Escolar Documentos

Profissional Documentos

Cultura Documentos

News Plus

Enviado por

tariq883Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

News Plus

Enviado por

tariq883Direitos autorais:

Formatos disponíveis

NEWS Wednesday, 7 Mar 2012 11:22 pm | Comments (0)

LAHORE - Cement manufacturers are ruing the decision to increase their capacities as the cement consumption remained stagnant in past four years while the exports are also on constant decline forcing the sector to operate at 69 per cent installed capacity. A spokesman of All Pakistan Cement Manufacturers Association (APCMA) said that it is not possible for the industry to service its high cost loans carrying high interest rates by operating at low capacities. This is the reason that the non-performing loans of this capital intensive industry have exceeded 22 per cent and are still rising, he said. During the first eight months of this fiscal year the industry despatched 20.5 million tonne of cement recording a nominal rise of 3.48 per cent against the despatches of 19.74 million tonne during the same period last year, he added.

Reining in cartels

InpaperMagzine By Dilawar Hussain 23rd January, 2012 THE All-Pakistan Cement Manufacturers Association, incorporated 20 years ago in 1992, knows that when the regulator the Competition Commission of Pakistan comes calling to its offices, it rarely is to convey good news. The allegation for the latest raid the previous Monday was the same: Potential violation of Sec 4 of Competition Ordinance, 2007 that prohibits all undertakings to enter into an agreement in respect of the production, supply, distribution, acquisition or control of goods or the provision of services which have the object or effect of preventing, restricting or reducing competition within the relevant market. Simply put: cartelisation. In situation like this, the CCP slaps heavy fine on the industry. The regulator would still be examining the seized documentary and incrementing evidence, to prove that the association might have been involved in monitoring and controlling cement supply and prices to avoid competition. The amount of penalty or fine would possibly be announced in due course. But history suggests that Apcma and its members are unlikely to immediately write cheques for any potential fine. The CCP had previously mounted a raid on the offices of Apcma on April 24, 2008 and later imposed a heavy fine of Rs6.3 billion on the industry on August 27, 2009. The association and its members have got away without paying a rupee in penalty, by challenging the CCP verdict in courts. And the matter remains unresolved.

It is thus that analysts believe the industry might be able to weather the storm yet again. But was the Mondays raid by CCP justified? Absolutely not, says Aizaz Mansoor Sheikh, chairman Apcma and CEO at Attock Cement Limited. The Apcma chief says he is still at a loss to understand what the CCP team was looking for. There was nothing to hide or conceal, he argued. The Apcma chairman emphasised that for umpteen times, the Apcma had requested the government and taken up the matter in meetings with the Federal Board of Revenue (FBR) to either waive the excise duty on cement or bring it under supervised clearance so that the unscrupulous among its 20- member body do not get away without paying their due. Excise duty and sales tax of Rs100 is charged on a cement bag of 50 kgs. He said the association had also called upon the government to monitor the cement bags destined for Afghanistan. As they are excise and sales tax free, it is essential to see that those do not get diverted to local markets, which would deprive other manufacturers of level playing field and deter fair competition, he said. The Apcma chairman alleged that excise duty was an incentive to steal. He said to monitor its due payment, the association had started supervised clearance or self-monitoring by putting a representative in each factory. Rahat Kaunain Hassan, chairperson at CCP disputes such pious objective. Who has given them the authority to supervise such movement of cement? she asks. She said that monitoring of despatches looked like monitoring of compliance with a quota arrangement which manufacturers may have entered into earlier. That, she said, was a possibility and the facts would be revealed after the completion of enquiry. Avoiding the word raid, the CCP chairperson said that Mondays act was search and inspection exercise undertaken with the permission of the parties. The CCP chairperson criticised the industry for maintaining peak price of cement on grounds of energy crisis, though 80 per cent of the cement plants ran on coal, the international prices of coal touching record low. She admitted that because of cases being in courts, the penalties still remained unpaid by cement manufacturers. She said issues of economic importance need to be prioritised and judicial matters be expedited so that cartels get the message that penalties can hurt. According to analysts, the cement prices were currently hovering around all-time high level of Rs425 per bag (up 25 per cent over the earlier year). Walibhai Patel, a leading cement dealer, mentioned that price per bag had increased by Rs5 since the CCP raid of Monday. What is a cartel? The Competition Ordinance 2007 simply defines cartel as an agreement amongst willing competitors; the competitors collude on any business aspect (whether capacity utilisation, division of markets, introduction of innovation etc.) rather than taking such decisions competitively.

