Escolar Documentos

Profissional Documentos

Cultura Documentos

ADCA Case Book 2012 Preview

Enviado por

Steven GrayDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ADCA Case Book 2012 Preview

Enviado por

Steven GrayDireitos autorais:

Formatos disponíveis

The case book for nonbusiness people

Elementary perspectives on business frameworks and analysis

1st Edition

Advanced Degree Consulting Alliance

Purchase the full version for $4.99 by clicking this box

Advanced Degree Consulting Alliance

Publication data 2012 The Advanced Degree Consulting Alliance

Self-published on Lulu.com

Editor in Chief Associate Editors

Steven Greene Norman Atkins, Jr Nikhil Mutyal Xiaoqing Lin Aarohi Zokarkar Yikai Chen Siamak Pour Graham Siegel Jennifer Heller Sabil Huda Ke Huang Sumanth Swaminathan Marla Isaac Steven Greene Yikai Chen Wendy Yip Brian Quist Ke Huang Brandon Strom Song Liu Joseph R Owens

The Advanced Degree Consulting Alliance (ADCA) is a graduate-student run organization consisting of PhDs, JDs, and MDs at Northwestern University in Chicago, IL, USA. This case book is the fruition of one years work by a large ADCA team to make the world of case interview preparation more accessible to the nonbusiness person. Several of the case book editorial board and ADCAs members have gone on to work at BCG, Booz, LEK, McKinsey, ZS Associates, and other firms. If you are an academic, someone transitioning careers, new to business principles, or just simply interested in an elementary perspective of business frameworks and analysis this is the book for you.

Assistant Editors Contributors

Case authors

Check out our free preview at www.scribd.com Please report feedback or errata to adca@u.northwestern.edu

3

This case book is neither sponsored nor Advanced Degree Consulting Alliance endorsed by Northwestern University

2012 The Advanced Degree Consulting Alliance

Self-published on Lulu.com

ILLEGAL DISTRIBUTION IS STRICTLY PROHIBITED

This publication is protected under the US Copyright Act of 1976 and all other applicable international, federal, state and local laws, and all rights are reserved, including resale rights: you are not allowed to give or sell this Case Book to anyone else. If you received this publication from anyone other than lulu.com or The Advanced Degree Consulting Alliance, you've received a pirated copy. Please contact us via e-mail to notify us of the situation. All contents copyright 2012 by The Advanced Degree Consulting Alliance. All rights reserved. No part of this document or the related files may be reproduced or transmitted in any form, by any means (electronic, photocopying, recording, or otherwise) without the prior written permission of the authors.

Advanced Degree Consulting Alliance

No problem can be solved from the same level of consciousness that created it.

Albert Einstein

Advanced Degree Consulting Alliance

How to move around this document

CS

CT

CA

CS

Contents by sequence (directs to page 4)

Upper corner of each page

CT

Contents by topic (directs to page 5)

CA

Case bank (directs to page 85)

Advanced Degree Consulting Alliance

Contents Organized sequentially (all linked)

CS

CT

CA

SECTIONS 1 2 3 4 5 6 Introduction to consulting Elementary business concepts Elementary quantitative analysis for businesses Business frameworks Case bank References (8) (18) (50) (64) (88) (196)

Advanced Degree Consulting Alliance

Contents Organized by topic (all linked)

CS

CT

CA

TOPIC (ABC order) 1 2 3 4 5 6 7 8 9 10 11 12 13 Accounting basics (financial statements) Breakeven analysis Cost identification Competitive strategy Corporate organization Decision tree External factors Integration Macroeconomic definitions Product or industry life cycle Segmentation Time value of money, net present value Value chain

FRAMEWORK (ABC order) 1 2 3 4 5 6 7 8 9 10 11 12 13 BCG matrix Benefit-price-consumer (BPC) Four Ps, four Cs GE-McKinsey matrix Growth strategy (3 horizons) Market entry McKinsey 7S Porters 5 forces Pricing strategy Product development Profitability SWOT VRIO

