Escolar Documentos

Profissional Documentos

Cultura Documentos

EBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's History

Enviado por

Klabin_RIDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

EBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's History

Enviado por

Klabin_RIDireitos autorais:

Formatos disponíveis

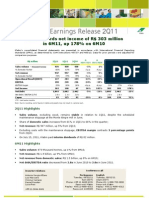

Earnings Release 4Q11

EBITDA of R$ 1,077 million in 2011 the best result in the Companys history

Klabin's consolidated financial statements are presented in accordance with International Financial Reporting Standards (IFRS), as determined by CVM Instructions 457/07 and 485/10. The information related to Vale do Corisco is not consolidated in the Financial Statements. It is only presented through the equity income method.

R$ million Sales volume - thousand tonnes

% Domestic Market

4Q11 432

66%

3Q11 434

71%

4Q10 417

68%

4Q11/3Q11 4Q11/4Q10

2011 1.739

66%

2010 1.716

68%

2011/2010

0%

-5 p.p.

4%

-2 p.p.

1%

-2 p.p.

Net Revenue

% Domestic Market

994

77%

991

81%

931

78%

0%

-4 p.p.

7%

-1 p.p.

3.889

78%

3.663

78%

6%

0 p.p.

Operational Result (EBIT) EBITDA Adjusted EBITDA

Adjusted EBITDA Margin

270 359 319

32%

147 277 269

27%

315 231 231

25%

84% 30% 19%

5 p.p.

-14% 55% 38%

7 p.p.

797 1.077 1.028

26%

821 962 962

26%

-3% 12% 7%

0 p.p.

Net Income (loss) Net Debt

Net Debt / EBITDA (LTM)

122 2.735

2.5 x

(243) 2.313

2.4 x

225 2.128

2.2 x

N/A 18% 503%

-46% 29% 320%

183 2.735

2.5 x

560 2.128

2.2 x

-67% 29% 129%

Capex*

578

96

138

883

386

LTM - last twelve months / N/A - not applicable *Includes R$ 428 million from the acquisition of Vale do Corisco in 4Q11.

Note: Due to rounding, some figures in tables and graphs may not result in a precise sum.

4Q11 Highlights

EBITDA of R$ 359 million. Excluding the non-recurring revenue from the property sale, adjusted EBITDA amounted to R$ 319 million, with margin of 32%; Net revenue of R$ 994 million, 7% higher than in 4Q10 and stable in relation to 3Q11; Unit cash cost, excluding non-recurring revenue, of R$ 1,561/t, down 3% from 3Q11, at the same level of September, giving continuity to the cost reduction program; Sale of property at the Del Castilho Unit (RJ), with positive effect of R$ 40 million in cash generation; Acquisition of 51% interest in Vale do Corisco, increasing planted forests in Paran state by 31 thousand hectares.

2011 Highlights

Adjusted EBITDA of R$ 1,028 million, excluding the non-recurring profit from the sale of assets in the year. Nonetheless, this was the best result in the Companys history; Net revenue of R$ 3.9 billion, up 6% from 2010; Net income of R$ 183 million, negatively impacted by the non-cash foreign exchange variation in the second half of the year.

Investor relations Antonio Sergio Alfano Vinicius Campos Daniel Rosolen Lucia Reis Mariana Arajo +55 11 3046-8401 Conference call Portuguese Friday, 03/02/12 8am (EDT) Phone: +55 11 4688-6331 Password: Klabin Replay: +55 11 46886312 Password: 3232509 English Friday, 03/02/12 9am (EDT) Phone US: 1-888-700-0802 Password: Klabin Replay: +55 11 46886312 Password: 0566818

4Q11 Results March 1, 2012

4Q11 Summary

Klabin, the largest manufacturer, exporter and recycler of paper in Brazil and the leader in the production of papers and coated boards for packaging, corrugated boxes and industrial bags, besides selling wood logs, closes the year 2011 with EBITDA of R$ 1,077 million and margin of 28%. EBITDA, which stands for earnings before interest, taxes, depreciation and amortization, was the highest registered by the Company in all of its 112 years of existence. EBITDA in 4Q11 was R$ 359 million, 30% higher than in the previous quarter. Klabins sales, excluding wood, totaled 432 thousand tonnes in 4Q11 and 1,739 thousand tonnes in 2011, 1% more than in 2010.

EBITDA and EBITDA margin

(R$ million)

700 600 500 400 300 200 100 -

36% 28% 359 277 231

35% 30%

25% 25%

20% 15% 10% 5% 0%

4Q11

3Q11

4Q10

The Companys net revenue in the fourth quarter, including wood sales, was R$ 994 million, 7% more than in the same period in 2010. Net revenue in 2011 totaled R$ 3.9 billion, a 6% growth over the previous year, reflecting the Companys strategy of positioning its products with focus on higher margins. Net revenue from the domestic market was R$ 3,017 million, 6% more than in 2010, and accounted for 78% of the years total net revenue - the same share as in 2010. In line with the efforts concentrated on the operational and financial performance, unit cash cost in 4Q11 was 3% lower than in 3Q11 and 5% lower than in 2Q11 (excluding the maintenance stoppage costs in that quarter), evidencing the results of the cost reduction program, driven by the optimization of processes and increased efficiency in production.

Sales volume

(excluding wood)

Net revenue

(R$ million)

994 991 188

(thousand tonnes)

432 EM 146 434 126 417 133 761

931 201

EM

233

DM

287

308

283

DM

803

730

4Q11

3Q11

4Q10

4Q11

3Q11

4Q10

Klabin posted net income of R$ 122 million in 4Q11. Net income in 2011 stood at R$ 183 million. The Companys investments in 2011 totaled R$ 883 million, including R$ 428 million disburse on the Vale do Corisco acquisition. The acquisition of 51% interest in Vale do Corisco in November, in the state of Paran, added 31 thousand hectares to Klabins planted areas, closing 2011 with 243 thousand hectares were planted forests of which 110 thousand hectares available for new industrial projects. The focus of the investments in 2011 was on reducing variable costs. The biomass boiler at the Otaclio Costa mill in Santa Catarina went operational in March and the debottlenecking of the evaporation plant in the mill was concluded in the fourth quarter. At the Monte Alegre mill in Paran, a high voltage (230 kV) power transmission line was installed to bring energy at a lower cost. At the conversion units, two corrugators were acquired. The first, with production capacity of 72 thousand tonnes, went operational in September at the Goiana (PE) mill. The second corrugator, which has production capacity of 100 thousand tonnes, is being installed at the Jundia-DI (SP) mill and is scheduled to go operational in June this year.

4Q11 Results March 1, 2012

Markets and Exchange Rate

The year 2011 was marked by the uncertainty in the global economy, the European crisis, the decline in the growth rates of emerging economies and, consequently, of the worlds GDP. Brazils economic scenario also reflected the instabilities in the global market, and the demand for paper for packaging did not increase as expected at the end of 2010. The countrys GDP grew approximately 3% from the previous year, impacted by the stable industrial production and the 7% growth in the domestic consumer goods market, according to the retail sales index calculated by the Brazilian Institute of Geography and Statistics (IBGE). The foreign exchange rate, which closed at R$ 1.67/US$ on December 31, 2010, appreciated 13% in the year to reach R$ 1.88/US$ at the end of December 2011. However, the average exchange rate stood at R$ 1.67/US$ in 2011, down 5% from 2010.

