Escolar Documentos

Profissional Documentos

Cultura Documentos

09 Book Debt Service 2011 Budget

Enviado por

seoversightDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

09 Book Debt Service 2011 Budget

Enviado por

seoversightDireitos autorais:

Formatos disponíveis

City of South Euclid

2011 Budget Workpapers

BOND RETIREMENT GENERAL - FUND #327

The Bond Retirement fund is used to account for activity related to the issuance/repayment of general obligation debt of the City. Expenses are limited to the repayment of debt and expenses related to the issuance of debt. In 2003, outstanding general obligation debt is made up of the $5,900,000 Flood Improvement Note and a $3,000,000 Road Improvement Note. The interest on this obligation will be paid from the Flood Control Fund, Road Improvement Fund as well as using the premium received from the sale of this note in 2002 which is in this Bond Retirement Fund.

The City issued a bond in the amount of $9,400,000 in April 2003. This fund receipted $8,400,000, which paid all but $500,000 of the note. The remaining $500,000 was paid from the Flood Control Fund.

Revenues Received in 2010 Total Unencumbered Balance 1/1/11 2011 Certified Estimated Revenues 2011 Appropriations are not to exceed: $0 $31,681 0 $31,681

current budget ending balance

$31,681 $0

10/12/2011

City of South Euclid

2011 Budget Workpapers

BOND RETIREMENT GENERAL - FUND #327

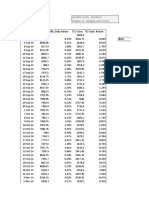

Actual 2007 Personal Services Materials and Supplies Contractual Services Other Charges $0 0 0 0 $0 Actual 2008 $0 0 0 0 $0 Actual 2009 $0 0 0 0 $0 Actual 2010 $0 0 0 4,575 $4,575 Budget 2011 $0 0 0 31,681 $31,681

10/12/2011

City of South Euclid

2011 Budget Workpapers

BOND RETIREMENT GENERAL - FUND #327.8850

CONTRACTUAL SERVICES Flood Control/Road Improvement Note Note Principal Bond Interest TOTALS Actual 2007 52603 52602 $0 0 $0 Actual 2007 4,975 $4,975 Actual 2008 $0 0 $0 Actual 2008 4,975 $4,975 Actual 2009 $0 0 $0 Actual 2009 4,975 $4,975 Actual 2010 $0 0 $0 Actual 2010 4,575 $4,575 Budget 2011

$0 Budget 2011 31,681 $31,681

OTHER Miscellaneous TOTALS

52799

10/12/2011

City of South Euclid

2011 Budget Workpapers

BOND RETIREMENT RECREATION - FUND #328

The Recreation Bond Retirement fund is used to account for activity related to the repayment of the bond issued to pay for recreational improvements for City, including swimming pools and parks. This bond will be totally repaid in 2011. Expenses are limited to the repayment of debt (principal and interest) and expenses related to this debt. The source of revenue to repay this debt are funds collected from property owners on their property tax bills. The millage is 1.3 mills Revenues Received in 2010 Real Property Taxes 328.1000.41102 Personal Property Taxes 328.1000.41103 10 % Rollback 328.2000.42102 2.5 % Rollback 328.2000.42103 Homestead 328.2000.42104 Total Unencumbered Balance 1/1/11 2011 Certified Estimated Revenues 2011 Appropriations are not to exceed:

$447,478 $481 $45,443 9,451 18,839 $521,692 $610,690 $610,690

current budget ending balance

$610,690 $0

10/12/2011

City of South Euclid

2011 Budget Workpapers

BOND RETIREMENT RECREATION - FUND #328

Actual 2007 Personal Services Materials and Supplies Contractual Services Other Charges $0 0 495,787 0 $495,787 Actual 2008 $0 0 492,339 0 $492,339 Actual 2009 $0 0 525,560 0 $525,560 Actual 2010 $0 0 582,948 0 $582,948 Budget 2011 $0 0 610,690 0 $610,690

10/12/2011

City of South Euclid

2011 Budget Workpapers

BOND RETIREMENT RECREATION - FUND #328.8850

Actual 2007 52324 52358 52399 52601 52602 52799 0 282 0 $435,000 60,505 0 0 0 0 0 0 0 $495,787 Actual 2008 539 $450,000 41,800 Actual 2009 0 3,560 0 $500,000 22,000 0 Actual 2010 0 7,948 0 $0 575,000 Budget 2011 9,000 $0 570,000 31,690

