Escolar Documentos

Profissional Documentos

Cultura Documentos

cmt1 Sampleques Bookb

Enviado por

Suvodeep GhoshDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

cmt1 Sampleques Bookb

Enviado por

Suvodeep GhoshDireitos autorais:

Formatos disponíveis

Sample Questions for CMT Level 1

Booklet B

C M T L e v e l 1 S a m p l e Q u e s t i o n s

These sample questions are used to provide the candidate with examples of how the questions may appear on the CMT exam. Theactual CMTexam doesnot have any true/false questions.ThesesamplequestionscovermuchofthemateriallistedintheBodyofKnowledge, while the actual exam questions may be more difficult. In addition, these sample questions cover a variety of topics; however, the actual exam weighting may vary. The actual exam consistsof132questionsofwhich120arescoreditems. Pleasenotethatthissamplequestionbookletwaspreparedentirelyseparatelyfromthe actualexamtoensurethesecurityoftheactualexamquestions.Insomeaspects,thesesample questions are designed differently from the actual exam so as to better serve as a review for candidates.Forexample,manyquestionsand/oranswersmaybelongerthanintheactualexam sothatthequestionsandanswersserveasareviewofthematerial. TheMTAmaintainsadiscussiongroupforumforCMTcandidatesonitswebsite. CandidatesareencouragedtoutilizethisresourceandtodiscussanyareasoftheBodyof Knowledgewithwhichtheyarenotfamiliar. Thisbookofpracticeexamsisproducedby: MarketTechniciansAssociation,Inc., 61Broadway,Suite514 NewYork,NY10006 Allmaterialisbelievedtobereliableattimeofpublication,butnotguaranteed.The MarketTechniciansAssociation,Inc.,anditsofficers,assumesnoresponsibilityforerrorsor omissions.

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

P a g e 3

CMTLevel1SampleQuestionsAnswerSheet

1. 2. 3. 4. 5. 6. 7. 8. 9. __________ __________ __________ __________ __________ __________ __________ __________ __________ 24. __________ 25. __________ 26. __________ 27. __________ 28. __________ 29. __________ 30. __________ 31. __________ 32. __________ 33. __________ 34. __________ 35. __________ 36. __________ 37. __________ 38. __________ 39. __________ 40. __________ 41. __________ 42. __________ 43. __________ 44. __________ 45. __________ 46. __________ 47. __________ 48. __________ 49. __________ 50. __________ 51. __________ 52. __________ 53. __________ 54. __________ 55. __________ 56. __________ 57. __________ 58. __________ 59. __________ 60. __________ 61. __________ 62. __________ 63. __________ 64. __________ 65. __________ 66. __________ 67. __________ 68. __________ 69. __________ 70. __________ 71. __________ 72. __________ 73. __________ 74. __________ 75. __________ 76. __________ 77. __________ 78. __________ 79. __________ 80. __________ 81. __________ 82. __________ 83. __________ 84. __________ 85. __________ 86. __________ 87. __________ 88. __________ 89. __________ 90. __________ 91. __________ 92. __________ 93. __________ 94. __________ 95. __________ 96. __________ 97. __________ 98. __________ 99. __________ 100.__________ 101.__________ 102.__________ 103.__________ 104.__________ 105.__________

10. __________ 11. __________ 12. __________ 13. __________ 14. __________ 15. __________ 16. __________ 17. __________ 18. __________ 19. __________ 20. __________ 21. __________ 22. __________ 23. __________

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

C M T L e v e l 1 S a m p l e Q u e s t i o n s

CMTLevel1SampleQuestions

1. Movingaveragecrossoverscanbeusedtoindicate: a. Buyandsellsignals b. Positiverelativestrength c. Negativevolume d. Trenddivergence 2. Whichofthefollowingcanbeconsideredasentimentindicator: a. SpecialistShortSalesRatio b. MutualFundCash/AssetRatio c. OddLotPurchase/SalesRatio d. Alloftheabove 3. Speedresistancelines: a. Divideatrendinthirds b. Measuretherateofascentordescentofatrend c. Areusedtomeasurepercentageretracements d. Alloftheabove 4. Anexhaustiongapisobserved: a. Inthebeginningstageofabearmarket b. Afterpriceshavemovedsidewaysforanextendedperiodoftime c. Neartheendofamajorpricemove d. Withlighttradingvolume 5. Onadailybarchart: a. Eachdayspriceactionisrepresentedbyaverticalbar;thedailyhigh,lowandcloseareplotted b. Pricesareplottedvertically,timehorizontally c. Thepricescalemaybeeitherarithmeticorlogarithmic d. Alloftheabove 6. Anappropriatetimeintervalselectionforabarchartwhichisdesignedtoshowverylongtermtrends wouldbe: a. Daily b. Weekly c. Monthly d. Annually 7. Onabarchart,volumeisNORMALLYshown: a. Totherightofthepricetimeseries b. Underthepricetimeseries c. Abovethepricetimeseries d. Totheleftofthepricetimeseries 8. APointandFigurechartDIFFERSfromabarchartas: a. Anewplotonapointandfigurechartismadeonlywhenthepricechangesbyagivenamount b. Timeintervalsareclearlyshowninapointandfigurechart

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

P a g e 5 c. Pointandfigurechartsareonlyconcernedwithmeasuringpricemomentum d. Anewplotonabarchartismadeonlywhenthepricechangesbyagivenamount 9. PointandFigurechartsdisplay: a. Dailyhighlowclose b. Dailyclosereversals c. Sequentialreversalsofpriceinunitincrements d. Dailypriceandvolumedata 10. InconstructingaPointandFigurechart,anewboxisaddedONLYwhen: a. Thepricehasmovedbylessthanthespecifiedboxsize b. Thepricehasmovedbyequaltoormorethanthespecifiedboxsize c. Thevolumeconfirmsthepricemovement d. Thepricehasmovedtoanewhigh 11. AsthepriceunitofareversalonaPointandFigurechartisdecreased: a. Timeanalysisbecomesmorecriticalforinterpretation b. Thedetailofpricemovementgraphicallydisplayedisdecreased c. Thedetailofpricemovementgraphicallydisplayedisincreased d. Thepossibilityofwhipsawsdecreases 12. Whichcharttypeismorecommonlyusedfordisplayingrelativestrengthbetweenastockandthe market? a. Linechart b. Barchart c. PointandFigurechart d. Reversalchart 13. Thebodyofthecandlesticklinedisplaystherelationshipbetween: a. Thecurrentsessionshighandlow b. Thecurrentsessionscloseandthepriorsessionsclose c. Thecurrentsessionsopenandhigh d. Thecurrentsessionsopenandclose 14. Ablackrealbodyincandlechartingmeansthat: a. Thecloseishigherthantheopen b. Thecloseislowerthantheopen c. Theopenishigherthanthelow d. Thecurrentsessionscloseislowerthanthepriorsessionsclose 15. WhichWesterntechnicaltoolscanbeusedoncandlecharts: a. Trendlines b. Movingaverages c. Fibonacciretracements d. Alloftheabove 16. Atrendlineishelpfulindetermining: a. Overboughtoroversoldmarketconditions

