Escolar Documentos

Profissional Documentos

Cultura Documentos

NMP Apr11 Eedition

Enviado por

Andrew T. BermanDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

NMP Apr11 Eedition

Enviado por

Andrew T. BermanDireitos autorais:

Formatos disponíveis

P R E S O R T E D S T A N D A R D

U . S . P O S T A G E P A I D

N M P M E D I A C O R P .

N M P M E D I A C O R P .

1 2 2 0 W A N T A G H A V E N U E

W A N T A G H , N E W Y O R K 1 1 7 9 3

www.streetlinks.com | 1.800.778.4947

FACT - You can manage YOUR appraisal process with YOUR employees.

FACT - You can use YOUR own appraiser panel.

FACT - Without StreetLinks LenderX appraisal software, you WILL fail at

self-managed appraisal execution and compliance.

Spreadsheets and emails simply wont stand up to compliance audits

and inferior systems lack the features you need to manage the entire

appraisal process, including appraiser payables and accounting.

StreetLinks LenderX helps you do it yourself from start to fnish.

Our Guarantee: If, after previewing the StreetLinks LenderX

platform, you dont agree that its the best in the industry, well

donate $1000 to your favorite recognized charity.

Take Appraisal Management into Your Own Hands

MORE

OF A

Call 1.800.778.4947 to talk to a

solution consultant today.

>

Why the Future is Bound to be Paperless

By Rene Rodriguez 28

Going Paperless: The Technology is Ready the People

Are Not By Chris Knowlton 29

Help Clients Go Green With FHA By Jeff Mifsud 30

Three Ways Your LOS Can Help You Go Green

By BJ Bounds 30

The Color of Money is Getting Greener By Dain Ehring 32

Americas Greenest Mortgage Companies 36

In Memoriam: Armand Cosenza

By James L. Nabors, CMC, CRMS 12

Value Nation: Tempering the American Dream

By Charlie W. Elliott Jr., MAI, SRA, ASA 13

The NAMB Perspective 14

The Secondary Market Overview: From Bonds

to Production Things Are Not Always what

They Seem on the Yellow Brick Road By Dave Hershman 16

Leaders on the Frontline: A Critical Value for

Community Building By Stewart Hunter and Jim McMahan 17

Getting the Most Out of LinkedIn By Katrina Lennon 19

NMP Mortgage Professional of the Month:

Chad Jampedro, COO, GSF Mortgage Corporation 20

The Brokers Future: an Overview of

the New Commission Landscape By Steven A. Milner 23

Forward on Reverse: FIT for Reverse Mortgage

Lenders (Part VIII) Out of Pocket Burn-Through Risk

By Atare E. Agbamu 26

Lykken on Leadership: Conviction A Key Ingredient

of Leadership By David Lykken 27

NMP News Flash: April 2011 4

Heard on the Street 8

New to Market 22

Mortgage Heroes 24

NMP Mortgage Professional Resource Registry 40

NMP Calendar of Events 44

1

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

O

N

A

T

I

O

N

A

L

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

A

P

R

IL

2

0

1

1

Visit

NationalMortgageProfessional.com.

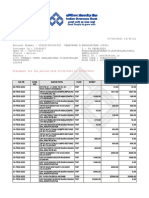

COMPANY WEB SITE PAGE

Accurate Quality Control .................................. www.accurateqc.com ............................................4

Bay Equity LLC ................................................ www.bayeq.com ..................................................38

Benchmark Mortgage ...................................... www.iambenchmark.info ......................................17

Calyx Software ................................................ www.calyxsoftware.com ......................................18

Comergence Compliance Monitoring, LLC .......... www.comergencecompliance.com ........................10

Elliott and Company Appraisers, Inc................... www.appraisalanywhere.com ................................13

Flagstar Wholesale Lending .............................. www.wholesale.flagstar.com ....................Back Cover

Freedom Mortgage .......................................... www.fmbranch.com ......................Inside Back Cover

Frost Mortgage Lending Group .......................... www.frostmortgage.com/nmp ..............................35

GSF Mortgage Corporation ................................ www.gsfprobranch.com ........................................33

Guaranteed Home Mortgage.............................. www.joinguaranteed.com ......................................9

HVCC Appraisal Ordering .................................. www.hvccappraisalordering.com ..........................13

Majestic Security LLC ........................................ www.majesticsecurityidsafe.com/nmp.htm ............25

MortgageProShop.com...................................... www.mortgageproshop.com ..................................44

Mortgage Dashboard ........................................ www.mortgagedashboard.com ..............................11

Nationwide Equities Corp. ................................ www.nwecorp.com ..............................................39

PB Financial Group Corp. .................................. pbfinancialgrp.com ..............................................29

REMN (Real Estate Mortgage Network)................ www.remnwholesale.com ....................................34

Ridgewood Savings Bank .................................. www.ridgewoodbank.com ......................................8

StreetLinks National Appraisal Services .............. www.streetlinks.com/SCORe ..........Inside Front Cover

TMS Funding.................................................... www.tmsfunding.com ............................................6

United Northern Mortgage Bankers Ltd. ............ www.unitednorthern.jobs................................7 & 31

US Mortgage .................................................... www.usmortgage.com ............................................5

USA Cares ........................................................ www.usacares.org ................................................24

Windvest Corporation ...................................... www.windvestcorp.com ........................................19

National Mortgage Professional Magazine

TABLE OF CONTENTS

N

A

T

I

O

N

A

L

M

O

RTGAGE P

R

O

F

E

S

S

I

O

N

A

L

M

AGAZI N

E

N

M

P N

M

P

Special Focus on

Going Green/Paperless

Features

Columns

April 2011 Volume 3, Number 4

A Message From NMP Media Corp.

Executive Vice President Andrew T. Berman

Going green in the mortgage space

Twenty-plus years ago when I first entered the mortgage industry, I never thought Id

hear the word paperless in the same sentence as mortgages. At the time, I was see-

ing files in our shop that were three inches thick at a minimum. As time went on, those

files grew and grew (especially FHA files and at least twice the file size for 203k deals).

Yet here we are in 2011, with a large number of mortgage companies running at 75 per-

cent to 100 percent paperless. You can find some of these companies on pages 36-37 in

our Americas Greenest Mortgage Companies feature.

This months focus on Going Green/Paperless includes some great submissions.

Folks like Mortgage Dashboards Chief Executive Officer Rene Rodriguez writing about the rush to paper-

less being more than just going green, but as a requirement of doing business. Inlantas VP of Technology

and Marketing Chris Knowlton discussing some of the obstacles mortgage companies face when going

paperless. Our FHA expert, Jeff Mifsud, explaining how FHA can help your company cater to borrowers

seeking mortgages for green projects. Calyxs BJ Bounds shares some tools that are available to you as well

as how going green can save you green in your bottom line. The section wraps up with a piece from

CoreLogic Dorados CEO Dain Ehring about all the driving forces that push going green into the forefront

of mortgage companies.

NAMB in action fighting for the mortgage industry

In March, I had the pleasure of attending the National Association of Mortgage Brokers 2011 Legislative &

Regulatory Conference in Washington, D.C. There were more than 200 mortgage professionals from around

the country present to get updates from NAMB and officials from the U.S. Department of Housing & Urban

Development (HUD), participate in networking functions, and lobby on Capitol Hill. The most impressive

part of the event was attending the meetings NAMB members had with their elected members of the House

and Senate.

While it seemed that the meetings were all just show and legislators appeasing their constituents,

several of those meetings resulted in letters in support of NAMBs position on the Feds loan origina-

tor compensation rule. Theres more on the NAMB 2011 Legislative Conference on page 14 of this

issue.

