Escolar Documentos

Profissional Documentos

Cultura Documentos

Goldberg Etal AER09

Enviado por

randommdudeDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Goldberg Etal AER09

Enviado por

randommdudeDireitos autorais:

Formatos disponíveis

American Economic Review: Papers & Proceedings 2009, 99:2, 494500 http://www.aeaweb.org/articles.php?doi=10.1257/aer.99.2.

494

Trade Liberalization and New Imported Inputs

By Pinelopi Goldberg, Amit Khandelwal, Nina Pavcnik, and Petia Topalova*

Understanding the role of international trade in explaining vast differences in productivity across countries remains a key question in international economics. Recent literature emphasizes the microfoundations underlying this relationship. One strand of literature highlights how new export opportunities and toughness of competition generate aggregate productivity gains by reallocating resources from less to more productive firms (Marc J. Melitz 2003; Melitz and Gianmarco Ottaviano 2008). Trade also increases aggregate productivity through improvements in firm productivity (Pavcnik 2002), which have recently been linked to the reallocation of resources across products within firms (Andrew B. Bernard, Stephan J. Redding, and Peter K. Schott 2006) and use of imported inputs (Mary Amiti and Jozef Konings 2007). The latter relate to the idea that trade provides domestic firms access to cheaper and previously unavailable inputs. The idea that international trade benefits countries by providing access to new products or new varieties of existing products is reflected in many trade and growth models (e.g., Luis RiveraBatiz and Paul M. Romer 1991, Gene Grossman and Elhanan Helpman 1991). In these models, a countrys access to foreign inputs raises productivity levels, thereby generating static gains from trade. New foreign inputs also lower the cost of innovation, enabling the creation of new varieties, and this generates dynamic gains from

* Goldberg: Princeton University, Department of Economics, Fisher Hall, Princeton, NJ 085441021, BREAD, and NBER (e-mail: pennykg@princeton.edu); Khandelwal: Columbia Business School, 3022 Broadway, Uris Hall 606, New York, NY 10027 (e-mail: ak2796@ columbia.edu); Pavcnik: Dartmouth College, Department of Economics, 6106 Rockefeller Hall, Hanover, NH 03755, BREAD, CEPR, and NBER (e-mail:nina. pavcnik@dartmouth.edu); Topalova: International Monetary Fund, Asian and Pacific Department, 700 19th Street NW, Washington, DC 20431 (e-mail: PTopalova@imf.org). We thank Beata Smarzynska Javorcik for comments. The views expressed in this paper are those of the authors and do not implicate the International Monetary Fund, its management, or Executive Board. 494

trade. With a few exceptions (Robert C. Feenstra et al. 1999; Christian Broda, Joshua Greenfield, and David E. Weinstein 2006), however, the empirical evidence on dynamic gains from trade has remained elusive. Our research on India (Goldberg, Khandelwal, Pavcnik, and Topalova, henceforth GKPT, 2008a, b) indicates that access to new input varieties from abroad enables the creation of new varieties in the domestic market. The raw data provide initial support for this hypothesis based on two facts following Indias trade liberalization during the 1990s. First, the trade liberalization dramatically increased Indian firms access to new imported inputs; two-thirds of the surge in imported inputs occurred in products not imported prior to the reforms. Second, inside Indias borders, firms were expanding their product scope during this same period; during the 1990s, a quarter of Indias manufacturing output growth was driven by new products (GKPT 2008a). In order to connect these two facts, which are consistent with the models mentioned above, we rely on methods developed by Feenstra (1994) and Broda and Weinstein (2006) to quantify the gains from new imported input varieties for Indian firms. We find that these new imported varieties generated an additional annual 4.7 percent decline in the imported input price index, and that firms access to new imported inputs increased firms ability to manufacture new products. In this article, we dissect changes in the composition of Indian imports following its 1991 trade liberalization to illustrate the potential scope for previously unavailable inputs to bolster the performance of domestic firms. The analysis reveals that trade reform spurred imports of previously unavailable products and varieties in many products that arguably can be characterized as important inputs for manufacturing firms. New imported inputs in large extent originated from more advanced countries and new imported varieties exhibited higher unit values relative to existing imports. These findings are consistent across narrow classifications of inputs

VOL. 99 NO. 2

tRAdE LiBERALizAtiON ANd NEw imPORtEd iNPuts

495

and therefore indicative that Indias trade liberalization relaxed the technological constraints faced by Indian firms under import substitution policies. This more descriptive analysis provides further confirmation of the importance of the extensive product margin in input trade noted in GKPT (2008b).

