Escolar Documentos

Profissional Documentos

Cultura Documentos

Assessment Procedure

Enviado por

Abhishek SharmaDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Assessment Procedure

Enviado por

Abhishek SharmaDireitos autorais:

Formatos disponíveis

Amit Kumar

9891463160, 9891026051

Assessment Procedure

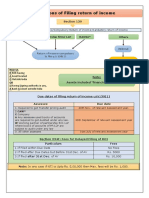

Return of Income Submission of Return of Income [Sec.-139(1)] Every person (a) being a company or a firm, or (b) being a person other than company or a firm, if (i) his total income or (ii) the total income of any other person in respect of which he is assessable under the Income tax Act, during the previous year [without giving effect to the provision of sec10A, 10B, 10BA or sec80] exceeds the maximum amount which is not chargeable to income tax.

Shall file a return of income On or before the due date In the prescribed form Verified in the prescribed manner and Setting forth such other particulars as may be prescribed.

Due date of furnishing return of income Assessee 1. In case of a person being: (a) Company; (b) a person whose accounts are required to be audited under this Act or under any other law; (c ) working partner of a firm whose accounts are so required to be audited; and (d) a person who is required to furnish a return on the basis of 1/6th economic criteria In the case of any other assessee 31st October of relevant assessment year. Due date

2.

31st July of relevant assessment year.

Notes: 1. Due date of furnishing return of income in case of a non-working partner shall be 31st July of the assessment year whether the accounts of the firm are required to be audited or not.

Amit Kumar

9891463160, 9891026051

2.

In case of firm whose accounts are not required to be audited under this Act or any other law, the last date for furnishing the return by the firm as well as partners (whether working or nonworking) shall be 31st July of the assessment year.

New Scheme to facilitate submission of returns through Tax return preparers [Sec.-139B]

Returns of loss [Sec.-139(3)] If a person has sustained a loss u/h PGBP or Capital Gain And claims that such loss or any party thereof Should he may furnish a return of loss Within the time prescribed u/s 139(1) and All the provisions of this Act shall apply as if it were a return u/s 139(1). Section 80 in the chapter on Set off and Carry forward of losses, losses can not be carried forward unless return of loss is submitted on or before due date mentioned u/s 139(1) and it is duly assessed. Notes: 1. Losses u/h House Property and unabsorbed depreciation can be claimed even return is filled after the due date. 2. Losses can be set off even return is filed after due date. It only prohibits the carry forward of such losses. 3. Although the loss of current year can not be carried forward unless a return of loss is submitted before the due date but the loss of earlier years can be carried forward if the return of loss of that year(s) was submitted within the due date and such loss has been assessed.

Belated Return [Sec.-139(4)] If an assessee has not submitted his return of income: (a) on or before due date maintained u/s 139(1) or (b) within the time allowed under a notice u/s 142(1). He can still file the return of income Such return is called Belated Return.

2

Amit Kumar

9891463160, 9891026051

Belated Return can be filed at any time (a) before the expiry of one year from end of relevant previous year or (b) before the completion of Assessment. Whichever is earlier. Return of income of charitable trust and institutions [Sec.-139(4A)] Required to file a return if following incomes (before exemption u/s 11 and 12) exceeds the maximum amount not chargeable to tax (i) income from property under trust (ii) voluntary contributions The return is to be filled within due date u/s 139(1) by the representative of the trust and such return shall be deemed to have been filed u/s 139(1).

Return of income of political party [Sec.-139(4B)] If total income (before exemption u/s 13A) Exceeds the maximum amount not chargeable to tax, Chief executive officer shall file the return on or before due date u/s 139(1) and Such return shall be deemed to have been filed u/s 139(1).

Return of income of certain associations and institutions [Sec.-139(4C)] if the total income of any scientific research association, news agency, association or institution having as its object the control, regulation or encouragement of the profession of law, medicine, accountancy or other specified profession or university or other educational institution or any hospital or other medical institution or trade union, Note: Educational and medical institutions other than those substantially financed by the Government are required to furnish return of income, whether its gross receipts are less than or more than Rs.1crore. before claiming exemption under section 10, exceeds the maximum amount not chargeable to income tax,

Shall furnish a return of such income and it shall be treated as if it were a return to be furnished u/s (1).

