Escolar Documentos

Profissional Documentos

Cultura Documentos

Ie463 CHP5 (2010-2011)

Enviado por

Gözde ŞençimenDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ie463 CHP5 (2010-2011)

Enviado por

Gözde ŞençimenDireitos autorais:

Formatos disponíveis

Depreciation

IE463 Chapter 5

DEPRECIATION AND INCOME TAXES

Depreciation is the decrease in the value of physical properties with passage of time Because, depreciation is a non-cash cost that affects income taxes we must consider depreciation properly, when making After-Tax Engineering Economy studies

CHAPTER 5 2

Depreciable Property

Basic Terminology

It is a property for depreciation is allowed under governmental income tax laws and regulations In general, property is depreciable if it meets the following basic requirements:

It

must be used in business or held to produce income. It must have a determinable useful life, and the life must be longer than one year. It must be something that wears out, decays, gets used up, becomes obsolete, or loses value from natural causes.

CHAPTER 5 3

Depreciation = an annual non-cash charge against income. It represents an estimate of the dollar cost of fixed assets used in the production of a good or service. Cost Basis (B) = actual cash cost plus book value of trade-in (if any) plus costs of making asset serviceable (e.g., installation). Book Value (BVk) = value of asset as shown on the accounting records. Represents amount of money still invested in the property. BVk = book value at EOY k SVN = estimated salvage value in year N (used in depreciation calculations where applicable) MVN = market (resale) value at EOY N from the disposal of an asset

CHAPTER 5 4

STRAIGHT-LINE (SL) METHOD

DECLINING BALANCE (DB) METHOD

5

A constant amount is depreciated each year over the asset's life. N = depreciable life of the asset in years. dk = annual depreciation deduction in year k dk = (B - SVN ) / N for k = 1, 2, ..., N dk* = cumulative depreciation through year k. dk* = k x dk BVk = B - dk *

Annual depreciation is a constant percentage of the asset's value at the BOY R = 2/N 200% declining balance R = 1.5/N 150% declining balance d1 = B x R dk = B(1-R)k-1 (R) = BVk-1 (R) dk* = B[1 - (1 - R)k ] BVk = B(1 - R)k BVN = B(1 - R)N

CHAPTER 5 6

CHAPTER 5

SL and DB Example

Cost basis:

The La Salle Bus Company has decided to purchase a new bus for $85,000, with a trade-in of their old bus. The old bus has a trade-in value of $10,000. The new bus will be kept for 10 years before being sold. Its estimated salvage value at that time is expected to be $5,000. Compute the following quantities using (a) the straight-line method, (b) the 200% declining balance method

B = $10,000 + $85,000 = $95,000

trade-in value cash-cost

SV10

Deduction amounts are fixed for SL:

dk 95,000 - 5,000 $9,000 for k 1 to10 10 2 10

N

Deduction ratios are fixed for DB:

200% DB

depreciation deduction in the first year and the fourth year cumulative depreciation through year four book value at the end of the fourth year

CHAPTER 5 7

0.2 , thus,(dk

CHAPTER 5

0.2 BVk -1 )

8

Straight Line Method (k = 1 to 4)

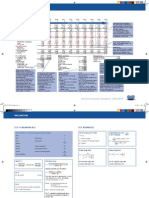

EOY, k 0 1 2 3 4 dk 0 9,000 9,000 9,000 9,000 BVk 95,000 86,000 77,000 68,000 59,000

Straight Line Method (k = 5 to 10)

EOY, k 5 6 7 8 9 10 dk 9,000 9,000 9,000 9,000 9,000 9,000 BVk 50,000 41,000 32,000 23,000 14,000 5,000 = 59,000 9,000 = 50,000 9,000 = 41,000 9,000 = 32,000 9,000 = 23,000 9,000 = 14,000 9,000

= 95,000 9,000 = 86,000 9,000 = 77,000 9,000 = 68,000 9,000 BV4 = 95,000 36,000

9

d4 = d1 d4* = 4 x 9000 = 36,000

CHAPTER 5

SV10 = B N x dk

CHAPTER 5 10

200% Declining Balance Method (k = 1 to 4)

EOY, k 0 1 2 3 4 dk 0 19,000 15,200 12,160 9,728 d1 = BV0 x R = B x 0.2 = 95,000 x 0.2 = 19,000 BVk 95,000 76,000 60,800 BV1 = BV0 d1 = B d1 48,640 = 95,000 19,000 38,912 BV4 = B d4* d4 = 48,640 x 0.2

11

200% Declining Balance Method (k = 5 to 10)

EOY, k 5 6 7 8 9 10 dk 7,782 6,226 4,981 3,985 3,188 2,550 BVk 31,130 24,904 19,923 15,938 12,750 10,200 BV10 = B d10* = BV9 d10

