Escolar Documentos

Profissional Documentos

Cultura Documentos

Derivatives Report 24th April 2012

Enviado por

Angel BrokingDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Derivatives Report 24th April 2012

Enviado por

Angel BrokingDireitos autorais:

Formatos disponíveis

Derivative Report

India Research

April 24, 2012 Comments

The Nifty futures open interest increased by 1.86% while

Nifty Vs OI

Minifty futures open interest is increased by 7.06% as market closed at 5200.60 levels.

The Nifty April future closed at a discount of 2.00 point

against a premium of 11.15 points. The May series closed at a premium of 32.20 points.

The Implied Volatility of at the money options is

increased from 17.03% to 23.44%

The PCR-OI has being decreased from 1.14 to 1.06

points.

The total OI of the market is `1,26,125/-cr. and the

stock futures OI are `29,920/-cr.

Few of the liquid counters where we have seen high cost-

of-carry are HCC, POWERGRID, HINDUNILVR, TTML and BANKINDIA.

OI Gainers

SCRIP BHARATFORG ASIANPAINT BIOCON EDUCOMP BOMDYEING OI 5066000 105875 2879000 3660000 864000 OI CHANGE (%) 32.79 23.83 16.46 14.05 11.92 PRICE 318.65 3471.00 236.30 193.35 517.45 PRICE CHANGE (%) -0.65 3.91 -2.54 -5.06 -5.63

View

FIIs were net sellers in cash market segment; they

were net sellers worth of `408/- cr. On derivatives front they were net sellers in index futures, while in index options they were net buyers.

On options front significant amount of buildup was

visible in 5200-5400 call option, while in put option 5300-5400 strike price have seen some unwinding and 5000 put option have seen some buildup in open interest in yesterdays trading session.

The counter of HEROMOTOCO has seen decent

OI Losers

SCRIP PUNJLLOYD BFUTILITIE BPCL NMDC DHANBANK OI 29140000 692500 957000 1119000 2860000 OI CHANGE (%) -20.32 -17.02 -16.53 -15.67 -14.37 PRICE 53.45 407.20 674.65 172.20 63.30 PRICE CHANGE (%) -2.91 -5.82 -3.10 0.82 -5.66

buildup of long positions since the starting of this expiry. However the stock has seen some long unwinding pressure around its resistance level of `2200-2220 and followed by some short buildup in yesterdays trading session. We feel further long unwinding could come in this stock which could take the counter to around `2045. Hence we recommend to go short on this stock at around `2145-2155 with the stop loss of `2220.

Put-Call Ratio

SCRIP NIFTY INFY BANKNIFTY SBIN RELIANCE PCR-OI 1.06 0.26 0.74 0.71 0.83 PCR-VOL 1.08 0.56 0.81 0.64 0.90

Historical Volatility

SCRIP

MCDOWELL-N ASIANPAINT ESCORTS IDEA FORTIS

HV

75.62 31.21 59.90 42.76 46.86 For Private Circulation Only 1

SEBI Registration No: INB 010996539

Derivative Report | India Research

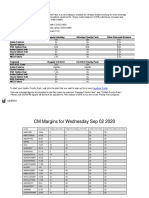

FII Statistics for 23-April-2012

Open Interest Detail Buy Sell Net Contracts INDEX FUTURES INDEX OPTIONS STOCK FUTURES STOCK OPTIONS TOTAL Value (Rs. in cr.) 11425.39 39378.87 23879.26 1267.05 75950.57 Change (%) 1.39 1.21 1.91 -7.05 1.31

Turnover on 23-April-2012

No. of Contracts Turnover (Rs. in cr.) Change (%)

Instrument

2081.40

2589.65

(508.25) 510.84 (177.33) 64.10 (110.64)

445597 1514480 871008 46171 2877256

INDEX FUTURES INDEX OPTIONS STOCK FUTURES STOCK OPTIONS TOTAL

545708 4612346 734508 247737 6140299

13460.52 122121.73 20655.07 6843.12 163080.44

0.32 13.80 18.95 5.76 12.81

20944.49 20433.65 4043.90 989.01 4221.22 924.92

28058.79 28169.43

Nifty Spot =5200.60

Lot Size = 50

Bull-Call Spreads

Action Buy Sell Buy Sell Buy Sell Strike 5200 5300 5200 5400 5300 5400 Price 44.55 11.15 44.55 2.35 11.15 2.35 8.80 91.20 5308.80 42.20 157.80 5242.20 Risk 33.40 Reward 66.60 BEP 5233.40

