed life of the asset. Example Let us consider an asset worth Rs. 1,00,000.. For this example consider a deprec iation percentage of 20%. In this method, at the end of 5 th year the value of the asset will be zero. This asset will be depreciated by Rs. 20,000 (Rs.100,000 x 20%) every year. 3.3.1.2 Written Down Value (WDV) Method or Reducing/Diminishing Balance Method In this method, a fixed percentage of the reduced or written down value of the asset is charged to the profit and loss account every year. Since the value of the asset goes on diminishing year after year, the annual depreciation charge likewise goes on dim inishing. Example Let us consider an asset worth Rs. 1,00,000.. For this example consider a deprec iation percentage of 20%. In this method, the value of the asset will never be zero. 1 st Year Depreciation is Rs. 20,000 (Rs.100,000 x 20%) 2 nd Year The value of the asset is now Rs. 80,000 (Rs. 1,00,000 Rs. 20,000). Hence

Depreciation charged is on Rs. 80,000., i.e. Rs. 80,000 x 20 % = Rs. 16,000 3 rd Year The value of the asset is now Rs. 64,000 (Rs. 80,000 Rs. 16,000). Hence Depreciation charged is on Rs. 64,000., i.e. Rs. 64,000 x 20 % = Rs. 12,800 Note that in this method the Asset value goes on diminishing and also the deprec iation. 3.4 Chart of Account The chart of accounts is basically a list of the categories of financial transac tions for a particular business. In other words, this is a comprehensive listing of all the GL heads, which will be impacted by any banking transaction. General Ledger is the ultimate dest ination for all transactions. These GL heads can be categorized or grouped as: Asset Account Liability Account Income Account Expense Account Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 18of 53 All the GL heads under the Asset and Liability heads affect the Balance Sheet an d the GL heads under the Income and Expense account affect the Profit and Loss Statement. The level of detail, that is, the number of accounts, required in each classific ation depends on a variety of factors including the following: regulatory reporting requirements, internal management reporting requirements, level of automation Products and services offered by the bank. A bank may modify its chart of accounts to accommodate its particular needs at a ny given time; therefore it may be useful to review in order to determine current and pas t activities in which the bank may have engaged. The chart of accounts may use a numbering schem e which permits flexibility to add accounts to appropriate categories without renu mbering the entire chart. Example GL Head : Savings (Liability) GL Sub Head : NRE NRO Normal Trust The balances of Savings account will be maintained at the Sub Head Level. A ban k can define more sub categories or sub head as the need may be. GL Head : Term Deposit (Liability) GL Sub Head : Fixed Deposit (FD) Recurring Deposit (RD) Cumulative Deposit (CD) Similarly, the balances of Term Deposits account will be maintained at the Sub Head Level of FD, RD, CD. The bank can define more sub head or categories as required. GL Head : Cash (Asset) GL Sub Head : Cash on Hand

Current Account with other banks The balance in Cash account will be maintained at the Sub Head Level of Cash on hand and CA with other banks. The bank can define more sub head or categories as required . 3.4.1 Control Accounts These are also termed as sensitive accounts. Every transaction affecting these h eads has to be authorized and these accounts are monitored periodically. Amount-wise and Age -wise analysis is done and submitted to the controlling authorities. 3.4.1.1 Suspense This is a General Ledger account used for making payments to either staff or sup pliers for which the final settlement will be done at a later date. This originating entry is squared off when the payment is settled and the amount is debited to the appropriate GL head . The originating entry will always be a debit entry. Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 19of 53 Example 1 Payment of medical advance of Rs. 50,000/- to a staff member. Debit GL Suspense Rs. 50,000/-Credit Staff Account Rs. 50,000/-When the actual b ill of Rs. 70,000/- is submitted by the staff Debit P&L Staff Welfare Account Rs. 70,000/-Credit Suspense Rs. 50,000/-Credit S taff Account Rs. 20,000/-Example 2 Pension is paid to the customers from GL Suspense account because unlike banks st aff members it can not be debited to any PL account. These pension claims are sent t o respective treasuries for payment. The suspense entry is squared off after getting the resp ective payments. If the entry is outstanding i.e. not squared off, the unique reference number for a transaction facilitates to follow it up with respective department / person. When pension is paid Debit GL Suspense Railways Pension a/c Rs. 10,00,000/-Credit various pension acc ount holders a/c Rs. 10,00,000/-After claim is received Debit GL Bankers Cheque a/c Rs. 10,00,000/-Credit GL Suspense Railways Pension a/ c Rs. 10,00,000/-There is a unique reference number generated for each originati ng transaction for later reconciliation and settlement. 3.4.1.2 Sundry Opposite to suspense account, originating entry is sundry account is always a cr edit. This GL head is generally used to account for any entry for which no right claimant is f ound. Just like suspense, all the entries in the sundry account are identified with a unique ref erence number, used later on for tracking and squaring off purpose. Example 1 If a customer has deposited some money and inadvertently filled in the paying-in slip with wrong information i.e. correct account number but wrong name OR correct name but wrong account number, in that case bank can not account for this entry. Since customer has already

