Escolar Documentos

Profissional Documentos

Cultura Documentos

EFA For 3factors (Construal, Trust & Respect) PY4108 Data

Enviado por

Sinthu Ragupalan0 notas0% acharam este documento útil (0 voto)

12 visualizações55 páginasTítulo original

EFA for 3factors (Construal,Trust & Respect) PY4108 Data

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

12 visualizações55 páginasEFA For 3factors (Construal, Trust & Respect) PY4108 Data

Enviado por

Sinthu RagupalanDireitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 55

Reading: http://www.ats.ucla.edu/stat/mplus/seminars/lntroMplus_CFA/default.htm#3.

Exploratory factor analysis with categorical outcomes

Mplus VER8ON 6

MUTHEN & MUTHEN

11/25/2010 4:23 PM

NPUT N8TRUCTON8

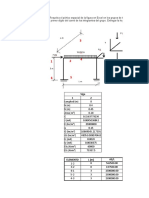

Title : EFA for PY 4108 Data Analyses

Data : FLE 8 f:\py4108data.txt ;

Variable: NAME8 = u1-u16 y1-y10 y11-y20 ;

CATEGORCAL = u1-u16 ;

Analysis: TYPE = EFA 1 3 ;

MXU = NTERATON8 ;

CONVERGENCE;

ROTATON = OBLMN

*** WARNNG in ANALY88 command

The MXU option is not available with this analysis.

MXU will be ignored.

1 WARNNG{8} FOUND N THE NPUT N8TRUCTON8

EFA for PY 4108 Data Analyses

8UMMARY OF ANALY88

Number of groups 1

Number of observations 35

Number of dependent variables 36

Number of independent variables 0

Number of continuous latent variables 0

Observed dependent variables

Continuous

Y1 Y2 Y3 Y4 Y5 Y6

Y7 Y8 Y9 Y10 Y11 Y12

Y13 Y14 Y15 Y16 Y17 Y18

WARNING - In this case, the output includes a warning that the MIXU

option was not available with this analysis - and it was ignored

Number of observations : the number of

observations used in the analysis. By default,

MPlus will include all cases that have at least

partial data on the variables in the analysis

Number of Dependent Varibales : gives the

number of dependent (outcome) varibales in

the model. Note that MPlus classies the

factor indicators as Dependent variables

Observed Dependent Variables : the list of variables included in this

analysis. All the variables in our model are listed under continuous. If

the model included categorical variables, they would be listed under the

heading CATEGORICAL. If this section includes variables you did not

intend to include in your analysis, you may need to use the

USEVARIABLES options of the DATA command.

Y19 Y20

Binary and ordered categorical {ordinal}

U1 U2 U3 U4 U5 U6

U7 U8 U9 U10 U11 U12

U13 U14 U15 U16

Estimator WL8MV

Rotation OBLMN

Row standardization CORRELATON

Type of rotation OBLOUE

Gamma value 0.000D+00

Maximum number of iterations 1000

Convergence criterion 0.500D-04

Maximum number of steepest descent iterations 20

Optimization 8pecifications for the Exploratory Factor Analysis

Rotation Algorithm

Number of random starts 0

Maximum number of iterations 10000

Derivative convergence criterion 0.100D-04

nput data file{s}

Estimator: The method used to estimate the model,

in this case a WLSMV (?) (e.g. maximum likelihood

- MD)

Roation: The specic rotation method usd in the

model; in this case OBLIMIN

Type of Rotation: Rotations that allow the factors

to be correlated are oblique, while rotations that

force factors to be uncorrelated are known as

orthogonal. The default geomin rotation is

OBLIQUE. In this case : OBLIQUE

f:\py4108data.txt

nput data format FREE

UNVARATE PROPORTON8 AND COUNT8 FOR CATEGORCAL VARABLE8

U1

Category 1 0.457 16.000

Category 2 0.543 19.000

U2

Category 1 0.486 17.000

Category 2 0.514 18.000

U3

Category 1 0.629 22.000

Category 2 0.371 13.000

U4

Category 1 0.686 24.000

Category 2 0.314 11.000

U5

Category 1 0.657 23.000

Category 2 0.343 12.000

U6

EXTRA: Under SUMMARY OF DATA - number of missing data

patterns: This gives the number of different patterns of

missingness present in the variables included in the model.

Large numbers of missing data patterns can result in difculty

estimating the model

Covariance Coverage: If any of the variables in the model

have missing values, MPlus provides information on the

number and distribtion of missing values. The covariance

coverage matrix gives the proportion of values present for

each variable individually ( on the diagonal) and pairwise

combinations of variables (below the diagonal).

combination of variables (below the diagonal)

Category 1 0.343 12.000

Category 2 0.657 23.000

U7

Category 1 0.314 11.000

Category 2 0.686 24.000

U8

Category 1 0.343 12.000

Category 2 0.657 23.000

U9

Category 1 0.429 15.000

Category 2 0.571 20.000

U10

Category 1 0.543 19.000

Category 2 0.457 16.000

U11

Category 1 0.600 21.000

Category 2 0.400 14.000

U12

Category 1 0.486 17.000

Category 2 0.514 18.000

U13

Category 1 0.371 13.000

Category 2 0.629 22.000

U14

Category 1 0.371 13.000

Category 2 0.629 22.000

U15

Category 1 0.543 19.000

Category 2 0.457 16.000

U16

Category 1 0.171 6.000

Category 2 0.829 29.000

RE8ULT8 FOR EXPLORATORY FACTOR ANALY88

EGENVALUE8 FOR 8AMPLE CORRELATON MATRX

1 2 3 4 5

________ ________ ________ ________ ________

1 17.756 3.152 2.797 2.366 1.881

EGENVALUE8 FOR 8AMPLE CORRELATON MATRX

6 7 8 9 10

Eigenvalues for sample correlation matrix - An

eigenvalue is the variance of the factor. In the initial

factor solution, the rst factor will account for the

most variance, the second will account for the next

highest amount of variance and so on.

