Escolar Documentos

Profissional Documentos

Cultura Documentos

Economic Analysis

Enviado por

ArXlan AliDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Economic Analysis

Enviado por

ArXlan AliDireitos autorais:

Formatos disponíveis

Economic analysis The Philippines has shown resilience to the global economic crisis.

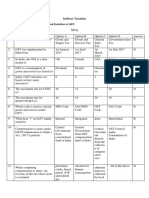

The country saw its GDP growth rebound to nearly 8% in 2010, from just 1.1% in 2009. The economy posted impressive growth in 2010 supported by gains in the agriculture, industry, and services sectors. The country has also witnessed a decline in the debt to GDP ratio. However, its reduction in spending to cut the fiscal deficit is a cause for concern, as it could prove counterproductive for the economic and social development of the country. Current strengths Robust economic growth in 2010 GDP growth jumped to a high of 7.6% in 2010, after plunging to 1.1% in 2009. High GDP growth in 2010 was driven by election-related expenditure, the formation of a new government, and a strong monetary policy. Agricultural growth improved to 4.6% in 2010 from 4.0% in 2009. In value terms, agricultural output was PHP1.24tn ($27.3bn) in 2010, an increase from PHP1.18tn ($24.8bn) in 2009. Industrial growth decreased to 0.5% in 2009, but rebounded to 15.7% in 2010. In terms of value, industrial output in the Philippines stood at PHP2.78tn ($61.5bn) in 2010, an increase from PHP2.41tn ($50.5bn) in 2009. Services output came down to 7.4% in 2009 before increasing to 11.4% in 2010. Services output reached a value of PHP4.89tn ($108bn) in 2010, up from PHP4.4tn ($92bn) in 2009. Revenue from the BPO sector increased 26% in 2010 to $9bn, creating around 100,000 jobs. The government also used privatization revenues to counter the shortfall in tax revenues. The balance of payments surplus increased from $6.4bn in 2009 to $14.4bn in 2010. Decline in debt to GDP ratio The debt to GDP ratio decreased from 57.3% in 2009 to 55.4% in 2010 due to higher economic growth and a lower budget deficit. The 2010 ratio was well below the 2000 ratio of more than 70%. The countrys fiscal deficit widened to 3.9% of GDP in 2009. The budget deficit in 2010 was PHP314bn ($6.9bn) or 3.7% of GDP, slightly higher than the 2009 deficit of nearly PHP300bn ($6.3bn). The government plans to narrow the fiscal deficit to PHP290bn ($6.7bn) or 3.2% of GDP in 2011. In the first seven months of 2011, the government narrowed its budget deficit by nearly 81% due to strong revenue collection and lower expenditure. The Aquino

administration plans to reduce its debt to GDP ratio to 43% by 2016 by meeting its budget deficit target of 2% of GDP in 2013. Current challenges Spending cut to reduce fiscal deficit The countrys fiscal position is the most immediate challenge faced by the Aquino government. The budget deficit in 2010 was PHP314bn ($6.9bn) or 3.7% of GDP, slightly more than the 2009 deficit of nearly PHP300bn ($6.3bn) or 3.9% of GDP. The government plans to narrow the fiscal deficit to PHP290bn ($6.7bn) or 3.2% of GDP in 2011. In the first seven months of 2011, the government narrowed its budget deficit by nearly 81% due to strong revenue collection and lower expenditure, which stood at PHP699bn ($16.1bn) compared to the expected PHP839bn ($19.4bn). The budget deficit for the seven month period ending July 2011 was PHP43.7bn ($1bn), significantly less than the period ending July 2010, when the figure stood at PHP229.4bn ($5.1bn). During the same period, revenue grew 13.5% to PHP788.6bn ($18.2bn), up from PPH695bn ($14.6bn) collected in 2010. In 2011 the government has tried to cut spending in order to reduce its deficit, but this could prove counterproductive for the economic and social development of the country, which faces the critical issues of poverty, increased crime, and poor infrastructure. Delay in public-private partnership program The public-private partnership program, a major initiative of the Aquino administration, is yet to take off. Under the program, the president plans to upgrade infrastructure in the country through 80 partnerships, with an aggregate investment of PHP740bn ($17bn) by 2016. None of the projects that the government planned to execute in 2011 have been put out to tender; many have been pushed back to 2012, and some could even be scrapped. Although the government has tried to improve the regulation, financing guarantees, transparency, and credibility of the program, undue delays could have an adverse impact. The government is banking on this program to provide a major fillip to infrastructure development in the country, as well as support its medium-term goals for economic development. Therefore, any delays represent a major challenge.

