Escolar Documentos

Profissional Documentos

Cultura Documentos

Corp Bank India Services

Enviado por

Priyanka SawantDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Corp Bank India Services

Enviado por

Priyanka SawantDireitos autorais:

Formatos disponíveis

About Corporation Bank India

The Corporation Bank in India started its journey in the name of the Canara Banking Corporation (Udupi) Ltd in 1906 with a sum of ` 5000 only in a small town of Udupi near the city of Mangalore in Karnataka. Corp Bank received RBI license in 1952 and saw a merger with the Bank of Citizens in 1961. In the month of April 1980, it was given a status of nationalized bank. From the time of its establishment till today, the bank has never looked back. Currently it is one of the well recognized Public Sector Banks in India. Today, Corporation Bank India is identified with dynamic services of its young and dedicated staffs, who know no bounds. It runs more than 600 ATMs extending across 21 States and 2 Union Territories. It shares ATM network with Andhra Bank, ING Vysya Bank Ltd. and IndusInd Bank Ltd.

Products and Services of Corporation Bank India

Customers of the Corporation Bank enjoy a vast range of products and services, comprising:

Credit Card & Debit Card Services Value Added Banking Services Corporate Banking Services Personal Banking Services Internet Banking Services

Customers looking for corporate and international business support can look for its personalized services like Gold Card Scheme for Exporters. The bank has introduced an effective range of products and services to meet the needs of the customers who run Micro and Small Enterprises (MSE). Forex, Cash Management, Project Finance, Corp Vyapar, Corp Rental and Working Capital are just to name a few of them. For NRI customers, the Corporation Bank arranges for Speed Cash and Speed Remittance, Corp Quick Remit, loans, deposits and portfolio services. Forex Facilities for Residents, NRIs or PIOs are also available. In the field of personal banking services, any customer can seek services like Corp Pragathi Account, Current Account, Term Deposit, EMI / Deposit Maturity Calculator, Home Loan and Insurance, Savings Bank A/C and Loans. This bank assists in the sale of gold coins and bars. For the convenience of the customers, ATM Locator has also been introduced.

Branches of Corporation Bank India

The branches of the Corporation Bank India are located at all the key destinations like Bangalore, Belgaum, Bhopal, Chandigarh, Chennai, Coimbatore, Delhi, Goa, Mumbai, Gujarat, Hassan, Hubli, Hyderabad, Kerala, Kolkata, Lucknow, Pune, Udupi and Vijayawada.

Awards and Recognition of Corporation Bank India

In its journey to cater successfully to the needs of valuable customers, Corporation Bank has bagged many awards and accolades. Some of them are as follows:

National Award for Assistance to Exporters Gem & Jewellery Export Promotion Council Award (it won this award 5 times in a row from 1981 to 1985) Shiromani Award for Banking Best Bank Award for Excellence in Banking Technology Best Bank Award for Innovative Usage and Application on INFINET (Indian Financial Network) Best Bank Award for Delivery Channels Runner-up Awards in the categories of "Best Online and Multi-channel Banking Team" and "Outstanding achiever of the year-corporate".

Corporation Bank has been recognized as one of the Best Public Sector Banks in India by Business Today on 26 February 2006. Prior to this, Forbes Global announced it one of the Best 200/100 companies in Asia/Pacific and Europe. Outlook Money called it Best Public Sector Bank in India and The Asian Banker said it to be the strongest bank in India and second strongest in Asia.

Three authorities, Central and State Governments and RBI, are presently involved in regulating, supervising and/or administering UCBs. There are as many as 2,084 UCBs of which 51 are scheduled and the rest are non-scheduled UCBs. In view of their large number as well as their dispersed and local character, their supervision and inspection pose special problems.

At present, while accounts of UCBs are required to be audited by State Governments,

there has been substantial delay in completing audit of a large number of UCBs. RBI conducts statutory inspections normally once in two years in respect of scheduled UCBs, once in two to three years in respect of non-scheduled UCBs, while the identified weak banks are inspected on annual basis.