________ ________ ________ ________ ________

1 1.657 1.474 1.327 1.089 0.850

EGENVALUE8 FOR 8AMPLE CORRELATON MATRX

11 12 13 14 15

________ ________ ________ ________ ________

1 0.670 0.531 0.497 0.457 0.342

EGENVALUE8 FOR 8AMPLE CORRELATON MATRX

16 17 18 19 20

________ ________ ________ ________ ________

1 0.295 0.261 0.173 0.166 0.126

EGENVALUE8 FOR 8AMPLE CORRELATON MATRX

21 22 23 24 25

________ ________ ________ ________ ________

1 0.097 0.069 0.051 0.048 0.022

EGENVALUE8 FOR 8AMPLE CORRELATON MATRX

26 27 28 29 30

________ ________ ________ ________ ________

1 0.005 -0.012 -0.025 -0.074 -0.083

EGENVALUE8 FOR 8AMPLE CORRELATON MATRX

31 32 33 34 35

________ ________ ________ ________ ________

1 -0.137 -0.161 -0.312 -0.359 -0.428

EGENVALUE8 FOR 8AMPLE CORRELATON MATRX

36

________

1 -0.566

EXPLORATORY FACTOR ANALY88 WTH 1 FACTOR{8}:

TE8T8 OF MODEL FT

Chi-8quare Test of Model Fit

Chi-square test of model t: Compares the t of the model to a model with

no restrictions (i.e. all variables correlated freely). Chi-square values can be

used to test the difference in t between nested models.

Value 647.482*

Degrees of Freedom 594

P-Value 0.0634

* The chi-square value for MLM, MLMV, MLR, UL8MV, WL8M and WL8MV

cannot be used

for chi-square difference testing in the regular way. MLM, MLR and WL8M

chi-square difference testing is described on the Mplus website. MLMV,

WL8MV,

and UL8MV difference testing is done using the DFFTE8T option.

Chi-8quare Test of Model Fit for the Baseline Model

Value 895.734

Degrees of Freedom 630

P-Value 0.0000

CF/TL

CF 0.799

TL 0.787

Number of Free Parameters 56

Fit Indices - The Comparative Fit Indeix (CFI) and the

Tucker Lewis Index (TLI) are measure of model t. They

have a range from 0 to 1 with higher values indicating

better t.

*Extra: Under Information Criteria;

- Number of Free Parameters

- Akaike (AIC)

- Bayesian (BIC)

- Sample-size Adjusted BIC

: The Akaike Information Criteria (AIC) and the Bayesian

Information Criteria (BIC, Schwarz criterion), can also be used to

compare models, including non-nested models

RM8EA {Root Mean 8quare Error Of Approximation}

Estimate 0.051

MNMUM ROTATON FUNCTON VALUE 0.00000

OBLMN ROTATED LOADNG8

1

________

U1 0.207

U2 0.477

U3 0.099

U4 -0.120

U5 0.347

U6 0.711

U7 0.665

U8 0.749

U9 0.173

RMSEA : The root mean square error of approximation

is another measure of model t. Smaller values

indicate better model t.

** GEOMIN ROTATED LOADINGS (in this case

OBLIMIN) : the rotated loadings are the linear

combination of variables that make up the factor. In

addition to the factor loadings, to completely interpret

an oblique rotation one which needs to take into

account both the factor pattern and the factor

structre matrices (shown below) and the correlations

among factors. Note that orthogonal rotations produce

only ONE (A) single matrix, which gives the

correlations between the variable and the factor

U10 0.667

U11 -0.342

U12 0.577

U13 0.473

U14 0.554

U15 0.357

U16 0.665

Y1 0.782

Y2 0.833

Y3 0.723

Y4 0.717

Y5 0.800

Y6 0.750

Y7 0.906

Y8 0.853

Y9 0.704

Y10 0.832

Y11 0.891

Y12 0.809

Y13 0.842

Y14 0.900

Y15 0.705

Y16 0.922

Y17 0.857

Y18 0.769

Y19 0.820

Y20 0.822

OBLMN FACTOR CORRELATON8

1

________

1 1.000

E8TMATED RE8DUAL VARANCE8

U1 U2 U3 U4 U5

________ ________ ________ ________ ________

1 0.957 0.773 0.990 0.985 0.880

E8TMATED RE8DUAL VARANCE8

U6 U7 U8 U9 U10

________ ________ ________ ________ ________

1 0.494 0.558 0.439 0.970 0.556

** GEOMIN factor correlations (OBLIMIN in our case): the

factor correlations matrix gives the correlations between the

factors. For e.g., the correlation between factor 1 and factor

1 is 1.000.... etc.

Estimated Residual Variances : there are the variances of the

observed variables after accounting for all of the vairance in the

EFA model.