CONTRACTUAL SERVICES Outside legal fees Auditor/treas collection fees Other professional fees Bond Principal Bond Interest Miscellaneous Bond Payment Underwriter Bond Counsel Rating Agency Paying Registrar Insurance TOTALS

$492,339

$525,560

$582,948

$610,690

Huntington National Bank

10/12/2011

City of South Euclid

2011 Budget Workpapers

BOND RETIREMENT SPECIAL BOND (STANHOPE) - FUND #510

The Special Bond Retirement fund is used to account for activity related to the repayment of the bond issued to pay for improvements to the Stanhope parking lot. This bond will be totally repaid in 2014. Expenses are limited to the repayment of debt (principal and interest) and expenses related to this debt.

The source of revenue to repay this debt are funds collected from special assessments on specific property owners on their property tax bills.

Revenues Received in 2010 Special assessments 510.3000.43103 Transfer in from General Fund Total Unencumbered Balance 1/1/11 2011 Certified Estimated Revenues Transfer from General Fund 2011 Appropriations are not to exceed: 3,824 20,000 $3,824 $8,947 0 60,000 $68,947

current budget ending balance

$58,230 $10,717

10/12/2011

City of South Euclid

2011 Budget Workpapers

BOND RETIREMENT SPECIAL BOND (STANHOPE) - FUND #510

Actual 2007 Personal Services Materials and Supplies Contractual Services Other Charges $0 0 58,306 0 $58,306 Actual 2008 $0 0 55,497 0 $55,497 Actual 2009 $0 0 58,115 0 $58,115 Actual 2010 $0 0 55,448 0 $55,448 Budget 2011 $0 0 58,230 0 $58,230

10/12/2011

City of South Euclid

2011 Budget Workpapers

BOND RETIREMENT SPECIAL BOND (STANHOPE) - FUND #510

Actual 2007 $526 35,000 22,780 $58,306 Actual 2008 $62 35,000 20,435 $55,497 Actual 2009 $25 40,000 18,090 $58,115 Actual 2010 $38 40,000 15,410 $55,448 Budget 2011 $500 45,000 12,730 $58,230

CONTRACTUAL SERVICES Special Assessment Fees Principal Interest TOTALS

52358 52601 52602

U S Bank

10/12/2011

Você também pode gostar

- 08 Book Special Rev 2011 BudgetDocumento73 páginas08 Book Special Rev 2011 BudgetseoversightAinda não há avaliações

- 10 Book Capital Projects 2011 BudgetDocumento39 páginas10 Book Capital Projects 2011 BudgetseoversightAinda não há avaliações

- City of Bingham Project FinancialsDocumento46 páginasCity of Bingham Project FinancialsNicky 'Zing' Nguyen100% (7)

- 08 Book Special Rev - 2013 BudgetDocumento67 páginas08 Book Special Rev - 2013 BudgetseoversightAinda não há avaliações

- 10 Book Capital Projects 2012Documento43 páginas10 Book Capital Projects 2012seoversightAinda não há avaliações

- Week 4Documento5 páginasWeek 4Erryn M. ParamythaAinda não há avaliações

- 05 Book Utility 2011 BudgetDocumento8 páginas05 Book Utility 2011 BudgetseoversightAinda não há avaliações

- Citizen's Budget & Finance Advisory Committee April 13, 2010Documento14 páginasCitizen's Budget & Finance Advisory Committee April 13, 2010lchipsAinda não há avaliações

- c6 Question BankDocumento25 páginasc6 Question BankWaseem Ahmad QurashiAinda não há avaliações

- Citizen's Budget & Finance Advisory Committee June 14, 2010Documento19 páginasCitizen's Budget & Finance Advisory Committee June 14, 2010lchipsAinda não há avaliações

- 10 Book Capital Projects - 2013 BudgetDocumento37 páginas10 Book Capital Projects - 2013 BudgetseoversightAinda não há avaliações

- 2011-2012 County RevenuesDocumento23 páginas2011-2012 County RevenuesMichael ToddAinda não há avaliações