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

C M T L e v e l 1 S a m p l e Q u e s t i o n s

b. Whenapricereversalhastakenplace c. Thecyclicalintervalbetweenbullandbearmarkets d. Aprobablepricetargetfortheextentofthepricemove 17. Thebasicconceptbehindtheuseofatrendlineisthat: a. Priceandvolumetendtoconfirmeachother b. Pricesriseandfallincyclicalpatterns c. Pricesfollowanaturalrhythm d. Atrendinmotionwillremaininmotionuntilitreverses 18. TechnicalanalystsGENERALLYbelieve: a. Thattrendlineanalysiscannotbeappliedtopointandfigurecharts b. Apriceclosebeyondthetrendlineismoresignificantthananintradaypenetration c. Trendlinesareusefulforvalidationofpricegaps d. Pricewhipsawscanbeavoidedusingtrendlines 19. Ingeneral,markettechniciansbelieve: a. Thattrendlineanalysiscanbeusedinconjunctionwithvolumetopredictmoneyflows b. Thatthemoretimesatrendlinehasbeensuccessfullytested,thegreaterthesignificanceofits violation c. Trendlinesarenothelpfulingaugingsupportandresistancepoints d. Trendlinesareanartformwhichdonotlendthemselvestocomputerconstruction 20. Inaheadandshoulderspattern,volumeUSUALLY: a. Isgreatestinthemiddleleg b. Increaseswitheachsuccessivepeak c. Decreaseswitheachsuccessivepeak d. Isconstantthroughoutthepattern 21. Thecharacteristicsofacycleare: a. Length,widthandbreadth b. Price,volumeandflow c. Amplitude,breadthandwidth d. Amplitude,periodandphase 22. Amovingaverage: a. Isaleadingpriceindicator b. Amplifiesthedata c. Smoothesoutdatafluctuations d. Isnotappropriateforuseonbarcharts 23. MovingaveragesareMOSToftenusedtosignal: a. Areversalinpricetrend b. Pricecycles c. Volumeconfirmation d. Pricetargets

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

P a g e 7 24. Asimplemovingaverageisoftencriticizedbecause: a. Themostrecenteventsaregivenextraweight b. Theentirepricetimeseriesisusedinitscalculation c. Equalweightisgiventoeachpointincludedinthecalculation d. Itisdifficulttocalculate 25. Anexponentiallysmoothedmovingaverage: a. Excludesolderpricepointsinthecalculation b. Givesmoreweighttomorerecentobservations c. Cannotbeplottedonabarchart d. Noneoftheabove 26. AsellsignalisNORMALLYgivenwhen: a. Ashorterlengthmovingaveragecrossesalongerlengthmovingaveragefromabove b. Alongerlengthmovingaveragecrossesashorterlengthmovingaveragefromabove c. Ashorterlengthmovingaverageremainsabovealongerlengthmovingaverage d. Alongerlengthmovingaverageremainsaboveashorterlengthmovingaverage 27. Oscillatorsareusedtoalerttheanalystto: a. Volumedivergences b. Continuationpatterns c. Extendedrallies d. Overboughtoroversoldpriceconditions 28. AllthefollowingaremomentumoscillatorsEXCEPT: a. Advance/declineline b. RelativeStrengthIndex(RSI) c. Stochastic d. MovingAverageConvergence/Divergence(MACD) 29. MOSToscillatorsareconstructed: a. Sothatthemidpointgoesthroughzero b. Onasemilogarithmicscaletohighlightmomentum c. Sothatallpointsarepositiveinvalue d. Withoutanupperboundary 30. OscillatorsareMOSThelpfultogaugepricebehaviorin: a. Sharplyrisingmarkets b. Sharplyfallingmarkets c. Sharplyrisingandsharplyfallingmarkets d. Nontrendingmarketswherepricesfluctuateinawelldefinedtradingrange

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

C M T L e v e l 1 S a m p l e Q u e s t i o n s

31. OscillatorsareMOSTvaluablewhen: a. Theyareconfirmedbyrelativestrengthmeasures b. Theyareacceleratingintrend c. Theirvaluereachesanextremereadingneartheupperorlowerendoftheirboundaries d. Evaluatedusingmultiplemovingaverages 32. Usinganoscillator,oneMOSToftenobserves: a. Apeakinmomentuminabullmarketbeforeapeakinthepricetrend b. Anaccelerationinpricemomentumpriortoamajormarketbottom c. Constantpricemomentumthroughoutapricerallyextendingforatleastoneyear d. Significantchangeinpricemomentumthroughoutatypicalfouryearcycle 33. Atypicalmomentumindexisconstructedby: a. Plottingthechangeinpricebetweenthebeginningandendofatimeinterval b. Plottingthedifferenceinvolumebetweenthedailyhighpriceandthedailylowprice c. Plottingcumulativepricebetweentwopoints d. Connectingtheboxesonapointandfigurechart 34. Ingaugingtheimportanceofapotentialsupportorresistancelevel,theanalystmustconsider: a. Theamountoftimethathaselapsedbetweentheformationoftheoriginalcongestionandthe natureofgeneralmarketdevelopmentsinthemeantime b. Thevolumeofstockthathastradedinthesupportorresistancezone c. Thespeedandextentofthepreviouspricemove d. Alloftheabove 35. Violatedsupportlevelstypically: a. Becomesupportlevelsaspricesfalllower b. Areassociatedwithdecliningpriceprojections c. Becomeresistancelevelsonpricebounces d. Indicateanimminentpricereversal 36. Aswithtrendlines,speedresistancelines: a. Canbeusedinconjunctionwithsentimentindicators b. Indicatethepotentialforimmediatepricereversals c. Mustbeconfirmedwithvolume d. Reverserolesoncetheyarebroken 37. TheMINIMUMdownsideprojectionfromaheadandshoulderstoppatternisderived: a. Byestimatingthelengthoftheprimarypricecycle b. Bymeasuringthedistancefromthepenetrationofthenecklinebytheleftshouldertothe penetrationofthenecklinebytherightshoulderandextendingdownfromthepointof penetrationoftherightshoulder c. Bymeasuringthewidthoftheleftshoulderandsubtractingthatdistancefromtheneckline d. Byprojectingdownwardfromthenecklinetheverticaldistancefromthetopoftheheadtothe neckline