CHAPTER 5 12

d4* = 19,000 + ... + 9,728 = 56,088

CHAPTER 5

SL vs. DB

Consideration of Income Taxes in EE

Income tax represents a significant cash outflow that we cannot ignore

Notation: Rk = gross revenues in year k Ek = operating expenses in year k plus interest paid on borrowed capital dk = depreciation allowance for year k t = effective income tax rate used for computing income taxes Tk = income tax liability for year k

CHAPTER 5 13 CHAPTER 5 14

General Tax Procedure

BTCF = Before tax cash flow = R E NIBT = Net income before tax = R E d T = tax liability = t ( NIBT ) = t (R E d) NIAT = Net income after tax = NIBT T = (R E d) t (R E d) = (1 t)(R E d) ATCF = After tax cash flow = NIAT + d ATCF = BTCF t (R E d)

General Tax Procedure - Example

You invested $113,028 on an asset with the depreciable life of 10 years. You can earn $30,000 per year from this investment for 10 years. Asset has a negligible or zero MV at the end of its useful life. Published income tax rate is 40% on annual taxable income (NIBT). Use after-tax MARR of 15% per year, and straight line depreciation method. NIBT? NIAT? ATCF? Is it profitable investment after taxes?

CHAPTER 5 16

a) b) c) d)

CHAPTER 5

15

Solution to (a), (b) and (c)

Solution to part (d)

AW (15%) = ATCF 113,028 (A/P, 15%, 10) = 22,521 22,521 = $0

d = 113,028 / 10 = $11,303 (depreciation amount) (+) Net income 30,000 (-) Deprecation 11,303 (a) NIBT $18,697 (R E d) (-) Income Tax (0.4) 7,479 (b) NIAT $11,218 (1 t)(R E d) (+) Depreciation 11,303 (c) ATCF $22,521 (1 t)(R E d)+d

CHAPTER 5

17

CHAPTER 5

18

Typical Before-Tax Cash Flow Diagram:

After-Tax Cash Flow Analysis

Typical After-Tax Cash Flow Diagram:

CHAPTER 5

19

CHAPTER 5

20

After-tax MARR

ATCF Analysis Example

To perform an after-tax evaluation of a project's after-tax cash flows, we must use an after-tax MARR. After - tax MARR Before - tax MARR 1 - effective income tax rate, t

Example: Suppose the before-tax MARR = 20% and t = 40%. What is the approximate after-tax MARR?

MARR BT

MARR AT 1- t

MARR AT 0.2 (1 - 0.4) 0.12

21

Investment $10,000 Net Annual Receipts $4,000/yr Study Period 4 years Market Value at EOY 4 $5,000 After-tax MARR 15% Effective income tax rate 40% Depreciable recovery period 5 years Is this a worthwhile investment after taxes? Use Straight Line Method for depreciation.

CHAPTER 5

CHAPTER 5

22

Step 1: Find depreciation amounts for the study period of 4 years:

dk 10,000 - 0 5 $2,000 for k 1 to 5

dk --2000 2000 2000 2000

CHAPTER 5

Step 2: Determine the ATCF with tax rate of 40%:

EOY, k BTCFk - 10,000 4000 4000 4000 4000 5000 2000 2000 2000 2000 2000 2000 2000 2000 3000 -800 -800 -800 -800 -1200 dk TIk Tk (t = 0.4) ATCFk - 10,000 3200 3200 3200 3200 3800

24

EOY, k 0 1 2 3 4

BVk 10000 8000 6000 4000 2000

23

0 1 2 3 4a 4b

MV4 BV4 = 5000 2000

CHAPTER 5

Step 3: Use the ATCF to evaluate this investment @ MARR = 15%:

After-tax cash flow diagram:

Non-depreciable asset - Example

PW(15%) = 10,000 + 3,200 (P/A, 15%, 3) + 7,000 (P/F, 15%, 4) = + $1,309

CHAPTER 5 25

Construction cost of the facility $600,000 Purchasing cost of land $550,000 Annual gross income $230,000 Operating expenses per year $30,000 Facility will be depreciated for 5 years, using 200% DB MARRAT 12% Tax rate 40% Is the investment worthwhile after taxes for the study period of 5 years? Note: Land will be kept after the five-year operation! Facility has a market value of zero @EOY5