Bear-Put Spreads

Action Buy Sell Buy Sell Buy Sell Strike 5200 5100 5200 5000 5100 5000 Price 46.05 14.65 46.05 4.20 14.65 4.20 10.45 89.55 5089.55 41.85 158.15 5158.15 Risk 31.40 Reward 68.60 BEP 5168.60

Note: Above mentioned Bullish or Bearish Spreads in Nifty (April. Series) are given as information and not as a recommendation.

Nifty Put-Call Analysis

For Private Circulation Only

SEBI Registration No: INB 010996539

Derivative Report | India Research

Strategy Date 02-04-2012 09-04-2012 16-04-2012 23-04-2012

Scrip NIFTY TATAMOTORS HDFC SBIN

Strategy Ratio Put Spread Ratio Put Spread Call Hedge Long Put

Status Open Open Open Open

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section).

Derivative Research Team

Email Id : - derivatives.desk@angelbroking.com

For Private Circulation Only

SEBI Registration No: INB 010996539

Você também pode gostar

- Derivatives Report 7th February 2012Documento3 páginasDerivatives Report 7th February 2012Angel BrokingAinda não há avaliações

- Derivatives Report 26th March 2012Documento3 páginasDerivatives Report 26th March 2012Angel BrokingAinda não há avaliações

- Derivatives Report 20th April 2012Documento3 páginasDerivatives Report 20th April 2012Angel BrokingAinda não há avaliações

- Derivatives Report 23 March 2012Documento3 páginasDerivatives Report 23 March 2012Angel BrokingAinda não há avaliações

- Derivative Report: Nifty Vs OIDocumento3 páginasDerivative Report: Nifty Vs OIAngel BrokingAinda não há avaliações

- Derivatives Report 9th March 2012Documento3 páginasDerivatives Report 9th March 2012Angel BrokingAinda não há avaliações

- Derivatives Report 10th February 2012Documento3 páginasDerivatives Report 10th February 2012Angel BrokingAinda não há avaliações

- Derivatives Report 12th April 2012Documento3 páginasDerivatives Report 12th April 2012Angel BrokingAinda não há avaliações

- Derivatives Report 06 Sep 2012Documento3 páginasDerivatives Report 06 Sep 2012Angel BrokingAinda não há avaliações

- Derivatives Report 11th April 2012Documento3 páginasDerivatives Report 11th April 2012Angel BrokingAinda não há avaliações

- Derivatives Report 2nd JanDocumento3 páginasDerivatives Report 2nd JanAngel BrokingAinda não há avaliações

- Derivatives Report, 11 March 2013Documento3 páginasDerivatives Report, 11 March 2013Angel BrokingAinda não há avaliações

- Derivatives Report 10 Jul 2012Documento3 páginasDerivatives Report 10 Jul 2012Angel BrokingAinda não há avaliações

- Derivatives Report 14 Aug 2012Documento3 páginasDerivatives Report 14 Aug 2012Angel BrokingAinda não há avaliações

- Derivatives Report 30 MAY 2012Documento3 páginasDerivatives Report 30 MAY 2012angelbrokingAinda não há avaliações

- Derivatives Report 28th March 2012Documento3 páginasDerivatives Report 28th March 2012Angel BrokingAinda não há avaliações

- Derivatives Report 31st January 2012Documento3 páginasDerivatives Report 31st January 2012Angel BrokingAinda não há avaliações

- Derivatives Report, 21 March 2013Documento3 páginasDerivatives Report, 21 March 2013Angel BrokingAinda não há avaliações

- Derivatives Report, 23 April 2013Documento3 páginasDerivatives Report, 23 April 2013Angel BrokingAinda não há avaliações

- Derivatives Report 27 Jun 2012Documento3 páginasDerivatives Report 27 Jun 2012Angel BrokingAinda não há avaliações

- Derivatives Report 17th February 2012Documento3 páginasDerivatives Report 17th February 2012Angel BrokingAinda não há avaliações