It is the supreme evil of Anti-Trust Law, says the CCP chairperson. A corporate lawyer explained that among cartels, cement industry was known to be one of the most pathological. Cartelisation is one of the most egregious forms of anti-competitive practice and prosecuting cartels is one of the most difficult tasks entrusted to competition agencies. The problem with detecting cartels is collecting incontrovertible evidence owing to its secretive nature. It is a rarity to find documentary evidence, that too in the form of an executed agreement. It is held that even globally, cement industries were most susceptible to scrutiny of competition agencies as often they were alleged to collude as a cartel either by fixing price, dividing markets by territory allocation or by customers among competitors, or by output restriction thus adversely affecting consumers and other businesses. And how common are cartels? An activist against monopolistic practices related a rather amusing quote of the father of modern economicsAdam Smith: When people of the same trade meet, the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.

The news FEB4, 2012

LAHORE The cement industry is not passing on to the consumers the reduction in Sales Tax and Federal Excise Duty (FED) along with removal of Special Excise Duty (SED) on their product as announced in budget 2011-12. The high price of building material is expected to dent the growth of the manufacturing sector during FY12, experts said. This has rendered the cement sector to save Rs22-23 per bag, depriving the consumers of the taxation benefit announced by the government. The cement sector is making extremely high margins, as the stakeholders pushed up rates of cement to a new record of Rs425 per bag, while in some areas of the country it is being sold for Rs470 per 50kg bag. Sensing abrupt increase in demand after the floods in the country, the cement cartel, who had forced the government to withdraw Special Excise Duty (SED) on cement to avoid raise in rates, is now fully cashing the situation. Knowing the fact that no action would be taken, the manufacturers have pushed up rate cement bag to a new record of Rs470 in remote areas of the country. Experts said that the cartel has not passed on the relaxation in different taxes and raise the prices of good despite reduction in sales tax and Federal Excise Duty (FED) along with removal Special Excise Duty (SED). Instead of providing any benefit to public, the manufacturers raised the prices without any fear by Rs35 per 50 kg bag after budget 2011-12, market sources said.

Manufacturers have continued to increase the prices despite the reduction in sales tax and FED by 1 percent (benefit of Rs200 per ton) respectively along with removal of 2.5 percent SED, they added. It is to be noted that SBP, in its State of Pakistans Economy report, has revealed that cement prices remained inexplicably high. The SBP report, released on 28th of Jan, expressing concerns over an increase of 17.3 percent in cement prices during July-Nov FY12 over the same period last year, has highlighted that this increase arose despite a reduction on cement taxes and only 10.7 percent increase in coal prices during the period. High prices of building materials coupled with the strain of sales tax on already hurting sectors are expected to dent the growth of the manufacturing sector during FY12. The LSM sector has registered growth of 2.1 percent in the first quarter of the current fiscal, compared to a 2.9 percent decline over the same period last year. Lower duties on beverages, automobiles, cement and air conditioners provided fiscal support to this sector; while a marginal improvement in export demand for value-added textiles and leather helped these industries, according to SBP. It is unfortunate that despite concern of the central bank and tight vigilance of the CCP, the profitability of the manufactures has not been affected as the cartel always managed to retain its high profit through low production, experts said. It is to be noted that CCP had raided the offices of APCMA in Jan 2012 earlier in Apr 2008, convicted the industry and imposing a fine of Rs6.3b on the industry on August 27, 2009. According to cement industry expert, interestingly, despite the raid on April 24, 2008 cement prices had improved on a QoQ basis by 16 percent in 4QFY08. Further rise was seen in average retention cement prices by 33-39 percent on a QoQ basis during 1QFY09, thus indicating that the threat of a vigilant investigation had not disturbed the pricing power within the cartel. Experts said that that cartelization in the cement sector has now been proved owing to exorbitant rise in cement prices during current year, as the cement rates increased sharply from Rs330 in Jan to reach Rs425 in Nov 2010. They further complained that there was no justification of raising the prices of cement when the global coal price has declined to $130 per ton from $150 per ton in the few months.

MFN status win-win for both cement industries

KARACHI: The Indian cement industry which has been facing a hard time to meet its local demand can get help from cross-border peers as Pakistan manufactures more than its requirements, according to an InvestCap research note.

There are roughly 300 small and 130 large plants in India with an installed capacity of around 234 million tons whereas the aggregate production capacity stands at around 167 million tons. This is fuelling delays in construction schedules and forcing the Indian government to import cement from other countries, says the note. Importing cement from across the border seems viable price-wise as Pakistani imported cement would be available at a discount of 16% at INR235 per 50kg bag in India compared with Indian cement price of INR280 per 50kg bag. Pakistani cement manufactures need a place where they can off-load their surplus stock of 10 million tons. Local installed capacity is around 44 million tons, whereas cement demand stands at around 31 million tons including 30% exports and 70% local. Pakistan has already exported bulk of cement to Afghanistan while India received only a tiny chunk of it. Local cement manufacturers are exporting cement to India through trains only, the reason for the limited quantity of export. If India allowed cement imports through Wagha border, it would be more beneficial for the players in the northern region including giants DG Khan Cement as they would face lower transportation cost and improved export margins. Conversely, exporting cement to India through Gujrat port would benefit southern cement players including Lucky Cement as they are situated nearer to the sea port. Relations between Pakistan and India seem to be on the right track as Pakistan has finally awarded the Most Favoured Nation status to India and took a step forward to further enhance trade relationships. However, the list of goods is yet to be finalised, says the note. All cement manufacturers are now putting their efforts towards the renewal of the BIS (Board of Indian Standard) licences, adds the note. However, it is still unclear whether India would allow imports by road or not but, one thing is clear that, if exports to India do materialise, it would provide the ailing local cement industry a breathing space to boost volumetric growth. Published in The Express Tribune, November 12th, 2011.

APCMA

is the apex body of the cement manufacturers of Pakistan. It is registered body under section 3 of the Trade Organization Ordinance 2007 wide license no 14, dated April 26, 2008 issued by Ministry of

Commence. It was incorporated on14th of September 1992 under section 32 of the Companies Ordinance 1984. Services o APCMA plays a significant role in projecting the cement industry to the Government and coordinating various activities in respect of formulation of Government policies for the cement industry through its continuous dialogues and interactions. Represents on all major policy making bodies concerned with cement. Supplies desired information to all concerned Ministries Helps in preparation of important Government documents concerning cement like Reports for Five Year Plans, etc.

o o o

INDUSTRY

o o o o

APCMA identifies and strengthens industrys role in the economic development of the country. Provides up-to-date statistical data/information to the industry and other agencies. Interacts for Industry's problems with the Government and co-ordinates various activities with other bodies. Focuses infrastructural problems (Rail, Coal, Power, etc) and suggests suitable measures for their solution.

COMMERCE

o o o o

APCMA disseminates information on proper and economic use of cement as well as on properties and application of different varieties. Provides technical advice on concrete roads. Creates awareness about eco-friendly packaging. Creates awareness and supports industry efforts on quality, environment, consumer protection and similar other issues.

Early times

One of the few industries that existed in Pakistan before partition of the subcontinent was the Cement Industry, the annual production, being about 300,000 tons (1947). By 1953-54 the production increased to 660,000 tons per year against a demand of over a million tons. At this stage PIDC took the initiative and established two Cement Factories 'Zealpak' and 'Maple Leaf' at Hyderabad and Daudkhel having a capacity of 240,000 tons and 100,000 tons respectively which went into production in 1956 thereby increasing the production capacity of the industry to nearly one million tons per year.

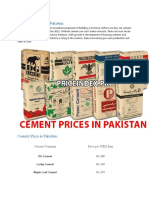

Duties and taxes on export import and locaal consumption SUMMARY

Presently the country exports cement to Afghanistan, India, Africa, and Middle East. Export of cement is exempted from the Sales Tax and Federal Excise Duty (FED). However, the domestic consumption is charged the Sales Tax at 17 percent and Federal Duty (FED) Rs. 700 per ton. The import of cement and coal used as fuel for the cement plants is allowed at zero percent customs duty and17 % sales tax. As per investment policy of the government, the import of plant machinery & equipment for manufacturing sector is allowed at 5 percent customs duty. However national average retail price of cement in the domestic market has shown gradual increasing trend since June 2010.

Você também pode gostar

- Contract For Artist and Gallery AgreementDocumento7 páginasContract For Artist and Gallery AgreementMirelaStefanAinda não há avaliações

- Report and Swot Analysis On Cement IndustryDocumento23 páginasReport and Swot Analysis On Cement IndustryAhmed Raza Jafri50% (4)

- Ratio Analysis of Fauji Cement and Lucky CementDocumento46 páginasRatio Analysis of Fauji Cement and Lucky Cementsidra_ali82% (22)

- Cement Industry (MEF - 2021)Documento23 páginasCement Industry (MEF - 2021)Sharif BalouchAinda não há avaliações

- Cement Industry in IndiaDocumento19 páginasCement Industry in IndiaShobhit Chandak100% (14)

- 2013 Cbs Case CompetitionDocumento54 páginas2013 Cbs Case CompetitionthanhAinda não há avaliações

- Offensive and Defensive StrategiesDocumento23 páginasOffensive and Defensive StrategiesAsad Farooq80% (5)

- Supply Chain Management (Report)Documento10 páginasSupply Chain Management (Report)tahshan tonmoyAinda não há avaliações

- Deliverable # 3 Cement Rate List in Pakistan:: Cement Company Price Per 50KG BagDocumento11 páginasDeliverable # 3 Cement Rate List in Pakistan:: Cement Company Price Per 50KG BagErumYaqoobAinda não há avaliações

- Impact of WTO On Cement Industry in PakistanDocumento6 páginasImpact of WTO On Cement Industry in PakistanErumYaqoobAinda não há avaliações

- INTRODUCTIONDocumento3 páginasINTRODUCTIONmanisha prasadAinda não há avaliações

- Cement IndustryDocumento11 páginasCement IndustryHassan MohsinAinda não há avaliações

- Group01 - End Term ProjectDocumento35 páginasGroup01 - End Term ProjectSiddharth GuptaAinda não há avaliações

- Builders Association of IndiaDocumento8 páginasBuilders Association of IndiaDipanshuGuptaAinda não há avaliações

- ARTICLE (December 20 2009) : The Markets ReportDocumento2 páginasARTICLE (December 20 2009) : The Markets Reportali12qwaszAinda não há avaliações

- Indian Cement Industry: Riding The High Tide Managerial Economics Case AnalysisDocumento11 páginasIndian Cement Industry: Riding The High Tide Managerial Economics Case AnalysisVrushabh ShelkarAinda não há avaliações

- Marketing Plan of Maple Leaf CementDocumento21 páginasMarketing Plan of Maple Leaf Cementcoolbouy85100% (11)

- Builders Association of India v. CCIDocumento9 páginasBuilders Association of India v. CCIAkshita choubey100% (1)

- Tapping The Potential of NepalDocumento3 páginasTapping The Potential of NepalMadanKarkiAinda não há avaliações

- The Cement Industry Is One of The Main Beneficiaries of The Infrastructure BoomDocumento9 páginasThe Cement Industry Is One of The Main Beneficiaries of The Infrastructure BoomSyedFaisalHasanShahAinda não há avaliações

- Cement Industry: Submitted To Sir Abdus Salam SheikhDocumento29 páginasCement Industry: Submitted To Sir Abdus Salam SheikhOsama YaqoobAinda não há avaliações

- Builders Association of IndiaDocumento9 páginasBuilders Association of IndiaApurva SinghAinda não há avaliações

- Conditions For Metal Scrap ImportDocumento5 páginasConditions For Metal Scrap ImportAnonymous U6rqzv5LJtAinda não há avaliações

- Cement 16 12 2020Documento59 páginasCement 16 12 2020Murtaza HashimAinda não há avaliações

- Cementing Growth - Prospects For Pakistan's Cement Industry - Marketing - AuroraDocumento6 páginasCementing Growth - Prospects For Pakistan's Cement Industry - Marketing - AuroraHend MoneimAinda não há avaliações

- When Economy Slows, Cartelisation Grows: Binding The PricesDocumento3 páginasWhen Economy Slows, Cartelisation Grows: Binding The PricesPritom Kumar GogoiAinda não há avaliações

- Industry Overviews: Pakistan Cement Industry Past Over ViewDocumento8 páginasIndustry Overviews: Pakistan Cement Industry Past Over ViewHuble PrinceAinda não há avaliações

- Case Analysis IclDocumento22 páginasCase Analysis IclYash BansalAinda não há avaliações

- CC CC CC C !""#$ %&' (!""!) (CC '&&+ '&!&) (Documento4 páginasCC CC CC C !""#$ %&' (!""!) (CC '&&+ '&!&) (Rahat Ul AminAinda não há avaliações

- Nepal Cement IssuesDocumento5 páginasNepal Cement IssuesSUNIL TVAinda não há avaliações

- Textile Sector Profit Phenomenal Rise of 295% Pakistan Textile Journal December 2010Documento6 páginasTextile Sector Profit Phenomenal Rise of 295% Pakistan Textile Journal December 2010buhduAinda não há avaliações

- Cement Industry in Pakistan: Group MembersDocumento20 páginasCement Industry in Pakistan: Group MembersJunaid MazharAinda não há avaliações

- Ahmedabad 27 December 2011 1Documento1 páginaAhmedabad 27 December 2011 1Rishit DalsaniaAinda não há avaliações

- ACC's Sumit Banerjee: 'Profits and Cartelization Are Two Different Things'Documento6 páginasACC's Sumit Banerjee: 'Profits and Cartelization Are Two Different Things'Dixit ShahAinda não há avaliações

- Economic and Political WeeklyDocumento3 páginasEconomic and Political WeeklyKamalDeep SidhuAinda não há avaliações

- Cement Industry of BangladeshDocumento22 páginasCement Industry of BangladeshAfrin Tonni33% (3)

- Indian Cement IndustryDocumento22 páginasIndian Cement IndustryBnaren NarenAinda não há avaliações

- Top Three Sectors of Kse During 2009-2010?Documento5 páginasTop Three Sectors of Kse During 2009-2010?Ali SandhuAinda não há avaliações

- Cases On Competition ActDocumento10 páginasCases On Competition Actczarina210Ainda não há avaliações

- MCCI News - Published - Newspaper On 14 January 2011Documento7 páginasMCCI News - Published - Newspaper On 14 January 2011Moksud Belal SiddiquiAinda não há avaliações

- EconomyDocumento8 páginasEconomyعبداللہ یاسر بلوچAinda não há avaliações

- Cement Industry PakistanDocumento23 páginasCement Industry Pakistansyed usman wazir100% (27)

- Cement Industry in India - A CartelDocumento35 páginasCement Industry in India - A CartelVarun NandaAinda não há avaliações

- Chairman Statement 2008Documento3 páginasChairman Statement 2008Gyan PrakashAinda não há avaliações

- Cartel in Cement IndustryDocumento13 páginasCartel in Cement IndustryBhavani Prasad ChittimallaAinda não há avaliações

- Total Production: Technological ChangeDocumento6 páginasTotal Production: Technological Changeagrawalrohit_228384Ainda não há avaliações

- Cement Industry in NepalDocumento8 páginasCement Industry in NepalMadanKarkiAinda não há avaliações

- Binani Cement Research ReportDocumento11 páginasBinani Cement Research ReportRinkesh25Ainda não há avaliações

- 02.12.2017 Sack Race, Textile and SubsidyDocumento2 páginas02.12.2017 Sack Race, Textile and SubsidySamina KhanAinda não há avaliações

- Indian Cement IndustryDocumento7 páginasIndian Cement IndustrymayankAinda não há avaliações

- W79-Non-competitive Behaviour (3601)Documento19 páginasW79-Non-competitive Behaviour (3601)InciaAinda não há avaliações

- Malabar Cements Performance AppraisalDocumento92 páginasMalabar Cements Performance AppraisalDoraiBalamohan0% (1)

- Porters FiveDocumento8 páginasPorters FiveNayan SahaAinda não há avaliações

- Daily Agri Report 07 March 2013Documento8 páginasDaily Agri Report 07 March 2013Angel BrokingAinda não há avaliações

- NTPC - Cement Manufacturers AssociationDocumento53 páginasNTPC - Cement Manufacturers Associationlaloo01Ainda não há avaliações

- RETRAK and the Ministry of Trade Advocacy PartnershipNo EverandRETRAK and the Ministry of Trade Advocacy PartnershipAinda não há avaliações

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesNo EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesAinda não há avaliações

- Impact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesNo EverandImpact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesAinda não há avaliações

- The Regional Comprehensive Economic Partnership Agreement: A New Paradigm in Asian Regional Cooperation?No EverandThe Regional Comprehensive Economic Partnership Agreement: A New Paradigm in Asian Regional Cooperation?Ainda não há avaliações

- The Korea Emissions Trading Scheme: Challenges and Emerging OpportunitiesNo EverandThe Korea Emissions Trading Scheme: Challenges and Emerging OpportunitiesAinda não há avaliações

- An Analysis of the Product-Specific Rules of Origin of the Regional Comprehensive Economic PartnershipNo EverandAn Analysis of the Product-Specific Rules of Origin of the Regional Comprehensive Economic PartnershipAinda não há avaliações

- Penn Exemption Rev-1220Documento2 páginasPenn Exemption Rev-1220jpesAinda não há avaliações

- Interspire Import Export GuideDocumento25 páginasInterspire Import Export Guidecosty72Ainda não há avaliações

- Exclusive Authority To Sell Agreement PDFDocumento4 páginasExclusive Authority To Sell Agreement PDFjohn milo67% (3)

- Push Pull Boundary SCMDocumento40 páginasPush Pull Boundary SCMniteshaptAinda não há avaliações

- MccoyDocumento2 páginasMccoyMahesh DulaniAinda não há avaliações

- 4 Gross and Profit Method Retail Inventory MethodDocumento6 páginas4 Gross and Profit Method Retail Inventory MethodSilverly Batisla-ongAinda não há avaliações

- Discovery Inc. v. Lisi Group - ComplaintDocumento32 páginasDiscovery Inc. v. Lisi Group - ComplaintSarah BursteinAinda não há avaliações

- C2 Course Test 3Documento16 páginasC2 Course Test 3Tinashe MashoyoyaAinda não há avaliações

- 7Cs ExerciseDocumento2 páginas7Cs ExerciseSharif Jan67% (3)

- Customer Buying Behavior: Retailing Management 8E © The Mcgraw-Hill Companies, All Rights ReservedDocumento30 páginasCustomer Buying Behavior: Retailing Management 8E © The Mcgraw-Hill Companies, All Rights ReservedDavid Lumaban GatdulaAinda não há avaliações

- Elecon Eng Bba ReportDocumento47 páginasElecon Eng Bba Reportarjunj_4Ainda não há avaliações

- Industry Life Cycle StagesDocumento7 páginasIndustry Life Cycle StagesUmar ButtAinda não há avaliações

- Daf1201 Cost Accounting CatDocumento3 páginasDaf1201 Cost Accounting CathaggaiAinda não há avaliações

- PartnershipDocumento43 páginasPartnershipIvhy Cruz EstrellaAinda não há avaliações

- RFBT Business Law Reviewer ChallengeDocumento7 páginasRFBT Business Law Reviewer ChallengeRegine YbañezAinda não há avaliações

- Assignment 1 Front SheetDocumento27 páginasAssignment 1 Front SheetTina NguyenAinda não há avaliações

- Export FinanceDocumento56 páginasExport Financesahil8844100% (1)

- 11th Full Course With AnsDocumento20 páginas11th Full Course With AnsShilpan ShahAinda não há avaliações

- SAP MM Module Resume With 3 Years ExperienceDocumento5 páginasSAP MM Module Resume With 3 Years ExperienceTamil Ka Amutharasan0% (1)

- Positioning of Company XDocumento15 páginasPositioning of Company X2rohitjacob100% (1)

- Module 6Documento16 páginasModule 6RhealynBalboaLopezAinda não há avaliações

- By Ashish Narang - 53 Slide 1 - 6 Gaurav Saini - 58 Slide 7 - 11 Abhishek Kakkar - 12 - 15 Kumar Abhishek 16 - EndDocumento19 páginasBy Ashish Narang - 53 Slide 1 - 6 Gaurav Saini - 58 Slide 7 - 11 Abhishek Kakkar - 12 - 15 Kumar Abhishek 16 - EndAshish NarangAinda não há avaliações

- Capitulo 6 Baye PDFDocumento34 páginasCapitulo 6 Baye PDFDiego Vigueras Quijada100% (1)

- Sky Blue FRP Canopy, Rs 55 - Piece, Sri Lakshmi Fibers - ID - 13701496633Documento6 páginasSky Blue FRP Canopy, Rs 55 - Piece, Sri Lakshmi Fibers - ID - 13701496633Manish PandeyAinda não há avaliações

- UNIT 1 Introduction of Data MiningDocumento40 páginasUNIT 1 Introduction of Data MiningprajakAinda não há avaliações

- Master Budget ProjectDocumento10 páginasMaster Budget Projectapi-268950886Ainda não há avaliações