- Mayor'S Office (33) : Agency Plan: Mission, Goals and Budget SummaryDocumento20 páginasMayor'S Office (33) : Agency Plan: Mission, Goals and Budget SummaryMatt HampelAinda não há avaliações

- Town of Galway: Financial OperationsDocumento17 páginasTown of Galway: Financial OperationsdayuskoAinda não há avaliações

- 2015 South Euclid, Ohio Budget (Final Council Draft)Documento128 páginas2015 South Euclid, Ohio Budget (Final Council Draft)seoversightAinda não há avaliações

- General Fund Trial Balances and TransactionsDocumento9 páginasGeneral Fund Trial Balances and TransactionsAbdii Dhufeera100% (2)

- 11 Book Treasury 2011 BudgetDocumento4 páginas11 Book Treasury 2011 BudgetseoversightAinda não há avaliações

- Ac550 FinalDocumento4 páginasAc550 FinalGil SuarezAinda não há avaliações

- Cash FlowDocumento5 páginasCash FlowmagoimoiAinda não há avaliações

- Accounting Quiz Chpts 3 & 4Documento5 páginasAccounting Quiz Chpts 3 & 4sweetsaki19Ainda não há avaliações

- Stonecrest 2022 BudgetDocumento29 páginasStonecrest 2022 BudgetZachary HansenAinda não há avaliações

- University of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelDocumento8 páginasUniversity of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelSherjeel AhmedAinda não há avaliações

- Government-Wide Statements & Budgetary Comparison Schedule Part OneDocumento5 páginasGovernment-Wide Statements & Budgetary Comparison Schedule Part Onecyics TabAinda não há avaliações

- ACCA Dec 2011 F7 Mock PaperDocumento10 páginasACCA Dec 2011 F7 Mock PaperCharles AdontengAinda não há avaliações

- Department of Administrative Hearings (45) : Agency Plan: Mission, Goals and Budget SummaryDocumento8 páginasDepartment of Administrative Hearings (45) : Agency Plan: Mission, Goals and Budget SummaryMatt HampelAinda não há avaliações

- 2011 Preliminary Budget & Levy PresentationDocumento15 páginas2011 Preliminary Budget & Levy PresentationCity of HopkinsAinda não há avaliações

- Soal AkmDocumento5 páginasSoal AkmCarvin HarisAinda não há avaliações

- CK 2010 Audited FinancialsDocumento39 páginasCK 2010 Audited FinancialskrobinetAinda não há avaliações

- 2012 Budget PresentationDocumento29 páginas2012 Budget PresentationCity of HopkinsAinda não há avaliações

- Uses of Accounting Information and The Financial Statements - SolutionsDocumento31 páginasUses of Accounting Information and The Financial Statements - SolutionsmacfinpolAinda não há avaliações

- Ministry of Finance and Planning, Sri Lanka Annual Report 2012 Financial StatementsDocumento78 páginasMinistry of Finance and Planning, Sri Lanka Annual Report 2012 Financial StatementsKushan PereraAinda não há avaliações

- Revenue or Balance SheetDocumento8 páginasRevenue or Balance SheetsjbhargavAinda não há avaliações

- Practice Exam Chapters 1-5 (2) Income StatementDocumento5 páginasPractice Exam Chapters 1-5 (2) Income StatementJohn Arvi ArmildezAinda não há avaliações

- Chapter 5 Governmental AccountingDocumento9 páginasChapter 5 Governmental Accountingmohamad ali osmanAinda não há avaliações

- Ch02 SolDocumento7 páginasCh02 Solalex5566Ainda não há avaliações

- LMT 2011 1st Quarter Finance ReportDocumento14 páginasLMT 2011 1st Quarter Finance ReportBucksLocalNews.comAinda não há avaliações

- Government & NPF AssignmentDocumento10 páginasGovernment & NPF AssignmentkiduseAinda não há avaliações

- Binder - HCT - Collusion - MartinDocumento9 páginasBinder - HCT - Collusion - MartinMy-Acts Of-SeditionAinda não há avaliações

- IrvingCC Packet 2011-09-01Documento546 páginasIrvingCC Packet 2011-09-01Irving BlogAinda não há avaliações

