Escolar Documentos

Profissional Documentos

Cultura Documentos

Watson Indictment

Enviado por

The Salt Lake TribuneDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Watson Indictment

Enviado por

The Salt Lake TribuneDireitos autorais:

Formatos disponíveis

DAVIDB.BARLOW, United States Attorney (No. 13117) lUlZ ttlMi 114 ,6..

11: 22

ANNA M. PUGSLEY, Special Assistant United States Attorney (Provisionally A,4witted)

Attorneys for the United States of America DiS , 'v 1/\,1

185 South State Street, Suite 300

Salt Lake City, Utah 84111

Telephone: (801) 524-5682

IN THE UNITED STATES DISTRICT COURT

DISTRICT OF UTAH, NORTHERN DIVISION

UNITED STATES OF AMERICA,

Plaintiff,

vs.

ROBERT R. WATSON and

MARIE M. WATSON,

Defendants.

Case No.

INDICTMENT

VIO. 18 U.S.C. 371

Conspiracy

26 U.S.C. 7206(1)

Making and Subscribing to a

False Return

Case: 1:12-cr-00012

Assigned To : Waddoups, Clark

Assign. Date: 03/14/2012

Description: USA v.

The Grand Jury charges:

COUNT 1

18 U.S.C. 371

Conspiracy

Parties, Persons, and Entities

At all relevant times,

Case 1:12-cr-00012-CW Document 1 Filed 03/14/12 Page 1 of 7

1. Teazers Sports Bar & Grill (Teazers) was a corporation registered in the

state of Utah. It was a sports and entertainment club licensed to serve alcohol in Ogden,

Utah.

2. The Drink, Inc. was a corporation registered in the state of Utah and acting

as an S-Corporation. The Drink, Inc. owned the building and equipment of Teazers and

the land on which it was located.

3. Defendant ROBERT R. WATSON, age 52, of Pleasant View, Utah, was

president and general manager of Teazers.

4. Defendant MARIE M. WATSON, age 51, of Pleasant View, Utah, kept the.

books and records of Teazers. Defendants ROBERT R. WATSON and MARIE M.

WATSON were the sole owners and shareholders of The Drink, Inc.

5. The Internal Revenue Service (IRS) was an agency of the United States

Department of the Treasury, responsible for administering and enforcing the tax laws of

the United States.

The Conspiracy

6. From on or about January 1, 2004, the exact date being unknown to the

Grand Jury, and continuing thereafter up to and including at least December 31, 2009, in

the Northern Division of the District of Utah and elsewhere,

ROBERT R. WATSON and

MARIE M. WATSON,

-2

Case 1:12-cr-00012-CW Document 1 Filed 03/14/12 Page 2 of 7

defendants herein, did unlawfully, voluntarily, intentionally, and knowingly conspire,

combine, confederate, and agree together and with each other to defraud the United States

for the purpose of impeding, impairing, obstructing, and defeating the lawful Government

functions of the Internal Revenue Service of the Treasury Department in the

ascertainment, computation, assessment, and collection of the revenue: to wit, income

taxes.

Manner and Means of tbe Conspiracy

7. It was a part of the conspiracy that defendants MARIE M. WATSON and

ROBERT R. WATSON caused substantial cash receipts from Teazers not to be recorded

on any ofthe books and records of the company.

8. It was further a part of the conspiracy that defendants ROBERT R.

WATSON and MARIE M. WATSON prepared financial records for Teazers knowing

that substantial cash receipts from Teazers were not included therein.

9. It was further a part of their conspiracy that defendants ROBERT R.

WATSON and MARIE M. WATSON delivered to their tax preparer financial records

that did not include substantial cash receipts from Teazers, knowing that these records

were false and misleading.

-3

Case 1:12-cr-00012-CW Document 1 Filed 03/14/12 Page 3 of 7

10. It was further a part of the conspiracy that defendants ROBERT R.

WATSON and MARJE M. WATSON used cash receipts from Teazers to pay personal

expenses and did not report this information to their tax preparer or to the IRS.

Overt Acts

In furtherance of the and to effect the objects thereof, the following

acts were committed in the Northern Division of the District and elsewhere:

11. On or about the dates shown below, ROBERT R. WATSON and MARJE

M. WATSON prepared and caused to be prepared, signed, and filed with the IRS tax

returns for the taxyears shown below which were false and fraudulent.