Mortgage Professional of the Month Chad Jampedro

I had the pleasure of meeting with Chad Jampedro from GSF Mortgage Corporation for this months NMP

Mortgage Professional of the Month. I really think one of the major factors behind Chads success is his

well-rounded career path. Chad started at the other end of the mortgage industry in the servicing depart-

ment for a big bank. You can read more about Chad on page 20.

Remembering a great friend of the industry Armand Cosenza

Earlier this month, the world lost a truly classy gentleman in Armand Cosenza. I see his face with that

forever grin, the same grin that greeted me when I took my first mortgage convention road trip to icy

cold Cleveland for the Ohio Association of Mortgage Brokers Annual Convention. Armands warm smile

and hospitality was a sigh of relief as we entered the state-specific mortgage publishing business.

Armand was a crucial supporter in helping us see this vision, as we expanded from Ohio into other

states. We got to know the real Armand and his devotion to our profession but more importantly, saw

his dedication to and the pride for his family. He will be missed! Our condolences and sympathies go

out to his family and friends. May he continue to live forever in our hearts as the wonderful memories

of his rich life carry forward.

Until next month

Andrew T. Berman, Executive Vice President

NMP Media Corp.

2

A

P

R

IL

2

0

1

1

O

N

A

T

I

O

N

A

L

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

April 2011

Volume 3 Number 4

1220 Wantagh Avenue Wantagh, NY 11793-2202

Phone: (516) 409-5555 / (888) 409-9770

Fax: (516) 409-4600

Web site: NationalMortgageProfessional.com

Mortgage

PROFESSIONAL

N A T I O N A L

M A G A Z I N E

Your source for the latest on originations, settlement, and servicing

STAFF

Eric C. Peck

Editor-in-Chief

(516) 409-5555, ext. 312

ericp@nmpmediacorp.com

Andrew T. Berman

Executive Vice President

(516) 409-5555, ext. 333

andrew@nmpmediacorp.com

Domenica Trafficanda

Art Director

domenicat@nmpmediacorp.com

Karen Krizman

Senior National Account Executive

(516) 409-5555, ext. 326

karenk@nmpmediacorp.com

Jon Blake

Advertising Coordinator

(516) 409-5555, ext. 301

jonb@nmpmediacorp.com

Tara Cook

Billing Coordinator

(516) 409-5555, ext. 324

tarac@nmpmediacorp.com

ADVERTISING

To receive any information regarding advertising rates, deadlines and require-

ments, please contact Senior National Account Executive Karen Krizman at

(516) 409-5555, ext. 326 or e-mail karenk@nmpmediacorp.com.

ARTICLE SUBMISSIONS/PRESS RELEASES

To submit any material, including articles and press releases, please

contact Editor-in-Chief Eric C. Peck at (516) 409-5555, ext. 312 or e-mail

ericp@nmpmediacorp.com. The deadline for submissions is the first of

the month prior to the target issue.

SUBSCRIPTIONS

To receive subscription information, please call (516) 409-5555, ext.

301; e-mail orders@nmpmediacorp.com or visit www.nationalmort-

gageprofessional.com. Any subscription changes may be made to the

attention of Circulation via fax to (516) 409-4600.

Statements, articles and opinions in National Mortgage Professional Magazine

are the responsibility of the authors alone and do not imply the opinion or

endorsement of NMP Media Corp., or the officers or members of National

Association of Mortgage Brokers and its State Affiliates (NAMB), National

Association of Professional Mortgage Women (NAPMW), National Credit

Reporting Association (NCRA) and/or other state mortgage trade associations.

Participation in NAMB, NAPMW, NCRA, and/or other state mortgage

trade associations events, activities and/or publications is available on

a non-discriminatory basis and does not reflect the endorsement of the

product and/or services by NMP Media Corp., NAMB, NAPMW, NCRA,

and other state mortgage trade associations.

National Mortgage Professional Magazine, NAMB, NAPMW, NCRA,

and/or other state mortgage trade associations do not make any misrepre-

sentations or warranties concerning the regulatory and/or compliance

aspects of advertisers, products or services and/or the editorial content con-

tained in NMP Media Corp. publications. National Mortgage Professional

Magazine and NMP Media Corp. reserve the right to edit, reject and/or post-

pone the publication of any articles, information or data.

National Mortgage Professional Magazine

is published monthly by NMP Media Corp.

Copyright 2011 NMP Media Corp.

N

A

T

IO

N

A

L

M

O

RTGAGE PR

O

F

E

S

S

IO

N

A

L

M

AGAZI N

E

N

M

P N

M

P

Lykken on Lending is a weekly 60-minute show hosted by mortgage veteran of 37 yrs, David Lykken,

along with special guest Alice Alvey & Joe Farr as well as featured special guests. Each week we provide

our listeners with up-to-the-minute information of what is happening in mortgage and housing industry.

Sign-on weekly at nmpmag.com/lykkenonlending

3

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

O

N

A

T

I

O

N

A

L

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

A

P

R

IL

2

0

1

1

National Credit Reporting Association Inc.

125 East Lake Street, Suite 200 O Bloomingdale, IL 60108

Phone #: (630) 539-1525 O Fax #: (630) 539-1526

Web site: www.ncrainc.org

The National Association of

Mortgage Brokers

11325 Random Hills Road, Suite 360

Fairfax, VA 22030

Phone #: (703) 342-5900 O Fax #: (703) 342-5905

PresidentMichael DAlonzo, CMC

Creative Mortgage Group

1126 Horsham Road, Suite D

Maple Glen, PA 19002

(215) 657-9600 O mjdalonzo@hotmail.com

Vice PresidentDonald J. Frommeyer, CRMS

Amtrust Mortgage Funding Inc.

200 Medical Drive, Suite D

Carmel, IN 46032

(317) 575-4355 O dfrommeyer@amtrust.net

SecretaryVirginia Ferguson, CMC

Heritage Valley Mortgage Inc.

5700 Stoneridge Mall Road, Suite 225

Pleasanton, CA 94588

(925) 469-0100 O hvm1@msn.com

TreasurerJohn Councilman, CMC,CRMS

AMC Mortgage Corporation

2613 Fallston Road

Fallston, MD 21047

(410) 557-6400 O jlc@amcmortgage.com

Immediate Past PresidentJim Pair, CMC

Mortgage Associates Corpus Christi

6262 Weber Road, Suite 208

Corpus Christi, TX 78413

(361) 853-9987 O jlpair@aol.com

Michael Anderson, CRMS

Essential Mortgage

3029 S. Sherwood Forest Boulevard, Suite 200

Baton Rouge, LA 70816

(225) 297-7704 O mikea@essentialmtg.com

Donald Fader, CRMS

SMC Home Finance

P.O. Box 1376

Kinston, NC 28503-1376

(252) 523-5800 O dfader@smchf.com

Deb Killian, CRMS

Charter Oak Lending Group LLC

3 Corporate Drive, P.O. Box 3196

Danbury, CT 06813-3196

(203) 778-9999, ext. 103 O debkillian@snet.net

Olga Kucerak, CRMS

Crown Lending

222 East Houston, Suite 1600

San Antonio, TX 78205

(210) 828-3384 O olga@crownlending.com

Walter Scott

Excalibur Financial Inc.