- 13 Week Cash Flow ModelDocumento16 páginas13 Week Cash Flow ModelASChipLeadAinda não há avaliações

- Frankwood Question Bank DSEDocumento19 páginasFrankwood Question Bank DSEAu Tsz Man50% (4)

- 11 Book Treasury 2012Documento4 páginas11 Book Treasury 2012seoversightAinda não há avaliações

- Govt & NFP Accounting - Ch7Documento23 páginasGovt & NFP Accounting - Ch7Bikila MalasaAinda não há avaliações

- Financial Outturn for 2011 SummaryDocumento8 páginasFinancial Outturn for 2011 SummaryDiana Ni DhuibhirAinda não há avaliações

- Practice QuestionsDocumento2 páginasPractice QuestionsnoumantamilAinda não há avaliações

- Chapter 2 Exercises 1Documento13 páginasChapter 2 Exercises 1Ana María Del CerroAinda não há avaliações

- Accounting Errors Impact on Income and Retained EarningsDocumento5 páginasAccounting Errors Impact on Income and Retained EarningsGlizette SamaniegoAinda não há avaliações

- FIN300 Homework 1Documento7 páginasFIN300 Homework 1JohnAinda não há avaliações

- EB 10-11 General Services - StampedDocumento29 páginasEB 10-11 General Services - StampedMatt HampelAinda não há avaliações

- Journal Entries for Accounting TransactionsDocumento9 páginasJournal Entries for Accounting TransactionsKhushi RaiAinda não há avaliações

- 2012 FinancialsDocumento1 página2012 FinancialsVanderLakesAinda não há avaliações

- 9706 June 2011 Paper 41Documento8 páginas9706 June 2011 Paper 41Diksha KoossoolAinda não há avaliações

- EB 10 11 Non Departmental - StampedDocumento40 páginasEB 10 11 Non Departmental - StampedMatt HampelAinda não há avaliações

- 4 Borrowing CostDocumento16 páginas4 Borrowing CostHafizur RahmanAinda não há avaliações

- Back Duty Investigations PDFDocumento7 páginasBack Duty Investigations PDFSimon silaAinda não há avaliações

- FA1 Chapter 1 EngDocumento21 páginasFA1 Chapter 1 EngYong ChanAinda não há avaliações

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryNo EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1No EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Ainda não há avaliações

- 2016 Final Draft Budget City of South Euclid, Ohio (Council Copy)Documento149 páginas2016 Final Draft Budget City of South Euclid, Ohio (Council Copy)seoversightAinda não há avaliações

- NSP Financial TrackingDocumento42 páginasNSP Financial TrackingseoversightAinda não há avaliações

- CPA AssessmentDocumento2 páginasCPA AssessmentseoversightAinda não há avaliações

- 2015 South Euclid, Ohio Budget (Final Council Draft)Documento128 páginas2015 South Euclid, Ohio Budget (Final Council Draft)seoversightAinda não há avaliações

- South Euclid Judge Scrutinizes Mayor Georgine WeloDocumento15 páginasSouth Euclid Judge Scrutinizes Mayor Georgine Weloseoversight100% (1)

- NSP Financial TrackingDocumento42 páginasNSP Financial TrackingseoversightAinda não há avaliações

- South Euclid Judge Scrutinizes Mayor Georgine WeloDocumento15 páginasSouth Euclid Judge Scrutinizes Mayor Georgine Weloseoversight100% (1)

- Coyne Letter 11-21-14Documento2 páginasCoyne Letter 11-21-14seoversightAinda não há avaliações

- Brief of Defendant-Appellees Emilie DiFranco and David Furry 8-2013Documento32 páginasBrief of Defendant-Appellees Emilie DiFranco and David Furry 8-2013seoversightAinda não há avaliações

- 11-25-14 South Euclid Mayor Georgine Welo's Son Hired by Law Firm That Works For CityDocumento10 páginas11-25-14 South Euclid Mayor Georgine Welo's Son Hired by Law Firm That Works For CityseoversightAinda não há avaliações

- Reply Brief of Appellant Michael Lograsso To Respondents Emilie DiFranco and David Furry 9-20-2013Documento13 páginasReply Brief of Appellant Michael Lograsso To Respondents Emilie DiFranco and David Furry 9-20-2013seoversightAinda não há avaliações