left the bank premises and he can not come immediately and correct the slip, Ban k deposits this amount into sundry account. Entries passed for aforesaid example are: Debit Cash a/c Rs. 10,000/-Credit GL Sundry a/c Rs. 10,000/-When the customer co mes back to bank for correction of the above entries: Debit GL Sundry a/c Rs. 10,000/-Credit Customer a/c Rs. 10,000/-3.4.2 Contra Ac counts It is a pair of accounts, where the balances are equal and opposite. i.e. One ac count will be an Asset and the other corresponding account will be a Liability. When an entry is passed in one Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 20of 53 of the contra accounts, a corresponding entry of the same amount has to be passe d in the other contra account. Generally, Bank requires to pass Contra Entries to take care of Contingent Liabi lities (like payment against Letter of Credit, invocation of Guarantee, etc.), Remittances in transit, Outstation Cheques in Clearing, etc. Example 1 If a Performance Guarantee has been issued for Rs. 10,00,000/- in favour of Govt . of India at the request of a customer, then bank charges a commission and passes contra entr ies in Assets and Liabilities for this amount. In case of invocation of this Guarantee due to non performance, these contra entries are reversed and the money is paid to the Govt . to the debit of the customers account. Example 2 When a customer deposits an outstation cheque of Rs. 1000 into his Savings accou nt in Dena bank, assume that it takes 7 days for the cheque to get cleared. Till that time, the balance of the customer is not affected. However, Dena bank has to account for this to know the extent of liability. CONTRA ACCOUNTS Liability Asset Customers Liability Bank is liable to pay this to the customer Banks Liability Other bank is liable to pay Dena bank. i.e. money is owed to Dena bank On Depositing the cheque Cr. Rs. 1000 Dr. 1000 On Realization Dr. Rs. 1000 Cr. 1000 Now the actual transactions are passed Dr. HO account - Rs. 1000 Cr. Savings Account - Rs. 1000 3.4.3 Head Office Account Head Office Account is a GL account maintained by all the branches of the bank f or reflecting all transactions with its Head Office or with other branches (inter-branch trans

actions). All deposits and loans that happen in a branch are reflected in the HO Account. The HO account of a branch conveys the position of the branch to the Head Office. If th e HO account is having a Dr. balance, it reflects that the branch is having more deposits tha n loans. If the HO account is having a Cr. balance, it reflects that the branch is having more l oans than deposits. The Head Office has to take funds from the branches that have more dep osits and forward it to the branches that have more loans. This is basically a balancing f unction that the HO performs between the branches that are heavy in deposits and loans. Typically, the H.O. A/c is affecting in all the types of transactions Cash, Clea ring, Transfer : Cash Cr. H.O. A/c Dr. Cash - If the branch has a deficit Dr. H.O. A/c Cr. Cash - If the branch has excess Clearing Cr. Customer A/c Dr. H.O. A/c - Outward Clearing Dr. Customer A/c Cr. H.O. A/c - Inward Clearing Transfer Dr. Customer A/c Cr. H.O. A/c - Sending Branch Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 21of 53 Cr. Customer A/c Dr. H.O. A/c - Receiving Branch Example 1 Dena bank, Andheri branch issues a DD for Rs. 5000.00 payable at Ashram Road bra nch. Entries at Andheri Branch Dr. DD Payable / Customer Account Cr. Head Office Account Entries at Ashram Road Branch Dr. Head Office Account Cr. DD Payable / Customer Account Basically, the transaction between adjustment between the Andheri and Ashram Roa d branch is handled through the Head Office account. Example 2 Profit Payable by the branch to Head Office during Half Year end or Year-End is transferred through Head Office Account maintained at the branch. Dr. P/L Appropriation Cr. Head Office Account 3.5 Summary At the time of starting operations the chart of accounts containing all the acc ounts to be maintained in the branch general ledger, is to be prepared. In the case of bank branches the chart of accounts as defined by the Head Office will be maintained. After completion of the days work, the various departments of the branch like S avings, Current, Cash, Clearing etc. shall prepare consolidated credit and debit vouch ers for the GL accounts affected as a result of transactions originating from the department . The Officer at the branch responsible for the maintenance of the General Ledger shall collect the vouchers from all the departments, and verify that the total credit is equal to the