Mandatory to file return of income/loss [Sec.-139 (4D)]:

3

Amit Kumar

9891463160, 9891026051

Every university, college or other institution referred to in clause (ii) and clause (iii) of sub-section (1) of section 35 i.e. institutions accepting donations for scientific research or social or statistical research, which is not required to furnish return of income or loss under any other provision of this section, shall furnish the return in respect of its income or loss in every previous year and all the provisions of this Act shall, so far as may be, apply as if it were a return required to be furnished under section 139(1).

Revised Return [Sec.-139(5)] If an assessee, after furnishing the return of income (a) u/s 139(1) or (b) in pursuance of a notice u/s 142(1), discovers any omission or any wrong statement in the return filed he may furnish a revised return.

Revised return can be filed any time (a) before the expiry of one year from the end of relevant assessment year or (b) before the completion of Assessment. Whichever is earlier. Note: 1. In the case of Kumar Jagdish Chandra Sinha SC held that Belated Return filed u/s 139(4) can not be revised. 2. time. 3. 4. Revised return can be further revised provided it is revised within same prescribed Revised return substitutes the original return An application or letter to the Assessing Officer can not constitute revised return.

Particulars to be furnished with the return [Sec.-139(6)/ 139(6A)] (a) Particulars required to be furnished u/s 139(6) 1. Income exempt from tax. 2. Assets of the prescribed nature, value and belonging to the assessee. 3. His bank account and credit card held by him. 4. Expenditure exceeding the prescribed limits incurred by him under the prescribed heads. 5. Such other out going as may be prescribed.

Amit Kumar (b)

9891463160, 9891026051

Particulars to be furnished in case of an assessee engaged in any business or profession [Sec.-139(6A)] 1. The report of audit referred to in section 44AB )if it is already furnished, a copy thereof with a proof of furnishing the same); 2. The particulars of location and style of the principal place where he carries on the business or profession; and all branches thereof; 3. Names and addresses of his partners if any in such business or profession; 4. If assessee is a member of an association or body of individuals, the names of other members; 5. The extent of assessees share and of other partners/ members of the profits of the business or of the branches.

Defective Return [Sec.-139(9)] Where the Assessing Officer considers that return of income furnished by assessee is defective, he may intimate the defect to the Assessee and give him an opportunity to rectify the defect within 15 days from the date of such intimate such time may be extended by A.O. on an application by the assessee if the defect is not rectified within time allowed the return filed shall be treated as invalid return

if the assessee rectifies the defect even after 15 days or extended time, but before the completion of assessment, the A.O. may condone the delay and treat the return as valid return. When a return of income shall be regarded as defective A return of income shall be regarded as defective unless all the following conditions are satisfied: (i) A return in the prescribed form with all annexure, columms and statements duly filled in. (ii) (iii) A statement showing computation of tax payable. Proofs of tax, if any, claimed to have been deducted or collected at source before 1st day of April, 2008 and the advance tax and self-assessment tax, if any, claimed to have been paid. Provided that where return is not accompanied by proof of tax, if any, claimed to have been deducted or collected at source, the return of income shall not be regarded as defective if

5

Amit Kumar

9891463160, 9891026051

(a) (b) (iv) (v)

a certificate for tax deducted or collected was not furnished u/s 203 or sec.206 to the person furnishing his return of income; and such certificate is provided within a period of two years specified under sub-section (14) of section 155.

Report of audit u/s 44AB or where the report has been furnished prior to the furnishing of the return, a copy of such report together with the proof of furnishing of the report. In a case where regular books of accounts are maintained by the assessee, then copies of: (a) Manufacturing Account, Trading Account, Profit & Loss Account or Income & Expenditure Account and Balance Sheet. (b) (c) (d) (e) (f) In case of a partnership firm, the personal accounts of the members. In case of AOP/BOI, the personal accounts of the members. In case of a proprietary concern, the personal account of the proprietor. In case of a partner of a firm, his personal account in the firm. In case of a member of AOP/BOI, his personal account in the AOP/BOI.

(vi) (vii) (viii)

Where the accounts of the assessee have been audited, then copies of audited profit & loss account, balance sheet and the auditors report. In a case where cost-audit u/s 233B of the Companies Act has been conducted, then the copy of such cost audit report. Where regular books of accounts are not maintained by the assessee, then a statement showing the amount of turnover, gross receipts, gross profits, expenses and net profit of the business or profession carried on by the assessee and the basis on which such amounts have been computed and also disclosing the amount of total Sundry Debtors, Sundry Creditors, Stock-inhand, cash and bank balances at the end of the year.