- Derivative Report: Nifty Vs OIDocumento3 páginasDerivative Report: Nifty Vs OIAngel BrokingAinda não há avaliações

- Derivatives Report 27th February 2012Documento3 páginasDerivatives Report 27th February 2012Angel BrokingAinda não há avaliações

- Derivatives Report 19th January 2012Documento3 páginasDerivatives Report 19th January 2012Angel BrokingAinda não há avaliações

- Derivatives Report 9th February 2012Documento3 páginasDerivatives Report 9th February 2012Angel BrokingAinda não há avaliações

- Derivatives Report 12th March 2012Documento3 páginasDerivatives Report 12th March 2012Angel BrokingAinda não há avaliações

- Derivatives Report 14 Sep 2012Documento3 páginasDerivatives Report 14 Sep 2012Angel BrokingAinda não há avaliações

- Derivatives Report 07 Feb 2013Documento3 páginasDerivatives Report 07 Feb 2013Angel BrokingAinda não há avaliações

- Derivatives Report 1 JUNE 2012Documento3 páginasDerivatives Report 1 JUNE 2012Angel BrokingAinda não há avaliações

- Derivatives Report 23rd April 2012Documento3 páginasDerivatives Report 23rd April 2012Angel BrokingAinda não há avaliações

- Derivatives Report 14th February 2012Documento3 páginasDerivatives Report 14th February 2012Angel BrokingAinda não há avaliações

- Derivatives Report 23rd February 2012Documento3 páginasDerivatives Report 23rd February 2012Angel BrokingAinda não há avaliações

- Derivatives Report 16th December 2011Documento3 páginasDerivatives Report 16th December 2011Angel BrokingAinda não há avaliações

- Derivatives Report 20th Dec 2012Documento3 páginasDerivatives Report 20th Dec 2012Angel BrokingAinda não há avaliações

- Derivatives Report 10th August 2011Documento3 páginasDerivatives Report 10th August 2011Angel BrokingAinda não há avaliações

- Derivatives Report 21st March 2012Documento3 páginasDerivatives Report 21st March 2012Angel BrokingAinda não há avaliações

- Derivatives Report 08 Oct 2012Documento3 páginasDerivatives Report 08 Oct 2012Angel BrokingAinda não há avaliações

- Derivatives Report 18 JUNE 2012Documento3 páginasDerivatives Report 18 JUNE 2012Angel BrokingAinda não há avaliações

- Derivatives Report, 15 March 2013Documento3 páginasDerivatives Report, 15 March 2013Angel BrokingAinda não há avaliações

- Derivatives Report 03 Sep 2012Documento3 páginasDerivatives Report 03 Sep 2012Angel BrokingAinda não há avaliações

- Derivatives Report, 17 April 2013Documento3 páginasDerivatives Report, 17 April 2013Angel BrokingAinda não há avaliações

- Derivatives Report 13 Jul 2012Documento3 páginasDerivatives Report 13 Jul 2012Angel BrokingAinda não há avaliações

- Derivatives Report, 02 April 2013Documento3 páginasDerivatives Report, 02 April 2013Angel BrokingAinda não há avaliações

- Derivatives Report 22nd September 2011Documento3 páginasDerivatives Report 22nd September 2011Angel BrokingAinda não há avaliações

- Derivative Report: Nifty Vs OIDocumento3 páginasDerivative Report: Nifty Vs OIAngel BrokingAinda não há avaliações

- Derivatives Report 16 Aug 2012Documento3 páginasDerivatives Report 16 Aug 2012Angel BrokingAinda não há avaliações

- Derivatives Report 2nd May 2012Documento3 páginasDerivatives Report 2nd May 2012Angel BrokingAinda não há avaliações

- Derivatives Report, 04 Apr 2013Documento3 páginasDerivatives Report, 04 Apr 2013Angel BrokingAinda não há avaliações

- Derivatives Report 13 APR 2012Documento3 páginasDerivatives Report 13 APR 2012Angel BrokingAinda não há avaliações

- Derivatives Report 22nd March 2012Documento3 páginasDerivatives Report 22nd March 2012Angel BrokingAinda não há avaliações

- Derivatives Report 21 Sep 2012Documento3 páginasDerivatives Report 21 Sep 2012Angel BrokingAinda não há avaliações