total debit. The vouchers shall be sorted and the day-book will be prepared. As mentioned e arlier, the day-book will contain a listing of the GL accounts affected during the day, along with the consolidated transaction for each account. The officer shall verify that the day-book is tallied i.e. ! the total credits are equal to the total debits ! the total cash, clearing and transfer figures match the figures obtained from the respective departments The above two checks would ensure that all the transactions carried out during t he day, have been effected into the General Ledger, and also that the total credits matc h the total debits. After the day-book is tallied the General Ledger will be updated to reflect the latest position. Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 22of 53 The Trial Balance shall be prepared and it will be verified that the total asse ts is equal to the total liability i.e. Total (Asset + Expense) = Total (Liability + Income) Since the Trial Balance has been tallied for the previous day, and the day-book for the current GL processing day has been tallied, the Trial Balance for the day also h as to tally. At the end of the financial year (31st March) the net total of the income and e xpense accounts will be transferred to the Profit & Loss account (Liability or Asset de pending on whether the bank has made Profit or loss. Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 23of 53 4. SAVINGS ACCOUNT 4.1 Concepts Savings Bank deposits are Demand Deposits meaning that they are repayable on dem and. Money can be deposited into and withdrawn from this account at the customers dis cretion barring a few exceptions like number of withdrawals, amount of withdrawals, etc. depending upon type / product and regulatory requirements. These accounts have facility for withdrawal by cheque, withdrawal slip, simple l etter with exceptions relating to the type of constituents who can open such accounts and c ertain restrictions with regards to withdrawal. This deposit carries a nominal rate of interest. The need for keeping cash reserves against such deposits by the bank is comparat ively larger vis--vis the fixed deposits but smaller as against the current deposits because o n the restrictions on the number of withdrawals. The restriction of withdrawal is gene

rally set to refrain savings account being utilised for business purpose. Therefore, bank lev ies service charges if the number of withdrawal exceed the specified limits. However, the ba nk does not stop a customer from making more withdrawals. Some of the basic definitions, rules governing Savings accounts are as listed be low : A Savings Bank Account is an unfixed running deposit account The Savings account is a running account, and the customer has total flexibility w.r.t. deposit / withdrawal of funds. The customer is free to deposit money into his account at a ny point of time, and also withdraw money from his account anytime subject to satisfying the minimum balance norm. The balances maintained in the savings accounts are reflected unde r Demand Liabilities in the banks Balance Sheet. A Savings Account may be opened by, ! Indian Nationals (both resident and non-resident) ! Societies, Associations, Trusts, Clubs ! Minors (but operated jointly with a guardian) Note : A Savings Account may not be opened by companies. Requirements for opening a Savings Account A customer wishing to open a Savings Account has to approach the officer concern ed. After filling the account opening card and the signature card, an account number and c ustomer number, if not an existing customer, is assigned to the customer. The customer h as to deposit cash into the account, and produce the stamped cash deposit slip to the officer, and collect his passbook and chequebook. Bank generally asks for an introduction also, which cou ld be from any other account holder or staff of bank or any renowned person, which is accep table to the bank. As per a recent notification, customers are also supposed to submit two copies o f photograph. This is to check fictitious accounts. Mode of Operation of Savings Accounts Mode of operation governs how and by whom the account is going to be operated. T he Mode of Operation of the account is to be specified by the customer in the Account Op ening form. The Mode of Operation for a Savings Account may be specified as ! Self ! Either or Survivor Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 24of 53 ! Authorised Signatories ! Minor Account Operated by Guardian Classification of Savings Accounts ! Resident ! Non Resident ! Minor Savings Account are classified based on the customer categories, schemes for ope rational