E8TMATED RE8DUAL VARANCE8

U11 U12 U13 U14 U15

________ ________ ________ ________ ________

1 0.883 0.667 0.776 0.693 0.872

E8TMATED RE8DUAL VARANCE8

U16 Y1 Y2 Y3 Y4

________ ________ ________ ________ ________

1 0.557 0.388 0.307 0.477 0.486

E8TMATED RE8DUAL VARANCE8

Y5 Y6 Y7 Y8 Y9

________ ________ ________ ________ ________

1 0.360 0.438 0.179 0.272 0.504

E8TMATED RE8DUAL VARANCE8

Y10 Y11 Y12 Y13 Y14

________ ________ ________ ________ ________

1 0.307 0.207 0.345 0.291 0.190

E8TMATED RE8DUAL VARANCE8

Y15 Y16 Y17 Y18 Y19

________ ________ ________ ________ ________

1 0.503 0.150 0.265 0.409 0.327

E8TMATED RE8DUAL VARANCE8

Y20

________

1 0.324

8.E. OBLMN ROTATED LOADNG8

1

________

U1 0.204

U2 0.169

U3 0.219

U4 0.216

U5 0.201

U6 0.119

U7 0.125

U8 0.117

U9 0.206

U10 0.151

U11 0.193

U12 0.144

U13 0.159

U14 0.130

U15 0.188

U16 0.151

Y1 0.094

Y2 0.057

Y3 0.091

Y4 0.101

Y5 0.068

Y6 0.080

Y7 0.048

Y8 0.052

Y9 0.092

Y10 0.083

Y11 0.040

Y12 0.068

Y13 0.067

Y14 0.049

Y15 0.083

Y16 0.041

Y17 0.052

Y18 0.081

Y19 0.079

Y20 0.062

8.E. OBLMN FACTOR CORRELATON8

1

________

1 0.000

8.E. E8TMATED RE8DUAL VARANCE8

U1 U2 U3 U4 U5

________ ________ ________ ________ ________

1 0.084 0.161 0.044 0.052 0.139

8.E. E8TMATED RE8DUAL VARANCE8

U6 U7 U8 U9 U10

Below are the standard errors for the OBLIMIN rotated loadings, factor correlations, and estimated residual

variances. These values can be used to perform hypothesis tests and estimate condence intervals

________ ________ ________ ________ ________

1 0.169 0.166 0.176 0.071 0.201

8.E. E8TMATED RE8DUAL VARANCE8

U11 U12 U13 U14 U15

________ ________ ________ ________ ________

1 0.132 0.166 0.151 0.144 0.134

8.E. E8TMATED RE8DUAL VARANCE8

U16 Y1 Y2 Y3 Y4

________ ________ ________ ________ ________

1 0.200 0.147 0.095 0.131 0.145

8.E. E8TMATED RE8DUAL VARANCE8

Y5 Y6 Y7 Y8 Y9

________ ________ ________ ________ ________

1 0.109 0.120 0.088 0.089 0.129

8.E. E8TMATED RE8DUAL VARANCE8

Y10 Y11 Y12 Y13 Y14

________ ________ ________ ________ ________

1 0.138 0.071 0.110 0.112 0.088

8.E. E8TMATED RE8DUAL VARANCE8

Y15 Y16 Y17 Y18 Y19

________ ________ ________ ________ ________

1 0.116 0.076 0.089 0.124 0.130

8.E. E8TMATED RE8DUAL VARANCE8

Y20

________

1 0.102

Est./8.E. OBLMN ROTATED LOADNG8

1

________

U1 1.013

U2 2.828

U3 0.455

Below are the z-statistics (i.e. estimate/standard error) for the OBLIMIN rotated loadings, factor correlations, and

estimated residual variances. These values can be compared to a normal distribution to perform hypothesis test.

U4 -0.557

U5 1.727

U6 5.975

U7 5.338

U8 6.377

U9 0.840

U10 4.415

U11 -1.776

U12 4.012

U13 2.972

U14 4.250

U15 1.901

U16 4.420

Y1 8.320

Y2 14.627

Y3 7.964

Y4 7.104

Y5 11.792

Y6 9.389

Y7 18.744

Y8 16.340

Y9 7.694

Y10 10.008

Y11 22.219

Y12 11.958

Y13 12.614

Y14 18.310

Y15 8.535

Y16 22.443

Y17 16.446

Y18 9.532

Y19 10.357

Y20 13.254

Est./8.E. OBLMN FACTOR CORRELATON8

1

________

1 0.000

Est./8.E. E8TMATED RE8DUAL VARANCE8

U1 U2 U3 U4 U5

________ ________ ________ ________ ________

1 11.343 4.802 22.748 18.903 6.321

Est./8.E. E8TMATED RE8DUAL VARANCE8

U6 U7 U8 U9 U10

________ ________ ________ ________ ________

1 2.921 3.366 2.494 13.600 2.762

Est./8.E. E8TMATED RE8DUAL VARANCE8

U11 U12 U13 U14 U15

________ ________ ________ ________ ________

1 6.706 4.021 5.143 4.797 6.490

Est./8.E. E8TMATED RE8DUAL VARANCE8

U16 Y1 Y2 Y3 Y4

________ ________ ________ ________ ________

1 2.784 2.638 3.235 3.633 3.356

Est./8.E. E8TMATED RE8DUAL VARANCE8

Y5 Y6 Y7 Y8 Y9

________ ________ ________ ________ ________

1 3.313 3.662 2.042 3.049 3.906

Est./8.E. E8TMATED RE8DUAL VARANCE8

Y10 Y11 Y12 Y13 Y14

________ ________ ________ ________ ________

1 2.218 2.898 3.150 2.586 2.152

Est./8.E. E8TMATED RE8DUAL VARANCE8

Y15 Y16 Y17 Y18 Y19

________ ________ ________ ________ ________

1 4.324 1.976 2.962 3.297 2.514

Est./8.E. E8TMATED RE8DUAL VARANCE8

Y20

________

1 3.172

EXPLORATORY FACTOR ANALY88 WTH 2 FACTOR{8}:

TE8T8 OF MODEL FT

Chi-8quare Test of Model Fit

Value 598.269*

Degrees of Freedom 559

P-Value 0.1214

* The chi-square value for MLM, MLMV, MLR, UL8MV, WL8M and WL8MV

cannot be used

for chi-square difference testing in the regular way. MLM, MLR and WL8M

chi-square difference testing is described on the Mplus website. MLMV,

WL8MV,

and UL8MV difference testing is done using the DFFTE8T option.

Chi-8quare Test of Model Fit for the Baseline Model

Value 895.734

Degrees of Freedom 630

P-Value 0.0000

CF/TL

CF 0.852

TL 0.833

Number of Free Parameters 91

RM8EA {Root Mean 8quare Error Of Approximation}

Estimate 0.045

MNMUM ROTATON FUNCTON VALUE 0.26868

OBLMN ROTATED LOADNG8

1 2

________ ________

U1 0.408 -0.304

U2 0.087 0.574

U3 0.301 -0.307

U4 0.215 -0.510

U5 0.730 -0.551

U6 0.206 0.725

U7 0.237 0.616

U8 0.168 0.831

U9 0.331 -0.237

U10 0.492 0.267

U11 -0.164 -0.271

U12 0.500 0.122

U13 0.171 0.451

U14 0.080 0.712

U15 0.351 0.014

U16 0.092 0.818

Y1 0.675 0.180

Y2 0.943 -0.107

Y3 0.565 0.248

Y4 0.730 0.021

Y5 0.503 0.445

Y6 0.849 -0.090

Y7 0.807 0.178

Y8 0.772 0.150

Y9 0.762 -0.043

Y10 0.781 0.112

Y11 0.810 0.155

Y12 0.856 -0.012

Y13 0.788 0.117

Y14 0.758 0.235

Y15 0.518 0.282

Y16 0.931 0.046

Y17 0.952 -0.063

Y18 0.751 0.063

Y19 0.891 -0.041

Y20 0.880 -0.020

OBLMN FACTOR CORRELATON8

1 2

________ ________

1 1.000

2 0.501 1.000

E8TMATED RE8DUAL VARANCE8

U1 U2 U3 U4 U5

________ ________ ________ ________ ________

1 0.866 0.612 0.908 0.804 0.567

E8TMATED RE8DUAL VARANCE8

U6 U7 U8 U9 U10

________ ________ ________ ________ ________

1 0.282 0.419 0.141 0.913 0.555

E8TMATED RE8DUAL VARANCE8

U11 U12 U13 U14 U15

________ ________ ________ ________ ________

1 0.855 0.673 0.690 0.429 0.872

E8TMATED RE8DUAL VARANCE8

U16 Y1 Y2 Y3 Y4

________ ________ ________ ________ ________

1 0.247 0.390 0.200 0.479 0.451

E8TMATED RE8DUAL VARANCE8

Y5 Y6 Y7 Y8 Y9

________ ________ ________ ________ ________

1 0.325 0.349 0.173 0.265 0.450

E8TMATED RE8DUAL VARANCE8

Y10 Y11 Y12 Y13 Y14

________ ________ ________ ________ ________

1 0.290 0.194 0.279 0.274 0.192

E8TMATED RE8DUAL VARANCE8

Y15 Y16 Y17 Y18 Y19

________ ________ ________ ________ ________

1 0.505 0.089 0.150 0.386 0.241

E8TMATED RE8DUAL VARANCE8

Y20

________

1 0.243

8.E. OBLMN ROTATED LOADNG8

1 2

________ ________

U1 0.188 0.261

U2 0.203 0.192

U3 0.214 0.248

U4 0.270 0.242

U5 0.156 0.221

U6 0.195 0.164

U7 0.254 0.219

U8 0.193 0.138

U9 0.208 0.245

U10 0.230 0.217

U11 0.239 0.243

U12 0.212 0.240

U13 0.249 0.241

U14 0.216 0.207

U15 0.215 0.232

U16 0.226 0.185

Y1 0.106 0.192

Y2 0.059 0.112

Y3 0.150 0.178

Y4 0.124 0.144

Y5 0.175 0.168

Y6 0.061 0.109

Y7 0.078 0.100

Y8 0.104 0.121

Y9 0.110 0.162

Y10 0.116 0.161

Y11 0.063 0.071

Y12 0.084 0.125

Y13 0.102 0.098

Y14 0.084 0.075

Y15 0.113 0.111

Y16 0.039 0.078

Y17 0.058 0.092

Y18 0.098 0.139

Y19 0.074 0.117

Y20 0.066 0.088

8.E. OBLMN FACTOR CORRELATON8

1 2

________ ________

1 0.000

2 0.153 0.000

8.E. E8TMATED RE8DUAL VARANCE8

U1 U2 U3 U4 U5

________ ________ ________ ________ ________

1 0.134 0.189 0.114 0.189 0.247

8.E. E8TMATED RE8DUAL VARANCE8

U6 U7 U8 U9 U10

________ ________ ________ ________ ________

1 0.168 0.164 0.123 0.115 0.197

8.E. E8TMATED RE8DUAL VARANCE8

U11 U12 U13 U14 U15

________ ________ ________ ________ ________

1 0.150 0.165 0.167 0.198 0.133

8.E. E8TMATED RE8DUAL VARANCE8

U16 Y1 Y2 Y3 Y4

________ ________ ________ ________ ________

1 0.185 0.134 0.063 0.134 0.140

8.E. E8TMATED RE8DUAL VARANCE8

Y5 Y6 Y7 Y8 Y9

________ ________ ________ ________ ________

1 0.099 0.089 0.081 0.091 0.116

8.E. E8TMATED RE8DUAL VARANCE8

Y10 Y11 Y12 Y13 Y14

________ ________ ________ ________ ________

1 0.125 0.065 0.089 0.111 0.087

8.E. E8TMATED RE8DUAL VARANCE8

Y15 Y16 Y17 Y18 Y19

________ ________ ________ ________ ________

1 0.119 0.050 0.062 0.110 0.105

8.E. E8TMATED RE8DUAL VARANCE8

Y20

________

1 0.086

Est./8.E. OBLMN ROTATED LOADNG8

1 2

________ ________

U1 2.167 -1.164

U2 0.431 2.991

U3 1.407 -1.236

U4 0.796 -2.105

U5 4.674 -2.490

U6 1.056 4.416

U7 0.932 2.805

U8 0.873 6.024

U9 1.588 -0.965

U10 2.141 1.227

U11 -0.688 -1.116

U12 2.361 0.509

U13 0.686 1.874

U14 0.371 3.435

U15 1.636 0.060

U16 0.409 4.425

Y1 6.390 0.939

Y2 15.869 -0.960

Y3 3.765 1.393

Y4 5.906 0.143

Y5 2.876 2.645

Y6 13.918 -0.831

Y7 10.375 1.782

Y8 7.442 1.235

Y9 6.947 -0.267

Y10 6.742 0.692

Y11 12.760 2.189

Y12 10.182 -0.099

Y13 7.743 1.191

Y14 9.033 3.118

Y15 4.587 2.534

Y16 23.904 0.586

Y17 16.552 -0.688

Y18 7.671 0.450

Y19 12.019 -0.349

Y20 13.398 -0.228

Est./8.E. OBLMN FACTOR CORRELATON8

1 2

________ ________

1 0.000

2 3.279 0.000

Est./8.E. E8TMATED RE8DUAL VARANCE8

U1 U2 U3 U4 U5

________ ________ ________ ________ ________

1 6.463 3.232 7.930 4.261 2.299

Est./8.E. E8TMATED RE8DUAL VARANCE8

U6 U7 U8 U9 U10

________ ________ ________ ________ ________

1 1.681 2.550 1.143 7.926 2.810

Est./8.E. E8TMATED RE8DUAL VARANCE8

U11 U12 U13 U14 U15

________ ________ ________ ________ ________

1 5.704 4.080 4.126 2.163 6.559

Est./8.E. E8TMATED RE8DUAL VARANCE8

U16 Y1 Y2 Y3 Y4

________ ________ ________ ________ ________

1 1.338 2.908 3.180 3.584 3.223

Est./8.E. E8TMATED RE8DUAL VARANCE8

Y5 Y6 Y7 Y8 Y9

________ ________ ________ ________ ________

1 3.269 3.922 2.137 2.909 3.868

Est./8.E. E8TMATED RE8DUAL VARANCE8

Y10 Y11 Y12 Y13 Y14

________ ________ ________ ________ ________

1 2.309 2.969 3.140 2.458 2.199

Est./8.E. E8TMATED RE8DUAL VARANCE8

Y15 Y16 Y17 Y18 Y19

________ ________ ________ ________ ________

1 4.262 1.771 2.420 3.502 2.303

Est./8.E. E8TMATED RE8DUAL VARANCE8

Y20

________

1 2.831

FACTOR 8TRUCTURE

1 2

________ ________

U1 0.256 -0.099

U2 0.376 0.618

U3 0.148 -0.156

U4 -0.041 -0.402

U5 0.454 -0.185

U6 0.569 0.828

U7 0.546 0.734

U8 0.585 0.915

U9 0.212 -0.071

U10 0.626 0.514

U11 -0.300 -0.354

U12 0.562 0.373

U13 0.397 0.537

U14 0.437 0.752

U15 0.358 0.190

U16 0.502 0.864

Y1 0.766 0.519

Factor Structure: With an oblique rotation, the factor

structre matrix presents the correlations between the

variables and the factors. For e.g., the correlation

between U1 and factor 1 is 0.256. As noted above, the

factor structure matrix is used along with the factor

loadings and factor correlations to interpret the model

* EXTRA: FACTOR DETERMINACIES (come after

factor structre - before the end) :

are the proportion of variance in each factor that

is explained by the observed variables. Higher

proportions of variance explained indicate better

t.

Y2 0.889 0.366

Y3 0.689 0.531

Y4 0.741 0.387

Y5 0.726 0.697

Y6 0.803 0.335

Y7 0.896 0.582

Y8 0.847 0.537

Y9 0.740 0.339

Y10 0.837 0.503

Y11 0.888 0.561

Y12 0.849 0.417

Y13 0.846 0.512

Y14 0.876 0.615

Y15 0.660 0.542

Y16 0.954 0.513

Y17 0.920 0.414

Y18 0.782 0.439

Y19 0.870 0.406

Y20 0.870 0.421

EXPLORATORY FACTOR ANALY88 WTH 3 FACTOR{8}:

TE8T8 OF MODEL FT

Chi-8quare Test of Model Fit

Value 552.484*

Degrees of Freedom 525

P-Value 0.1965

* The chi-square value for MLM, MLMV, MLR, UL8MV, WL8M and WL8MV

cannot be used

for chi-square difference testing in the regular way. MLM, MLR and WL8M

chi-square difference testing is described on the Mplus website. MLMV,

WL8MV,

and UL8MV difference testing is done using the DFFTE8T option.

