Escolar Documentos

Profissional Documentos

Cultura Documentos

Agrani 1

Enviado por

Mohsinat NasrinDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Agrani 1

Enviado por

Mohsinat NasrinDireitos autorais:

Formatos disponíveis

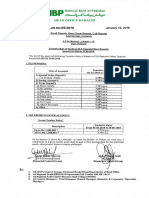

CREDIT RATING REPORT ON AGRANI BANK LIMITED

REPORT: RR/470/10

Address: CRISL Nakshi Homes (4th & 5th Floor), 6/1A, Segunbagicha, Dhaka-1000 Tel: 7173700-1 Fax: 88-02-9565783 Email: crisl@bdonline.com

Analysts:

This is a credit rating report as per the provisions of the Credit Rating Companies Rules 1996 and as per BRPD Circular No. 5 of Bangladesh Bank dated on April 29, 2009. CRISLs entity rating is valid one year for long-term rating and 6 months for short term rating. CRISLs Bank Loan Rating (blr) is valid one year for long term facilities and up-to 365 days (according to tenure of short term facilities) for short term facilities. CRISL followed Corporate Rating Methodology published in CRISL website www.crislbd.com

Long Term Entity Rating as Government Guaranteed Bank Entity Rating as Commercial Bank-2009 Entity Rating as Commercial Bank-2008 Outlook Date of Rating 1.0 RATIONALE AAA A AStable

Short Term ST-1 ST-2 ST-2

Kaniz Fatema kaniz@crislbd.com

6 September, 2010

Entity Rating Long Term: A Short Term: ST-2

Outlook: Stable

AGRANI BANK LIMITED

ACTIVITY

Credit Rating Information and Services Limited (CRISL) reaffirms AAA ( Pronounced as Tripple A) rating for Long Term and ST-1 rating for short term to AGrani Bank Limited (hereinafter referred as ABL) as one of the highly supported, State Owned Commercial Banks (SOCB). The long term rating implies that banks rated in this category are adjudged to be of best quality, offer highest safety and have highest credit quality. Risk factors are negligible and risk free, nearest to risk free Government bonds and securities. Changing economic circumstances are unlikely to have any serious impact on this category of banks. The short term rating implies highest certainty of timely payment. Short-term liquidity including internal fund generation is very strong and access to alternative sources of funds is outstanding, Safety is almost like risk free Government short-term obligations. In addition to the above CRISL also evaluated Agrani Bank Limited as a stand-alone commercial bank without considering the support of the State/Government. Accordingly CRISL assigns A long term rating (Pronounced as Single A) and reaffirms ST-2 short term rating on the basis of financial and other performance upto the period of rating declaration. The above rating has been done in consideration of its fundamentals such as Government support, stable financial performance, good liquidity position, satisfactory internal capital generation rate, slow and steady business growth, satisfactory performance in capital market operation, wide branch network, enhanced product and services and satisfactory delegation of power. However, the above rating was moderated, to some extent, by exposed to capital shortfall risk, unsatisfactory assets quality, declining trend in market share, decline in non-funded business, investment concentration to fewer loan accounts and low loan recovery performance etc. Banks rated in this category are adjudged to offer adequate safety for timely repayment of financial obligations. This level of rating indicates a bank entity with an adequate credit profile. Risk factors are more variable and greater in periods of economic stress than those rated in the higher categories. The short term rating indicates good certainty of timely payment. Liquidity factors and company fundamentals are sound. Although ongoing funding needs may enlarge total financing requirements, access to capital markets is good. Risk factors are small. In view of the above fundamentals and performance, CRISL considers the bank with stable outlook. 2.0 CORPORATE PROFILE

Commercial banking

INCORPORATED (AS PUBLIC LIMITED COMPANY) May 17,2007

CHAIRMAN

Dr. Khondoker Bazlul Hoque

MANAGING DIRECTOR

Mr. Syed Abdul Hamid

EQUITY TK. 9.17 billion ASSETS TK. 211.79 billion LOANS & ADVANCES Tk.122.24 billion DEPOSIT Tk.163.35 billion

