Escolar Documentos

Profissional Documentos

Cultura Documentos

June 2011 f3

Enviado por

Nicolae CaminschiDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

June 2011 f3

Enviado por

Nicolae CaminschiDireitos autorais:

Formatos disponíveis

Examiners report

F3 Financial Accounting June 2011

General Comments The following three questions have been taken from the International variant of the paper and were the three questions with the lowest pass rates on the paper. The aim of reviewing these questions is to give future candidates an indication of the types of questions asked and guidance on dealing with exam questions. Sample Questions for Discussion Example 1 Which one of the following errors would lead to the creation of a suspense account? A B C D Sales returns were credited to the purchase returns account and debited to receivables The total of the sales daybook has been added incorrectly before being posted to the ledger accounts Discounts allowed have been dealt with correctly in the receivables account, but debited to the purchases account Purchases from the purchases daybook have been credited to sales and dealt with correctly in the payables control account

The correct answer is D. Only 33% of candidates answered this correctly, with option C being the most popular incorrect answer. The key to answering these types of questions correctly is to consider each option individually and establish if the error will cause a suspense account to be created. This will only occur if there has been a one-sided entry or both sides of a journal have been posted to the same side of the ledger. In option A, we can see that there is a debit and a credit entry in the transaction so even though these are incorrect entries, they will not cause the trial balance to be out of balance. In option B, the sales daybook total is posted to the sales account and the receivables account, so even though the total is incorrect, there will still be a journal that balances and this will not cause the trial balance to be out of balance. In option C, discounts allowed should be credited to receivables, which has happened, and should be debited to discounts allowed expense. They have been incorrectly debited to purchases, but as the transaction has a debit and credit entry it will not cause the trial balance to be out of balance. Finally, in option D, purchases from the purchase daybook should have been debited to purchases and credited to payables. The credit entry has been dealt with correctly but instead of debiting purchases the entry has been made to credit sales. This journal entry has two credits and does not balance so the trial balance will not balance leading to a suspense account being required. Example 2 Pelle has a balance on his suspense account of $1,820 credit. He discovered the following errors: (1) Sundry income of $1,750 has been recorded in the sundry income account as $1,570

Examiners report F3 June 2011

(2) (3)

Sales of $2,800 from the sales day book have been posted to the receivables control account, but no other entry has been made The purchases daybook was undercast by $950

What is the balance on the suspense account after Pelle has corrected the above errors? A $4,800 CR B $1,160 DR C $210 DR D $3,850 DR The correct answer is B and is calculated as follows: $ 1,820 CR (180) DR (2,800) DR (1,160) DR

Balance b/f 1. sundry income 2. sales ledger Balance c/f

As with the first suspense account question in Example 1, the key to answering this question is to look at each transaction individually and determine if the transaction causes an entry to be made in the suspense account. Transaction (1) requires an entry to the suspense account as too little sundry income has been recorded in the ledger account. The correcting journal entry is to Dr Suspense and Cr Sundry income with the difference of $180. In Transaction (2) there has been a one-sided entry so to correct it we need to post Dr Suspense Cr Sales with $2,800 sales that have not been posted. Transaction (3) does not require an entry to the suspense account as the incorrect total of the daybook will be posted into the ledger accounts and will not cause the trial balance to be out of balance. Only 30% of candidates answered this question correctly with 35% of candidates answering C which adjusted for item (3) as well as items (1) and (2). Example 3 Abigails receivables ledger control account does not agree with the total of the receivables ledger balances. She discovered the following errors: (1) (2) (3) The receivables column of the cash received daybook has been undercast by $300 A contra of $150 against the purchase ledger has only been entered in the control account A sales invoice of $454 has been entered into the sales daybook as $544

Which of the above errors would cause a difference between the receivables control account and the total of the receivables ledger? A B 2 and 3 only 1 and 3 only 2