Several committees, including a high power committee set up by RBI in May 1999 under the Chairmanship of Shri K. Madhava Rao, have made wide-ranging recommendations for eliminating dual control and for improving the functioning of the co-operative banks.

Most of these recommendations have been accepted by RBI, but recommendations requiring legislative action at the level of State Governments have yet to be implemented.

Initially many a State Government expressed its reservation in sharing the control over cooperative societies carrying on banking business with Reserve Bank of India. A conference convened by RBI in November 1963 to deliberate on the issue, "witnessed intense debate over the virtues of vesting in the Bank powers to liquidate a cooperative bank or supersede its management, with the Madras Government, in particular, marshalling ideological, constitutional and practical arguments against the idea.

Mysore joined Madras in suggesting that the regulation by Reserve Bank was too high a price to pay for extending insurance cover to depositors of cooperative banks"

Cooperative banks not only received substantial funds by way of created money from RBI but also accepted deposits from public and financed agriculture, industry, commerce and trade.

With the State Governments committed to a policy of positive support to cooperative banks, it was felt that the impact of cooperative credit institutions on the monetary and credit policy was going to become more and more significant. In late fifties and early sixties, a number of banks had failed, thus, adversely affecting the interests of the depositors. This had led to certain amendments in the Banking Regulation Act. It was considered desirable to extend some of these provisions also to banks in the cooperative sector so as to safeguard the interest of depositors. Hence, the RBI felt that

it was a regulatory necessity to bring the banking institutions operating in the cooperative sector within the statutory control of RBI. Thus, the application of banking laws to cooperative banks basically emanated because of the following reasons;

i) Interests of depositors required extension of Banking Regulation Act to banks in the cooperative sector, ii) RBI's supervision was considered necessary for extending deposit insurance, iii) Substantial funds were granted to cooperative credit structure by way of created money from RBI and, hence, it had a monetary policy connotation, iv) Public interest required that institutions having substantial public deposits and functioning as banks should operate under the supervision of Reserve Bank of India.

After prolonged deliberations on the need for RBI to have control over cooperative societies carrying on banking business, the Banking Laws (Application to Cooperative Societies) Bill was passed by the Parliament. It received the assent of the President in September 1965 and the Act came in to force from 1 March, 1966. With this amendment in the Banking Regulation Act, certain provisions of the Banking Regulation Act became applicable to cooperative banks carrying on banking business. This brought in an era of dual control over cooperative banks. In terms of the Cooperative Societies Act of the State, the Registrar of Cooperative Societies was to have jurisdiction over the incorporation, registration, management, amalgamation, merger, liquidation etc. and the Reserve Bank was to have jurisdiction over the banking activities of the cooperative society.

After having heard the views of the cooperators, federations and cooperative banks as also the State Governments officials, and after examining the existing statutory framework under the State Cooperative Societies Acts, the High Power Committee felt that the dual control regime, per se, need not cause any hindrance to the growth of the urban banking movement.

Você também pode gostar

- Banking India: Accepting Deposits for the Purpose of LendingNo EverandBanking India: Accepting Deposits for the Purpose of LendingAinda não há avaliações

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Ainda não há avaliações

- Profile of SBIDocumento15 páginasProfile of SBIkarthikrishnaAinda não há avaliações

- Chapter 1 Profile of Sbi and Its Customer SatisfactionDocumento13 páginasChapter 1 Profile of Sbi and Its Customer SatisfactionNirav PatelAinda não há avaliações

- Banking in India SumeshDocumento26 páginasBanking in India Sumeshsumesh894Ainda não há avaliações

- Research Paper On Cooperative Banks in IndiaDocumento8 páginasResearch Paper On Cooperative Banks in Indiagz45tyye100% (1)

- "Credit Risk Management in State Bank of India": Title of The ProjectDocumento43 páginas"Credit Risk Management in State Bank of India": Title of The Projectswarali deshmukhAinda não há avaliações

- Scenario of Foreign Banks in IndiaDocumento62 páginasScenario of Foreign Banks in IndiaYesha Khona100% (1)