I. Decomposing Imports

Our analysis relies on official Indian import data from Tips Software Services. The data record the quantity and values of Indias imports at the eight-digit Harmonized Tariff System (HS) level by trade partner from 1987 to 2000. However, we analyze trade flows primarily at the HS6 level, which contains about 5,000 product codes, since HS6 codes are standardized across countries. Thus, the focus on trade flows at the HS6 level ensures that the level of detail of product codes does not reflect factors specific to Indias trade patterns. We rely on the original 1987 HS code classification in order to distinguish true product turnover from false product changes reflecting the revisions of HS6 classification. Conducting the analysis at the HS6 level provides a more conservative estimate of variety growth and therefore biases our estimate of the extensive margin downward. The literature on new goods and varieties in international economics often focuses on varieties, where a variety is defined as a product (for example, an HS6 category) imported from a particular country. Since most developed countries import a majority of HS6 products, variation in the extensive margins of trade is driven by the variety margin (Broda et al. 2006). The distinction between products and varieties might be potentially more important in a developing country setting, where a countrys level of economic development or trade policy might constrain not only the varieties they import within a particular product, but also entire sets of products. In what follows, we thus distinguish between products, defined as an HS6 category, and varieties, defined as an HS6 country combination. For example, HS6 854220 (hybrid integrated circuits) is a product that is distinct from HS6 854280 (electronic integrated circuits/microassemblies, not specified elsewhere), while a hybrid integrated circuit imported from Japan is treated as a distinct variety from a German hybrid integrated circuit.

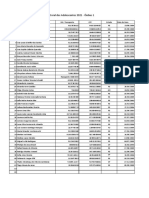

The raw trade data reveal a large expansion in both products and varieties following Indias trade reform. While India imported 3,249 products and 23,571 varieties in 1987, these numbers grew to 4,443 and 55,819, respectively, by 2000. Not only did India import about 35 percent more products, but products were, on average, sourced by 12.6 countries compared to 7.3 countries prior to the reform. The observed increases in the number of imported products and variety translate into substantive gains from trade only if the extensive margin of trade accounts for a sizable share of imports. In Table 1, we analyze the role of the extensive margin by decomposing the growth in Indias imports between 1987 and 2000 (column 1) into the contribution due to the (net) extensive product margin (new HS6 codes, column 2), the extensive variety margin (new HS6 country pairs, column 5), and the intensive variety margin (existing HS6 country pairs, column 8). The rows of Table 1 report this decomposition for different subsets of products. The first row decomposes Indias import growth over all products. Overall, imports increase 130 percentage points between 1987 and 2000. Of this growth, 65 percent (84/130) can be attributed to new HS6 products entering the economy. The remaining growth occurred within existing HS products and about half of this growth is due to growth in imports of new varieties (22/(22 + 23)). Thus, new products and new varieties within existing products account for 82 percent ((84 + 22)/130) of Indias import growth during the reform period. Further analysis suggests that the growth in the extensive margin of trade is particularly pronounced for products that serve as inputs into the production process of Indian firms. Rows 2 and 3 of Table 1 decompose imports across two mutually exclusive groups: final products and imported inputs.1 Two features are striking. First, growth in imported inputs is substantially higher than for final goods, 227 percentage

Each HS6 code is assigned to an end use category following the classification from Hasheem Nouroz (2001), which relies on Indias input-output matrix and distinguishes between consumer durables, consumer nondurables, intermediates, capital, and basic products. We group these categories into imported final products (consumer durables and nondurables) and imported inputs (comprising intermediate products, capital products, and basic products).

496

AEA PAPERs ANd PROCEEdiNGs Table 1Extensive and Intensive Margin of India's Imports, 19872000 Import growth Product extensive margin Total (2) 84 33 153 154 37 278 59 7 4 666 34 33 72 OECD (3) 59 21 115 124 27 200 0 4 2 576 16 23 63 NonOECD (4) 25 11 38 30 10 78 59 2 2 89 18 10 9 Variety extensive margin Total (5) 22 25 42 62 33 28 11 92 58 28 24 27 35 OECD (6) 9 9 15 31 23 1 4 12 20 4 21 19 NonOECD (7) 13 16 26 31 10 39 11 88 46 8 20 6 16

mAY 2009

Intensive margin Total (8) 23 32 32 45 55

(1) Final products (consumer durables and nondurables) Inputs (capital, basic, intermediates) Basic products Capital products Intermediate products HS Code 27 (mineral fuels and oil) HS Code 28 (inorganic chemicals) HS Code 29 (organic chemicals) HS Code 71 (precious stones and metals) HS Code 72 (iron and steel) HS Code 84 (nuclear reactors, boilers, and machinery) HS Code 85 (electrical machinery and equipment) All products 130 90 227 260 125 297 89 227 158 668 27 100 173