4Q11 Average Rate End Rate

Source: Bacen

3Q11 1.64 1.85

4Q10 1.70 1.67

4Q11/3Q11

4Q11/4Q10

2011 1.67 1.88

2010 1.76 1.67

2011/2010

1.80 1.88

10% 1%

6% 13%

-5% 13%

In this scenario, Klabin concentrated its efforts in its operational and financial performance and, consequently, in increasing margins and return on assets. International kraftliner prices contracted during the year. According to data published by FOEX, average kraftliner list price in Europe was 604/t in December 2010, versus 535/t in December 2011. The slowdown in the Brazilian economy in 2011 also affected the coated board market. Domestic demand was negatively impacted by the lower average exchange rate, which favored imports of packaged goods, and by the high inventory levels at the end of 2010. According to the Brazilian Pulp and Paper Producers Association (Bracelpa), domestic coated board sales (excluding liquid packaging boards) fell 10% from 2010. However, the diversification of Klabin's coated board line offset the weaker demand, with domestic coated board sales increasing 2% over the previous year. Exports declined 4%. The focus on increasing margins also increased revenues at the Conversion Units. The weaker economic growth also impacted the corrugated boxes market in 2011. According to the Brazilian Corrugated Boxes Association (ABPO), the countrys corrugated box shipments grew 2% in 2011. In line with the Companys strategy of prioritizing margins, Klabins sales volume fell 2% in the period while net revenue increased 6%. The construction industry pushed up domestic cement sales in the year. According to preliminary data from the National Cement Industry Union (SNIC), cement consumption increased 7% from the previous year. The Company renegotiated contracts with clients, which affected sales volume in the second and third quarters. In the fourth quarter, however, sales once again recovered to the Units installed capacity and margins picked up. In 2011 Klabin's domestic sales volume fell by 4% from 2010, while net revenue from industrial sacks grew 3%. Despite the slowdown in economic growth, the Company strategically positioned its products to boost revenue from sales in the markets where it operates. As a result, sales volume (excluding wood) grew 1% and total net revenue grew 6% in the year, despite a scenario of falling international prices and the 5% lower real, on average, than the dollar compared to 2010. In 2011, Klabins sales, excluding wood, came to 1,739 thousand tonnes, bringing net revenue to R$ 3,889 million, including wood. Cash generation (EBITDA) amounted to R$ 1,077 million, the highest annual result in the Companys history.

4Q11 Results March 1, 2012

Operating and Financial Performance

Sales volume

Sales volume in 4Q11, excluding wood, totaled 432 thousand tonnes. In 2011, sales volume came to 1,739 thousand tonnes, up 1% from 2010, due to the increased kraftliner exports. Domestic sales amounted to 287 thousand tonnes, down 7% from 3Q11, due to collective vacation and the holiday season, which affect demand for packaging. Sales volume in Brazil totaled 1,151 thousand tonnes in 2011, stable in relation to 2010, with coated board sales growing 2%, which was offset by the slight reduction in the sale of converted products. Exports in 4Q11 totaled 146 thousand tonnes, up 15% from the previous quarter. In 2011, exports came to 587 thousand tonnes, 6% higher than in 2010. The growth in annual sales volume is due to the increased production at the Monte Alegre unit, thanks to its operational stability.

Sales volume (excluding wood) (thousand tonnes) 1,739

34%

Sales volume by product 2011

Ind. Bags 8% Kraftliner 24% Others 2%

1,716

32%

Coated Boards 37%

432

34% 66%

434

29% 71%

417

32% 68%

66%

68%

4Q11

3Q11

4Q10

2011

2010 Total

does not include wood

Corrugat . Boxes 29%

Domestic Market

Export Market

Net Revenue

Net revenue, including wood, came to R$ 994 million in 4Q11, up 7% from 4Q10. In 2011, net revenue amounted to R$ 3,889 million, up 6% from 2010, reflecting the Companys strategy to pursue higher margins.

Net revenue (R$ milliion) 3,889

22%

Net Revenue by Product 2011 3,663

22% Ind bags 12% Wood Others 1% 7% Coated Boards 34%

78%

78% Kraftliner 14%

994

23% 77%

991

19% 81%

931

22% 78%

4Q11

3Q11

4Q10

2011 Export Market

2010

inc ludes wood

Corrugat. Boxes 32%

Domestic Market Total

4Q11 Results March 1, 2012

Net revenue from domestic sales stood at R$ 761 million in 4Q11, 4% higher than in 4Q10, and R$ 3,017 million in 2011, up 6% from 2010. The domestic market accounted for 78% of total net revenue in the year, remaining stable in relation to 2010. Exports totaled R$ 233 million (US$ 129 million) in 4Q11, up 16% from 4Q10, also reflecting the appreciation of the US dollar in the period. Net revenue from exports was R$ 872 million (US$ 521 million), up 7% from 2010, even with a 5% lower real, on average, than the dollar.

Exports

In 4Q11, Brazilian demand was affected by seasonal factors such as collective vacation and the yearend holiday season, and so the Company directed a bigger volume to exports than in the previous quarter. As a result, the share of exports increased from 29% in 3Q11 to 34% this quarter. The 10% appreciation of the exchange rate in the quarter increased the prices in real and compensated for the change in the Companys sales mix. As a result, export revenues increased 24% in relation to 3Q11. In relation to 4Q10, export revenues increased 16% as the dollar was 6% stronger, on average, than the real between the periods. Latin America remains Klabin's main export market, accounting for 44% of the Company's sales volume and 45% of net export revenue in the year, besides being the major buyer of kraftliner.

Sales Volume - 4Q11 Net Revenue - 4Q11

North America frica 3% 8% Europe 13% Amrica Latina 49%

North frica America 3% 6% Europe 12%

Amrica Latina 50% sia 29%

sia 27%

Sales Volume - 2011 North America frica 4% 7% Amrica Latina 44% Europe 18%

Net Revenue - 2011 North America frica 4% 6%

Europe 19%

Amrica Latina 45%

sia 26%

sia 27%

4Q11 Results March 1, 2012

Operational Costs and Expenses

Unit cash cost, including fixed and variable costs and operating expenses, and excluding non-recurring revenue from the sale of assets and the effects of the maintenance stoppages in the quarters, stood at R$ 1,561/t in 4Q11, down 3% from 3Q11 and 5% from 2Q11. This result was already expected, given the sustainable reduction in unit cash cost as of September. Cost of goods sold (COGS) in 4Q11 was R$ 614 million, down 16% from 3Q11. In addition to the lower unit cash cost, COGS was impacted by the lower depletion of biological assets, which was booked in the quarter. COGS in 2011 came to R$ 2,827 million, up 3% on 2010. Unit COGS was R$ 1,626/t, 2% higher than in 2010, lower than the inflation rate of 6.5% in the period. The increase in labor costs and maintenance stoppages was partially offset by the cost reduction programs and lower consumption of fuel oil. Selling expenses totaled R$ 82 million in 4Q11, up 7% and 6% from 3Q11 and 4Q10, respectively, mainly due to the higher freight costs. In 4Q11, freight costs amounted to R$ 50 million, R$ 3 million higher than in 3Q11. Selling expenses in 2011 amounted to R$ 321 million, a 7% increase over 2010, mainly reflecting the higher freight costs and fixed selling expenses. General and administrative expenses totaled R$ 73 million in the quarter, up 14% from 3Q11, due to the wage increase in October and the additional provision for profit-sharing booked in the quarter in view of the better-than-expected result in 2011. General and administrative expenses in 2011 amounted to R$ 249 million, up 16% from 2010, due to the higher labor costs, contracting of third-party services to reorganize the Companys processes, and indemnity payments. Other operating revenue/expenses were a revenue of R$ 47 million in 4Q11, mainly due to the sale of the property at the Del Castilho Unit (RJ). The corrugated boxes unit will be shut down in the second half of 2012 and its operations will be transferred to Jundia where a new corrugator is being installed. In 2011, other operating revenue/expenses were a revenue of R$ 35 million. Apart from the Del Castilho property sale, another positive factor was the sale of land in Mato Grosso do Sul in September.

Effect of variations in the fair value of biological assets

The non-cash effect of the variation in the fair value of biological assets was a negative R$ 2 million in 4Q11, due to the higher wood prices. In the year, this effect was a gain of R$ 271 million, lower than in 2010, due to the lower volume of forests booked at fair value. The effect of the depletion of the fair value of biological assets on COGS was R$ 15 million in the quarter due to an adjustment of approximately R$ 45 million in the calculation of depletion booked in 4Q11. In 2011, the effect from depletion totaled R$ 272 million, down 12% from 2010, also due to the revision of the procedure to calculate depletion. As a result, the effect from the variation in the fair value of biological assets on operating income (EBIT) was a loss of R$ 17 million in 4Q11 and of R$ 3 million in 2011. In 2010, this effect was a gain of R$ 141 million.

