Escolar Documentos

Profissional Documentos

Cultura Documentos

SEB Report: More Quantitative Easing Looms in The US

Enviado por

SEB GroupTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

SEB Report: More Quantitative Easing Looms in The US

Enviado por

SEB GroupDireitos autorais:

Formatos disponíveis

Views on the U.S.

labor market and Fed policy

EVERYONE GETS THEIR FAIR SHARE OF CALLS RIGHT AND WRONG and we have certainly been very wrong on the U.S. unemployment rate since the recovery began. While real GDP growth has averaged 2.4 per cent since mid-2009, unemployment has fallen by 1.7 percentage points from the peak. Despite unprecedented generosity of Uncle Sam, in terms of GDP growth this is the weakest recovery in the postwar era. Had we known in advance that real GDP growth would have been so slow we would probably make the same call on the unemployment rate all over again.

WEDNESDAY FEBRUARY 22, 2012

YOU HAVE TO LOVE THE OPTIMISM and it looks like the 2012 economic recovery story is more sustainable than its 2011 edition. The labor market is on the right track but it is climbing out of a very deep hole. While falling unemployment is good news, the labor market like any market in excess supply, will clear at a lower price in our view. The proof of the pudding is in the eating and the turnaround in unemployment has so far at least not exactly produced strong income numbers.

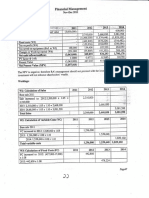

Historically there has been a close relationship between real GDP growth and future changes in the unemployment rate; in economic terms Okuns Law. If the 60-year database is of any use, the law shows that, on average, when GDP growth exceeds trend by one percentage point for a period of one year, the unemployment rate falls by around 0.4 percentage points. However, as the chart below shows, Okuns Law has failed since the recovery began. One possible explanation is that GDP growth will eventually be revised upward. Alternatively, the speed limit or trend growth rate has been much lower since the recovery began. WE LIKE TO LOOK AT THE JOB MARKET BACKDROP FROM 10,000 FEET and over 30 months into the economic recovery employment at 132 million is actually lower than it was 11 years ago. At its current 200k+ rate a

Percent

Economic Insights

month, it will take nearly 30 more months for payrolls to recoup all their recession losses. Meanwhile what is normal is a post-recession bungee jump in the data with employment usually hitting new highs at this stage of the cycle. Despite continuing population growth the labor force is approximately the same size today as in 2008. However, as it has increased by almost 15 million since 2001, the labor market gap is huge in our opinion. IT IS ALWAYS BEST TO BE AWARE OF BOTH SIDES OF THE ARGUMENT and with respect to the unemployment rate we think a dose of reality is needed. Most if not all of the current decline can be attributed to a marked decrease in labor force participation, which has trended lower since peaking around 12 years ago at 67.3 per cent. However, as soon as the recovery began the participation rate started to fall much more quickly; it has decreased by 1.8 percentage points since mid-2009 alone to currently a post-1983 low. Believe it or not if the participation rate had remained at its end-of-recession level (65.7 per cent) the present unemployment rate would have been 11 per cent. So when we scratch beneath the surface there are self-contradictory elements in the data, suggesting that the unemployment rate is skewed to the downside. Note that the rate including the underemployed and the total pool of available labor (U6) remains above 15 per cent. Be that as it may, the classic unemployment rate measure (U3) is arguably the most emotional of economic statistics, and its downtrend is boosting President Obamas chances of winning the upcoming election.

concerned by longer-term unemployment which has hardly budged; cyclical unemployment may therefore become structural which is why the Fed is so aggressive. IT IS HARD TO FORECAST THE PARTICIPATION RATE with any degree of certainty. If the recovery stays on track, more people should eventually start looking for jobs. However, U.S. demographics have so far helped drive the participation rate downward, and will probably continue to do so for the foreseeable future. Despite the Fed having the worlds most sophisticated macroeconomic model at its disposal, the FOMC does not appear to have a strong view on the participation rate. According to the most recent FOMC minutes a few participants noted that the recent decline in the unemployment rate reflected declining labor force participation in large part, and judged that the decline in the participation rate was likely to be reversed So the remaining participants either hold the opposite view or no view at all.

All we know is that if participation continues to trend lower, it will drag the unemployment rate down as well. However, there is a cost involved as lower labor force participation has adverse consequences for the U.S. economy, in terms of its long run productivity and potential growth rate. While estimating the output gap is fraught with risks, perhaps especially when emerging from a severe financial crisis, it remains substantial in our opinion. From a shorter term perspective, we recommend focusing less on the unemployment rate and more on employment, GDP and inflation trends. Remember that according to the FOMC minutes last week, a few members think that current and prospective economic conditions could warrant QE3. Other members thought that either lost momentum in GDP growth or below-mandate inflation would justify more easing. In our opinion therefore, QE3 remains on the table. mattias.bruer@seb.se +46 (0) 73 98 38 506

CENTRAL BANKERS PREFER TO USE THE EMPLOYMENT RATE instead as the unemployment rate is often influenced by the vagaries of labor force definition at 58.5 per cent the employment rate remains near its latest lows. Further, according to a recent statement by Ben Bernanke, the 8.3% unemployment rate understates the weakness in the labor market. In addition, we note that the current unemployment rate is still well above the 5.2-6 per cent range into which the Fed expects it to settle in time. Nobody at the FOMC expects to see the unemployment rate below 6.7 per cent during the next three years. Moreover, Bernanke is clearly