175 Strafford Avenue, Suite 1

Wayne, PA 19087

(215) 669-3273 O wscott.afcs@gmail.com

Tom Conwell

President

(248) 473-7400

tconwell@credittechnologies.com

Donald J. Unger

Vice President

(303) 670-7993, ext. 222

don@advcredit.com

Daphne Large

Treasurer

(901) 259-5105

daphnel@datafacts.com

Marty Flynn

Ex-Officio

(925) 831-3520, ext. 224

marty@ccireports.com

William Bower

DirectorTenant Screening Chair

(800) 288-4757

wbower@confinfo.com

Mike Brown

DirectorTechnology Chair

(800) 285-6691

mike.brown@ncogroup.com

Susan Cataldo

DirectorEducation & Compliance Chair

(404) 303-8656, ext. 204

susancds@cdsusa.net

Janet Curtis

DirectorNew Membership

& Elections Co-Chair

(212) 224-6121

jcurtis@sarma.com

Renee Erickson

DirectorTenant Screening Co-Chair

(800) 311-1585, ext. 2101

renee@zipreports.com

Nancy Fedich

DirectorConference Chair

(908) 813-8555, ext. 3010

nancy@cisinfo.net

Judy Ryan

DirectorNew Membership

& Elections Chair

(800) 929-3400, ext. 201

jryan@kroll.com

Tom Swider

DirectorLegislative Co-Chair

(856) 787-9005, ext. 1201

tswider@creditlenders.com

Terry Clemans

Executive Director

(630) 539-1525

tclemans@ncrainc.org

Jan Gerber

Office Manager/Membership Services

(630) 539-1525

jgerber@ncrainc.org

President

Gary Tumbiolo, CMI

(919) 452-1529

garytumbiolo@aol.com

President-Elect

Laurie Abshier, GML, CMI

(661) 283-1262

E-Mail: lauriea@gemcorp.com

Senior Vice President

Candace Smith, CMI, CME

(512) 329-9040

csmith@wrstarkey.com

Vice PresidentNorthwestern Region

Jill M. Kinsman

(206) 344-7827

jill.kinsman@usbank.com

Vice PresidentWestern Region

Tim Courtney

(760) 792-5620

desertranchrealty@hotmail.com

Vice PresidentCentral Region

Lisa Puckett

(405) 741-5485

lpuckett@ameagletitle.com

Vice PresidentEastern Region

Christine Pollard

(646) 584-8332

cpollard1046@gmail.com

Secretary

Murielle Barnes, CME

(806) 373-6641

napmw123@yahoo.com

Treasurer

Hulene Bridgman-Works

(972) 494-2788

hulene137@yahoo.com

Parliamentarian

Dawn Adams, GML, CMI

(607) 737-2584

dawnvadams@live.com

NAMB Board of Directors

National Association of Professional

Mortgage Women

P.O. Box 451718 O Garland, TX 75042

Phone #: (800) 827-3034 O Fax #: (469) 524-5121

Web site: www.napmw.org

Officers

Directors

2011 Board of Directors & Staff

National Board of Directors

4

A

P

R

IL

2

0

1

1

O

N

A

T

I

O

N

A

L

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

FHA Commissioner Stevens

to Replace Courson as

Head of the Mortgage

Bankers Association

The Mortgage Bankers

Association (MBA) has

announced that John A.

Courson, the associations

president and chief exec-

utive officer, will be leaving

the association, effective June 1, 2011,

and will be replaced by David H. Stevens,

Assistant Secretary for Housing and

Commissioner of the Federal Housing

Administration (FHA) at the U.S. Department

of Housing & Urban Development (HUD) in

May. Stevens had announced earlier that he

would be resigning from his position at

HUD, effective March 31, 2011.

John Courson has led MBA through

the most turbulent times that this

industry, and the association, have ever

seen, said MBA Chairman Michael D.

Berman, CMB. John inherited an asso-

ciation facing serious financial chal-

lenges precipitated by the meltdown in

the mortgage market and MBAs deci-

sion to purchase its own headquarters

building in the year leading up to the

Great Recession. He was compelled

from the outset to make difficult finan-

cial decisions, both to bring MBAs

budget under control and to extricate

MBA from the building, but he leaves

MBA with a budget in the black and

having executed the sale of the building

while maintaining MBAs commitment

to it members.

Courson came to MBA as chief oper-

ating officer in August, 2008 and

became the associations president and

chief executive officer in January, 2009.

Prior to joining the MBA, John spent

more than 40 years in the mortgage

banking industry during which time he

was an active MBA member and served

as the associations chairman in 2003.

Stevens joins the MBA after nearly

two years leading FHA through the

same tumultuous times. During his

tenure, Commissioner Stevens imple-

mented a myriad of changes to improve

FHAs risk management to ensure the

programs future viability and to help

FHA weather the storm of increased

losses. At FHA, Stevens has direct

responsibility for oversight and admin-

istration of the FHA insurance portfolio,

which includes multifamily housing,

insured healthcare facilities and well

more than 20 percent of mortgages in

the domestic single family market.

David H. Stevens is uniquely quali-

fied to lead the association in its next

chapter, said Berman. Most recently he

has had a tremendous impact at FHA, as

that program faced its own unprecedent-

ed challenges. He also brings a wealth of

industry experience in mortgage lending

that will help him further build MBAs

position as the industrys leading voice in

advocacy, communications, education

and research.

A graduate of the University of

Colorado, Boulder, Stevens has a strong

background in housing, including expe-

rience in finance, construction, sales,

mortgage acquisition and investment,

and regulatory oversight. He began his

journey to HUD at the dining room

table, where he listened to stories

about the creation of FHA and other

efforts to stabilize the housing market

from his father, who started as a runner

on Wall Street during the depression.

The dining room table soon became the

board room as Stevens started his pro-

fessional career with a 16-year tenure

at the World Savings Bank. He later

held positions as senior vice president

of single-family business at Freddie

Mac, and then executive vice president,

national wholesale manager at Wells

Fargo. Prior to being confirmed at HUD,

Stevens had been president and chief

operating officer of Long and Foster

Companies, the nations largest, pri-

vately-held real estate firm.

FHFA Announces

One-Year Extension

to Refi Program

Federal Housing Finance

Agency (FHFA) Acting

Director Edward J. DeMarco

has announced an exten-

sion of the Home

Affordable Refinance Program (HARP), a

refinancing program administered by

Fannie Mae and Freddie Mac, to June

30, 2012. The program was set to expire

on June 30, 2011. In addition, Fannie

Mae and Freddie Mac will make the fol-

lowing adjustments to their programs:

Freddie Mac will exempt HARP loans

from their recently announced price

Check

Us Out!

www.AccurateQC.com

Quality Control Services . Training . Consulting

Experience? Check! Knowledge?

Check! Comprehensive nationwide

quality control services with over-

the-top attention to detail, the best

customer care, plus reasonable

prices? Check! When selecting a

quality control service provider,

AQC is the only choice. Isnt it

time you transferred quality control

tasks from your checklist to ours?

770.931.5999

Call Genny Kelly or Judy Nash-Ellis

2 Free QC Reviews

Give Us a Try ~ No Strings Attached

*New AQC Clients Only

Post Closing Reviews

Early Default Reviews

Repurchase Reviews

Suspected Fraud Reviews

Rejected App Reviews

Training & Consulting

continued on page 6

6

A

P

R

IL

2

0

1

1

O

N

A

T

I

O

N

A

L

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

adjustments and Fannie Mae will con-

form their eligibility date to May 2009.

The program expands access to refi-

nancing for qualified individuals and

families whose homes have lost value.

HARP has grown over the past year.