2.1 The Genesis Agrani Bank Limited, initially emerged as a Nationalized Commercial Bank under The Bangladesh Banks (Nationalization) order, 1972 (Presidents Order No. 26 of 1972) after the emergence of Bangladesh. On May 17, 2007 the bank was restructured as a State Owned Commercial Bank (SCB) through a vendor agreement by taking over the business, assets, liabilities, rights and obligations. The bank provides a wide range of products to its customers

Você também pode gostar

- Unlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditNo EverandUnlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditAinda não há avaliações

- Crisl Rating Prime Bank LTD 2 PDFDocumento1 páginaCrisl Rating Prime Bank LTD 2 PDFgastro8606342Ainda não há avaliações

- Credit Rating PolicieDocumento1 páginaCredit Rating PolicieAshiqul IslamAinda não há avaliações

- Approved: How to Get Your Business Loan Funded Faster, Cheaper, & with Less StressNo EverandApproved: How to Get Your Business Loan Funded Faster, Cheaper, & with Less StressNota: 5 de 5 estrelas5/5 (1)

- Credit Rating Report On Pinaki Garments LimitedDocumento1 páginaCredit Rating Report On Pinaki Garments LimitedNishita AkterAinda não há avaliações

- Chapter 5 Credit Management Policy of JBLDocumento20 páginasChapter 5 Credit Management Policy of JBLMd. Saiful IslamAinda não há avaliações

- Public Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesNo EverandPublic Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesAinda não há avaliações

- First Security Islami Bank LTDDocumento26 páginasFirst Security Islami Bank LTDIqbal Mahmud Polash0% (1)

- Financing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksNo EverandFinancing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksNota: 5 de 5 estrelas5/5 (1)

- Credit Rating BangladeshDocumento41 páginasCredit Rating BangladeshSumedh PujariAinda não há avaliações

- The Hongkong and Shanghai Banking Corporation Limited, Bangladesh BranchesDocumento4 páginasThe Hongkong and Shanghai Banking Corporation Limited, Bangladesh Branchesjubayer2252Ainda não há avaliações

- PNBDocumento20 páginasPNBShuchita BhutaniAinda não há avaliações

- RatingDocumento4 páginasRatinganumnasikAinda não há avaliações

- Factors Influencing Loan Classification of BHBFC - An EvaluationDocumento11 páginasFactors Influencing Loan Classification of BHBFC - An EvaluationrakhalbanglaAinda não há avaliações

- Basel I: CASA Ratio: The Percentage of Total Bank Deposits That Are in A CASADocumento13 páginasBasel I: CASA Ratio: The Percentage of Total Bank Deposits That Are in A CASApratik deshmukhAinda não há avaliações

- 04-Aug-2018 - 1533294145 - 7. Hints - Indian Economy + Internal SecurityDocumento44 páginas04-Aug-2018 - 1533294145 - 7. Hints - Indian Economy + Internal SecurityMahtab AlamAinda não há avaliações

- Cash Credit (H), Loan Procedure Over National Bank Limited, Khulna BranchDocumento19 páginasCash Credit (H), Loan Procedure Over National Bank Limited, Khulna BranchShuvro Kumar Paul50% (2)

- Chapter One: Introduction: 1.2 Objectives of The ReportDocumento13 páginasChapter One: Introduction: 1.2 Objectives of The ReportshababAinda não há avaliações

- SBI - Credit AppraisalDocumento31 páginasSBI - Credit AppraisalSuvra Ghosh25% (4)

- Redit Ating AgenciesDocumento44 páginasRedit Ating AgencieschumbavambaAinda não há avaliações

- Subscribe: Company BackgroundDocumento4 páginasSubscribe: Company BackgroundSunil KumarAinda não há avaliações

- General Banking - IIDocumento6 páginasGeneral Banking - IIPallaviprasad kasturiAinda não há avaliações

- Research Paper 2Documento7 páginasResearch Paper 2Pooja AgarwalAinda não há avaliações

- Interim Report ModifiedDocumento37 páginasInterim Report ModifiedsrikanthkgAinda não há avaliações

- Credit Rating Report On Dana Sweater Industries LimitedDocumento1 páginaCredit Rating Report On Dana Sweater Industries LimitedMdBelaluddinAinda não há avaliações

