Escolar Documentos

Profissional Documentos

Cultura Documentos

State of MI W4P

Enviado por

AJLDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

State of MI W4P

Enviado por

AJLDireitos autorais:

Formatos disponíveis

Reset Form

Michigan Department of Treasury 4924 (Rev. 01-12)

MI W-4P

Withholding Certificate for Michigan Pension or Annuity Payments

INSTRUCTIONS: Use Form MI W-4P to notify administrators of the correct amount of Michigan income tax to withhold from your pension or annuity payment(s). You may also use this form to choose not to have any Michigan income tax withheld from your payment(s). This does not apply to military pensions or certain pensions paid by the Railroad Retirement Board. Significant income tax changes take effect for the 2012 tax year. Entities, over whom Michigan has jurisdiction, disbursing pension or annuity payments are required to collect withholding on those payments that are expected to be included in taxable income unless you choose to opt out by submitting this form (See instructions for line 1). Entities over which Michigan does not have jurisdiction are not required to withhold Michigan income tax from your pension or annuity payment(s). If your pension administrator does not withhold, you may need to make estimated income tax payments to avoid owing penalty and interest. For further information, see General Instructions on page two, the Michigan Estimated Income Tax for Individuals (MI-1040ES) or consult a tax advisor. If you have more than one administrator, you will need to complete a form for each pension or annuity. If you do not file MI W-4P, the administrator may need to withhold even if you will not owe tax on your pension income. See instructions on page two.

GENERAL INFORMATION

Name Mailing Address (Number, Street, P.O. Box) City Marital Status Single Married Married (withhold the same as Single) State ZIP Code Social Security Number

For joint filers, the age of the oldest spouse determines the age category. Check only ONE box.

1. Check here if your pension or annuity payments are not taxable or you wish to opt out. STOP HERE AND SIGN FORM. NOTE: Opting out may result in a balance due on your MI-1040 as well as penalty and/or interest.

2. Check here if you (or your spouse) were born before 1946. See instructions for line 2. 3. Check here if you (or your spouse) were born during the period 1946 through 1952. See instructions for line 3. 4. Check here if you (and your spouse) were born after 1952. See instructions for line 4.

Complete the following applicable lines:

5. 6. Enter number of personal exemptions allowed on your Michigan Income Tax Return (MI-1040). Exemptions should only be claimed once on all MI W-4s (wages) or MI W-4P forms submitted. Additional percentage amount, if any, you want withheld from your pension or annuity payment. This amount must be a percentage. 5. 6.

AUTHORIZATION

Signature

Printed or Typed Name and Title

Date

Sign and return this completed form to the administrator of your pension or annuity. Keep a copy for your records. Visit www.michigan.gov/taxes for additional information.

Form 4924, Page 2

Instructions for Completing MI W-4P, Withholding Certificate for Michigan Pension or Annuity Payments

General Instructions

Significant income tax changes take effect for the 2012 tax year. These changes may result in a balance due if the incorrect amount is withheld from pension or annuity payment(s). There is no change in 2012 in the tax treatment of pension and retirement benefits for taxpayers born before 1946. Recipients born during the period 1946 through 1952 are eligible to deduct pension and retirement benefits up to $20,000 for single taxpayers or married filing separate, or $40,000 if married filing a joint return. Recipients born after 1952 may not deduct pension and retirement benefits on the Michigan Income Tax Return (MI1040). For joint filers, the age of the oldest spouse determines the age category. Multiple pensions: If you (and your spouse) receive multiple pension payments, your withholding on those payments may not cover your entire tax liability. Married couples where each spouse receives payments on their own pension may choose to have withholding calculated as if they were single on the MI W-4P and select one personal exemption in order to have sufficient withholding to cover their tax liability. Taxpayers with multiple pensions may need to consult the MI-1040ES or a tax advisor to ensure the proper amount is withheld or paid in estimated income tax payments. Estimated Payments: There are penalties for not paying enough state income tax during the year, either through withholding or estimated tax payments. Taxpayers who have chosen not to have tax withheld from their pension or annuity payments may be required to make estimated tax payments. Refer to Form MI-1040ES for estimated tax requirements. When should I complete this form? Complete Form MI W-4P and give it to the administrator of your pension or annuity payments as soon as possible. Your tax situation may change from year to year; you may want to evaluate your withholding each year. You can change the amount to be withheld by submitting an updated Form MI W-4P to your pension or annuity administrator at any time. Is every pension administrator required to withhold Michigan tax? Only companies over whom Michigan has taxing jurisdiction are required to withhold Michigan tax from your pension and/or annuity payment(s). If your pension administrator does not fall under Michigan jurisdiction, you may request to have Michigan tax withheld, but the company is not required to do so. If no taxes are withheld from your payments, it is likely you will be required to make estimated payments in place of the withholding. Contact your pension and/or annuity administrator to verify if tax will be withheld from your payments.