- Assessments of BanksDocumento94 páginasAssessments of Bankskavita.m.yadavAinda não há avaliações

- State Bank of IndiaDocumento14 páginasState Bank of IndiaMahadevan KrishnamurthyAinda não há avaliações

- State Bank of India: A Pivotal Role in India's Banking SectorDocumento91 páginasState Bank of India: A Pivotal Role in India's Banking Sectoraditya desaiAinda não há avaliações

- Corporation Bank Report FinalDocumento61 páginasCorporation Bank Report FinalJasmandeep brarAinda não há avaliações

- Banking SectorDocumento12 páginasBanking SectorVijay RaghunathanAinda não há avaliações

- Growth of Merchant Banking in IndiaDocumento7 páginasGrowth of Merchant Banking in IndiamgajenAinda não há avaliações

- Comparitive Analysis of Public Sector and Private Sectors Banks PDFDocumento67 páginasComparitive Analysis of Public Sector and Private Sectors Banks PDFAnonymous y3E7ia100% (1)

- Introduction Historical Background: The Law Relating To Banking, As WeDocumento125 páginasIntroduction Historical Background: The Law Relating To Banking, As WeBalaji Rao N100% (2)

- Small Finance Banks: A New Category of Differentiated Banks in IndiaDocumento8 páginasSmall Finance Banks: A New Category of Differentiated Banks in IndiaUnitti ChauhanAinda não há avaliações

- Functions of Reserve Bank of IndiaDocumento5 páginasFunctions of Reserve Bank of IndiapraveenAinda não há avaliações

- Growth in Banking SectorDocumento30 páginasGrowth in Banking SectorHarish Rawal Harish RawalAinda não há avaliações

- A Study of Bank Audit ProcessDocumento61 páginasA Study of Bank Audit ProcessSunil PawarAinda não há avaliações

- Industry Profile Banking Industry in India:: Study On Agricultural Credit Facility of Canara BankDocumento66 páginasIndustry Profile Banking Industry in India:: Study On Agricultural Credit Facility of Canara BankGoutham BindigaAinda não há avaliações

- BFS Unit 1-5Documento56 páginasBFS Unit 1-5kaipulla1234567Ainda não há avaliações

- CRMDocumento25 páginasCRMAlana PetersonAinda não há avaliações

- HUMAN RESOURCE STRATEGIES AT SBIDocumento26 páginasHUMAN RESOURCE STRATEGIES AT SBIAmul KapoorAinda não há avaliações

- Term Paper: SUBMITTED TO: Prabhjot KaurDocumento23 páginasTerm Paper: SUBMITTED TO: Prabhjot KauramritabarunAinda não há avaliações

- Regional Rural BanksDocumento4 páginasRegional Rural BanksSiddhartha BindalAinda não há avaliações

- Growth in Indian Banking SectorDocumento59 páginasGrowth in Indian Banking SectorKishan KudiaAinda não há avaliações

- Brief Introduction to India's Banking SectorDocumento18 páginasBrief Introduction to India's Banking SectorSumit PoddarAinda não há avaliações

- Co OperativeDocumento220 páginasCo OperativeMeenukutty MeenuAinda não há avaliações

- Banking: Prof. Rahul Mailcontractor Assistant Professor, Jain College of MCA and MBA, BelgaumDocumento69 páginasBanking: Prof. Rahul Mailcontractor Assistant Professor, Jain College of MCA and MBA, BelgaumhakecAinda não há avaliações

- 180 Sample-Chapter PDFDocumento15 páginas180 Sample-Chapter PDFhanumanthaiahgowdaAinda não há avaliações

- Project - Loans and AdvancesDocumento60 páginasProject - Loans and AdvancesRajendra Gawate75% (12)

- Merger of Banks in India Is It Leading To A Monopoly in Banking Sector?Documento6 páginasMerger of Banks in India Is It Leading To A Monopoly in Banking Sector?TJPRC PublicationsAinda não há avaliações

- A Study On Credit Risk ManagementDocumento44 páginasA Study On Credit Risk ManagementShabreen Sultana100% (1)

