Escolar Documentos

Profissional Documentos

Cultura Documentos

Numericals On Cost of Capital and Capital Structure

Enviado por

Patrick AnthonyDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Numericals On Cost of Capital and Capital Structure

Enviado por

Patrick AnthonyDireitos autorais:

Formatos disponíveis

Numericals on cost of capital and capital structure 1. A company has 15 % perpetual debt of Rs. 1,00,000.

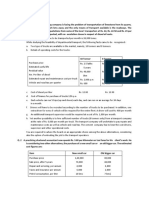

The tax rate is 35%. Determine the cost of capital (before tax as well as after tax) assuming the debt is issued at (i) par, (ii) 10% discount, and (iii) 10% premium 2. A company issues a new 15 % debentures of Rs. 1000 face value to be redeemed after 10years. The debenture is expected to be sold at 5 % discount. It will also involve flotation costs of 2.5 % of face value. The companys tax rate is 35% What would the cost of debt be? Illustrate the computations using (i) trial and error approach and (ii) shortcut method 3. A company issues 15 % debentures of Rs. 100 for an amount aggregating Rs. 1,00,000 at 10% premium, redeemable at par after five years. The companys tax rate is 35% . Determine the cost of debt, using the shortcut method. 4. A company issues 14% irredeemable preference shares of the face value of Rs. 100 each. Flotation costs are estimated at 5% of the expected sale price. (a) What is the kp, if preference shares are issued at (i) par value, (ii) 10% premium, and (iii) 5% discount? (b) Also, compute kp in these situations assuming 10% dividend tax. 5. ABC Ltd. Has issued 14% preference shares of the face value of Rs. 100 each to be redeemed after 10 years. Flotation cost is expected to be 5%. Determine the cost of preference shares(kp). 6. Suppose that dividend per share of a firm is expected to be Re. 1 per share next year and is expected to grow at 6 % per year perpetually. Determine the cost of equity capital, assuming the market price per share is R.25. 7. The hypothetical Ltd. wishes to calculate its cost of equity capital using the capital asset pricing model approach. From the information provided to the firm by its investment advisors along with the firms own analysis, it is found that the risk-free rate of return equals 10%; the firms beta equals 1.5 and the return on the market portfolio equals 12.5 %. Compute the cost of equity capital. 8. (a) A firms after-tax cost of capital of the specific sources is as follows: Cost of debt 8% Cost of preference shares 14% Cost of equity funds 17% (b) The following is the capital structure: Source Amount Debt Rs. 3.00,000 Preference capital 2,00,000 Equity capital 5,00,000 10,00,000 ( c) Calculate the weighted average cost of capital, ko, using book value weights. 9. From the information contained in the earlier problem, calculate the weighted average cost of capital , assuming that the market values of different sources of funds are as follows: Source Market value Debt Rs. 2,70,000 Preference shares 2,30,000 Equity and retained earnings 7,50,000 Total 12,50,000

10. Calculate the explicit cost of debt for each of the following situations: (a) Debentures are sold at par and flotation costs are 5 %. (b) Debentures are sold at premium of 10% and flotation costs are 5% of issue price. (c) Debentures are sold at discount of 5% and flotation costs are 5% of issue price. Assume: (i) coupon rate of interest on debentures is 15%; (ii) face value of debentures is Rs. 100; (iii) maturity period is 10 years; and (iv) tax rate is 35%.

Você também pode gostar

- Corporate Financial Analysis with Microsoft ExcelNo EverandCorporate Financial Analysis with Microsoft ExcelNota: 5 de 5 estrelas5/5 (1)

- Working Capital MGTDocumento14 páginasWorking Capital MGTrupaliAinda não há avaliações

- EVA Practice SheetDocumento17 páginasEVA Practice SheetVinushka GoyalAinda não há avaliações

- EbitDocumento3 páginasEbitJann KerkyAinda não há avaliações

- Numericals On Capital BudgetingDocumento3 páginasNumericals On Capital BudgetingRevati ShindeAinda não há avaliações

- Cash Flows IIDocumento16 páginasCash Flows IIChristian EstebanAinda não há avaliações

- 46793bosinter p8 Seca cp5 PDFDocumento42 páginas46793bosinter p8 Seca cp5 PDFIsavic AlsinaAinda não há avaliações

- InventoryDocumento46 páginasInventoryAnkit SharmaAinda não há avaliações

- Nov 2019Documento39 páginasNov 2019amitha g.sAinda não há avaliações

- Quanti Question and AnswersDocumento22 páginasQuanti Question and AnswersOFORIAinda não há avaliações

- Tata Consultancy Services: Financial Statements AnalysisDocumento13 páginasTata Consultancy Services: Financial Statements AnalysisChhaya ThakorAinda não há avaliações

- Dividend Policy - Sample Problems - ICAIDocumento2 páginasDividend Policy - Sample Problems - ICAIgfahsgdahAinda não há avaliações

- A Report On: Analysis of Financial Statements OF Tata Consultancy Services & Maruti SuzukiDocumento38 páginasA Report On: Analysis of Financial Statements OF Tata Consultancy Services & Maruti SuzukiSaurabhAinda não há avaliações

- Receivable Management KanchanDocumento12 páginasReceivable Management KanchanSanchita NaikAinda não há avaliações

- Irctc Ipo PPT FM PDFDocumento12 páginasIrctc Ipo PPT FM PDFAnshita JainAinda não há avaliações

- Service CostingDocumento6 páginasService Costingbinu100% (1)

- Amendment Mat BookDocumento99 páginasAmendment Mat BookSomsindhu NagAinda não há avaliações

- UdhyogDocumento1 páginaUdhyogVishal KashyapAinda não há avaliações

- Unit 2 Capital Budgeting Decisions: IllustrationsDocumento4 páginasUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaAinda não há avaliações

- 4 - Estimating The Hurdle RateDocumento61 páginas4 - Estimating The Hurdle RateDharmesh Goyal100% (1)

- Capital Structure PDFDocumento3 páginasCapital Structure PDFnikitaAinda não há avaliações

- Continuous ProbDocumento10 páginasContinuous Probtushar jainAinda não há avaliações

- FM - Assignment Batch 19 - 21 IMS IndoreDocumento3 páginasFM - Assignment Batch 19 - 21 IMS IndoreaskjdfaAinda não há avaliações

- CS Executive MCQ and Risk AnalysisDocumento17 páginasCS Executive MCQ and Risk Analysis19101977Ainda não há avaliações

- 2 CRM AT TATA SKY - Group 2Documento17 páginas2 CRM AT TATA SKY - Group 2manmeet kaurAinda não há avaliações

- FM - Dividend Policy and Dividend Decision Models (Cir 18.3.2020)Documento129 páginasFM - Dividend Policy and Dividend Decision Models (Cir 18.3.2020)Rohit PanpatilAinda não há avaliações

- Strengths in The SWOT Analysis of ICICI BankDocumento2 páginasStrengths in The SWOT Analysis of ICICI BankSudipa RouthAinda não há avaliações

- Financial Management CIA-1.2Documento9 páginasFinancial Management CIA-1.2arnav chandnaAinda não há avaliações

- 2 - Time Value of MoneyDocumento68 páginas2 - Time Value of MoneyDharmesh GoyalAinda não há avaliações

- Joint Products & by Products: Solutions To Assignment ProblemsDocumento5 páginasJoint Products & by Products: Solutions To Assignment ProblemsXAinda não há avaliações

- 2.2-Module 2 Only QuestionsDocumento46 páginas2.2-Module 2 Only QuestionsHetviAinda não há avaliações

- Advance Financial Management AssignmentDocumento4 páginasAdvance Financial Management AssignmentRishabh JainAinda não há avaliações

- Rights Duties and Liabilities of Auditor PDFDocumento2 páginasRights Duties and Liabilities of Auditor PDFNakul goniAinda não há avaliações

- Assignment 2 - Numerical QuestionsDocumento6 páginasAssignment 2 - Numerical QuestionsGazala KhanAinda não há avaliações

- Assignment Cost Sheet SumsDocumento3 páginasAssignment Cost Sheet SumsMamta PrajapatiAinda não há avaliações

- Questions On LeasingDocumento5 páginasQuestions On Leasingriteshsoni100% (2)

- DT, Cem, RadrDocumento46 páginasDT, Cem, RadrShivaprasadAinda não há avaliações

- Kota Tutoring: Financing The ExpansionDocumento7 páginasKota Tutoring: Financing The ExpansionAmanAinda não há avaliações

- Cost of Capital: Vivek College of CommerceDocumento31 páginasCost of Capital: Vivek College of Commercekarthika kounderAinda não há avaliações

- Ilide - Info Review Qs PRDocumento93 páginasIlide - Info Review Qs PRMobashir KabirAinda não há avaliações

- SFM Suggested Answers PDFDocumento352 páginasSFM Suggested Answers PDFAindrila BeraAinda não há avaliações

- Cash Management QuestionsDocumento5 páginasCash Management QuestionsManasi Jamsandekar100% (1)

- FINANCIAL MANAGEMENT AssignmentDocumento9 páginasFINANCIAL MANAGEMENT AssignmentMayank BhavsarAinda não há avaliações

- Caiib - BFM - Case Studies: Dedicated To The Young and Energetic Force of BankersDocumento2 páginasCaiib - BFM - Case Studies: Dedicated To The Young and Energetic Force of BankersssssAinda não há avaliações

- Special QuestionsDocumento42 páginasSpecial QuestionsSaloni BansalAinda não há avaliações

- FM - 30 MCQDocumento8 páginasFM - 30 MCQsiva sankarAinda não há avaliações

- Investment Analysis & Portfolio Management: Equity ValuationDocumento5 páginasInvestment Analysis & Portfolio Management: Equity ValuationNitesh Kirar100% (1)

- Ca Ipcc Costing and Financial Management Suggested Answers May 2015Documento20 páginasCa Ipcc Costing and Financial Management Suggested Answers May 2015Prasanna KumarAinda não há avaliações

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocumento15 páginasQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answerritz meshAinda não há avaliações

- Chapter 5 Digital Marketing Strategy Definition - Fundamentals of Digital Marketing, 2 - e - Dev TutorialsDocumento54 páginasChapter 5 Digital Marketing Strategy Definition - Fundamentals of Digital Marketing, 2 - e - Dev TutorialsViruchika PahujaAinda não há avaliações

- IplDocumento13 páginasIplintisarAinda não há avaliações

- 18415compsuggans PCC FM Chapter7Documento13 páginas18415compsuggans PCC FM Chapter7Mukunthan RBAinda não há avaliações

- Sapm Ete 2019-20 BDocumento7 páginasSapm Ete 2019-20 BRohit Kumar Pandey0% (1)

- Ipcc Cost Accounting RTP Nov2011Documento209 páginasIpcc Cost Accounting RTP Nov2011Rakesh VermaAinda não há avaliações

- Solved Problems: OlutionDocumento5 páginasSolved Problems: OlutionSavoir PenAinda não há avaliações

- Factors Affecting Cost of CapitalDocumento40 páginasFactors Affecting Cost of CapitalKartik AroraAinda não há avaliações

- Cost of Capital Questions FinalDocumento4 páginasCost of Capital Questions FinalMadhuram SharmaAinda não há avaliações

- Unit 4Documento2 páginasUnit 4Sweta YadavAinda não há avaliações

- Institute of Professional Education and Research (Technical Campus) Financial Management Practice BookDocumento3 páginasInstitute of Professional Education and Research (Technical Campus) Financial Management Practice Bookmohini senAinda não há avaliações