12

9 19 128 95

25 31 39 66

Notes: The table decomposes import growth into the extensive and intensive margins between 1987 and 2000. The first column reports overall import growth. Column 2 reports the contribution to import growth due to the extensive (new HS6) margin. Columns 3 and 4 disaggregate column 2 according to the source country. Column 5 reports the contribution to growth due to existing HS6 codes. This product extensive margin is decomposed into the variety extensive margin (column 5) and the variety intensive margin (column 8). Columns 2, 5, and 8 sum to column 1. The variety extensive margin is decomposed in the variety extensive margins in columns 6 and 7. All variables are deflated by wholesale price indices. Please see footnote for the list of OECD countries. The units in the table are percentage growth in import values (rupees).

points versus 90 percentage points.2 Second, the margins through which each product classification grows differ. While the product intensive margin dominates growth in final goods, 67 percent (153/227) of the growth in intermediate products is driven by new HS6 products. An additional 20 percent of the growth in intermediate imports occurs through new varieties. Thus, new products and new varieties within existing products account for 86 percent ((153 + 42)/227) of Indias imports of inputs during the reform period. The corresponding number for final goods is 65 percent. These figures imply that Indias trade liberalization enabled Indian

2 This could in part reflect that import licenses were removed later on consumer products than imported inputs.

firms to import more, and new types of, production inputs. The next three rows of Table 1 reinforce this point by further classifying imported inputs into basic, capital, and intermediate products. The contribution of the product extensive margin for basic, capital, and intermediate import growth is 59, 30, and 93 percent, respectively. Adding the variety-extensive margin indicates that new products and varieties accounted for 83, 59, and 103 percent of each products import growth. Thus, the growth of all subcategories of imported inputs is driven predominantly by products and varieties unavailable prior to the trade reform. While columns 2, 5, and 8 of Table 1 delineate the importance of the extensive margin, these columns are silent on the country-origin of these new products and varieties. Recent research

VOL. 99 NO. 2

tRAdE LiBERALizAtiON ANd NEw imPORtEd iNPuts

497

in international trade provides compelling evidence that export quality differs across countries, with the finding that richer and more capital-abundant countries export higher quality varieties (see Schott 2004; Khandelwal 2008). We address the origin of imports by decomposing new products and varieties according to OECD countries and the rest of the world.3 The product extensive margin in column 2 is decomposed into these two mutually exclusive country groupings in columns 3 and 4. Overall, 70 percent (59/84) of the growth in product extensive margin occurred in products exported by OECD countries. New products imported from advanced countries account for 75 percent of the growth in product extensive margin. Looking at the finer classifications of inputs in rows 46, OECD countries were responsible for over 70 of the product extensive margin in the basic, capital, and intermediate products. Columns 6 and 7 provide an analogous decomposition of the variety extensive margin. Overall, OECD countries account for 41 percent of new varieties within existing HS6 products during the reform period. This is a remarkable number given that OECD countries were already likely exporting these products to other countries in 1987; this is suggestive that Indias trade liberalization enabled firms to cover the fixed costs of exporting to India. For basic and capital products, new OECD varieties accounted for more than half of the variety extensive margin. Only in the case of intermediates do we observe some evidence that new varieties are taking away the market share of existing varieties. Table 1 therefore offers compelling evidence that not only did India experience a surge in new types of inputs to be used in the manufacturing process from abroad following the trade liberalization, but these new inputs were sourced from more advanced countries. We also find that within HS6 products, new OECD varieties were 2.7 percent more expensive than

3 We define the OECD countries as Australia, Austria, Belgium, Canada, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Hong Kong, Iceland, Ireland, Italy, Japan, Korea, Luxembourg, Mexico, Netherlands, New Zealand, Norway, Portugal, Poland, Slovak Republic, Singapore, Spain, Sweden, Switzerland, Taiwan, Turkey, United Kingdom, and United States.

existing OECD varieties, and new non-OECD varieties were 5.5 percent more expensive than existing non-OECD varieties.4 While acknowledging the caveat of interpreting unit values as quality (Khandelwal 2008), these price differences reflect differentiation in products and are consistent with new imported varieties plausibly possessing higher quality than existing varieties. The results discussed so far are obtained from fairly coarse product classifications. The bottom panel of Table 1 focuses on specific HS two-digit sectors to obtain a better understanding of specific imported inputs that India began importing following the trade liberalization. We focus on two-digit HS codes related to the imports of fuels (HS 27), chemicals (HS 28 and 29), precious stones and metals (HS 71), iron and steel (HS 72), and machinery (HS 84 and 85). These sectors account for two-thirds of Indias imports in 2000 and include many products classified as imported inputs. The analysis of these more detailed categories paints the picture consistent with the findings from more aggregate groups of imported inputs. Although the importance of the (net) extensive product and variety margin differs across sectors, new products and varieties account anywhere from 40 (organic chemicals) to 214 (iron and steel) percent of the import growth in the sector.5

