Escolar Documentos

Profissional Documentos

Cultura Documentos

Nmills Xacc280 Wk8 Internal Control Assign-1

Enviado por

Nicole MillsDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Nmills Xacc280 Wk8 Internal Control Assign-1

Enviado por

Nicole MillsDireitos autorais:

Formatos disponíveis

Internal Controls

Internal Controls Nicole Mills XACC/280 1/14/2012 Lisa Pendleton

Internal Controls Internal Controls

Internal control is designed to govern a companys financial system by ensuring effective and efficient operations, reliable financial reporting, and compliance with applicable state and federal laws and regulations. Internal controls safeguard assets against theft and unauthorized use, acquisition, and disposal. A system of internal control serves to enhance accuracy by minimizing errors in accounting records and to prevent fraud, embezzlement and theft by employees, customers, and vendors. The following paragraphs will describe the Sarbanes-Oxley Act of 2002 and how it has affected internal controls; explain deficiencies and how they affect stock prices, and examples of internal control limitations. Bloch (2003), "The Sarbanes-Oxley Act of 2002 addresses perceived weaknesses in internal controls, the systems a public company employs to collect, process, and disclose financial information to satisfy its statutory reporting requirements. Recent corporate and accounting frauds have demonstrated the inadequacy of internal controls with regard to revenue recognition. The Act also contains requirements aimed at ensuring proper revenue recognition (para. 1). Prior to the passage of the Act, corporations were not required to maintain such a high standard of financial recordkeeping. It requires companies to establish a system of internal controls, preparation of quarterly statements assessing the strengths and weaknesses of these controls, and forces the company to company to hire an outside accounting agency to provide an independent assessment of the in-house auditing controls, and to report flaws or fraudulent practices that occurred. Lawmakers made certain that corporations are required to maintain paper and electronic records for a minimum of five years, which has imposed a heavy strain on IT departments. Internal controls limit the amount of unethical practices and errors that occur in the financial reporting process. Under the Sarbanes-Oxley Act companies are required to assess their

Internal Controls internal controls systems and report any deficiencies. Internal controls protect against theft and manipulation of accounting figures by employees (Waygandt, Kimmel, & Kieso, 2008). In the event that a company has poor internal controls, investors will have less confidence that its financial statements are accurate. Resulting in company stock price falling (Waygandt, Kimmel, & Kieso, 2008).

A proficient internal control system can only offer reasonable assurance that an agencys financial control, operating systems, reporting, and other agency processes are working effectively. No matter how well designed and functioning, internal control systems are, they cannot provide complete guarantee that agency objectives have been, and will continue to be, met. Effective internal control systems decrease the likelihood of mistakes or exclusions in agency operations. However, there can be limitations in the effectiveness of internal controls. Limitations of internal controls may result from human factors, system omissions, lack of system flexibility, or resource constraints. There are many potential limitations of internal controls including staff carelessness, lack of knowledge, or poor judgment. The internal control system may be outdated and no longer reflects the changes that have been made in operating conditions or new risks. Collusions made by staff, eliminates the protection that segregation provides (Waygandt, Kimmel, & Kieso, 2008). Controls become undermined when methods are viewed as a hindrance in the delivery of agency services. To maintain high standards of record keeping, companies follow precise control principles. Establishment of responsibly must be determined. Each employee should be assigned specific responsibilities to preserve an effective internal control system. For example, only designated personnel have the authority to sign company checks (Waygandt, Kimmel, & Kieso, 2008). Assigning duties to one person makes it easier to determine who is responsible for the mistake. Segregation of duties is imperative to have in an internal control system. This

Internal Controls

requires individuals to be responsible for related duties. Record keeping of an asset should be the responsibility of a separate individual than from the person in physical custody of the asset to decrease possible errors. Physical, Mechanical, and electronic controls play a significant role in the internal control system. Physical controls safeguard material assets. Vaults, safety deposit boxes, locked warehouses, computer facilities with fingerprint scans are different methods of physically safeguarding company assets. Mechanical and electronic controls include alarms to prevent break-ins, television monitors, garment sensors, and time clocks. Each form of control protects company assets from internal or external theft. Independent internal verification is another form on internal control that is useful in comparing recorded accountability with existing assets (Waygandt, Kimmel, & Kieso, 2008). Large companies often hire internal auditors to evaluate the effectiveness of its internal control system. This person is responsible for making sure that procedures are being followed and to recommend improvements to the system when necessary. Internal controls are an important part in maintaining a profitable company that reports its financial situation honestly and accurately to investors. After corporate scandals in the early 2000s, the government intervened and began to demand transparency from publically traded corporations. This is when the Sarbanes-Oxley Act of 2002 was passed into legislation. As a consequence, companies were forced to maintain better financial records for a longer period and to report deficiencies when standards are not met. To reduce the amount of theft, unauthorized use, acquisition, and disposal of assets a company can implement a number of internal controls including segregation of duties. Although internal controls have limitations, they offer a significant amount of asset protection.

