Escolar Documentos

Profissional Documentos

Cultura Documentos

New Text Document

Enviado por

Raviteja BathinaDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

New Text Document

Enviado por

Raviteja BathinaDireitos autorais:

Formatos disponíveis

Dataflow diagrams are depictured below to give the clear understanding of Online Banking Application.

The Online banking Application project will be divided into 4 modules namely: 1. Bank Account 2. Bank Account Administrator 3. Credit Card Customer 4. Credit Card Account Administrator Module 1 In this module the customer is allowed to logon to the website and can access hi s/her account by getting user name and password which will be verified with the server and the database. Once he/she gets verified then they are allowed to view their personal account and perform operations such as change of address, paying bills online, viewing transactions and transferring money into other accounts. The data will be highly secured using Secure Socket Layer (SSL) technology. Once the customer finishes the task the update information instantly gets stored into the database. The customer is then allowed to sign out from his/her account. Module 2 In this module the administrator is allowed to log on to the website and can acc ess his/her administrative account by using the user name and password which will then be ve rified with the database. Once he/she gets verified the administrative interface will b e displayed, where the administrator can perform operations for both new customers and existing customers. Administrator will help a new customer in opening their acco unt by taking complete information from them. Administrator provides services like with drawal, deposit, transfer and deleting customer during the time of closing the account. In this module administrator provides great customer service to the customers who want t o do phone banking or teller banking. The data will be highly secured using Secure So cket Layer (SSL) technology. The interface for administrator will be both very user f riendly and efficient. The data gets stored in the database instantly when the administr ator hits the submit button. Module 3 In this module, the customer is allowed to apply for the credit cards (Student, Premium and Basic) or for the loan (home, auto and education). Depending upon their sele ction the corresponding page will be shown when they will be asked to fill out the form. Depending on the credit rating the customer will be either accepted or rejected. Usually the credit rating will be checked with national credit bureau, which will be int ernally connected to INS and Social Security office database. Once the customer gets app roved 7 for the credit card or loan, their credit card will be sent to them by postal se

rvice. Once they decided to register themselves to an online credit card banking they enroll by using the enroll form, where they will be asked to enter their credit card number, the ir Social Security Number and user defined password(Numbers only). To access the account, customers should visit the credit card website and get ve rified with the database by entering the user name and the password they have created. If the verification is successful then they will be allowed to view their credit card a ccount which will display information about their credit limit and balance. They are al so allowed to make online bill payments using their credit card account. As this module con tains allimportant data like credit card numbers, account user name and password and online bill payments, it needs to be secure, therefore Secure Socket Layer (SSL) will be use d. It encrypts the data before it is sent and gets decrypted at the server and vise-ve rsa. This will prevent the hackers to view the data, which is being transferred through an y media. Module 4 In this module the administrator is allowed to log on to the website and will be allowed to access his/her administrative account by using its user name and password which will then gets verified with the database. Depending upon their authentication, the administrative page will be displayed, where administrator is allowed to assign credit limits for the customer depending upon what kind of request the customer has mad e. The administrator will be allowed to put a hold on the credit card account for secur ity reasons, like lost/stolen credit card and this facility will protect customer information from getting misused by others. Once the administrator selects the type of card or loan reque sted and the social security number from the database on a single click the credit limit will be assigned. There will be a special field in the database, which will allow the ad ministrator to keep track of the customers who have already been issued their cards. The application will be having other functionalities such as: Password retrieval for existing customer. Locator [in case of teller banking] Career at the bank. Enrollment for online banking. The application will be using a backend as MS- Access database, all the front-en d will be written in Java Server Pages (JSP) and Jakarta Tomcat application server will be used as a middle ware which will take care of the connection between front-end and backe nd.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Getoutofdebtfree - Ebook-Uk PDFDocumento74 páginasGetoutofdebtfree - Ebook-Uk PDFWilliam Styles100% (2)

- FinalONLINE TRANSACTION INDEXDocumento2 páginasFinalONLINE TRANSACTION INDEXLaraya, Roy MatthewAinda não há avaliações

- Impact of Cryptocurrency on Global EconomyDocumento13 páginasImpact of Cryptocurrency on Global EconomyTanvir AhmedAinda não há avaliações