Through 2010, Fannie Mae and Freddie

Mac have purchased or guaranteed more

than 6.8 million refinanced mortgages. Of

this total, 621,803 were HARP refinances

with loan-to-value (LTV) ratios between 80

percent and 125 percent. This is up from

190,180 in 2009, when HARP began.

Attorneys General

Probe Highlights the

Illegal Practices of

Mortgage Servicers

Responding to wide-

spread evidence of

improper accounting,

unwarranted fees,

false documentation, and arbitrary fore-

closure decisions, the 50 state Attorneys

General are crafting a plan to hold the

mortgage servicing industry account-

able. The plan would address accusa-

tions that banks and servicers have

engaged in illegal and negligent servic-

ing practices that have been a contin-

ued drag on the U.S. housing market

and economy.

When unnecessary foreclosures

flood the market, taxpayers end up

picking up the tab, said Mike Calhoun,

president of the Center of Responsible

Lending (CRL). Loan servicers have

repeatedly broken the law to push fore-

closures through, even when loan mod-

ifications made more sense financially

for everyone, including lenders and

investors.

Based on information that has been

made public, the plan of the Attorneys

General is sorely needed to fix the bro-

ken mortgage servicing industry. The

bulk of the provisions are common-

sense measures that require servicers

to obey the law, stop losing docu-

ments, stop giving homeowners the

runaround, and prevent unnecessary

foreclosures. However, some proposed

provisions raise concerns that the plan

may be inadequate. For example,

there has been discussion of a mone-

tary fine of $20 billion, which repre-

sents only a fraction of the damage

caused by the banks. Other key parts

of the proposal remain under consid-

eration or have not yet been made

public.

So far, banks and mortgage servicers

have objected to the plan, but they

ignore the extraordinary damage they

inflicted on homeowners, the housing

market and the overall economy, and

they also ignore the extensive aid they

received from taxpayers.

The sooner banks and servicers can

move forward and begin to rebuild

trust with the public, said Calhoun,

the sooner we can start to stabilize the

housing market and build a more

robust economy.

Equi-Trax Survey Finds

Nothing Short About

Short Sales

Equi-Trax Asset Solutions

LP has released a survey

of the difficulties real

estate agents face com-

pleting short sales.

According to the survey, 71.9 percent

of respondents reported that a short

sale can take four to nine months to

complete, and they think that is simply

too long, said Guy Taylor, chief execu-

tive officer at Equi-Trax. They would

like to see the time period reduced so

that deals go through faster and are less

costly.

In addition, nearly 10 percent of

short sale transactions require more

than 10 months to complete, though

18.2 percent of deals require less than

three months to complete. The survey

reflects the views of more than 600

real estate agents who responded to

the survey.

When agents are asked to select

ways to make short sales easier, 57.6

percent think lenders should take less

time to close the transactions; 14 per-

cent think borrowers should be better

educated about short sales; and 40.4

percent think both of these changes

are necessary to improve the process.

Respondents to this question could

select as many answers as they

thought were relevant.

One way to speed the process and

help all parties involved in these

deals is to ensure that valuations are

accurate and current, said Taylor.

If they are not, the willingness to

complete these deals will be reduced

and the time they take to complete

will increase. That means unneces-

sary expenses for borrowers and

lenders.

news flash continued from page 4

continued on page 9

TMS Funding is made up of experienced, dedicated wholesale profession-

als ready to close loans. Experience you can count on!

TMS Funding believes mortgage brokers are essential to consumers looking

for options when choosing a mortgage! Brokers matter!

TMS Funding understands pricing is key but consistently competitive pricing

is a must! Pricing Leader!

TMS Funding delivers technology that works best for YOU! Paperless, quick

and easy!

TMS Funding believes in empowering our mortgage broker partners to

succeed! Where we win!

TMS Funding is your new lender of choice!

Who is TMS Funding?

Call us today to find out how great it is to have a

true wholesale lending partner!

888.371.2989

888.371.2989

www.tmsfunding.com

www.tmsfunding.com

326 West Main St. Suite 206 milford, CT 06460

Want to Find a Wholesale Lending Partner that

Actually Cares About You and Your Clients?

Your Partner in Success!

32 years ef success in mertgage banking.

Jo|n a 0row|ng and 3trong company-

Your opportun|ty awa|ts!

Learn about the great opportun|t|es ava||ab|e by mak|ng an appo|ntment w|th

0n|ted horthern Nortgage 8ankers xecut|ve V|ce Pres|dent Ju||o de 0ardenas

by ca|||ng 888-00-8808, ext. 1 or by ema|||ng |nfo@un|tednorthern.[obs

United Northern Mortgage Bankers, Ltd. Corporate NMLS ID# 7230 New York State Dept. - Licensed Mortgage Banker - License #100724 New Jersey Dept. of Banking and Insurance - Mortgage Lender - License #L0046623 Pennsylvania Dept. of Banking - Mortgage Lender - License #20887 Connecticut

Dept. of Banking - Mortgage Lender - License #20372 Massachusetts Div. of Banks and Loan Agencies - Mortgage Lender & Mortgage Broker - License #MC5070 North Carolina Commissioner of Banks - Mortgage Lender - License #L140365 South Carolina State Board of Financial Institutions - Supervised

Lender - License #S7, 461 Florida Dept. of Financial Institutions - Mortgage Lender - License #ML0700679 Senior Security Home Advantage is a lending area of United Northern Mortgage Bankers, Ltd. Direct FHA Endorsed Lender

Investing in communities

MEMBER

8

A

P

R

IL

2

0

1

1

O

N

A

T

I

O

N

A

L

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

were committed

to brokers!

#SPOYt#SPPLMZOt.BOIBUUBOt'BJSmFME

8FTUDIFTUFSt3PDLMBOEt1VUOBN

IN:

Call Bijan Farassat at 917-731-4870

or email bfarassat@ridgewoodbank.com

2VFFOTt4UBUFO*TMBOEt/BTTBV

4VGGPML

IN:

Call Lisa Constant at 516-640-8375

or email lconstant@ridgewoodbank.com

.FNCFS'%*$

A Member of the New York

Association of Mortgage Brokers

Markets may be volatile, but theres one thing you can always count on, the total commitment

of our Mortgage Team. Loyalty, continuity of service and our dedication to protecting the

integrity of our relationships are just a few of the things that set us apart.

Ridgewood understands the needs of its communities and develops specic product benets

to meet those needs.

www.ridgewoodbank.com

Jumbo Mortgages AvaiIabIe up to $3.5 MiIIion on 1 to 4 FamiIy, Co-ops and Condos

Loans Made to Bank-Approved LLCs and Trusts

OnIy One AppraisaI No Matter What the Loan Amount or Property VaIue

Up to $1.5 MiIIion Cash Out on Primary Pesidences*

*LTVs apply.

to

w

broke o

were co

ers!

ommitte

ed

Loan

Jum

to mee

Ridgew

integr

our of

Marke

o ns Made to Bank-Appr

vaiIab mbo Mortgages AAv

et those needs.

ne the understands wood

e elationships ar ity of our r

Loyalty eam. TTe Mortgage r

the but volatile, be may ets

rusts oved LLCs and T Tr

Ie up to $3.5 MiIIion on

an communities its of eeds

e just a few of the things

an service of continuity , y

alw can you thing one s e er

, Co-ops n 1 to 4 FamiIy y,

od pr specic develops nd

that set us apart.

o pr to dedication our nd

c total the on, count ways

and Condos

benets uct

the otecting

ommitment

Up t

8

#

or ema

IN IN: N:

Call Bij

IN:

OnIy

to $1.5 MiIIion Cash Ou

FTUDIFTUFS t 3PDLMBOE t 88F

PPLMZOt.BOIBU POYt#S #S

ail bfarassat@ridgewoo

jan Farassat at 917-731

y One AppraisaI No Ma

ut on Primary Pesidence

1VUOBN

UUBOt'BJSmFME

odbank.com

1-4870

4

2

or ema

IN IN: N:

Call Lis

IN:

atter What the Loan Am

*

GPML VGG

2VFFOTt4UBUFO*TMBOEt/

ail lconstant@ridgewoo

sa Constant at 516-640

es

aIu operty V Va mount or Pr

ue

/BTTBV

dbank.com

-8375

pp TVs a *LLT .

g

ply

www

or ema

.FNCFS '%*$

ail lconstant@ridgewoo

.ridgewoodbank.c ww.

dbank.com

kers o e Bro tgag ion of Mor ciatt Asso

ork YYo w e er of the N AMemb

com

they can better manage their mortgage

compliance and risk.