- 12-10-14 South Euclid Councilwoman Ruth Gray Accuses Colleagues, Law Director of Breaking Executive Session Rules.Documento8 páginas12-10-14 South Euclid Councilwoman Ruth Gray Accuses Colleagues, Law Director of Breaking Executive Session Rules.seoversightAinda não há avaliações

- Resolution 69-14Documento2 páginasResolution 69-14seoversightAinda não há avaliações

- 12-17-14 South Euclid Law Director Michael Lograsso Owes Thousands in Delinquent Federal Income Taxes.Documento13 páginas12-17-14 South Euclid Law Director Michael Lograsso Owes Thousands in Delinquent Federal Income Taxes.seoversightAinda não há avaliações

- City of South Euclid, Ohio: Salaries 2003-2012Documento8 páginasCity of South Euclid, Ohio: Salaries 2003-2012seoversightAinda não há avaliações

- 5 - 15 - 14 JournalEntryOpinion 8th District Court of AppealsDocumento19 páginas5 - 15 - 14 JournalEntryOpinion 8th District Court of AppealsseoversightAinda não há avaliações

- Brief of Appellant Michael Lograsso 8-9-2013Documento18 páginasBrief of Appellant Michael Lograsso 8-9-2013seoversightAinda não há avaliações

- RC-3 Records Disposal - Service DepartmentDocumento6 páginasRC-3 Records Disposal - Service DepartmentseoversightAinda não há avaliações

- Response To Defendants Emilie DiFranco's and David Furry's Joint Motion For Judgment On The Pleadings 3-29-2013Documento15 páginasResponse To Defendants Emilie DiFranco's and David Furry's Joint Motion For Judgment On The Pleadings 3-29-2013seoversightAinda não há avaliações

- Defendants Emilie DiFranco's and David Furry's Joint Answer To Plaintiff's Complaint 3-6-2013Documento19 páginasDefendants Emilie DiFranco's and David Furry's Joint Answer To Plaintiff's Complaint 3-6-2013seoversightAinda não há avaliações

- RC-3 Records Disposal - Fire DepartmentDocumento2 páginasRC-3 Records Disposal - Fire DepartmentseoversightAinda não há avaliações

- RC-3 Records Disposal - Police Department Part 1Documento30 páginasRC-3 Records Disposal - Police Department Part 1seoversightAinda não há avaliações

- 12-28-12 Complaint PDFDocumento8 páginas12-28-12 Complaint PDFCrystal McbrideAinda não há avaliações

- American Judges Association2013 Educational ConferenceDocumento6 páginasAmerican Judges Association2013 Educational ConferenceseoversightAinda não há avaliações

- RC-3 Records Disposal - Police Department Part 2Documento25 páginasRC-3 Records Disposal - Police Department Part 2seoversightAinda não há avaliações

- RC-3 Records Disposal - Community CenterDocumento2 páginasRC-3 Records Disposal - Community CenterseoversightAinda não há avaliações

- RC-3 Records Disposal - Finance DepartmentDocumento7 páginasRC-3 Records Disposal - Finance DepartmentseoversightAinda não há avaliações

- RC-3 Records Disposal - Mayor's OfficeDocumento5 páginasRC-3 Records Disposal - Mayor's OfficeseoversightAinda não há avaliações

- RC-3 Records Disposal - Building DepartmentDocumento4 páginasRC-3 Records Disposal - Building DepartmentseoversightAinda não há avaliações

- 72-CIR v. Priscila Estate, Inc. G.R. No. L-18282 May 29, 1964Documento2 páginas72-CIR v. Priscila Estate, Inc. G.R. No. L-18282 May 29, 1964Jopan SJ100% (1)

- NPAs and SecuritizationDocumento18 páginasNPAs and SecuritizationVikku AgarwalAinda não há avaliações

- DemergerDocumento14 páginasDemergerShubham SakhujaAinda não há avaliações

- Columbia Class Notes - Mauboussin (2000)Documento60 páginasColumbia Class Notes - Mauboussin (2000)Michael James Cestas100% (2)

- 02 Sample PaperDocumento43 páginas02 Sample Papergaming loverAinda não há avaliações