- Credit AwarenessDocumento62 páginasCredit AwarenessHimanshu Mishra100% (1)

- Credit Appraisal System of Commercial Vehicle Loans.Documento43 páginasCredit Appraisal System of Commercial Vehicle Loans.Pravin Kolpe92% (12)

- Project Credit RatingDocumento92 páginasProject Credit Ratingtulasinad123Ainda não há avaliações

- About IndustryDocumento36 páginasAbout IndustryHardik AgarwalAinda não há avaliações

- BSRM Credit Rating ReportDocumento1 páginaBSRM Credit Rating ReportRadioactivekhanAinda não há avaliações

- Business Standard-The M&M-RBL Bank Saga by Tamal BandyopadhyayDocumento1 páginaBusiness Standard-The M&M-RBL Bank Saga by Tamal BandyopadhyayGarima ChaudhryAinda não há avaliações

- Case Study On Loan Portfolio of Southeast Bank LimitedDocumento31 páginasCase Study On Loan Portfolio of Southeast Bank LimitedMahi MaheshAinda não há avaliações

- Circular Risk Capital Assistance For Msme UnitsDocumento7 páginasCircular Risk Capital Assistance For Msme Unitss.k.pandeyAinda não há avaliações

- Research Paper On Corporate Debt RestructuringDocumento5 páginasResearch Paper On Corporate Debt Restructuringefj02jba100% (1)

- Credit RatingDocumento8 páginasCredit RatingchandanchiksAinda não há avaliações

- IDFC BankDocumento12 páginasIDFC Bankdrmadmax1963Ainda não há avaliações

- Insurance Among The Least Profitable Across Asia Business Standard 24 November, 2011Documento1 páginaInsurance Among The Least Profitable Across Asia Business Standard 24 November, 2011Dr Vidya S SharmaAinda não há avaliações

- Project 26.05.2022Documento56 páginasProject 26.05.2022Targget CafeAinda não há avaliações

- Chapter1: Introduction: Nonperforming Asset in BankDocumento35 páginasChapter1: Introduction: Nonperforming Asset in BankMaridasrajanAinda não há avaliações

- PacraDocumento6 páginasPacraJunaid KhalidAinda não há avaliações

- Credit Appraisal & RenewalDocumento56 páginasCredit Appraisal & Renewalshaad_g100% (3)

- Mba Finance ProjectDocumento23 páginasMba Finance ProjectPriya SivakumarAinda não há avaliações

- CRISIL SME RatingsDocumento11 páginasCRISIL SME RatingsParesh NainvaniAinda não há avaliações

- Fahana Najnin Rajib SirDocumento24 páginasFahana Najnin Rajib Sirmrs solutionAinda não há avaliações

- Credit Appraisal in Banking Sector PPT at Bec DomsDocumento31 páginasCredit Appraisal in Banking Sector PPT at Bec DomsBabasab Patil (Karrisatte)100% (2)

- Rating Criteria For Finance CompaniesDocumento12 páginasRating Criteria For Finance CompaniesGupta AdityaAinda não há avaliações

- DCB Bank Buy Emkay ResearchDocumento23 páginasDCB Bank Buy Emkay ResearchGreyFoolAinda não há avaliações

- Non Performing Assets BasitDocumento20 páginasNon Performing Assets Basitshaykh basharatAinda não há avaliações

- Credit Rating AND Term Loans: Presented By: Hemant Kumar Upadahyay Pawan Kumar Ravi Kumar Sonika SharmaDocumento28 páginasCredit Rating AND Term Loans: Presented By: Hemant Kumar Upadahyay Pawan Kumar Ravi Kumar Sonika SharmaSush KaushikAinda não há avaliações

- Non Performing AssetsDocumento24 páginasNon Performing AssetsAmarjeet DhobiAinda não há avaliações

- Research Paper On NpaDocumento4 páginasResearch Paper On Npaafeazleae100% (1)

- CRISIL Ratings - Report - Pandemic To Weigh On India Inc Credit Quality - 03april2020 PDFDocumento32 páginasCRISIL Ratings - Report - Pandemic To Weigh On India Inc Credit Quality - 03april2020 PDFmurthyeAinda não há avaliações