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

P a g e 9 38. Amovingaveragecrossoversystemisanacceptedmethodofgeneratingbuyandsellsignals.An oscillatorcanbecreatedfromsuchasystemthatutilizesanhistogramtomeasurethedistance betweenthetwomovingaverages.WhichofthefollowingwouldNOTbeanapplicationofsuchan oscillator? a. Identifyingareasofaccumulationanddistribution b. Identifyingdivergences c. Identifyingshorttermvariationsfromthelongtermtrendwhentheshorteraveragemovestoo farabovethelongeraverage d. Identifypointswherethetwomovingaveragescross 39. WhichofthefollowingoscillatorsisconsideredtobeofMOSTuseinanalyzingtrendingmarkets? a. Stochastic b. RSI c. MACD d. Noneareespeciallyusefulintrendingmarkets 40. Arisingrelativestrengthlineforastockinafallingmarketindicates: a. Thatpriceandvolumearediverging b. Thatthestockisperformingworsethanthemarket c. Thatthestockisperformingbetterthanthemarket d. Thatthestockspriceisrisingdespitethefallingmarket 41. WhichsetofindicatorswouldbeMOSThelpfulinanalyzingtradingrangemarkets? a. Movingaverages b. Oscillators c. Cycles d. ElliottWave 42. Ifoneisstudyingacycleof8weekstheassumptionisthatthenextlongestcycle: a. 10weeks b. 12weeks c. 16weeks d. 24weeks 43. TheDeadCatBounceUSUALLYoccurs: a. Atmarketbottoms b. Atmarkettops c. Duringapauseintrend d. Onceaweek 44. Thefouryearcycle,alsoknownasthePresidentialcycle,realizesBESTreturnsinthestockmarketto be: a. Electionandpreelection b. Midtermandelection c. Preelectionandpostelection d. Postelectionandmidterm

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

C M T L e v e l 1 S a m p l e Q u e s t i o n s

45. Theideathatallpricemovementistheadditionofallactivecyclesisthebasisfortheprincipleof: a. Synchronicity b. Summation c. Proportionality d. Harmonicity 46. Whichofthefollowingindicatorsisusedtomeasuremarketbreadth? a. Cumulativebreadthline b. Advance/Declineratio c. McClellanoscillator d. Alloftheabove Thefollowingthreequestionsrefertorelativestrengthanalysisasappliedtoequitytechnicalanalysis(not WellesWilderRSI) 47. RelativestrengthisUSUALLYcalculatedby: a. Determiningthemoneyflowsoftwosecurities b. Dividingthepriceofasecuritybythepriceofanothersecurity,indexorsubgroup c. Dividingasecurityspricebyitstradingvolume d. Calculatingthe14daypricechangeofthesecurity 48. Risingrelativestrengthindicates: a. Lackofinvestorconviction b. Thesecurityisperformingbetterthanthemarketortheentitybeingcompared c. Themarketisperformingbetterthanthesecurity d. Positivepricemomentum 49. Relativestrengthanalysisisusefulinidentifying: a. Decliningvolumetrends b. Reversalinpricemomentum c. Significantpricegaps d. Industrygrouprotation 50. Tospotweaknessinanuptrend,volumeshouldbe: a. Rising b. Falling c. Greaterthantheaveragevolume d. aandc 51. WhichofthefollowingisNOTanunderlyingassumptionoftechnicalanalysis? a. Pricesmoveintrends b. Pricediscountseverything c. Theconsensusisalwayswrong d. Supplyanddemanddeterminesprice 52. WhenBollingerBandscontract(getclosertogether)itUSUALLYmeans: a. Astockisreadytorally

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

P a g e 11 b. Astockisreadytodecline c. Volatilityhasincreased d. Volatilityhasdecreased 53. PointandFigurechartsareMOSTusefulinidentifying: a. Trends b. Areasofaccumulationanddistribution c. Reversalpoints d. Areasofsupportandresistance 54. WhichofthefollowingwouldNOTbeconsideredameansofidentifyingatrend? a. Regressionlines b. Trendlines c. Relativestrengthlines d. Movingaverages 55. WhichofthefollowingdoesNOTdescribestandarddeviationlines: a. Twostandarddeviationsrepresentsabout95%ofthetradingrange b. Consistsoftwovariables,startingpointandslope c. Thecenterlineisabestfitline d. Abuyisgeneratedwhenpricecrossesthe1standarddeviationlinefromabove 56. Candlestickchartscanbeusedtoidentify: a. Pricepatterns b. Trendreversals c. Pausesintrends d. Alloftheabove 57. WhichofthefollowingwouldNOTbeconsideredanimportantfactorindeterminingthesignificanceof atrendline? a. Duration b. Distancefromprice c. Numberoftimestouched d. Angleofascentordescent 58. Whichmovingaveragegivesequalweighttoeachdaysprice? a. Exponential b. Weighted c. Simple d. aandc 59. WhichistheLEASTsignificantpenetrationofarisingtrendline? a. A1%penetrationabovethetrendline b. Acloseabovethetrendline c. Twosuccessiveintradaypenetrationsoftrendline d. Alltheaboveareequallysignificant

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

C M T L e v e l 1 S a m p l e Q u e s t i o n s

60. Whichareconsideredimportantindeterminingthevalidityofatrendlinebreak? a. Time b. Price c. Volume d. Alltheabove 61. Movingaveragestendtochangedirectionwellafterapeakortroughinpriceandthereforeare consideredlateinchangingdirection.WhichofthefollowingisgenerallyconsideredtheMOST effectivewaytooffsetthistendencytolag? a. Usingaweightedmovingaverage b. Usinganunweightedmovingaverage c. Usingmovingaveragecrossovers d. Noneoftheabove 62. WhichofthefollowingwouldNOTbeconsideredasupportlevel? a. Previoushigh b. Previouslow c. Tradingrange d. Alltheaboveareconsideredaspotentialsupportlevels 63. Whatismeantbythestatementvolumeprecedesprice? a. Buyingpressureusuallyprecedessellingpressure b. Sellingpressureisgreaterthanbuyingpressure c. Priceislessimportantthanvolume d. Changesinsupplyanddemandareoftenapparentinvolumebeforeprice 64. AcompleteElliottwaveismadeupof: a. Fivemotiveimpulsewaves b. Threecorrectivewaves c. Anextended3rdwave d. aandb 65. Adescendingtrianglethatformsinadowntrendwouldprobablybeconsidereda: a. Reversalpattern b. Continuationpattern c. Eitheraorb d. Probablywouldntbeusefulinforecastingthefuturedirectionofthetrend 66. WhichofthefollowingisLEASTreliable? a. Broadeningformations b. Wedges c. Triangles d. Pennants 67. WhichofthefollowingisNOTtrueaboutvolume? a. Arallythatdevelopsondecliningvolumeissuspect b. Arallythatoccursonrisingvolumepointstoaprobabletrendreversal