8

Advanced Degree Consulting Alliance

CS

CT

CA

SECTION 2

Elementary business concepts

ADCA

Advanced Degree Consulting Alliance

Value chain analysis Assessing firms activities-driven profitability

CS

CT

CA

DEFINITION

The term value chain has an ambiguous meaning. Some use it to refer to an entire industrys value chain (as in the lobster consumption value chain (use reference), others use it to refer to a specific company. Either way, the industry or company may be decomposed into a series of value adding activities, as was discussed by Michael Porter in his book Competitive Advantage. The various activities that a company or industry is involved in each add a certain value to the product it offers. These activities may be decomposed into primary and support activities. Not all companies take part in the full value chain, in fact this is rare.

EXAMPLE: LOBSTER CONSUMPTION Upstream

Lobster on ocean floor Lobster on ocean floor

Upstream

Value adding activities

Wholesale Retail Lobster consumers

Value adding activities

Lobster fishing

Input: boat, fuel, fishing tackle Operations: go fishing! Delivery of lobster to wholesaler at dock Marketing to wholesaler, customer if possible

Downstream

Lobster for dinner!

Lobster to wholesaler

Downstream

IMPORTANT: Lobster fishing incumbent firms can only expect to be valuable if lobster fishing captures a significant portion of value created by entire lobster consumption value chain (left figure).

Advanced Degree Consulting Alliance

10

Market structure Defining the landscape of a market

CS

CT

CA

DEFINITIONS Monopoly

Only one provider of a product or service, leads to higher prices for inferior quality, but illegal in developed economies.

Market control Total control

**BUSINESS SENSE ALERT Here the focus is on the supply side of businesses. The term monopoly is well known to most people, but its analogue on the buyer side is known as a monopsony. If there is a monopsony, there is one buyer in the market who has all the power.

Oligopoly

A market dominated by a small number of incumbent firms comfortably differentiated from one another so profitability may be strong.

Competitive market

Also called monopolistic competition, a large number of firms have a small proportion of market share and only slightly differentiated products. Here, competitive pricing dominates.

No control 1 Few Many Perfect competition Number of competitors

Monopoly

Oligopoly

Competitive market

11

Advanced Degree Consulting Alliance

Strategic control map Competitive pressure in the 5 forces

DEFINITION

CS

CT

CA

Partial control through performance Performance [$ earnings / share]

Complete control

The strategic control map shows market capitalization of different players in an industry relative to one another HOW TO READ THE MAP Companies with high market capitalization have stronger position, more strategic control, and the likelihood to be in a position to acquire other companies. Conversely, companies with a combination of low assets and low market-to-book ratio are vulnerable

Vulnerable Size [market capitalization**] LEGEND OF MAP ELEMENTS

Companies that are performing well, but have the risk of being acquired by companies that are performing just as well and bigger in size

Partial control through size

Companies that get most value of their from cutting cost and gaining scale. They are vulnerable to players bigger in size or have better performance

Companies that have large book capital and high returns. They have the advantage of acquiring other companies.

**BUSINESS SENSE ALERT Market Capitalization is calculated as number of shares * price per share and is seen as the total worth of all a companys assets.

Advanced Degree Consulting Alliance

12

CS

CT

CA

SECTION 3

Elementary Quantitative Analysis for Businesses

ADCA

Advanced Degree Consulting Alliance

13

Contribution analysis Determining the breakeven point

In the graph, the point on the x-axis where the contribution curve intersects the fixed costs is called the breakeven point, i.e. the number of units sold where the total costs and revenues cancel out. For breakeven, divide unit contribution into fixed costs [$]

Total sales Contribution curve Variable cost

CS

CT

CA

Breakeven calculation using unit contribution concept

P x

0, Profit = Revenue Total Cost = Profit P xbe ( Cv xbe C f ) = 0, =

0, Profit = Revenue ( Cv xbe C f ) =

Cv x

( P Cv ) xbe = C f

U

Therefore

U x

Profit Loss Fixed cost

xbe =

Cf U

Cf

Applications

Cost-profit-volume analysis Net income calculation

Units sold

Advanced Degree Consulting Alliance

xbe

Sales achievability and benchmarking

14

Time value of money Net present value (NPV)

CS

CT

CA

DEFINITION

A dollar today is worth more than a dollar tomorrow due to inflation. If you put $100 in a savings account today, it will accrue interest and contain more dollars at the end of the year.