Operating Income

Operating income before financial result (EBIT) was R$ 270 million in 4Q11. In 2011, EBIT was R$ 797 million.

4Q11 Results March 1, 2012

Operating cash flow (EBITDA)

EBITDA Composition R$ million Operational result (after financial result) (+) Financial result (+) Depreciation, amortization, depletion (-) Biological assets adjustment (+) Vale do Corisco EBITDA (-) Sale of assets Adjusted EBITDA Adjusted EBITDA Margin

N / A - Not applicable

4Q11 206 64 85 2 2 359 (40) 319 32%

3Q11 (378) 524 150 (19) 277 (8) 269 27%

4Q10 339 (24) 64 (148) 231 231 25%

4Q11/3Q11 4Q11/4Q10

2011 296 501 548 (271) 2 1,077 (48) 1,028 26%

2010 850 (28) 589 (449) 962 962 26%

2011/2010

N/A -88% -43% N/A N/A 30% N/A 19% 5 p.p.

-39% N/A 34% N/A N/A 55% N/A 38% 7 p.p.

-65% N/A -7% -40% N/A 12% N/A 7% 0 p.p.

Operating cash flow (EBITDA) was R$ 359 million in the quarter, positively impacted by the R$ 40 million gain from the sale of assets at Del Castilho. Excluding this non-recurring effect, adjusted EBITDA in 4Q11 came to R$ 319 million, with an EBITDA margin of 32%. With the acquisition of interest in Florestal Vale do Corisco Ltda., on November 17, 2011, Klabin started booking EBITDA from the sale of wood by this company, which totaled R$ 2.2 million in 4Q11. The table below clearly shows that the Companys performance improved significantly in 3Q11, thanks to the efforts to reduce costs and the more aggressive commercial approach taken since the beginning of the year. This improvement was further evident in 4Q11, with adjusted EBITDA up 38% over 4Q10, when the overall scenario was more favorable, and 19% over 3Q11, though it was seasonally a stronger quarter.

R$ million Net Revenue EBITDA Adjusted EBITDA* Adjusted EBITDA Margin

*Excluding gain from the sale of assets

1Q09

722 180 180 25%

2Q09

683 150 150 22%

3Q09

750 199 199 27%

4Q09

805 219 219 27%

1Q10

844 242 242 29%

2Q10

905 236 236 26%

3Q10

983 252 252 26%

4Q10

931 231 231 25%

1Q11

957 249 249 26%

2Q11

947 190 190 20%

3Q11

991 277 269 27%

4Q11

994 359 319 32%

In 2011, EBITDA was R$ 1,077 million, the best result in the Companys history, up 12% from 2010. EBITDA margin was 28%, as against 26% in 2010. Apart from the factors mentioned above, EBITDA in 2011 had a positive impact of R$ 8 million from the sale of land in Mato Grosso do Sul in 3Q11. Excluding these effects, adjusted EBITDA in the year was R$ 1,028 million, which is still the best result in the Companys history. The growth in EBITDA reflected the pursuit of higher margins on product sales and the cost reduction program.

Indebtedness and financial investments

Gross debt stood at R$ 5,297 million on December 31, 2011, compared with R$ 4,857 million on December 31, 2010, of which R$ 3,629 million (US$ 1,935 million), or 69%, was denominated in foreign currency, mostly export pre-payment facilities. On December 31, cash and financial investments amounted to R$ 2,562 million, down 6% from 2010, due to the acquisition of Florestal Vale do Corisco in November. This amount exceeds the amortizations of loans coming due in the next 34 months. Consolidated net debt amounted to R$ 2,735 million, versus R$ 2,128 million on December 31, 2010, impacted by the dollars appreciation on foreign currency debt and the disbursement of R$ 428 million for the Vale do Corisco acquisition. The net debt/EBITDA ratio increased from 2.2x at the end of 2010 to 2.5x at the end of 2011. In December 2011, the net foreign exchange exposure was US$ 1,774 million, of which US$ 1,935 million corresponded to export pre-payment facilities with average term of over 4 years and assets in foreign currency of US$ 161 million. The effect of foreign exchange variation on 2011 results is solely accounting in nature and does not signify any actual loss.

4Q11 Results March 1, 2012

Net Debt / EBITDA (R$ million)

5,500 4,500 3,500

3.6

3.1

2.8

2,462

2.2

2,106

2.2

2,128

2.1

2,002

2.0

1,893

2.4

2,313

2.5

2,735

Dec-11

2,676

1,500 500 (500)

Dec-09

Mar-10

2,528

2,500

Jun-10

Sep-10

Dec-10

Mar-11

Jun-11

Sep-11

6.0 5.5 5.0 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 -0.5 -1.0 -1.5 -2.0

Net Debt (R$ million)

Net Debt / EBITDA (LTM)

The average debt term stood at 43 months, or 31 months for debt denominated in local currency and 49 months for debt denominated in foreign currency. At the end of December, short-term debt accounted for 17% of total debt, the same as in December 2010. Average cost of debt stood at 8.9% p.a. in local currency and 4.0% p.a. in foreign currency.

Debt (R$ million) Short term

Local currency Foreign currency

12/31/11 910

373 537

12/31/10 842

496 346

17% 7% 10% 83% 24% 58% 100% 31% 69%

17% 10% 7% 83% 31% 52% 100% 41% 59%

Long term

Local currency Foreign currency

4,387

1,295 3,092

4,015

1,506 2,509

Gross debt

Local currency total Foreign currency total

5,297

1,668 3,629

4,857

2,002 2,855

(-) Cash Net debt Net debt / EBITDA

2,562 2,735 2.5 x

2,729 2,128 2.2 x

Financial Result

Financial expenses totaled R$ 96 million in 4Q11, up 12% from 4Q10, and R$ 435 million in 2011. Excluding the adjustment of financial expenses due to the Federal Tax Debt Restructuring Program (REFIS), financial expenses were 13% higher than in 2010. Financial revenues amounted to R$ 74 million in the quarter, up 11% from the same period last year, and came to R$ 316 million in 2011, up 35% year-on-year, due to the higher average SELIC rate compared with 2010 and the increase in financial investments during most part of the year. The net foreign exchange variations generated an effect of R$ 42 million in 4Q11. In the year, these variations amounted to R$ 382 million, reflecting the impact of the dollars appreciation on the Companys balance sheet. This is an exclusively accounting effect, with no cash disbursement. As a result, the financial result in 4Q11 was a loss of R$ 64 million. In the year, the financial result was a loss of R$ 501 million, mainly impacted by the dollars strong appreciation against the real in

4Q11 Results March 1, 2012

3Q11. Excluding the effect of net foreign exchange variations, the financial result in 2011 was a loss of R$ 118 million, of which R$ 96 million refer to the REFIS adjustment.

Net Income

Net income amounted to R$ 122 million in 4Q11, versus a loss of R$ 243 million in 3Q11, and R$ 183 million in 2011.

Business Performance

Consolidated information by operational segment in 2011.

R$ million Net revenue

Domestic market Exports 282 1,110 781 1,625 91 3,017 872

Forestry

Papers

Conversion

Consolidation adjustments

Total

Third part revenue

Segments revenue

282

478

1,891

869

1,716

14

(1,361)

3,889

-

Total net revenue

Change in fair value - biological assets Cost of goods sold

760

271 (778)

2,760

(2,027)

1,730

(1,386)

(1,361)

1,363

3,889

271 (2,828)

Gross income

Operating expenses

253

(59)

733

(298)

344

(191)

2

13

1,332

(535)

Operating results before financial results

194

435

153

15

797

Note: The figures in the table for total net sales include sales of other products.

