Escolar Documentos

Profissional Documentos

Cultura Documentos

Predatory Lending Interview

Enviado por

Adam TracyDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Predatory Lending Interview

Enviado por

Adam TracyDireitos autorais:

Formatos disponíveis

PREDATORY LENDING INTERVIEW Please read and complete the following interview, attaching copies of any of the documents

requested Truth-In-Lending Act (TILA) The purpose of the Truth-In-Lending Act (TILA) is to standardize the way credit is disclosed to consumers. TILA is a remedial legislation, designed for consumers to correct lender errors after the transaction is consummated. The penalties for lenders violating TILA can be significant, including rescission of the loan transaction. Yes No 1. Is the property subject to the loan your principal dwelling? 2. Has it been three (3) years since the loans closing date? 3. Was the loan used to purchase or build the property? 4. Was a mortgage broker fee charged in connection with the loan? a. If Yes state the amount here (if known): $___________ 5. Have you attached copies the following documents? a. HUD-1 Settlement Statement b. TILA Statement c. Credit report provided to you at closing d. Invoice(s) for appraisal, courier or credit report e. Cancelled checks for monies paid at closing Home Ownership and Equity Protection Act (HOEPA) The Home Ownership and Equity Protection Act (HOEPA) is an amendment to TILA that delineates stringent guidelines regarding certain high cost refinance loans. Where a loan is subject to HOEPA, the lender must provide specific notices to the borrower three (3) or more days before closing. Violations of HOEPA may entitle the borrower to both rescission and monetary damages. Yes No 1. Is the property subject to the loan your principal dwelling? 2. Has it been three (3) years since the loans closing date? 3. Was the loan used to purchase or build the property? a. If No did you refinance with a new lender? i. If No did you take cash-out of the property? 4. Does your loan contain (if known): a. Balloon payment? b. Negative amortization? c. Advance payments? d. Rebates? e. Prepayment penalty? f. An increase in interest rates after default? 5. Have you attached copies of the following documents? a. HUD-1 Settlement Statement b. HOEPA or other disclosures provided by your lender

Right to Rescind Under TILA, every borrower is required to be provided with a accurate notice of the borrowers right to rescind the transaction within three (3) days after the closing. Should a borrower fail to provide this notice, the borrower may be entitled to rescind the transaction up to three (3) years later. Yes No 1. Is the property subject to the loan your principal dwelling? 2. Has it been three (3) years since the loans closing date? 3. Was the loan used to purchase or build the property? a. If No did you refinance with a new lender? i. If No did you take cash-out of the property? 4. Were you provided with a Notice of Right to Cancel ? a. If Yes were you provided with two (2) copies? b. If Yes have you attached a copy? Real Estate Settlement Procedures Act (RESPA) The Real Estate Settlement Procedures Act (RESPA) was designed to help consumers shop for settlement services (e.g., broker and title companies) and eliminate excess fees from the process. Violations of RESPA may entitle a borrower to damages for both actual losses and statutory damages provided for under the Act. Yes No 1. Is the property a residential property? 2. Is the property vacant land? 3. Were you provided with a Good Faith Estimate (GFE) ? a. If Yes when? (specify) _________________________ 4. Do you have a variable rate loan? a. Where you provided with a CHARM booklet? 5. Have you submitted a Qualified Written Request? a. If Yes when? (specify) _________________________ b. If Yes did you receive a response? 6. Were you required to use a particular title insurance company? a. If Yes what was your closing date? ______________ 7. Were you provided a notice regarding servicing? 8. Have you attached copies of the following documents? a. Purchase contract b. HUD-1 Settlement Statement c. Good Faith Estimate d. Qualified Written Request

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Cma Part 1 Mock 2Documento44 páginasCma Part 1 Mock 2armaghan175% (8)

- The Effect of Management TrainingDocumento30 páginasThe Effect of Management TrainingPulak09100% (1)

- Abbott Vascular Coronary Catheter FSN 3-16-17Documento7 páginasAbbott Vascular Coronary Catheter FSN 3-16-17medtechyAinda não há avaliações

- 2017 Virtus Interpress Book Corporate GovernanceDocumento312 páginas2017 Virtus Interpress Book Corporate GovernanceMohammad Arfandi AdnanAinda não há avaliações