Future prospects Benefits from the ASEAN and Australia and New Zealand free trade agreement Philippine exporters will now be able to benefit from the opportunities presented by the free trade agreement between the ASEAN and Australia and New Zealand. The agreement took effect on February 10, 2010, and will provide improved market access to the Australian and New Zealand economy. Beginning in January 2010, most of the countrys exports to Australia have enjoyed zero tariffs; by 2020 nearly all sectors will benefit, with Australia and New Zealand set to eliminate tariffs on all products. Through the agreement, most companies will be able to take advantage of these preferential tariff rates. Future risks Impact of the Japanese crisis The nuclear crisis in Japan due to the earthquake and tsunami in March 2011 could have a serious impact on Philippine exports in 2011. A slowdown in the Japanese economy could seriously impact the Philippines, as Japan was the countrys biggest export market in 2010 (valued at $7.8bn and equivalent to 15.2% of total exports), as well as its biggest import market (valued at $6.7bn and equivalent to 12.2% of total imports). According to the central bank, Filipino workers in Japan sent home remittances worth $883m in 2010. Japan was also the leading source of direct investments in the country in 2010, accounting for around 34% of total investment at a value of PHP196.1bn ($4.5bn). According to the central bank, foreign direct investment (FDI) inflows into the country declined 15.1% to $552m during the first four months of 2011 compared to the figure of $650m recorded during the same period of 2010 due to poor growth in the US and Japan. Slowdown of remittances from overseas Filipinos Earnings from Filipinos working overseas have long been a strong contributor to the Philippines' current account surplus, which has provided a substantial boost to private consumption. The country registered growth rates of more than 10% in remittances for several years. Remittances from overseas Filipino workers increased 8.2% in 2010 to $18.7bn. According to the central bank, Filipino workers in Japan sent home remittances worth $883m in 2010, equivalent to around 5% of total remittances during the year. However, political unrest in the Middle East and North Africa, as well as the economic fallout of the Japanese crisis, is expected to affect

remittances in 2011. A decline in remittance inflows is likely to negatively affect consumer spending in the Philippines.

Performance GDP and growth rate The Philippine economy experienced a slowdown after the country recorded robust growth of 6.9% in 2007, the fastest expansion in 31 years. The countrys GDP growth came down to 4.2% in 2008. After plunging to 1.1% in 2009, GDP growth jumped to a high of 7.6% in 2010. Datamonitor estimates suggest that GDP growth for 2011 will drop to 4.3%. GDP composition by sector The services sector is the largest in terms of contribution to GDP. Services output accounts for 54.8% of GDP and employs around 52% of the workforce. The industry sector contributes around 31.3% of GDP and employs around 15% of the countrys labor. The agriculture sector contributes around 13.9% of GDP while providing employment to around 33% of the workforce. Agriculture Agricultural output in the country recorded a growth rate of 10.2% in 2007, which rose to 19.4% in 2008. However, growth slowed to 4.0% in 2009, before improving to 4.6% in 2010. In value terms, agricultural output totaled PHP1,236.1bn ($27.3bn) in 2010, an increase from PHP1,181.2bn ($24.8bn) in 2009. The country is one of the leading producers of rice and coconuts in the world, but the agricultural sector generally suffers from low economies of scale, poor productivity, and inadequate infrastructural support. Fishing contributes 3% to the country's GDP. Industry In the industrial sector, electronics and food processing are the two most important activities. The country has rich mineral resources, and its untapped mineral wealth is estimated to be worth more than $800bn. The countrys industrial output grew at healthy rates of 9.5% and 14.3% in 2007 and 2008 respectively. Growth decreased to 0.5% in 2009, but rebounded to 15.7% in 2010. In terms of value, industrial output in the Philippines stood at PHP2,784.4bn ($61.5bn) in 2010, an increase from PHP2,406.1bn ($50.5bn) in 2009.