convenience. The terms and conditions governing the operation of Non Resident ac counts are different from those governing normal resident accounts. Thus it will be conveni ent operationally, to classify the account separately. Also the balance under the va rious categories of Savings accounts are to be reflected separately in the General Ledger. Savings Accounts can be with / without cheque book A customer may or may not choose to avail of the cheque book facility. The minim um balance to be maintained is higher for a cheque book account. Though it is not prevalent in India as on date, it could happen that accounts without chequebook might earn more interest. Nomination Facility is available for Savings Accounts At the time of account opening or subsequently, the account holder can specify a nominee, who in the event of the death of the account holder, will be permitted to operat e the account. In the event that a nominee is not specified, then upon the death of the account ho lder, the bank will allow the legal heir to operate the account, only after he produces the nec essary legal papers. The nomination facility has been provided, to avoid such unnecessary inc onvenience to the heir. Upto 60 withdrawals are permitted in a Savings Account per year. If the number of withdrawals exceeds 60, then the bank branch may levy additiona l service charge. This however varies from time to time and from bank to bank. Dormant Account All accounts in which there was no operations for the last 12 months will be bra nded as Dormant. For this purpose the Ledger will be scrutinized once a month to identif y the Dormant accounts. These are interest bearing accounts. However, some banks charge a spec ific fee on these accounts and the customer is intimated about this accordingly. In-operative accounts Accounts in which there have been no operations during the past 24 months are tr eated as in-operative accounts. There are 2 types of such accounts ! Interest bearing ! Non Interest Bearing This is dependent based on whether the account is maintaining the minimum stipul ated balance. 4.2 Processing of Financial Transactions Financial transactions pertaining to Savings Accounts can be broadly classified as Cash, Clearing and Transfer transactions. Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 25of 53 We will study the operational procedure followed by the bank branch for executin g each of these types of transactions. Before going onto the details of each of the above transaction types, we will study certain general details required for understanding the proc edures followed. 4.2.1 Ledger Maintenance

Any financial transaction to an account results in the flow of money in or out o f the account and thereby affect the account balance. It is essential to correctly record the transactions affecting an account, and also have a reliable control and checking mechanism, t o ensure that the transactions are recorded correctly. Failure to record a transaction or reco rding it incorrectly can have severe implications. The procedure below pertains to a situation where the branch operations are carr ied out manually. In an automated environment the ledgers can be generated automatically based on the banking transactions. The Ledger Book is the primary tool used by the bank branch to keep track of the financial position of an account. At the bank branch, the Ledger Books are kept with perso nnel at the front counters. Each front counter will be able to handle accounts belonging to around 10 ledger books. The bank personnel at the front counters maintain the ledgers, and hence are also referred to as the ledger keepers. The Ledger Book has one page for each account and is sorted according to the acc ount number. The top portion of the page is used to maintain certain static informati on related to the account, like names of the account holders, mode of operation, special instructi ons etc. The rest of the page can be likened to a Savings bank passbook, with columns for rec ording details of the transactions, like date of transaction, transaction particulars, the tran saction amount (deposits and withdrawals are recorded in separate columns), account balance aft er executing the transaction, initials of the official making the ledger entry etc. At the time of account opening, a new page is opened in the Savings ledger book, and the static information as well as details of the initial deposit is recorded in the ledger book. All subsequent financial transactions are recorded meticulously in the ledger book s o that the up to date financial position of each account is available in the ledger book. The ledger books are kept under lock after office hours to prevent any tampering of the figures. 4.2.2 Cash Deposit Transaction Two systems are followed by banks for handling cash deposits. These are Scroll S ystem and Receipt system. The bank branches follow the system as per the directives from t he Head Office. We will discuss these two systems, along with their relative merits and demerits. 4.2.2.1 Scroll System Under the Scroll System a cash deposit into an account will involve the followin g sequence of steps : (Again the process described below is specific to manual operations) ! The customer will have to fill in a scroll slip for cash deposit containing d etails including account number, amount with denominations, and give it to the scroll clerk / off icer. ! The scroll clerk will record the details from the scroll slip in the Cash Scr