PAN [Sec.-139A] In the following cases an application for allotment of PAN has to be made (i) If return is to be filled u/s 139 (4A) (ii) If total sales or gross receipts are more than Rs.5 lacs in any previous year.

(iii) If the total income of any person during any previous year exceeded maximum amount not chargeable to tax. (iv) Being an employer, who is required to furnish a return of fringe benefits. However any other person may also apply for allotment of PAN. In case of (i) and (ii) above application has to be made on or before the end of accounting year.

Amit Kumar

9891463160, 9891026051

While in case of (iii) application for allotment of PAN has to be made on or before 31st May of the A/Y relevant year to the previous year whose income exceeded the exemption limit. Every person who has been allotted PAN shall quote it. 1. In all returns, challans and correspondence with income-tax authority 2. 3. 4. Sale/ purchase of Motor vehicle other than two wheeler Sale/ purcahse of any immovable property for Rs.5 lacs or more Application for telephone connection including cellular connection

5. Payment in cash in connection with foreign travel excluding travel to neighboring countries or specified places of pilgrimage at any one time of exceeding Rs.25, 000. 6. 7. 8. 9. Payment to hotels, restaurant bills exceeding Rs.25, 000 at any time. Opening a Bank account. Time deposits with a bank or post office saving bank account exceeding Rs.50, 000. Deposit in cash with a bank aggregating Rs.50, 000 or more during any one day.

10. Payment in cash for purchase of bank draft or pay orders aggregating Rs.50, 000 or more during any one-day. 11. Contract for sale/ purchase of securities exceeding Rs.1 lakh. Any person who has not been allotted PAN or GIR no. shall make a declaration in Form 60. Self-Assessment [Sec.-140A] Every person, before submitting a return of income Is under an obligation to make a self-assessment of his income and After taking in account the amount of tax, if any, already paid, pay the self-assessment tax, if due. The assessee shall be liable to pay such tax together with interest payable for any in furnishing the return or any default or delay in payment of Advance tax. Self-assessment of income returned: (i) Compute the total income (ii) (iii) Compute the tax payable on it according to rates in force Allow rebate, if any, u/s 88E

Amit Kumar

9891463160, 9891026051

(iv) (v) (vi) (vii) (viii)

Add surcharge if applicable Allow relief, if any, u/s 89(1), 90 and 91 To the balance tax payable, add education cess @ 2% From the tax payable, calculated under step (vi), deduct TDS/Advance tax. Add interest payable (a) u/s 234A (b) u/s 234B (c) u/s 234C

(ix) The above tax and interest payable should be paid as selfassessment tax before filing the return of income. Return by whom to be signed [Sec.-140] S. NO. Assessee 1.

Individual

2.

When absent from India; mentally incapacitated; for any other reason he is not able to sign HUF Where karta is absent from India or is mentally incapacitated Company Where M.D. is unable to sign or where there is no M.D. When company is not resident in India When the company is in liquidation When the companys management is taken over by the government

Signatory Himself His guardian or any other person competent to act on his behalf duly authorised by him. Karta Any other adult member of the family. Managing Director Any other director; Any person who holds a valid power of Attorney from the company The liquidator The principal officer

3.

4. 5. 6. 7. 8.

Partnership firm Local authority Political party Association of person Any other person

Managing partner or any other partner not being a minor Principal officer Chief executive officer Any member or principal officer That person or some other person who is competent to sign.

Você também pode gostar

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeNo Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeNota: 1 de 5 estrelas1/5 (1)

- Harley Davidson Brand AnalysisDocumento17 páginasHarley Davidson Brand AnalysisRahul D'sa100% (3)

- A Report On Audit Planning of ACI LIMITEDDocumento33 páginasA Report On Audit Planning of ACI LIMITEDAtiaTahiraAinda não há avaliações

- Adr SyllabusDocumento2 páginasAdr SyllabusValerie TioAinda não há avaliações

- Risk Management of SbiDocumento30 páginasRisk Management of SbiTanay Pandey100% (2)

- Air Compressor Parts PDFDocumento51 páginasAir Compressor Parts PDFRudi Arianto Rismod0% (1)