Chi-8quare Test of Model Fit for the Baseline Model

Value 895.734

Degrees of Freedom 630

P-Value 0.0000

CF/TL

CF 0.897

TL 0.876

Number of Free Parameters 125

RM8EA {Root Mean 8quare Error Of Approximation}

Estimate 0.039

MNMUM ROTATON FUNCTON VALUE 0.44774

OBLMN ROTATED LOADNG8

1 2 3

________ ________ ________

U1 0.338 -0.243 0.227

U2 0.146 0.535 -0.267

U3 -0.026 0.058 0.644

U4 0.050 -0.343 0.419

U5 0.463 -0.274 0.589

U6 0.228 0.716 -0.168

U7 0.193 0.659 0.087

U8 0.199 0.805 -0.149

U9 0.005 0.059 0.924

U10 0.324 0.428 0.369

U11 -0.061 -0.377 -0.232

U12 0.513 0.103 -0.015

U13 -0.103 0.728 0.565

U14 0.072 0.728 -0.054

U15 0.305 0.057 0.118

U16 0.036 0.870 0.113

Y1 0.633 0.211 0.102

Y2 0.917 -0.101 0.145

Y3 0.634 0.175 -0.124

Y4 0.759 -0.022 0.032

Y5 0.501 0.444 -0.031

Y6 0.786 -0.041 0.165

Y7 0.851 0.131 -0.059

Y8 0.877 0.052 -0.185

Y9 0.783 -0.072 0.009

Y10 0.743 0.140 0.086

Y11 0.864 0.105 -0.093

Y12 0.946 -0.099 -0.123

Y13 0.879 0.024 -0.118

Y14 0.829 0.167 -0.111

Y15 0.583 0.224 -0.153

Y16 0.931 0.036 0.045

Y17 0.907 -0.034 0.152

Y18 0.792 0.008 -0.011

Y19 0.854 -0.018 0.124

Y20 0.860 -0.012 0.087

OBLMN FACTOR CORRELATON8

1 2 3

________ ________ ________

1 1.000

2 0.515 1.000

3 0.105 0.053 1.000

E8TMATED RE8DUAL VARANCE8

U1 U2 U3 U4 U5

________ ________ ________ ________ ________

1 0.850 0.564 0.582 0.733 0.454

E8TMATED RE8DUAL VARANCE8

U6 U7 U8 U9 U10

________ ________ ________ ________ ________

1 0.260 0.381 0.144 0.136 0.390

E8TMATED RE8DUAL VARANCE8

U11 U12 U13 U14 U15

________ ________ ________ ________ ________

1 0.765 0.673 0.185 0.413 0.863

E8TMATED RE8DUAL VARANCE8

U16 Y1 Y2 Y3 Y4

________ ________ ________ ________ ________

1 0.186 0.392 0.197 0.457 0.435

E8TMATED RE8DUAL VARANCE8

Y5 Y6 Y7 Y8 Y9

________ ________ ________ ________ ________

1 0.326 0.360 0.153 0.182 0.438

E8TMATED RE8DUAL VARANCE8

Y10 Y11 Y12 Y13 Y14

________ ________ ________ ________ ________

1 0.299 0.158 0.200 0.213 0.151

E8TMATED RE8DUAL VARANCE8

Y15 Y16 Y17 Y18 Y19

________ ________ ________ ________ ________

1 0.474 0.086 0.157 0.368 0.248

E8TMATED RE8DUAL VARANCE8

Y20

________

1 0.248

8.E. OBLMN ROTATED LOADNG8

1 2 3

________ ________ ________

U1 0.201 0.248 0.225

U2 0.205 0.218 0.162

U3 0.225 0.219 0.166

U4 0.262 0.292 0.229

U5 0.192 0.298 0.191

U6 0.213 0.191 0.196

U7 0.191 0.183 0.231

U8 0.179 0.142 0.173

U9 0.103 0.234 0.108

U10 0.215 0.254 0.238

U11 0.235 0.233 0.244

U12 0.218 0.249 0.214

U13 0.147 0.263 0.282

U14 0.158 0.169 0.268

U15 0.219 0.244 0.216

U16 0.178 0.144 0.183

Y1 0.092 0.182 0.099

Y2 0.058 0.116 0.073

Y3 0.135 0.167 0.130

Y4 0.118 0.148 0.107

Y5 0.129 0.136 0.170

Y6 0.055 0.118 0.102

Y7 0.069 0.106 0.071

Y8 0.069 0.097 0.126

Y9 0.103 0.148 0.122

Y10 0.101 0.159 0.105

Y11 0.039 0.061 0.106

Y12 0.070 0.091 0.084

Y13 0.072 0.100 0.101

Y14 0.051 0.081 0.083

Y15 0.105 0.127 0.125

Y16 0.039 0.080 0.059

Y17 0.062 0.091 0.072

Y18 0.078 0.140 0.109

Y19 0.074 0.135 0.080

Y20 0.064 0.087 0.086

8.E. OBLMN FACTOR CORRELATON8

1 2 3

________ ________ ________

1 0.000

2 0.128 0.000

3 0.185 0.113 0.000

8.E. E8TMATED RE8DUAL VARANCE8

U1 U2 U3 U4 U5

________ ________ ________ ________ ________

1 0.140 0.195 0.209 0.201 0.242

8.E. E8TMATED RE8DUAL VARANCE8

U6 U7 U8 U9 U10

________ ________ ________ ________ ________

1 0.172 0.158 0.130 0.187 0.241

8.E. E8TMATED RE8DUAL VARANCE8

U11 U12 U13 U14 U15

________ ________ ________ ________ ________

1 0.203 0.165 0.203 0.186 0.143

8.E. E8TMATED RE8DUAL VARANCE8

U16 Y1 Y2 Y3 Y4

________ ________ ________ ________ ________

1 0.174 0.137 0.062 0.127 0.136

8.E. E8TMATED RE8DUAL VARANCE8

Y5 Y6 Y7 Y8 Y9

________ ________ ________ ________ ________

1 0.100 0.094 0.070 0.077 0.114

8.E. E8TMATED RE8DUAL VARANCE8

Y10 Y11 Y12 Y13 Y14

________ ________ ________ ________ ________

1 0.126 0.052 0.077 0.076 0.067

8.E. E8TMATED RE8DUAL VARANCE8

Y15 Y16 Y17 Y18 Y19

________ ________ ________ ________ ________

1 0.119 0.042 0.062 0.096 0.101

8.E. E8TMATED RE8DUAL VARANCE8

Y20

________

1 0.083

Est./8.E. OBLMN ROTATED LOADNG8

1 2 3

________ ________ ________

U1 1.684 -0.981 1.008

U2 0.712 2.458 -1.646

U3 -0.115 0.267 3.887

U4 0.190 -1.173 1.828

U5 2.416 -0.920 3.080

U6 1.070 3.744 -0.856

U7 1.011 3.606 0.378

U8 1.114 5.665 -0.859

U9 0.052 0.251 8.576

U10 1.512 1.688 1.551

U11 -0.259 -1.618 -0.951

U12 2.358 0.415 -0.070

U13 -0.702 2.766 2.004

U14 0.456 4.313 -0.203

U15 1.395 0.234 0.547

U16 0.204 6.059 0.617

Y1 6.907 1.158 1.029

