Escolar Documentos

Profissional Documentos

Cultura Documentos

Li S Paragon 6050 Marked

Enviado por

Song LiDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Li S Paragon 6050 Marked

Enviado por

Song LiDireitos autorais:

Formatos disponíveis

AS SI G NM E N T 1

PARAGON TOOLS CASE SGMT 6050

SUBMITTED TO: MARIA RADFORD SUBMITTED BY: SONG LI STUDENT NO. 210191716 EMAIL ADDRESS: SLI09@SCHULICH.YORKU.CA DUE DATE: JANUARY 31, 2012

SGMT 6050 Case Assignment I: PARAGON TOOLS CASE Song Li

Introduction:

The Paragon Tools CEO, Nicky Anaptyxi is facing a real dilemma: should he acquire MonioRobitics to accelerate the development of manufacturing service software or should he forego this opportunity and seek other alternatives to achieve organic growth of the company. In assessing the current situation of Paragon Tools, I would like to present three alternatives: First, acquire MonioRobitics and transform Paragon Tools from a manufacturing company into a cutting edge technology company; Second, forego this acquisition opportunity and grow the companys own service division internally; Third, follow the advice of CFO and divest the services division altogether. My recommendation to the company is to not pursue the acquisition of MonioRobitics and to grow the companys own service division internally. I will further illustrate my analysis and rationale below.

Analysis and Rationale

I will use the Strategic Analysis Framework to determine the critical issues for Paragon Tools and why shouldnt Paragon Tools acquire MonioRobitics and make the transformation now. Stakeholders Analysis Lets start with the Stakeholders Analysis. Paragon Tools has a variety of stakeholders including its Management Team, CEO Nicky and CFO Littlefield and other senior managers; Stock analysts who cover Paragon Tools; The employees within the company; Paragon Tools customers; Paragon Tools competitors who are in preparation of a hostile takeover etc. The first issue that the company faces is its management dissension, especially the divergence between its CEO and CFO who have different aspirations. Stock analysts are eager to see the near term results. Given the facts that the companys annual earning has dropped continuously for several years, if this trend continues, it will have negative impact on analyst prediction for the companys future earnings. From the employees point of view, they would anticipate more hiring and training opportunities. The acquisition would certainly offer additional benefit to Paragon Tools customers who would expect to receive a valuable trouble shooting services in a more timely fashion. However there is some issue related with current financial situation of Paragon Tools customers: Even though this add on service appears valuable to its customers, it is highly possible that they are not profitable enough to pay for the service. Last issue arises from Paragons competitors. Due to a hostile takeover that is under preparation by its major competitor, the price that Paragon eventually has to pay may be highly inflated. Paragon maybe end up paying much

2

SGMT 6050 Case Assignment I: PARAGON TOOLS CASE Song Li

higher premium than it should be. Through this stakeholder analysis, I quickly formed my first impression that Paragon Tools should not rush for change. Environment and Industry Analysis My second reasoning will be mainly focus on the environment and Industry Analysis. The major issue we need to solve is whether transforming from manufacturing industry to an emerging software servicing industry is a smart move for Paragon Tools? I decided to use Porters Five Forces Model to analyze the competitive environment of the software servicing industry. This industry appears to have low barrier of entry and limited customer base. Threat of new entrants is high. Competition is a common theme in this industry, with rivalries between some of the companies particularly keen. (ValueLine Website) This explains why MonioRobitics would so quickly become a target of acquisition for various companies within this field. Entry into this industry is not uncommon, but its competitive nature requires new comers to be able to sustain a technological and product marketing edge over its target rivals. If successful, the new entrant can grow very quickly. (ValueLine Website) Switching cost and customer loyalty are low. Buying power is high because customers can choose the servicing company and software they prefer the most. In contrast, the manufacturing industry that Paragon Tools is currently in is more stable and less competitive because Paragon Tools already have secured customer base with demand for high-end machines. Based on the above analysis, I am further convinced that it would probably be dangerous for Paragon Tools to rush into this market without being fully prepared to deal with this competitive and unfamiliar environment. Core Competencies Analysis Now the last step in the Strategic Analysis Framework is to analyze the company as a whole and its core competencies. Based on the SWOT analysis, I have determined the companys major strength and weaknesses. Paragon Tools major strength lies in its solid business operation within manufacturing field. Paragon Tools appears to be a company in its matured stage. Its main operations and profit drivers come from the sale of its manufacturing products. This market has low level of growth and is comprise of a relatively stable customer base. The company was built around a line of high-end machines used by manufacturers of aerospace engines. (CK Page 13) This indicates that the company possesses the advantage of servicing high-end customers over its peers. Among all these, the company CEO are able to initiate aggressive expansion and spur revenue growth to fight against the impending foreign competition. The company also has very high employee morale. People who once had been merely content to work at Paragon now couldnt wait to tackle the next challenge. (CK Page 12). However the company also faces numerous challenges. Due to the rapid expansion and several aggressive acquisitions, the company has encountered real pressure on its margins. Earning continues to drop year by year, which starts to cause concern from the analysts. Customers themselves have suffered decline in profit, which could indicate that this industry is quickly approaching decline and any further