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

P a g e 13 c. Bothpriceandvolumecanfalloffsharplyafterabuyingclimax d. Adownsidebreakofamovingaverageortrendlineshouldoccuronheavyvolumetoqualifyas abearishsignal 68. WhichofthefollowingisLEASTtrueofadojipattern? a. Itrepresentsindecision b. Itisusuallyacontinuationpattern c. Itisusuallyareversalpattern d. Theopeningandclosingpricesareatidenticallevels 69. WhichofthefollowingisNOTtrueaboutgaps? a. Commongapsareoflittleornoforecastingvalue b. Breakawaygapsusuallyoccuronheavyvolume c. Gapsarealmostalwaysfilled d. Whenexhaustiongapsarefilleditisoftenthesignofatrendreversal 70. WhichofthefollowingwouldMOSTlikelybeacontinuationpattern? a. Engulfingpattern b. Headandshoulders c. Doublebottom d. Flag 71. Riskcanbedefinedas: a. Variabilityofreturns b. Amountoflosspertrade c. Beta d. Alloftheabove 72. Ina10dayrateofchangeindicator,ifthelatest(morerecent)priceishigherthantheprice10days ago: a. Theratiowouldbebetween+1and1 b. Theratiowouldbepositive c. Theratiowouldbenegative d. Theratiowouldbeconstantuntilthemarketchangestrend 73. Anextremeoverboughtreadingonamomentumindicatorintheearlystagesofarally: a. Showsthatthemarketisreadytocorrect b. Indicatesthattherallyisstrongandwillprobablycarryfurther c. Isaclearindicationthatthepaceoftherallyisabouttoslowdown d. Isaclearindicationthatthepaceoftherallyisabouttoaccelerate 74. WhichstatementisTRUEofanuptrendingmarket? a. Momentumindicatorswilltendtohitgreateroversoldextremes b. Momentumindicatorswilltendtostayoverboughtlonger c. Momentumindicatorswilltendtohitgreateroverboughtextremesthaninadowntrending market d. bandc

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

C M T L e v e l 1 S a m p l e Q u e s t i o n s

75. WhichwouldnormallybeconsideredasentimentindicatorthatisMOSTusefultotraders? a. Corporatebuybacks b. Price/earningsratios c. Insiderbuying d. Put/callratios 76. WhichtypeofchartisUSUALLYconsideredBESTsuitedforestablishingpricetargetsbasedona horizontalmeasurement? a. Linecharts b. Dailybarcharts c. Pointandfigurecharts d. Candlestickcharts 77. Contraryopinionisausefulinvestmenttoolbecause: a. Thelittleguyisalwayswrong b. Tradersareoftenmostbearishnearmarkettops c. Institutionalinvestorshaveaccesstobetterinformation d. Itisatturningpointswherepeoplearewrong 78. WhichofthefollowingisNOToneoftheessentialareasoftechnicalanalysis? a. Businesscycleanalysis b. Flowoffunds c. Sentiment d. Marketstructureindicators 79. Thelongesttermtrendinthemarketisthe: a. Primary b. Cyclical c. Secular d. Noneoftheabove 80. IntheDowTheory,theMOSTimportantpriceisthe: a. Open b. High c. Low d. Close 81. ThemostpopulartypesofmarketindexesincludeallthefollowingEXCEPT: a. Logarithmicweighted b. Capitalizationweighted c. Unweighted d. Priceweighted 82. TheMOSTcomprehensive(allinclusive)indexis: a. ValueLineIndex b. NYStockExchangeCompositeIndex c. Standard&PoorsComposite500Index d. Wilshire5000EquityIndex

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

P a g e 15 83. WhichistheMOSTimportantinidentifyingahead&shoulderstoppattern? a. Theshouldersmustbeofequalheight b. Volumeontherightshouldermustdecreasesubstantiallyfrompreviousrallies c. Ahead&shoulderswithahorizontalnecklineismorereliable d. Volumemustdecreaseonthesuccessiveralliesfromtherightshouldertoheadtoleftshoulder 84. ThelongesttermcycleisGENERALLYrecognizedasthe: a. Juglarcycle b. Kitchincycle c. Decennialcycle d. Kondratieffcycle 85. TheJanuaryEffectreferstoaseasonaltendencywhen: a. Largecapitalizationstocksoutperformsmallcapitalizationstocks b. Smallcapstocksoutperformlargecapstocks c. Stocks,regardlessofsizeofmarketcaps,bouncebackfromyearendtaxselling d. Secondaryindexesfrequentlyshowtheirlargestgainsfortheyear 86. WhichofthefollowingisNOTasentimentindicator? a. Put/callratio b. Consumerconfidenceindex c. Brokeragefirmhiring d. Relativestrength ThefollowingquestionsfivequestionsapplytotheMTACodeofEthics: 87. AccordingtotheMTACodeofEthics,MembersandAffiliatesareheldtothesamestandardsof conduct. a. True b. False 88. MembersandAffiliatesareallowedtousesubstantiallythesamelanguagefromareportpreparedby anauthornowdeceasediftheoriginalauthorreceivesprominentandadequatecreditforthework. a. True b. False 89. AMemberoranAffiliatemustwaitatleastaweekbeforeactingonanyrecommendationmadebythe MemberorAffiliate,inordertogiveboththeMembersorAffiliatesemployerandclientsadequate timetoactonsuchrecommendationfirst. a. True b. False 90. MembersandAffiliatesarepermittedtousetheAssociationmailinglistforcommercialpurposes providedtheyobtainpriorpermissionfromtheMTA. a. True b. False

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

C M T L e v e l 1 S a m p l e Q u e s t i o n s

91. IfaMemberorAffiliatetakesajobwithanewemployer,heorsheisthenfreefromtheresponsibility tokeepinconfidenceknowledgeconcerningthelawfulprivateaffairsofhisorherclients,former employer,ortheclientsoftheformeremployer. a. True b. False 92. Asimplemovingaverageis______torespondtopricechangesthana________movingaverage. a. Slower,weighted b. Faster,exponential c. Faster,geometric d. Noneoftheabove 93. Onereasonwhypriceoscillatorsareusefulisbecause_____________________. a. Momentumtendstoleadprice b. Pricetendstoleadmomentum c. Theygiveyouquickentryandexitpoints d. Theyaretobeusedinisolationandareusefulinanymarket 94. Asecondarycyclecanbeusedtodeterminethemajortrendofthemarket. a. True b. False 95. ThetrendofeachcycleisMOSTstronglyinfluencedbythetrendofthenextlongestcycle. a. True b. False 96. DivergencesandfailureswingsareMOSTusefulonanRSIindicatorwhentheyoccurbelowthe _______________line. a. 70andabovethe30 b. 80andabovethe20 c. 60andabovethe40 d. 90andabovethe10 97. WhichofthefollowingdescribestheEquivolumecharting? a. Itisatechniquewhichcomparesmarketperformanceondayswithequalvolume b. Itisthesumoftwoexponentialmovingaverages c. Itisabarchartwherethebarsvaryinwidthwhichisdeterminedbyvolume d. ItisavariationoftheMcClellanOscillator 98. Whichofthefollowingdescribesonbalancevolume? a. Ondayswhenpricesclosehigher,itisassumedthatallvolumeisrepresentedbybuyers b. Itisabreadthmomentumoscillator c. Itisatechniquewhichcomparesmarketperformanceondayswithequalvolume d. Itrepresentsadvancingissuesasapercentoftotalissuestraded 99. WhichofthefollowingisNOTtrueofpointandfigurecharting? a. Duetothecomplexityincreatingthesecharts,ithasonlycomeintocommonusagewiththe adventofcomputers b. Ithassimple,welldefinedtradingrules

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

P a g e 17 c. Iteliminatespricereversalsbelowaminimumvalue d. Ithasnotimefactor 100. Whatistherelevanceoftheboxsizeinpointandfigurecharting? a. Boxsizerepresentsvolumetradedataparticularpricelevel b. Boxsizeistheamountthepricemustchangebeforeanewcolumniscreated c. Boxsizedeterminesthesensitivityoffrequencyoftrading d. Boxsizeutilizedshouldbeconsistentforallsecuritiesbeinganalyzed 101. Whatisthedefinitionofopeninterestinthefuturesmarkets? a. Thesumoflongandshortcontracts b. Thetotalnumberofoutstandinglongorshortcontracts c. Thedifferencebetweenlongandshortcontracts d. Thevolumetradedsinceinceptionofthecontract 102. Whichofthefollowingisadifferencebetweenpointandfigurechartsandbarcharts? a. Pointandfigurechartsmoreaccuratelyportraytime b. Barchartsprovideclearertradingsignals c. Pointandfigurechartsprovideclearertradingsignals d. Alloftheabove 103. Whichofthefollowingistrueofthecomparisonofcandlestickchartstobarcharts? a. Candlestickchartsarebasedonmoredata b. Candlestickchartsexhibitdifferenttrendpatterns c. Candlestickchartsproducedifferentsupportandresistancelevels d. Candlestickchartsallowforeasiervisualinterpretation 104. Incandlestickcharts,whatisconsideredtheessenceofthepricemovement? a. Pricetrend b. Wick c. Realbody d. Shadow 105. Whatadditionalinterpretationispossiblewithcandlestickchartscomparedtobarcharts? a. Trends b. Closingprices c. Relativestrengthbetweenbullsandbears d. Supportlevels

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

C M T L e v e l 1 S a m p l e Q u e s t i o n s

CMTLevel1SampleQuestionsAnswerSheet

1. Movingaveragecrossoverscanbeusedtoindicate: a.Buyandsellsignals 2. Whichofthefollowingcanbeconsideredasentimentindicator: d.Alloftheabove 3. Speedresistancelines: d.Alloftheabove 4. Anexhaustiongapisobserved: c.Neartheendofamajorpricemove 5. Onadailybarchart: d.Alloftheabove 6. Anappropriatetimeintervalselectionforabarchartwhichisdesignedtoshowverylongtermtrends wouldbe: c.Monthly 7. Onabarchart,volumeisNORMALLYshown: b.Underthepricetimeseries 8. APointandFigurechartDIFFERSfromabarchartas: a.Anewplotonapointandfigurechartismadeonlywhenthepricechangesbyagivenamount 9. PointandFigurechartsdisplay: c.Sequentialreversalsofpriceinunitincrements 10. InconstructingaPointandFigurechart,anewboxisaddedONLYwhen: b.Thepricehasmovedbyequaltoormorethanthespecifiedboxsize 11. AsthepriceunitofareversalonaPointandFigurechartisdecreased: c.Thedetailofpricemovementgraphicallydisplayedisincreased 12. Whichcharttypeismorecommonlyusedfordisplayingrelativestrengthbetweenastockandthe market? a.Alinechart 13. Thebodyofthecandlesticklinedisplaystherelationshipbetween: d.Thecurrentsessionsopenandclose 14. Ablackrealbodyincandlechartingmeansthat: b.Thecloseislowerthantheopen 15. WhichWesterntechnicaltoolscanbeusedoncandlecharts? d.Alloftheabove

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

P a g e 19 16. Atrendlineishelpfulindetermining: b.Whenapricereversalhastakenplace 17. Thebasicconceptbehindtheuseofatrendlineisthat: d.Atrendinmotionwillremaininmotionuntilitreverses 18. TechnicalanalystsGENERALLYbelieve: b.Apriceclosebeyondthetrendlineismoresignificantthananintradaypenetration 19. Ingeneral,markettechniciansbelieve: b.Thatthemoretimesatrendlinehasbeentested,thegreaterthesignificanceofitsviolation 20. Inaheadandshoulderspattern,volumeUSUALLY: c.Decreaseswitheachsuccessivepeak 21. Thecharacteristicsofacycleare: d.Amplitude,periodandphase 22. Amovingaverage: c.Smoothesoutdatafluctuations 23. MovingaveragesareMOSToftenusedtosignal: a.Areversalinpricetrend 24. Asimplemovingaverageisoftencriticizedbecause: c.Equalweightisgiventoeachpointincludedinthecalculation 25. Anexponentiallysmoothedmovingaverage: b.Givesmoreweighttomorerecentobservations 26. AsellsignalisNORMALLYgivenwhen: a.Ashorterlengthmovingaveragecrossesalongerlengthmovingaveragefromabove 27. Oscillatorsareusedtoalerttheanalystto: d.Overboughtoroversoldpriceconditions 28. AllthefollowingaremomentumoscillatorsEXCEPT: a.Advance/declineline 29. MOSToscillatorsareconstructed: a.Sothatthemidpointgoesthroughzero 30. OscillatorsareMOSThelpfultogaugepricebehaviorin: d.Nontrendingmarketswherepricesfluctuateinawelldefinedtradingrange 31. OscillatorsareMOSTvaluablewhen: c.Theirvaluereachesanextremereadingneartheupperorlowerendoftheirboundaries

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

C M T L e v e l 1 S a m p l e Q u e s t i o n s

32. Usinganoscillator,oneMOSToftenobserves: a.Apeakinmomentuminabullmarketbeforeapeakinthepricetrend 33. Atypicalmomentumindexisconstructedby: a.Plottingthechangeinpricebetweenthebeginningandendoftimeinterval 34. Ingaugingtheimportanceofapotentialsupportorresistancelevel,theanalystMUSTconsider: d.Alloftheabove 35. Violatedsupportlevelstypically: c.Becomeresistancelevelsonpricebounces 36. Aswithtrendlines,speedresistancelines: d.Reverserolesoncetheyarebroken 37. TheMINIMUMdownsideprojectionfromaheadandshoulderstoppatternisderived: d.Byprojectingdownwardfromthenecklinetheverticaldistancefromthetopoftheheadtothe neckline 38. Amovingaveragecrossoversystemisanacceptedmethodofgeneratingbuyandsellsignals.An oscillatorcanbecreatedfromsuchasystemthatutilizesanhistogramtomeasurethedistance betweenthetwomovingaverages.WhichofthefollowingwouldNOTbeanapplicationofsuchan oscillator? a.Identifyingareasofaccumulationanddistribution 39. WhichofthefollowingoscillatorsisconsideredtobeofMOSTuseinanalyzingtrendingmarkets? c.MACD 40. Arisingrelativestrengthlineforastockinafallingmarketindicates c.Thatthestockisperformingbetterthanthemarket 41. WhichsetofindicatorswouldbeMOSThelpfulinanalyzingtradingrangemarkets? b.Oscillators 42. Ifoneisstudyingacycleof8weeks,theassumptionisthatthenextlongestcyclewouldbe: c.16weeks 43. TheDeadCatBounceUSUALLYoccurs: a.Atmarketbottoms 44. Thefouryearcycle,alsoknownasthePresidentialcycle,realizesBESTreturnsinthestockmarketto be: a.Electionandpreelection 45. Theideathatallpricemovementistheadditionofallactivecyclesisthebasisfortheprincipleof: b.Summation