Examiners report F3 June 2011

C D

1 and 2 only 1, 2 and 3

The correct answer is C. Only 30% of candidates answered this question correctly with the most popular incorrect answer being B. This question is similar to the suspense account questions above in that each error has to be considered individually to assess whether it causes a difference between the control account, which contains a summary of transactions, and the individual customer accounts that are totalled to make the receivables ledger balances. So we are looking for items that have only been included in either the control account or ledger accounts or vice versa. Item (1) will cause a difference as the individual items in the daybook are posted to the receivables ledger, and the daybook is totalled and posted to the control account. If the daybook has been added incorrectly then different amounts will have been posted to the ledger and control account. Item (2) causes a difference as the contra has only been posted to the control account and has not been entered into the individual account. Item (3) will not cause a difference as the incorrect amount has been entered in the daybook and this will be posted individually to the customer account and then posted to the control account as part of the total. Conclusion In this exam, the worst answered questions all dealt with errors with two questions covering suspense accounts and one covering control account reconciliations. These are key exam topics and require a focused approach as detailed above in arriving at the correct answer. Candidates need to ensure that they understand how transactions are posted from daybooks to control accounts so they can establish if a journal entry will cause a suspense account to be created or a reconciling item between a control account and the subsidiary ledgers. Questions on these topics have featured in previous examiner reports which suggests that more work is needed in this area.

Examiners report F3 June 2011

Você também pode gostar

- Entity-Resolution Report QuantexaDocumento39 páginasEntity-Resolution Report QuantexaRajiv sharma100% (2)

- Sage Line 50 Manufacturing User GuideDocumento672 páginasSage Line 50 Manufacturing User GuideNicolae Caminschi50% (2)

- Chapter 3 The Double-Entry Accounting System: Fundamental Financial Accounting Concepts, 10e (Edmonds)Documento68 páginasChapter 3 The Double-Entry Accounting System: Fundamental Financial Accounting Concepts, 10e (Edmonds)brockAinda não há avaliações

- GreenpeaceDocumento6 páginasGreenpeacePankaj KolteAinda não há avaliações

- Examiner's Report - FA2 PDFDocumento40 páginasExaminer's Report - FA2 PDFSuy YanghearAinda não há avaliações

- F13 Acct 311 Midterm 2 Solution For PostingDocumento15 páginasF13 Acct 311 Midterm 2 Solution For PostingSteven Daniel DayAinda não há avaliações

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNota: 5 de 5 estrelas5/5 (5)

- Dutch Lady Milk Industries Berhad-2Documento16 páginasDutch Lady Milk Industries Berhad-2Navinya Gopala Krishnan100% (2)

- Examiner's Report: F3/FFA Financial Accounting June 2012Documento4 páginasExaminer's Report: F3/FFA Financial Accounting June 2012Ahmad Hafid HanifahAinda não há avaliações

- Fa1 Examreport July Dec18Documento5 páginasFa1 Examreport July Dec18Sergelen TurkhuuAinda não há avaliações

- Fa1 Examiner's Report S21-A22Documento6 páginasFa1 Examiner's Report S21-A22ArbazAinda não há avaliações

- FA2 Part 2Documento3 páginasFA2 Part 2uzma qadirAinda não há avaliações

- Examiner Report 2009Documento3 páginasExaminer Report 2009acca810decAinda não há avaliações

- Examiner's Report: FA1 Recording Financial Transactions For CBE Exams Covering September 2017 To June 2018Documento4 páginasExaminer's Report: FA1 Recording Financial Transactions For CBE Exams Covering September 2017 To June 2018Sergelen TurkhuuAinda não há avaliações

- ACCA F3 Jan 2014 Examiner ReportDocumento4 páginasACCA F3 Jan 2014 Examiner Reportolofamojo2Ainda não há avaliações

- FA2 Part 4Documento4 páginasFA2 Part 4uzma qadirAinda não há avaliações

- Fa1 Examreport d15Documento3 páginasFa1 Examreport d15S RaihanAinda não há avaliações

- FA2 Part 6Documento3 páginasFA2 Part 6uzma qadirAinda não há avaliações

- FA1 S20-A21 Examiner's ReportDocumento6 páginasFA1 S20-A21 Examiner's ReportMuhammad DanishAinda não há avaliações

- Biltrite Case Module I Through X 04 16 2014Documento8 páginasBiltrite Case Module I Through X 04 16 2014nknknknAinda não há avaliações

- Theory of Correction of Errors and The Suspense AccountDocumento3 páginasTheory of Correction of Errors and The Suspense AccountYcarta SleumasAinda não há avaliações

- FA2 S20-A21 Examiner's ReportDocumento6 páginasFA2 S20-A21 Examiner's ReportAreeb AhmadAinda não há avaliações

- FA1 S22-A23 Examiner's ReportDocumento7 páginasFA1 S22-A23 Examiner's ReportLola LiAinda não há avaliações

- F3.ffa Examreport d14Documento4 páginasF3.ffa Examreport d14Kian TuckAinda não há avaliações

- 3int 2005 Jun QDocumento9 páginas3int 2005 Jun QlowchangsongAinda não há avaliações