Você também pode gostar

- Insights From 2014 of Significance For 2015Documento5 páginasInsights From 2014 of Significance For 2015SEB GroupAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Economic Insights: Riksbank To Lower Key Rate, While Seeking New RoleDocumento3 páginasEconomic Insights: Riksbank To Lower Key Rate, While Seeking New RoleSEB GroupAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Economic Insights: The Middle East - Politically Hobbled But With Major PotentialDocumento5 páginasEconomic Insights: The Middle East - Politically Hobbled But With Major PotentialSEB GroupAinda não há avaliações

- Economic Insights: Subtle Signs of Firmer Momentum in NorwayDocumento4 páginasEconomic Insights: Subtle Signs of Firmer Momentum in NorwaySEB GroupAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- CFO Survey 1403: Improving Swedish Business Climate and HiringDocumento12 páginasCFO Survey 1403: Improving Swedish Business Climate and HiringSEB GroupAinda não há avaliações

- SE-Banken, Investment Outlook, Dec 2013, "Market Hopes Will Require Some Evidence"Documento35 páginasSE-Banken, Investment Outlook, Dec 2013, "Market Hopes Will Require Some Evidence"Glenn ViklundAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Assignment Brief - Btec (RQF) Higher National Diploma in BusinessDocumento2 páginasAssignment Brief - Btec (RQF) Higher National Diploma in BusinessRan KarAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Nov-Dec 2011Documento9 páginasNov-Dec 2011Usuf JabedAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Commodity Forwards and FuturesDocumento22 páginasCommodity Forwards and FuturesAliza RajaniAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Riello Ups CatalogDocumento109 páginasRiello Ups CatalogJose LopezAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Understanding OFR, A Guide To Florida's Office of Financial RegulationDocumento23 páginasUnderstanding OFR, A Guide To Florida's Office of Financial RegulationNeil GillespieAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- BSBSTR602 Project PortfolioDocumento16 páginasBSBSTR602 Project Portfoliocruzfabricio0Ainda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- LIst of CA AgentDocumento12 páginasLIst of CA AgentParikshit SalvepatilAinda não há avaliações

- Sampel For CAT 2022Documento15 páginasSampel For CAT 2022Vidhi ChoithaniAinda não há avaliações

- Assembly - June 2017Documento84 páginasAssembly - June 2017Varun KumarAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Comprehensive Bike Insurance PolicyDocumento2 páginasComprehensive Bike Insurance PolicyGodwin LoboAinda não há avaliações

- Research Memorandum Re Usec Dela GuardiaDocumento5 páginasResearch Memorandum Re Usec Dela GuardiaJohn Kevin Carmen SamsonAinda não há avaliações

- Quiz 2 HolyeDocumento47 páginasQuiz 2 Holyegoamank100% (5)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Financial Statement Analysis of Suzuki MotorsDocumento21 páginasFinancial Statement Analysis of Suzuki MotorsMuhammad AliAinda não há avaliações

- Final Draft - Banana ChipsDocumento34 páginasFinal Draft - Banana ChipsAubrey Delgado74% (35)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Investment Ass#6 - Daniyal Ali 18u00265Documento3 páginasInvestment Ass#6 - Daniyal Ali 18u00265Daniyal Ali100% (1)

- Diversifikasi Korporasi Dan Biaya Modal: Jurnal Siasat Bisnisvol.21 No. 2, 2017,181-198Documento18 páginasDiversifikasi Korporasi Dan Biaya Modal: Jurnal Siasat Bisnisvol.21 No. 2, 2017,181-198sriintan09gmail.com intan99Ainda não há avaliações

- VRIO AnalysisDocumento2 páginasVRIO AnalysisrenjuannAinda não há avaliações

- JKSSB Account Assistant Syllabus 2020 1588580337 PDFDocumento4 páginasJKSSB Account Assistant Syllabus 2020 1588580337 PDFMuDas IrAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 2 (Partnership - Continuation) - Solution To Multiple Choice (Part A)Documento2 páginas(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 2 (Partnership - Continuation) - Solution To Multiple Choice (Part A)John Carlos DoringoAinda não há avaliações

- Registration Form 16TH Wsho Conference 2018 FinalDocumento1 páginaRegistration Form 16TH Wsho Conference 2018 FinalSuresh ThevanindrianAinda não há avaliações

- CYBERPRENEURSHIPDocumento13 páginasCYBERPRENEURSHIPMash ScarvesAinda não há avaliações

- Buta Market and FeedstocksDocumento49 páginasButa Market and FeedstocksChemEngGirl89Ainda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- International Business and Trade: Tony Angelo C. AlvaranDocumento40 páginasInternational Business and Trade: Tony Angelo C. AlvaranKutoo BayAinda não há avaliações

- Business EnviromentDocumento40 páginasBusiness EnviromentMalav NanavatiAinda não há avaliações

- Borja, Ma. Sofia Madeline N. Bsba HRM 1-1N Case AnalysisDocumento4 páginasBorja, Ma. Sofia Madeline N. Bsba HRM 1-1N Case AnalysisMadie StellarAinda não há avaliações

- Lecture 5 ConsiderationDocumento17 páginasLecture 5 ConsiderationMason TangAinda não há avaliações

- Remote Deposit Capture Project Part 1: Project Integration ManagementDocumento2 páginasRemote Deposit Capture Project Part 1: Project Integration ManagementManasa KarumuriAinda não há avaliações

- Tanggal Uraian Transaksi Nominal Transaksi SaldoDocumento3 páginasTanggal Uraian Transaksi Nominal Transaksi SaldoElina SanAinda não há avaliações

- Sales Manager Sample - Everest GreenDocumento1 páginaSales Manager Sample - Everest GreenH AAinda não há avaliações

- Uniform System of Accounts For The Lodging IndustryDocumento10 páginasUniform System of Accounts For The Lodging Industryvipul_khemkaAinda não há avaliações