3

SGMT 6050 Case Assignment I: PARAGON TOOLS CASE Song Li

growth of the company could be impeded by this declining trend in the manufacturing industry. The fact that several of its major competitors have already began to make moves into the manufacturing services software industry indicates that Paragon was indeed need some efficient growth strategy. Software services industry is a fast growing industry. Its technology has shown significant potential but has not yet been fully implemented. Although the companys service division currently accounts for less than 10% of the companys total revenue, it could potentially be a great revenue stream if the company develops a standard means for machine tool services and maintenances for a variety of industrial machines. Gap Analysis Based on all the above analysis, I have identified the gaps between the companys stakeholders aspirations, the opportunities I have recognized in this environment and the companys own capabilities. Company need to seek additional growth opportunities in the service industry. There is an obvious gap between its current capacity and its growth needs. Given the external environment and constraints, the question become: can the acquisition of MonioRobitics fits into this gap perfectly? Lets do some further analysis in terms of the pros and cons of this acquisition in order to decide whether MonitoRobotics can add value to Paragon Tools business if the managers eventually make the decision to acquire. There are some obvious benefits that the acquisition of MonitoRobotics can bring to the table. The cutting edge technology of MonitoRobotics will give Paragon Tools a definite advantage of taking the pre-emptive opportunities and setting standard norm in machine tools servicing industry. It could also provide the Paragon Tools an entering point into software service business which has fastgrowing potential. However, everything comes with a cost. The value should be always weighted against the risk. The major risk would come from the financial perspective. As the case has mentioned, Besides the costs associated with the acquisition itself, wed be looking at some significant expenses in the near term, including accelerated software research, hiring and training, and even brand development. (CK page 13) These are the cost that the company has to bear on top of the costs that already incurred due to other expansion initiatives that the Paragon Tools undertook recently. The possibility of recoup the cost in the near term is uncertain. Another major concern is whether MonitoRobotics technology could be successfully integrated into manufacturing system of Paragon Tools machines. According to the case, the engineers of Paragon Tools still could not confirm an exact time line as to when will they be able to successfully modify MonitoRobotics technology for use on complex assembly lines at Paragon Tools. This uncertainty could develop into a major crisis given the company current financial situation. Last but not least, the motivation of Paragon Tools CEO to acquire MonitoRobotics is questionable. It is solely based on the reaction of its competitors move. The fear that the company may miss out on the action could lead to a reckless decision.

SGMT 6050 Case Assignment I: PARAGON TOOLS CASE Song Li

Conclusions

Based on above analysis and reasoning, my recommendation to the company is to not pursue the acquisition of MonitoRobotics. Instead, developing the companys own service division internally would be a less risky and more appropriate solution. It could be the first step towards filling the gap while allowing Paragon to test the water and prepare a solid foundation for future growth. I would like to reiterate my major reasons for not acquiring MonitoRobotics: first of all, whether MonitoRobotics is a good fit to Paragon Tools is uncertain. Secondly, it is foolish to pay a premium price and rush into an unfamiliar and highly competitive market simply because the competitor is doing so. Last but not least, Paragon Tools financial situation should be a major constraint. Based on the above consideration, I would conclude that the potential risk that this acquisition could bring to Paragon Tools clearly out-weights its added value. If Paragon makes a rush decision to acquire MonitoRobotics, it may run into the risk of continuous decline in earnings and possible financial difficulties that would take years to recover, or in the worst case, a financial crisis from which the company can never recover.