Date Filed Tax Year Form

March 15,2005 2004 Corporation Income Tax Return (Form 1120)

March 15,2006 2005 Corporation Income Tax Return (Form 1120)

March 16, 2007 2006 Corporation Income Tax Return (Form 1120)

March 28, 2008 2007 Corporation Income Tax Return (Form 1120)

March 15,2009 2008 Corporation Income Tax Return (Form 1120)

April 15, 2005 2004 Joint Individual Income Tax Return (Form 1040)

April 15, 2006 2005 Joint Individual Income Tax Return (Form 1040)

April 15,2007 2006 Joint Individual Income Tax Return (Form 1040)

April 16, 2008 2007 Joint Individual Income Tax Return (Form 1040)

April 17, 2009 2008 Joint Individual Income Tax Return (Form 1040)

All in violation of 18 U.S.C. 371.

-4

Case 1:12-cr-00012-CW Document 1 Filed 03/14/12 Page 4 of 7

COUNTS 2-5

26 U.S.C. 7206(1)

Making and Subscribing to a False Return

12. On or about the dates shown below, in the Northern Division of the District

of Utah and elsewhere,

ROBERTR. WATSON,

a resident of Pleasant View, Utah, did willfully make and subscribe United States

Corporation Income Tax Returns (Form 1120), for Teazers for the tax years 2005-2008,

which were verified by written declarations that they were made under the penalties of

perjury and which he did not believe to be true and correct as to every material matter.

Those income tax returns, which were prepared and signed in the District of Utah and

were filed with the Internal Revenue Service, reported on Line 11 (Total Income) the

amounts shown below, whereas, as he then and there well knew and believed, these line

items were false because the tax returns failed to report material additional gross receipts

received by Teazers during each respective tax year.

Count Date Filed Tax Year Total Income

2 March 15,2006 2005 $846,166

3 March 16,2007 2006 $865,371

4 March 28, 2008 2007 $807,350

5 March 15,2009 2008 $842,804

All in violation of26 U.S.C. 7206(1).

-5

Case 1:12-cr-00012-CW Document 1 Filed 03/14/12 Page 5 of 7

COUNTS 6-9

26 U.S.C. 7206(1)

Making and Subscribing to a False Return

13. On or about the dates shown below, in the Northern Division of the District

of Utah elsewhere,

ROBERT R. WATSON and

MARlEM. WATSON,

defendants herein, did willfully make and subscribe joint U.S. Individual Income Tax

Returns (Form 1040), for the tax years 2005-2008, which were verified by a written

declaration that they were made under the penalties of perjury and which the defendants

did not believe to be true and correct as to every material matter. Those income tax

returns, which were prepared and signed in the District of Utah and were filed with the

Internal Revenue Service, reported on Line 37 (Adjusted Gross Income) the amounts

shown below, whereas, as the defendants then and there well knew and believed, these

line items were false because the tax returns failed to report material additional income

received by the defendants during each respective tax year.

Count Date Filed Tax Year Adjusted Gross Income

6 April 15, 2006 2005 $42,086

7 April 15, 2007 2006 $70,114

8 April 15, 2008 2007 $90,952

9 Apri115,2009 2008 $77,584

-6

Case 1:12-cr-00012-CW Document 1 Filed 03/14/12 Page 6 of 7

All in violation of26 U.S.C. 7206(1).

A TRUE BILL:

10\

FOREPERSON OF THE GRAND JURY

DAVID B. BARLOW

United States Attorney

ANNA M. PUGSLEY

Special Assistant United States Attorney

-7

Case 1:12-cr-00012-CW Document 1 Filed 03/14/12 Page 7 of 7

Você também pode gostar

- Upper Basin Alternative, March 2024Documento5 páginasUpper Basin Alternative, March 2024The Salt Lake TribuneAinda não há avaliações

- Teena Horlacher LienDocumento3 páginasTeena Horlacher LienThe Salt Lake TribuneAinda não há avaliações

- Salt Lake City Council text messagesDocumento25 páginasSalt Lake City Council text messagesThe Salt Lake TribuneAinda não há avaliações

- Richter Et Al 2024 CRB Water BudgetDocumento12 páginasRichter Et Al 2024 CRB Water BudgetThe Salt Lake Tribune100% (4)

- Goodly-Jazz ContractDocumento7 páginasGoodly-Jazz ContractThe Salt Lake TribuneAinda não há avaliações

- Unlawful Detainer ComplaintDocumento81 páginasUnlawful Detainer ComplaintThe Salt Lake Tribune100% (1)

- U.S. Army Corps of Engineers LetterDocumento3 páginasU.S. Army Corps of Engineers LetterThe Salt Lake TribuneAinda não há avaliações

