Escolar Documentos

Profissional Documentos

Cultura Documentos

Questions

Enviado por

Yat Kunt ChanDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Questions

Enviado por

Yat Kunt ChanDireitos autorais:

Formatos disponíveis

The application of linear programming to management accounting

G Limited, manufacturers of superior garden ornaments, is preparing its production budget for the coming period. The company makes four types of ornament, the data for which are as follows: Product Direct materials Variable overhead Selling price Direct labour hours: Type 1 Type 2 Type 3 Pixie ( per unit) 25 17 111 Hours per unit 8 Elf ( per unit) 35 18 98 Hours per unit 6 Queen ( per unit) 22 15 122 Hours per unit 10 5 King ( per unit) 25 16 326 Hours per unit 10 25

Question IM 26.1 Intermediate: Optimal output using the graphical approach

Fixed overhead amounts to 15 000 per period. Each type of labour is paid 5 per hour but because of the skills involved, an employee of one type cannot be used for work normally done by another type. The maximum hours available in each type are: Type 1 Type 2 Type 3 8 000 hours 20 000 hours 25 000 hours

The marketing department judges that, at the present selling prices, the demand for the products is likely to be: Pixie Elf Queen King Unlimited demand Unlimited demand 1500 units 1000 units

You are required: (a) to calculate the product mix that will maximize profit, and the amount of the profit; (14 marks) (b) to determine whether it would be worthwhile paying Type 1 Labour for overtime working at time and a half and, if so, to calculate the extra profit for each 1000 hours of overtime; (2 marks) (c) to comment on the principles used to find the optimum product mix in part (a), pointing out any possible limitations; (3 marks) (d) to explain how a computer could assist in providing a solution for the data shown above. (3 marks) (Total 22 marks) CIMA Stage 3 Management Accounting Techniques

THE APPLICATION OF LINEAR PROGRAMMING TO MANAGEMENT ACCOUNTING

191

Question IM 26.2 Advanced: Optimal output using the graphical approach and the impact of an increase in capacity

A company makes two products, X and Y. Product X has a contribution of 124 per unit and product Y 80 per unit. Both products pass through two departments for processing and the times in minutes per unit are: Product X Department 1 Department 2 150 100 Product Y 90 120

Currently there is a maximum of 225 hours per week available in department 1 and 200 hours in department 2. The company can sell all it can produce of X but EEC quotas restrict the sale of Y to a maximum of 75 units per week. The company, which wishes to maximize contribution, currently makes and sells 30 units of X and 75 units of Y per week. The company is considering several possibilities including (i) altering the production plan if it could be proved that there is a better plan than the current one; (ii) increasing the availability of either department 1 or department 2 hours. The extra costs involved in increasing capacity are 0.5 per hour for each department; (iii) transferring some of their allowed sales quota for Product Y to another company. Because of commitments the company would always retain a minimum sales level of 30 units. You are required to (a) calculate the optimum production plan using the existing capacities and state the extra contribution that would be achieved compared with the existing plan; (8 marks) (b) advise management whether they should increase the capacity of either department 1 or department 2 and, if so, by how many hours and what the resulting increase in contribution would be over that calculated in the improved production plan. (7 marks) (c) calculate the minimum price per unit for which they could sell the rights to their quota, down to the minimum level, given the plan in (a) as a starting point. (5 marks) (Total 20 marks) CIMA Stage 3 Management Accounting Techniques

Question IM 26.3 Advanced: Maximizing profit and sales revenue using the graphical approach

Goode, Billings and Prosper plc manufactures two products, Razzle and Dazzle. Unit selling prices and variable costs, and daily fixed costs are: Razzle () Selling price per unit Variable costs per unit Contribution margin per unit Joint fixed costs per day 20 08 12 60 Dazzle () 30 20 10

Production of the two products is restricted by limited supplies of three essential inputs: Raz, Ma, and Taz. All other inputs are available at prevailing prices without any restriction. The quantities of Raz, Ma, and Taz necessary to produce single units of Razzle and Dazzle, together with the total supplies available each day, are: kg per unit required Razzle Dazzle Raz Ma Taz