- Direct Tax CS FinalDocumento19 páginasDirect Tax CS FinalkapilAinda não há avaliações

- Filing of Returns (Section 139) : By-Mohan Patel Mba 3 Sem. MonirbaDocumento13 páginasFiling of Returns (Section 139) : By-Mohan Patel Mba 3 Sem. MonirbaMohan PatelAinda não há avaliações

- Tax - AssignmentDocumento29 páginasTax - Assignmentjai_thakker7659Ainda não há avaliações

- Return of IncomeDocumento6 páginasReturn of Incometoton33Ainda não há avaliações

- Roi 2Documento5 páginasRoi 2Shankar SinghAinda não há avaliações

- Assesment Procedure: By: Smriti KhannaDocumento25 páginasAssesment Procedure: By: Smriti KhannaSmriti KhannaAinda não há avaliações

- Return of Income: Group 3Documento17 páginasReturn of Income: Group 3Khushi SonarAinda não há avaliações

- Return of IncomeDocumento9 páginasReturn of Incomes4sahithAinda não há avaliações

- Chapter 12 MCQs On Assessment ProcedureDocumento21 páginasChapter 12 MCQs On Assessment ProcedureJashaswee MishraAinda não há avaliações

- Provisions For Filing of Return of IncomeDocumento17 páginasProvisions For Filing of Return of IncomeJoseph SalidoAinda não há avaliações

- After The Previous Year ExpiryDocumento4 páginasAfter The Previous Year ExpiryRaj JamadarAinda não há avaliações

- Income Tax AsgmentDocumento9 páginasIncome Tax AsgmentPARVATHA VARTHINIAinda não há avaliações

- Filing of ReturnsDocumento28 páginasFiling of ReturnsrpsinghsikarwarAinda não há avaliações

- Final DTL Chapter 3Documento33 páginasFinal DTL Chapter 3Raja NarayananAinda não há avaliações

- Advance Payment of TaxDocumento3 páginasAdvance Payment of TaxsadathnooriAinda não há avaliações

- Chapter 10Documento5 páginasChapter 10Amar SharmaAinda não há avaliações

- Filing of ReturnsDocumento10 páginasFiling of ReturnsSayudh SarkarAinda não há avaliações

- Chapter 6 - Return of Income and AssessmentsDocumento22 páginasChapter 6 - Return of Income and AssessmentsBRYNA BHAVESH 2011346Ainda não há avaliações

- Assessment ProcedureDocumento7 páginasAssessment ProcedureVachanamrutha R.VAinda não há avaliações

- Assessment ProcedureDocumento58 páginasAssessment ProcedureDrop Singh MeenaAinda não há avaliações

- Submitted To Submitted by MR Mayank Shrivastava RachitaDocumento6 páginasSubmitted To Submitted by MR Mayank Shrivastava RachitaRachita WaghadeAinda não há avaliações

- 5.1-Module 5Documento3 páginas5.1-Module 5Arpita ArtaniAinda não há avaliações

- DT 4Documento29 páginasDT 4Charu JagetiaAinda não há avaliações

- Itr Returns On Listed EntitiesDocumento21 páginasItr Returns On Listed EntitiesShyam SultaniaAinda não há avaliações

- Asses MentDocumento4 páginasAsses MentEngr. Md. Ishtiak HossainAinda não há avaliações

- Chapter 13 - Return Filing - NotesDocumento6 páginasChapter 13 - Return Filing - NotesAkshay PooniaAinda não há avaliações

- Instructions For Filling Out FORM ITR-2: Page 1 of 10Documento10 páginasInstructions For Filling Out FORM ITR-2: Page 1 of 10mehtakvijayAinda não há avaliações

- Direct Tax Final Suggestion: For Offline Admission Call / Whatsapp - +91 70031 65955Documento9 páginasDirect Tax Final Suggestion: For Offline Admission Call / Whatsapp - +91 70031 65955AhiaanAinda não há avaliações

- CA Final DT Amendments For May 2022 Exam - Part 2Documento23 páginasCA Final DT Amendments For May 2022 Exam - Part 2Bhuvanesh RavichandranAinda não há avaliações

- Adjudication - Case (1) .Docx 1Documento14 páginasAdjudication - Case (1) .Docx 1aliciag4342Ainda não há avaliações