- NetChoice V Reyes Official ComplaintDocumento58 páginasNetChoice V Reyes Official ComplaintThe Salt Lake TribuneAinda não há avaliações

- Park City ComplaintDocumento18 páginasPark City ComplaintThe Salt Lake TribuneAinda não há avaliações

- Opinion Issued 8-Aug-23 by 9th Circuit Court of Appeals in James Huntsman v. LDS ChurchDocumento41 páginasOpinion Issued 8-Aug-23 by 9th Circuit Court of Appeals in James Huntsman v. LDS ChurchThe Salt Lake Tribune100% (2)

- Settlement Agreement Deseret Power Water RightsDocumento9 páginasSettlement Agreement Deseret Power Water RightsThe Salt Lake TribuneAinda não há avaliações

- Wasatch IT-Jazz ContractDocumento11 páginasWasatch IT-Jazz ContractThe Salt Lake TribuneAinda não há avaliações

- The Church of Jesus Christ of Latter-Day Saints Petition For Rehearing in James Huntsman's Fraud CaseDocumento66 páginasThe Church of Jesus Christ of Latter-Day Saints Petition For Rehearing in James Huntsman's Fraud CaseThe Salt Lake TribuneAinda não há avaliações

- Spectrum Academy Reform AgreementDocumento10 páginasSpectrum Academy Reform AgreementThe Salt Lake TribuneAinda não há avaliações

- Gov. Cox Declares Day of Prayer and ThanksgivingDocumento1 páginaGov. Cox Declares Day of Prayer and ThanksgivingThe Salt Lake TribuneAinda não há avaliações

- Superintendent ContractsDocumento21 páginasSuperintendent ContractsThe Salt Lake TribuneAinda não há avaliações

- David Nielsen - Memo To US Senate Finance Committee, 01-31-23Documento90 páginasDavid Nielsen - Memo To US Senate Finance Committee, 01-31-23The Salt Lake Tribune100% (1)

- Employment Contract - Liz Grant July 2023 To June 2025 SignedDocumento7 páginasEmployment Contract - Liz Grant July 2023 To June 2025 SignedThe Salt Lake TribuneAinda não há avaliações

- US Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022Documento5 páginasUS Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022The Salt Lake TribuneAinda não há avaliações

- PLPCO Letter Supporting US MagDocumento3 páginasPLPCO Letter Supporting US MagThe Salt Lake TribuneAinda não há avaliações

- HB 499 Utah County COG LetterDocumento1 páginaHB 499 Utah County COG LetterThe Salt Lake TribuneAinda não há avaliações

- 2023.03.28 Emery County GOP Censure ProposalDocumento1 página2023.03.28 Emery County GOP Censure ProposalThe Salt Lake TribuneAinda não há avaliações

- SEC Cease-And-Desist OrderDocumento9 páginasSEC Cease-And-Desist OrderThe Salt Lake Tribune100% (1)

- US Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022Documento5 páginasUS Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022The Salt Lake TribuneAinda não há avaliações

- Final Signed Republican Governance Group Leadership LetterDocumento3 páginasFinal Signed Republican Governance Group Leadership LetterThe Salt Lake TribuneAinda não há avaliações

- US Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022Documento5 páginasUS Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022The Salt Lake TribuneAinda não há avaliações

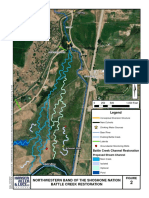

- EWRP-035 TheNorthwesternBandoftheShoshoneNation Site MapDocumento1 páginaEWRP-035 TheNorthwesternBandoftheShoshoneNation Site MapThe Salt Lake TribuneAinda não há avaliações

- Utah Senators Encourage Gov. DeSantis To Run For U.S. PresidentDocumento3 páginasUtah Senators Encourage Gov. DeSantis To Run For U.S. PresidentThe Salt Lake TribuneAinda não há avaliações

- Ruling On Motion To Dismiss Utah Gerrymandering LawsuitDocumento61 páginasRuling On Motion To Dismiss Utah Gerrymandering LawsuitThe Salt Lake TribuneAinda não há avaliações

- Proc 2022-01 FinalDocumento2 páginasProc 2022-01 FinalThe Salt Lake TribuneAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- GN12 WTIA Comparison of Welding Inspector Qualifications and CertificationsDocumento4 páginasGN12 WTIA Comparison of Welding Inspector Qualifications and Certificationskarl0% (1)

- Tacas Vs Tobon (SC)Documento7 páginasTacas Vs Tobon (SC)HenteLAWcoAinda não há avaliações