oll Register, and hand over the scroll slip to the customer. ! The customer will then hand-over the cash together with the scroll slip to th e receiving cashier. The receiving cashier shall validate that the details given in the scro ll slip are consistent with the physical cash being deposited. After receiving cashier count s the cash tendered by customer and if it is in order, he will stamp the scroll slip, and h andover the counterfoil of the scroll slip to the customer. The stamped scroll slip is an Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 26of 53 acknowledgement of the cash deposit. The main voucher is then released for makin g entry in respective account / ledger ! The receiving cashier will retain the scroll slip, and at the end of the day he shall verify that the physical cash with him, is consistent with the figure arrived at based on th e total of the scroll slips. ! The ledger keeper will enter the cash deposit entry in the ledger. The scroll slip will then be clubbed with the rest of the vouchers for the days transactions, and stored sa fely for future reference. The Scroll System provides a control mechanism to ensure that the receiving cash ier reports all the cash receipt correctly, and the scope of any fraud is checked. This is a chieved by checking the total cash deposit figure from the scroll register against the phys ical cash deposit reported by the receiving cashier. This also helps in checking any compensatory mistakes either at the cashier or ledger keeper level, i.e. if any one has wrongly entere d the amount, it can be traced at the end of the day. In the absence of the scroll register, the receiving cashier may throw away a scroll slip, and pocket the money himself by not reporting the receipt. Unless the customer comes back and reports that the amount has not been credited to his account, the fraud may not be detected. 4.2.2.2 Receipt System Under the Receipt System, the customer will approach the receiving cashier direc tly without going to the scroll clerk. In fact there will be no scroll clerk, and the custom er will hand over the scroll slip along with the cash to the receiving cashier. The subsequent procedu re will be identical to that for a scroll system, except for the fact that there will be no end of day checking against the figures from the scroll register. Receipt System is more convenient for the customer, and reduces the service time . 4.2.3 Cash Payment Customer wishing to withdraw cash from his account has two alternatives viz. Tel ler Payment

and Token Payment. Teller Payment facility is not available at all the branches. The Teller Payment facility may be offered based on the size of the branch and the number o f cash payments. In small branches with low transaction volumes, it may not be necessar y to have Teller Payment. The operational procedure followed for both the cash payment sys tems are described below. 4.2.3.1 Teller System Under the Teller System a customer can draw money upto a certain limit (say Rs. 5000/-) as decided by the bank, directly from the Teller Counter without authorisation from the second level. The Teller has a list of accounts with low balances, and he checks agains t this list before he makes any payment. Under the Teller System, payment is made primarily on trus t without checking either the balance or the signature. In an automated environment, the teller can query on the account and verify the balance and signature of the customer accoun t before making the payment. The Teller puts his initials on the instrument, and writes the payment details i ncluding account number, amount and denominations in the Cash Payment Register. (The cash payment register need not be maintained in an automated environment, where the details o f cash payment are directly entered in to the system and cash payment register is gener ated at the end of day for verification). Teller Payments are usually not made against a withdrawal slip (even if the pass -book is also furnished). Most banks permit Teller Payments only against cheque. If a customer does not Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 27of 53 have his chequebook with him, then he can collect a loose leaf cheque from the o fficer; but even against this loose leaf cheque, payment is permitted only through token iss ue. The Teller retains the cheques until the end of the days work. After tallying his physical cash against the total figure extracted from the Cash Payment Register, he releases t he instruments to the ledger keepers for entry into the ledger. The Teller System has been introduced to offer faster service to the customers, and in the process the bank is taking a risk to a certain extent. 4.2.3.2 Token System The Teller Payment that we saw earlier is permitted only for amounts upto a cert ain limit. For payments beyond the Teller Limit, the customer has to collect a token from the S avings Account counter against his cheque, and collect the payment from the Paying Cash ier against his token. The stages involved in token payment are as follows : (These processe s specific