Our goal is to continually provide

members with opportunities to expand

and diversify their business, said Scott

Stern, chief executive officer of Lenders

One. Imaging is a process historically

reserved for national lenders, but

DocVelocity provides a platform that is

more feasible for smaller and midsized

lenders to deploy. Our members now

have the ability to create their own

paperless environment, which improves

productivity and reduces costs to

enhance their growth possibilities in any

market.

Lenders One members will benefit

from DocVelocitys simplified online

workflow and 24-hour Web access to all

mortgage loan documents, as well as

options for converting paper into elec-

tronic files. The paperless technology

additionally benefits members with

quicker turn times and lower operating

costs in originating loans due to instant

digital file delivery, searchable long-

term document storage and automatic

filing and naming capabilities. Built-in

audit and compliance logs also allow

Lenders One members to more effec-

tively approach their observance of

regulatory guidelines.

We are excited to partner with an

organization as reputable as Lenders One

and provide its members with the paper-

less tools that are key to progressing their

business, said Jason Dufner, director,

product development at DocVelocity.

DocVelocity is committed to the cause of

making our customers paperless and

helping them realize its associated bene-

fits. Aligning with Lenders One gives us

direct access to a group of top quality

lenders that can incorporate an auto-

mated origination experience to improve

their performance.

Infomercial Icon

Guthy-Renker to Enter

the Mortgage Business

Paramount Equity

Mortgage Inc. has

a nnounc e d i t s

intention to enter

into a partnership

with Guthy-Renker LLC, one of the

nations largest direct-to-consumer

marketing companies, to help the

regional mortgage lender significantly

expand its mortgage and consumer

financial operations. Guthy-Renker will

assume a significant equity position in

Paramount Equity. In addition, Guthy-

Renker will provide its preeminent

direct television marketing expertise

and resources to take Paramount

Equitys message of efficient, service-

oriented home loans and consumer

finance solutions to a national market.

The real estate downturn of the last

several years has created tremendous

opportunities for growth as economic

conditions begin to improve. In our opin-

ion, the opportunity in the mortgage mar-

ket coupled with our value-added services

has never been greater, and Guthy-

Renkers marketing expertise will help us

engage a new set of customers who, oth-

erwise, might be beyond our reach, said

Hayes Barnard, founder and chief execu-

tive officer of Paramount Equity. Guthy-

Renker is unmatched in its expertise, scale

and ability to create awareness for nation-

al products. Combining those factors with

our highly efficient money-saving platform

will redefine the consumer experience for

home loans, energy conservation and

insurance.

Founded in 2003, Paramount Equity

Mortgage has completed more than $8

billion in loans in California, Oregon,

Washington, Arizona, Utah, and Virginia.

Paramount Equity seeks to save families

money on their mortgage, insurance and

electric bills by matching the right con-

Lenders One Partners

With Flagstars

DocVelocity on Paperless

Loan Origination

Lenders One Mortgage

Cooperative has

announced a part-

nership with DocVelocity, a Web-based

paperless solution that simplifies the

mortgage loan origination experience,

as its newest preferred vendor.

DocVelocity is the flagship product of

Paperless Office Solutions Inc., a wholly-

owned subsidiary of Flagstar Bancorp.

DocVelocity provides an online

paperless solution that allows mort-

gage documents to be processed elec-

tronically from start to finish.

Automating the review and sharing of

loan documents gives lenders greater

overall control and transparency so

continued on page 10

9

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

O

N

A

T

I

O

N

A

L

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

A

P

R

IL

2

0

1

1

(888) 329-GHMC

ltesoriero@ghmc.com

www.joinguaranteed.com

Call Louis Tesoriero

Today & Find out what

Guaranteed can do for you!

THEY SIMPLY WANT YOUR VOLUME.

WELL HELP YOU GROW.

Openings for all mortgage professionals, originators, managers, operations.

MORTGAGE BANKING FOR PROFESSIONALS SINCE 1992

888-329-GHMC

Licensed in: AL, AR, CA, CT, DE, FL, GA, IL, IN, LA, MA, MD, ME, MI, MO, NC, NH, NJ, NM, NY, OH, PA, SC, TN, TX, VA, WV and growing.

EXECUTIVE OFFICES: 108 Corporate Park Drive, Suite 301 White Plains, NY 10604

SEC Files MBS Fraud

Charges Against Radius

Capital Corporation and

Its Owner

The U.S. Securities &

Exchange Commission

(SEC) has announced

that it has filed a civil

injunctive action against

Robert A. DiGiorgio of Cape Coral, Fla.,

and his company, Radius Capital

Corporation, charging them with securi-

ties fraud for making false and mislead-

ing statements relating to Radius

issuance of mortgage-backed securities

(MBS) guaranteed by Ginnie Mae.

The SECs complaint, filed in the

U.S. District Court for the Middle

District of Florida, alleges that from

December 2005-October 2006, Radius

and DiGiorgio offered and sold 15

Ginnie-Mae guaranteed MBS to

investors totaling approximately

$23.5 million. According to the com-

plaint, Radius and DiGiorgio repre-

sented to Ginnie Mae, and to investors

in 15 separate prospectuses, that the

residential loans underlying the secu-

rities were, or would be, insured by

the Federal Housing Administration

(FHA) as required to receive Ginnie

Maes guarantee.

The SEC alleges that Radius and

DiGiorgios representations about the

insurability of the underlying loans

were false and misleading as the vast

majority, more than 100 of the 154

underlying loans, were not, and could

not, be insured by the Federal Housing

Administration (FHA). According to the

complaint, Radius never even applied

for FHA insurance for most of the unin-

sured loans and failed to submit the

upfront mortgage insurance premiums

(UFMIP) it had collected from borrow-

ers at closing to the FHA which were

required for the loans to be insured.

Even if Radius and DiGiorgio had

applied for FHA insurance and proper-

ly submitted the mortgage insurance

premiums, the uninsured loans could

not have been insured because the

borrowers failed to meet FHAs debt-

to-income, credit history, employment

history, and other underwriting

requirements.

The SEC alleges that many of the

mortgages backing Radius securities

quickly fell into default. In October

2006, Radius correspondingly default-

ed on its pass-through payments to

the investors holding the MBS. As a

result, Ginnie Mae was required to

pay investors the remaining principal

balance on each uninsured loan that

was in default, thereby incurring sev-

eral million dollars in losses. In addi-

tion, investors holding the Radius

securities lost interest income due to

the unexpectedly high rate of prepay-

ment of principal (by Ginnie Mae) as

the Radius loans fell into default.