BUSINESS UNIT FORESTRY

In 2011, the Brazilian wood market contracted due to the impacts of the global economic scenario. In addition, Klabins harvest in the state of Santa Catarina was affected by weather conditions. Wood sales to third parties decreased 4% in relation to 3Q11, totaling 663 thousand tonnes, impacted by the weakened market and it being the year end, when there is a decline in clients business activity on account of collective vacation. Wood sales in 2011 totaled 2,753 thousand tonnes, 12% lower than in 2010. The Company directed its investments to optimize its processes and to boost its efficiency and productivity throughout 2011 in order to prepare itself for a program in 2012 to reduce forestry costs. Net revenue from log sales to third parties in 4Q11 was R$ 64 million, down 8% from 3Q11, and R$ 265 million in 2011, up 2% from 2010, thanks to a better sales mix and the higher prices during the year.

Sales volume (thousand tonnes) Net revenue (R$ million) 265 3,113 2,753 260

663 4Q11

688 3Q11

761

64

69

66

4Q10

2011

2010

4Q11

3Q11

4Q10

2011

2010

4Q11 Results March 1, 2012

In December 2011, the Company had 506 thousand hectares of land, of which 243 thousand hectares were planted forests (31 thousand hectares more than in 2010 due to the acquisition of Vale do Corisco) and 212 thousand hectares of preserved native forests. In 2011, a total of 24 thousand hectares were planted, 15 thousand hectares in the Companys own land and 9 thousand hectares in third-party land (development program). The Forestry Development Program has 60 thousand hectares in regions close to the forestry units in Paran, Santa Catarina and So Paulo, benefitting 5 thousand rural producers. Eucalyptus forest yields, measured in tonnes of pulp produced per hectare of planted forest, have been increasing every year as a result of the investments in research and development. The estimated yield from the areas planted in 2011 is 36% higher than from the areas planted five years ago.

BUSINESS UNIT PAPER

Despite the less favorable scenario, Klabins packaging paper business delivered solid performance in 2011. Paper and coated board sales (kraftliner, white top liner, testliner, sack kraft, folding box board, carrier board and liquid packaging board) to third parties totaled 266 thousand tonnes in 4Q11. In the year, sales volume totaled 1,068 thousand tonnes, up 4% from 2010. Net revenue from paper and coated board sales in 4Q11 totaled R$ 480 million, up 12% and 4% from 4Q10 and 3Q11, respectively. Annual net revenue from paper sales came to R$ 1,851 million, up 8% from 2010.

Kraftliner

International kraftliner consumers registered high inventory levels in the beginning of the year, which, however, was normalized in the first quarter itself. Demand was also affected by the European crisis and international prices declined continuously since December 2010. Klabins kraftliner sales volume was 101 thousand tonnes in 4Q11, up 14% on 4Q10. In the year, sales volume totaled 415 thousand tonnes, up 13% from 2010. The higher sales volume is due to the increased production at the Monte Alegre mill, in turn, due to its operational stability. Domestic kraftliner sales stood at 32 thousand tonnes in the quarter, representing 31% of total kraftliner sales. In the year, domestic kraftliner sales came to 146 thousand tonnes, stable in relation to 2010. Exports came to 69 thousand tonnes in 4Q11 and 269 thousand tonnes in 2011, 48 thousand tonnes (22%) more than in 2010. Net revenue from kraftliner sales totaled R$ 135 million in 4Q11, up 9% and 3% from 4Q10 and 3Q11, respectively, reflecting the better sales mix and the higher average dollar in the quarter. In 2011, net revenue reached R$ 534 million, up 15% on 2010, driven by the improved sales mix and higher sales in the year.

Sales volume (thousand tonnes) Net revenue (R$ million) 367 534 466

415

65%

60%

101

69% 31%

100

56% 44%

88

67% 33% 35% 40%

135

132

124

4Q11

3Q11

4Q10

2011 Export Market

2010

4Q11

3Q11

4Q10

2011

2010

Domestic Market

10

10

4Q11 Results March 1, 2012

According to data from FOEX, the average list price in euros of kraftliner in Europe fell 4% in 4Q11, reaching an average of 552/t. The average list price in real was R$ 1,339/t in 4Q11, up 1% from 3Q11. Average kraftliner list price in 2011 was 580/t, versus 509/t in 2010.

Kraftliner Brown 175 g/m list price (/tonne and R$/tonne)

1,392 1,162 1,029 1,038 1,207 1,079 1,089

1,364

1,373

1,352

1,332

1,339

462

411

385

404

433

478

533

592

602

588

577

552

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

Quarter average

Source: FOEX and BAC EN

Kraftliner ( / tonne)

Kraftliner (R$ / tonne)

Coated boards

The coated boards segment was strongly impacted by two factors: high inventory levels at the end of 2010 due to clients concerns of a possible shortage in the production chain and higher imports of packaged goods on account of the stronger real during most of the year. Although data from Bracelpa points to a drop in domestic demand compared to 4Q10, Klabins domestic sales grew 6%, mainly due to the more diversified coated boards line. Domestic sales in the year totaled 362 thousand tonnes, up 2% from 2010. Coated board sales in 4Q11 totaled 165 thousand tonnes, up 5% from 4Q10, due to the increase in exports. Net revenue from coated board sales amounted to R$ 345 million in the quarter and R$ 1,317 million in the year, up 13% and 6%, respectively, from the same periods in the previous year. The higher average real against the dollar contributed to the revenue increase in 4Q11.

Sales volume (thousand tonnes) 653

45%

Net revenue (R$ million) 656 1,317

46%

1,247

165

42% 58%

161

39% 61%

158

43% 57%

55%

54%

345

328

306

4Q11

3Q11

4Q10

2011 Export Market

2010

4Q11

3Q11

4Q10

2011

2010

Domestic Market

11

11

4Q11 Results March 1, 2012

According to Bracelpa, domestic sales of coated boards, excluding liquid packaging boards, came to 138 thousand tonnes in 4Q11. Though domestic demand was lower than in 4Q10, it was 1% higher than in 3Q11. Domestic coated board sales in 2011 totaled 519 thousand tonnes, down 10% from 2010.

BUSINESS UNIT - CONVERSION

Sales of converted products (corrugated boxes and industrial bags) totaled 158 thousand tonnes in 4Q11 and 638 thousand tonnes in 2011, down 2% from 2010. Net revenue from converted products totaled R$ 434 million in 4Q11 and R$ 1,712 million in 2011, up 5% from 2010.

Corrugated boxes

The growth in domestic demand for corrugated boxes, measured by shipments of boxes and boards, was below the estimates for 2011. However, according to preliminary data from ABPO, Brazil shipped around 3.2 million tonnes between January and December, around 2% more than in the previous year. Shipments in 4Q11 were 1% lower than in 3Q11.

Brazilian Corrugated Shipments thousand tonnes

271 265 251 232 212 249 268 266 253 270 276 273

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

Quarter average

Source: Brazilian C orrugated Boxes Association

Monthly volume

Note: In June 2011, the ABPO revised its figures for corrugated boxes shipments disclosed previously.

In addition to fresh investments to expand production capacity and modernize equipment, especially its corrugators, Klabin adopted a policy of maintaining its margins in 2011. In accordance with this strategy, it decided to shut down the Del Castilho mill, whose production will be more than offset by the expansion of the Jundia-DI mill. With the increased capacity, the Company will reduce its fixed production costs, thus continuing to improve performance. Shipments of corrugated boxes totaled 123 thousand tonnes in 4Q11, down 2% and 5% from 4Q10 and 3Q11, respectively. In 2011, sales volume reached 502 thousand tonnes, 2% lower than in 2010, mainly due to the more selective approach and the pursuit of higher margins in the segment. Net revenue from corrugated boxes totaled R$ 304 million in the quarter and R$ 1,223 million in the year, up 6% from 2010.

12

12

4Q11 Results March 1, 2012

Sales Volume (thousand tonnes)

Net revenue (R$ million)

1,223 502 512

1,157

123

130

126

304

323

304

4Q11

3Q11

4Q10

2011

2010

4Q11

3Q11

4Q10

2011

2010

Industrial Bags

Brazils cement industry, the main consumer of Klabins industrial bags, has been prioritizing the domestic market and investing heavily in expanding production capacity. Preliminary data from the National Cement Industry Union (SNIC) and market estimates indicate that domestic cement sales in 2011 were around 64 million tonnes, up from 59 million tonnes in 2010. The north region led the sales growth with a 10% increase over the previous year.