- Coinbase User Agreement As of January 31 2019Documento38 páginasCoinbase User Agreement As of January 31 2019Hugh WoodAinda não há avaliações

- Become Debt Free Now by Gregory Mannarino.Documento20 páginasBecome Debt Free Now by Gregory Mannarino.momentumtrader100% (1)

- Debt Rebuttals SpielDocumento2 páginasDebt Rebuttals SpielFrancisJayson SalcedoAinda não há avaliações

- Fiyaj Ali BillDocumento4 páginasFiyaj Ali BillVIKASHAinda não há avaliações

- Group Rooms Agreement Template ExampleDocumento3 páginasGroup Rooms Agreement Template ExampleFazla HaisamAinda não há avaliações

- MOTO Card Authorisation Form (F - FINANCE AR - V202102)Documento1 páginaMOTO Card Authorisation Form (F - FINANCE AR - V202102)Monseiur FarhanAinda não há avaliações

- Reading ComprehensionDocumento22 páginasReading Comprehensionwawa6462Ainda não há avaliações

- ABTA Quarterly Winter 2018Documento36 páginasABTA Quarterly Winter 2018JulieAinda não há avaliações

- GUIDE For JAPANDocumento92 páginasGUIDE For JAPANSuzata SharmaAinda não há avaliações

- Travel and Expense Policy V1Documento14 páginasTravel and Expense Policy V1Damien FloresAinda não há avaliações

- StatementjDocumento4 páginasStatementjCerise MahAinda não há avaliações

- Longmont Winter Spring 2022 BrochureDocumento44 páginasLongmont Winter Spring 2022 BrochureCity of Longmont, ColoradoAinda não há avaliações

- Jeopardy - EverFi High SchoolDocumento26 páginasJeopardy - EverFi High SchoolChrisAinda não há avaliações

- FSRS NetBenefits AccessCardSM FAQSDocumento6 páginasFSRS NetBenefits AccessCardSM FAQSKris LymanAinda não há avaliações

- (Please Write The Name That Appears On Your Card) : PNB Credit Card Rewards Redemption FormDocumento1 página(Please Write The Name That Appears On Your Card) : PNB Credit Card Rewards Redemption FormJane PulmaAinda não há avaliações

- Your Verizon ReceiptDocumento3 páginasYour Verizon ReceiptnfdshdfabasAinda não há avaliações

- GrammerDocumento5 páginasGrammerALICE GRIGORAS50% (2)

- CAses SOlution MalhotraDocumento60 páginasCAses SOlution MalhotramanzakAinda não há avaliações

- Insurance Product Information Document (IPID) : International Student Insurance EuropeDocumento2 páginasInsurance Product Information Document (IPID) : International Student Insurance EuropeHoàng ĐứcAnhAinda não há avaliações

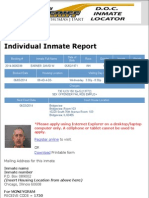

- Cook County Sheriff Inmate Locator Search ResultsDocumento3 páginasCook County Sheriff Inmate Locator Search Resultsapi-214091549Ainda não há avaliações

- Lembar Kerja AkuntansiDocumento75 páginasLembar Kerja AkuntansifaiqAinda não há avaliações

- PAY OFF CREDIT CARD DEBT IN 12 MONTHSDocumento18 páginasPAY OFF CREDIT CARD DEBT IN 12 MONTHSBrahmanand SinghAinda não há avaliações

- Some of The More Common Accounting Best Practices IncludeDocumento6 páginasSome of The More Common Accounting Best Practices IncludeCalvince OumaAinda não há avaliações

- Catálogo Ferree's ToolsDocumento224 páginasCatálogo Ferree's ToolsLuiggi Fornicalli100% (1)

- Credit Card Bill PaymentsDocumento1 páginaCredit Card Bill Paymentsarpit shahAinda não há avaliações

- Tarjetas de Credito EcuadorDocumento11 páginasTarjetas de Credito EcuadorMichael GarzonAinda não há avaliações

- TNC For Sow Flipkart Voucher OfferDocumento4 páginasTNC For Sow Flipkart Voucher OfferMohammed NajmuddinAinda não há avaliações