192

Total available (kg per day) 75 80 15

5 8 2

12.5 10 0

THE APPLICATION OF LINEAR PROGRAMMING TO MANAGEMENT ACCOUNTING

William Billings, the sales director, advises that any combination of Razzle and/or Dazzle can be sold without affecting their market prices. He also argues very strongly that the company should seek to maximize its sales revenues subject to a minimum acceptable profit of 44 per day in total from these two products. In contrast, the financial director, Silas Prosper, has told the managing director, Henry Goode, that he believes in a policy of profit maximization at all times. You are required to: (a) calculate: (i) the profit and total sales revenue per day, assuming a policy of profit maximization, (10 marks) (ii) the total sales revenue per day, assuming a policy of sales revenue maximization subject to a minimum acceptable profit of 44 per day, (10 marks) (b) suggest why businessmen might choose to follow an objective of maximizing sales revenue subject to a minimum profit constraint. (5 marks) (Total 25 marks) ICAEW Management Accounting Usine Ltd is a company whose objective is to maximize profits. It manufactures two speciality chemical powders, gamma and delta, using three processes: heating, refining and blending. The powders can be produced and sold in infinitely divisible quantities. The following are the estimated production hours for each process per kilo of output for each of the two chemical powders during the period 1 June to 31 August: Gamma (hours) Heating Refining Blending 400 100 100 Delta (hours) 120 90 250

Question IM 26.4 Advanced: Optimal output and shadow prices using the graphical approach

During the same period, revenues and costs per kilo of output are budgeted as Gamma ( per kilo) Selling price Variable costs Contribution 16 000 12 000 04 000 Delta ( per kilo) 25 000 17 000 08 000

It is anticipated that the company will be able to sell all it can produce at the above prices, and that at any level of output fixed costs for the three month period will total 36 000. The companys management accountant is under the impression that there will only be one scarce factor during the budget period, namely blending hours, which cannot exceed a total of 1050 hours during the period 1 June to 31 August. He therefore correctly draws up an optimum production plan on this basis. However, when the factory manager sees the figures he points out that over the three month period there will not only be a restriction on blending hours, but in addition the heating and refining hours cannot exceed 1200 and 450 respectively during the three month period. Requirements: (a) Calculate the initial production plan for the period 1 June to 31 August as prepared by the management accountant, assuming blending hours are the only scarce factor. Indicate the budgeted profit or loss, and explain why the solution is the optimum. (4 marks)

THE APPLICATION OF LINEAR PROGRAMMING TO MANAGEMENT ACCOUNTING

193

(b) Calculate the optimum production plan for the period 1 June to 31 August, allowing for both the constraint on blending hours and the additional restrictions identified by the factory manager, and indicate the budgeted profit or loss. (8 marks) (c) State the implications of your answer in (b) in terms of the decisions that will have to be made by Usine Ltd with respect to production during the period 1 June to 31 August after taking into account all relevant costs. (2 marks) (d) Under the restrictions identified by the management accountant and the factory manager, the shadow (or dual) price of one extra hour of blending time on the optimum production plan is 27.50. Calculate the shadow (or dual) price of one extra hour of refining time. Explain how such information might be used by management, and in so doing indicate the limitations inherent in the figures. (6 marks) Note: Ignore taxation. Show all calculations clearly. (20 marks) ICAEW Management Accounting and Financial Management I Part Two

Question IM 26.5 Advanced: Formulation of initial tableau and interpretation of final tableau

The Alphab Group has five divisions A, B, C, D and E. Group management wish to increase overall group production capacity per year by up to 30 000 hours. Part of the strategy will be to require that the minimum increase at any one division must be equal to 5% of its current capacity. The maximum funds available for the expansion programme are 3 000 000. Additional information relating to each division is as follows: Existing capacity (hours) 20 000 40 000 24 000 50 000 12 000 Investment cost per hour () 90 75 100 120 200 Average contribution per hour () 12.50 9.50 11 8 14

Division A B C D E

A linear programme of the plan has been prepared in order to determine the strategy which will maximise additional contribution per annum and to provide additional decision-making information. The Appendix to this question shows a print-out of the LP model of the situation. Required: (a) Formulate the mathematical model from which the input to the LP programme would be obtained. (6 marks) (b) Use the linear programme solution in the Appendix in order to answer the following: (i) State the maximum additional contribution from the expansion strategy and the distribution of the extra capacity between the divisions. (3 marks) (ii) Explain the cost to the company of providing the minimum 5% increase in capacity at each division. (3 marks) (iii) Explain the effect on contribution of the limits placed on capacity and investment. (2 marks) (iv) Explain the sensitivity of the plan to changes in contribution per hour. (4 marks) (v) Group management decide to relax the 30 000 hours capacity constraint. All other parameters of the model remain unchanged. Determine the change in strategy which will then maximise the increase in group contribution. You should calculate the increase in contribution which this change in strategy will provide. (6 marks)