II. Case in Point: Machinery

The results up to now do not condition on the substitutability of the imports. As discussed extensively in Feenstra (1994) and Broda and Weinstein (2006), the importance of new varieties is diminished if the varieties have a high elasticity of substitution. We use the methodology developed by Feenstra (1994) and Broda and Weinstein (2006) to compute a variety index that accounts for the both the share of expenditure

Results are available upon request. The large extensive margin growth in HS 71 (precious stones and metals) mostly reflects the growth of two HS categories: unworked diamonds (HS 710231) and gold in unwrought form, nonmonetary (HS 710812). The exclusion of these two categories lowers the magnitude of overall import and extensive margin growth in HS 71, but the extensive product and variety margin continue to account for a large share of import growth.

5

498

AEA PAPERs ANd PROCEEdiNGs Table 2Variety Index within Nuclear Reactors, Boilers, and Machinery (HS 84) HS4 Code 8471 8479 8473 8443 8445 8406 8416 8428 8429 8438 8439 8453 8462 8475 8454 Automatic data process machines Machines having individual functions Parts for office machines Printing machinery Machines for preparing textile fibers Steam turbines Furnace burners, mechanical stokers, etc. Lifting, handling, loading, and unloading machinery Self-propelled bulldozers, graders, shovels, etc. Machinery for industrial preparation of food and drink Machinery for making pulp Machinery for working leather Machine tools for forging, bending, etc. Machines for assembling electric tubes, etc. Converters, ladles, and casting machines Variety index 0.196 0.940 0.319 0.822 0.940 0.899 0.978 0.744 0.774 0.747 0.834 0.903 0.702 0.816 0.873 0.196 1.135 0.911 0.861

mAY 2009

Minimum (8471 automatic data process machines) Maximum (8476 vending machines) Median variety index Mean variety index

tilted towards new varieties and the elasticity of substitution.6 This variety index is defined as

where vi denotes imports from a country-product pair in 1989, is the set of country-product pairs imported in 1989, and the corresponding values with primes refer to 1997 data. In assessing the gains from variety, this index accounts for both the increase in expenditure on new varieties in 1997 and for the elasticity of substitution across varieties. So, an increase in imports will not deliver substantial gains to the price index if

We compute the index for each HS4 category. We obtain estimates for the elasticity of substitution from Broda et al. (2006), who estimate Indias elasticities of substitution at the three-digit HS level.

6

/ = q __________ r v / v

vi vi

i i

Notes: This table reports the variety index developed by Feenstra (1994) for selected HS4 codes within sector HS 84 between 1989 and 1997. The top panel reports the five largest HS4 codes in 1997. Summary statistics computed over the 85 possible HS4 codes within HS 84 are reported in the bottom panel. Estimates for the elasticity of substitution are from Broda, Greenfield, and Weinstein (2006), who estimate Indias elasticities of substitution at the HS3 level.

1/(1)

the imported varieties are highly substitutable. Note that a lower variety index indicates larger gains from new imported varieties. In GKPT (2008b), we show that variety growth deflates Indias (overall) conventional import price index by 31 percent between 1989 and 1997. Moreover, variety growth deflated the overall conventional imported input index by 38 percent, or 4.7 percent annually. In Table 2, we continue our dissection of the sources of variety growth by investigating one particular sector, HS 84 (nuclear reactors, boilers, and machinery). We choose this sector because it plausibly contains important capital inputs for several manufacturing industries. The top panel reports the largest five HS4 codes, which accounted for 30 percent of the imports into sector HS 84 in 2000. The largest category, automatic data process machines (HS 8471), also had the lowest variety index across four-digit HS codes within HS 84. The middle panel reports additional HS4 codes that experienced large gains in varieties, as indicated by a relatively

VOL. 99 NO. 2

tRAdE LiBERALizAtiON ANd NEw imPORtEd iNPuts

499

low variety index. For instance, the index for machine tools for forging metal (HS 8462) was 0.702 over this period. This implies that new varieties deflated the conventional import price index, which only considers changes in prices of existing varieties, by an additional 30 percent. This is indicative of the substantial benefit for firms using forging machinery in their production process. Furthermore, Table 2 shows that while there was heterogeneity in the importance of new varieties across machinery types, the average variety index over these machinery codes was 0.861. Thus, this detailed picture of the types of new inputs that Indian firms began to use provides evidence for dismantling trade barriers potentially can deliver both static and dynamic gains from trade.

