Escolar Documentos

Profissional Documentos

Cultura Documentos

Super Case Study Report

Enviado por

ankurhbtiDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Super Case Study Report

Enviado por

ankurhbtiDireitos autorais:

Formatos disponíveis

Analysis of Super Project Case

Submitted by: FM2, Team 2 Ankur Gautam Atsushi Nagako Atul Ganeriwala Bo Wang Fahd Ahmed

Situation Background In 1967 General Foods Corporation planned to launch a new product by the name SUPER (flavored water soluble, powdered instant dessert). General Foods already had few products in the dessert market by the name Jelly-O , Kool Aid etc. Super was planned to use the same building where Jelly-O was manufactured and was to use the excess capacity of Jelly-O agglomerator. Further capital investment needed for Super was $200,000/ Super was expected to capture 10% of the market share upon its launch, of which 80% was to come from the dessert market and 20% from the erosion of Jelly-O. Problem Description While evaluating whether Super would be a good investment or not, Crosby Sanberg, a manager of financial analysis at General Foods presented three different ways of evaluating the return on Super. 1. Incremental basis: Considering only incremental revenue and investment which was $200,000/. This method did not accounted for $453,000/, which was the opportunity cost of the excess building capacity and Aggalomerator, and the over head cost of $19,000/ for the project. On calculating ROFE by this approach paid back period was 7years and ROFE was 63%. 2. Facility used basis: This approach took into account initial investment of $200,000/ and opportunity cost of $453,000/ but avoided accounting for $19,0000/ of overhead cost . ROFE for it was 34%. 3. Fully allocated basis: This approach included the opportunity cost and overhead costs. This method projected that Super would have a return of 25%, hence just barley meeting the minimum required return of 24% for a project of it's risk. Crosby is in a dilemma to decide the best method for evaluating the Super project since each method produced drastically different returns.

Evaluation of various aspects of cash flow and assumptions: 1. We have chosen to consider third approach of taking into account $453,000/ and $19,000/ while calculating the evaluation of Super as we feel that the facility is a un used assert which can be made to use for other projects as the Agglomerator and Building can be used for more than single function We also propose to adjust financial documents of Jelly-o and have the cost of the 2 asserts be written of it.. so that the assert is not taken into account at 2 places. 2. Inclusion of all incidental Effects: We support to take into account the effect of cannibalization for Jelly_O as we take this into consideration the fact that Super is expected to capture 10% of total desert market on its launch , this scenario is feasible only if General Foods Cooperation 's products have the monopoly (example of Microsofts products) and only its new products can reduce the sales of its existing products.

3. Tax calculation correction: We have taken into account the depreciation of the asserts acquired by Super before calculating the taxes and then adding the depreciation back to calculate the required cash flows. 4. Inclusion of opportunity cost: $453,000/ to be taken into account and be depreciated over the period of 10 years in the same ratios as proposed in exhibit 6 for initial investment of $200,000/.

5. Forget sunk cost: $360,000 has been considered as an sunk cost hence not been taken into account for calculating the NPV of the project. Reason for doing so is that we assume the research was done to estimate the acceptability of Super among the customers and hence that data will not be of any use later or to other projects. 6. Startup costs: Exbit 5 mentions about $15,000/ as the start up cost for engineering completion. We have considered this as an expense not a sunk cost as the money has been spent to renovate the old building of Jelly-O fish and has added value to the existing assert. And also if the Super project does not use it , the building could be used by General Foods Cooperation for some other project. 7. 8. Over head cost: $19,000/ is the over head cost and taken into consideration beginning year 5 and has been equally divided over year 5 to year 10 . Account for salvage value: As we are not provided with the details of the market value of the asserts, at the end of 10 year so we calculated the NPV of Super using the book value of the asserts.

Our Proposal: NPV of Super project comes to $319,000/ hence we recommend to take the project.