26

CHAPTER 5

200% DB

EOY, k 0 1 2 3 4 5 dk --240,000 144,000 86,400 51,840 31,104

R = 2/5 = 0.4

BVk 600,000 360,000 216,000 129,600 77,760 46,656

CHAPTER 5

ATCF analysis with t = - 0.4

EOY BTCF d TI Tax ATCF 0 -1,150,000 -1,150,000 1 200,000 240,000 -40,000 16,000 216,000 2 200,000 144,000 56,000 -22,400 177,600 3 200,000 86,400 113,600 -45,440 154,560 4 200,000 51,840 148,160 -59,264 140,736 5a 200,000 31,104 168,896 -67,558 132,442 - 46,656 18,662 568,662 5b 550,000 MV5 BV5 = 0 46,656 CHAPTER 5 550,000 + 18,662 28

cost basis for only depreciable asset 600,000 x 0.4 600,000 240,000 BV5 MV5 = 0

27

ATCF analysis with MARRAT = 12%

EOY ATCF 0 -1,150,000 PW(12%) = - 1,150,000 1 216,000 + 216,000(P/F, 12%, 1) 2 177,600 + 177,600(P/F,12%, 2) 3 154,560 + 154,560(P/F, 12%, 3) 4 140,736 + 140,736(P/F, 12%, 4) 5a 132,442 + (132,442 + 568,662)(P/F, 12%, 5) 5b 568,662 = - $218,283 < 0 reject !

CHAPTER 5 29

Lease versus Purchase - Example

a) b)

Determine the more economic means of acquiring a copier in your business if you may either: purchase the copier for $5,000 with a probable resale value of $1,000 at the end of 5 years or rent the copier for an annual fee of $900 per year for 5 years with an initial deposit of $500 refundable upon returning the copier in good condition. If you own the copier, you will depreciate it by using the 150% DB method (class life of 5 years). All rental fees are deductible for income tax purposes. As the owner or lessee, you will pay all expenses associated with the operation of the copier. A deposit does not affect taxes when paid out or received back. Compare these alternatives by using the equivalent uniform annual cost method. The after-tax MARR is 10% per year, and the effective income tax rate is 40%.

CHAPTER 5 30

Option A Purchase Copier

EOY 0 1 2 3 4 5a 5b BTCF -5000 R=0.3 d 1500 1050 735 515 360 840 TI -1500 -1050 -735 -515 -360 160

CHAPTER 5

Option A Purchase Copier

EOY 0 1 2 3 4 5a 5b ATCF -5000 600 420 294 206 144 936 AW(10%) = [-5000 + 600(P/F,10%,1) +420(P/F,10%,2) +294(P/F,10%,3) +206(P/F,10%,4) +(144+936)(P/F,10%,5)](A/P,10%,5) = - 3075(A/P,10%,5) = - 811.185

t= -0.4 Tax 600 420 294 206 144 -64

1000

ATCF -5000 600 420 294 206 144 936

31

CHAPTER 5

32

Option B Rent (lease) Copier

EOY BTCF 0 -500 1 -900 2 -900 3 -900 4 -900 5a -900 5b 500 d TI -900 -900 -900 -900 -900 t = -0.4 Tax 360 360 360 360 360 ATCF -500 -540 -540 -540 -540 -540 500

33

Option B Rent (lease) Copier

EOY 0 1 2 3 4 5a 5b ATCF -500 -540 -540 -540 -540 -540 500 AW (10%) = -500(A/P,10%,5) + 500(A/F,10%,5) 540 = - 590 Option B (lease) is the least cost alternative for having the coppier

CHAPTER 5

CHAPTER 5

34

Before tax leasing cost?

Over what range of before-tax leasing costs would you choose the purchase option based on an after-tax analysis?

AW_lease =AW_purchase AW_lease = - 811.185 -500(A/P,10%,5) + 500 (A/F,10%,5) + (1 t) L say L = before tax leasing cost 0.6 L = 811.185 + 500(A/P,10%,5) 500 (A/F,10%,5) L = 1269 (if before tax leasing cost is greater than 1269, purchasing option will be preferred)

CHAPTER 5 35

Você também pode gostar

- Ch. 13 Leverage and Capital Structure AnswersDocumento23 páginasCh. 13 Leverage and Capital Structure Answersbetl89% (27)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)No EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Nota: 3.5 de 5 estrelas3.5/5 (17)

- CHAPTER 18 Multiple Choice Answers With ExplanationDocumento10 páginasCHAPTER 18 Multiple Choice Answers With ExplanationClint-Daniel Abenoja75% (4)

- Chapter13 Income TaxesDocumento17 páginasChapter13 Income TaxesKhilbran MuhammadAinda não há avaliações

- Ade Meyli (Hal 337-364)Documento47 páginasAde Meyli (Hal 337-364)Untung PriambodoAinda não há avaliações

- Depreciation PDFDocumento28 páginasDepreciation PDFMominaAinda não há avaliações

- Capital Budgeting Practical Questions 1Documento139 páginasCapital Budgeting Practical Questions 1Amita Bissa100% (1)

- Final Exam Corporate Finance CFVG 2016-2017Documento8 páginasFinal Exam Corporate Finance CFVG 2016-2017Hạt TiêuAinda não há avaliações