- Derivatives Report, 06 Jun 2013Documento3 páginasDerivatives Report, 06 Jun 2013Angel BrokingAinda não há avaliações

- Derivatives Report 18 Sep 2012Documento3 páginasDerivatives Report 18 Sep 2012Angel BrokingAinda não há avaliações

- Derivatives Report 6th March 2012Documento3 páginasDerivatives Report 6th March 2012Angel BrokingAinda não há avaliações

- Derivative Report 21st September 2011Documento3 páginasDerivative Report 21st September 2011Angel BrokingAinda não há avaliações

- Derivatives Report 26th April 2012Documento3 páginasDerivatives Report 26th April 2012Angel BrokingAinda não há avaliações

- Derivatives Report 14th November 2011Documento3 páginasDerivatives Report 14th November 2011Angel BrokingAinda não há avaliações

- Derivatives Report 20 Jun 2012Documento3 páginasDerivatives Report 20 Jun 2012Angel BrokingAinda não há avaliações

- Derivatives Report 7th December 2011Documento3 páginasDerivatives Report 7th December 2011Angel BrokingAinda não há avaliações

- Value Investing in Asia: The Definitive Guide to Investing in AsiaNo EverandValue Investing in Asia: The Definitive Guide to Investing in AsiaAinda não há avaliações

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocumento4 páginasRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingAinda não há avaliações

- Daily Metals and Energy Report September 16 2013Documento6 páginasDaily Metals and Energy Report September 16 2013Angel BrokingAinda não há avaliações

- Oilseeds and Edible Oil UpdateDocumento9 páginasOilseeds and Edible Oil UpdateAngel BrokingAinda não há avaliações

- WPIInflation August2013Documento5 páginasWPIInflation August2013Angel BrokingAinda não há avaliações

- International Commodities Evening Update September 16 2013Documento3 páginasInternational Commodities Evening Update September 16 2013Angel BrokingAinda não há avaliações

- Daily Agri Report September 16 2013Documento9 páginasDaily Agri Report September 16 2013Angel BrokingAinda não há avaliações

- Daily Agri Tech Report September 16 2013Documento2 páginasDaily Agri Tech Report September 16 2013Angel BrokingAinda não há avaliações

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocumento6 páginasTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingAinda não há avaliações

- Daily Agri Tech Report September 14 2013Documento2 páginasDaily Agri Tech Report September 14 2013Angel BrokingAinda não há avaliações

- Currency Daily Report September 16 2013Documento4 páginasCurrency Daily Report September 16 2013Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Documento4 páginasDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingAinda não há avaliações

- Market Outlook: Dealer's DiaryDocumento13 páginasMarket Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Derivatives Report 8th JanDocumento3 páginasDerivatives Report 8th JanAngel BrokingAinda não há avaliações

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocumento1 páginaPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingAinda não há avaliações

- Metal and Energy Tech Report Sept 13Documento2 páginasMetal and Energy Tech Report Sept 13Angel BrokingAinda não há avaliações

- Currency Daily Report September 13 2013Documento4 páginasCurrency Daily Report September 13 2013Angel BrokingAinda não há avaliações

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocumento4 páginasJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingAinda não há avaliações

- Market Outlook: Dealer's DiaryDocumento12 páginasMarket Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Daily Agri Tech Report September 12 2013Documento2 páginasDaily Agri Tech Report September 12 2013Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Documento4 páginasDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Currency Daily Report September 12 2013Documento4 páginasCurrency Daily Report September 12 2013Angel BrokingAinda não há avaliações

- Market Outlook: Dealer's DiaryDocumento13 páginasMarket Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Daily Metals and Energy Report September 12 2013Documento6 páginasDaily Metals and Energy Report September 12 2013Angel BrokingAinda não há avaliações

- Metal and Energy Tech Report Sept 12Documento2 páginasMetal and Energy Tech Report Sept 12Angel BrokingAinda não há avaliações

- Daily Agri Report September 12 2013Documento9 páginasDaily Agri Report September 12 2013Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Documento4 páginasDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingAinda não há avaliações

- Nism Xvi - Commodity Derivatives Exam - Practice Test 6Documento53 páginasNism Xvi - Commodity Derivatives Exam - Practice Test 6Sohel KhanAinda não há avaliações