to branches where the operations are performed manually) ! The customer hands over the cheque to the Savings Account Counter correspondi ng to his account number. The counter clerk gives a token to the customer acknowledgin g the receipt of the cheque, and writes the token number on the cheque. He makes the e ntry in the Ledger Book after checking for existence of sufficient balance in the accoun t. He then passes on the cheque to the officer for authorisation. (In an automated environm ent, the clerk keys in the details of the payment request into the system. After basic validation like balance, signature, etc., this transaction goes to the officer f or authorisation on the system itself. The physical cheque is also sent to the offi cer for verification.) ! The officer after checking the signature, the mode of operation instruction , stop payment instruction if any, and the account balance, will authorise or reject the cheque . If he authorises the cheque, then the cheque is passed on to the Paying Cashier for pa yment, otherwise it is returned to the customer giving appropriate reasons for the reje ction. ! The paying cashier, on receiving the cheque for payment will either call out the number or display the token number on the Token Number Display Board. The paying cashier w ill make the payment to the customer against the token and enter the details in the Cash Payment Register. The customer has to countersign at the back of cheque as acknowledgement of receiving the cash. The cheque will be retained by the cashie r till the end of the days operation, and will release it to the ledger keepers only after t allying his physical cash position with the cash payment register figures. He then releases the cheques to be kept together with the other transaction vouchers for the day. The Token Payment System is more time consuming, but is very essential for large payments to be properly validated and authorized by the officer. 4.2.4 Cheque Clearing System Clearing is an arrangement through which a bank exchanges cheques drawn on other banks for those drawn on it. In the absence of such an arrangement, each bank will hav e to present cheques to each of the other banks for receiving payment of cheques over which t hey have a claim. The cheque clearing system provides a easy, systematic, efficient and cos t-effective method of clearing cheques. Vinod Shah deposits a cheque into his account, at Dadar Branch of Bank of Baroda . This cheque has been given to him by Paresh Modi who has an account with Andheri Bran ch of Dena Bank. The processing of this cheque deposit transaction involves the debit of Pareshs account at Andheri Branch of Dena Bank, and credit Vinods account at Dadar Branch of Bank

of Baroda. The activities involved in carrying out this transaction are as follo ws : Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 28of 53 ! The cheque has to be sent to Andheri Branch of Dena Bank, so that they can ca rry out the validations, and debit Pareshs account in their branch. ! Andheri Branch of Dena Bank has to then debit the account in their branch and send the credit to Dadar Branch of Bank of Baroda. ! On getting the credit from Andheri Branch of Dena Bank, Dadar Branch of Bank of Baroda will in turn credit Vinods account in their branch. This activity becomes a complex task as every day individuals all over the count ry are sending cheques drawn on their account at one bank to people who bank with other banks. There wll be a continual stream into each bank, of cheques drawn on each of the other bank s. Such exchange of cheques therefore takes place in a Clearing House. 4.2.4.1 Service Branch Service Branch is a specialised branch of a bank for handling clearing of cheque s, payment towards Demand Drafts, Pay Orders an collection of outstation cheques. Its basic objective is to facilitate the clearing process. Generally, banks have one Service branch in major cities. Wherever it is not feasible to operate an exclusive service branch, an existing branch acts as a nodal branch and carries out functions of service branch. 4.2.4.2 Clearing House The primary objective of the clearing house is to facilitate the speedy and econ omic way of collecting cheques, bills and other documents payable or deliverable at or throu gh offices of the members and sub-members of the house situated in that town by a system of sy stems of clearing. In general, RBI undertakes the management of the clearing house. In the absence of this, one of the public sector banks in that centre, which may be specified by RBI shall b e managing the Clearing house. Clearing houses are established in all the cities, towns and even large villages where the volume of cheques is large and number of banks in the area are more than 2. This results in considerable saving of time and cost. Clearing houses are autonomous institution s having uniform regulations and rules regarding the conduct of operations. 4.2.4.3 Settlement This is explained with the help of an example. Central Bank of India presents cheques drawn on other banks which were deposited by its customers. The instruments are grouped by Central Bank of India bank-wise and th e amount due from each bank is shown therein. The aggregate of these amounts represents t he total