- Super Final Applied Economics First Periodical ExamDocumento4 páginasSuper Final Applied Economics First Periodical ExamFrancaise Agnes Mascariña100% (2)

- IE4503 - Chapter 5: Depreciation and Income TaxesDocumento25 páginasIE4503 - Chapter 5: Depreciation and Income TaxesSajid IqbalAinda não há avaliações

- Solution Assignment Chapter 9 10 1Documento14 páginasSolution Assignment Chapter 9 10 1Huynh Ng Quynh NhuAinda não há avaliações

- Exercise Cash FlowDocumento5 páginasExercise Cash FlowSiti AishahAinda não há avaliações

- Cheatsheet (FINAL) 1Documento2 páginasCheatsheet (FINAL) 1darciechoyAinda não há avaliações

- SolutionCH9 CH11Documento9 páginasSolutionCH9 CH11qwerty1234qwer100% (1)

- Exercise On Capital Budgeting-BSLDocumento19 páginasExercise On Capital Budgeting-BSLShafiul AzamAinda não há avaliações

- Depreciation CH 10Documento40 páginasDepreciation CH 10احمد عمر حديدAinda não há avaliações

- Case01 02Documento24 páginasCase01 02Sakshi SharmaAinda não há avaliações

- Final CaseDocumento25 páginasFinal CaseSakshi SharmaAinda não há avaliações

- Capital BudgetingDocumento38 páginasCapital Budgetingvini2710Ainda não há avaliações

- FM09 CH 10 Im PandeyDocumento19 páginasFM09 CH 10 Im PandeyJack mazeAinda não há avaliações

- FAM Nov 14 Practice Questions - : Answers Investment Appraisal Project BDocumento8 páginasFAM Nov 14 Practice Questions - : Answers Investment Appraisal Project Bmohsin1024Ainda não há avaliações

- Unit 5, 6 & 7 Capital Budgeting 1Documento14 páginasUnit 5, 6 & 7 Capital Budgeting 1ankit mehtaAinda não há avaliações

- Depreciation: Principles of Engineering Economic Analysis, 5th EditionDocumento25 páginasDepreciation: Principles of Engineering Economic Analysis, 5th EditionnorahAinda não há avaliações

- Financial Management Session 10Documento20 páginasFinancial Management Session 10vaidehirajput03Ainda não há avaliações

- Chapter 20Documento12 páginasChapter 20Aiko E. LaraAinda não há avaliações

- Capital BudgetingDocumento14 páginasCapital BudgetingbhaskkarAinda não há avaliações

- Hapter 9-Company AccountsDocumento48 páginasHapter 9-Company AccountsJINENDRA JAINAinda não há avaliações

- UBS Capital BudgetingDocumento19 páginasUBS Capital BudgetingRajas MahajanAinda não há avaliações

- Module 8 Benefit Cost RatioDocumento13 páginasModule 8 Benefit Cost RatioRhonita Dea AndariniAinda não há avaliações

- LBO Valuation - Working File CV2Documento5 páginasLBO Valuation - Working File CV2Ayushi GuptaAinda não há avaliações

- Module 8 Benefit Cost RatioDocumento13 páginasModule 8 Benefit Cost Ratiozulma siregarAinda não há avaliações

- Module 8 Benefit Cost RatioDocumento13 páginasModule 8 Benefit Cost RatioAbu Abdul Fattah100% (1)

- BudgetingDocumento44 páginasBudgetingYellow CarterAinda não há avaliações

- Morales Palma Pontanares Tech Report 11 1Documento7 páginasMorales Palma Pontanares Tech Report 11 1Kurt PabairaAinda não há avaliações

- HW Git Man 10 Solution CH 08Documento21 páginasHW Git Man 10 Solution CH 08Latifah MunassarAinda não há avaliações

- Chapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Documento31 páginasChapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarAinda não há avaliações

- 8-Security-Valuation 2Documento29 páginas8-Security-Valuation 2saadullah98.sk.skAinda não há avaliações

- Chapter 6Documento26 páginasChapter 6dshilkarAinda não há avaliações

- DCF TakeawaysDocumento2 páginasDCF TakeawaysvrkasturiAinda não há avaliações

- ExcelsDocumento45 páginasExcelsPrashanthDalawaiAinda não há avaliações

- CBE 5 Module 5 TrueDocumento8 páginasCBE 5 Module 5 TrueChristian John Resabal BiolAinda não há avaliações

- (IE) Chapter 4 - Investment EfficiencyDocumento88 páginas(IE) Chapter 4 - Investment EfficiencyJane VickyAinda não há avaliações

- Chapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Documento26 páginasChapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (1)

- Sampa VideoDocumento24 páginasSampa Videopawangadiya1210Ainda não há avaliações

- