Escolar Documentos

Profissional Documentos

Cultura Documentos

Perkins Loan Info

Enviado por

khrixzDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Perkins Loan Info

Enviado por

khrixzDireitos autorais:

Formatos disponíveis

FEDERAL PERKINS LOAN PROGRAM STATEMENT OF RIGHTS AND RESPONSIBILITIES Below are your rights and responsibilities for

the master promissory note you will sign. 1. The school is the holder of my Master Promissory Note and I must, without exception, contact the school if I: o withdraw from school. o change my name. o change my telephone number. o transfer to another school. o change my address. o drop below half-time status. o change my social security number. o change my expected graduation date. o change my driver's license number.

2. An Exit Interview is required when I graduate, withdraw, or drop below half-time status from the school. A half-time student is defined as an enrolled student who is carrying a half-time academic workload, as determined by the institution, which amounts to at least half of the workload of the applicable minimum requirement of a full-time student. I must arrange for an exit interview by calling the school. Failure to comply can result in an administrative hold being placed on my diploma, transcripts, and registration status. 3. The SUNY Student Loan Service Center (hereafter referred to as the SLSC) is the central billing and collection office for the State University of New York state-operated campuses. Once I am no longer in attendance at one of the SUNY campuses - whether by graduation, withdrawal, or a change in status to less than half-time, all correspondence and loan payments are to be directed to the SUNY Student Loan Service Center and not to the campus I attended. Please contact the SLSC at: SUNY Student Loan Service Center 5 University Place Rensselaer, New York 12144-3440 (518) 525-2626 E-mail: slsc@uamail.albany.edu 4. I MUST repay my loan even if I do not complete the program I was enrolled in, I do not complete the program within the regular time for

program completion, I do not graduate, I do not get a job after leaving school, or my education did not meet my expectations. I can prepay my loan(s) at any time without penalty, request a shorter repayment schedule and possibly change repayment plans. 5. My first payment will be due ten (10) months from the time I cease to be enrolled as at least a half-time student. 6. If I re-enroll at least half-time during my grace period and I file for student deferment I get another nine-month grace period the next time I drop below half-time or leave school. If I re-enroll after the grace period, my next grace period will only be six months. 7. My minimum payment will be $40.00 per month, unless the amount I borrowed exceeds $3,750. The maximum length of time for repayment is ten (10) years. 8. The principal amount of my Perkins loan and statement of the total cumulative balance owed can be obtained by logging onto http://slsc.albany.edu and selecting Borrower Account Inquiry. (Account number and PIN for account access will be provided to you upon completion of this promissory note process). 9. The interest rate will be 5% per annum on the unpaid principal balance. Interest will begin to accrue nine (9) months after I cease to be enrolled as at least a half-time student with my first payment due the following month. 10. I may be eligible to receive a partial loan cancellation for certain types of services performed as stipulated in my master promissory note. I am required to inform the SLSC of such status in writing in a timely manner. 11. I may request that payments on my loan be deferred based on provisions stated in my master promissory note. I must request such deferment in writing in a timely manner. 12. If I cannot pay on time, I must contact the SLSC to make arrangements. I will be charged late fees or penalty charges for each month I fail to make a payment when due or comply with other terms of my promissory note or written repayment agreement. 13. If I fail to repay my loan as agreed, the total balance may become due and payable immediately. 14. If my loan goes into default, I will no longer be eligible to receive further financial aid or enroll in any SUNY school. My loan could be sent to an outside collection agency, legal action could be taken against me, my loan could be subject to NYS and/or federal tax offset and my loan may be

assigned to the U.S. Department of Education for collection. I will be responsible for all costs of collections as stipulated in my Promissory Note. If I default, I may lose my benefits for deferment and cancellation. Default is defined as the failure to make an installment when due or to comply with other terms of your promissory note or written repayment agreement. 15. I understand that if I default on my loan, it will be reported to the national credit bureaus and the State University of New York may intercept my New York State tax refund. 16. I will promptly answer any communication from the school or the SLSC regarding my loan. 17. I may prepay the entire loan balance, or any portion thereof, at any time without penalty. 18. I authorize any employer to release to the school or the SLSC any information concerning employment, wages, application information or my current address. 19. I realize that aggregate loan limits are $27,500.00 for an undergraduate and $60,000.00 for a graduate or professional student. The maximum I may borrow in any given year is $5,500.00 for an undergraduate and $8,000.00 for a graduate or professional student. The amount I am eligible to receive is at the discretion of the financial aid director at my campus. 20. I authorize the school to contact any school that I may attend to obtain information concerning my student status, year of study, dates of attendance, graduation or withdrawal, my transfer to another school, or my current address. This authorization is in effect until my loan is paid in full. 21. I understand that I may consolidate my Federal Loans but in doing so, will relinquish my cancellation benefits specific to the Perkins Loan Program. 22. If during my repayment I develop student loan problems that I can not resolve through the SLSC, I may contact the U.S. Department of Educations Ombudsmans Office. They will collect documentation and work to resolve the situation. Their web site is http://www.ombudsman.ed.gov/ and their address and phone number is:

Office of the Ombudsman U.S. Department of Education FSA Ombudsman 830 First Street, NE Fourth Floor Washington, DC 20202-5144

Phone: 1-877-557-2575 Fax: 1-202-275-0549 E-mail: fsaombudsmanoffice@ed.gov

2.

NATIONAL STUDENT LOAN DATA SYSTEM (NSLDS) The NSLDS is the U.S. Department of Educations central database for student aid. NSLDS provides you with a centralized, integrated view of all of your Title IV loans and grants. The NSLDS Student Access Website is available 24 hours a day, 7 days a week.

Internet: Telephone: http://www.nslds.ed.gov (800) 4-FED-AID If you do not agree to the loan terms described above, you must stop now! Contact your school if you have any questions regarding your rights and responsibilities associated with the signing of this master promissory note. By checking this box, I accept the terms outlined in the Rights and Responsibilities presented above.

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Client Needs AssessmentDocumento3 páginasClient Needs AssessmentNunoAinda não há avaliações

- Nabard SHG CircularDocumento10 páginasNabard SHG Circularpankaj92Ainda não há avaliações

- ACCA When Does Debt Seem To Be EquityDocumento3 páginasACCA When Does Debt Seem To Be Equityyung kenAinda não há avaliações

- Co v. Court of Appeals, G.R. No. 124922, (June 22, 1998) : Maica P. LocsinDocumento3 páginasCo v. Court of Appeals, G.R. No. 124922, (June 22, 1998) : Maica P. LocsinVida MarieAinda não há avaliações

- Agoncillo v. Javier FULL TEXTDocumento5 páginasAgoncillo v. Javier FULL TEXTAlykAinda não há avaliações

- CFA® Level I - Fixed Income: Fixed-Income Markets: Issuance, Trading and Funding WWW - Irfanullah.coDocumento32 páginasCFA® Level I - Fixed Income: Fixed-Income Markets: Issuance, Trading and Funding WWW - Irfanullah.coAbhishek GuptaAinda não há avaliações

- Release 3Q23 BlauDocumento21 páginasRelease 3Q23 BlaumarsveloAinda não há avaliações

- MatbisDocumento8 páginasMatbisAditya DzikirAinda não há avaliações

- An Empirical Study On The Determinants of Dividend Policy in The UK PDFDocumento17 páginasAn Empirical Study On The Determinants of Dividend Policy in The UK PDFHoàng NhânAinda não há avaliações

- Tally Group ListsDocumento7 páginasTally Group Listskrishna7852100% (2)

- Week 6Documento30 páginasWeek 6Shaima Al SanadAinda não há avaliações

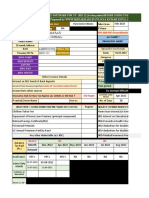

- Agro Business Poultry Business PlanDocumento33 páginasAgro Business Poultry Business Plangabriel chinechenduAinda não há avaliações

- TS IT FY 2022-23 Income Tax Software 16.11.2022.Documento37 páginasTS IT FY 2022-23 Income Tax Software 16.11.2022.TestAinda não há avaliações

- ChapterDocumento78 páginasChaptershaannivasAinda não há avaliações

- Ratios Analysis Notes and Questions NewDocumento7 páginasRatios Analysis Notes and Questions NewAnthony OtiatoAinda não há avaliações

- Case: Calpine Corporation: The Evolution From Project To Corporate FinanceDocumento7 páginasCase: Calpine Corporation: The Evolution From Project To Corporate FinanceKshitishAinda não há avaliações

- Comprehensive Tabular Summary On Pledge Real Mortgage Chattel Mortgage and AntichresisDocumento14 páginasComprehensive Tabular Summary On Pledge Real Mortgage Chattel Mortgage and AntichresisJaquielou MaglinaoAinda não há avaliações

- 2nd EXAM OBLI. Case DigestsDocumento31 páginas2nd EXAM OBLI. Case DigestsJennica Gyrl G. DelfinAinda não há avaliações

- ICRA Rating Methodology: Construction CompaniesDocumento11 páginasICRA Rating Methodology: Construction Companieshesham zakiAinda não há avaliações

- Sme Finance: Best-Practice GuidelineDocumento16 páginasSme Finance: Best-Practice GuidelinesgdfgfdfAinda não há avaliações

- Brian McDonagh, Granja & Ulster BankDocumento23 páginasBrian McDonagh, Granja & Ulster BankAnonymous Cr1ckuup5Ainda não há avaliações

- Central Banking and Moneytary PolicyDocumento16 páginasCentral Banking and Moneytary PolicyNahidul Islam IUAinda não há avaliações

- Fundamentals of Corporate Finance 8th Edition Brealey Test Bank PDFDocumento79 páginasFundamentals of Corporate Finance 8th Edition Brealey Test Bank PDFa819334331Ainda não há avaliações

- Relaxo Footwears - R - 05082019Documento7 páginasRelaxo Footwears - R - 05082019Dhrubajyoti DattaAinda não há avaliações

- SBA Loan ChartDocumento2 páginasSBA Loan ChartsbdcwtAinda não há avaliações

- Cash Received From Customers During The YearDocumento5 páginasCash Received From Customers During The Yearelsana philipAinda não há avaliações

- CH - 5 Accounting RatiosDocumento47 páginasCH - 5 Accounting RatiosAaditi V100% (1)

- Chapter 1-Liabilities PDFDocumento5 páginasChapter 1-Liabilities PDFMarx Yuri JaymeAinda não há avaliações

- Assignment 2Documento4 páginasAssignment 2Muhammad BilalAinda não há avaliações

- Business FinanceDocumento7 páginasBusiness FinanceMaria Veronica BubanAinda não há avaliações