- Evanston Alternative Opportunities Fact Sheet 10-01-2019Documento5 páginasEvanston Alternative Opportunities Fact Sheet 10-01-2019David BriggsAinda não há avaliações

- Backup Withholding - What Is It and How Can I Obtain A RefundDocumento35 páginasBackup Withholding - What Is It and How Can I Obtain A RefundAyodeji Badaki100% (1)

- Capped Outperformance Certificate On London Gold MarketDocumento1 páginaCapped Outperformance Certificate On London Gold Marketapi-25889552Ainda não há avaliações

- Audit of Shareholders EquityDocumento6 páginasAudit of Shareholders EquityMark Lord Morales Bumagat71% (7)

- Thesis On Indian Capital MarketDocumento7 páginasThesis On Indian Capital MarketAsia Smith100% (1)

- Letter To HMRC Relating To The ISA (Amendment No.2) Regulations 2016 (Approved)Documento3 páginasLetter To HMRC Relating To The ISA (Amendment No.2) Regulations 2016 (Approved)CrowdfundInsiderAinda não há avaliações

- INTERNAL AUDIT OF STOCK BROKERSDocumento75 páginasINTERNAL AUDIT OF STOCK BROKERSAnmol Kumar0% (1)

- EQIF LatestDocumento4 páginasEQIF LatestBryan SalamatAinda não há avaliações

- Academic Qualifications: Contact: +91 9163060425 E-Mail: Diveshp2013@email - Iimcal.ac - inDocumento1 páginaAcademic Qualifications: Contact: +91 9163060425 E-Mail: Diveshp2013@email - Iimcal.ac - insupriyaJAinda não há avaliações

- Beta Calculation: Zerodha Varsity - Module 4 Chapter 11 - Hedging With FuturesDocumento4 páginasBeta Calculation: Zerodha Varsity - Module 4 Chapter 11 - Hedging With FuturesPrathamesh NaikAinda não há avaliações

- ESSAYDocumento6 páginasESSAYSimonAinda não há avaliações

- January 13, 2021 Philippine Stock ExchangeDocumento5 páginasJanuary 13, 2021 Philippine Stock Exchangekjcnawkcna calkjwncaAinda não há avaliações

- Essentials of Treasury Management - Working Capital Class Final OutlineDocumento32 páginasEssentials of Treasury Management - Working Capital Class Final OutlinePablo VeraAinda não há avaliações

- Nalco Holding CO 10-K (Annual Reports) 2009-02-25Documento135 páginasNalco Holding CO 10-K (Annual Reports) 2009-02-25http://secwatch.com100% (1)

- Edelweiss Financial Services Initiating Coverage Scaling New Heights Buy Target Rs 280Documento19 páginasEdelweiss Financial Services Initiating Coverage Scaling New Heights Buy Target Rs 280chatuuuu123Ainda não há avaliações

- Enrolled Agent Training in India OverviewDocumento9 páginasEnrolled Agent Training in India OverviewAbinashAinda não há avaliações

- Dividend Policy and Commercial Banks in NepalDocumento65 páginasDividend Policy and Commercial Banks in NepalShishir Pokharel67% (3)

- Questions ACG, CCADocumento6 páginasQuestions ACG, CCAHamza El MissouabAinda não há avaliações

- Salient Features o The Insurance ActDocumento15 páginasSalient Features o The Insurance Actchandni babunuAinda não há avaliações

- 3 - 1-Asset Liability Management PDFDocumento26 páginas3 - 1-Asset Liability Management PDFAlaga ZelkanovićAinda não há avaliações

- PL Capital v. Orrstown Financial Services BoardDocumento53 páginasPL Capital v. Orrstown Financial Services BoardPublic OpinionAinda não há avaliações

- Introduction To Framework-Based Teaching ApproachDocumento8 páginasIntroduction To Framework-Based Teaching ApproachOladipupo Mayowa PaulAinda não há avaliações

- GMRDocumento22 páginasGMRSanthosh GoliAinda não há avaliações

- Time Value of Money 1Documento27 páginasTime Value of Money 1Namaku ImaAinda não há avaliações

- The Complete Breakout Trader Day Trading John Connors PDFDocumento118 páginasThe Complete Breakout Trader Day Trading John Connors PDFKaushik Matalia88% (8)