- Open Minded InquiryDocumento27 páginasOpen Minded InquiryPatrick AnthonyAinda não há avaliações

- 44 Inspiring John CDocumento2 páginas44 Inspiring John CPatrick AnthonyAinda não há avaliações

- Becoming A Critic of Your ThinkingDocumento13 páginasBecoming A Critic of Your ThinkingPatrick AnthonyAinda não há avaliações

- Case AnalysisDocumento46 páginasCase AnalysisPatrick Anthony100% (1)

- Sampling and Sample Size DeterminationDocumento55 páginasSampling and Sample Size DeterminationPatrick Anthony100% (3)

- Natfm PricingDocumento36 páginasNatfm PricingPatrick AnthonyAinda não há avaliações

- Outline: 1. The What S & Why S of CRMDocumento98 páginasOutline: 1. The What S & Why S of CRMPatrick AnthonyAinda não há avaliações

- STS Chapter III STS and The Philippine SocietyDocumento18 páginasSTS Chapter III STS and The Philippine SocietyRizza Olano100% (1)

- Internship Report On Customer Satisfaction of Dutch-Bangla Bank LimitedDocumento59 páginasInternship Report On Customer Satisfaction of Dutch-Bangla Bank LimitedIbrahim Khailil 1915216660Ainda não há avaliações

- Driving Success Through True Product ExcellenceDocumento8 páginasDriving Success Through True Product ExcellenceAshwin LeonardAinda não há avaliações

- Claiming Back Tax Paid On A Lump Sum: What To Do Now If The Form Is Filled in by Someone ElseDocumento9 páginasClaiming Back Tax Paid On A Lump Sum: What To Do Now If The Form Is Filled in by Someone ElseErmintrudeAinda não há avaliações

- Blake MorrisonDocumento4 páginasBlake MorrisonAnonymous jF8rU5Ainda não há avaliações

- Understanding Results Analysis For WIP: Introduction and Configuration GuideDocumento3 páginasUnderstanding Results Analysis For WIP: Introduction and Configuration GuidegildlreiAinda não há avaliações

- FAQ On CARPDocumento5 páginasFAQ On CARPJ. O. M. SalazarAinda não há avaliações

- AIU EssayDocumento17 páginasAIU EssayGodfred AbleduAinda não há avaliações

- Guidance Note On Accoounting For LeasesDocumento22 páginasGuidance Note On Accoounting For LeasesANUSHA DAVEAinda não há avaliações

- IntroductionDocumento5 páginasIntroductionKemy CameliaAinda não há avaliações

- Telling Price: Ditempel Di Buku B. Inggris Kelas 5Documento1 páginaTelling Price: Ditempel Di Buku B. Inggris Kelas 5Ely AwatiAinda não há avaliações

- Form16-2018-19 Part ADocumento2 páginasForm16-2018-19 Part AMANJUNATH GOWDAAinda não há avaliações

- USAA - USAA Growth & Income Fund - USGRX - Summary Prospectus 12.01.2017Documento4 páginasUSAA - USAA Growth & Income Fund - USGRX - Summary Prospectus 12.01.2017anthonymaioranoAinda não há avaliações

- SDPL Co. ProfileDocumento48 páginasSDPL Co. ProfileShyam SutharAinda não há avaliações

- ECON20063 TemplateDocumento6 páginasECON20063 TemplateKristel LacaAinda não há avaliações

- Coca Cola Company PresentationDocumento29 páginasCoca Cola Company PresentationVibhuti GoelAinda não há avaliações

- This Agreement, Was Made in 24/02/2021 Between:: Unified Employment ContractDocumento9 páginasThis Agreement, Was Made in 24/02/2021 Between:: Unified Employment ContractMajdy Al harbiAinda não há avaliações

- Reflection Paper and AnswersDocumento8 páginasReflection Paper and AnswersDonita BinayAinda não há avaliações

- UTS Akmen - Ahmad RoyhaanDocumento5 páginasUTS Akmen - Ahmad RoyhaanOppa Massimo MorattiAinda não há avaliações

