Escolar Documentos

Profissional Documentos

Cultura Documentos

Different: ... and Better Than Ever

Enviado por

Viral PatelDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Different: ... and Better Than Ever

Enviado por

Viral PatelDireitos autorais:

Formatos disponíveis

Different

...and better than ever.

Your selection from the Annual report and financial statements 2011

60

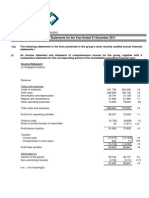

Consolidated statement of comprehensive income

52 weeks ended 30 January 2011

Note

2011 m

2010 m

Turnover Cost of sales Gross profit Other operating income Administrative expenses (Losses)/profits arising on property transactions Operating profit Analysed as: Operating profit before pensions credit Pensions credit within administrative expenses Operating profit Finance costs Finance income Profit before taxation Taxation Profit for the period attributable to the owners of the Company Other comprehensive income/(expense): Actuarial gain/(loss) arising in the pension scheme Foreign exchange movements Cash flow hedging movement Tax in relation to components of other comprehensive income/(expense) Other comprehensive income/(expense) for the period, net of tax Total comprehensive income for the period attributable to the owners of the Company Earnings per share (pence) basic diluted

16,479 (15,331) 1,148 80 (323) (1) 904

15,410 (14,348) 1,062 65 (224) 4 907

20

904 904 (43) 13 874 (242) 632

816 91 907 (60) 11 858 (260) 598

6 6 7

20

34 3 (11) 26 658

(71) (1) (11) 22 (61) 537

9 9

23.93 23.43

22.80 22.37

Wm Morrison Supermarkets PLC

Annual report and financial statements 2011

61

Consolidated balance sheet

30 January 2011

Strategic review Performance review Governance Group financial statements Company financial statements Investor information

4 22 32 52 89 102

21 31 51 88 101 105

Note

2011 m

Restated (note 11) 2010 m

Restated (note 11) 2009 m

Assets Non-current assets Intangible assets Property, plant and equipment Investment property Net pension asset Other financial assets Current assets Stocks Debtors Other financial assets Cash and cash equivalents Liabilities Current liabilities Creditors Other financial liabilities Current tax liabilities Non-current liabilities Other financial liabilities Deferred tax liabilities Net pension liabilities Provisions Net assets Shareholders equity Called-up share capital Share premium Capital redemption reserve Merger reserve Retained earnings and hedging reserve Total equity attributable to the owners of the Company

10 11 12 20 14

184 7,557 229 38 3 8,011 638 268 4 228 1,138

7,439 229 7,668 577 199 71 245 1,092

6,838 242 81 7,161 494 244 327 1,065

15 14

16 17

(1,914) (172) (2,086) (1,052) (499) (92) (1,643) 5,420

(1,845) (213) (94) (2,152) (1,027) (515) (17) (100) (1,659) 4,949

(1,915) (1) (108) (2,024) (1,049) (472) (49) (112) (1,682) 4,520

17 19 20 21

22 22 23 23 23

266 107 6 2,578 2,463 5,420

265 92 6 2,578 2,008 4,949

263 60 6 2,578 1,613 4,520

The financial statements on pages 54 to 88 were approved by the Board of Directors on 9 March 2011 and were signed on its behalf by:

Dalton Philips Chief Executive

Richard Pennycook Group Finance Director

www.morrisons.co.uk/annualreport11

Annual report and financial statements 2011

92

Wm Morrison Supermarkets PLC Company balance sheet

30 January 2011

Note

2011 m

2010 m

Fixed assets Tangible assets Derivative financial assets Investments Current assets Stocks goods for resale Derivative financial assets Debtors amounts falling due within one year Cash-in-hand Creditors amounts falling due within one year Net current liabilities Total assets less current liabilities Creditors amounts falling due after more than one year Provisions for liabilities Net assets excluding pension asset Net pension asset Net assets including pension asset Capital and reserves Called-up share capital Share premium Capital redemption reserve Merger reserve Profit and loss account and hedging reserve Equity shareholders funds

34 35 36

3,086 3 3,366 6,455 400 4 514 69 987 (3,032) (2,045) 4,410

2,975 3,366 6,341 350 395 151 896 (2,766) (1,870) 4,471 (455) (90) 3,926 16 3,942

35 37

38

39 40

(475) (96) 3,839 12 3,851

41

43 44 44 44 44

266 107 6 2,578 894 3,851

265 92 6 2,578 1,001 3,942

The accounting policies on pages 89 to 91 and notes on pages 93 to 101 form part of these financial statements. The financial statements on pages 89 to 101 were approved by the Board of Directors on 9 March 2011 and signed on its behalf by:

Dalton Philips Chief Executive

Richard Pennycook Group Finance Director

Wm Morrison Supermarkets PLC

Annual report and financial statements 2011

Você também pode gostar

- HKSE Announcement of 2011 ResultsDocumento29 páginasHKSE Announcement of 2011 ResultsHenry KwongAinda não há avaliações

- Myer AR10 Financial ReportDocumento50 páginasMyer AR10 Financial ReportMitchell HughesAinda não há avaliações

- Financial Statements Review Q4 2010Documento17 páginasFinancial Statements Review Q4 2010sahaiakkiAinda não há avaliações

- 2011 Financial Statements NESTLE GROUPDocumento118 páginas2011 Financial Statements NESTLE GROUPEnrique Timana MAinda não há avaliações

- Consolidated Accounts June-2011Documento17 páginasConsolidated Accounts June-2011Syed Aoun MuhammadAinda não há avaliações

- MCB Consolidated For Year Ended Dec 2011Documento87 páginasMCB Consolidated For Year Ended Dec 2011shoaibjeeAinda não há avaliações

- Interim Report Q4 2012 EngDocumento25 páginasInterim Report Q4 2012 Engyamisen_kenAinda não há avaliações

- Consolidated First Page To 11.2 Property and EquipmentDocumento18 páginasConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564Ainda não há avaliações

- Assets: Balance Sheet 2009 2010Documento21 páginasAssets: Balance Sheet 2009 2010raohasanAinda não há avaliações

- In Thousands of Euros: Balance SheetDocumento5 páginasIn Thousands of Euros: Balance SheetNguyễn Hải YếnAinda não há avaliações

- 155.ASX IAW Aug 16 2012 16.33 Preliminary Final ReportDocumento14 páginas155.ASX IAW Aug 16 2012 16.33 Preliminary Final ReportASX:ILH (ILH Group)Ainda não há avaliações

- Reports 6Documento18 páginasReports 6Asad ZamanAinda não há avaliações

- Consolidated Accounts December 31 2011 For Web (Revised) PDFDocumento93 páginasConsolidated Accounts December 31 2011 For Web (Revised) PDFElegant EmeraldAinda não há avaliações

- New Look Retail Group Limited profile with financialsDocumento16 páginasNew Look Retail Group Limited profile with financialsSeine LaAinda não há avaliações

- UBL Financial Statement AnalysisDocumento17 páginasUBL Financial Statement AnalysisJamal GillAinda não há avaliações

- Metro Holdings Limited: N.M. - Not MeaningfulDocumento17 páginasMetro Holdings Limited: N.M. - Not MeaningfulEric OngAinda não há avaliações

- Analysis of Financial StatementDocumento4 páginasAnalysis of Financial StatementArpitha RajashekarAinda não há avaliações

- Banking System of Japan Financial DataDocumento44 páginasBanking System of Japan Financial Datapsu0168Ainda não há avaliações

- HOLCIM 2011 Annual ResultsDocumento5 páginasHOLCIM 2011 Annual ResultsgueigunAinda não há avaliações

- Interim Condensed Consolidated Financial Statements: OJSC "Magnit"Documento41 páginasInterim Condensed Consolidated Financial Statements: OJSC "Magnit"takatukkaAinda não há avaliações

- Ar 11 pt03Documento112 páginasAr 11 pt03Muneeb ShahidAinda não há avaliações

- Ual Jun2011Documento10 páginasUal Jun2011asankajAinda não há avaliações

- 5ead0financial RatiosDocumento3 páginas5ead0financial RatiosGourav DuttaAinda não há avaliações

- Airbus Annual ReportDocumento201 páginasAirbus Annual ReportfsdfsdfsAinda não há avaliações

- Financial Statements PDFDocumento91 páginasFinancial Statements PDFHolmes MusclesFanAinda não há avaliações

- Macy's 10-K AnalysisDocumento39 páginasMacy's 10-K Analysisapb5223Ainda não há avaliações

- Balance Sheet: As at June 30,2011Documento108 páginasBalance Sheet: As at June 30,2011Asfandyar NazirAinda não há avaliações

- Cash Flow Statement: For The Year Ended March 31, 2013Documento2 páginasCash Flow Statement: For The Year Ended March 31, 2013malynellaAinda não há avaliações

- IfrsDocumento272 páginasIfrsKisu ShuteAinda não há avaliações

- Half-Year Report Julius Baer Group LTDDocumento24 páginasHalf-Year Report Julius Baer Group LTDEvgeny SkorobogatkoAinda não há avaliações

- Ejemplo Balance GeneralDocumento10 páginasEjemplo Balance GeneralAndreaAinda não há avaliações

- 2012 Annual Financial ReportDocumento76 páginas2012 Annual Financial ReportNguyễn Tiến HưngAinda não há avaliações

- 3Q14 CIMB Group Financial Statements PDFDocumento50 páginas3Q14 CIMB Group Financial Statements PDFleong2007Ainda não há avaliações

- M&A project-IIMK - TESTDocumento34 páginasM&A project-IIMK - TESTSohom KarmakarAinda não há avaliações

- ICI Pakistan Balance Sheet TitleDocumento9 páginasICI Pakistan Balance Sheet TitleSehrish HumayunAinda não há avaliações

- Balance sheet and cash flow analysisDocumento1.832 páginasBalance sheet and cash flow analysisjadhavshankar100% (1)

- Hannans Half Year Financial Report 2012Documento19 páginasHannans Half Year Financial Report 2012Hannans Reward LtdAinda não há avaliações

- ASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedDocumento14 páginasASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedASX:ILH (ILH Group)Ainda não há avaliações

- Jabil Circuit Vertical Analysis (6050)Documento12 páginasJabil Circuit Vertical Analysis (6050)Roy OmabuwaAinda não há avaliações

- Financial+Data+Excel of UBMDocumento100 páginasFinancial+Data+Excel of UBMmohammedakbar88Ainda não há avaliações

- Financial Statements: December 31, 2011Documento55 páginasFinancial Statements: December 31, 2011b21t3chAinda não há avaliações

- Aplicación Del MNT Multifilamentos 2010Documento17 páginasAplicación Del MNT Multifilamentos 2010Juan KsanovaAinda não há avaliações

- Analyze Dell's FinancialsDocumento18 páginasAnalyze Dell's FinancialsSaema JessyAinda não há avaliações

- Unaudited Financial Statements for Year Ended 31 Dec 2011Documento18 páginasUnaudited Financial Statements for Year Ended 31 Dec 2011Jennifer JohnsonAinda não há avaliações

- Income StatementDocumento1 páginaIncome StatementDeepan BaluAinda não há avaliações

- TCS Ifrs Q3 13 Usd PDFDocumento23 páginasTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiAinda não há avaliações

- Annual Report OfRPG Life ScienceDocumento8 páginasAnnual Report OfRPG Life ScienceRajesh KumarAinda não há avaliações

- Valuasi TLKM Aditya Anjasmara Helmi DhanuDocumento64 páginasValuasi TLKM Aditya Anjasmara Helmi DhanuSanda Patrisia KomalasariAinda não há avaliações

- 2010 Ibm StatementsDocumento6 páginas2010 Ibm StatementsElsa MersiniAinda não há avaliações

- The Siam Cement Public and Its Subsidiaries: Company LimitedDocumento73 páginasThe Siam Cement Public and Its Subsidiaries: Company LimitedMufidah 'mupmup'Ainda não há avaliações

- Hls Fy2010 Fy Results 20110222Documento14 páginasHls Fy2010 Fy Results 20110222Chin Siong GohAinda não há avaliações

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Documento18 páginasSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoAinda não há avaliações

- OLAM FY2013 FINANCIALSDocumento28 páginasOLAM FY2013 FINANCIALSashokdb2kAinda não há avaliações

- Patriculars Equity and LiabilitiesDocumento12 páginasPatriculars Equity and LiabilitiesSanket PatelAinda não há avaliações

- Strabag 2010Documento174 páginasStrabag 2010MarkoAinda não há avaliações

- ST Aerospace Financial ReportDocumento4 páginasST Aerospace Financial ReportMuhammad FirdausAinda não há avaliações

- First Resources Q1 2013 Financial Statements SummaryDocumento17 páginasFirst Resources Q1 2013 Financial Statements SummaryphuawlAinda não há avaliações

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawNo EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawNota: 3.5 de 5 estrelas3.5/5 (4)

- Ass 1Documento4 páginasAss 1Viral PatelAinda não há avaliações

- Intern Assessment - Assessment FormDocumento2 páginasIntern Assessment - Assessment FormViral PatelAinda não há avaliações

- Viral N ResumexxxxrDocumento2 páginasViral N ResumexxxxrViral PatelAinda não há avaliações

- Sample WorkDocumento20 páginasSample WorkViral PatelAinda não há avaliações

- Objectives / Importance / Benefits of Personal SellingDocumento6 páginasObjectives / Importance / Benefits of Personal Sellingzakirno19248Ainda não há avaliações

- Chapter 3 Marketing Mix of Life InsuranceDocumento19 páginasChapter 3 Marketing Mix of Life Insurancerahulhaldankar0% (1)

- Day 1 Schedule of 6th Research ForumDocumento9 páginasDay 1 Schedule of 6th Research ForumTrisha Ann BarteAinda não há avaliações

- Balance Sheet Management SolutionDocumento8 páginasBalance Sheet Management SolutionSana NaazAinda não há avaliações

- Audit and Assurance June 2009 Past Paper Answers (ACCA)Documento15 páginasAudit and Assurance June 2009 Past Paper Answers (ACCA)Serena JainarainAinda não há avaliações

- Final PracticeDocumento2 páginasFinal PracticeHuyền TrangAinda não há avaliações

- Entrepreneur KKVDocumento96 páginasEntrepreneur KKVAsraihan RaihanAinda não há avaliações

- Analysing Effectiveness of Point of Purchase Display On Consumer Purchases in Bigbazaar, HebbalDocumento8 páginasAnalysing Effectiveness of Point of Purchase Display On Consumer Purchases in Bigbazaar, HebbalShiv HanchinamaniAinda não há avaliações

- Marketing PlanDocumento20 páginasMarketing PlanSyed Junaid100% (2)

- Userbased ValueDocumento18 páginasUserbased ValueNovariAinda não há avaliações

- MBA Admission Test QuestionsDocumento4 páginasMBA Admission Test QuestionsRaihan RahmanAinda não há avaliações

- Methods of Comparison of Alternatives:: Unit - 3-Engineering Economics and Finance Cash FlowDocumento16 páginasMethods of Comparison of Alternatives:: Unit - 3-Engineering Economics and Finance Cash FlowPoovizhi RajaAinda não há avaliações

- CA 03 - Cost Accounting CycleDocumento6 páginasCA 03 - Cost Accounting CycleJoshua UmaliAinda não há avaliações

- LeadsArk Sales ProcessDocumento6 páginasLeadsArk Sales ProcessShashank PrasoonAinda não há avaliações

- BY Dr. Kumar Saurav Segmentation Targeting and Positioning About The STP Process?Documento11 páginasBY Dr. Kumar Saurav Segmentation Targeting and Positioning About The STP Process?Sneha SahaAinda não há avaliações

- Chapter 01-Introduction Marketing For Hospitality and TourismDocumento26 páginasChapter 01-Introduction Marketing For Hospitality and TourismQuagn TruognAinda não há avaliações

- Standard Costing and Variance Analysis ExplainedDocumento115 páginasStandard Costing and Variance Analysis ExplainedAnne Thea AtienzaAinda não há avaliações

- P2 RevisionDocumento16 páginasP2 RevisionfirefxyAinda não há avaliações

- CFA Level I Revision Day IIDocumento138 páginasCFA Level I Revision Day IIAspanwz SpanwzAinda não há avaliações

- The 8 Step Personal Selling ProcessDocumento13 páginasThe 8 Step Personal Selling ProcessAdamZain788Ainda não há avaliações

- eBay's Evolution from Auctions to E-commerce MarketplaceDocumento13 páginaseBay's Evolution from Auctions to E-commerce MarketplaceShehryar RajaAinda não há avaliações

- The Four Types of Market Structures: Perfect CompetitionDocumento26 páginasThe Four Types of Market Structures: Perfect CompetitionAnnAinda não há avaliações

- Travel and Tourism Promotion and SalesDocumento33 páginasTravel and Tourism Promotion and Salesnahnah2001Ainda não há avaliações

- Cash Flows Cheat SheetDocumento13 páginasCash Flows Cheat SheetSumeet RanuAinda não há avaliações

- Daythree Digital Berhad IPODocumento9 páginasDaythree Digital Berhad IPO健德Ainda não há avaliações

- RECEIVABLESDocumento12 páginasRECEIVABLESNath BongalonAinda não há avaliações

- Husky Group7Documento2 páginasHusky Group7Shruti Mandal80% (5)

- Innovation Management and New Product DevelopmentDocumento27 páginasInnovation Management and New Product DevelopmentNagunuri SrinivasAinda não há avaliações

- Consolidating Balance SheetsDocumento4 páginasConsolidating Balance Sheetsangel2199Ainda não há avaliações

- Accounting test questions and solutionsDocumento7 páginasAccounting test questions and solutionsSheldon Bazinga67% (3)