amount to be received by Central Bank of India from all other banks. The instrum ents are presented to the respective bank alongwith a memo in a clearing house. Likewise Central Bank of India also received cheques presented by other banks. T he aggregate of the totals of such instruments delivered by other banks represents the total amount of cheques drawn on Central Bank of India and payable by it. The differen ce between the two amounts is the net debit or credit to Central Bank of India. The Central Bank of India as well as other member banks keep an account with the presiding bank-branch whi ch manages the clearing house, through which these debits/credits are passed. 4.2.4.4 Magnetic Ink Character Recognition This is a technology for mechanised cheque processing for clearing. It is the te chnique of using ink containing magnetised particles to print characters of cheques, drafts , travelers Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 29of 53 cheques and other clearing instruments, which can be translated to machine langu age by a device that senses magnetisation. The imprint in magnetic ink appears in a coded but optically readable form. When the magnetised portion of the instrument is placed below the electrical field, the magnetisation generates a certain wave pattern which is readable by t he computer. MICR processing requires standardisation of the sizes of cheques, paper quality, specified font type, magnetic ink, printing position, location of the magnetic fields of inform ation and the number of digits in the information, etc. MICR cheques contain a white band at the bottom where information about the cheque is recorded in a coded form. The code appearing in the MICR band denotes the follow ing : First 6 digits - Cheque Serial Number Next 9 digits - is a collection of three codes of three digits each as follows 999 - the city where the branch is located 999 - the bank to which the branch belongs 999 - the code allotted to the branch itself Next 6 digits - Account number Next 2 digits - Transaction type (10 Savings, 11 Current, 13 Cash Credit, ) Next 13 digits - Amount The code for account number may or may not be pre-printed. The code for amount i s not pre-printed; it is printed by the electronic Encoder machine where necessary . The electronic machines called Reader Sorters will be used at the clearing house to sort the cheq ues branch/bank wise 4.2.4.5 Procedure for Cheque Clearing We will describe below the stages involved in cheque clearing. This is the proce ss followed when the cheque that has been deposited is drawn on a bank that is in the same c ity. This is referred to as Local Clearing .

The timings indicated are not uniformly applicable across all branches, but are quoted for better understanding. The various stages involved in the clearing of cheques are as follows : ! Let us say that on any day around 500 cheques are deposited by the customers at Mahim Branch of Bank of Baroda. The branch would collect the cheques upto a fixed time say 3.00 p.m. Cheques deposited after 3.00 p.m. will be sent for clearing on the nex t working day only. ! After collecting all the cheques, a clerk in the clearing department would en ter the details of all these cheques in an Outward Clearing Register. The cheque amounts will th en be totaled using an adding machine. The listing from the adding machine will be att ached to the bundle of cheques, and sent to the Service Branch of the bank. The cheques a re collected upto 3.00 p.m., and are sent out of the branch to the banks Service Bra nch at around 4.00 p.m. ! As per RBI guidelines, each clearing cheque bundle or lot should contain at m ost 300 cheques. This activity at Bank of Baroda where the cheques drawn on different banks that have been deposited by the customers are collected and sent to Service branch is referred to as Outward clearing. ! The Service branch of a bank receives cheques from all the branches of that b ank in that city. These cheques would be of different banks. At the Service branch, the cheq ues are sorted bank-wise and encoded using the encoding machines. Encoding of the cheque s involves the printing of the cheque amount, city code, bank code and branch code on the MICR line (at the bottom of the cheque). After encoding, the Service branch bund les the Introduction to Banking Part I Version 1.0 Tata Consultancy Services Confidential 30of 53 cheques bank-wise with control information on the number of cheques and the tota l amount for each bank. ! The cheques from the Service Branch are then sent to the Clearing House which is generally managed by RBI or nominated bank. ! Once the Clearing House receives the encoded cheques from the various banks ( through their Service Branches), these cheques are processed during the night by the rea der sorter machines. These machines read the encoded information from the MICR line, which contains details such as the bank branch where the cheque was issued, the bank b ranch where the cheque has been sent for clearing, and the cheque amount. The clearing of cheques involves transfer of funds from one bank to another, i.e . settlement. At the Clearing House, each bank has to maintain an account with the