Escolar Documentos

Profissional Documentos

Cultura Documentos

Chapter13 Current Liabilities

Enviado por

Kelly XieDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Chapter13 Current Liabilities

Enviado por

Kelly XieDireitos autorais:

Formatos disponíveis

Current Liabilities:

Characteristics of Liabilities:

Liability,is a future payment of assets or services that a company is currently obligated to make as a result of past transactions or events. 3-Crucial Element, past(because of a past event), present(the company has a present obligation), Future(For future settlement) -Liabilities do Not include all expected future settlements. Example, wages payment (most company expect to pay wages to their employees in upcoming months and years, but these future amounts are not liabilities because the revenue recognition principle says we record an event only when it occurs.) Current liabilities: are due within one year of the balance sheet date or the next operating cycle. Accounts Payable Sales taxes payable Unearned revenues Notes payable Payroll liabilities Current portion of long-term debt Long-term liabilities: not expected to be settled within the longer of one year of the balance sheet date or the next operating cycle. Long-term notes payable Lease liabilities Bonds payable Note Long-Term debt: the part of long-term debt that is due within the longer of one year of the balance sheet date or the next operation cycle. Current Portion of Long-Term Debt: is the part of long-term debt that is due within the longer of one year of the balance sheet date or the next operating cycle and reported under current liabilities. Dividing a liability between its current and long-term portions involves only the principal amount of the debt and not the anticipated future interest payments. Any interest that has accrued up to the date of the balance sheet is reported as interest payable under current liabilities. A debt of $7500 is issued on Jan 1,2011. It is to be repaid in installments of $1500 per year for five years each Dec 31. On Dec 31,2011, the first principal payment of $1500 was made, leaving a principal balance owning on Dec 31,2011, of $6000. Balance Sheet Excerpt Liabilities: Current Liabilities: Current Portion of long-term debt...1 500 Long-term debt.........................................4 500 General Ledger Long-Term Debt 7 500 Jan.1/11 Dec.31/11 1 500 6 000 Bal. Dec 31/11

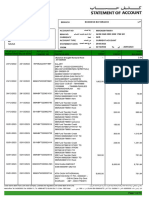

Balance Sheet Presentation of Current Liabilities: focuses on the liability section of the balance sheet, while the actual balance sheet details the assets and shareholders' equity items and contains notes corresponding to items on the balance sheet.

Known(Determinable) Liabilities:

Known Liabilities: the company knows whom to pay, when to pay, and how much to pay. Liabilities are set by agreements, contracts or laws, and are measurable and include accounts payable, payroll, sales taxes, unearned revenues, and notes payable. Trade Account Payable: frequently shortened to accounts payable, are amounts owed to suppliers

with whom we trade regarding products or services purchased on credit.

Danier Leather purchases $12000 of office supplies from Staples on Nov 14,2011, on credit, terms n/30. 2011 Nov. 14 Office Supplies Accounts Payable-Stapes 12000 12000

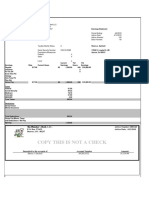

To record the purchase of office supplies on credit: term /30. Payroll Liabilities: Payroll, represents employee compensation for work performed. Payroll Liabilities are employee compensation amounts owing to employees. Debit the salaries or wages expense, they are used to record an employee's gross earnings. Credit the salaries payable, wages payable, or accrued wages payable, they are used to record the net pay obligation to employees. And additional payroll-related liabilities include amounts owed to third parties for any amounts withheld from the gross earnings of each employee and the payroll taxes owed by the employer. 1.record the payroll 2.Record the payroll taxes.

Provincial Sales Tax(PST) and Federal Goods and Services Tax(GST) payable:

Provincial Sales Tax: is a tax levied on sales to the final consumers of products. It is caculated as a percentage of the sale price of the item being sold. While the sales aren't to the final consumers, it does not pay PST on purchases. Any balance in PST Payable at the end of the period is reported as a current liability on the balance sheet. Alberta British Columbia Manitoba Northwest Territories Nunavut Ontario Quebec Saskatchewan Yukon Territory 2011 July 14 Cash Sales PST Payable 17 120 16 000 1 120 0% 7% 7% 0% 0% 8% 7.5% 7% 0%

Prince Edward Island 10%

If Best Furniture 's total cash sales on July 14,2011, were $16 000 (Cost of Sale $12000).

To record cash sales plus applicable PST; 16 000 x 7% = 1 120. 14 Cost of Good Sold To record cost of sales. Federal Goods and Services Tax(GST): is a tax on nearly all goods and services sold in Canada. Exempt supplies: GST-exempt services are educational, health care, and financial services. Harmonized Sales Tax(HST): A combined GST and PST rate of 13% (in Canada) applied to taxable supplies. 12 000 12 000

Merchandise Inventory

Input Tax Credit(ITC): GST paid by the registrant on purchases of taxable supplies. Input tax credits are applied against(reduce) GST payable. Input tax credits are also known as an recorded by the registrant as GST Receivable. Receiver General for Canada: Federal government authority to which GST payable is remitted Registrant: Registered individual or entity selling taxable supplies that is responsible for collecting the GST on behalf of the government. Taxable Supplies: taxable goods or services on which GST is calculated and includes everything except zero-rated and exempt supplies. Zero-Rated Supplies: goods including groceries, prescription drugs, and medical devices, which have zero GST. On August 3,2011, Best Furniture purchased $20 000 of merchandise inventory on credit from Holt Industries; term n/30. With 6% of taxable supplies. 2011 Aug. 3 Merchandise Inventory GST Receivable Accounts Payable-Holt Industries 20 000 1 200 21 200 GST Receivable Aug.3 1 200

To record purchase on credit plus applicable ITC; 20 000x6%=1 200.

On August 6,2011, Best Furniture recorded total sales (All CASH) of $45 000 (Cost of Sales $33 750) 2011 Aug. 3 Cash Sales GST Payable 47 700 45 000 2 700

To record cash sales plus applicable GST; 45 000x6%=2 700 3 Cost of Good Merchandise Inventory To record cost of sales. After posting the August 6 transaction, the GST accounts show a net balance owing to the Receiver General for Canada of $1500 (GST payable of 2 700 - GST receivable of $1 200) Assume Best Furniture remitted the balance to the Receiver General for Canada on August 7. 2011 Aug 3 GST Payable Cash GST Receivable 2 700 1 500 1 200 33 750 33 750

To record remittance of GST to Receiver General for Canada. The balance in GST Receivable and GST payable would be zero after posting the August 7 entry. If the balance in GST Receivable exceeds the balance in GST payable, Best furniture would be entitled to receive a refund. Credit Balance in the GST Payable: current liability-GST Payble Debit Balance in the GST Payable: current asset-GST Receivable

Unearned Revenues:

Unearned Revenues: are amounts received in advance from customers for future products or services and are reported as current liabilities. Unearned revenues include advance ticket sales for sporting events, music concerts, or airline flights.

West Jet reported advance ticket sales $127 450 000 in its December 31,2005, annual report. When West Jet sells $100 000 of advance tickets: Cash Advance Ticket sales 100 000 100 000

To record airline tickets sold in advance If $40 000 in airline tickets purchased in advance are redeemed at a later date. Advance Ticket Sales Cash 40 000 40 000

To record redemption of airline tickets sold in advance.

Short-Term Notes Payable

Short-Term Notes Payable: is a written promise to pay a specified amount on a specified future date within one year or the company's operating cycle, whichever is longer, and is reported as a current liability. -Notes payable are interest-bearing to compensate for the time until payment is made -A company often issues a note payable to purchase merchandise inventory and other assets or to replace an account payable. -Short-term notes payable also arise when money is borrowed from a bank. Note Given to Extend Credit Period: a company can substitute an interest-bearing note payable to replace an overdue account payable that does not bear interest. On Nov 23,2011, Weston Holdings asks to extend its past-due $6 000 account payable to TchNology Inc. After some negotiations, TechNology Inc. Agrees to accept $1 000 cash and a 60-day, 12%, $5 000 note payable to replace the account payable. 2011 Nov. 23 Accounts Payable-TechNology Inc 6 000 Cash Notes Payable 1 000 5 000

Gave $1 000 cash and a 60-day note to extend due date on account. Signing the note changes the form of the debt from an account payable to a note payable On Dec 31,2011, Weston's year-end, accrued interest on the note(38 days from Nov 23 to Dec 31): 2011 Dec. 31 Interest Expense Interest Payable 62.47 62.47

Accrued interest expense on note; $5000x12%x(38/365)

Interest = Principal of the Note x Annual Interest Rate x Time

Current Liabilities: Notes Payable,Short-term Interest Payable $5 000 $ 62

On the due date of Jan 22,2012(uses Maturity Date to calculate the due date/maturity date), Weston Pays the note and interest by giving TechNology a cheque for $5 098.63; $ 000 represents payment for the note paable and $98.63 is payment of the total interest for the 60-day note calculated at the rate of 12%. 2012 Jan. 22 Notes Payable Interest Payable 5 000 62.47

Interest Expense 36.16 Cash 5 098.63 Paid note with interest; $5 000 x 12% x (22/365) = $36.16 Note Given To Borrow From Bank: a bank requires a borrower to sign a promissory note when making a loan. The borrowing company records its receipt of cash and the new liability: Sept. 30 Cash Notes payable 2 000 2 000

Borrowed $2 000 cash with a 60-day, 12%, $2 000 note.

Estimated(or Uncertain) Liabilities:

Estimated liability: is a know obligation of an uncertain amount, but one that can be reasonably estimated. Such as warranties offered by a seller and income taxes. Warranty Liabilities: A warranty is an estimated liability of the seller. A warranty obligates a seller to pay for replacing or repairing the product(or services) when it fails to perform as expected within a specified period. (example: cars) Warranty expense can also be based on a percent of units sold. A dealer who sells a used car for $160 000 on Dec 1,2011, with a one-year or 15 000-kilometre warranty covering parts and labour. This dealer's experience shows warranty expense average 4% of a car's selling price or $640 (16 000 x 4%). 2011 Dec. 1 Warranty Expense 640 640 (Income Statement) (Balance Sheet) Estimated Warranty Liability

Torecord warranty expense and liability at 4% of selling price. Suppose the customer returns the car for warranty repairs on Jan 9,2012. The dealer performs this work by replacing parts costing $200 and using $180 for labour regarding installation of the parts. 2012 Jan. 9 Estimated Warranty Liability 380 Auto parts inventory Wages Payable 200 180 Jan.9/12 Estimated Warranty Liability 380 640 260 Dec.1/11 Balance.

To record costs of warranty repairs.

Income Tax Liabilities For Corporations

Income Tax: income tax expense for a corporation creates a liability until payment is made to the government. This tax must usually be paid monthly under federal regulations. The monthly installment is equal to one-twelfth of the corporation's estimated income tax liability for the year. Monthly financial statements, 2010, this corporation estimates it will owe income tax of $144 000 in 2011. In Jan 2011: 2011 Jan 31 income tax expense 12 000 12 000 Income tax payable

Accrued income tax based on 1/12 of total estimated; $144 000 x (1/12) Assume that the tax installment is paid the next day: Feb 01 Income tax payable 12 000

Income tax expense

12 000

Paid income tax installment for January 2011. Suppose this corporation determines that its income tax liability for 2011 is a total of $156 700. The income tax expense account reflects estimated taxes of $132 000 based on installments recorded at the rate of $12 000 per month for each of Jan to Nov: Dec 31 Income Tax Expense Income tax payable 24 700 24 700

To record additional tax expense and liability; $156 700 - $132 000 = $24 700 balance owing.

Contingent Liabilities:

Contingent Liability:is a potential future liability caused by a past event. Any future payment of a contingent liability depends on uncertain future events. (example: lawsuit pending in court). A past transaction or event leads to a lawsuit whose result is uncertain because it is to be determined by the court. Accounting for Contingent Liabilities: depends on the likelihood of a future event occurring along with our ability to estimate the amount owed in the future if it occurs. In accounting, a contingent liability and the related contingent loss are recorded with a journal entry only if the contingency is both probable

and the amount can be estimated. Examples: A contingent liability is a potential liabilityit depends on a future event occurring or not occurring. For example, if a parent guarantees a daughters first car loan, the parent has a contingent liability. If the daughter makes her car payments and pays off the loan, the parent will have no liability. If the daughter fails to make the payments, the parent will have a liability. If a company is sued by a former employee for $500,000 for age discrimination, the company has a contingent liability. If the company is found guilty, it will have a liability. However, if the company is not found guilty, the company will not have an actual liability.

Two main categories of contingent liabilities: 1. Likely and the amount can be reasonably estimated (the amount is recorded on the balance sheet as a liability. These amounts must be accrued because they meet the two criteria of being likely to occur and the amount can be reasonably estimated.) 2. Unlikely The journal entry to record a likely contingent liability, which is estimated to be in the amount of $10 000: Contingent Loss Contingent Liability 10 000 10 000

To record a likely and estimable contingent loss.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Summary Notes On Regular Allowable Itemized Deductions - CompressDocumento4 páginasSummary Notes On Regular Allowable Itemized Deductions - CompressRochel Ada-olAinda não há avaliações

- Baroda High School Campus Kalpur - 390005Documento3 páginasBaroda High School Campus Kalpur - 390005Vijay LadAinda não há avaliações

- Your Adv Plus Banking: Account SummaryDocumento4 páginasYour Adv Plus Banking: Account SummaryGuilherme Gaspar67% (3)

- Payslip Feb 2024Documento1 páginaPayslip Feb 2024usemask2Ainda não há avaliações

- Sample of Contract With Direct Sellers PDFDocumento2 páginasSample of Contract With Direct Sellers PDFPankaj PandeyAinda não há avaliações

- RR On Estate Tax Amnesty - FINALDocumento98 páginasRR On Estate Tax Amnesty - FINALtina0% (1)

- Statement: Please Note When Making Payment To Us Our Bank Account Details Remain UnchangedDocumento1 páginaStatement: Please Note When Making Payment To Us Our Bank Account Details Remain UnchangedDebyAinda não há avaliações

- Tax Compliance SummaryDocumento2 páginasTax Compliance SummaryModiegi SeaneAinda não há avaliações

- Account StatementDocumento10 páginasAccount Statementalihassan459001Ainda não há avaliações

- Knowledge Hut RecepitDocumento1 páginaKnowledge Hut RecepitVikas SoniAinda não há avaliações

- Sheria Pay CHK 04-12-2019 2 PDFDocumento1 páginaSheria Pay CHK 04-12-2019 2 PDFLynn JonesAinda não há avaliações

- Nikita Jain (Socio Economic Offences)Documento9 páginasNikita Jain (Socio Economic Offences)Nikita JainAinda não há avaliações

- LC Acct LL CH4@2015Documento12 páginasLC Acct LL CH4@2015newaybeyene5Ainda não há avaliações

- Chapter 1 HomeworkDocumento3 páginasChapter 1 HomeworkEmily ClevelandAinda não há avaliações

- Martinez V RamosDocumento1 páginaMartinez V RamosattyalanAinda não há avaliações

- Invoice IAB89077 2023 09 01Documento1 páginaInvoice IAB89077 2023 09 01LSMartinAinda não há avaliações

- Customer Inquiry ReportDocumento4 páginasCustomer Inquiry ReportHartito HargiastoAinda não há avaliações

- Account Statement From 01 Apr 2021 To 14 Apr 2021Documento2 páginasAccount Statement From 01 Apr 2021 To 14 Apr 2021chaithu goudAinda não há avaliações

- PM Reyes Notes On Taxation 1 - Income Tax (Updated 14 January 2013)Documento88 páginasPM Reyes Notes On Taxation 1 - Income Tax (Updated 14 January 2013)reylaxa100% (1)

- Account Summary - 7902819734Documento2 páginasAccount Summary - 7902819734Heather Franks0% (1)

- Sbi SaralDocumento12 páginasSbi Saralmevrick_guyAinda não há avaliações

- Bandhan Statement SandipDocumento4 páginasBandhan Statement SandipIndranilGhosh0% (1)

- Document Remitly Western Union SendwaveDocumento5 páginasDocument Remitly Western Union SendwaveEvans SolianAinda não há avaliações

- Guidelines For Standardization of ATM OperationsDocumento6 páginasGuidelines For Standardization of ATM Operationsarslan0989Ainda não há avaliações

- Payment Schedule: Buyer: Jo Tri Holdings Corp. 2021-0135187 Request Code: Status: ApprovedDocumento2 páginasPayment Schedule: Buyer: Jo Tri Holdings Corp. 2021-0135187 Request Code: Status: ApprovedmacsAinda não há avaliações

- Nothing Phone (1) (Black, 128 GB) : Grand Total 27009.00Documento1 páginaNothing Phone (1) (Black, 128 GB) : Grand Total 27009.00Rehan KahnAinda não há avaliações

- StatementDocumento3 páginasStatementStephen SnowdenAinda não há avaliações

- Bill of Supply For Electricity: BSES Rajdhani Power LimitedDocumento4 páginasBill of Supply For Electricity: BSES Rajdhani Power LimitedHema KatiyarAinda não há avaliações

- Kepco Philippines Corporation v. CIRDocumento17 páginasKepco Philippines Corporation v. CIRAronJamesAinda não há avaliações

- Statement 11105685 USD 20230626Documento2 páginasStatement 11105685 USD 20230626Sarah DavidAinda não há avaliações