Line-by-Line Instructions

Line 1: You may opt out of withholding tax from your pension and annuity benefits if you believe you will not have a balance due on your MI-1040. If you (and your spouse) opt to have no Michigan tax withheld from your pension or retirement benefits by checking the box on line 1, it may result in a balance due on your MI-1040 as well as penalty and/or interest. If you check the box on line 1, do not complete lines 5 and 6. STOP HERE AND SIGN THE FORM. Line 2: If you (or your spouse) were born prior to 1946, all benefits from public sources are exempt and benefits from private sources may be subtracted up to for $47,309 for a single filer or married filer filing separately or $94,618 if married filing a joint return for the 2012 tax year. In addition, benefits that will be rolled into another qualified plan or IRA will not be taxable if the amount rolled over is not included in federal adjusted gross income (AGI). Any private pension payment in excess of the limits above is taxable. Line 3: If you (or your spouse) were born during the period 1946 through 1952, the first $20,000 for single filers or $40,000 for joint filers of all private and public pension and annuity benefits may be subtracted from Michigan taxable income. Benefits in excess of these limits are taxable to Michigan. Line 4: If you (and your spouse) were born after 1952, all private and public pension and annuity benefits are fully taxable and may not be subtracted from Michigan taxable income. Line 5: Enter personal exemptions based on box checked on lines 1-4. The total number of exemptions you claim on line 6 may not exceed the number of exemptions you are entitled to claim when you file your MI-1040. Line 6: You may designate additional withholding if you expect to owe more than the amount withheld. This amount must be a percentage. NOTE: If you enter a number on line 5 and/or a percentage on line 6, do not check box 1. If box 1 is checked and line(s) 5 and/or 6 are completed, this will override line 1. Failure to have sufficient tax withheld from your pension and/or annuity payment(s) may result in a balance due on your MI-1040 as well as penalty and/or interest.

Você também pode gostar

- State Tax FormDocumento2 páginasState Tax FormRon SchingsAinda não há avaliações

- Withholding Certificate For Pension or Annuity Payments: General InstructionsDocumento6 páginasWithholding Certificate For Pension or Annuity Payments: General InstructionsАндрей КрайниковAinda não há avaliações

- Maryland Withholding Form ExplainedDocumento2 páginasMaryland Withholding Form ExplainedVenkatesh GorurAinda não há avaliações

- MW507Documento2 páginasMW507Thirunavukkarasu AnandanAinda não há avaliações

- Lousianna Tax InstructionDocumento17 páginasLousianna Tax Instructionchuckhsu1248Ainda não há avaliações

- US Internal Revenue Service: p967 - 1997Documento5 páginasUS Internal Revenue Service: p967 - 1997IRSAinda não há avaliações

- Connecticut W-4 Form Explains Codes For Withholding RatesDocumento4 páginasConnecticut W-4 Form Explains Codes For Withholding RatesestannardAinda não há avaliações

- California Employee Withholding Allowance Certificate FormDocumento4 páginasCalifornia Employee Withholding Allowance Certificate FormAmandaAinda não há avaliações

- Missouri Form Mo W 4Documento1 páginaMissouri Form Mo W 4itargetingAinda não há avaliações

- Tax Form 2016Documento2 páginasTax Form 2016Sharkman1234566100% (1)

- 2016-2017 - State Form IL-W-4Documento2 páginas2016-2017 - State Form IL-W-4Mason FrasherAinda não há avaliações