Appendix

I. The Strategic Analysis Framework:

II.

Business Life Cycle

SGMT 6050 Case Assignment I: PARAGON TOOLS CASE Song Li

Manufacturin g Industry

Software Service Industry

III.

Industry Structure for Software Servicing Industry Five Forces

Threat of New Entry

Supplier Power Competitive Rivalry Buyer Power

Threat of Substitution

Threat of New Entrant is high: Time and cost of entry is low 6

Competitive Rivalry is high: - Large number of competitors

SGMT 6050 Case Assignment I: PARAGON TOOLS CASE Song Li

Specialist Knowledge is needed Barriers to entry is low Cost advantages on Economies of scale relatively low

- Switching cost is low - Customer loyalty is low - Quality difference is

Supplier Power is low: Number is supplier is large limited Size of supplier is low competitors low Uniqueness of service is low Ability to substitute is high

Buying Power is high: - Number of customers is - Differences between - Price sensitivity is high - Ability to substitute is high - Cost of changing is low

Threat of Substitution is high: Cost of change is low

I.

SWOT Analysis for Paragon Tools Strength: Management capability Employee morale is high Manufacturing business has good margin Healthy operation Stable customer Weakness: Rapid expansion caused earning to drop Management Dissension on acquisition Service division is struggling for profit Engineers are unsure about the time line of possible integration of new technology into their existing assembly line. Threats: Customers were struggling with profitability. Major competitor is preparing for hostile takeover. Manufacturing industry is in the mature to decline stage Continue to face cyclical economic swings

Opportunities: Software service industry is an emerging and fast growing industry. Has potential to transform from manufacturing into high tech company Has possibility to provide valuable service to customers and cross selling opportunities 7

SGMT 6050 Case Assignment I: PARAGON TOOLS CASE Song Li

May develop a software technology that becomes standard means for machine tools

References

1. http://www.valueline.com/Stocks/Industry_Report.aspx?id=10650 2. SGMT 6050 Mergers & Acquisitions Course Kit

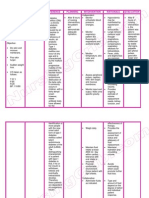

SGMT 6050 Winter 2012 Prof. Larry Ginsberg Assignment Grading Scheme Paragon Tools

Note that the order in which these criteria appear in the paper is not critical.

Quality & Depth of Analysis Critical Issues Case for Change Fit of Acquisition in Core Business Analysis of Pros & Cons of Acquisition

Comment A well argued and logical analysis. I would question the use of generic software industry data to analyze this particular branch of software, however. Robotic monitoring has been in existence since the 1980s but exploded during the 1990s. If anything the issue is more that Paragon is late into the industry and that is a concern. The list of stakeholders and their interest is better placed in an appendix and analyzed briefly in the test of the answer. The analysis of the customer base for the machine tool industry is crucial. The fact that the industry is cyclical reflect the cyclical nature of the aerospace and automotive industries, especially in the United States. The question is no so much

Grade

SGMT 6050 Case Assignment I: PARAGON TOOLS CASE Song Li whether this acquisition makes sense but how to grow or if, given the mature nature of the industry, the firm needs a diversification strategy. If it does, is it product or geographical diversification. Alternatives & Recommendation Insightful & relevant Tied to critical issues & analysis Specific (not abstract) There are no alternatives presented other than those that are obvious from the case. See above. If the machine tools industry is to survive, what do you recommend as alternatives to the purchase of MonitoRobotics?

37/50%

14/20% Communications A. Case Write Up CEO (Professional) Approach/Style Introduction & Conclusion Meaningful subheadings Easy to Understand Sources Referenced Grammar/Spelling/L ength B. Appendices Meaningful headings/key message on charts Axes clearly labeled Clearly referenced in text of essay 23/30% 74/100 % There are too many errors in grammar and capitalization for me to correct them all but they are serious enough to make the document hard to read and understand in places. The introduction is good aside from the points I note. The conclusion is inverted. The alternatives should be analyzed and followed by a recommendation with implementation steps. If you removed the stakeholder analysis from the text you would have room for a more complete recommendation. You could make more use of readings and the text to support your arguments. You make a good attempt at using appendices and they are useful (except for the points above).