- 0452 w16 Ms 13Documento10 páginas0452 w16 Ms 13cheah_chinAinda não há avaliações

- PPRA Procurement Code 4th EditionDocumento116 páginasPPRA Procurement Code 4th Editionaon waqasAinda não há avaliações

- Admin Cases PoliDocumento20 páginasAdmin Cases PoliEunice Iquina100% (1)

- Nutanix Support GuideDocumento29 páginasNutanix Support GuideEko PrasetyoAinda não há avaliações

- Characteristics of SovereigntyDocumento9 páginasCharacteristics of SovereigntyVera Mae RigorAinda não há avaliações

- Me Review: Von Eric A. Damirez, M.SCDocumento25 páginasMe Review: Von Eric A. Damirez, M.SCKhate ÜüAinda não há avaliações

- Evidence Drop: Hawaii DOH Apparently Gave Obama Stig Waidelich's Birth Certificate Number - 3/27/2013Documento62 páginasEvidence Drop: Hawaii DOH Apparently Gave Obama Stig Waidelich's Birth Certificate Number - 3/27/2013ObamaRelease YourRecords100% (3)

- 2020.11.30-Notice of 14th Annual General Meeting-MDLDocumento13 páginas2020.11.30-Notice of 14th Annual General Meeting-MDLMegha NandiwalAinda não há avaliações

- The Medical Act of 1959Documento56 páginasThe Medical Act of 1959Rogelio Junior RiveraAinda não há avaliações

- 1981 MIG-23 The Mystery in Soviet Skies WPAFB FTD PDFDocumento18 páginas1981 MIG-23 The Mystery in Soviet Skies WPAFB FTD PDFapakuniAinda não há avaliações

- MUH050220 O-12 - Final PDF 061221Documento123 páginasMUH050220 O-12 - Final PDF 061221Ricardo OkabeAinda não há avaliações

- Case StudyDocumento15 páginasCase Studysonam shrivasAinda não há avaliações

- ITD GYE21 GTS 2051 2021 0026 SignedDocumento6 páginasITD GYE21 GTS 2051 2021 0026 SignedY'aa M'ichaelAinda não há avaliações

- RBM ListDocumento4 páginasRBM ListEduardo CanelaAinda não há avaliações

- DPC Cookie GuidanceDocumento17 páginasDPC Cookie GuidanceshabiumerAinda não há avaliações

- Manage Your Risk With ThreatModeler OWASPDocumento39 páginasManage Your Risk With ThreatModeler OWASPIvan Dario Sanchez Moreno100% (1)

- Columbia Aaltius: Columbia Developers Private LimitedDocumento4 páginasColumbia Aaltius: Columbia Developers Private LimitedRishav GoyalAinda não há avaliações

- VW - tb.26-07-07 Exhaust Heat Shield Replacement GuidelinesDocumento2 páginasVW - tb.26-07-07 Exhaust Heat Shield Replacement GuidelinesMister MCAinda não há avaliações

- Mindanao Mission Academy: Business FinanceDocumento3 páginasMindanao Mission Academy: Business FinanceHLeigh Nietes-GabutanAinda não há avaliações

- Canadian History VocabularyDocumento3 páginasCanadian History VocabularyJessica WilsonAinda não há avaliações

- Separation, Delegation, and The LegislativeDocumento30 páginasSeparation, Delegation, and The LegislativeYosef_d100% (1)

- Evolving Principles of Dominant Position and Predatory Pricing in the Telecommunication Sector (1)Documento20 páginasEvolving Principles of Dominant Position and Predatory Pricing in the Telecommunication Sector (1)Aryansh SharmaAinda não há avaliações

- Myths, Heroes and Progress in Mrs. Rania's Speaking ClassDocumento26 páginasMyths, Heroes and Progress in Mrs. Rania's Speaking ClassRania ChokorAinda não há avaliações

- Online Tax Payment PortalDocumento1 páginaOnline Tax Payment Portalashish rathoreAinda não há avaliações

- Case No. 13 - ROBERTO S. BENEDICTO and HECTOR T. RIVERA vs. THE COURT OF APPEALSDocumento2 páginasCase No. 13 - ROBERTO S. BENEDICTO and HECTOR T. RIVERA vs. THE COURT OF APPEALSCarmel Grace KiwasAinda não há avaliações

- Hilltop Market Fish VendorsDocumento7 páginasHilltop Market Fish Vendorsanna ticaAinda não há avaliações

- Sanchez Vs AsinganDocumento1 páginaSanchez Vs AsinganJanice100% (1)