Brazilian cement consumption million tons

5.4 4.6 3.9 4.1 4.4 4.6 4.8 5.2 4.9 5.2 5.6 5.4

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

Quarter average

Source: Nation Labor Union of C ement Industry

Monthly consumption

To optimize its sales mix and tap markets with higher margins, the Company was more selective in selling industrial bags in 2011. The renegotiation of contracts with clients in the year impacted sales volume in the second and third quarters. However, sales returned to normal levels in 4Q11, accompanied by margin gains. Sale of industrial bags in Brazil and Argentina totaled 35 thousand tonnes in 4Q11, for growth of 3% and 4% on 4Q10 and 3Q11, respectively. In 2011, sales volume reached 136 thousand tonnes, 4% lower than in 2010. Net revenue in 4Q11 was R$ 130 million, 12% higher than in 4Q10 and 6% lower than in 3Q11. In the year, net revenue came to R$ 489 million, up 3% from 2010.

13

13

4Q11 Results March 1, 2012

Net revenue (R$ million)

Sales volume (thousand tonnes) 142

136

489

472

35

34

34

130

123

116

4Q11

3Q11

4Q10

2011

2010

4Q11

3Q11

4Q10

2011

2010

Capital Expenditure

In 2011, the Company continued its focus on high-return investments in order to reduce its variable costs. With the operational start-up of the biomass boiler at the Otaclio Costa mill in March, the Company reduced fuel oil consumption by 25% by burning forest waste to generate energy. Debottlenecking at the evaporation plant at the Otaclio Costa mill was concluded in the fourth quarter, which also helped reduce steam generation costs in the period. At Monte Alegre, a high voltage (230 kV) power transmission line was installed to bring energy at a lower cost. At the conversion units, two corrugators were acquired. The first, with production capacity of 72 thousand tonnes, went operational in September at the Goiana (PE) mill. The second corrugator, which has production capacity of 100 thousand tonnes, is being installed at the Jundia-DI (SP) mill and is scheduled to go operational in June 2012. In 2011, one more complete line for producing multi-layered valve-type bags was acquired and installed. The line, which started operating at the Lages 1 mill towards the end of 2011, will result in productivity gains and improved quality. The Goiana mill will get additional capacity in 4Q12. In November, the Company acquired 51% of Florestal Vale do Corisco Ltda., which owns 107 thousand hectares of land, of which 63 thousand hectares for forests planted in the state of Paran. The transaction amounted to R$ 428 million, which were disbursed during the same month. With this acquisition, Klabins planted forest area totals 243 thousand hectares, of which 110 thousand hectares are available for new industrial projects. The Forestry Business Unit planted 15 thousand of own hectares during the year. The increased planting of higher yield species guarantees the supply of raw materials for expanding fiber production capacity. Harvesting machinery, equipment and modules were also acquired during the year to speed up wood cutting. Investments in 2011 totaled R$ 883 million, including R$ 428 million spent on the Vale do Corisco acquisition and R$ 455 million in the business units, of which 51% was allocated to the Paper Business Unit, 31% to the Forestry Business Unit and 16% to the Conversion Unit. Excluding the Vale do Corisco acquisition, total investments in the year were 18% higher than in 2010.

14

14

4Q11 Results March 1, 2012

R$ million Forestry Papers Conversion Others Subtotal Vale do Corisco Total 4Q11 44 66 39 1 150 428 578 3Q11 31 43 20 2 96 96 4Q10 49 52 34 2 138 138 2011 142 233 75 4 455 428 883 2010 133 181 68 3 386 386

Capital Markets

Stock Performance

December 31 , 2011 Preferred shares Share price (KLBN4) Book value Average daily trading volume 4Q11 Market capitalization 600.9 million R$ 8.00 R$ 5.40 R$ 22 million R$ 7.1 billion

st

In 4Q11, Klabins preferred shares (KLBN4) appreciated by 54%, while the Ibovespa index recorded gains of 8%. In the past 12 months, Klabins preferred shares gained 37%, while the Ibovespa fell 18%.

Performance KLBN4 x Brazilian Index (Ibovespa)

137

100 82

Mar11

Apr11

May11

Nov11

Jan11

Jul11

Klabin

Ibovespa Index

Klabins shares were traded in all sessions of BM&FBovespa in 4Q11, registering 273 thousand trades involving 201 million shares, for an average daily trading volume of R$ 22 million, 20% and 77% higher than in 4Q10 and 3Q11, respectively. Average trading volume in 2011 came to R$ 15 million, 27% more than in 2010.

15

Dec11

Jun11

Sep11

Aug11

Feb11

Oct11

15

4Q11 Results March 1, 2012

Average Daily Volume (R$ million/day)

22 15 10 12 8 7 17 14 14 13 12 17 16 12 11 13

24 21 14 21

14 12 9 8 9

Jun10

Aug10

Jun11

Apr10

Apr11

May10

May11

Aug11

Jul10

Jan10

Mar10

Jan11

Mar11

Dec09

Dec10

Jul11

Sep10

Sep11

Nov10

Klabins shares are also traded in the US market as Level I ADRs listed in the over-the-counter under the ticker KLBAY. The Extraordinary Board of Directors Meeting held on October 13, 2011, authorized the Preferred Shares Buyback Program involving up to 42.0 million shares. The program will be in effect for 365 days, that is, until October 12, 2012. During the year, the Company repurchased 2.8 million shares, ending December with 30 million preferred shares in treasury, which is equivalent to 5% of total preferred stock. During the year, BNDESPAR sold 20.4 million preferred shares of Klabin, reducing its interest in the Companys preferred capital from 18% to 15%. Klabin's capital stock is represented by 918 million shares, composed of 317 million common shares and 601 million preferred shares. The Extraordinary Shareholders Meeting held on December 20, 2011, approved the capital increase of R$ 771.5 million with the capitalization of the capital reserve, legal reserve and the reserve for investments and working capital, and without the issue of new shares. As a result, the Companys capital increased from R$ 1,500 million on December 31, 2010 to R$ 2,271.5 million on December 31, 2011. The Meeting also approved the creation of a new statutory reserve called Biological Asset Reserve.

Dividends

In 2011, Klabin paid R$ 70 million as complementary dividends and R$ 137 million as interim dividends, for a total dividend payout of R$ 207 million, which corresponds to R$ 229.47 per lot of thousand common shares and R$ 252.41 per lot of thousand preferred shares. The Management will submit to the Annual Shareholders Meeting to be held on April 3, 2012, a proposal for the payment of complementary dividends in the amount of R$ 80 million, which corresponds to R$ 84.74 per lot of thousand common shares and R$ 93.21 per lot of thousand preferred shares. With this, total dividends paid for the fiscal year 2011 come to R$ 217 million.

16

Nov11

Dec11

Feb10

Feb11

Oct10

Oct11

16

4Q11 Results March 1, 2012

Conference Call

Portuguese Friday, March 2, 2012 at 10:00 a.m. (Braslia). Password: Klabin Dial-in: (11) 4688-6331 Replay: +55 (11) 46886312 Code: 3232509 English Friday, March 2, 2012 at 9:00 a.m. (EDT). Password: Klabin Dial-in: U.S. participants: 1-888-700-0802 International participants: 1-786-924-6977 Brazilian participants: (55 11) 4688-6331 Replay: (55 11) 46886312 Password: 0566818 Webcast The audio webcast of the conference call will be available online. The conference call will also be broadcast over the Internet. Access: www.ccall.com.br/klabin

With gross revenue of R$ 4.7 billion in 2011, Klabin is the largest integrated manufacturer, exporter and recycler of packaging paper in Brazil, with annual production capacity of 1.9 million tonnes. Klabin has adopted a strategic focus on the following businesses: paper and coated boards for packaging, corrugated boxes, industrial bags and wood logs. Klabin is the leader in all its market segments.