- Credit Risk at Sbi Project Report Mba FinanceDocumento103 páginasCredit Risk at Sbi Project Report Mba FinanceBabasab Patil (Karrisatte)100% (3)

- BANKING AWAREESS: Different Types of Bank: 1. Commercial BanksDocumento12 páginasBANKING AWAREESS: Different Types of Bank: 1. Commercial BanksKumar KushAinda não há avaliações

- Ramya Canara Bank Project Final ReportDocumento106 páginasRamya Canara Bank Project Final ReportShiva Kumar Mahadevappa79% (14)

- Unit 1 Introduction to BankingDocumento61 páginasUnit 1 Introduction to Bankingceweli8890Ainda não há avaliações

- Classification of BanksDocumento14 páginasClassification of BanksJas KaranAinda não há avaliações

- Types of BankingDocumento10 páginasTypes of BankingJinu SajiAinda não há avaliações

- Rural DevelopmentsDocumento88 páginasRural DevelopmentsVyom K ShahAinda não há avaliações

- Credit Risk Project PDFDocumento104 páginasCredit Risk Project PDFDenish PatelAinda não há avaliações

- History of Indian BankingDocumento11 páginasHistory of Indian BankingSohini KarAinda não há avaliações

- Overview of BanksDocumento9 páginasOverview of BanksParesh MaradiyaAinda não há avaliações

- Comparative Study Between Two BanksDocumento26 páginasComparative Study Between Two BanksAnupam SinghAinda não há avaliações

- Homeloans IciciDocumento83 páginasHomeloans Icicitajju_121Ainda não há avaliações

- ANUP College 1Documento49 páginasANUP College 1NMA NMAAinda não há avaliações

- A study on home loans of icici bank (1)Documento50 páginasA study on home loans of icici bank (1)Saumya BajpaiAinda não há avaliações

- VAdv Template - EPR KC - ST - Bank2Documento53 páginasVAdv Template - EPR KC - ST - Bank2Prateek KhublaniAinda não há avaliações

- Unit - 1Documento93 páginasUnit - 1Suji MbaAinda não há avaliações

- Regional Rural Banks of India: Evolution, Performance and ManagementNo EverandRegional Rural Banks of India: Evolution, Performance and ManagementAinda não há avaliações

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsAinda não há avaliações

- Marketing of Consumer Financial Products: Insights From Service MarketingNo EverandMarketing of Consumer Financial Products: Insights From Service MarketingAinda não há avaliações

- The Bankable SOE: Commercial Financing for State-Owned EnterprisesNo EverandThe Bankable SOE: Commercial Financing for State-Owned EnterprisesAinda não há avaliações

- Public Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesNo EverandPublic Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesAinda não há avaliações

- Financing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesNo EverandFinancing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesAinda não há avaliações

- Guidance Note on State-Owned Enterprise Reform for Nonsovereign and One ADB ProjectsNo EverandGuidance Note on State-Owned Enterprise Reform for Nonsovereign and One ADB ProjectsAinda não há avaliações

- Group 2 Ancom BerhadDocumento21 páginasGroup 2 Ancom Berhad杰小Ainda não há avaliações

- Impact of Foreign Aid on Economic DevelopmentDocumento10 páginasImpact of Foreign Aid on Economic DevelopmentMazwan ManselahAinda não há avaliações

- Forex Ict Amp MMM Notespdf 5 PDF FreeDocumento109 páginasForex Ict Amp MMM Notespdf 5 PDF FreeHaneePatel100% (1)

- Business OrganizationDocumento26 páginasBusiness OrganizationChandura PriyankAinda não há avaliações

- For HDFC ERGO General Insurance Company LTDDocumento2 páginasFor HDFC ERGO General Insurance Company LTDvivaan shahAinda não há avaliações

- 2011-SMU-MBA 2nd (Production & Operations Manageme) Set-2Documento75 páginas2011-SMU-MBA 2nd (Production & Operations Manageme) Set-2Ali Asharaf Khan0% (1)

- The IS-LM ModelDocumento13 páginasThe IS-LM ModelKatherine Asis NatinoAinda não há avaliações