- Telebrands Corp V Martfive - DJ ComplaintDocumento37 páginasTelebrands Corp V Martfive - DJ ComplaintSarah BursteinAinda não há avaliações

- Is Wal-Mart Too Powerful - BusinessweekDocumento5 páginasIs Wal-Mart Too Powerful - BusinessweekDavid TanAinda não há avaliações

- Andersen violated auditing standards in Enron auditDocumento2 páginasAndersen violated auditing standards in Enron auditJanelAlajasLeeAinda não há avaliações

- MEDICINE INVENTORY MANAGEMENT SYSTEM (MIMSDocumento3 páginasMEDICINE INVENTORY MANAGEMENT SYSTEM (MIMSChris ValduezaAinda não há avaliações

- Capital Alert 6/13/2008Documento1 páginaCapital Alert 6/13/2008Russell KlusasAinda não há avaliações

- Table 2.5 SolutionDocumento3 páginasTable 2.5 SolutionMarghoob AhmadAinda não há avaliações

- McKinsey Quarterly - Issue 1 2012 (A Resource Revolution)Documento136 páginasMcKinsey Quarterly - Issue 1 2012 (A Resource Revolution)DeividasBerAinda não há avaliações

- Blue Ribbon NovemberDocumento32 páginasBlue Ribbon NovemberDavid PenticuffAinda não há avaliações

- 90-Day PlannerDocumento8 páginas90-Day PlannerNikken, Inc.Ainda não há avaliações

- Asian EfficiencyDocumento202 páginasAsian Efficiencysilvia100% (5)

- CHED New Policies On Tuiton and Other School FeesDocumento13 páginasCHED New Policies On Tuiton and Other School FeesBlogWatch100% (2)

- Purchasing Training Introduction and Working RulesDocumento29 páginasPurchasing Training Introduction and Working RulesBirlan AdrianAinda não há avaliações

- Temu 4Documento8 páginasTemu 4leddy teresaAinda não há avaliações

- Agora - Managing Supply ChainDocumento25 páginasAgora - Managing Supply Chainabid746Ainda não há avaliações

- Introduction To Industrial Relations - Chapter IDocumento9 páginasIntroduction To Industrial Relations - Chapter IKamal KatariaAinda não há avaliações

- Group Directory: Commercial BankingDocumento2 páginasGroup Directory: Commercial BankingMou WanAinda não há avaliações

- (NAK) Northern Dynasty Presentation 2017-06-05Documento39 páginas(NAK) Northern Dynasty Presentation 2017-06-05Ken Storey100% (1)

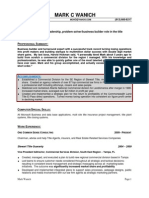

- Senior Executive Title Operations Management in Tampa Bay FL Resume Mark WanichDocumento2 páginasSenior Executive Title Operations Management in Tampa Bay FL Resume Mark WanichMarkWanichAinda não há avaliações

- Quotation For Security Guards and Housekeeping Lpersons-340270102Documento11 páginasQuotation For Security Guards and Housekeeping Lpersons-340270102ajaysharma.npcilAinda não há avaliações

- Clinical Audit: A Process for Improving Patient Care and OutcomesDocumento8 páginasClinical Audit: A Process for Improving Patient Care and OutcomesAranaya DevAinda não há avaliações

- Nestle - Marketing ProjectDocumento24 páginasNestle - Marketing ProjectSarosh AtaAinda não há avaliações

- The coverage details for windstorm, lightning, earthquake, and fire in property insurance policiesDocumento1 páginaThe coverage details for windstorm, lightning, earthquake, and fire in property insurance policiesKim EstalAinda não há avaliações

- Foreshore ApplicationDocumento2 páginasForeshore ApplicationjovanAinda não há avaliações

- Spoilage and Rework ProbsDocumento3 páginasSpoilage and Rework ProbsShey INFTAinda não há avaliações

- Banks Guarantee Rules Under UNCITRALDocumento6 páginasBanks Guarantee Rules Under UNCITRALjewonAinda não há avaliações

- Q3 - Financial Accounting and Reporting (Partnership Accounting) All About Partnership DissolutionDocumento3 páginasQ3 - Financial Accounting and Reporting (Partnership Accounting) All About Partnership DissolutionALMA MORENAAinda não há avaliações