The statements made in this earnings release concerning the Company's business prospects, projected operating and financial results and potential growth are merely projections and were based on Management's expectations regarding the Company's future. These expectations are highly susceptible to changes in the market, the general economic performance of the Brazilian economy, industry and international markets, and therefore are subject to change.

17

17

4Q11 Results March 1, 2012

Appendix 1 Consolidated Income Statement (Thousand R$)

4Q11

Gross Revenue Net Revenue Change in fair value - biological assets Cost of Products Sold Gross Profit Selling Expenses General & Administrative Expenses Other Revenues (Expenses) Total Operating Expenses Operating Income (before Fin. Results) Equity pickup Financial Expenses Financial Revenues Net Foreign Exchange Losses Net Financial Revenues Net Income before Taxes Income Tax and Soc. Contrib. Net income Depreciation and amortization Change in fair value of biological assets EBITDA excluding Vale do Corisco Vale do Corisco EBITDA 1,197,225 994,076 (1,569) (613,922) 378,585 (82,059) (73,038) 46,676 (108,421) 270,164 (429) (96,303) 74,333 (42,229) (64,199) 205,536 (83,105) 122,431 85,433 1,569 357,166 2,200 359,366 277,406 231,326 (112,572) 89,135 (500,955) (524,392) (377,542) 134,487 (243,055) 149,811 (19,255) 277,406 (85,839) 66,695 43,010 23,866 339,205 (114,063) 225,142 63,599 (147,612) 231,326

3Q11

1,199,418 990,623 19,255 (729,482) 280,396 (76,594) (64,311) 7,359 (133,546) 146,850

4Q10

1,125,600 930,940 147,612 (591,580) 486,972 (77,435) (56,542) (37,656) (171,633) 315,339

2011

4,686,275 3,889,151 270,577 (2,827,442) 1,332,286 (321,055) (249,405) 35,308 (535,152) 797,134 (429) (434,696) 316,311 (382,183) (500,568) 296,137 (113,416) 182,721 547,768 (270,577) 1,074,325 2,200 1,076,525

2010

4,431,465 3,663,317 448,625 (2,741,103) 1,370,839 (300,153) (214,876) (34,421) (549,450) 821,389

% of Net Revenue

4Q11 3Q11 4Q10 2011

100.0%

100.0%

100.0%

100.0%

61.8% 38.1% 8.3% 7.3% 4.7% 10.9% 27.2%

73.6% 28.3% 7.7% 6.5% 0.7% 13.5% 14.8%

63.5% 52.3% 8.3% 6.1% 4.0% 18.4% 33.9%

72.7% 34.3% 8.3% 6.4% 0.9% 13.8% 20.5%

(330,689) 234,111 124,796 28,218 849,607 (289,831) 559,776 588,936 (448,625) 961,700

9.7% 7.5% 4.2% 6.5% 20.7% 8.4% 12.3% 8.6%

11.4% 9.0% 50.6% 52.9% 38.1% 13.6% 24.5% 15.1%

9.2% 7.2% 4.6% 2.6% 36.4% 12.3% 24.2% 6.8%

11.2% 8.1% 9.8% 12.9% 7.6% 2.9% 4.7% 14.1%

35.9%

28.0%

24.8%

27.6%

961,700

36.2%

28.0%

24.8%

27.7%

18 18

4Q11 Results March 1, 2012

Appendix 2 Consolidated Balance Sheet (Thousand R$)

Assets

Current Assets Cash and banks Short-term investments Securities Receivables Inventories Recoverble taxes and contributions Other receivables

Dec-11

4.083.482 87.342 2.253.722 221.260 821.148 506.218 100.619 93.173

Dec-10

4.127.147 39.880 2.491.225 198.222 753.961 460.128 131.102 52.629

Liabilities and StockholdersEquity

Current Liabilities Loans and financing Suppliers Income tax and social contribution Taxes payable Salaries and payroll charges Dividends to pay Dividends to pay - minority REFIS reserve Other accounts payable Noncurrent Liabilities Loans and financing Imp Renda e C.social diferidos

Dec-11

1.932.606 910.497 335.045 56.852 40.426 103.121 0 430.213 56.452 5.850.687 4.386.839 1.101.160 200.014 162.674 4.958.302 2.271.500 0 50.691 1.692.542 1.085.045 (141.476) 12.741.595

Dec-10

1.690.913 842.121 269.839 37.013 40.669 93.542 2.584 349.340 55.805 5.576.245 4.014.976 1.235.635 160.417 165.217 4.994.085 1.500.000 84.491 51.404 2.365.900 1.120.643 (128.353) 12.261.243

Noncurrent Assets Long term Taxes to compensate Judicial Deposits Other receivables Other investments Property, plant & equipment, net Biological assets Intangible assets

8.658.113 136.752 102.457 160.923 618.029 4.917.083 2.715.769 7.100

8.134.096 131.621 90.698 125.678 11.542 5.004.023 2.762.879 7.655

Other accounts payable - Investors SCPs Other accounts payable StockholdersEquity Capital Capital reserves Revaluation reserve Profit reserve Valuation adjustments to shareholders'equity Treasury stock

Total

12.741.595

12.261.243

Total

19 19

4Q11 Results March 1, 2012

Appendix 3 Loan Maturity Schedule December 31, 2011

R$ million BNDES Others Local Currency Trade Finance Fixed Assets Others Foreign Currency Gross Debt 2012 371 2 373 465 10 62 537 910 2013 339 1 340 530 10 72 612 952 2014 332 5 337 407 8 70 485 822 2015 367 15 381 349 8 70 427 809 2016 87 8 96 169 5 136 310 405 2017 32 12 45 241 5 246 290 2018 43 12 55 224 8 233 287 2019 22 9 31 321 5 47 373 404

After 2020

Total 1,596 72 1,668 3,018 61 551 3,629 5,297

2 8 10 313 1 94 407 417

910

952 822 809

R$ Million

Local Currency Foreign Currency Gross Debt

Average Cost 8.9 % p.y. 4.0 % p.y.

Average Tenor 31 months 49 months 43 months

537

612 485 427

Foreign Currency 3,629 Gross Debt 5,297

405 290

310 373 340 337 381 246 96

2012 2013 2014 2015 2016

404 287

373 233

417

407

Local Currency 1,668

45

2017

55

2018

31

2019

10

After 2020

Local Currency

Foreign Currency

20 20

4Q11 Results March 1, 2012

Appendix 4 Consolidated Cash Flow (Thousand R$)

4Q11

Cash flow from operating activities Operating activities . Net income . Depreciation and amortization . Depletion in biological assets . Change in fair value - biolgical assets . Equity results . Results on Equity Pickup . Deferred income taxes and social contribution . Fixed assets costs result . Income taxes and social contribution . Interest and exchange variation on loans and financing . REFIS Reserve . Interest Payment . Others Variations in Assets and Liabilities . Receivables . Inventories . Recoverable taxes . Marketable Securities . Prepaid expenses . Other receivables . Suppliers . Taxes and payable . Salaries, vacation and payroll charges . Other payables Net Cash Investing Activities . Purchase of property, plant and equipment . Purchase of biological assets . Purchase of investments . Sale of property, plant and equipment Net Cash Financing Activities . New loans and financing . Amortization of financing . Payment of capital at subsidiaries by minority shareholders . Acquisition of minority shares in subsidiaries . Dividends Paid . Stocks repurchase Increase (Decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period 185,068 193,861 122,431 60,073 25,360 1,569 (44,480) 429 2,839 (26,827) 119,274 9,596 (63,469) (12,934) (8,793) (40,836) (9,616) 61,282 (5,774) (8,078) (57,639) 70,742 (29,980) 1,797 9,309 (498,186) (91,237) (29,344) (428,423) 50,818 (160,515) 249,926 (351,986) (3,452) (55,003) (473,633) 2,814,697 2,341,064

2011

728,920 704,972 182,721 235,960 311,808 (270,577) (55,596) 429 (102,354) (111,607) 681,803 96,402 (255,924) (8,093) 23,948 (70,214) (12,523) 153,186 (23,038) 5,113 (92,661) 5,334 19,596 9,579 29,576 (721,237) (277,667) (117,747) (428,423) 102,600 (197,724) 827,379 (813,019) 10,420 (2,378) (207,003) (13,123) (190,041) 2,531,105 2,341,064