The SECs complaint charges Radius

and DiGiorgio with violations of

Section 17(a) of the Securities Act of

1933 and Section 10(b) of the

Securities Exchange Act of 1934 and

Rule 10b-5 promulgated thereunder.

The SEC is seeking permanent injunc-

tive relief against future violations, a

conduct-based injunction preventing

Radius and DiGiorgio from offering

MBS, disgorgement of ill-gotten gains

with prejudgment interest and civil

penalties, jointly and severally,

against Radius and DiGiorgio.

news flash continued from page 6

Your turn

National Mortgage Professional Magazine

invites you to submit any information

on regulatory changes, legislative

updates, human interest stories or

any other newsworthy items pertain-

ing to the mortgage industry to the

attention of:

NMP News Flash column

Phone #: (516) 409-5555

E-mail:

newsroom@nmpmediacorp.com

Note: Submissions sent via e-mail are

preferred. The deadline for submissions

is the 1st of the month prior to the target

issue.

SAVE THE DATE

2011 Mortgage

Leader Cruise

Sets Sail

Oct 13th-17th

Visit NMPMag/mlc for details.

10

A

P

R

IL

2

0

1

1

O

N

A

T

I

O

N

A

L

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

Comergence is preferred by leading lenders nationwide.

2

0

1

1

C

o

m

e

r

g

e

n

c

e

C

o

m

p

lia

n

c

e

M

o

n

it

o

r

in

g

,

L

L

C

.

A

ll

r

ig

h

t

s

r

e

s

e

r

v

e

d

.

Ahh yes

the broker

approval desk.

At Comergence, helping lenders holistically manage relationships with their

mortgage broker clients is the most important thing we do. And with FHA

now holding lenders accountable and responsible for approving brokers,

theres no better time than the present to have us show you how we can

help with this important change to your business.

For more information and to schedule an appointment, call 714.740.9000

or visit us at www.ComergenceCompliance.com

Gets you all warm and fuzzy just thinking about having to

approve and reapprove your brokers, now doesnt it?

heard on the street continued from page 8

executive officer of Guthy-Renker. The

offering of mortgage, solar and insurance

delivers a powerful combination that will

enable Paramount Equity to become a

sizeable player in the national market.

CoreLogic Completes Its

Acquisition of Dorado

CoreLogic has announced

that it has completed its

acquisition of Dorado

Network Systems Corporation

in a $32 million all-cash transaction.

Dorado is a recognized leader in col-

laborative cloud computing applica-

tions and architecture to the financial

services industry. CoreLogic previously

held a 38 percent equity interest in

Dorado. With the acquisition, CoreLogic

gains patented cloud computing-based

technology that extends and accelerates

the embedding of CoreLogic decision

management applications into client

operating environments, making trans-

action decisions faster, more automat-

ed, and more accurate.

CoreLogic anticipates expanding these

services to enhance its 360-degree

approach to delivering improved loan

quality and transaction transparency

from point of sale through investor deliv-

ery to the secondary market. Additionally,

CoreLogic will deploy Dorado technology

into its strategic outsourcing business.

The mortgage industry is entering

an era that demands a new watermark

in efficiency and transparency across

all aspects of financial transactions,

said CoreLogic President and Chief

Executive Officer Anand Nallathambi.

The existing capabilities that Dorado

brings to the table, as well as the

potential opportunities that exist to

expand these capabilities, make this a

growth enabler for us. This acquisition

extends our leadership position in

helping clients anticipate, adapt and

respond to their market environment.

The Dorado platform will help shape

our next generation decision manage-

ment applications into solutions that

ensure integrity and quality through-

out the entire lifespan of a loan. It also

enables CoreLogic to customize and

embed solutions directly within the

lender operating environment, provid-

ing increased ROI to our clients.

Dorado, which will operate as

CoreLogic Dorado, provides a compre-

hensive suite of enterprise lending

solutions that automates loan origina-

tion and consolidates internal and

external service integrations into a uni-

fied process, connecting lenders, their

partners and consumers through a col-

laborative, real-time workflow. Dorado

technology not only automates data

handling, but also facilitates the inte-

gration of real-time borrower, organi-

zational and market information into

mortgage finance transactions so that

lenders, servicers, investors, and bor-

rowers experience improved loan qual-

ity and transaction transparency.

Dorado will offer clients a blended

portfolio of cloud-based lending solu-

tions complemented by an enhanced

array of data and analytics. At a time

when financial institutions worldwide

are increasingly adopting sophisticated

analytics as a way to increase the effec-

tiveness, agility and flexibility of their

operations, this transaction strength-

ens our growth trajectory, said Dorado

Co-Founder and Chief Executive Officer

Dain Ehring.

Lender Processing Services

Announces the Acquisition

of PCLender.com

Lender Processing

Services Inc. (LPS)

has announced that

it has acquired

PCLender.com Inc., a provider of enter-

prise, Web-based mortgage lending solu-

tions and a complete loan origination

system (LOS). The acquisition of

PCLender.com complements LPS state-

of-the-art core loan origination plat-

form, LPS Empower, and expands the

companys reach in the loan origina-

tion market.

LPS Empower will continue to target

large national and regional mortgage

lenders as the optimal solution for its

loan origination platform. PCLender.com

offers a more cost-effective solution for

smaller and mid-sized mortgage compa-

nies, credit unions and community

sumer with the right product, whether its

a purchase or refinance loan, insurance

policy or solar energy system. Paramount

Energy Solutions is one of the largest solar

sales companies in California and is now

poised for national growth and expansion.

Guthy-Renkers history is about team-

ing up with extraordinary people and

companies to get their stories told.

Paramount Equity is a great company

with outstanding employees, a vibrant

culture and passionate vision. Were

excited by the opportunity to give them

the marketing help that they need to

grow, said Ben Van de Bunt, co-chief

continued on page 16

LOS | CRM | MORTGAGE BANKING | CLOSING

2011 by visiting www.MortgageDashboard.com.

I received three new buyers over the

weekend and was able to work on my

my daughters basketball game.

Jeremy Stump, Branch Manager

LeaderOne Financial

On Monday, April 4, Armand Cosenza passed away. For those of you who hadnt

had the privilege of knowing him, let me simply say that its too bad you never

got the opportunity.

First and foremost, Armand loved his family, Judy, Denise and Vickie, and of

course, the grandkids. Many people from the National Association of Mortgage

Brokers (NAMB) and the Ohio Association of Mortgage Brokers (OAMB) think that

they were his family as well, but we werent even close. He loved this family, his

faith, his golf but I know that we were somewhere on this list.

Armand graduated from Cathedral Latin High School and John Carroll University

and began his working career at Society National Bank where he rose to the position

of vice president before leaving to start his own company, Commonwealth Financial

Services. It was with Commonwealth that Armand became a founding member of

OAMB and headed our affiliation with NAMB. As a member of OAMB, he served on

the board of directors from 1993 until 2007, when he decided to dedicate more time

to his new grandchildren. From the beginning with both associations, Armand spe-

cialized in our Industry Partners Program, and starting from scratch, raised more

than $7 million for the benefit of both associations. He served two terms as president

of OAMB and rose to the position of president of NAMB in 2002 when the NAMB

Annual Convention was held in Armands hometown of Cleveland.

If you know Armand, or even if you were one of those who thought you knew

Armand, then you know he was everything above and much, much more. Armand

could be the easiest guy in the world one minute, and the next thing, youd be

pulling him off someone who had made disparaging remarks about his friends, the

association, the Indians or even the Browns. Hed think nothing of giving me his first

class seat and sit back in coach for a long three or four hour flight, then would joke

as we would deplane that if my ass wasnt so fat that he could have had a few Grey

Gooses on the flight for free all with a smile and a hug telling you he loved you.