Internal Controls

Internal Controls References Bloch, G.D. (2003). The CPA Journal. Retrieved from http://www.nysscpa.org/cpajournal/2003/0403/dept/d046803.htm Waygandt, J.J., Kimmel, P.D., & Kieso, D.E. (2008). Financial Accounting (6th ed.). Hoboken, NJ: Wiley.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- ARMA Guide To The Information ProfessionDocumento102 páginasARMA Guide To The Information Professiontim lu100% (2)

- Nmills XMGT WK7 CHPT-2Documento4 páginasNmills XMGT WK7 CHPT-2Nicole MillsAinda não há avaliações

- Nmills Xacc Wk9 CapstoneDocumento1 páginaNmills Xacc Wk9 CapstoneNicole MillsAinda não há avaliações

- Nmills Xacc280 Wk9 Financial Analysis-2Documento10 páginasNmills Xacc280 Wk9 Financial Analysis-2Nicole MillsAinda não há avaliações

- Nmills Xmgt216 Wk9 FinalDocumento16 páginasNmills Xmgt216 Wk9 FinalNicole MillsAinda não há avaliações

- Nmills LearningteamsDocumento1 páginaNmills LearningteamsNicole MillsAinda não há avaliações

- Nmills Bcom275 WK1Documento4 páginasNmills Bcom275 WK1Nicole MillsAinda não há avaliações

- Nmills Xacc280 Wk9 Financial Analysis-2Documento10 páginasNmills Xacc280 Wk9 Financial Analysis-2Nicole MillsAinda não há avaliações

- Nmills Xacc WK7 CHPT-1Documento3 páginasNmills Xacc WK7 CHPT-1Nicole MillsAinda não há avaliações

- Nmills Xacc WK7 CHPT-1Documento3 páginasNmills Xacc WK7 CHPT-1Nicole MillsAinda não há avaliações

- Nmills Xacc280 Wk9 Financial Analysis-2Documento10 páginasNmills Xacc280 Wk9 Financial Analysis-2Nicole MillsAinda não há avaliações

- Nmills Xacc280 Wk9 Financial Analysis-2Documento10 páginasNmills Xacc280 Wk9 Financial Analysis-2Nicole MillsAinda não há avaliações

- Nmills Xmgt216 Wk9 FinalDocumento16 páginasNmills Xmgt216 Wk9 FinalNicole MillsAinda não há avaliações

- Bcom Wk2 AssignDocumento8 páginasBcom Wk2 AssignNicole MillsAinda não há avaliações

- Nmills Bcom275 WK1Documento4 páginasNmills Bcom275 WK1Nicole MillsAinda não há avaliações

- Bcom WK2 Assign-1Documento5 páginasBcom WK2 Assign-1Nicole MillsAinda não há avaliações

- Nmills Outline 2Documento3 páginasNmills Outline 2Nicole MillsAinda não há avaliações

- Nmills Outline 2Documento3 páginasNmills Outline 2Nicole MillsAinda não há avaliações

- Bcom WK2 Assign-1Documento5 páginasBcom WK2 Assign-1Nicole MillsAinda não há avaliações

- Nmills Outline 2Documento3 páginasNmills Outline 2Nicole MillsAinda não há avaliações

- Legalization of Marijuana 1Documento6 páginasLegalization of Marijuana 1Nicole MillsAinda não há avaliações

- Nmills WK4 RefelctionDocumento1 páginaNmills WK4 RefelctionNicole MillsAinda não há avaliações

- Nmills Bcom275 WK3-2Documento4 páginasNmills Bcom275 WK3-2Nicole MillsAinda não há avaliações

- Nmills Bcom275 WK4Documento6 páginasNmills Bcom275 WK4Nicole MillsAinda não há avaliações

- Nmills Bcom275 WK3-2Documento4 páginasNmills Bcom275 WK3-2Nicole MillsAinda não há avaliações

- Nmills Wk4 ReflectionDocumento1 páginaNmills Wk4 ReflectionNicole MillsAinda não há avaliações

- Nmills Bcom275 Final ResultsDocumento1 páginaNmills Bcom275 Final ResultsNicole MillsAinda não há avaliações

- Nmills Bcom275 WK3-2Documento4 páginasNmills Bcom275 WK3-2Nicole MillsAinda não há avaliações

- Nmills Bcom275 WK4Documento6 páginasNmills Bcom275 WK4Nicole MillsAinda não há avaliações