194

THE APPLICATION OF LINEAR PROGRAMMING TO MANAGEMENT ACCOUNTING

(vi) Group management wish to decrease the level of investment while leaving all other parameters of the model (as per the Appendix) unchanged. Determine and quantify the change in strategy which is required indicating the fall in contribution which will occur. (6 marks) (c) Explain the limitations of the use of linear programming for planning purposes. (5 marks) (Total 35 marks) Appendix Divisional investment evaluation Optimal solution detailed report Variable 1 DIV A 2 DIV B 3 DIV C 4 DIV D 5 DIV E Constraint 1 Max. Hours 2 DIV A 3 DIV B 4 DIV C 5 DIV D 6 DIV E 7 Max. Funds Type <= >= >= >= >= >= <= RHS 30 000.00 1 000.00 2 000.00 1 200.00 2 500.00 600.00 3 000 000.00 Value 22 090.91 2 000.00 1 200.00 2 500.00 2 209.09 Slack 0.00 21 090.91 0.00 0.00 0.00 1 609.09 0.00 Shadow price 11.2727 0.0000 2.7955 1.6364 4.9091 0.0000 0.0136

Objective function value=359 263.6

Sensitivity Analysis of Objective Function Coefficients Variable 1 DIV A 2 DIV B 3 DIV C 4 DIV D 5 DIV E Current coefficient 12.50 9.50 11.00 8.00 14.00 Allowable minimum 10.7000 Infinity Infinity Infinity 12.5000 Allowable maximum 14.0000 12.2955 12.6364 12.9091 27.7778

Sensitivity Analysis of Right-hand Side Values Constraint 1 Max. Hours 2 DIV A 3 DIV B 4 DIV C 5 DIV D 6 DIV E 7 Max. Funds Type <= >= >= >= >= >= <= Current value 30 000.00 1 000.00 2 000.00 1 200.00 2 500.00 600.00 3 000 000.00 Allowable minimum 18 400.00 Infinity 0.00 0.00 0.00 Infinity 2 823 000.00 Allowable maximum 31 966.67 22 090.91 20 560.00 18 900.00 8 400.00 2 209.09 5 320 000.00

Note: RHS=Right-hand side

ACCA Paper 9 Information for Control and Decision Making

THE APPLICATION OF LINEAR PROGRAMMING TO MANAGEMENT ACCOUNTING

195

Question IM 26.6 Advanced: Formulation of an initial tableau and interpretation of a final tableau using the simplex method

Hint: Reverse the signs and ignore entries of 0 and 1. The Kaolene Co. Ltd has six different products all made from fabricated steel. Each product passes through a combination of five production operations: cutting, forming, drilling, welding and coating. Steel is cut to the length required, formed into the appropriate shapes, drilled if necessary, welded together if the product is made up of more than one part, and then passed through the coating machine. Each operation is separate and independent, except for the cutting and forming operations, when, if needed, forming follows continuously after cutting. Some products do not require every production operation. The output rates from each production operations, based on a standard measure for each product, are set out in the tableau below, along with the total hours of work available for each operation. The contribution per unit of each product is also given. It is estimated that three of the products have sales ceilings and these are also given below: Products X1 X2 X3 X4 X5 X6 14.0 420 380 720 450 70

Contribution per unit () 5.7 10.1 12.3 9.8 17.2 Output rate per hour: Cutting 650 700 370 450 300 Forming 450 450 520 180 Drilling 200 380 300 Welding 380 670 400 Coating 500 540 480 600 Maximum sales 150 20 units (000) Cutting Forming Drilling Welding Coating Production hours 12 000 16 000 4000 4000 16 000 available

The production and sales for the year were found using a linear programming algorithm. The final tableau is given below.