I could write a book on the things that we did together in both NAMB and

OAMB. He was a dyed in the wool Eastside republican, and I am a Westside liber-

al democrat, yet we always got along. I guess it was that special bond of both

being from Cleveland.

Armand loved to travel, loved to gamble and loved to play golf. If you could

put all three of those things together, it was even better. The Western Regional

Conference, which later became NAMB WEST, was his favorite event food,

drink, gambling, shows, golf and thousands of friends to share it all with. Who

could ask for more? Hed often say that NAMB should hold all of their events in

Vegas, just like the Teamsters. Id point out that itd be a little hard to move the

Legislative & Regulatory Conference from D.C., then hed point out that most of

Congress would probably rather be in Vegas in February anyway. Good point, but

we never could get that to happen.

I last saw Armand about seven weeks ago. We had lunch and he looked great.

He came from work and we spent about two hours talking about our families and

his grandkids. We talked about the battles we all thought hed won with cancer

and Judys battle to. We talked politics and naturally about the thing that first

made us friends, NAMB and the OAMB. Although things had moved in different

directions over the last few years, he still loved the associations and the people

who made it so special. That day he looked just like he did on the cover of The

Mortgage Press or any of the dozens of other magazine covers he had adorned.

The only difference with this lunch was there was no Skyy or Grey Goose. Now it

was iced tea, but we did go

for dessert.

Sitting and thinking the

night I learned of Armands

passing, I thought of hun-

dreds of stories. The great

victories hed accom-

plished, as well as a few

of the defeats that are

just part of the job. Some

things were great, others good, many

might even be considered plain stupid, but they all had one

thing in common working to make things better for the broker industry,

and through that, our families and the association. Having fun made the victories

better and the setbacks bearable.

I was asked to write about Armand for both those who knew him and those

who didnt. I hope that the above gave you some idea of Armand and what he

accomplished and cared about. But, I think not including one personal story for

those who really, really knew Armand is necessary and out of all the possible sto-

ries Id like to leave you with this one. Its the one that makes me laugh every time

I think about it. Of course, its about the brokers and politics.

It was election night in 1994, and we are at the Fingerhut for Congress re-elec-

tion party. We were supporting Eric Fingerhut because of his position on HOEPA

and his influence in keeping a 35 percent DTI ratio out of the bill. Naturally, he

lost to Steve LaTourette who would later become our friend. We sat there listing

to some 18-year-old explain to us how, in the end, Eric would win. Of course he

didnt and later that night, he looked at me and said that we really needed to fig-

ure out what the hell was going on. Losing was not in his plans.

Jump to 1996 and I talk Armand and Jim DeGeronimo into donating our PAC

money to Dennis the Menace who was running for Congress. Dennis Kucinich

the most liberal democrat in the entire world and a Westsider to boot and I

want to give him our money. The guy hes running against actually liked us.

They thought I was nuts, but I pointed out that he didnt like to lose and Dennis

was going to win and so we gave. The night of the election, we are at the

Kucinich election headquarters. Here is Armand, about as Republican as you

can get among all of Denniss supporters. The dancing and conga lines and

finally Dennis comes out to accept his victory and grabs Armand and I to go

onstage while he makes his victory speech. Live on every channel in Cleveland

in on many national broadcasts. Armand should have been in his glory stand-

ing next to the newly elected congressman, in front of a citywide and even

national audience. Everyone seeing his smiling face as Dennis personally thank

him for his support. What could possibly be better? Well, Dennis could be a

Republican to begin with. Maybe even a blue dog democrat. But, Armand and

a liberal democrat and in particular Dennis? Not going to happen. He looked

at me and said that if Judy saw him on TV standing next to Dennis that she

would kill him. That his family would never quit busting on him and that it

wasnt going to happen and it didnt. Dennis grabbed his arm and said come

with me and somehow Armand got untangled between the floor and the stage.

Later, as I laughed, he told me never to let that happen again. Well, we never

went to another democratic election night event, but later were at both Steves

and Bob Neys.

Today, as bad as I feel and I know most of you do. As sad as it is, I just think of

Armand and the election night with Dennis Kucinich and I have to laugh. After all,

he was Armand and he will be missed.

Most of all, I miss my friend. Someone I always felt would be there and I took

it for granted. Cancer wasnt a problem; this was Armand were talking about. If I

had only known I would have tried to be as good of a friend to him as he was to

me. Never did we leave without a hug, and I wish I could get at least one more.

James L. Nabors, CMC, CRMS is past president of both the National Association of

Mortgage Brokers (NAMB) and Ohio Association of Mortgage Brokers (OAMB). He is

currently senior vice president of consumer mortgage at Citizens Bank in Sandusky,

Ohio. He may be reached by phone at (419) 627-4531 or e-mail jlnabors@citizens-

bankco.com.

By James L. Nabors, CMC, CRMS

earnings to better prepare for rainy

days and retirement.

Based upon the above data, little

imagination is required for all of us to

envision a reduction in our housing

costs at levels approaching 10 to 20 per-

cent, while still allowing for state-of-

the-art housing and high levels of

homeownership. We partied hard, buy-

ing homes that were beyond our

means. We then woke up with financial

hangovers, and we have taken our med-

icine. That does not mean that we can-

not get it right this time. The U.S. eco-

nomic engine offers us, as homeowners,

efficiencies never dreamed of by our

ancestors. We can all live in homes that

offer us many times the utility of those

enjoyed by our grandparents, while

staying within our budgets and living

within our means.

Yes, many of us in the United States

and, for that matter, all around the

world, have grown quite accustomed to

living too high on the housing hog. The

time has come for us to exercise better

judgment in investing our shelter dol-

lars. We can own beautiful homes, of

which we can be very proud, while con-

centrating upon spatial efficiency.

Charlie W. Elliott Jr., MAI, SRA, is presi-

dent of Elliott & Company Appraisers, a

national real estate appraisal company.

He can be reached at (800) 854-5889, e-

mail charlie@elliottco.com or visit his

companys Web site, www.appraisalsany-

where.com.

13

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

O

N

A

T

I

O

N

A

L

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

A

P

R

IL

2

0

1

1

Web: www.appraisalsanywhere.com

I REAL TIME COMMUNICATION OF APPRAISAL STATUS

I NATIONWIDE SERVICE WITH LOCAL APPRAISERS IN ALL COUNTIES

I IMMEDIATE SERVICE FROM QUALIFIED STAFF

I COMPETITIVE FEES

I OFFERING "REALview

TM

" THE MOST ADVANCED UNDERWRITING AND

GRADING SYSTEM IN THE INDUSTRY

I QUALITY APPRAISALS AND REVIEW

I STAFFED BY APPRAISERS WITH OVER 150 YEARS COMBINED EXPERIENCE

NATIONWIDE APPRAISAL MANAGEMENT CENTER

866-396-6260

www.hvccappraisalordering.com

EMAIL: orders@hvccappraisalordering.com

Tempering the American Dream

The mortgage meltdown was allegedly

caused by mortgage lenders lending

money to people who were not quali-

fied to purchase the homes. Aside from

whatever part fraud had to do with this

calamity, most of us would probably

agree with this statement. I certainly

believe it.

Having made that statement, I am

of the opinion that this accusation can

be carried a step further,

more specifically, to hold

accountable those who

purchased larger homes

than they could afford.

This theory implies that

many, if not most, of the

foreclosures would not

have occurred if the peo-

ple who are losing their

homes, had purchased

smaller, more affordable

homes, within their means.

