Escolar Documentos

Profissional Documentos

Cultura Documentos

Course Outline Finance Management

Enviado por

Sanjog BeheraDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Course Outline Finance Management

Enviado por

Sanjog BeheraDireitos autorais:

Formatos disponíveis

INDUS BUSINESS ACADEMY II Trimester Financial Management

(Course outline) OBJECTIVES: 1. To understand the theories, concepts and techniques of financial management for prudent decision making. 2. To familiarize students on basic aspects of Finance Management & Corporate Finance 3. To enable the students to apply the knowledge for proper decision making. MODULE 1: 2 Hrs

Nature and Scope of Financial Management Distinction between Finance and Accounts - Objectives of Financial Management, profit maximization and wealth maximization. Finance Functions, Structure of finance department, and Emerging role of the Finance Managers. MODULE 2: 6 hrs (including application problems)

Time value of money Time Lines & notation, Future value of single cash flow & annuity, present value of single cash flow, annuity& perpetuity. Effective rate of return. (Problems and theory). Techniques of Financial Statement Analysis - Trend Analysis, Common Size Statements, Ratio Analysis: Classification of Ratios Liquidity Ratios, Leverage Ratios, Activity Ratios- And Profitability Ratios. MODULE 3: 9 hrs (including application problems)

Working Capital Management I: factors influencing working capital requirements. Current asset policy and current asset finance policy. Determination of operating cycle and cash cycle Management of cash and Marketable Estimation of working capital requirements of a firm - Securities receivables management

Inventory Management- working capital financing. (Relevant problems need to be covered under all heads) Working Capital Management II: Cash management, concept of float and managing float, preparation of cash budget. Working capital management in service sectors (Banking, insurance etc) MODULE 4: 6 hrs (including application problems)

Sources of Finance: Sources of Long Term & Short Term finance-Financing decisions: Cost of capital Hybrid Financing Instruments Lease financing - and hire purchase Venture Capital MODULE 5: 6 hrs (including application problems)

Capital Budgeting: Investment decisions - Investment evaluation techniques Nature and Significance - Techniques of Capital Budgeting - Pay Back Method Internal rate of return, Modified internal rate of return Accounting Rate of Return Net Present Value and profitability index. Estimation of cash flow for new project, replacement projects MODULE 6: 2 hrs

Capital structure decisions Planning the capital structure. (No Capital structure theories to be covered) Leverages Determination of operating leverage, financial leverage and total leverage. Cost of capital- Calculation of cost of equity, debt, debentures, preference shares, equity shares and retained earnings. Calculation of WACC, Marginal WACC. MODULE 7: 2 hrs

Dividend policy Management of Profits: Dividend policy - Determinants of dividend policy, bonus shares and stock splits - Factors affecting the dividend policy - dividend policies- stable dividend, stable payout. (No dividend theories to be covered). Corporate Restructuring

Text Books: I M Pandey - Financial Management, Vikas Publications, 9th Edition, 2005. References: 1. Prasanna Chandra - Financial Management, Tata McGraw-Hill, 6th Edition 2004. 2. M Y Khan and P K Jain - Financial Management, Tata McGraw-Hill, 5th Edition 2007 3. Brigham & Houston, Fundamentals of Financial Management, 10th Edition, Thomson 4. Damodaran, Ashwath, Corporate Finance, www.damodaran.com 5. Ravi Kishore. (2005).Financial Management (2ndEd.), New Delhi: Kitamahal publishers ON LINE RESOURCES www.icai.com www.economictimes.com www.ey.com News papers and Journals: 1. 2. 3. 4. 5. 6. 7. www.indiainfoline.com www.reportgallery.com www.deloitte.com

Indian Journal of Finance ICFAI Journal of Applied Finance Economic Times Business Line Business standard Finance India( Quarterly Journal of Indian Institute of Finance) Journal of Finance(The American Finance Association publication)

Evaluation Criteria: Mid-Term Exam-15% , End-Term Exam-25% In course Assessment-60% (Quizzes, test, assignments, presentations, class participation, etc)

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- 219 Ho SBC (WJB) 9-30-02Documento36 páginas219 Ho SBC (WJB) 9-30-02arkhom1Ainda não há avaliações

- Animatronics Workshop ManualDocumento44 páginasAnimatronics Workshop ManualMithun P S100% (1)

- Challenger AC9000 Series Garage Door OperatorDocumento24 páginasChallenger AC9000 Series Garage Door Operatorjackanddiane1Ainda não há avaliações