Y2 15.840 -0.866 1.985

Y3 4.704 1.049 -0.953

Y4 6.417 -0.150 0.297

Y5 3.899 3.254 -0.185

Y6 14.234 -0.347 1.622

Y7 12.400 1.238 -0.823

Y8 12.795 0.539 -1.468

Y9 7.634 -0.490 0.078

Y10 7.340 0.884 0.818

Y11 22.000 1.720 -0.875

Y12 13.477 -1.085 -1.461

Y13 12.208 0.241 -1.165

Y14 16.201 2.070 -1.334

Y15 5.531 1.762 -1.230

Y16 24.060 0.448 0.752

Y17 14.715 -0.377 2.116

Y18 10.158 0.059 -0.104

Y19 11.495 -0.136 1.557

Y20 13.348 -0.134 1.008

Est./8.E. OBLMN FACTOR CORRELATON8

1 2 3

________ ________ ________

1 0.000

2 4.027 0.000

3 0.566 0.469 0.000

Est./8.E. E8TMATED RE8DUAL VARANCE8

U1 U2 U3 U4 U5

________ ________ ________ ________ ________

1 6.089 2.887 2.780 3.655 1.872

Est./8.E. E8TMATED RE8DUAL VARANCE8

U6 U7 U8 U9 U10

________ ________ ________ ________ ________

1 1.513 2.411 1.113 0.727 1.623

Est./8.E. E8TMATED RE8DUAL VARANCE8

U11 U12 U13 U14 U15

________ ________ ________ ________ ________

1 3.760 4.089 0.915 2.226 6.045

Est./8.E. E8TMATED RE8DUAL VARANCE8

U16 Y1 Y2 Y3 Y4

________ ________ ________ ________ ________

1 1.067 2.870 3.159 3.601 3.198

Est./8.E. E8TMATED RE8DUAL VARANCE8

Y5 Y6 Y7 Y8 Y9

________ ________ ________ ________ ________

1 3.274 3.823 2.169 2.358 3.842

Est./8.E. E8TMATED RE8DUAL VARANCE8

Y10 Y11 Y12 Y13 Y14

________ ________ ________ ________ ________

1 2.381 3.031 2.616 2.804 2.261

Est./8.E. E8TMATED RE8DUAL VARANCE8

Y15 Y16 Y17 Y18 Y19

________ ________ ________ ________ ________

1 3.972 2.026 2.539 3.833 2.455

Est./8.E. E8TMATED RE8DUAL VARANCE8

Y20

________

1 2.965

FACTOR 8TRUCTURE

1 2 3

________ ________ ________

U1 0.237 -0.057 0.249

U2 0.393 0.596 -0.223

U3 0.072 0.079 0.644

U4 -0.083 -0.295 0.406

U5 0.384 -0.004 0.623

U6 0.578 0.824 -0.106

U7 0.541 0.763 0.143

U8 0.598 0.899 -0.085

U9 0.132 0.110 0.927

U10 0.583 0.615 0.426

U11 -0.279 -0.420 -0.259

U12 0.565 0.367 0.044

U13 0.331 0.705 0.593

U14 0.441 0.762 -0.008

U15 0.347 0.220 0.153

U16 0.496 0.894 0.163

Y1 0.752 0.542 0.179

Y2 0.880 0.379 0.235

Y3 0.711 0.494 -0.048

Y4 0.751 0.370 0.110

Y5 0.726 0.700 0.045

Y6 0.782 0.372 0.246

Y7 0.912 0.565 0.037

Y8 0.884 0.494 -0.090

Y9 0.747 0.331 0.088

Y10 0.824 0.527 0.171

Y11 0.908 0.545 0.003

Y12 0.882 0.381 -0.029

Y13 0.879 0.470 -0.024

Y14 0.903 0.588 -0.016

Y15 0.682 0.516 -0.080

Y16 0.955 0.518 0.144

Y17 0.905 0.440 0.245

Y18 0.795 0.415 0.072

Y19 0.858 0.428 0.213

Y20 0.863 0.436 0.177

Beginning Time: 16:23:16

Ending Time: 16:23:28

Elapsed Time: 00:00:12

MUTHEN & MUTHEN

3463 8toner Ave.

Los Angeles, CA 90066

Tel: {310} 391-9971

Fax: {310} 391-8971

Web: www.8tatModel.com

8upport: 8upport8tatModel.com

Copyright {c} 1998-2010 Muthen & Muthen

Você também pode gostar

- An Original DocumentDocumento1 páginaAn Original DocumentSinthu RagupalanAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Body Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchDocumento1 páginaBody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchSinthu RagupalanAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Lesson Plan - PhotographyDocumento3 páginasLesson Plan - PhotographySinthu RagupalanAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- 2008 9 SALAnnRev 247 Criminal LawDocumento18 páginas2008 9 SALAnnRev 247 Criminal LawSinthu RagupalanAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Assistance SchemesDocumento82 páginasAssistance SchemesSinthu RagupalanAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Body Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchDocumento1 páginaBody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchSinthu RagupalanAinda não há avaliações

- Body Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchDocumento1 páginaBody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchSinthu RagupalanAinda não há avaliações

- Body Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchDocumento1 páginaBody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchSinthu RagupalanAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Body Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchDocumento1 páginaBody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchSinthu RagupalanAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Body Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchDocumento1 páginaBody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchSinthu RagupalanAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Country Summary SingaporeDocumento17 páginasCountry Summary SingaporeSinthu RagupalanAinda não há avaliações