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

P a g e 21 46. Whichofthefollowingindicatorsisusedtomeasuremarketbreadth? d.Alloftheabove 47. RelativestrengthisUSUALLYcalculatedby: b.Dividingthepriceofasecuritybythepriceofanothersecurity,indexorsubgroup 48. Risingrelativestrengthindicates: b.Thesecurityisperformingbetterthanthemarketortheentitybeingcompared 49. Relativestrengthanalysisisusefulinidentifying: d.Industrygrouprotation 50. Tospotweaknessinanuptrend,volumeshouldbe: b.Falling 51. WhichofthefollowingisNOTanunderlyingassumptionoftechnicalanalysis? c.Theconsensusisalwayswrong 52. WhenBollingerBandscontract(getclosertogether)itUSUALLYmeans: d.Volatilityhasdecreased 53. PointandFigurechartsareMOSTusefulinidentifying: d.Areasofsupportandresistance 54. WhichofthefollowingwouldNOTbeconsideredameansofidentifyingatrend? c.Relativestrengthlines 55. WhichofthefollowingdoesNOTdescribestandarddeviationlines: d.Abuyisgeneratedwhenpricecrossesthe1standarddeviationlinefromabove 56. Candlestickchartscanbeusedtoidentify: d.Alloftheabove 57. WhichofthefollowingwouldNOTbeconsideredanimportantfactorindeterminingthesignificanceof atrendline? b.Distancefromprice 58. Whichmovingaveragegivesequalweighttoeachdaysprice? c.Simple 59. WhichistheLEASTsignificantpenetrationofarisingtrendline? c.Twosuccessiveintradaypenetrationsoftrendline 60. Whichareconsideredimportantindeterminingthevalidityofatrendlinebreak? d.Alltheabove 61. Movingaveragestendtochangedirectionwellafterapeakortroughinpriceandthereforeare consideredlateinchangingdirection.WhichofthefollowingisGENERALLYconsideredthemost

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

C M T L e v e l 1 S a m p l e Q u e s t i o n s

effectivewaytooffsetthistendencytolag? a.Usingaweightedmovingaverage 62. WhichofthefollowingwouldNOTbeconsideredasupportlevel? d.Alltheaboveareconsideredaspotentialsupportlevels 63. Whatismeantbythestatementvolumeprecedesprice? d.Changesinsupplyanddemandareoftenapparentinvolumebeforeprice 64. AcompleteElliottwaveismadeupof: d.aandb 65. Adescendingtrianglethatformsinadowntrendwouldprobablybeconsidereda: b.Continuationpattern 66. WhichofthefollowingisLEASTreliable? a.Broadeningformations 67. WhichofthefollowingisNOTTRUEaboutvolume? b.Arallythatoccursonrisingvolumepointstoaprobabletrendreversal 68. WhichofthefollowingisLEASTTRUEofadojipattern? b.Itisusuallyacontinuationpattern 69. WhichofthefollowingisNOTTRUEaboutgaps? c.Gapsarealmostalwaysfilled 70. WhichofthefollowingwouldMOSTlikelybeacontinuationpattern? d.Flag 71. Riskcanbedefinedas: d.Alloftheabove 72. Ina10dayrateofchangeindicator,ifthelatest(morerecent)priceishigherthantheprice10days ago: b.Theratiowouldbepositive 73. Anextremeoverboughtreadingonamomentumindicatorintheearlystagesofarally: b.Indicatesthattherallyisstrongandwillprobablycarryfurther 74. WhichstatementisTRUEofanuptrendingmarket? d.bandc 75. WhichwouldnormallybeconsideredasentimentindicatorthatisMOSTusefultotraders? d.Put/callratios

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

P a g e 23 76. WhichtypeofchartisUSUALLYconsideredBESTsuitedforestablishingpricetargetsbasedona horizontalmeasurement? c.PointandFigurecharts 77. Contraryopinionisausefulinvestmenttoolbecause d.Itisatturningpointswherepeoplearewrong 78. WhichofthefollowingisNOToneoftheessentialareasoftechnicalanalysis? a.Businesscycleanalysis 79. Thelongesttermtrendinthemarketisthe: c.Secular 80. IntheDowTheory,theMOSTimportantpriceisthe: d.Close 81. TheMOSTpopulartypesofmarketindexesincludeallthefollowingEXCEPT: a.Logarithmicweighted 82. TheMOSTcomprehensive(allinclusive)indexis: d.Wilshire5000EquityIndex 83. WhichistheMOSTimportantinidentifyingahead&shoulderstoppattern? b.Volumeontherightshouldermustdecreasesubstantiallyfrompreviousrallies 84. ThelongesttermcycleisGENERALLYrecognizedasthe: d.Kondratieffcycle 85. TheJanuaryEffectreferstoaseasonaltendencywhen: b.Smallcapstocksoutperformlargecapstocks 86. WhichofthefollowingisNOTasentimentindicator? d.Relativestrength 87. AccordingtotheMTACodeofEthics,MembersandAffiliatesareheldtothesamestandardsof conduct. a.True 88. MembersandAffiliatesareallowedtousesubstantiallythesamelanguagefromareportpreparedby anauthornowdeceasediftheoriginalauthorreceivesprominentandadequatecreditforthework. a.True 89. AMemberoranAffiliateMUSTwaitatleastaweekbeforeactingonanyrecommendationmadeby theMemberorAffiliate,inordertogiveboththeMembersorAffiliatesemployerandclientsadequate timetoactonsuchrecommendationfirst. b.False