4Q10

189,032 195,280 225,142 58,280 (21,246) (147,613) (255) 91,458 28,197 (13,608) 15,819 4,494 (61,842) 16,454 (6,248) 41,353 (17,198) 68,595 (4,960) (8,644) (3,669) 1,147 (75,139) (685) (7,048) (140,044) (97,193) (43,059) 208 (55,918) 283,772 (230,930) 9,861 (815) (69,263) (48,543) (6,930) 2,538,035 2,531,105

2010

910,465 706,210 559,776 223,639 337,100 (448,625) 2,496 189,286 28,197 (36,093) 108,452 17,655 (281,723) 6,050 204,255 (96,060) (32,244) 232,311 11,652 (872) (12,599) 80,333 24,497 24,683 (27,446) (384,756) (266,489) (119,108) 841 163,744 1,042,934 (740,515) 90,122 (3,251) (177,003) (48,543) 689,453 1,841,652 2,531,105

21

Você também pode gostar

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryNo EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Klabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Documento20 páginasKlabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Klabin_RIAinda não há avaliações

- Release 4Q12Documento18 páginasRelease 4Q12Klabin_RIAinda não há avaliações

- Relatório Trimestral 1T13 1Q13 Earnings Release Relatório Trimestral 1T13 1Q13 Earnings ReleaseDocumento17 páginasRelatório Trimestral 1T13 1Q13 Earnings Release Relatório Trimestral 1T13 1Q13 Earnings ReleaseKlabin_RIAinda não há avaliações

- Earnings Release 3Q11: EBITDA of R$277 Million in 3Q11Documento20 páginasEarnings Release 3Q11: EBITDA of R$277 Million in 3Q11Klabin_RIAinda não há avaliações

- EBITDA of R$ 249 Million in 1Q11, With EBITDA Margin of 26%Documento18 páginasEBITDA of R$ 249 Million in 1Q11, With EBITDA Margin of 26%Klabin_RIAinda não há avaliações

- Release 3Q12Documento17 páginasRelease 3Q12Klabin_RIAinda não há avaliações

- Ebitda of R Up 25% From 1Q11 EBITDA of R$ 311 Million in 1Q12, Up 25% From 1Q11Documento17 páginasEbitda of R Up 25% From 1Q11 EBITDA of R$ 311 Million in 1Q12, Up 25% From 1Q11Klabin_RIAinda não há avaliações

- Quarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateDocumento15 páginasQuarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateKlabin_RIAinda não há avaliações

- First Quarter Results 2001: Qoq R$ Million 1Q/01 4Q/00 1Q/00Documento10 páginasFirst Quarter Results 2001: Qoq R$ Million 1Q/01 4Q/00 1Q/00Klabin_RIAinda não há avaliações

- Klabin S.A.: Anagement EportDocumento9 páginasKlabin S.A.: Anagement EportKlabin_RIAinda não há avaliações

- Quarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioDocumento18 páginasQuarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioKlabin_RIAinda não há avaliações

- iKRelease2005 2qDocumento16 páginasiKRelease2005 2qKlabin_RIAinda não há avaliações

- 2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineDocumento19 páginas2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineKlabin_RIAinda não há avaliações

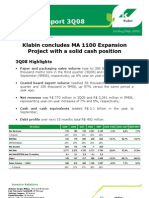

- Quarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionDocumento15 páginasQuarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionKlabin_RIAinda não há avaliações

- Quarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Documento19 páginasQuarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Klabin_RIAinda não há avaliações

- Quarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginDocumento17 páginasQuarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginKlabin_RIAinda não há avaliações

- Release 1Q15Documento17 páginasRelease 1Q15Klabin_RIAinda não há avaliações

- Quarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginDocumento19 páginasQuarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginKlabin_RIAinda não há avaliações

- Anagement Eport: Initial ConsiderationsDocumento8 páginasAnagement Eport: Initial ConsiderationsKlabin_RIAinda não há avaliações

- Quarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Documento16 páginasQuarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Klabin_RIAinda não há avaliações

- iKRelease2005 1qDocumento16 páginasiKRelease2005 1qKlabin_RIAinda não há avaliações

- Market Notes May 13 FridayDocumento3 páginasMarket Notes May 13 FridayJC CalaycayAinda não há avaliações

- Klabin Reports Net Profit of R$ 163 Million in 1Q06: F I R S T Q U A R T e R R e S U L T S 2 0 0 6Documento15 páginasKlabin Reports Net Profit of R$ 163 Million in 1Q06: F I R S T Q U A R T e R R e S U L T S 2 0 0 6Klabin_RIAinda não há avaliações

- Quarterly Release: Start Up of Paper Machine # 9Documento19 páginasQuarterly Release: Start Up of Paper Machine # 9Klabin_RIAinda não há avaliações

- Bank of Kigali Announces Q2 2011 & 1H 2011 ResultsDocumento9 páginasBank of Kigali Announces Q2 2011 & 1H 2011 ResultsBank of KigaliAinda não há avaliações

- Klabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsDocumento10 páginasKlabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsKlabin_RIAinda não há avaliações

- Cash Generation Exceeds R$ 181 Million: January/March 2002Documento10 páginasCash Generation Exceeds R$ 181 Million: January/March 2002Klabin_RIAinda não há avaliações

- 1Q10 Quarterly Report: EBITDA in 1Q10 of R$242 Million, Up 35% From 1Q09, With EBITDA Margin of 29%Documento18 páginas1Q10 Quarterly Report: EBITDA in 1Q10 of R$242 Million, Up 35% From 1Q09, With EBITDA Margin of 29%Klabin_RIAinda não há avaliações

- Klabin Reports Gross Revenues of US$ 1.1 Billion in 2004: Oct / Nov / Dec 2004Documento19 páginasKlabin Reports Gross Revenues of US$ 1.1 Billion in 2004: Oct / Nov / Dec 2004Klabin_RIAinda não há avaliações

- Result Y15 Doc3Documento6 páginasResult Y15 Doc3ashokdb2kAinda não há avaliações

- Tiger BrandsAnnual Financial Results November 2011Documento20 páginasTiger BrandsAnnual Financial Results November 2011anon_470778742Ainda não há avaliações

- PR Fibria 2T11 v7 EngfinalDocumento21 páginasPR Fibria 2T11 v7 EngfinalFibriaRIAinda não há avaliações

- PR913g Rio Tinto Announces Record First Half EarningsDocumento52 páginasPR913g Rio Tinto Announces Record First Half EarningskhotarisAinda não há avaliações

- Cash Generation Grows by 12% in The Third Quarter: July/September 2001Documento13 páginasCash Generation Grows by 12% in The Third Quarter: July/September 2001Klabin_RIAinda não há avaliações

- BM&FBOVESPA S.A. Announces Earnings For The Fourth Quarter of 2010Documento12 páginasBM&FBOVESPA S.A. Announces Earnings For The Fourth Quarter of 2010BVMF_RIAinda não há avaliações

- Quarterly Release: Klabin Reports Net Profit of R$ 111 Million in 4Q06, and Reaches R$ 474 Million in 2006Documento18 páginasQuarterly Release: Klabin Reports Net Profit of R$ 111 Million in 4Q06, and Reaches R$ 474 Million in 2006Klabin_RIAinda não há avaliações

- Quarterly Release: Klabin Reports Net Profit of R$ 261 Million in 1H06, Up 19% Over 1H05Documento16 páginasQuarterly Release: Klabin Reports Net Profit of R$ 261 Million in 1H06, Up 19% Over 1H05Klabin_RIAinda não há avaliações

- 4Q09 Quarterly Report: Record Coated Board Sales in 2009Documento19 páginas4Q09 Quarterly Report: Record Coated Board Sales in 2009Klabin_RIAinda não há avaliações

- Kingspan TrranscriptDocumento13 páginasKingspan Trranscriptdaveholohan8868Ainda não há avaliações