- Financial Economic Analysis Shadow Pricing Apr2013 PDFDocumento13 páginasFinancial Economic Analysis Shadow Pricing Apr2013 PDFAlfred PatrickAinda não há avaliações

- Order in The Matter of M/s Sunshine Global Agro LimitedDocumento16 páginasOrder in The Matter of M/s Sunshine Global Agro LimitedShyam SunderAinda não há avaliações

- Du Pont Capital Structure Case Maximizes Firm ValueDocumento4 páginasDu Pont Capital Structure Case Maximizes Firm Valueabhishekhrc0% (1)

- Chapter 3 Entrepreneurship, New Ventures, and Business OwnershipDocumento47 páginasChapter 3 Entrepreneurship, New Ventures, and Business OwnershipAnas Khalid shaikhAinda não há avaliações

- Essentials of Islamic Finance Course OutlineDocumento5 páginasEssentials of Islamic Finance Course OutlineSyeda HaifaAinda não há avaliações

- Bank Recon ShortcutDocumento2 páginasBank Recon ShortcutMethlyAinda não há avaliações

- Application of Fixed Asset DepreciationDocumento4 páginasApplication of Fixed Asset DepreciationGiffari Ibnu ToriqAinda não há avaliações

- RTO Programme Pitchbook 20191213Documento7 páginasRTO Programme Pitchbook 20191213Kung FooAinda não há avaliações

- Credit and Credit Administration LatestDocumento297 páginasCredit and Credit Administration LatestPravin GhimireAinda não há avaliações

- House No 2, Street No 2, F-7/3, Islamabad Suriya Nauman Rehan & CoDocumento4 páginasHouse No 2, Street No 2, F-7/3, Islamabad Suriya Nauman Rehan & Cowaqas aliAinda não há avaliações

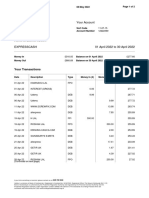

- 2022 April StatementDocumento2 páginas2022 April StatementAvishekAinda não há avaliações

- BISI - Equity Research - FikryDocumento12 páginasBISI - Equity Research - Fikryaly_rowiAinda não há avaliações

- (See Right Options & Solutions On The Next Sheet "Solution"Documento17 páginas(See Right Options & Solutions On The Next Sheet "Solution"nishiAinda não há avaliações

- Director Finance Operations in New York City Resume Elliot GoldsteinDocumento2 páginasDirector Finance Operations in New York City Resume Elliot GoldsteinElliotGoldsteinAinda não há avaliações

- Starting a Chocolate Company Business PlanDocumento26 páginasStarting a Chocolate Company Business PlanYummy Choc83% (6)

- SY1920 1st Sem ACCO4083 - 3rd EvaluationDocumento9 páginasSY1920 1st Sem ACCO4083 - 3rd EvaluationPaul Adriel BalmesAinda não há avaliações

- Chairmans AGM Speech 20170809092431Documento17 páginasChairmans AGM Speech 20170809092431parry0843Ainda não há avaliações

- Rice Husking Polishing Unit Rs. 105.76 Million Feb-2021Documento25 páginasRice Husking Polishing Unit Rs. 105.76 Million Feb-2021Saeed AkhtarAinda não há avaliações

- ICAI Nagapoor Branch - Relevent Case LawDocumento1 páginaICAI Nagapoor Branch - Relevent Case LawkrishnaAinda não há avaliações

- FDIC PresentationDocumento31 páginasFDIC PresentationMuthiani MuokaAinda não há avaliações

- The 6 Secrets To Build Business CreditDocumento8 páginasThe 6 Secrets To Build Business CreditJake Song67% (3)

- Kingsbridge Armory Request For Proposals 2011 FF 1 11 12Documento54 páginasKingsbridge Armory Request For Proposals 2011 FF 1 11 12xoneill7715Ainda não há avaliações

- The Banking Companies Rules 1963Documento4 páginasThe Banking Companies Rules 1963Jia BilalAinda não há avaliações