- Issue of Assessment s59Documento4 páginasIssue of Assessment s59Sum YinAinda não há avaliações

- Section 139Documento7 páginasSection 139dhanishta906Ainda não há avaliações

- Return of Income: (Date in Connection With Assessment Order Is Ignored From All Sections)Documento6 páginasReturn of Income: (Date in Connection With Assessment Order Is Ignored From All Sections)omar zohorianAinda não há avaliações

- 9 Assessment ProcedureDocumento5 páginas9 Assessment ProcedureHarry Singh ButtarAinda não há avaliações

- Section 139 of Income TaxDocumento4 páginasSection 139 of Income TaxMOUSOM ROYAinda não há avaliações

- AssessmentDocumento7 páginasAssessmentGopiAinda não há avaliações

- Purpose of It ReturnDocumento4 páginasPurpose of It ReturnJithu Jose ParackalAinda não há avaliações

- 51178bos40861 Mod1init cp10 PDFDocumento40 páginas51178bos40861 Mod1init cp10 PDFNithish minnalAinda não há avaliações

- Semester: UG SEM - V Subject: Taxation - II Teacher: SKG Lecture No:I Module - I (Direct Tax) Chapter: Filing of ReturnDocumento4 páginasSemester: UG SEM - V Subject: Taxation - II Teacher: SKG Lecture No:I Module - I (Direct Tax) Chapter: Filing of ReturnShanzaiAinda não há avaliações

- IT12. Assessments and RevisionsDocumento12 páginasIT12. Assessments and Revisionsshree varanaAinda não há avaliações

- Instruction ITR1 Sahaj 2018Documento8 páginasInstruction ITR1 Sahaj 2018MadAinda não há avaliações

- Return of Income & AssessmentDocumento3 páginasReturn of Income & AssessmentABC 123Ainda não há avaliações

- Procedure For Assessment: Presented By-Rahul Kesarwani III SemesterDocumento29 páginasProcedure For Assessment: Presented By-Rahul Kesarwani III Semesterrahulkesarwani01Ainda não há avaliações

- Search and SeizureDocumento26 páginasSearch and SeizureShivansh JaiswalAinda não há avaliações

- DT Assessment ProceduresDocumento6 páginasDT Assessment ProceduresSri PeketiAinda não há avaliações

- Unit 18Documento20 páginasUnit 18Raja SahilAinda não há avaliações

- Assesment of Undisclosed Income: SUBMITTED BY - Anshu Kumar ROLL NO-18MB01 MBA2018-2020Documento15 páginasAssesment of Undisclosed Income: SUBMITTED BY - Anshu Kumar ROLL NO-18MB01 MBA2018-2020Dhruv BrahmbhattAinda não há avaliações

- Assessment (Full) Quick RevisionDocumento16 páginasAssessment (Full) Quick RevisionKush ShahAinda não há avaliações

- Tax Assignment: Manisha Verma Year Tut Group-A3 ROLL NO. - 130Documento5 páginasTax Assignment: Manisha Verma Year Tut Group-A3 ROLL NO. - 130Manisha VermaAinda não há avaliações

- Advance Payment of TaxDocumento35 páginasAdvance Payment of TaxTrapti Garg Goyal0% (1)

- Provision Related To Advance Payment of TaxDocumento8 páginasProvision Related To Advance Payment of TaxBISHWAJIT DEBNATHAinda não há avaliações

- Wtax (A) 721 2015Documento13 páginasWtax (A) 721 2015Neena BatlaAinda não há avaliações

- 11 - Return of IncomeDocumento2 páginas11 - Return of IncomesreejithAinda não há avaliações

- ITR's and AssessmentDocumento11 páginasITR's and Assessmentashutosh4iipmAinda não há avaliações

- ICMAP Business Law Past PapersDocumento5 páginasICMAP Business Law Past Papersmuhzahid786Ainda não há avaliações

- Semester: VI Subject: Computerised Accounting and E-Filing of Tax Return Name of The Teacher: Dr. Sujit Kumar Roy (SKR) Lecture Note # 1Documento4 páginasSemester: VI Subject: Computerised Accounting and E-Filing of Tax Return Name of The Teacher: Dr. Sujit Kumar Roy (SKR) Lecture Note # 1BenstarkAinda não há avaliações