With this in mind, I exam-

ined national statistical

data, pertaining to historic

average home sizes in the

United States. Based upon

the above hypothesis, I set

out to perform a research

project to determine if we,

as a people, have been liv-

ing higher on the housing hog in recent

years.

My findings included the following.

O In 1900, the average-sized home was

800-sq. ft.

O In 1950, the average-sized home was

1,000-sq. ft.

O In 1980, the average-sized home was

1,700-sq. ft.

O In 2008, the average-size home was

2,473-sq. ft.

O In 1900, the average household size

was 4.6 people.

O In 2010, the average household size

was 2.59 people.

O In 1900, the average home cost

$4,000.

O In 2010, the average home cost

$178,000.

O In 1900, 47 percent of all homes

were owner-occupied.

O In 2010, 67 percent of all homes

were owner-occupied.

O In 1900, average individual income

was $600 per year.

O In 2009, average individual income

was $40,000 per year.

O In 1900, the average worker made $2

per day (.25 cents per hour/48-hour

work week).

O In 2010, the average worker made

$160 per day ($20 per

hour/40-hour work week).

The above data was

assembled using a variety

of resources, including

the U.S. Census Bureau,

the National Association

of Realtors (NAR), the

National Association of

Home Builders (NAHB)

and other sources that I

consider to be reliable.

Due to the lack of ade-

quate and accurate statis-

tical data from the early

1900s, I made estimates

in some cases. I also

rounded off numbers for

the sake of simplicity.

The results of the sur-

vey are quite telling.

While the data was not intended to be

technical in nature, it offers undeniably

antidotal evidence of the excesses we

have enjoyed at the expense of our

economy.

I offer the following as evidence to

support my conclusion:

O In 1900, the average person con-

sumed 174-sq. ft. of living space.

O Today, the average person consumes

935-sq. ft. of living space.

O In 1900, the average cost of a house

per occupant was $900.

O In 2010, the average cost of a house

per occupant was $69,000.

O In 1900, the average worker must

work 16,000 hours or about eight

years, before payroll taxes, to pur-

chase an average home.

O In 2010, the average worker must

work 8,900 hours or about four-and-

By Charlie W. Elliott Jr., MAI, SRA, ASA

We partied hard, buy-

ing homes that were

beyond our means. We

then woke up with

financial hangovers,

and we have taken our

medicine.

a-half years, before payroll taxes, to

purchase an average home.

Today, we enjoy homes with more

sophisticated plumbing, heating, air

conditioning, electrical, appliances,

insulation, kitchens, bathrooms, high-

quality decor and much more than was

in the homes of 1900. We invest fewer

of our working hours to purchase a

home than our forefathers did four gen-

erations ago, and we enjoy the spa-

ciousness of castles, relative to the

bygone days of the early 1900s. Most of

us would be able to enjoy more modest

homes, which would fall well within our

budgets and still be light years ahead of

what our predecessors had to accept.

No, the American dream is not dead; it

is still very much alive. It is up to those

of us doing the dreaming to fashion our

dreams within the realms of reality and

within our budgets.

We can expect the homes of the

future to be smaller, especially those

built for first-time homebuyers. We

can expect more multi-family housing

to be sold. More of us will be sharing

housing with others in an effort to

better capitalize on the efficiencies of

having housemates and extended

family living under our roofs. Low

downpayment loans will still be avail-

able to those responsible people, with

good credit and who are willing to

purchase homes in price ranges that

they can afford. Approaching housing

in a more common-sense manner will

permit all of us to save more of our

14

A

P

R

IL

2

0

1

1

O

N

A

T

I

O

N

A

L

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

For more information on the National Association of Mortgage Brokers, visit www.namb.org.

of Advocacy; Peggy Twohig, director of the Office of Consumer Protection for the

U.S. Department of the Treasury; and Roy DeLoach of DC Strategies, chief lobbyist

for NAMB.

The hot topic was the Federal Reserve Boards loan officer compensation rule

LO and Dr. Winslow Sargeant received a standing ovation and a huge roar of

applause for his role in the two letters SBA Advocacy issued to the Federal Reserve

Board in asking for a delay in the LO compensation rule. Every session was stand-

ing room only, and the participants were very engaged with great questions for

the panelists. In fact, no one left early during any session. We ended the day by

distributing more than 300 lobby day packets that were to be presented the fol-

lowing day during the trip to Capitol Hill.

Then, we all attended the opening reception with a delicious spread of Italian

cuisine and of course an open bar. The room was packed with everyone engaged

in deep conversations about the panelists, networked and discussed the red hot

topic of the LO compensation rule.

Day two of the 2011 Legislative & Regulatory Conference, better known as Lobby

Day, was certainly a day to remember. Any of the lawmakers were shocked to hear

about the Federal Reserve Boards LO compensation rule, and almost all were com-

mitted to help in any way they could to stop this rule from being enforced on April 1st.

In the end, I think we can all say that the 2011 Legislative & Regulatory

Conference was an event that brought unity and a sense of urgency to all who

attended. If we all stand together as one large voice, we can make a difference,

and for those of you who did not attend, I would strongly suggest you put it on

your list of things to do for 2012.

Mike Anderson, CRMS of Essential Mortgage in Metairie, La. is Government Affairs

Committee Chair of the National Association of Mortgage Brokers. He may be

reached by phone at (504) 451-3339 or e-mail mikea@essentialmtg.com.

Scenes From the NAMB 2011 Legislative & Regulatory Conference

March 1415 at the Capitol Skyline Hotel in Washington, D.C.

By Mike Anderson, CRMS

What a conference! The National Association of Mortgage

Brokers (NAMB) 2011 Legislative & Regulatory Conference was

sold out, with 200-plus attendees, great speakers and panelists,

great food and an opportunity for some face-to-face, peer-to-

peer networking.

I would like to start off by giving a huge thank you to Denise

Leonard for doing an absolutely spectacular job with putting this whole confer-

ence together and a special thanks to Olga Kucerak for helping Denise at the con-

ference. The service from the host hotel, the Capitol Skyline Hotel in Washington,

D.C., was exceptionally good and accommodating to our group.

I would like to especially thank Provident Funding for stepping up to the plate

as sponsor of this years Legislative & Regulatory Conference. They demonstrated

their commitment and loyalty to the mortgage broker and truly communicated

their support for our profession.

Its been a long time since weve seen a Legislative & Regulatory Conference as

successful as this one. In fact, we actually made a profit and after all that we are

facing with the April 1st deadline of the Federal Reserve rule on loan originator

compensation, our group joined together with an energy and enthusiasm like Ive

never seen before. The passion of all in attendance was remarkable, and I can

honestly say that the 200-plus attendees were true die hard professionals who

take our profession very serious.

The event was a quick, yet informative, two-day affair, consisting of one day of

speakers and panelists and a second of a lobbying trip to Capitol Hill. Some of our

guests included Vicki Bott, assistant secretary of the U.S. Department of Housing

& Urban Development (HUD); Barton Shapiro, director of RESPA for HUD; Dr.

Winslow Sargeant, chief counsel for the U.S. Small Business Administration Office

A Day on the Hill

A look back at the NAMB 2011 Legislative & Regulatory Conference

President Andy Harris (left) and Vice

President Jered Helton (right) from the

Oregon Association of Mortgage Professionals

(OAMP) visit with Rep. Kurt Schrader (D-

OR) (center) during NAMBs 2011 Legislative

& Regulatory Conference in D.C.

Members of the Pennsylvania delegation with

NAMB President Mike DAlonzo (far right) at the