SGMT 6050 Case Assignment I: PARAGON TOOLS CASE Song Li

10

Você também pode gostar

- Strategic Business Unit A Complete Guide - 2020 EditionNo EverandStrategic Business Unit A Complete Guide - 2020 EditionAinda não há avaliações

- Operational Readiness Review A Complete Guide - 2020 EditionNo EverandOperational Readiness Review A Complete Guide - 2020 EditionAinda não há avaliações

- Machine Learning For Revenue Management A Complete Guide - 2020 EditionNo EverandMachine Learning For Revenue Management A Complete Guide - 2020 EditionAinda não há avaliações

- Growth Strategy Process Flow A Complete Guide - 2020 EditionNo EverandGrowth Strategy Process Flow A Complete Guide - 2020 EditionAinda não há avaliações

- Business Improvement Districts: An Introduction to 3 P CitizenshipNo EverandBusiness Improvement Districts: An Introduction to 3 P CitizenshipAinda não há avaliações

- Transformation Change A Complete Guide - 2019 EditionNo EverandTransformation Change A Complete Guide - 2019 EditionAinda não há avaliações

- Relationships First: The New Relationship Paradigm in ContractingNo EverandRelationships First: The New Relationship Paradigm in ContractingAinda não há avaliações

- Reputation Management A Complete Guide - 2020 EditionNo EverandReputation Management A Complete Guide - 2020 EditionAinda não há avaliações

- Business Process Engineering A Complete Guide - 2020 EditionNo EverandBusiness Process Engineering A Complete Guide - 2020 EditionAinda não há avaliações

- Product Line Management A Complete Guide - 2019 EditionNo EverandProduct Line Management A Complete Guide - 2019 EditionAinda não há avaliações

- CRM in Virtual Business PDFDocumento5 páginasCRM in Virtual Business PDFIndika SampathAinda não há avaliações

- Make Your Organization a Center of Innovation: Tools and Concepts to Solve Problems and Generate IdeasNo EverandMake Your Organization a Center of Innovation: Tools and Concepts to Solve Problems and Generate IdeasAinda não há avaliações

- Competing For The Future - Hamel&prahaladDocumento15 páginasCompeting For The Future - Hamel&prahaladgendut_novriAinda não há avaliações

- Sourcing Strategy and Outsourcing and SRMDocumento66 páginasSourcing Strategy and Outsourcing and SRMApratim AryaAinda não há avaliações

- Entrepreneurship, Operations Manemant, Markeation Park, Derby Uni Grade 1st HNDDocumento23 páginasEntrepreneurship, Operations Manemant, Markeation Park, Derby Uni Grade 1st HND100134260100% (1)

- STR MGT Thompson Chp11 Managing Internal OperationsDocumento28 páginasSTR MGT Thompson Chp11 Managing Internal OperationsMîss Rajawiyà HajarAinda não há avaliações

- CDEV1830 Career Success Assignment 4 - Mock InterviewDocumento7 páginasCDEV1830 Career Success Assignment 4 - Mock InterviewArchanaAinda não há avaliações

- The Global Manufacturing Revolution: Product-Process-Business Integration and Reconfigurable SystemsNo EverandThe Global Manufacturing Revolution: Product-Process-Business Integration and Reconfigurable SystemsAinda não há avaliações

- 568Documento10 páginas568d1740246Ainda não há avaliações

- Post-merger integration A Complete Guide - 2019 EditionNo EverandPost-merger integration A Complete Guide - 2019 EditionAinda não há avaliações

- Service Oriented Business A Complete Guide - 2021 EditionNo EverandService Oriented Business A Complete Guide - 2021 EditionAinda não há avaliações

- Marketing Strategies Complete Self-Assessment GuideNo EverandMarketing Strategies Complete Self-Assessment GuideAinda não há avaliações