- Release 3Q15Documento17 páginasRelease 3Q15Klabin_RIAinda não há avaliações

- 4q2009release BRGAAP InglesnaDocumento22 páginas4q2009release BRGAAP InglesnaFibriaRIAinda não há avaliações

- Quarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginDocumento18 páginasQuarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginKlabin_RIAinda não há avaliações

- Q1 Earnings Transcript (310312)Documento13 páginasQ1 Earnings Transcript (310312)sgruen9903Ainda não há avaliações

- BM&FBOVESPA S.A. Posts Robust Results For The Third Quarter 2011Documento9 páginasBM&FBOVESPA S.A. Posts Robust Results For The Third Quarter 2011BVMF_RIAinda não há avaliações

- Excluding Exceptional Gains, Olam's H1 FY2010 Core Earnings Grew 39.1%Documento7 páginasExcluding Exceptional Gains, Olam's H1 FY2010 Core Earnings Grew 39.1%ouerdienAinda não há avaliações

- Klabin Reports A Net Profit of R$ 366 Million Up To September 2004Documento16 páginasKlabin Reports A Net Profit of R$ 366 Million Up To September 2004Klabin_RIAinda não há avaliações

- Release 3Q13Documento16 páginasRelease 3Q13Klabin_RIAinda não há avaliações

- 3q2009release BRGAAP InglesnaDocumento24 páginas3q2009release BRGAAP InglesnaFibriaRIAinda não há avaliações

- Sound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Documento18 páginasSound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Klabin_RIAinda não há avaliações

- Rio Tinto Delivers First Half Underlying Earnings of 2.9 BillionDocumento58 páginasRio Tinto Delivers First Half Underlying Earnings of 2.9 BillionBisto MasiloAinda não há avaliações

- BM&FBOVESPA Announces Results For The First Quarter 2011Documento9 páginasBM&FBOVESPA Announces Results For The First Quarter 2011BVMF_RIAinda não há avaliações

- Klabin Institutional Presentation 2 Q11Documento35 páginasKlabin Institutional Presentation 2 Q11Klabin_RIAinda não há avaliações

- BM&FBOVESPA S.A. Announces Second Quarter 2011 EarningsDocumento10 páginasBM&FBOVESPA S.A. Announces Second Quarter 2011 EarningsBVMF_RIAinda não há avaliações

- Release 4Q15Documento16 páginasRelease 4Q15Klabin_RIAinda não há avaliações

- KPresentation2009 1Q IngDocumento34 páginasKPresentation2009 1Q IngKlabin_RIAinda não há avaliações

- Klabin Webcast 3 Q11 INGDocumento8 páginasKlabin Webcast 3 Q11 INGKlabin_RIAinda não há avaliações

- Quarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Documento17 páginasQuarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Klabin_RIAinda não há avaliações

- 2 Ibp EcoLetter January 13, 2012Documento2 páginas2 Ibp EcoLetter January 13, 2012Chinkoz SagaAinda não há avaliações

- Klabin S.A.: Anagement EportDocumento7 páginasKlabin S.A.: Anagement EportKlabin_RIAinda não há avaliações

- Release 1Q17Documento19 páginasRelease 1Q17Klabin_RIAinda não há avaliações

- DFP Klabin S A 2016 EM INGLSDocumento87 páginasDFP Klabin S A 2016 EM INGLSKlabin_RIAinda não há avaliações

- DFP Klabin S A 2016 EM INGLSDocumento87 páginasDFP Klabin S A 2016 EM INGLSKlabin_RIAinda não há avaliações

- Comunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCDocumento26 páginasComunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCKlabin_RIAinda não há avaliações

- Demonstra??es Financeiras em Padr?es InternacionaisDocumento73 páginasDemonstra??es Financeiras em Padr?es InternacionaisKlabin_RIAinda não há avaliações

- Release 2Q16Documento19 páginasRelease 2Q16Klabin_RIAinda não há avaliações

- Rating Klabin - SDocumento1 páginaRating Klabin - SKlabin_RIAinda não há avaliações

- CH 06Documento4 páginasCH 06vivien100% (1)

- Investment Thesis: GLD-Time To Turn Greedy As Everyone T Turn Greedy As Everyone Turns FearfulDocumento3 páginasInvestment Thesis: GLD-Time To Turn Greedy As Everyone T Turn Greedy As Everyone Turns FearfulAnuradhaAinda não há avaliações

- Levi'sDocumento16 páginasLevi'sPeter ThomasAinda não há avaliações

- Trading Strategy 3.0Documento4 páginasTrading Strategy 3.0John MemoAinda não há avaliações

- Daftar Pustaka - 11-34 CrosbyDocumento6 páginasDaftar Pustaka - 11-34 CrosbyMuhammad Sidiq AAinda não há avaliações

- Economics Usa 8th Edition Behravesh Test BankDocumento19 páginasEconomics Usa 8th Edition Behravesh Test Banktimothyleonnsfaowjymq100% (12)

- FM - Assignment 1 - F & MDocumento1 páginaFM - Assignment 1 - F & MsravanAinda não há avaliações

- Zaverecna PraceDocumento109 páginasZaverecna PracenicolescuaAinda não há avaliações

- Instructional Material Product Management Topic 1Documento10 páginasInstructional Material Product Management Topic 1Rita DanielaAinda não há avaliações

- Research MethodologyDocumento11 páginasResearch MethodologyBalram SoniAinda não há avaliações

- Chapter 5Documento6 páginasChapter 5JPAinda não há avaliações

- Marketing & Communications Objectives, Strategies, Tactics: Let's Start With The First Set of SlidesDocumento5 páginasMarketing & Communications Objectives, Strategies, Tactics: Let's Start With The First Set of Slidesmuhammad arya tamaAinda não há avaliações

- Microsoft Word - The Secrets of Support & ResistanceDocumento9 páginasMicrosoft Word - The Secrets of Support & ResistanceDeden TarsomaAinda não há avaliações

- MM Chapter 1Documento32 páginasMM Chapter 1Robin Van SoCheat100% (2)

- BNP Informe ArgDocumento8 páginasBNP Informe ArgfacundoenAinda não há avaliações

- Aata PresentationDocumento20 páginasAata PresentationFiroz Ahamed100% (1)

- International Financial ManagementDocumento23 páginasInternational Financial Managementsureshmooha100% (1)

- Feasibility StudyDocumento17 páginasFeasibility StudyKarl Jay PimentelAinda não há avaliações

- A) Business Plan OutlineDocumento13 páginasA) Business Plan Outlinedurga_9Ainda não há avaliações

- Anta Min WgesDocumento6 páginasAnta Min WgesNini MohamedAinda não há avaliações

- Ecommerce Case StudiesDocumento7 páginasEcommerce Case StudiesSuranjana Das0% (1)

- Fasttrack - The Supply Chain Magazine (Apr-Jun 2009)Documento5 páginasFasttrack - The Supply Chain Magazine (Apr-Jun 2009)SaheemAinda não há avaliações

- Value Creation in E-BusinessDocumento29 páginasValue Creation in E-BusinessSwarni Weerasooriya100% (1)

- Pricing StrategyDocumento17 páginasPricing StrategyHeather ShaneAinda não há avaliações

- Grade 12 Civics Revision Questions: ADWA."Documento11 páginasGrade 12 Civics Revision Questions: ADWA."rune100% (1)

- Von Thunens ModelDocumento4 páginasVon Thunens ModelShailee SinghAinda não há avaliações

- Accenture - Winning in New Banking Era PDFDocumento20 páginasAccenture - Winning in New Banking Era PDFapritul3539100% (1)

- UTS Ak Man Lanjutan PPAk 2022 - I Gusti Agus Eka WidianaDocumento9 páginasUTS Ak Man Lanjutan PPAk 2022 - I Gusti Agus Eka WidianaIGusti WidianaAinda não há avaliações

- SL5298284 Additional Docs 3Documento7 páginasSL5298284 Additional Docs 3prnali.vflAinda não há avaliações

- B2B E CommerceDocumento29 páginasB2B E CommerceAtiQah NOtyhAinda não há avaliações