Variable in basic solution X1 X8 X2 X6 X11 X12 X13 X14 (ZiCi) Value of variable in basic solution 43 287.0 units 15 747.81 hours 13 333.3 units 48 019.2 units 150 806.72 hours 150 000.0 units 20 000.0 units 21 980.8 units 1 053 617.4

X1 1 0 0 0 0 0 0 0 0

X2 0 0 1 0 0 0 0 0 0

X3 1.6 0.53 1.9 0.06 1 0 1.9 10.0

X4

X5

X6 0 0 0 1 0 0 0 0 0

X7 10.8 1.4 0 0 1.3 0 0 0 61.7

X8 0 1 0 0 0 0 0 0 0

X9 3.0 0.3 3.33 0 0.37 0 0 0 16.0

X10 18.5 0.58 0 12 0.63 0 0 12 62.1

X11 X12 X13 X14 0 0 0 0 1 0 0 0 0 0 0 0 0 0 1 0 0 0 0 0 0 0 0 0 1 0 0 0 0 0 0 0 0 0 1 0

0.22 0.99 0.12 0.67 1.64 0 0 1 1.6 6.83 0 1.08 0.01 0 0 1.0 4

0.15 0.02

Variables X7 to X11 are the slack variables relating to the production constraints, expressed in the order of production. Variables X12 to X14 are the slack variables relating to the sales ceilings of X3, X5 and X6 respectively. After analysis of the above results, the production manager believes that further mechanical work on the cutting and forming machines costing 200 can improve their hourly output rates as follows:

196

THE APPLICATION OF LINEAR PROGRAMMING TO MANAGEMENT ACCOUNTING

Products Cutting Forming

X1 700 540

X2 770 540

X3 410

X4 500 620

X5 330 220

X6 470 460

The optimal solution to the new situation indicates the shadow prices of the cutting, drilling and welding sections to be 59.3, 14.2 and 71.5 per hour respectively. Requirements: (a) Explain the meaning of the seven items ringed in the final tableau. (9 marks) (b) Show the range of values within which the following variables or resources can change without changing the optimal mix indicated in the final tableau (i) c4: contribution of X4 (ii) b5: available coating time. (4 marks) (c) Formulate the revised linear programming problem taking note of the revised output rates for cutting and forming. (5 marks) (d) Determine whether the changes in the cutting and forming rates will increase profitability. (3 marks) (e) Using the above information discuss the usefulness of linear programming to managers in solving this type of problem. (4 marks) (Total 25 marks) ICAEW P2 Management Accounting (a) The Argonaut Company makes three products, Xylos, Yo-yos and Zicons. These are assembled from two components, Agrons and Bovons, which can be produced internally at a variable cost of 5 and 8 each respectively. A limited quantity of each of these components may be available for purchase from an external supplier at a quoted price which varies from week to week. The production of Agrons and Bovons is subject to several limitations. Both components require the same three production processes (L, M and N), the first two of which have limited availabilities of 9600 minutes per week and 7000 minutes per week respectively. The final process (N) has effectively unlimited availability but for technical reasons must produce at least one Agron for each Bovon produced. The processing times are as follows: Process Time (mins) required to produce 1 Agron 1 Bovon L 6 8 M 5 5 N 7 9

Question IM 26.7 Formulation of initial tableau and interpretation of final tableau using the simplex method

The component requirements of each of the three final products are: Product Number of components required Agrons Bovons Xylo 1 2 Yo-yo 1 1 Zicon 3 2

The ex-factory selling prices of the final products are given below, together with the standard direct labour hours involved in their assembly and details of other assembly costs incurred: Product Selling price Direct labour hours used Other assembly costs Xylo 70 6 4 Yo-yo 60 7 5 Zicon 150 16 15

197

THE APPLICATION OF LINEAR PROGRAMMING TO MANAGEMENT ACCOUNTING

The standard direct labour rate is 5 per hour. Factory overhead costs amount to 4350 per week and are absorbed to products on the basis of the direct labour costs incurred in their assembly. The current production plan is to produce 100 units of each of the three products each week. Requirements: (i) Present a budgeted weekly profit and loss account, by product, for the factory. (4 marks) (ii) Formulate the production problem facing the factory manager as a linear program: (1) assuming there is no external availability of Agrons and Bovons; (5 marks) and (2) assuming that 200 Agrons and 300 Bovons are available at prices of 10 and 12 each respectively. (4 marks) (b) In a week when no external availability of Agrons and Bovons was expected, the optimal solution to the linear program and the shadow prices associated with each constraint were as follows: Production of Xylos Production of Yo-yos Production of Zicons 50 units 0 units; shadow price 2.75 250 units

Shadow price associated with: Process L 0.375 per minute Process M 0.450 per minute Process N 0.000 per minute Agron availability 9.50 each Bovon availability 13.25 each If sufficient Bovons were to become available on the external market at a price of 12 each, a revised linear programming solution indicated that only Xylos should be made. Requirement: Interpret this output from the linear program in a report to the factory manager. Include calculations of revised shadow prices in your report and indicate the actions the manager should take and the benefits that would accrue if the various constraints could be overcome. (12 marks) (Total 25 marks) ICAEW P2 Management Accounting