- Taxguru - In-Step Up To Ind As 101 First Time Adoption of Indian Accounting Standards IND-AsDocumento6 páginasTaxguru - In-Step Up To Ind As 101 First Time Adoption of Indian Accounting Standards IND-AsBathina Srinivasa RaoAinda não há avaliações

- Assessment ProcedureDocumento47 páginasAssessment ProcedureHoor FatimaAinda não há avaliações

- Refund Under GST Regime Up To Date 12-03-2021 Detailed AnalysisDocumento17 páginasRefund Under GST Regime Up To Date 12-03-2021 Detailed AnalysisChaithanya RajuAinda não há avaliações

- Railway Interiors2013Documento108 páginasRailway Interiors2013christian_campean100% (1)

- QUIZ Week 1Documento2 páginasQUIZ Week 1hopefuldonorAinda não há avaliações

- Case Study - Parallel BankingDocumento11 páginasCase Study - Parallel BankinggopalushaAinda não há avaliações

- Secretary HandbookDocumento166 páginasSecretary HandbookShanShan Stella C100% (1)

- Brave Fencer MusashiDocumento288 páginasBrave Fencer MusashiDino Budi PrakosoAinda não há avaliações

- Sime Darby Annual Report 2012Documento342 páginasSime Darby Annual Report 2012nadiahamdanAinda não há avaliações

- China EMPEA 2009 ReportDocumento20 páginasChina EMPEA 2009 ReportJonathan ShieberAinda não há avaliações

- WordDocumento2 páginasWordRohan SugrimAinda não há avaliações

- TradeTutorials LCAdvising PDFDocumento2 páginasTradeTutorials LCAdvising PDFMunshi Masudur RahamanAinda não há avaliações

- Chapter 9 Cabrera Applied AuditingDocumento5 páginasChapter 9 Cabrera Applied AuditingCristy Estrella50% (4)

- (298048505) 148308699-Credit-Appraisal-of-TJSB-BankDocumento47 páginas(298048505) 148308699-Credit-Appraisal-of-TJSB-Bankmbm_likeAinda não há avaliações

- Deloitte - The East Eyes The West CoastDocumento22 páginasDeloitte - The East Eyes The West CoastThe Vancouver SunAinda não há avaliações

- Swift CodesDocumento1 páginaSwift CodesPradip BhavsarAinda não há avaliações

- Business Organization PDFDocumento46 páginasBusiness Organization PDFHitesh100% (1)

- Sri Lanka Accounting Standard-LKAS 31: Interests in Joint VenturesDocumento17 páginasSri Lanka Accounting Standard-LKAS 31: Interests in Joint VenturesMaithri Vidana KariyakaranageAinda não há avaliações

- Piano X GuideDocumento10 páginasPiano X Guiderokhgireh_hojjatAinda não há avaliações

- Air IndiaDocumento32 páginasAir IndiaPiyush KamraAinda não há avaliações

- Account Maintainance PostingDocumento5 páginasAccount Maintainance PostingSanket GaudAinda não há avaliações

- LAVCA Inaugural Startup Survey FINAL3 04.30.19Documento28 páginasLAVCA Inaugural Startup Survey FINAL3 04.30.19Thomas HeilbornAinda não há avaliações

- Business Ethics & Governance: Prof. Shruti NaikDocumento24 páginasBusiness Ethics & Governance: Prof. Shruti NaikKunjal RambhiaAinda não há avaliações

- Enron Corporation FINAL PDFDocumento28 páginasEnron Corporation FINAL PDFJohn Philip De GuzmanAinda não há avaliações

- Why Keep Good Business Records?Documento2 páginasWhy Keep Good Business Records?Mary Ann OrtizAinda não há avaliações

- THOMAS H. CASEY, Chapter 7 Trustee of The Estate 779 Stradella, LLC Versus Paul J. Manafort and Jeff Yohai, Bankruptcy, Dated 11/16/2018 31-PagesDocumento31 páginasTHOMAS H. CASEY, Chapter 7 Trustee of The Estate 779 Stradella, LLC Versus Paul J. Manafort and Jeff Yohai, Bankruptcy, Dated 11/16/2018 31-PagesHarry the GreekAinda não há avaliações

- 2018 Saln Additional SheetDocumento1 página2018 Saln Additional SheetElisa Cabacaba EcijaAinda não há avaliações