III. Concluding Remarks

Bernard, Andrew B., Stephen J. Redding, and Peter K. Schott. 2006. Multi-Product Firms

and Trade Liberalization. National Bureau of Economic Research Working Paper 12782.

Broda, Christian, Joshua Greenfield, and David Weinstein. 2006. From Groundnuts to Glo-

This article provides evidence that trade reform might have benefited Indian firms not only by providing access to more and cheaper inputs, but also, crucially, through importing of new input goods and varieties as trade barriers fell. In future work we plan to more directly link increased access to a broader range of imported inputs to dynamic gains from trade. While our work focuses on a particular developing country, India, Estevadeordal and Taylor (2008) offer cross-country evidence that declines in tariffs on capital and intermediate goods can raise GDP growth in countries that implement trade reforms. This suggests that the microeconomic mechanisms uncovered from detailed analyses of firms in specific developing countries may be generalizable. More generally, the availability of detailed firm and trade flow data enables researchers to explore the exact mechanisms through which international trade affects the performance of domestic firms, and ultimately productivity growth. Examining the microfoundation of the link between international trade and growth will thus likely continue to be a promising area of research. REFERENCES

Amiti, Mary, and Jozef Konings. 2007. "Trade

balization: A Structural Estimate of Trade and Growth. National Bureau of Economic Research Working Paper 12512. Broda, Christian, and David E. Weinstein. 2006. Globalization and the Gains from Variety. Quarterly Journal of Economics, 121(2): 54185. Estevadeordal, Antoni, and Alan M. Taylor. 2008. Is the Washington Consensus Dead? Growth, Openness, and the Great Liberalization, 1970s-2000s. National Bureau of Economic Research Working Paper 14264. Feenstra, Robert C. 1994. New Product Varieties and the Measurement of International Prices. American Economic Review, 84(1): 15777.

Feenstra, Robert C., Dorsati Madani, Tzu-Han Yang, and Chi-Yuan Liang. 1999. Testing

Endogenous Growth in South Korea and Taiwan. Journal of development Economics, 60(2): 31741. product Firms and Product Turnover in the Developing World: Evidence from India. National Bureau of Economic Research Working Paper 14416.

Goldberg, Pinelopi K., Amit K. Khandelwal, Nina Pavcnik, and Petia Topalova. 2008a. Multi-

Goldberg, Pinelopi K., Amit K. Khandelwal, Nina Pavcnik, and Petia Topalova. 2008b. Imported

Intermediate Inputs and Domestic Product Growth: Evidence from India. National Bureau of Economic Research Working Paper 14127.

Grossman, Gene M., and Elhanan Helpman.

1991. innovation and Growth in the Global Economy. Cambridge, MA: MIT Press. Khandelwal, Amit K. 2008. The Long and Short (of) Quality Ladders. Unpublished. Melitz, Marc J. 2003. The Impact of Trade on Intra-Industry Reallocations and Aggregate Industry Productivity. Econometrica, 71(6): 16951725.

Melitz, Marc J., and Gianmarco I. P. Ottaviano.

Liberalization, Intermediate Inputs, and Productivity: Evidence from Indonesia." American Economic Review, 97(5): 161138.

2008. Market Size, Trade, and Productivity. Review of Economic studies, 75(1): 291316. Nouroz, Hasheem. 2001. Protection in indian manufacturing: An Empirical study. Delhi: MacMillan India Ltd.

500

AEA PAPERs ANd PROCEEdiNGs

mAY 2009

Pavcnik, Nina. 2002. Trade Liberalization,

Exit, and Productivity Improvement: Evidence from Chilean Plants. Review of Economic studies, 69(1): 24576. Rivera-Batiz, Luis A., and Paul M. Romer. 1991. Economic Integration and Endogenous Growth. Quarterly Journal of Economics, 106(2): 53155.

Schott, Peter K. 2004. Across-Product versus

Within-Product Specialization in International Trade. Quarterly Journal of Economics, 119(2): 64778. Topalova, Petia. 2007. Trade Liberalization and Firm Productivity: The Case of India. imF working Paper wP/04/28.

Você também pode gostar

- Better Export For Better IndiaDocumento15 páginasBetter Export For Better IndiaThowseaf AhamedAinda não há avaliações

- Export and Economic Growth of India - A Cointegration and Causality EvidenceDocumento22 páginasExport and Economic Growth of India - A Cointegration and Causality EvidenceChetan KurdiaAinda não há avaliações

- Ronny ThomasDocumento31 páginasRonny ThomasShivraj SivanandanAinda não há avaliações

- Noorulain Work ...........................Documento56 páginasNoorulain Work ...........................UME SALMAAinda não há avaliações

- Freund PDFDocumento26 páginasFreund PDFKarthikBalasubramanianAinda não há avaliações

- NoteDocumento4 páginasNoteBinhAinda não há avaliações

- Exports-Led Growth Hypothesis in Pakistan: Further EvidenceDocumento26 páginasExports-Led Growth Hypothesis in Pakistan: Further EvidenceViverAinda não há avaliações

- The Impact of Import Competition From China On Firm Performance in The Peruvian Manufacturing Sector enDocumento36 páginasThe Impact of Import Competition From China On Firm Performance in The Peruvian Manufacturing Sector enBrusy RussAinda não há avaliações

- MPRA Paper 70744Documento33 páginasMPRA Paper 70744arbab buttAinda não há avaliações

- Innovation Product Sophistication and Export Market Survival Indian ManufacturingDocumento45 páginasInnovation Product Sophistication and Export Market Survival Indian ManufacturingfzapataAinda não há avaliações

- Innovation, Export Performance and Profitability of Lao Garment ExportersDocumento12 páginasInnovation, Export Performance and Profitability of Lao Garment ExportersMathi GomathiAinda não há avaliações

- Peruvian Economic Association: Jean Paul Rabanal Olga A. RabanalDocumento24 páginasPeruvian Economic Association: Jean Paul Rabanal Olga A. RabanalGuillermo Raffo RamosAinda não há avaliações

- Determinants of Exports in Developing Countries: The Pakistan Development ReviewDocumento12 páginasDeterminants of Exports in Developing Countries: The Pakistan Development Reviewyidnekachew baregaAinda não há avaliações

- Evaluating The Contribution of Exporting To UK Productivity Growth: Some Microeconomic EvidenceDocumento24 páginasEvaluating The Contribution of Exporting To UK Productivity Growth: Some Microeconomic EvidenceBilAl NafeesAinda não há avaliações

- File 0076 PDFDocumento1 páginaFile 0076 PDFEd ZAinda não há avaliações

- Fixed Export Costs and Trade Patterns - The Case of ChinaDocumento10 páginasFixed Export Costs and Trade Patterns - The Case of China- “Sem Cortes e Edição” -Ainda não há avaliações

- 2011 - Topalova - TRade Liberalization and Firm ProductivityDocumento15 páginas2011 - Topalova - TRade Liberalization and Firm ProductivitychipAinda não há avaliações

- The Linkage Between The FDI and Trade of China Japan Korea, The Korean PerspectiveDocumento19 páginasThe Linkage Between The FDI and Trade of China Japan Korea, The Korean PerspectiveArthur SkyAinda não há avaliações

- Trade Liberalization and Productivity Growth: Evidence From Indian ManufacturingDocumento32 páginasTrade Liberalization and Productivity Growth: Evidence From Indian ManufacturingenjoythesuccessAinda não há avaliações

- Impact of Exchange Rate Movements On Ind PDFDocumento14 páginasImpact of Exchange Rate Movements On Ind PDFNishatAinda não há avaliações

- Trade Growth and Poverty: A Case of Pakistan: Pak. J. Commer. Soc. SciDocumento13 páginasTrade Growth and Poverty: A Case of Pakistan: Pak. J. Commer. Soc. SciRana ToseefAinda não há avaliações

- Accounting For The New Gains From Trade Liberalization (29 PGS)Documento29 páginasAccounting For The New Gains From Trade Liberalization (29 PGS)Oluwatofunmi IdowuAinda não há avaliações

- Pras AnnaDocumento7 páginasPras Annachi1311Ainda não há avaliações

- Diaeia2017d2a2 enDocumento18 páginasDiaeia2017d2a2 enkanikaAinda não há avaliações

- Comparative Analysis of India and ChinaDocumento291 páginasComparative Analysis of India and Chinahitu4allAinda não há avaliações

- Economic and Political Weekly Economic and Political WeeklyDocumento6 páginasEconomic and Political Weekly Economic and Political WeeklyKrishna KumarAinda não há avaliações

- What Constrains Indian Manufacturing?Documento46 páginasWhat Constrains Indian Manufacturing?Asian Development BankAinda não há avaliações

- The Relationship Between Trade Openness andDocumento18 páginasThe Relationship Between Trade Openness andNur AlamAinda não há avaliações

- Imports and Exports at The Level of The Firm Evidence From BelgiumDocumento57 páginasImports and Exports at The Level of The Firm Evidence From BelgiumTasty BahrainAinda não há avaliações

- Global Value Chain Participation, Competition, and Markups: Evidence From Ethiopian Manufacturing FirmsDocumento27 páginasGlobal Value Chain Participation, Competition, and Markups: Evidence From Ethiopian Manufacturing FirmsI GEDE WIYASAAinda não há avaliações

- 26 Sep Soham's Updated AssDocumento37 páginas26 Sep Soham's Updated AssSohham ParingeAinda não há avaliações

- Importación y ExportaciónDocumento35 páginasImportación y Exportaciónromario geronimo benancio alcedoAinda não há avaliações

- 3 EffectDocumento8 páginas3 EffectNelu CiocanAinda não há avaliações

- Orep India 9Documento23 páginasOrep India 9rutuja sahareAinda não há avaliações

- Berhanu Lakew Determinants of Ethiopia ExportDocumento26 páginasBerhanu Lakew Determinants of Ethiopia ExportaychiluhimchulaAinda não há avaliações

- The Quarterly Journal of Economics 2010 Lileeva 1051 99Documento49 páginasThe Quarterly Journal of Economics 2010 Lileeva 1051 99Abel CamachoAinda não há avaliações

- Syed Zia Abbas RizviDocumento16 páginasSyed Zia Abbas RizvithinkaboutnavAinda não há avaliações

- The Significance of Export Promotion SCHDocumento13 páginasThe Significance of Export Promotion SCHaloksingh420aloksigh420Ainda não há avaliações

- Castellani 2010Documento34 páginasCastellani 2010Paulina Flores MerejildoAinda não há avaliações

- Koopman 2008Documento40 páginasKoopman 2008Mario Alberto Martínez BautistaAinda não há avaliações

- World BankDocumento44 páginasWorld BankToulouse18Ainda não há avaliações

- An Analysis of Exports & Growth in India (1971-2001)Documento18 páginasAn Analysis of Exports & Growth in India (1971-2001)Rakhi SinghAinda não há avaliações

- Exports Innovation EgyptDocumento19 páginasExports Innovation Egyptnyman493130Ainda não há avaliações

- Services Reform and Manufacturing Performance: Policy Research Working Paper 5948Documento59 páginasServices Reform and Manufacturing Performance: Policy Research Working Paper 5948Arvind ShuklaAinda não há avaliações

- Impact of Import On EconomicsDocumento5 páginasImpact of Import On EconomicsAhmed Shafkat NurAinda não há avaliações

- Journal of International Economy 10Documento17 páginasJournal of International Economy 10emilianocarpaAinda não há avaliações

- 090126laila PaperDocumento15 páginas090126laila PaperZulfikar AliAinda não há avaliações

- Domestic Segment of Global Value Chains in China - 2020 - Journal of ComparativDocumento25 páginasDomestic Segment of Global Value Chains in China - 2020 - Journal of ComparativRetno Puspa RiniAinda não há avaliações

- India's Economic Reforms: Private Corporate Sector ResponseDocumento47 páginasIndia's Economic Reforms: Private Corporate Sector ResponseruchikashyapAinda não há avaliações

- Quantity Restrictions and Price Adjustment of Chinese Textile Exports To The USDocumento18 páginasQuantity Restrictions and Price Adjustment of Chinese Textile Exports To The USkoro senseiAinda não há avaliações

- Brazilian Exports: Policy Research Working Paper 6302Documento31 páginasBrazilian Exports: Policy Research Working Paper 6302Dsantos Sman PiswanAinda não há avaliações

- Strategic Alliance in India Pharmaceutical in DustryDocumento21 páginasStrategic Alliance in India Pharmaceutical in DustryJagriti SinghAinda não há avaliações

- Regression Analysisi MariaDocumento11 páginasRegression Analysisi MariaInnocent escoAinda não há avaliações

- Dire Dawa University: College of Business and Economics Department of EconomicsDocumento24 páginasDire Dawa University: College of Business and Economics Department of Economicsmulugeta teferyAinda não há avaliações

- Factor Immobility and Regional Impacts of TradeDocumento41 páginasFactor Immobility and Regional Impacts of TradeRandolph Vargas OliveiraAinda não há avaliações

- 2010 AEJ - TopalovaDocumento44 páginas2010 AEJ - TopalovaEsteban LeguizamónAinda não há avaliações

- The Competitiveness and Future Challenges of Bangladesh in International TradeDocumento15 páginasThe Competitiveness and Future Challenges of Bangladesh in International TradeAnika RahmanAinda não há avaliações

- Battletech BattleValueTables3.0 PDFDocumento25 páginasBattletech BattleValueTables3.0 PDFdeitti333Ainda não há avaliações

- Botvinnik-Petrosian WCC Match (Moscow 1963)Documento9 páginasBotvinnik-Petrosian WCC Match (Moscow 1963)navaro kastigiasAinda não há avaliações

- Coding Decoding 1 - 5311366Documento20 páginasCoding Decoding 1 - 5311366Sudarshan bhadaneAinda não há avaliações

- ATI PN Maternal Newborn Proctored Exam Test Bank (38 Versions) (New-2022)Documento7 páginasATI PN Maternal Newborn Proctored Exam Test Bank (38 Versions) (New-2022)kapedispursAinda não há avaliações

- Lesson Agreement Pronoun Antecedent PDFDocumento2 páginasLesson Agreement Pronoun Antecedent PDFAndrea SAinda não há avaliações

- Case StudyDocumento2 páginasCase StudyRahul DhingraAinda não há avaliações

- Reading Job Advertisements 4Documento2 páginasReading Job Advertisements 456. Trần Thị Thanh Tuyền100% (1)

- OD2e L4 Reading Comprehension WS Unit 3Documento2 páginasOD2e L4 Reading Comprehension WS Unit 3Nadeen NabilAinda não há avaliações

- Case 46 (Villanueva)Documento8 páginasCase 46 (Villanueva)Nathalie YapAinda não há avaliações

- Calendar of ActivitiesDocumento2 páginasCalendar of ActivitiesAJB Art and Perception100% (3)

- Suggested Answer: Business Strategy May-June 2018Documento10 páginasSuggested Answer: Business Strategy May-June 2018Towhidul IslamAinda não há avaliações

- CEAT PresentationDocumento41 páginasCEAT PresentationRAJNTU7aAinda não há avaliações

- Region 12Documento75 páginasRegion 12Jezreel DucsaAinda não há avaliações

- Dua AdzkarDocumento5 páginasDua AdzkarIrHam 45roriAinda não há avaliações

- Numerical Problems Ni AccountingDocumento7 páginasNumerical Problems Ni AccountingKenil ShahAinda não há avaliações

- Rizal ParaniDocumento201 páginasRizal ParaniMuhammadd YaqoobAinda não há avaliações

- Assignment F225summer 20-21Documento6 páginasAssignment F225summer 20-21Ali BasheerAinda não há avaliações

- Richard Neutra - Wikipedia, The Free EncyclopediaDocumento10 páginasRichard Neutra - Wikipedia, The Free EncyclopediaNada PejicAinda não há avaliações

- Just Design Healthy Prisons and The Architecture of Hope (Y.Jewkes, 2012)Documento20 páginasJust Design Healthy Prisons and The Architecture of Hope (Y.Jewkes, 2012)Razi MahriAinda não há avaliações

- Managing A Person With ADHD - Team Skills FromDocumento7 páginasManaging A Person With ADHD - Team Skills FromHieu PhanAinda não há avaliações

- Reaserch ProstitutionDocumento221 páginasReaserch ProstitutionAron ChuaAinda não há avaliações

- Postcolonial FeministReadingDocumento10 páginasPostcolonial FeministReadinganushkamahraj1998Ainda não há avaliações

- 2020 Macquarie University Grading and Credit Point System PDFDocumento2 páginas2020 Macquarie University Grading and Credit Point System PDFRania RennoAinda não há avaliações

- Maharashtra Government Dilutes Gunthewari ActDocumento2 páginasMaharashtra Government Dilutes Gunthewari ActUtkarsh SuranaAinda não há avaliações

- 2018 Vaccine Services enDocumento200 páginas2018 Vaccine Services enCiprian BalcanAinda não há avaliações

- Sample TRF For Master TeacherDocumento10 páginasSample TRF For Master TeacherBernard TerrayoAinda não há avaliações

- Why Some Platforms Thrive and Others Don'tDocumento11 páginasWhy Some Platforms Thrive and Others Don'tmahipal singhAinda não há avaliações

- Test Present Simple TenseDocumento2 páginasTest Present Simple TenseSuchadaAinda não há avaliações

- Coral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascDocumento1 páginaCoral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascGabriel Kuhs da RosaAinda não há avaliações

- Airport Planning and Engineering PDFDocumento3 páginasAirport Planning and Engineering PDFAnil MarsaniAinda não há avaliações