- Rectification of Errors - Principles of AccountingDocumento7 páginasRectification of Errors - Principles of AccountingAbdulla Maseeh100% (1)

- Fa1 PilotDocumento14 páginasFa1 PilotMuhammad Yousuf100% (3)

- Suspense Accounts and Error CorrectionDocumento5 páginasSuspense Accounts and Error Correctionludin00Ainda não há avaliações

- Fundamentals of Financial Accounting - CIMA Financial Management MagazineDocumento5 páginasFundamentals of Financial Accounting - CIMA Financial Management MagazineLegogie Moses AnoghenaAinda não há avaliações

- Pa Chap 4Documento2 páginasPa Chap 4vananhguongmaunhatAinda não há avaliações

- Final Accounts-AdjustmentsDocumento197 páginasFinal Accounts-AdjustmentsRaviSankarAinda não há avaliações

- BA3 M KIT Chapter 15Documento10 páginasBA3 M KIT Chapter 15Nivneth PeirisAinda não há avaliações

- B-Lecture8-Acc Cycle-10-17-22Documento32 páginasB-Lecture8-Acc Cycle-10-17-22ALYANA LINOGAinda não há avaliações

- Fa1 Exam Report j14 1Documento3 páginasFa1 Exam Report j14 1Abdul SamadAinda não há avaliações

- FIA FA1 Mock Exam - QuestionsDocumento16 páginasFIA FA1 Mock Exam - Questionsmarlynrich3652100% (5)

- Errors Not Affecting Trial Balance AgreementDocumento4 páginasErrors Not Affecting Trial Balance AgreementTawanda Tatenda HerbertAinda não há avaliações

- Ncert AccountancyDocumento55 páginasNcert AccountancyArif ShaikhAinda não há avaliações

- AFM - Answers of IMP QuestionsDocumento6 páginasAFM - Answers of IMP QuestionsShiva JohriAinda não há avaliações

- CH 7, 8Documento4 páginasCH 7, 8Irfan UllahAinda não há avaliações

- Trial Balance Errors & Rectification 1Documento21 páginasTrial Balance Errors & Rectification 1Manju NathAinda não há avaliações

- Group D - Theory-18,20,21,25,28,29,31,46Documento36 páginasGroup D - Theory-18,20,21,25,28,29,31,46Risha RoyAinda não há avaliações

- Acct 3351Documento10 páginasAcct 3351RedWolf PopeAinda não há avaliações

- Suspense AccDocumento4 páginasSuspense AccAhmad Hafid HanifahAinda não há avaliações

- Acca Fa1-Examreport-D14Documento3 páginasAcca Fa1-Examreport-D14le duyAinda não há avaliações

- What Are Control Accounts? - Discounts - The Operation of Control Accounts - The Purpose of Control AccountsDocumento48 páginasWhat Are Control Accounts? - Discounts - The Operation of Control Accounts - The Purpose of Control AccountsAnh TúAinda não há avaliações

- Control Systems PDFDocumento12 páginasControl Systems PDFtylerAinda não há avaliações

- f3 Ffa ExamreportDocumento4 páginasf3 Ffa ExamreportAinaAinda não há avaliações

- Acct 5930 Quiz 1 Question 1Documento26 páginasAcct 5930 Quiz 1 Question 1Mauhammad NajamAinda não há avaliações

- DocxDocumento58 páginasDocxFluk75% (4)

- Chapter-2 Theory - 1-21 - Financial AccountingDocumento8 páginasChapter-2 Theory - 1-21 - Financial AccountingOmor FarukAinda não há avaliações

- ErrorsDocumento8 páginasErrorsShariff MohamedAinda não há avaliações

- Control Account ReconciliationsDocumento3 páginasControl Account ReconciliationsfurqanAinda não há avaliações

- Test Bank For Accounting Principles Volume 1 7th Canadian EditionDocumento37 páginasTest Bank For Accounting Principles Volume 1 7th Canadian Editiondupuisheavenz100% (17)

- Summary of Richard A. Lambert's Financial Literacy for ManagersNo EverandSummary of Richard A. Lambert's Financial Literacy for ManagersAinda não há avaliações

- Financial Accounting - Want to Become Financial Accountant in 30 Days?No EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Nota: 5 de 5 estrelas5/5 (1)

- Bookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingNo EverandBookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingNota: 4 de 5 estrelas4/5 (2)

- Credit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!No EverandCredit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!Nota: 1 de 5 estrelas1/5 (1)

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyNo EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyAinda não há avaliações

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNo EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNota: 5 de 5 estrelas5/5 (1)

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursAinda não há avaliações

- Examiner Report 2009Documento3 páginasExaminer Report 2009acca810decAinda não há avaliações

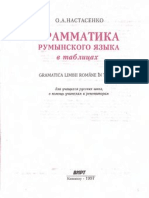

- Nastasenko Gramatika Ruminskogo V TablicahDocumento80 páginasNastasenko Gramatika Ruminskogo V TablicahNicolae CaminschiAinda não há avaliações

- Examiner's Report: F3 Financial Accounting December 2010Documento3 páginasExaminer's Report: F3 Financial Accounting December 2010Nicolae CaminschiAinda não há avaliações

- Fma Past Paper 3 (F2)Documento24 páginasFma Past Paper 3 (F2)Shereka EllisAinda não há avaliações

- Daftar Pustaka: WWW - Bkkbn.go - IdDocumento4 páginasDaftar Pustaka: WWW - Bkkbn.go - IdOca DocaAinda não há avaliações

- Oracle Fusion Chart of Accounts CreationDocumento41 páginasOracle Fusion Chart of Accounts CreationshankarAinda não há avaliações

- Corporate Finance: Class Notes 10Documento39 páginasCorporate Finance: Class Notes 10Sakshi VermaAinda não há avaliações

- Double Entry Cash BookDocumento3 páginasDouble Entry Cash BookGyanish JhaAinda não há avaliações

- Report PBCDocumento5 páginasReport PBCTOP No LimitAinda não há avaliações

- Boston Consulting Group Matrix (BCG Matrix)Documento19 páginasBoston Consulting Group Matrix (BCG Matrix)c-191786Ainda não há avaliações

- Money CreationDocumento3 páginasMoney CreationKarl_23Ainda não há avaliações

- SLAuS 700 PDFDocumento9 páginasSLAuS 700 PDFnaveen pragash100% (1)

- BLANKING VAM TOP ® 2.875in. 7.8lb-ft API Drift 2.229in.Documento1 páginaBLANKING VAM TOP ® 2.875in. 7.8lb-ft API Drift 2.229in.BaurzhanAinda não há avaliações

- Kase Fund Letter To Investors-Q1 14Documento4 páginasKase Fund Letter To Investors-Q1 14CanadianValue100% (1)

- DISBURSEMENT VOUCHER (JC) - AugustDocumento2 páginasDISBURSEMENT VOUCHER (JC) - Augusthekeho3180Ainda não há avaliações

- 10 AxiomsDocumento6 páginas10 AxiomsJann KerkyAinda não há avaliações

- BriefDocumento3 páginasBriefVăn LộcAinda não há avaliações

- NEW TRC Volunteer Application FormDocumento4 páginasNEW TRC Volunteer Application FormMark J ThompsonAinda não há avaliações

- Primary Research AnalysisDocumento5 páginasPrimary Research Analysisbhoven2nrbAinda não há avaliações

- May 22Documento2 páginasMay 22digiloansAinda não há avaliações

- Deviation Powers 07.12.16 BCC - BR - 108 - 587Documento11 páginasDeviation Powers 07.12.16 BCC - BR - 108 - 587RAJAAinda não há avaliações

- Project Management Professional (PMP) Training &NEWDocumento792 páginasProject Management Professional (PMP) Training &NEWAmer Rahmah100% (7)

- English CVDocumento8 páginasEnglish CVdragos_roAinda não há avaliações

- BS 2898Documento16 páginasBS 2898jiwani87Ainda não há avaliações

- 04 - Invesco European Bond FundDocumento2 páginas04 - Invesco European Bond FundRoberto PerezAinda não há avaliações

- Social MediaDocumento44 páginasSocial MediaAzam Ali ChhachharAinda não há avaliações

- Flipkart InitialDocumento9 páginasFlipkart InitialVivek MeshramAinda não há avaliações

- Chapter 19Documento51 páginasChapter 19Yasir MehmoodAinda não há avaliações

- Credit Application 2023Documento1 páginaCredit Application 2023Jean Pierre PerrierAinda não há avaliações

- A Question of Ethics - Student Accountant Magazine Archive - Publications - Students - ACCA - ACCA Global f1 PDFDocumento5 páginasA Question of Ethics - Student Accountant Magazine Archive - Publications - Students - ACCA - ACCA Global f1 PDFvyoung1988Ainda não há avaliações

- Search Engine MarketingDocumento6 páginasSearch Engine MarketingSachinShingoteAinda não há avaliações