COMPOUNDING PRINCIPLE

If you invest $100 in a bank-issued security of deposit what will its value be in 4 years at 8% interest per year? $100 $108 $116.64 $125.97 $136.04 Time [years] 0 1 2 3 4

Total compound periods

Future value C0 (1 + r ) =

Present value

NET PRESENT VALUE (NPV) is the difference between the present value of cash inflows and outflows Cash inflow Rt

Interest rate, cost of capital

Time [years] 1 2 3 t Cash outflow Ct T

C0

Net present value =

Cash flows estimated from an income statement

Advanced Degree Consulting Alliance

( Rt C t ) 1 + r t C0 t =1 ( )

T

15

CS

CT

CA

SECTION 4

Business Frameworks

ADCA

Advanced Degree Consulting Alliance

16

4-P and 4-C framework comparison Analysis of the marketing mix

CS

CT

CA

COMPARISONS

4-P

Product: tangible object or intangible service to be sold Price. The amount the customer pays for the product Place. Distribution channel for product, the place where a product is purchased Promotion. Advertising, sales promotion, etc.

4-C

Consumer. Focus on the end user and value offered by the product Cost. The cost incurred by the customer. Motivation to maximize value for customer. Convenience. Where and how is purchasing the product convenient for the customer Communication. The interface between the seller and customer, includes advertising, promotion, and PR

Consumer (Product)

Cost (Price)

Target market

Communication (Promotion) Convenience (Place)

USAGE

Both 4-P and 4-C framework serve the same purpose: provide guidelines for sound product/service marketing Sometimes one of the Cs is replaced by Competitor.

17

Advanced Degree Consulting Alliance

BCG matrix Product portfolio analysis

CS

CT

CA

BCG MATRIX

Reprint document here

Stars Achieving high growth but still require high levels of cash due to rapid growing market

Market growth

Question marks High growth, low share products. Expensive but do not generate high returnstry to move left.

Used to analyze a large companys product portfolio Requires identification of midpoint, how do we define high growth and high market share? Then, place products of a company into the matrix using measures relative to industry Develop company strategy that follows the purple arrows (red are bad!)

USAGE

Identify products to focus on efficiency or growth Identify divestments Re-think pricing strategies

Advanced Degree Consulting Alliance

Cash cows Low growth, high share products generate cash to invest in other business ventures but dont cost much.

Dogs These products generate little value (close to breakeven) due to competitive pricing and mature industry with stagnant sales.

Market share

18

Profitability framework A general outlook on profits

Problem, e.g.

Profits (bottom line in income statement) has been declining Client not satisfied with current profitability

Revenue stream 1 Volume sold Total Revenue Revenue stream i Price per unit Revenue stream N COGS Fixed Total costs SG&A OR Total costs Variable Cost per unit Volume sold Market share

CS

CT

CA

GENERAL PROFIT TREE

Market size

Tip: can be useful to verify this is not an industry-wide issue first, make brief check at beginning of case. If it is industry wide, there is little strategy we can use in this business segment to improve profits.

Profit*

Market size

Other (tax, depreciation, interest) Advanced Degree Consulting Alliance

Market share

19

CS

CT

CA

SECTION 5

Case bank

ADCA

Advanced Degree Consulting Alliance

20

List of cases (all linked)

CS

CT

CA

CASES 1 2 3 4 5 6 7 8 9 Solar eclipse Smart bridge A2 accounting Coffee pods The price is right Beer-for-all Consumer lending in China Skiing on fibers Retail nouveau

Advanced Degree Consulting Alliance

21

How to be the interviewer

CS

CT

CA

CASE FLOW

Each case in this section of the case book has the following linear flow. Below, the core analysis constitutes the most time consuming portion of the case for the interviewee. To successfully give each case, you, the interviewer, should be familiar with both the case setup page and case data page as each candidate may do the case in a different order. The better you know the case, the better experience the candidate will have! Therefore, we encourage giving cases you have done yourself previously. If this is not possible, you MUST read the case before you give it to someone. The next 4 pages give a summary of the first 2 pages of each case, and example of a component page, and a scoresheet to check a candidates progress, for your reference.

INTERVIEWER

CANDIDATE

Case question (1)

Broken into separate components, this is where the candidate will do quantitative and qualitative analysis Page with summary, recommendations, and synthesis of findings Exhibits used for the core analysis part

Case setup (1)

The case question to start things off Contains general notes for the interviewer, a simple structure for the case, and a summary of core analysis Second slide for interviewer use that has clarifications of the question and data for the candidate (e.g. competitors, suppliers, distribution channels, or relevant external factors)

Case data (1)

Core analysis (2-6)

Conclusion (1)

Exhibits (1-4)

Advanced Degree Consulting Alliance

22

Interviewer guide (empty template)

CS

CT

CA

NOTES TO INTERVIEWER

CASE FLOW AND KEY ELEMENTS TO EXPLORE

Component 1

Sub-component 1

This area contains information for the interviewer to read before administering the case. It includes any tricks, general insights, or areas to focus on while administering the case.

Component 2

Sub-component 1

Sub-component 2

Component 3

This area contains the specific flow of the case and identifies sub components in each area. A good candidate will hit all these throughout the case, working efficiently and getting key insights.

A POTENTIAL STRUCTURE This box has a simple structure that can be used to help struggling candidates form their analysis structure. The contents of this box are not required for a good case.

Advanced Degree Consulting Alliance

Case conclusion

23

Data bank & clarifications (empty template)

CS

CT

CA

BASIC CLARIFICATIONS OF CASE QUESTION This box contains any simple but extra information pertaining to any confusing points in the case question. This area is distinguished from the two below. Here, only simple clarifying statements are included noncentral to the case whereas the data below may be critical to solving the clients problem. DATA BANK (only give what is asked for) ADDITIONAL QUALITATIVE INFORMATION

This box contains any numbers or information relevant to the case. This may include information about suppliers, distribution, client products or services, customers, industry trends, competitors, or something else.

This box contains any additional information less vital to solving the case, though some of the tidbits will help the candidate put the problem in perspective.

Advanced Degree Consulting Alliance

24

Scoresheet for metric-based evaluation of candidate

CS

CT

CA

Metric Analysis structure

Description How the candidate identifies key areas to explore and prioritizes them with case-specific justifications. This is how the candidate gets going in solving the case. The uniqueness of the candidates ideas and his ability to structure idea generation.

Score (1-5)

Creativity

Quantitative analysis

The candidates ability to communicate his mathematical approach and get the right answer.

Synthesis

Whether or not the candidate gains key insights from any quantitative or qualitative analysis, relates findings to the client objectives, or uses findings to prioritize further exploration. How comfortable would you feel putting the candidate in front of a client? Grade the candidate based on confidence, eye contact, and assertiveness. The candidates ability to lucidly explain his thoughts, analysis steps, and results, as well as whether or not he is convincing in his conclusions or synthesis. The ability of the candidate to be both concise and comprehensive in conveying the recommendation -or summary -- to the client. Would the client CEO respond favorably? Did the candidate hit the key analysis points or bring up less relevant case components?

Poise

Communication

Conclusion

AVERAGE

Advanced Degree Consulting Alliance

25

Case 1 Solar Eclipse

CS

CT

CA

Author: Steven Greene

SOLAR ECLIPSE

Alpha Solaris (ASR), one of the largest US solar panel manufacturers at $2.5 billion in sales in 2010, has seen its stock price plummet from $150/share in March to below $50/share today. Though the company is scheduled to become the largest global solar provider next year due to locked-in contracts and currently has a sturdy balance sheet, the solar energy industry is in a squeeze, unnerving investors. ASRs management team has asked you to formulate a strategy to maintain short term profitability. How do you begin?

ADCA

Advanced Degree Consulting Alliance

26

CS

CT

CA

SECTION 6

References

ADCA

Advanced Degree Consulting Alliance

27

References

CS

CT

CA

1 2 3 4 5 6 7 8 9 10 11 12

Bain & Company. Bain insights, published montly online at http://www.bain.com/subscribe.aspx. Brealey, R.A., Myers, S.C., and Allen, F. Principles of corporate finance, 10th ed., McGraw-Hill: New York (2011). Cheng, V. Free 6 hour case interview tutorial, (2012). Online at www.caseinterview.com. Cosentino, M. Case in point: complete case interview preparation, 5th ed., Burgee Press: Needham, MA (2007). Online at www.casequestions.com. Harvard Business School. Financial statements: the elements of managerial finance, excerpted from Finance for Managers. Harvard Business School Press: Boston (2006). Kiechel, W. The lords of strategy: the secret intellectual history of the new corporate world, published by W. Kiechel III (2010). McKinsey & Company. McKinsey quarterly: the business journal of McKinsey & Company, published quarterly online at http://www.mckinseyquarterly.com/home.aspx. Ohrvall, D. Crack the case system: complete case interview prep, Ohrvall Media (2011). Online at www.mbacase.com. Porter, M.E. Competitive advantage: creating and sustaining superior performance, The Free Press: New York (1985). Porter, M.E. Competitive strategy: techniques for analyzing industries and competitors, The Free Press: New York (1980). Saloner, G., Shepard, A., and, Podolny, J. Strategic Management, Wiley: New York (2001). The Boston Consulting Group. BCG perspectives, published periodically online at https://www.bcgperspectives.com.

Advanced Degree Consulting Alliance

28

Você também pode gostar

- Building An Investment ThesisDocumento11 páginasBuilding An Investment ThesisJack Jacinto100% (2)

- New-Venture ValuationDocumento7 páginasNew-Venture ValuationBurhan Al MessiAinda não há avaliações

- What Industry Trends You Will Look at When You Are Looking For A Potential Investment?Documento7 páginasWhat Industry Trends You Will Look at When You Are Looking For A Potential Investment?helloAinda não há avaliações

- 10 Highest Rated Stocks - ToolsDocumento15 páginas10 Highest Rated Stocks - Toolsanon-469745100% (4)

- COL Fundamental AnalysisDocumento50 páginasCOL Fundamental AnalysismoxbAinda não há avaliações

- Measuring The Moat PDFDocumento70 páginasMeasuring The Moat PDFFlorent CrivelloAinda não há avaliações

- Determination Letter (June 15 2023) FOIA Request For Review - 2022 PAC 71791 71791 F 95c Improper 71b Improper 71c Improper 75r Improper Sd-1Documento4 páginasDetermination Letter (June 15 2023) FOIA Request For Review - 2022 PAC 71791 71791 F 95c Improper 71b Improper 71c Improper 75r Improper Sd-1John KuglerAinda não há avaliações

- Costovation: Innovation That Gives Your Customers Exactly What They Want--And Nothing MoreNo EverandCostovation: Innovation That Gives Your Customers Exactly What They Want--And Nothing MoreAinda não há avaliações

- X3 45Documento20 páginasX3 45Philippine Bus Enthusiasts Society100% (1)

- Valuation White PaperDocumento16 páginasValuation White Paperprateekbhatia13764Ainda não há avaliações

- Busi Environment MCQDocumento15 páginasBusi Environment MCQAnonymous WtjVcZCg57% (7)

- Cantorme Vs Ducasin 57 Phil 23Documento3 páginasCantorme Vs Ducasin 57 Phil 23Christine CaddauanAinda não há avaliações

- Strategic Alliances: Three Ways to Make Them WorkNo EverandStrategic Alliances: Three Ways to Make Them WorkNota: 3.5 de 5 estrelas3.5/5 (1)

- Economic Moats: The Five Rules For Successful Stock InvestingDocumento13 páginasEconomic Moats: The Five Rules For Successful Stock InvestingSachin KumarAinda não há avaliações

- Interview Questions: Always Find A Link Between The StepsDocumento9 páginasInterview Questions: Always Find A Link Between The StepsKarimAinda não há avaliações

- Literature Review On Break Even AnalysisDocumento6 páginasLiterature Review On Break Even Analysisafdtfhtut100% (1)

- Business Valuation DissertationDocumento7 páginasBusiness Valuation DissertationPaySomeoneToWriteYourPaperHighPoint100% (1)

- Presentation To Idaho CPAsDocumento39 páginasPresentation To Idaho CPAsTubagus Donny SyafardanAinda não há avaliações

- Strategic Capital Group Workshop #1: Stock Pitch CompositionDocumento28 páginasStrategic Capital Group Workshop #1: Stock Pitch CompositionUniversity Securities Investment TeamAinda não há avaliações

- Break Even Analysis ThesisDocumento7 páginasBreak Even Analysis Thesisangeljordancincinnati100% (2)

- Stock Pitch Guidelines - OriginalDocumento4 páginasStock Pitch Guidelines - Originaloo2011Ainda não há avaliações

- General Steps To Fundamental EvaluationDocumento9 páginasGeneral Steps To Fundamental EvaluationkazminoAinda não há avaliações

- Customers As AssetsDocumento27 páginasCustomers As AssetsOkutamboti KweneAinda não há avaliações

- UFC ValuationDocumento33 páginasUFC ValuationjjjjjjjjjkAinda não há avaliações

- Literature Review On Profit MaximizationDocumento6 páginasLiterature Review On Profit Maximizationea4c954q100% (1)

- Equity Valuation Research PapersDocumento7 páginasEquity Valuation Research Papersefjddr4z100% (1)

- All Revenue Is Not Created EqualDocumento11 páginasAll Revenue Is Not Created EqualJohnni M PoulsenAinda não há avaliações

- MO CH 2Documento10 páginasMO CH 2IceTea Wulan ArumitaAinda não há avaliações

- Financial Management Term PaperDocumento6 páginasFinancial Management Term Paperc5h71zzc100% (1)

- Drivers of Shareholder ValueDocumento19 páginasDrivers of Shareholder Valueadbad100% (1)

- Investment Strategies Using Fundamental Analysis - CompaniesDocumento15 páginasInvestment Strategies Using Fundamental Analysis - CompaniesdkldkdkdAinda não há avaliações

- Enterprise Value ThesisDocumento6 páginasEnterprise Value ThesisPedro Craggett100% (2)

- Common Stock Analysis ChecklistDocumento7 páginasCommon Stock Analysis ChecklistGurjeevAnandAinda não há avaliações

- Corporate Finance Term Paper TopicsDocumento4 páginasCorporate Finance Term Paper Topicsafdttqbna100% (1)

- Exit Ticket WK9L2 EC0Documento6 páginasExit Ticket WK9L2 EC0exlturesAinda não há avaliações

- If I Would Like To Protect My Downside, How Would I Structure The Investment?Documento7 páginasIf I Would Like To Protect My Downside, How Would I Structure The Investment?helloAinda não há avaliações

- Queen's - Interview GuideDocumento87 páginasQueen's - Interview GuideGABRIEL SALONICHIOSAinda não há avaliações

- Relative ValuationDocumento29 páginasRelative ValuationjayminashahAinda não há avaliações

- If I Would Like To Protect My Downside, How Would I Structure The Investment?Documento7 páginasIf I Would Like To Protect My Downside, How Would I Structure The Investment?helloAinda não há avaliações

- Cost Analysis PDFDocumento36 páginasCost Analysis PDFSteeeeeeeeph100% (1)

- Delgado - Forex: The Fundamental Analysis.Documento10 páginasDelgado - Forex: The Fundamental Analysis.Franklin Delgado VerasAinda não há avaliações

- Firm Valuation ThesisDocumento4 páginasFirm Valuation Thesisqfsimwvff100% (1)

- Corporate Finance Term PapersDocumento6 páginasCorporate Finance Term Papersafmzvaeeowzqyv100% (1)

- A2 Home Economics CourseworkDocumento7 páginasA2 Home Economics Courseworkf5dct2q8100% (2)

- Corporate Finance CourseworkDocumento4 páginasCorporate Finance Courseworkf5d7ejd0100% (2)

- Sample Research Paper On Financial ManagementDocumento8 páginasSample Research Paper On Financial Managementhxmchprhf100% (1)

- ACE VentureFundamentals 30november2021 GigiWangDocumento43 páginasACE VentureFundamentals 30november2021 GigiWangTom TawiAinda não há avaliações

- Chapter Nature and Scope of Managerial EconomicsDocumento24 páginasChapter Nature and Scope of Managerial EconomicsÖnder BalcıAinda não há avaliações

- TEG Presentation Utah 8-22-13 For WebDocumento31 páginasTEG Presentation Utah 8-22-13 For WebTheEdmondsGroupAinda não há avaliações

- Seatwork 206Documento2 páginasSeatwork 206Vangelyn ManguiranAinda não há avaliações

- Session 7 Cost of CapitalDocumento22 páginasSession 7 Cost of CapitalVishwa Deepak BauriAinda não há avaliações

- Financial Statements: Introduction: Printer Friendly Version (PDF Format)Documento9 páginasFinancial Statements: Introduction: Printer Friendly Version (PDF Format)Rajveer SinghAinda não há avaliações

- Giddy-Methods of ValuationDocumento12 páginasGiddy-Methods of ValuationAnil Kumar SankuruAinda não há avaliações

- Literature Review On Small Business FailureDocumento4 páginasLiterature Review On Small Business Failuresvgkjqbnd100% (1)

- Dollar GeneralDocumento112 páginasDollar GeneralSajal SinghAinda não há avaliações

- BAC 4674 Case 4 Freezing Out ProfitsDocumento18 páginasBAC 4674 Case 4 Freezing Out Profitschunlun87Ainda não há avaliações

- Investment Research PaperDocumento5 páginasInvestment Research Paperafeeotove100% (1)

- Company Valuation ThesisDocumento4 páginasCompany Valuation Thesisangelaweberolathe100% (1)

- EV The Price of A BusinessDocumento11 páginasEV The Price of A BusinesspatrickAinda não há avaliações

- Select The Universe of Comps and Spread Key RatiosDocumento2 páginasSelect The Universe of Comps and Spread Key RatiosSajsAinda não há avaliações

- FM414 LN 3 Master Copy Presentation Solutions - Working Capital MGT - 2024 ColorDocumento15 páginasFM414 LN 3 Master Copy Presentation Solutions - Working Capital MGT - 2024 ColorAntonio AguiarAinda não há avaliações

- Financial Statement Analysis Old School ValueDocumento5 páginasFinancial Statement Analysis Old School Valueredclay1234gmailAinda não há avaliações

- The Stock Market by SectorsDocumento3 páginasThe Stock Market by SectorsJose GuzmanAinda não há avaliações

- Literature Component SPM'13 Form 4 FullDocumento12 páginasLiterature Component SPM'13 Form 4 FullNur Izzati Abd ShukorAinda não há avaliações

- RAN16.0 Optional Feature DescriptionDocumento520 páginasRAN16.0 Optional Feature DescriptionNargiz JolAinda não há avaliações

- Microplastic Occurrence Along The Beach Coast Sediments of Tubajon Laguindingan, Misamis Oriental, PhilippinesDocumento13 páginasMicroplastic Occurrence Along The Beach Coast Sediments of Tubajon Laguindingan, Misamis Oriental, PhilippinesRowena LupacAinda não há avaliações

- Satisfaction On Localized Services: A Basis of The Citizen-Driven Priority Action PlanDocumento9 páginasSatisfaction On Localized Services: A Basis of The Citizen-Driven Priority Action PlanMary Rose Bragais OgayonAinda não há avaliações

- Scott Kugle-Framed, BlamedDocumento58 páginasScott Kugle-Framed, BlamedSridutta dasAinda não há avaliações

- Lord Chief Justice Speech On Jury TrialsDocumento10 páginasLord Chief Justice Speech On Jury TrialsThe GuardianAinda não há avaliações

- Annaphpapp 01Documento3 páginasAnnaphpapp 01anujhanda29Ainda não há avaliações

- Simple Yellow CartoonDocumento1 páginaSimple Yellow CartoonIdeza SabadoAinda não há avaliações

- Hassan I SabbahDocumento9 páginasHassan I SabbahfawzarAinda não há avaliações

- Mentor-Mentee 2020-2021Documento17 páginasMentor-Mentee 2020-2021sivakulanthayAinda não há avaliações

- EN 12953-8-2001 - enDocumento10 páginasEN 12953-8-2001 - enעקיבא אסAinda não há avaliações

- Asking Who Is On The TelephoneDocumento5 páginasAsking Who Is On The TelephoneSyaiful BahriAinda não há avaliações

- BPV Installation Inspection Request Form With Payment AuthorizationDocumento2 páginasBPV Installation Inspection Request Form With Payment AuthorizationBoriche DivitisAinda não há avaliações

- WN On LTC Rules 2023 SBDocumento4 páginasWN On LTC Rules 2023 SBpankajpandey1Ainda não há avaliações

- 2020 Rattlers Fall Sports ProgramDocumento48 páginas2020 Rattlers Fall Sports ProgramAna CosinoAinda não há avaliações

- Martin, BrianDocumento3 páginasMartin, Brianapi-3727889Ainda não há avaliações

- About Debenhams Company - Google SearchDocumento1 páginaAbout Debenhams Company - Google SearchPratyush AnuragAinda não há avaliações

- Online MDP Program VIIIDocumento6 páginasOnline MDP Program VIIIAmiya KumarAinda não há avaliações

- Methodology For Rating General Trading and Investment CompaniesDocumento23 páginasMethodology For Rating General Trading and Investment CompaniesAhmad So MadAinda não há avaliações

- Gogo ProjectDocumento39 páginasGogo ProjectLoyd J RexxAinda não há avaliações

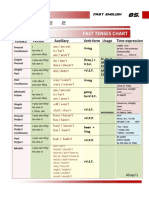

- Table 2: Fast Tenses ChartDocumento5 páginasTable 2: Fast Tenses ChartAngel Julian HernandezAinda não há avaliações

- The Body of The Atman in The Katha UpanishadDocumento4 páginasThe Body of The Atman in The Katha UpanishadmikikiAinda não há avaliações

- Engels SEM1 SECONDDocumento2 páginasEngels SEM1 SECONDJolien DeceuninckAinda não há avaliações

- Why Study in USADocumento4 páginasWhy Study in USALowlyLutfurAinda não há avaliações

- Assignment LA 2 M6Documento9 páginasAssignment LA 2 M6Desi ReskiAinda não há avaliações

- Dewi Handariatul Mahmudah 20231125 122603 0000Documento2 páginasDewi Handariatul Mahmudah 20231125 122603 0000Dewi Handariatul MahmudahAinda não há avaliações