- Circles Chapter Key ConceptsDocumento2 páginasCircles Chapter Key ConceptsViswapriyaa KrishnanAinda não há avaliações

- Software Engineering (210253)Documento12 páginasSoftware Engineering (210253)Prathamesh BhagatAinda não há avaliações

- Lab Report OnTensile Testing of SteelDocumento6 páginasLab Report OnTensile Testing of SteelSamuel Ogeda OtienoAinda não há avaliações

- CShearers-Geometry ProblemsDocumento13 páginasCShearers-Geometry ProblemsSreenath CharyAinda não há avaliações

- Extracting Features Using ENVI and ENVI LiDAR PDFDocumento26 páginasExtracting Features Using ENVI and ENVI LiDAR PDFvlady1Ainda não há avaliações

- LCA Lec20-21 Thevenin-Norton 082010Documento19 páginasLCA Lec20-21 Thevenin-Norton 082010Kainat KhalidAinda não há avaliações

- Medium Resolution Gamma Rays Spectroscopy For Safeguards Applications 1Documento253 páginasMedium Resolution Gamma Rays Spectroscopy For Safeguards Applications 1Saud AlshikhAinda não há avaliações

- Unit Iii - 80286Documento44 páginasUnit Iii - 80286khadarnawasAinda não há avaliações

- WMO No.306 Manual On Codes 2019 enDocumento480 páginasWMO No.306 Manual On Codes 2019 enAy AiAinda não há avaliações

- Fundamentals of The Electromagnetic MethodDocumento8 páginasFundamentals of The Electromagnetic MethodEder VacaAinda não há avaliações

- Watzlawick 1967 Beavin Jackson Pragmatics of Human CommunicationDocumento288 páginasWatzlawick 1967 Beavin Jackson Pragmatics of Human CommunicationPhalangchok Wanphet100% (21)

- Fraction As A Part of A WholeDocumento4 páginasFraction As A Part of A WholeWennyAinda não há avaliações

- Fanuc Hardware Connection MNL, GFZ 036867291Documento560 páginasFanuc Hardware Connection MNL, GFZ 036867291zcadAinda não há avaliações

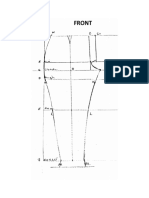

- Measure Front & Back Pants PatternDocumento8 páginasMeasure Front & Back Pants PatternAlicia MyersAinda não há avaliações

- Reporting Student LearningDocumento6 páginasReporting Student LearningKip PygmanAinda não há avaliações

- Describe How Light, Sound, and Heat Travel. Describe How The Path of Light TravelsDocumento3 páginasDescribe How Light, Sound, and Heat Travel. Describe How The Path of Light TravelsGemma Ito100% (2)

- Mathematics 5 Q1 W10Documento31 páginasMathematics 5 Q1 W10Aices Jasmin Melgar BongaoAinda não há avaliações

- Bioorganic & Medicinal ChemistryDocumento7 páginasBioorganic & Medicinal ChemistryIndah WulansariAinda não há avaliações

- Applications of Runge-Kutta-Fehlberg Method and Shooting Technique For Solving Classical Blasius EquationDocumento5 páginasApplications of Runge-Kutta-Fehlberg Method and Shooting Technique For Solving Classical Blasius Equationali belhocineAinda não há avaliações

- Elance Service Manaual - Rev H PDFDocumento94 páginasElance Service Manaual - Rev H PDFJuanAguileraOlivo67% (3)

- Revised ListDocumento10 páginasRevised List5paisaAinda não há avaliações

- Geometry m2 Topic C Lesson 12 TeacherDocumento14 páginasGeometry m2 Topic C Lesson 12 TeacherMae RohAinda não há avaliações

- Molecular Cell Biology 8th Edition Lodish Solutions ManualDocumento5 páginasMolecular Cell Biology 8th Edition Lodish Solutions Manualorianahilaryic3u1s100% (23)

- LeadGuitar Method 2 PDFDocumento69 páginasLeadGuitar Method 2 PDFsjlerman100% (2)

- Nuova Bravo 1.4 16V Instrument/Gauge Electrical Circuits 5505Documento18 páginasNuova Bravo 1.4 16V Instrument/Gauge Electrical Circuits 5505a123123123Ainda não há avaliações

- Request A One Time Passcode: DBS Online Account GuidanceDocumento3 páginasRequest A One Time Passcode: DBS Online Account GuidanceColly Boston-DuckAinda não há avaliações

- 0511-A 1Documento24 páginas0511-A 1suprita100% (1)