- Non Performing Assets 111111Documento23 páginasNon Performing Assets 111111renika50% (2)

- CIBILDocumento24 páginasCIBILSarthak GuptaAinda não há avaliações

- Analysis of Ratio Bank BcaDocumento6 páginasAnalysis of Ratio Bank BcaArya SingaAinda não há avaliações

- Sandeep GurungDocumento18 páginasSandeep GurungVijayKumar NishadAinda não há avaliações

- M.Phil. Student, MDU Rohtak Associate Professor, Dept. of Commerce Govt. College, BhiwaniDocumento2 páginasM.Phil. Student, MDU Rohtak Associate Professor, Dept. of Commerce Govt. College, BhiwaniAmandeep Singh MankuAinda não há avaliações

- PNB Summer Internship ReportDocumento90 páginasPNB Summer Internship ReportAnil Anayath88% (42)

- 1.1history of BankingDocumento18 páginas1.1history of BankingHarika KollatiAinda não há avaliações

- Distressed Homeowner GuideDocumento9 páginasDistressed Homeowner GuideJim HamiltonAinda não há avaliações

- The Accounting Cycle: Reporting Financial Results: Mcgraw-Hill/IrwinDocumento28 páginasThe Accounting Cycle: Reporting Financial Results: Mcgraw-Hill/Irwinazee inmixAinda não há avaliações

- Guarantee Dormant AccountsDocumento2 páginasGuarantee Dormant AccountsOo Oo Min KhantAinda não há avaliações

- Capital Budgeting Process - (Module 9, Updated)Documento51 páginasCapital Budgeting Process - (Module 9, Updated)demure claw19Ainda não há avaliações

- Valenzuela - Workshop 4Documento3 páginasValenzuela - Workshop 4Weiyee ValenzuelaAinda não há avaliações

- The Financial Sector and The Role of Banks in Economic DevelopmentDocumento6 páginasThe Financial Sector and The Role of Banks in Economic Developmentpravas ranjan beheraAinda não há avaliações

- Case Study - The Co Operative BankDocumento1 páginaCase Study - The Co Operative BankMahesh MochiAinda não há avaliações

- Operational Support Client Forum PDFDocumento129 páginasOperational Support Client Forum PDFASDFGHTAinda não há avaliações

- Our Lady of The Pillar College Cauayan: Prelim Examination Accounting 1 &2Documento8 páginasOur Lady of The Pillar College Cauayan: Prelim Examination Accounting 1 &2John Lloyd LlananAinda não há avaliações

- SMS Syntax For Non-Financial Transactions: SMS Short Code: 6556Documento2 páginasSMS Syntax For Non-Financial Transactions: SMS Short Code: 6556scrdAinda não há avaliações

- Questioning Tool: Accounting Firm's Standards Are As High As They Should Be?Documento2 páginasQuestioning Tool: Accounting Firm's Standards Are As High As They Should Be?Jeremy Ortega100% (1)

- Afar04 Business Combinations Mergers ReviewersDocumento17 páginasAfar04 Business Combinations Mergers ReviewersPam G.100% (6)

- Project TopicsDocumento2 páginasProject Topicsnandsa_ju2853% (19)

- CashDocumento3 páginasCashDahirAinda não há avaliações

- IDfC FD CertificateDocumento3 páginasIDfC FD Certificatenisha bhardwaj100% (1)

- Japfa Comfeed India PVT LTDDocumento2 páginasJapfa Comfeed India PVT LTDNaresh GanugulaAinda não há avaliações

- Account Summary: MalaysiaDocumento4 páginasAccount Summary: MalaysiaOmar MuhdAinda não há avaliações

- Debit CardDocumento22 páginasDebit CardDivya GoelAinda não há avaliações

- IYF8 GV LV YIWKdbyDocumento14 páginasIYF8 GV LV YIWKdbyArshadAinda não há avaliações

- A Project On: Submitted To University of Pune For The Partial Fulfilment of Master of Business AdministrastionDocumento69 páginasA Project On: Submitted To University of Pune For The Partial Fulfilment of Master of Business AdministrastionharshAinda não há avaliações