- The New Terrorism N CriticsDocumento26 páginasThe New Terrorism N CriticsSinthu RagupalanAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Body Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchDocumento1 páginaBody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchSinthu RagupalanAinda não há avaliações

- Body Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchDocumento1 páginaBody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchSinthu RagupalanAinda não há avaliações

- Deterring TerrorismDocumento38 páginasDeterring TerrorismSinthu RagupalanAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Body Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchDocumento1 páginaBody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchbody Type Researchabody Type Researchbody Type Researchbody Type ResearchSinthu RagupalanAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Yups MR ( (Documento1 páginaYups MR ( (Sinthu RagupalanAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Plate Page 1-15Documento15 páginasPlate Page 1-15Al Bashir SautiAinda não há avaliações

- Flatron Lb565t - 575le (Lb565t-Ea)Documento30 páginasFlatron Lb565t - 575le (Lb565t-Ea)Marcos RangelAinda não há avaliações

- A Primer On Process Mining Practical Skills With Python and GraphvizDocumento102 páginasA Primer On Process Mining Practical Skills With Python and Graphvizغ نيلىAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Decodificador PDFDocumento1 páginaDecodificador PDFJose David YepAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- 119-002 Thread Plug GaugeDocumento5 páginas119-002 Thread Plug GaugeRavichandran DAinda não há avaliações

- I-Profittracker mq4Documento8 páginasI-Profittracker mq4Juraizam Fazlen JafarAinda não há avaliações

- UNIVERSAL Worm Gear Units Si Und SmiDocumento104 páginasUNIVERSAL Worm Gear Units Si Und SmitienAinda não há avaliações

- Freq Plan DGPT - CompleteDocumento17 páginasFreq Plan DGPT - CompleteRadit TidarAinda não há avaliações

- Edit - Randomized Block Design Baru Banget 7.41Documento43 páginasEdit - Randomized Block Design Baru Banget 7.41erninda suputriAinda não há avaliações

- Chapter 7 Sequences: Try These 7.1Documento14 páginasChapter 7 Sequences: Try These 7.1Yagna LallAinda não há avaliações

- Finite Differences and Interpolation, Numerical Differentiation and IntegrationDocumento92 páginasFinite Differences and Interpolation, Numerical Differentiation and IntegrationKumar Ayush100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Planning and Design of Warehouse: Submitted byDocumento22 páginasPlanning and Design of Warehouse: Submitted byDineshkumar RajaAinda não há avaliações

- RoB Cost Estimates For Alt - 1, 45m Plate GirderDocumento20 páginasRoB Cost Estimates For Alt - 1, 45m Plate GirderHegdeVenugopalAinda não há avaliações

- MX1050DDocumento59 páginasMX1050DMarco Antonio Carretas UreñaAinda não há avaliações

- Brocade Icx7x50 Stacking DPDocumento83 páginasBrocade Icx7x50 Stacking DPAshutosh SrivastavaAinda não há avaliações

- Latihan Soal Matematika Dan PembahaanDocumento38 páginasLatihan Soal Matematika Dan PembahaanKenti MuliyaningsihAinda não há avaliações

- Analisis 2Documento75 páginasAnalisis 2Lorena SeguraAinda não há avaliações

- Info - Total War - Shogun 2.v 1.1.0.4768.314775 + 6 DLCDocumento14 páginasInfo - Total War - Shogun 2.v 1.1.0.4768.314775 + 6 DLCgabriela0011656Ainda não há avaliações

- Iitrace: A Memory Efficient Engine For Fast Incremental Timing Analysis and Clock Pessimism RemovalDocumento37 páginasIitrace: A Memory Efficient Engine For Fast Incremental Timing Analysis and Clock Pessimism RemovalmadhaviAinda não há avaliações

- Lip: A Lifetime and Popularity Based Ranking Approach To Filter Out Fake Files in P2P File Sharing SystemsDocumento6 páginasLip: A Lifetime and Popularity Based Ranking Approach To Filter Out Fake Files in P2P File Sharing SystemsNghĩa ZerAinda não há avaliações

- Trabajo EncargadoDocumento58 páginasTrabajo EncargadoorecaAinda não há avaliações

- Marsh Arabs & Ahwaz Y-DNADocumento16 páginasMarsh Arabs & Ahwaz Y-DNAndaou_1100% (2)

- Ajiet: Lecture Notes VTU - 21MAT31, Module 4 - Numerical Solution of PDEDocumento28 páginasAjiet: Lecture Notes VTU - 21MAT31, Module 4 - Numerical Solution of PDEAmarnath K VAinda não há avaliações

- FEhfhfhM Assigljljlnment 1 Dated Jankhkhjuary 24Documento17 páginasFEhfhfhM Assigljljlnment 1 Dated Jankhkhjuary 24Rahman PashariAinda não há avaliações

- Practical Techniques For Achieving Improved Accuracy in Bracket PositioningDocumento4 páginasPractical Techniques For Achieving Improved Accuracy in Bracket PositioningNgo Viet ThanhAinda não há avaliações

- Chronogram Level 1Documento16 páginasChronogram Level 1blaphemous gloryAinda não há avaliações

- Aay6826 Antonio SMDocumento117 páginasAay6826 Antonio SMRichard BlandiniAinda não há avaliações

- Planificari Frecventa Redusa 2014-2015Documento4 páginasPlanificari Frecventa Redusa 2014-2015Monica MarchitanAinda não há avaliações

- Service Guide: Kyesystems CorpDocumento23 páginasService Guide: Kyesystems CorpLucian MihaiasaAinda não há avaliações

- Operasi&DeteksiKerusakanDocumento27 páginasOperasi&DeteksiKerusakanYudhi YudadmokoAinda não há avaliações