Question IM 26.8 Advanced: Single and multi-period capital rationing

Raiders Ltd is a private limited company which is financed entirely by ordinary shares. Its effective cost of capital, net of tax, is 10% per annum. The directors of Raiders Ltd are considering the companys capital investment programme for the next two years, and have reduced their initial list of projects to four. Details of the projects are as follows: Cash flows (net of tax) After one year (000) +50 200 +150 300 After two years (000) +300 +400 +150 +250 After three years (000) +350 +400 +150 +300 Net present value (at 10%) (000) +157.0 +150.0 +73.5 +159.5 Internal rate of return (to nearest 1%) 26% 25% 23% 50%

Immediately (000) Project A B C D

198

400 300 300 0

THE APPLICATION OF LINEAR PROGRAMMING TO MANAGEMENT ACCOUNTING

None of the projects can be delayed. All projects are divisible; outlays may be reduced by any proportion and net inflows will then be reduced in the same proportion. No project can be undertaken more than once. Raiders Ltd is able to invest surplus funds in a bank deposit account yielding a return of 7% per annum, net of tax. You are required to: (a) prepare calculations showing which projects Raiders Ltd should undertake if capital for immediate investment is limited to 500 000, but is expected to be available without limit at a cost of 10% per annum thereafter; (5 marks) (b) provide a mathematical programming formulation to assist the directors of Raiders Ltd in choosing investment projects if capital available immediately is limited to 500 000, capital available after one year is limited to 300 000, and capital is available thereafter without limit at a cost of 10% per annum; (8 marks) (c) outline the limitations of the formulation you have provided in (b); (6 marks) (d) comment briefly on the view that in practice capital is rarely limited absolutely, provided that the borrower is willing to pay a sufficiently high price, and in consequence a technique for selecting investment projects which assumes that capital is limited absolutely, is of no use. (6 marks) (Total 25 marks) ICAEW Financial Management The directors of Anhang plc are considering how best to invest in four projects, details of which are given below. Project I Net present value (000) Beta factor of project Initial payment (000) +80 1.0 50 Project II +40 1.0 40 Project III +120 0.8 90 Project IV +110 1.2 55

Question IM 26.9 Advanced: Capital rationing and beta analysis

The net present values of the projects have been calculated using specific, riskadjusted discount rates. The directors choice is complicated because Anhang plc has only 90 000 currently available for investment in new projects. Each project must start on the same date and cannot be deferred. Acceptance of any one project would not affect acceptance of any other and all projects are divisible. The directors at a recent board meeting were unable to agree upon how best to invest the 90 000. A summary of the views expressed at the meeting follows: (i) Wendling argued that as the presumed objective of the company was to maximize shareholder wealth, project III should be undertaken as this project produced the highest net present value. (ii) Ramm argued that as funds were in short supply investment should be concentrated in those projects with the lowest initial outlay, that is in projects I and II. (iii) Ritter suggested that project III should be accepted on the grounds of risk reduction. Project III has the lowest beta, and by its acceptance the risk of the company (the companys present beta is 1.0) would be reduced. Ritter also cautioned against acceptance of project IV as it was the most risky project; he pointed out that its high net present value was, in part, a reward for its higher level of associated risk. (iv) Punto argued against accepting project III, stating that if the project were discounted at the companys cost of capital, its net present value would be greatly reduced. Requirements: (a) Write a report to the directors of Anhang plc advising them how best to invest the 90 000, assuming the restriction on capital to apply for one year only. Your report should address the issues raised by each of the four directors. (17 marks)

THE APPLICATION OF LINEAR PROGRAMMING TO MANAGEMENT ACCOUNTING

199

(b) Explain why the criteria you have used in (a) above to determine the best allocation of capital may be inappropriate if funds are rationed for a period longer than one year. (4 marks) (c) Describe the procedures available to a company for the selection of projects when capital is rationed in more than one period. (4 marks) (Total 25 marks) ICAEW Financial Management

200

THE APPLICATION OF LINEAR PROGRAMMING TO MANAGEMENT ACCOUNTING

Você também pode gostar

- Overhead VariancesDocumento11 páginasOverhead VariancesDanica VillaganteAinda não há avaliações