Você também pode gostar

- The Super ProjectDocumento5 páginasThe Super ProjectAbhiAinda não há avaliações

- Super Project CaseDocumento16 páginasSuper Project Casekanne_phAinda não há avaliações

- Super Project - July 2019Documento4 páginasSuper Project - July 2019Wally WannallAinda não há avaliações

- Super ProjectDocumento2 páginasSuper ProjectAnkit MehtaAinda não há avaliações

- Analisis Super ProjectDocumento4 páginasAnalisis Super Projectrcatherineb50% (2)

- Super Project: Corporate FinanceDocumento8 páginasSuper Project: Corporate Financebtarpara1Ainda não há avaliações

- The Super Project Case AnalysisDocumento5 páginasThe Super Project Case Analysisgpadhye123Ainda não há avaliações

- Super ProjectDocumento12 páginasSuper ProjectSrija LahiriAinda não há avaliações

- Super ProjectDocumento12 páginasSuper Projectkaran_w3Ainda não há avaliações

- Super ProjectDocumento1 páginaSuper ProjectVaibhav SaithAinda não há avaliações

- The Super Project: Mark Smukler, Griffin Meyer & Estefania GarciaDocumento8 páginasThe Super Project: Mark Smukler, Griffin Meyer & Estefania GarciaMark SmuklerAinda não há avaliações

- Super ProjectDocumento2 páginasSuper ProjectQiang ChenAinda não há avaliações

- Super ProjectDocumento6 páginasSuper ProjectMônica MelloAinda não há avaliações

- Super Project FinalDocumento29 páginasSuper Project FinalSamuel ChuquistaAinda não há avaliações

- Super Project AnalysisDocumento6 páginasSuper Project AnalysisPeeyush Khandka0% (1)

- Case The Super ProjectDocumento6 páginasCase The Super ProjectpaulAinda não há avaliações

- Nagornov Super Project CaseDocumento3 páginasNagornov Super Project Casetbsssilva100% (1)

- Ocean Carriers Executive SummaryDocumento2 páginasOcean Carriers Executive SummaryAniket KaushikAinda não há avaliações

- Case: Calpine Corporation: The Evolution From Project To Corporate FinanceDocumento7 páginasCase: Calpine Corporation: The Evolution From Project To Corporate FinanceKshitishAinda não há avaliações

- Sealed Air Corporation's Leveraged RecapitalizationDocumento7 páginasSealed Air Corporation's Leveraged RecapitalizationKumarAinda não há avaliações

- EC2101 Practice Problems 8 SolutionDocumento3 páginasEC2101 Practice Problems 8 Solutiongravity_coreAinda não há avaliações

- Analyse The Structure of The Personal Computer Industry Over The Last 15 YearsDocumento7 páginasAnalyse The Structure of The Personal Computer Industry Over The Last 15 Yearsdbleyzer100% (1)

- Group DDocumento16 páginasGroup DAbhishek VermaAinda não há avaliações

- Chasecase PaperDocumento10 páginasChasecase PaperadtyshkhrAinda não há avaliações

- Lockheed Case SolutionDocumento3 páginasLockheed Case SolutionKashish SrivastavaAinda não há avaliações

- A Note On Leveraged RecapitalizationDocumento5 páginasA Note On Leveraged Recapitalizationkuch bhiAinda não há avaliações

- Case 3 - Ocean Carriers Case PreparationDocumento1 páginaCase 3 - Ocean Carriers Case PreparationinsanomonkeyAinda não há avaliações

- Super Project Case SolutionDocumento3 páginasSuper Project Case SolutionasaqAinda não há avaliações

- Lockheed Tristar Case Study 11020241041Documento19 páginasLockheed Tristar Case Study 11020241041R Harika Reddy100% (7)

- Electronic Arts in Online Gaming PDFDocumento7 páginasElectronic Arts in Online Gaming PDFvgAinda não há avaliações

- BMA 12e SM CH 27 Final PDFDocumento9 páginasBMA 12e SM CH 27 Final PDFNikhil ChadhaAinda não há avaliações

- Question-Set 2: How Did You Handle The Ambiguity in Your Decision-Making? What WasDocumento6 páginasQuestion-Set 2: How Did You Handle The Ambiguity in Your Decision-Making? What WasishaAinda não há avaliações