Services The Philippines registered robust services output during 200108, with average growth of 10.6% during the period. A growth rate of 14% was recorded in 2005, which came down to 7.4% in 2009 but increased to 11.4% in 2010. Services output reached a value of PHP4,878.7bn ($108bn) in 2010, up from PHP4,381.0bn ($92bn) in 2009. Telecommunications, call centers, and the financial sector have grown substantially in the past few years, and the services sector accounts for more than 50% of GDP in the country.

Reference: Datamonitor, (November 2011) country analysis report of

Philippines

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- International Marketing PlanDocumento18 páginasInternational Marketing PlanSayed Abu SufyanAinda não há avaliações

- IB Geometry Demographic Transition EssayDocumento2 páginasIB Geometry Demographic Transition EssaykikiGuAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Role PlayDocumento2 páginasRole PlayDante Navarro PereaAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Importance of Agriculture MarketingDocumento3 páginasImportance of Agriculture MarketingShuvojeet MandalAinda não há avaliações

- Global Inflation and Matters ArisingDocumento9 páginasGlobal Inflation and Matters Arisingherbert abbeyquayeAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Bill Rides The Subway at A Cost of 75 CentsDocumento1 páginaBill Rides The Subway at A Cost of 75 CentsAmit PandeyAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- International Liquidity and Reserve ProblemsDocumento34 páginasInternational Liquidity and Reserve ProblemsUthama Veeran50% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Shantinagar 5 - Purnima SharmaDocumento6 páginasShantinagar 5 - Purnima SharmaSuresh ChyAinda não há avaliações

- P9B2005 - Tax Free RenumerationDocumento2 páginasP9B2005 - Tax Free RenumerationDavid SeweAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Private and Confidential: Payslip For PeriodDocumento1 páginaPrivate and Confidential: Payslip For PeriodYahya Uso YahyaAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento9 páginasDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceLohit MataniAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- DeclarationDocumento2 páginasDeclarationprimefxAinda não há avaliações

- Iron and Steel Industry: Economics AssignmentDocumento10 páginasIron and Steel Industry: Economics Assignmentsamikshya choudhuryAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- BFBANFIX - Activity Learning - 01Documento2 páginasBFBANFIX - Activity Learning - 01Spheal GTAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- CP 52 FormDocumento1 páginaCP 52 FormghaniAinda não há avaliações

- Time Limit and Election DateDocumento9 páginasTime Limit and Election DateDheeraj BatraAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Market Pulse Q1 - 18Documento2 páginasMarket Pulse Q1 - 18Duy Nguyen Ho ThienAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1091)

- Macro Economic Framework Statement 2010 11Documento6 páginasMacro Economic Framework Statement 2010 11emmanuel JohnyAinda não há avaliações

- Buba J T/A Queeny Real Estate: Customer StatementDocumento20 páginasBuba J T/A Queeny Real Estate: Customer StatementSunu AfricaAinda não há avaliações

- The Latvian Economy 2/2011Documento3 páginasThe Latvian Economy 2/2011Swedbank AB (publ)Ainda não há avaliações

- Case Study Sanchez Electronic DevicesDocumento2 páginasCase Study Sanchez Electronic DeviceszayikakaterinaAinda não há avaliações

- Readings in Philippine History/ Rizal Exercise 4.3.1 Chuga-Chuga, Choo-Choo Train!Documento4 páginasReadings in Philippine History/ Rizal Exercise 4.3.1 Chuga-Chuga, Choo-Choo Train!Ja BalancioAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- CH - 01 Introduction, Overview and Evolution of GST - MCQDocumento5 páginasCH - 01 Introduction, Overview and Evolution of GST - MCQSanket MhetreAinda não há avaliações

- SwotDocumento9 páginasSwotPun PunnieAinda não há avaliações

- Chapter 12 Production and GrowthDocumento38 páginasChapter 12 Production and GrowthNguyên NgôAinda não há avaliações

- Detailed StatementDocumento5 páginasDetailed StatementSantosh Kumar GuptaAinda não há avaliações

- Copy1 Paystub 1Documento1 páginaCopy1 Paystub 1raheemtimo1Ainda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Bank TaglineDocumento2 páginasBank TaglineSathish BabuAinda não há avaliações

- Appsc Group II Study PlanDocumento7 páginasAppsc Group II Study PlanabhiAinda não há avaliações

- Overview of Lending Activity: by Dr. Ashok K. DubeyDocumento19 páginasOverview of Lending Activity: by Dr. Ashok K. DubeySmitha R AcharyaAinda não há avaliações