- 3.sales Variance AnalysisDocumento38 páginas3.sales Variance Analysiskamasuke hegdeAinda não há avaliações

- Cost ManagementDocumento18 páginasCost ManagementGeo Rublico ManilaAinda não há avaliações

- Finance Assignment InstructionDocumento7 páginasFinance Assignment InstructionJe-Ta CllAinda não há avaliações

- Lecture 5: Interest Rate Risk (Part I) : DR Lixiong Guo Semester 2, 2015Documento31 páginasLecture 5: Interest Rate Risk (Part I) : DR Lixiong Guo Semester 2, 2015studentAinda não há avaliações

- Chapter 7Documento53 páginasChapter 7Baby KhorAinda não há avaliações

- Standard Costing and Variance Analysis: Fall 2007 CrossonDocumento20 páginasStandard Costing and Variance Analysis: Fall 2007 CrossonBernard SalongaAinda não há avaliações

- CH 8Documento16 páginasCH 8emanmamdouh596Ainda não há avaliações

- CH 13Documento28 páginasCH 13ReneeAinda não há avaliações

- Module IV - Working Capital ManagementDocumento50 páginasModule IV - Working Capital ManagementAshwin DholeAinda não há avaliações

- BM Introduction To BankingDocumento36 páginasBM Introduction To BankingNatasha OliviaAinda não há avaliações

- Target Costing Presentation FinalDocumento57 páginasTarget Costing Presentation FinalMr Dampha100% (1)

- International FInanceDocumento3 páginasInternational FInanceJemma JadeAinda não há avaliações

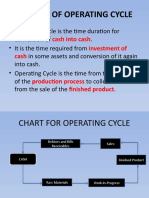

- Concept of Operating Cycle: Cash Into Cash Investment of CashDocumento6 páginasConcept of Operating Cycle: Cash Into Cash Investment of CashVenket RamanaAinda não há avaliações

- Chapter Five: The Financial Statements of Banks and Their Principal CompetitorsDocumento58 páginasChapter Five: The Financial Statements of Banks and Their Principal CompetitorsYoussef Youssef Ahmed Abdelmeguid Abdel LatifAinda não há avaliações

- MCS Assignment - 3Documento13 páginasMCS Assignment - 3MIRAL PATELAinda não há avaliações

- KOCH6Documento63 páginasKOCH6Swati SoniAinda não há avaliações

- Throughput Accounting: Prepared by Gwizu KDocumento26 páginasThroughput Accounting: Prepared by Gwizu KTapiwa Tbone Madamombe100% (1)

- Duration GAP AnalysisDocumento5 páginasDuration GAP AnalysisShubhash ShresthaAinda não há avaliações

- Transfer PricingDocumento57 páginasTransfer PricingbijoyendasAinda não há avaliações

- BEP N CVP AnalysisDocumento49 páginasBEP N CVP AnalysisJamaeca Ann MalsiAinda não há avaliações

- Product Life Cycle Costing / Whole Life Cycle Costing /life Cycle CostingDocumento23 páginasProduct Life Cycle Costing / Whole Life Cycle Costing /life Cycle CostingTapiwa Tbone MadamombeAinda não há avaliações

- Lecture 2: Exchange Rates and The Foreign Exchange Market: TopicsDocumento79 páginasLecture 2: Exchange Rates and The Foreign Exchange Market: TopicsSalvio MachaAinda não há avaliações

- Financial Derivatives: Prof. Scott JoslinDocumento49 páginasFinancial Derivatives: Prof. Scott Joslinarnav100% (2)

- Part Seven: THE Management of Financial InstitutionsDocumento40 páginasPart Seven: THE Management of Financial InstitutionsIrakli SaliaAinda não há avaliações

- Transfer Price Case Study 2Documento1 páginaTransfer Price Case Study 2Professor Sameer Kulkarni100% (5)

- Cash Coversion CYcleDocumento29 páginasCash Coversion CYcleZohaib HassanAinda não há avaliações

- Throughput Accounting: Today's Topics: HomeworkDocumento5 páginasThroughput Accounting: Today's Topics: HomeworkpalaviyaAinda não há avaliações

- ThroughputDocumento15 páginasThroughputVaibhav KocharAinda não há avaliações

- CHP 12 - Strategy, Balanced Scorecard, and Strategic Profitability (With Answers)Documento54 páginasCHP 12 - Strategy, Balanced Scorecard, and Strategic Profitability (With Answers)kenchong7150% (1)