- Form IL-W-4: Employee's Illinois Withholding Allowance Certificate and InstructionsDocumento2 páginasForm IL-W-4: Employee's Illinois Withholding Allowance Certificate and InstructionsMorning32Ainda não há avaliações

- Adjust Maryland withholdingDocumento2 páginasAdjust Maryland withholdingsosureyAinda não há avaliações

- Ca De-4Documento4 páginasCa De-4Kevin Marcos FelicianoAinda não há avaliações

- Tax Impact of Job LossDocumento7 páginasTax Impact of Job LossbullyrayAinda não há avaliações

- Alberta 2024Documento2 páginasAlberta 2024jennamthoAinda não há avaliações

- US Internal Revenue Service: p967 - 1998Documento6 páginasUS Internal Revenue Service: p967 - 1998IRSAinda não há avaliações

- Iowa W4Documento2 páginasIowa W4ts0m3Ainda não há avaliações

- Notice To Employee Instructions For Employee: (Continued From The Back of Copy B.)Documento1 páginaNotice To Employee Instructions For Employee: (Continued From The Back of Copy B.)redditor1276Ainda não há avaliações

- California DE-4Documento4 páginasCalifornia DE-4Tuğrul SarıkayaAinda não há avaliações

- Us W-2 2015 PDFDocumento7 páginasUs W-2 2015 PDFkevsAinda não há avaliações

- US Internal Revenue Service: p4128Documento6 páginasUS Internal Revenue Service: p4128IRSAinda não há avaliações

- The Delta Chi Fraternity, IncDocumento4 páginasThe Delta Chi Fraternity, IncKevin CammAinda não há avaliações

- 2024iaw-4 (44019) 0Documento4 páginas2024iaw-4 (44019) 0ahmedzahi964Ainda não há avaliações

- Advanced Certification - Study Guide (For Tax Season 2017)Documento7 páginasAdvanced Certification - Study Guide (For Tax Season 2017)Center for Economic Progress100% (4)

- Generic Form Preview DocumentDocumento4 páginasGeneric Form Preview Documentelena.69.mxAinda não há avaliações

- Income Based Repayment Plan Request and or RenewalDocumento5 páginasIncome Based Repayment Plan Request and or RenewalaquarianflowerAinda não há avaliações

- Yukon Tax Credits ReturnDocumento2 páginasYukon Tax Credits ReturnBryan WilleyAinda não há avaliações

- Income Tax Return For Single and Joint Filers With No DependentsDocumento2 páginasIncome Tax Return For Single and Joint Filers With No DependentsmarahmaneAinda não há avaliações

- Monica L Lindo Tax FormDocumento2 páginasMonica L Lindo Tax Formapi-299234513Ainda não há avaliações

- How To File Your Income Tax Return in The Philippines-COMPENSATIONDocumento10 páginasHow To File Your Income Tax Return in The Philippines-COMPENSATIONmiles1280Ainda não há avaliações

- Coronavirus-Related Withdrawal: SECTION 1: What's Included in This KitDocumento10 páginasCoronavirus-Related Withdrawal: SECTION 1: What's Included in This KitandryAinda não há avaliações

- File SE Tax for Self-Employment IncomeDocumento5 páginasFile SE Tax for Self-Employment Income5sfsfdAinda não há avaliações

- US Internal Revenue Service: p967 - 1996Documento5 páginasUS Internal Revenue Service: p967 - 1996IRSAinda não há avaliações

- 2012 Ontario Tax FormDocumento2 páginas2012 Ontario Tax FormHassan MhAinda não há avaliações

- Edd AfDocumento4 páginasEdd Afcsl K360Ainda não há avaliações

- MW 507Documento2 páginasMW 507anon-650325100% (1)

- Form 1040-ES: Purpose of This PackageDocumento12 páginasForm 1040-ES: Purpose of This PackageCaliCain MendezAinda não há avaliações

- PDF W2Documento1 páginaPDF W2John LittlefairAinda não há avaliações

- Td1on Fill 22eDocumento2 páginasTd1on Fill 22eOluwafeyikemi olusogaAinda não há avaliações

- Tax Credit Return PDFDocumento2 páginasTax Credit Return PDFserbisyongtotooAinda não há avaliações

- Webcam For AdultDocumento2 páginasWebcam For AdultDixieojmwwAinda não há avaliações

- 1040 Exam Prep: Module II - Basic Tax ConceptsNo Everand1040 Exam Prep: Module II - Basic Tax ConceptsNota: 1.5 de 5 estrelas1.5/5 (2)

- Frequently Asked Tax Questions 2015sdaDocumento8 páginasFrequently Asked Tax Questions 2015sdaVikram VickyAinda não há avaliações

- James Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244Documento2 páginasJames Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244api-270182608100% (2)

- EA LectureNotesDocumento84 páginasEA LectureNotesKim Nguyen100% (1)

- Fidelity RolloverDocumento5 páginasFidelity Rollovertimosh16Ainda não há avaliações

- Correct Form W-2 and Claim Refund or CreditDocumento2 páginasCorrect Form W-2 and Claim Refund or Creditlysprr0% (1)

- 1 Cares Act CRD Flyer FRDocumento2 páginas1 Cares Act CRD Flyer FRHarry HarrisAinda não há avaliações

- Income TaxationDocumento12 páginasIncome TaxationMonica Jarabelo RamintasAinda não há avaliações

- 2011 Irs Tax Form 1040 A Individual Income Tax ReturnDocumento3 páginas2011 Irs Tax Form 1040 A Individual Income Tax ReturnscribddownloadedAinda não há avaliações

- Direct Rollover and Withholding Form For Lump Sum Pension PaymentsDocumento5 páginasDirect Rollover and Withholding Form For Lump Sum Pension PaymentsMichaelMorganAinda não há avaliações

- F1040ez PDFDocumento2 páginasF1040ez PDFjc75aAinda não há avaliações

- 2013 Instructions For Schedule SE (Form 1040) : Self-Employment TaxDocumento6 páginas2013 Instructions For Schedule SE (Form 1040) : Self-Employment TaxJames D. SassAinda não há avaliações

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryAinda não há avaliações

- Lakeman Financial Launches The Lakeman Financial FoundationDocumento2 páginasLakeman Financial Launches The Lakeman Financial FoundationAJLAinda não há avaliações

- American Funds - Investment Insight - September 2013 - Active Vs Passive Investing.Documento12 páginasAmerican Funds - Investment Insight - September 2013 - Active Vs Passive Investing.AJLAinda não há avaliações

- State of Michigan Senate Bill 1040Documento20 páginasState of Michigan Senate Bill 1040AJLAinda não há avaliações

- Effective Tax RateDocumento3 páginasEffective Tax RateAJLAinda não há avaliações

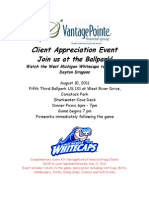

- Whitecaps 2012 InviteDocumento1 páginaWhitecaps 2012 InviteAJLAinda não há avaliações

- State of Michigan Senate Bill 1040Documento20 páginasState of Michigan Senate Bill 1040AJLAinda não há avaliações

- Effective Tax RateDocumento3 páginasEffective Tax RateAJLAinda não há avaliações

- Michigan Estate Recovery BrochureDocumento2 páginasMichigan Estate Recovery BrochureAJLAinda não há avaliações

- Ivy Funds - China at A CrossroadsDocumento8 páginasIvy Funds - China at A CrossroadsAJLAinda não há avaliações

- Michigan School Districts MapDocumento1 páginaMichigan School Districts MapAJLAinda não há avaliações

- Bow and Spear Fishing MichiganDocumento1 páginaBow and Spear Fishing MichiganAJLAinda não há avaliações

- Snapshot of The Week - Market StasticsDocumento2 páginasSnapshot of The Week - Market StasticsAJLAinda não há avaliações

- Whitecaps 2011Documento1 páginaWhitecaps 2011AJLAinda não há avaliações

- 2010 Callan Chart - The Periodic Table of InvestmentsDocumento2 páginas2010 Callan Chart - The Periodic Table of InvestmentsAJLAinda não há avaliações

- Snapshot of The Week - Market StatisticsDocumento2 páginasSnapshot of The Week - Market StatisticsAJLAinda não há avaliações

- Glenview Capital Third Quarter 2009Documento12 páginasGlenview Capital Third Quarter 2009balevinAinda não há avaliações

- Cash BookDocumento18 páginasCash BookDr. Mohammad Noor AlamAinda não há avaliações

- ASEAN Investment Report 2015Documento250 páginasASEAN Investment Report 2015mhudzzAinda não há avaliações

- Additional CAPM ExercisesDocumento8 páginasAdditional CAPM ExercisesMuhammad OsamaAinda não há avaliações

- Accounting Selfstudy 01Documento3 páginasAccounting Selfstudy 01Mohammed Al-YagoobAinda não há avaliações

- 20 Accounting Changes and Error CorrectionsDocumento17 páginas20 Accounting Changes and Error CorrectionsKyll MarcosAinda não há avaliações

- Impact of GST On Indian Economy: Vishal Singh Chouhan Mba-Fs 3 SemDocumento16 páginasImpact of GST On Indian Economy: Vishal Singh Chouhan Mba-Fs 3 SemstrewAinda não há avaliações

- Economic indicators and policy instrumentsDocumento1 páginaEconomic indicators and policy instrumentsThaminah ThassimAinda não há avaliações

- Tax Revenue Performance in KenyaDocumento47 páginasTax Revenue Performance in KenyaMwangi MburuAinda não há avaliações

- Mayberry v. KKR (KRS Lawsuit)Documento146 páginasMayberry v. KKR (KRS Lawsuit)Insider Louisville0% (2)

- What Is a Customer Relationship Management (CRM) SystemDocumento5 páginasWhat Is a Customer Relationship Management (CRM) SystemSan Lizas AirenAinda não há avaliações

- Mpic 2016 17a - FinalDocumento335 páginasMpic 2016 17a - FinalBryan Paul InocencioAinda não há avaliações

- 2011-12-15 Rothstein Scott AMDocumento204 páginas2011-12-15 Rothstein Scott AMmatthendley100% (1)

- Final Rule NoticeDocumento79 páginasFinal Rule NoticedechtersAinda não há avaliações

- Basel 2 Vs Basel 3 GEG-Working-Paper-Ranjit-LallDocumento37 páginasBasel 2 Vs Basel 3 GEG-Working-Paper-Ranjit-LallVishwa Raj SinghAinda não há avaliações

- eNPSForm PDFDocumento5 páginaseNPSForm PDFPradnyaAinda não há avaliações

- IACOVOU Cyprus EU Citizenship Permanent Residence PermitDocumento14 páginasIACOVOU Cyprus EU Citizenship Permanent Residence PermitStelios AgapiouAinda não há avaliações

- 97% Capital Protection 45% Participation 115% Cap 2 Year CHFDocumento1 página97% Capital Protection 45% Participation 115% Cap 2 Year CHFapi-25889552Ainda não há avaliações

- CIMA E3 Revision NotesDocumento81 páginasCIMA E3 Revision Notesbrighton_2014Ainda não há avaliações

- HEC Coach LBO CaseDocumento12 páginasHEC Coach LBO CasePrashant KhoranaAinda não há avaliações

- ComoditiesDocumento61 páginasComoditiesShankar VarmaAinda não há avaliações

- STRAMADocumento4 páginasSTRAMACarl MoliculesAinda não há avaliações

- The Dividend PolicyDocumento10 páginasThe Dividend PolicyTimothy Nshimbi100% (1)

- CH 17Documento55 páginasCH 17shierley rosalina100% (1)

- Shivangi Shukla AP GPDocumento36 páginasShivangi Shukla AP GPgaurav pandeyAinda não há avaliações

- GENERAL INSURANCE: AN OVERVIEWDocumento43 páginasGENERAL INSURANCE: AN OVERVIEWskenkan50% (6)

- Borders Group Inc. Bankruptcy AnalysisDocumento10 páginasBorders Group Inc. Bankruptcy AnalysisJill PiccioneAinda não há avaliações

- Chaikin Power Gauge Report JPM 08sep2011Documento4 páginasChaikin Power Gauge Report JPM 08sep2011Chaikin Analytics, LLC100% (2)

- The Shadow Government and Banking EliteDocumento145 páginasThe Shadow Government and Banking EliteThomas Anderson91% (11)

- Krishna Lal SadhuDocumento8 páginasKrishna Lal SadhuPranjal DubeyAinda não há avaliações