- Nmills Outline 2Documento3 páginasNmills Outline 2Nicole MillsAinda não há avaliações

- Pg&e Company's Response To The Application For Rehearing of Decision 16-08-020 10-11-16Documento127 páginasPg&e Company's Response To The Application For Rehearing of Decision 16-08-020 10-11-16L. A. PatersonAinda não há avaliações

- Court Form Discovery PlanDocumento5 páginasCourt Form Discovery PlanGregory HutchinsonAinda não há avaliações

- Archives in IndiaDocumento9 páginasArchives in IndiaNaeem DeswalyAinda não há avaliações

- Guidelines On National Inventory of RecordsDocumento12 páginasGuidelines On National Inventory of RecordsEm Es Nan DezherAinda não há avaliações

- EMBA 2012 Shehin DevjiDocumento123 páginasEMBA 2012 Shehin DevjiMalibu BarbieAinda não há avaliações

- BSBPMG430 Project Management Learner WorkbookDocumento58 páginasBSBPMG430 Project Management Learner WorkbookAkriti DangolAinda não há avaliações

- Chapter 4 2022Documento147 páginasChapter 4 2022syaza azwarAinda não há avaliações

- VALTO Infomatics Pvt. LTD: Outsourcing Technology ConsultingDocumento15 páginasVALTO Infomatics Pvt. LTD: Outsourcing Technology ConsultingMahendran IndAinda não há avaliações

- Worksheet Fhom Elec 03 - Lesson 8Documento1 páginaWorksheet Fhom Elec 03 - Lesson 8Marc Loui RiveroAinda não há avaliações

- Shimadzu Lcsolution: Chromatography Data System Operation ManualDocumento164 páginasShimadzu Lcsolution: Chromatography Data System Operation ManualEvgeniyAinda não há avaliações

- Information Technology Act, 2000: by Pranjal SrivastavaDocumento21 páginasInformation Technology Act, 2000: by Pranjal SrivastavaNishant AwasthiAinda não há avaliações

- 5) Module A1 School Records ManagementDocumento3 páginas5) Module A1 School Records ManagementsandeshAinda não há avaliações

- AE8 - Group1 - Chapter 2Documento44 páginasAE8 - Group1 - Chapter 2adarose romaresAinda não há avaliações

- Formal Meeting and MinutesDocumento59 páginasFormal Meeting and MinutesNoreena PrincessAinda não há avaliações

- N S ManiDocumento24 páginasN S ManiManish KumarAinda não há avaliações

- PA DOH Phase 1 Dispensary Evaluation Category Score Cards PDFDocumento284 páginasPA DOH Phase 1 Dispensary Evaluation Category Score Cards PDFNia TowneAinda não há avaliações

- Title Proposal - Online Veterinary Management Information SystemDocumento3 páginasTitle Proposal - Online Veterinary Management Information Systemwilliam sumalpongAinda não há avaliações

- Combinepdf PDFDocumento256 páginasCombinepdf PDFMaridasrajanAinda não há avaliações

- Annual Report Page-3Documento1 páginaAnnual Report Page-3Amin RizkyAinda não há avaliações

- Chain of Custody PolicyDocumento7 páginasChain of Custody PolicyRajaAinda não há avaliações

- Preserving Digital MaterialsDocumento265 páginasPreserving Digital MaterialsAna-Maria RomilaAinda não há avaliações

- Medina Lisa Resume MiracostaDocumento2 páginasMedina Lisa Resume Miracostaapi-255216529Ainda não há avaliações

- Effects of Non Computerization of Patient's RecordsDocumento66 páginasEffects of Non Computerization of Patient's RecordsDaniel ObasiAinda não há avaliações

- Magic Quadrant For Enterprise Content ManagementDocumento15 páginasMagic Quadrant For Enterprise Content ManagementguylarocheAinda não há avaliações

- School Archives and Their Potentials in PDFDocumento4 páginasSchool Archives and Their Potentials in PDFDimitris GoulisAinda não há avaliações

- Service Profile ConsultingDocumento2 páginasService Profile ConsultingAslam KhanAinda não há avaliações

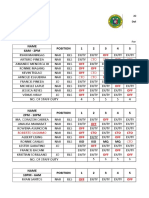

- Name Position 1 2 3 4 5 6AM - 2PM: CTO CTO CTODocumento29 páginasName Position 1 2 3 4 5 6AM - 2PM: CTO CTO CTOJericko MandapAinda não há avaliações

- Examen 9lin3Documento189 páginasExamen 9lin3selene diaz avilaAinda não há avaliações

- Contracts Paralegal Available in Dallas, TXDocumento2 páginasContracts Paralegal Available in Dallas, TXRuth WuAinda não há avaliações