- CVP AnalysisDocumento36 páginasCVP AnalysisNadian100% (1)

- Chapter 4Documento45 páginasChapter 4Yanjing Liu67% (3)

- Activity Based CostingDocumento51 páginasActivity Based CostingAbdulyunus AmirAinda não há avaliações

- Feasibility Study TemplateDocumento6 páginasFeasibility Study TemplateMUTHUVEL MAinda não há avaliações

- Capital BudgetingDocumento31 páginasCapital BudgetinggulafridiAinda não há avaliações

- Cost & Management Accounting - Paper 7Documento7 páginasCost & Management Accounting - Paper 7Turyamureeba JuliusAinda não há avaliações

- Assignment 1 - Investment AnalysisDocumento5 páginasAssignment 1 - Investment Analysisphillimon zuluAinda não há avaliações

- Target - Costing F5 NotesDocumento4 páginasTarget - Costing F5 NotesSiddiqua KashifAinda não há avaliações

- International Finance Lecture SlidesDocumento27 páginasInternational Finance Lecture Slidesmaryam ashfaqAinda não há avaliações

- Target CostingDocumento9 páginasTarget CostingRahul PandeyAinda não há avaliações

- PPT-4 Parity Conditions and Currency ForecastingDocumento42 páginasPPT-4 Parity Conditions and Currency ForecastingKamal KantAinda não há avaliações

- Hierarchy of VariancesDocumento1 páginaHierarchy of VariancesQaisar AbbasAinda não há avaliações

- IMT 58 Management Accounting M3Documento23 páginasIMT 58 Management Accounting M3solvedcareAinda não há avaliações

- Assignment 3Documento7 páginasAssignment 3Abdullah ghauriAinda não há avaliações

- Cost II Chapter ThreeDocumento11 páginasCost II Chapter ThreeSemira100% (1)

- Lecture 2 BEP Numericals AnswersDocumento16 páginasLecture 2 BEP Numericals AnswersSanyam GoelAinda não há avaliações

- Product Costing: Job and Process Operations: Learning Objectives - Coverage by QuestionDocumento45 páginasProduct Costing: Job and Process Operations: Learning Objectives - Coverage by QuestionJoeAinda não há avaliações

- Presented By: Ubaid Azam Wardag Babar Mustafa Muhammad UsmanDocumento13 páginasPresented By: Ubaid Azam Wardag Babar Mustafa Muhammad UsmanShahid AshrafAinda não há avaliações

- Capital Budgeting Techniques Capital Budgeting TechniquesDocumento58 páginasCapital Budgeting Techniques Capital Budgeting TechniquesMuhammad ZeeshanAinda não há avaliações

- 3 - Cost Volume Profit AnalysisDocumento1 página3 - Cost Volume Profit AnalysisPattraniteAinda não há avaliações

- Variable Production Overhead Variance (VPOH)Documento9 páginasVariable Production Overhead Variance (VPOH)Wee Han ChiangAinda não há avaliações

- Chapter 10 SolutionsDocumento68 páginasChapter 10 SolutionsMasha LankAinda não há avaliações

- Pricing PracticesDocumento43 páginasPricing PracticesLeiza FroyaldeAinda não há avaliações

- 324 - International Parity ConditionsDocumento49 páginas324 - International Parity ConditionsTamuna BibiluriAinda não há avaliações

- Topic 2 Support Department Cost AllocationDocumento27 páginasTopic 2 Support Department Cost Allocationluckystar251095Ainda não há avaliações

- Chapter 3 Life Cycle Costing: Answer 1 Target Costing Traditional ApproachDocumento11 páginasChapter 3 Life Cycle Costing: Answer 1 Target Costing Traditional ApproachadamAinda não há avaliações

- Financial Statements, Taxes, and Cash FlowDocumento32 páginasFinancial Statements, Taxes, and Cash Flowhafsa salmanAinda não há avaliações

- Suggested Answers (Chapter 7)Documento7 páginasSuggested Answers (Chapter 7)kokomama231Ainda não há avaliações

- 08 QuestionsDocumento8 páginas08 Questionsw_sampathAinda não há avaliações

- Cost Volume Profit Analysis For Paper 10Documento6 páginasCost Volume Profit Analysis For Paper 10Zaira Anees100% (1)

- MCQs EconomicsDocumento34 páginasMCQs Economicskhalid nazir90% (10)

- Project Report On Inflation NewDocumento78 páginasProject Report On Inflation NewArjun JhAinda não há avaliações