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

C M T L e v e l 1 S a m p l e Q u e s t i o n s

90. MembersandAffiliatesarepermittedtousetheAssociationmailinglistforcommercialpurposes providedtheyobtainpriorpermissionfromtheMTA. b.False 91. IfaMemberorAffiliatetakesajobwithanewemployer,heorsheisthenfreefromtheresponsibility tokeepinconfidenceknowledgeconcerningthelawfulprivateaffairsofhisorherclients,former employer,ortheclientsoftheformeremployer. b.False 92. Asimplemovingaverageisslowertorespondtopricechangesthanaweightedmovingaverage. a.Slower,weighted 93. Onereasonwhypriceoscillatorsareusefulisbecausemomentumtendstoleadprice. a.Momentumtendstoleadprice 94. Asecondarycyclecanbeusedtodeterminethemajortrendofthemarket. b.False 95. ThetrendofeachcycleisMOSTstronglyinfluencedbythetrendofthenextlongestcycle. a.True 96. DivergencesandfailureswingsareMOSTusefulonanRSIindicatorwhentheyoccurbelowthe _____________line. b.70andabovethe30 97. WhichofthefollowingdescribestheEquivolumecharting? c.Itisabarchartwherethebarsvaryinwidthwhichisdeterminedbyvolume 98. Whichofthefollowingdescribesonbalancevolume? a.Ondayswhenpricesclosehigher,itisassumedthatallvolumeisrepresentedbybuyers 99. WhichofthefollowingisNOTtrueofpointandfigurecharting? a.Duetothecomplexityincreatingthesecharts,ithasonlycomeintocommonusagewiththeadventof computer 100. Whatistherelevanceoftheboxsizeinpointandfigurecharting? c.Boxsizedeterminesthesensitivityoffrequencyoftrading 101. Whatisthedefinitionofopeninterestinthefuturesmarkets? b.Thetotalnumberofoutstandinglongorshortcontracts 102. Whichofthefollowingisadifferencebetweenpointandfigurechartsandbarcharts? c.Pointandfigurechartsprovideclearertradingsignals 103. Whichofthefollowingistrueofthecomparisonofcandlestickchartstobarcharts? d.Candlestickchartsallowforeasiervisualinterpretation

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

P a g e 25 104. Incandlestickcharts,whatisconsideredtheessenceofthepricemovement? c.Realbody 105. Whatadditionalinterpretationispossiblewithcandlestickchartscomparedtobarcharts? c.Relativestrengthbetweenbullsandbears

Copyright2011MarketTechniciansAssociation,Inc.Allrightsarereserved.

Você também pode gostar

- Practice Questions For CMT Level 1 Set 2Documento24 páginasPractice Questions For CMT Level 1 Set 2gaurav67% (3)

- 2014 CMT LEVEL I SAMPLE EXAM PREVIEWDocumento31 páginas2014 CMT LEVEL I SAMPLE EXAM PREVIEWMatthewTestaAinda não há avaliações

- CMT Level 1 - 2013 Practice ExamDocumento5 páginasCMT Level 1 - 2013 Practice Examdev2700100% (1)

- DA3976 CMT Quick Ref GuideDocumento9 páginasDA3976 CMT Quick Ref Guidewood102450% (2)

- Sample CMT Level I Exam PDFDocumento43 páginasSample CMT Level I Exam PDFZeeshan KhanAinda não há avaliações

- CMT LEVEL II Sample QuestionDocumento194 páginasCMT LEVEL II Sample QuestionAyush Chaudhari50% (4)

- CMT Level II Sample Exam QuestionsDocumento62 páginasCMT Level II Sample Exam QuestionsAditya GuptaAinda não há avaliações

- CMT Level III 2020Documento8 páginasCMT Level III 2020kien tranAinda não há avaliações

- CMT Level III Sample Exam Oct 2017Documento37 páginasCMT Level III Sample Exam Oct 2017Nabamita Pyne100% (1)

- CMT Level I and II exam reading guideDocumento10 páginasCMT Level I and II exam reading guideTanvir Ahmed100% (2)

- 2021 Exam Information & Learning Objective Statements: CMT Level IiDocumento26 páginas2021 Exam Information & Learning Objective Statements: CMT Level IiJamesMc1144Ainda não há avaliações

- CMT Level - 1Documento7 páginasCMT Level - 1Shivang Sharma60% (5)

- CMT Level1 PracticeTest1Documento9 páginasCMT Level1 PracticeTest1Aubrey SzternAinda não há avaliações

- CMT Level2 ReadingDocumento7 páginasCMT Level2 ReadingMuhammad Azhar Saleem0% (1)

- Cmt1-Sample-C-2016 050217Documento42 páginasCmt1-Sample-C-2016 050217anshul bansalAinda não há avaliações

- 2014may cmt2Documento4 páginas2014may cmt2Pisut OncharoenAinda não há avaliações

- Sample Questions For CMT Level II C M T 1Documento19 páginasSample Questions For CMT Level II C M T 1missmawarlinaAinda não há avaliações

- CMT1-Sample Question-Book A PDFDocumento40 páginasCMT1-Sample Question-Book A PDFMuhammad Azhar SaleemAinda não há avaliações

- 60 Câu (Có Đáp Án) - Ôn Tập PTCKDocumento13 páginas60 Câu (Có Đáp Án) - Ôn Tập PTCKvanpth20404cAinda não há avaliações

- CMT1Documento8 páginasCMT1pmlopez22220000Ainda não há avaliações

- CMT Level I Sample Questions 2018Documento44 páginasCMT Level I Sample Questions 2018congson87Ainda não há avaliações

- Bản Sao Của Trắc Nghiệm Đttc Tổng Hợp Thầy LinhDocumento19 páginasBản Sao Của Trắc Nghiệm Đttc Tổng Hợp Thầy LinhThảo LêAinda não há avaliações

- CYDocumento31 páginasCYkotepaa0% (1)

- CMT Level 1 Daily Batch 2nd Test Aug 2011Documento5 páginasCMT Level 1 Daily Batch 2nd Test Aug 2011Nagaganesh Muggalla100% (1)

- R13 Technical Analysis Q BankDocumento14 páginasR13 Technical Analysis Q Bankakshay mouryaAinda não há avaliações

- CMTDocumento9 páginasCMTAndres Ortuño0% (1)

- CMT Reading ListDocumento8 páginasCMT Reading ListftbearAinda não há avaliações

- LV 1 Sample 1Documento42 páginasLV 1 Sample 1Updatest newsAinda não há avaliações

- TorikoDocumento6 páginasTorikoSnapeSnapeAinda não há avaliações

- CMT L1 Question Bank (Set 1)Documento25 páginasCMT L1 Question Bank (Set 1)Nistha SinghAinda não há avaliações

- Cmt1 Sample 2018Documento44 páginasCmt1 Sample 2018ธรรม จักษ์100% (1)

- CMT Level I 2013 SummaryDocumento7 páginasCMT Level I 2013 Summaryplantszombie0% (1)

- Sample CMT Level II ExamDocumento67 páginasSample CMT Level II ExamHendra SetiawanAinda não há avaliações

- CMT Level 1 DefsDocumento21 páginasCMT Level 1 DefsIxjnxAinda não há avaliações

- Level III Learning ObjectivesDocumento7 páginasLevel III Learning ObjectiveschaudharyarvindAinda não há avaliações

- Chartered TechnicalDocumento14 páginasChartered Technicalcorreiojm100% (1)

- CMT Sample QuestionsDocumento32 páginasCMT Sample QuestionsGheorghe GigeluAinda não há avaliações

- CMT LEVEL III SAMPLE EXAM: Fundamentals of Technical AnalysisDocumento33 páginasCMT LEVEL III SAMPLE EXAM: Fundamentals of Technical AnalysischaudharyarvindAinda não há avaliações

- CMT Level2 ReadingDocumento8 páginasCMT Level2 Readingsankarjv100% (1)

- Sample Questions Level IIDocumento31 páginasSample Questions Level IItrongthien93Ainda não há avaliações

- CMT Level I Sample Exam AnswersDocumento14 páginasCMT Level I Sample Exam AnswersZahamish MalikAinda não há avaliações

- Forecasting Stock Trend Using R and Technical IndicatorsDocumento14 páginasForecasting Stock Trend Using R and Technical Indicatorsmohan100% (1)

- Chartered Market Technician (CMT) Program - Level I: Exam Time Length: 2 Hours, 15 Minutes Exam Format: Multiple ChoiceDocumento10 páginasChartered Market Technician (CMT) Program - Level I: Exam Time Length: 2 Hours, 15 Minutes Exam Format: Multiple ChoicesankarjvAinda não há avaliações

- Chartbook For Level 3.13170409Documento65 páginasChartbook For Level 3.13170409calibertraderAinda não há avaliações

- CMT1Documento11 páginasCMT1ongkew100% (2)

- Macro - Economics: Economic AnalysisDocumento50 páginasMacro - Economics: Economic AnalysisProfessional Training Academy100% (1)

- Sample Questions Level 3Documento41 páginasSample Questions Level 3Gheorghe GigeluAinda não há avaliações

- NCFM Exam Derivatives Market (Dealers) ModuleDocumento11 páginasNCFM Exam Derivatives Market (Dealers) Modulesatish_makAinda não há avaliações

- CMT Level3 ReadingDocumento7 páginasCMT Level3 Readingsankarjv0% (1)

- NISM Caselet 4Documento8 páginasNISM Caselet 4Harish MadanAinda não há avaliações

- 60 Post-Mortems on Nifty & BankNifty Q3 FY23-24No Everand60 Post-Mortems on Nifty & BankNifty Q3 FY23-24Ainda não há avaliações

- Proprietary trading The Ultimate Step-By-Step GuideNo EverandProprietary trading The Ultimate Step-By-Step GuideAinda não há avaliações

- Technical Analysis for Direct Access Trading: A Guide to Charts, Indicators, and Other Indispensable Market Analysis ToolsNo EverandTechnical Analysis for Direct Access Trading: A Guide to Charts, Indicators, and Other Indispensable Market Analysis ToolsNota: 2 de 5 estrelas2/5 (1)

- The Truth About Technical Analysis to Win on the Stock MarketNo EverandThe Truth About Technical Analysis to Win on the Stock MarketAinda não há avaliações

- Modelling Stock Market Volatility: Bridging the Gap to Continuous TimeNo EverandModelling Stock Market Volatility: Bridging the Gap to Continuous TimeNota: 3.5 de 5 estrelas3.5/5 (1)

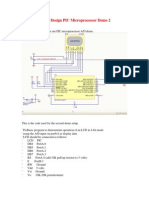

- Junior Design PIC Microprocessor Demo 2Documento2 páginasJunior Design PIC Microprocessor Demo 2ng_viet_cuong_groupAinda não há avaliações

- Cac Khai Niem Co Ban Ve DienDocumento8 páginasCac Khai Niem Co Ban Ve Dienninhnn83Ainda não há avaliações

- Project 10: Frequency Measurement Using Input CaptureDocumento18 páginasProject 10: Frequency Measurement Using Input Captureng_viet_cuong_groupAinda não há avaliações

- Um Mxr-22-b en VerabDocumento29 páginasUm Mxr-22-b en Verabng_viet_cuong_groupAinda não há avaliações

- Compact Photoelectric SensorDocumento20 páginasCompact Photoelectric Sensorng_viet_cuong_groupAinda não há avaliações

- LAB-X1 SchematicDocumento2 páginasLAB-X1 SchematicRenato MirandaAinda não há avaliações

- ElectronicsDocumento36 páginasElectronicsolivirus1007Ainda não há avaliações

- Easypic SchematicsDocumento3 páginasEasypic Schematicsng_viet_cuong_groupAinda não há avaliações

- RC Servo Wire Color Code ChartDocumento1 páginaRC Servo Wire Color Code Chartng_viet_cuong_groupAinda não há avaliações

- Cmt2 Reading Spr12Documento4 páginasCmt2 Reading Spr12ng_viet_cuong_groupAinda não há avaliações

- PLC Purdy March2011 PDFDocumento12 páginasPLC Purdy March2011 PDFng_viet_cuong_groupAinda não há avaliações

- Special Purpose Basic SwitchDocumento5 páginasSpecial Purpose Basic Switchng_viet_cuong_groupAinda não há avaliações

- PLC Solution BookDocumento49 páginasPLC Solution BookJagadeesh Rajamanickam71% (14)

- X'merDocumento13 páginasX'mervatsalAinda não há avaliações

- DC ElectrofisherDocumento4 páginasDC Electrofisherng_viet_cuong_groupAinda não há avaliações

- Smart Sensors Laser Displacement Sensors CMOS TypeDocumento8 páginasSmart Sensors Laser Displacement Sensors CMOS Typeng_viet_cuong_groupAinda não há avaliações

- EDS10 73dDocumento8 páginasEDS10 73dng_viet_cuong_groupAinda não há avaliações

- General Purpose RelayDocumento16 páginasGeneral Purpose Relayng_viet_cuong_groupAinda não há avaliações

- OrCad TutorialDocumento62 páginasOrCad Tutorialng_viet_cuong_groupAinda não há avaliações

- Clearing House Currency Delivery Processing ProceduresDocumento10 páginasClearing House Currency Delivery Processing Proceduresng_viet_cuong_groupAinda não há avaliações

- Emergency Stop Switch (16-Dia)Documento10 páginasEmergency Stop Switch (16-Dia)ng_viet_cuong_groupAinda não há avaliações

- Two Circuit Limit Switch Long LifeDocumento43 páginasTwo Circuit Limit Switch Long Lifeng_viet_cuong_groupAinda não há avaliações

- MCP3909 3-Phase Energy Meter Reference DesignDocumento88 páginasMCP3909 3-Phase Energy Meter Reference Designng_viet_cuong_groupAinda não há avaliações

- The Feds Bank Regulation ChallengesDocumento2 páginasThe Feds Bank Regulation Challengesng_viet_cuong_groupAinda não há avaliações

- OrCad TutorialDocumento62 páginasOrCad Tutorialng_viet_cuong_groupAinda não há avaliações

- De 1 - Concise for Vietnamese Language School Exam DocumentDocumento6 páginasDe 1 - Concise for Vietnamese Language School Exam Documentng_viet_cuong_groupAinda não há avaliações

- De 1 - Concise for Vietnamese Language School Exam DocumentDocumento6 páginasDe 1 - Concise for Vietnamese Language School Exam Documentng_viet_cuong_groupAinda não há avaliações

- 70 Test B 8955Documento503 páginas70 Test B 8955ng_viet_cuong_groupAinda não há avaliações

- Exercise On Preposition 5112Documento2 páginasExercise On Preposition 5112ng_viet_cuong_groupAinda não há avaliações