- Regions Bank StatementDocumento2 páginasRegions Bank StatementGalarraga H AbrahamAinda não há avaliações

- A Use The Capm To Compute The Required Rate ofDocumento2 páginasA Use The Capm To Compute The Required Rate ofDoreenAinda não há avaliações

- Habib MetroDocumento50 páginasHabib MetroMuhammad Fazal SaeedAinda não há avaliações

- Tentative Rates of Return On PLSDeposits OtherDepositsDocumento1 páginaTentative Rates of Return On PLSDeposits OtherDepositsAliAinda não há avaliações

- Reviewer - Cash & Cash EquivalentsDocumento5 páginasReviewer - Cash & Cash EquivalentsMaria Kathreena Andrea Adeva100% (1)

- Quiz 4Documento7 páginasQuiz 4Vivienne Rozenn LaytoAinda não há avaliações

- Standard Offer Letter For Regular CA CustomersDocumento3 páginasStandard Offer Letter For Regular CA CustomersmaheshvkrishnaAinda não há avaliações

- Republic vs. First National City Bank of New YorkDocumento7 páginasRepublic vs. First National City Bank of New YorkFD BalitaAinda não há avaliações

- Ifrs at A Glance IFRS 12 Disclosure of Interest: in Other EntitiesDocumento6 páginasIfrs at A Glance IFRS 12 Disclosure of Interest: in Other EntitiesNoor Ul Hussain MirzaAinda não há avaliações

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeNo EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeNota: 4.5 de 5 estrelas4.5/5 (89)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryNo EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryNota: 4 de 5 estrelas4/5 (26)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureNo EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureNota: 4.5 de 5 estrelas4.5/5 (100)

- How to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobNo EverandHow to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobNota: 4.5 de 5 estrelas4.5/5 (37)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurNo Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurNota: 4 de 5 estrelas4/5 (2)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverNo EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverNota: 4.5 de 5 estrelas4.5/5 (186)

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyNo EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyNota: 5 de 5 estrelas5/5 (22)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0No EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Nota: 5 de 5 estrelas5/5 (1)

- The First Minute: How to start conversations that get resultsNo EverandThe First Minute: How to start conversations that get resultsNota: 4.5 de 5 estrelas4.5/5 (57)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveAinda não há avaliações

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthNo EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthNota: 4.5 de 5 estrelas4.5/5 (1026)

- Unlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsNo EverandUnlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsNota: 4.5 de 5 estrelas4.5/5 (28)

- Billion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsNo EverandBillion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsNota: 4.5 de 5 estrelas4.5/5 (52)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizNo EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizNota: 4.5 de 5 estrelas4.5/5 (112)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldNo Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldNota: 5 de 5 estrelas5/5 (20)

- How to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersNo EverandHow to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersNota: 4.5 de 5 estrelas4.5/5 (95)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsNo EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsNota: 5 de 5 estrelas5/5 (48)

- The Master Key System: 28 Parts, Questions and AnswersNo EverandThe Master Key System: 28 Parts, Questions and AnswersNota: 5 de 5 estrelas5/5 (62)

- Every Tool's a Hammer: Life Is What You Make ItNo EverandEvery Tool's a Hammer: Life Is What You Make ItNota: 4.5 de 5 estrelas4.5/5 (249)

- The Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceNo EverandThe Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceNota: 5 de 5 estrelas5/5 (22)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeNo EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeNota: 4.5 de 5 estrelas4.5/5 (58)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessNo EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessNota: 4.5 de 5 estrelas4.5/5 (407)

- Spark: How to Lead Yourself and Others to Greater SuccessNo EverandSpark: How to Lead Yourself and Others to Greater SuccessNota: 4.5 de 5 estrelas4.5/5 (132)

- The Introverted Leader: Building on Your Quiet StrengthNo EverandThe Introverted Leader: Building on Your Quiet StrengthNota: 4.5 de 5 estrelas4.5/5 (35)

- The 7 Habits of Highly Effective People: 30th Anniversary EditionNo EverandThe 7 Habits of Highly Effective People: 30th Anniversary EditionNota: 5 de 5 estrelas5/5 (337)