- REVISED NOTES OF FOREIGN EXCHANGE Unit 1 2 - 1Documento40 páginasREVISED NOTES OF FOREIGN EXCHANGE Unit 1 2 - 1komalAinda não há avaliações

- Arithmetic: Problems For PracticeDocumento3 páginasArithmetic: Problems For PracticeArchit HingeAinda não há avaliações

- SubsidiesDocumento5 páginasSubsidiesMahendra ChhetriAinda não há avaliações

- Supply Chain ManagementDocumento2 páginasSupply Chain ManagementAhmed Jan Dahri100% (1)

- The 15 Truths No Coin Dealer Wants You To KnowDocumento36 páginasThe 15 Truths No Coin Dealer Wants You To KnowuighuigAinda não há avaliações

- ValueInvestorInsight Issue 364Documento21 páginasValueInvestorInsight Issue 364freemind3682Ainda não há avaliações

- Chapter 3 MCQs and Analytical Qs Supply and DemandDocumento8 páginasChapter 3 MCQs and Analytical Qs Supply and Demandhamna ikramAinda não há avaliações

- 2012 The Economics of Lotteries A Survey of The LiteratureDocumento40 páginas2012 The Economics of Lotteries A Survey of The LiteratureLe Doan Trung KhangAinda não há avaliações

- Trading GAPS Lazy Trader PDFDocumento12 páginasTrading GAPS Lazy Trader PDFAnonymous LhmiGjO71% (14)

- GBC ECON 101 S1 2023 AssignmentDocumento6 páginasGBC ECON 101 S1 2023 AssignmentBonkAinda não há avaliações

- ENTREP 1 Chapter 5 Opportunity SeizingDocumento92 páginasENTREP 1 Chapter 5 Opportunity SeizingCristineJoyceMalubayIIAinda não há avaliações

- Design BidDocumento57 páginasDesign BidpraveenAinda não há avaliações

- Buying Motives and RoleDocumento20 páginasBuying Motives and RoleBAHHEP BAHHEPAinda não há avaliações

- Assignment On EconomicsDocumento17 páginasAssignment On EconomicsRanganathan ChandrasekhranAinda não há avaliações

- SOL BA Program 1st Year Economics Study Material and Syllabus in PDFDocumento87 páginasSOL BA Program 1st Year Economics Study Material and Syllabus in PDFShamim Akhtar100% (1)

- Fundamentals of Supply and DemandDocumento3 páginasFundamentals of Supply and Demandpierre ejarqueAinda não há avaliações

- Almgren & Chriss - Optimal Execution of Portfolio TransactionsDocumento42 páginasAlmgren & Chriss - Optimal Execution of Portfolio TransactionsehkereiakesAinda não há avaliações

- United States Court of Appeals Second Circuit.: No. 430, Docket 28670Documento8 páginasUnited States Court of Appeals Second Circuit.: No. 430, Docket 28670Scribd Government DocsAinda não há avaliações

- Economics by Nitesh SirDocumento73 páginasEconomics by Nitesh SirKhalid gowharAinda não há avaliações

- Project ManagementDocumento58 páginasProject ManagementAyush VarshneyAinda não há avaliações

- PES Question-Accounting Exercise 2.1 SalamDocumento11 páginasPES Question-Accounting Exercise 2.1 SalamSolomon Tekalign100% (2)

- Commodity MarketingDocumento21 páginasCommodity MarketingNgoni MukukuAinda não há avaliações

- Om Co4 MaterialDocumento51 páginasOm Co4 MaterialvamsibuAinda não há avaliações

- 2019 Fuhrmann B Introduction To Business and EconomicsDocumento64 páginas2019 Fuhrmann B Introduction To Business and EconomicsDaka Radhiyan YahyaAinda não há avaliações

- 9 .Pricing StrategiesDocumento18 páginas9 .Pricing StrategiesMarylyn Tenorio LaxamanaAinda não há avaliações

- Dwnload Full Economics Today The Micro View 19th Edition Miller Solutions Manual PDFDocumento35 páginasDwnload Full Economics Today The Micro View 19th Edition Miller Solutions Manual PDFirisybarrous100% (10)

- Icaew Cfab Mi 2019 Study GuideDocumento42 páginasIcaew Cfab Mi 2019 Study GuideAnonymous ulFku1vAinda não há avaliações

- What Is A Platform?Documento49 páginasWhat Is A Platform?sasobaidAinda não há avaliações