- Advantages Disadvantages AFTA - ZatyDocumento3 páginasAdvantages Disadvantages AFTA - ZatyHameezAinda não há avaliações

- Case Study - 2Documento12 páginasCase Study - 2Khay GonzalesAinda não há avaliações

- Higher Pension As Per SC Decision With Calculation - Synopsis1Documento13 páginasHigher Pension As Per SC Decision With Calculation - Synopsis1hariveerAinda não há avaliações

- Coffee Shop Business Plan TemplateDocumento12 páginasCoffee Shop Business Plan TemplateLanurias, Gabriel Dylan S.Ainda não há avaliações

- ReportDocumento34 páginasReportTahirish Abbasi50% (2)

- Personal Financial Statement: Section 1-Individual InformationDocumento3 páginasPersonal Financial Statement: Section 1-Individual InformationAndrea MoralesAinda não há avaliações

- Bank StatementDocumento2 páginasBank StatementZakaria EL MAMOUNAinda não há avaliações

- Banking Chapter SummaryDocumento2 páginasBanking Chapter SummaryShaine SarabozaAinda não há avaliações

- PS2 ECGE 1113 Economics IDocumento2 páginasPS2 ECGE 1113 Economics Isouha mhamdiAinda não há avaliações

- Business and Society Ethics Sustainability and Stakeholder Management 10Th Edition Carroll Solutions Manual Full Chapter PDFDocumento29 páginasBusiness and Society Ethics Sustainability and Stakeholder Management 10Th Edition Carroll Solutions Manual Full Chapter PDFjaniceglover2puc6100% (13)

- Institute of Business Management and Research, Ips Academy, Indore Lesson PlanDocumento5 páginasInstitute of Business Management and Research, Ips Academy, Indore Lesson PlanSushma IssacAinda não há avaliações

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNo Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNota: 4.5 de 5 estrelas4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 4.5 de 5 estrelas4.5/5 (14)

- Creating Shareholder Value: A Guide For Managers And InvestorsNo EverandCreating Shareholder Value: A Guide For Managers And InvestorsNota: 4.5 de 5 estrelas4.5/5 (8)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 3.5 de 5 estrelas3.5/5 (8)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthNo EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthNota: 4 de 5 estrelas4/5 (20)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNo EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNota: 4.5 de 5 estrelas4.5/5 (8)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNo EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNota: 5 de 5 estrelas5/5 (6)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamAinda não há avaliações

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNota: 4.5 de 5 estrelas4.5/5 (32)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNo EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNota: 4.5 de 5 estrelas4.5/5 (17)

- Financial Risk Management: A Simple IntroductionNo EverandFinancial Risk Management: A Simple IntroductionNota: 4.5 de 5 estrelas4.5/5 (7)

- Finance Basics (HBR 20-Minute Manager Series)No EverandFinance Basics (HBR 20-Minute Manager Series)Nota: 4.5 de 5 estrelas4.5/5 (32)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsNo EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsNota: 5 de 5 estrelas5/5 (1)

- Mind over Money: The Psychology of Money and How to Use It BetterNo EverandMind over Money: The Psychology of Money and How to Use It BetterNota: 4 de 5 estrelas4/5 (24)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelAinda não há avaliações

- Value: The Four Cornerstones of Corporate FinanceNo EverandValue: The Four Cornerstones of Corporate FinanceNota: 4.5 de 5 estrelas4.5/5 (18)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetNo EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetNota: 5 de 5 estrelas5/5 (2)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsNo EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsAinda não há avaliações

- Product-Led Growth: How to Build a Product That Sells ItselfNo EverandProduct-Led Growth: How to Build a Product That Sells ItselfNota: 5 de 5 estrelas5/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNo EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNota: 4.5 de 5 estrelas4.5/5 (73)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistNo EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistNota: 4 de 5 estrelas4/5 (32)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)No EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Nota: 4 de 5 estrelas4/5 (5)