- Sample ProblemsDocumento9 páginasSample ProblemsDoshi VaibhavAinda não há avaliações

- Buckeye Bank CaseDocumento7 páginasBuckeye Bank CasePulkit Mathur0% (2)

- CBRM Calpine Case - Group 4 SubmissionDocumento4 páginasCBRM Calpine Case - Group 4 SubmissionPranavAinda não há avaliações

- HWDocumento6 páginasHWaarushiAinda não há avaliações

- WellfleetDocumento3 páginasWellfleetAziez Daniel AkmalAinda não há avaliações

- Cooper Industries Case QuestionsDocumento3 páginasCooper Industries Case QuestionsChip choiAinda não há avaliações

- Assignment 2 Lockheed CaseDocumento6 páginasAssignment 2 Lockheed CaseBob MarlowAinda não há avaliações

- OM Scott Case AnalysisDocumento20 páginasOM Scott Case AnalysissushilkhannaAinda não há avaliações

- Case Analysis I American Chemical CorporationDocumento13 páginasCase Analysis I American Chemical CorporationamuakaAinda não há avaliações

- Facebook IPO Valuation AnalysisDocumento13 páginasFacebook IPO Valuation AnalysisMegha BepariAinda não há avaliações

- CasoDocumento20 páginasCasoasmaAinda não há avaliações

- SUN Brewing (A)Documento6 páginasSUN Brewing (A)Ilya KAinda não há avaliações

- Sun Brewing Case ExhibitsDocumento26 páginasSun Brewing Case ExhibitsShshankAinda não há avaliações

- M&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun KoDocumento2 páginasM&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun Ko고지현100% (1)

- Decision Models and Optimization: Indian School of Business Assignment 4Documento8 páginasDecision Models and Optimization: Indian School of Business Assignment 4NAAinda não há avaliações

- American Home Products CorporationDocumento7 páginasAmerican Home Products Corporationpancaspe100% (2)

- FRAV Individual Assignment - Pranjali Silimkar - 2016PGP278Documento12 páginasFRAV Individual Assignment - Pranjali Silimkar - 2016PGP278pranjaligAinda não há avaliações

- Sealed Air Corporation's Leveraged Recapitalization (A)Documento7 páginasSealed Air Corporation's Leveraged Recapitalization (A)Jyoti GuptaAinda não há avaliações

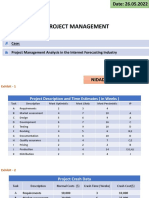

- Project Management Analysis in The Internet Forecasting IndustryDocumento14 páginasProject Management Analysis in The Internet Forecasting IndustryNiranjan NidadavoluAinda não há avaliações

- Polaroid Corporation: Group MembersDocumento7 páginasPolaroid Corporation: Group MemberscristinahumaAinda não há avaliações

- Tire City IncDocumento3 páginasTire City IncAlberto RcAinda não há avaliações

- Krispy Kreme Doughnuts: "It Ain't Just The Doughnuts That Are Glazed!"Documento9 páginasKrispy Kreme Doughnuts: "It Ain't Just The Doughnuts That Are Glazed!"dmaia12Ainda não há avaliações

- Case 5 Midland Energy Case ProjectDocumento7 páginasCase 5 Midland Energy Case ProjectCourse HeroAinda não há avaliações

- Case 22 Victoria Chemicals A DONEDocumento14 páginasCase 22 Victoria Chemicals A DONEJordan Green100% (5)

- Aerocomp Inc Case Study Week 7Documento5 páginasAerocomp Inc Case Study Week 7Aguntuk Shawon100% (4)

- Hola Kola - Docx 2Documento3 páginasHola Kola - Docx 2Gabriela PereiraAinda não há avaliações

- Baird - Euroland Foods CaseDocumento5 páginasBaird - Euroland Foods CaseKyleAinda não há avaliações

- Capital Budgeting - Adv IssuesDocumento21 páginasCapital Budgeting - Adv IssuesdixitBhavak DixitAinda não há avaliações