- The Executive Guide to Innovation: Turning Good Ideas Into Great ResultsNo EverandThe Executive Guide to Innovation: Turning Good Ideas Into Great ResultsAinda não há avaliações

- AssignmentDocumento11 páginasAssignmentHarshita JaiswalAinda não há avaliações

- Libro - Building A Project-Driven Enterprise - How To Slash Waste and Boost Profits Through Lean Project Management (2002) PDFDocumento384 páginasLibro - Building A Project-Driven Enterprise - How To Slash Waste and Boost Profits Through Lean Project Management (2002) PDFtlatuani1000Ainda não há avaliações

- Program Management Office A Complete Guide - 2020 EditionNo EverandProgram Management Office A Complete Guide - 2020 EditionAinda não há avaliações

- Talent Acquisition And Management A Complete Guide - 2020 EditionNo EverandTalent Acquisition And Management A Complete Guide - 2020 EditionAinda não há avaliações

- Public Service Motivation A Complete Guide - 2021 EditionNo EverandPublic Service Motivation A Complete Guide - 2021 EditionAinda não há avaliações

- Straight-Through Processing A Clear and Concise ReferenceNo EverandStraight-Through Processing A Clear and Concise ReferenceAinda não há avaliações

- Ford CaseDocumento9 páginasFord CaseAmal KrishnaAinda não há avaliações

- CIO Persona External Research and Gaps - May82013Documento31 páginasCIO Persona External Research and Gaps - May82013nehemiasjahcobAinda não há avaliações

- Is It Advantageous For A Company To Be Part of RPG Enterprise? Why and How? What Are The Concerns Being Addressed or Not Addressed?Documento2 páginasIs It Advantageous For A Company To Be Part of RPG Enterprise? Why and How? What Are The Concerns Being Addressed or Not Addressed?karthikawarrier100% (1)

- Building Business Acumen for Trainers: Skills to Empower the Learning FunctionNo EverandBuilding Business Acumen for Trainers: Skills to Empower the Learning FunctionAinda não há avaliações

- Change Management Skills A Complete Guide - 2020 EditionNo EverandChange Management Skills A Complete Guide - 2020 EditionAinda não há avaliações

- Deloitte - Sample Cases 20141210 - v2Documento13 páginasDeloitte - Sample Cases 20141210 - v2Aman BafnaAinda não há avaliações

- Unit 3 - HRM 2nd Semester 2018Documento130 páginasUnit 3 - HRM 2nd Semester 2018Halla Hussam BeaqeenAinda não há avaliações

- Alliance and Relationship Management Complete Self-Assessment GuideNo EverandAlliance and Relationship Management Complete Self-Assessment GuideAinda não há avaliações

- Automated Configuration and Provisioning A Clear and Concise ReferenceNo EverandAutomated Configuration and Provisioning A Clear and Concise ReferenceNota: 5 de 5 estrelas5/5 (1)

- Comprehensive Exam Answer - 13.12.2013Documento8 páginasComprehensive Exam Answer - 13.12.2013Yousab KaldasAinda não há avaliações

- Technology Roadmaps The Ultimate Step-By-Step GuideNo EverandTechnology Roadmaps The Ultimate Step-By-Step GuideAinda não há avaliações

- Lecture 1-7 Pom Paf-Kiet 2021Documento25 páginasLecture 1-7 Pom Paf-Kiet 2021Ahsan IqbalAinda não há avaliações

- International Strategic Management A Complete Guide - 2020 EditionNo EverandInternational Strategic Management A Complete Guide - 2020 EditionAinda não há avaliações

- A Review of Automatic License Plate Recognition System in Mobile-Based PlatformDocumento6 páginasA Review of Automatic License Plate Recognition System in Mobile-Based PlatformadiaAinda não há avaliações

- Eps 400 New Notes Dec 15-1Documento47 páginasEps 400 New Notes Dec 15-1BRIAN MWANGIAinda não há avaliações

- AQAR-Report 2018-19 Tilak VidyapeethDocumento120 páginasAQAR-Report 2018-19 Tilak VidyapeethAcross BordersAinda não há avaliações

- Forklift Driver Card and Certificate TemplateDocumento25 páginasForklift Driver Card and Certificate Templatempac99964% (14)

- Umihara Et Al-2017-Chemistry - A European JournalDocumento3 páginasUmihara Et Al-2017-Chemistry - A European JournalNathalia MojicaAinda não há avaliações

- Empowerment TechnologyDocumento2 páginasEmpowerment TechnologyRegina Mambaje Alferez100% (1)

- Warranties Liabilities Patents Bids and InsuranceDocumento39 páginasWarranties Liabilities Patents Bids and InsuranceIVAN JOHN BITONAinda não há avaliações

- User Manual ManoScanDocumento58 páginasUser Manual ManoScanNurul FathiaAinda não há avaliações

- Memo For Completed RubricDocumento3 páginasMemo For Completed Rubricnisev2003Ainda não há avaliações

- Concordance C Index - 2 PDFDocumento8 páginasConcordance C Index - 2 PDFnuriyesanAinda não há avaliações

- Inner DriveDocumento51 páginasInner DriveShaurya VajhulaAinda não há avaliações

- A3 Report Template Checklist - SafetyCultureDocumento4 páginasA3 Report Template Checklist - SafetyCulturewarriorninAinda não há avaliações

- PWC - Digital Pocket Tax Book 2023 - SlovakiaDocumento52 páginasPWC - Digital Pocket Tax Book 2023 - SlovakiaRoman SlovinecAinda não há avaliações

- 33kV BS7835 LSZH 3core Armoured Power CableDocumento2 páginas33kV BS7835 LSZH 3core Armoured Power Cablelafarge lafargeAinda não há avaliações

- The Mutant Epoch Mature Adult Content Mutations v1Documento4 páginasThe Mutant Epoch Mature Adult Content Mutations v1Joshua GibsonAinda não há avaliações

- 67 9268Documento34 páginas67 9268Salvador ReyesAinda não há avaliações

- SIRMDocumento9 páginasSIRMshailendra369Ainda não há avaliações

- MikroekonomiDocumento1 páginaMikroekonomiYudhaPrakosoIIAinda não há avaliações

- Nursing Care Plan Diabetes Mellitus Type 1Documento2 páginasNursing Care Plan Diabetes Mellitus Type 1deric85% (46)

- Steve Talbott Getting Over The Code DelusionDocumento57 páginasSteve Talbott Getting Over The Code DelusionAlexandra DaleAinda não há avaliações

- Wec14 01 Rms 20230112Documento23 páginasWec14 01 Rms 20230112Shafay SheikhAinda não há avaliações

- Boomer L2 D - 9851 2586 01Documento4 páginasBoomer L2 D - 9851 2586 01Pablo Luis Pérez PostigoAinda não há avaliações

- Manual en TC1 TD4 Curr 2018-07-16Documento39 páginasManual en TC1 TD4 Curr 2018-07-16Daniel Peña100% (1)

- Implementasi Sistem Pengenalan Candi Kecil Di Yogyakarta Menggunakan BerbasisDocumento7 páginasImplementasi Sistem Pengenalan Candi Kecil Di Yogyakarta Menggunakan BerbasisRivan AuliaAinda não há avaliações

- DIFFERENCE BETWEEN Intrior Design and DecorationDocumento13 páginasDIFFERENCE BETWEEN Intrior Design and DecorationSadaf khanAinda não há avaliações

- Delay Codes1 3Documento10 páginasDelay Codes1 3AhmedAinda não há avaliações

- Tok EssayDocumento2 páginasTok EssayNeto UkpongAinda não há avaliações

- Python Versus Matlab: Examples in Civil EngineeringDocumento32 páginasPython Versus Matlab: Examples in Civil EngineeringNiranjanAryan100% (1)

- Diploma Thesis-P AdamecDocumento82 páginasDiploma Thesis-P AdamecKristine Guia CastilloAinda não há avaliações

- Development and Application of "Green," Environmentally Friendly Refractory Materials For The High-Temperature Technologies in Iron and Steel ProductionDocumento6 páginasDevelopment and Application of "Green," Environmentally Friendly Refractory Materials For The High-Temperature Technologies in Iron and Steel ProductionJJAinda não há avaliações