- Binomial Option Pricing Model: Done By: Dheepa Ravi Mohana Priya. VDocumento13 páginasBinomial Option Pricing Model: Done By: Dheepa Ravi Mohana Priya. Vmohana2589Ainda não há avaliações

- Referensi PPT American OptionDocumento4 páginasReferensi PPT American Optionyess gilbertAinda não há avaliações

- Commodity SwapDocumento10 páginasCommodity SwapVirtee ShahAinda não há avaliações

- A&J Flashcards For Exam SOA Exam FM/ CAS Exam 2Documento39 páginasA&J Flashcards For Exam SOA Exam FM/ CAS Exam 2anjstudymanualAinda não há avaliações

- CRE52Documento44 páginasCRE52Renu MundhraAinda não há avaliações

- 2012 Fuel Hedging at JetBlue AirwaysDocumento181 páginas2012 Fuel Hedging at JetBlue Airwaysjk kumar100% (3)

- The Most Important Technical Indicators For Binary Options - InvestopediaDocumento6 páginasThe Most Important Technical Indicators For Binary Options - InvestopediaHandisaputra LinAinda não há avaliações

- AFAR 13 Derivatives and Hedge Accounting Under PFRS 9Documento10 páginasAFAR 13 Derivatives and Hedge Accounting Under PFRS 9Louie RobitshekAinda não há avaliações

- International Financial Management 5Documento53 páginasInternational Financial Management 5胡依然100% (1)

- Institute of Actuaries of India: Subject ST6 - Finance and Investment BDocumento7 páginasInstitute of Actuaries of India: Subject ST6 - Finance and Investment BVignesh SrinivasanAinda não há avaliações

- Derivatives Market: By-Ambika GargDocumento17 páginasDerivatives Market: By-Ambika GargRahul MauryaAinda não há avaliações

- 0809 KarlsenDocumento5 páginas0809 KarlsenprateekbaldwaAinda não há avaliações

- Assets:: I. Introduction: Derivatives Concept andDocumento58 páginasAssets:: I. Introduction: Derivatives Concept andRanti0% (1)

- Futures & OptionsDocumento32 páginasFutures & OptionsSwati Singh100% (1)

- Managing Interest Rate RiskDocumento4 páginasManaging Interest Rate RiskNyeko FrancisAinda não há avaliações

- Derivatives and Derivatives MarketsDocumento55 páginasDerivatives and Derivatives MarketsLulu Katima100% (1)

- Swaps - Interest Rate and Currency PDFDocumento64 páginasSwaps - Interest Rate and Currency PDFKarishma MittalAinda não há avaliações

- Binomial and Black Scholes - 111153Documento18 páginasBinomial and Black Scholes - 111153merijan31773Ainda não há avaliações

- PLATTS Crude 20190809Documento24 páginasPLATTS Crude 20190809Huixin dong100% (1)

- Project On Option StrategiesDocumento49 páginasProject On Option Strategieskamdica67% (9)

- Exam FM Practice Exam 1 Answer KeyDocumento71 páginasExam FM Practice Exam 1 Answer Keynad_natt100% (1)

- Lecture 0: Introduction To FINA 4529Documento6 páginasLecture 0: Introduction To FINA 4529levan1225Ainda não há avaliações

- Acca Afm Interest Rate RiskDocumento25 páginasAcca Afm Interest Rate RiskBijay AgrawalAinda não há avaliações

- Chapter 1Documento34 páginasChapter 1Sanjoy dasAinda não há avaliações

- CTM IndividualDocumento6 páginasCTM IndividualPhang Yu ShangAinda não há avaliações

- Intraday ScriptDocumento11 páginasIntraday ScriptvvpvarunAinda não há avaliações

- Hedging Strategies Using Futures: Options, Futures, and Other Derivatives 6Documento17 páginasHedging Strategies Using Futures: Options, Futures, and Other Derivatives 6Tor 1Ainda não há avaliações

- A Brief History of DerivativesDocumento12 páginasA Brief History of DerivativesPranab SahooAinda não há avaliações

- Derivatives NotesDocumento194 páginasDerivatives NotesnirleshtiwariAinda não há avaliações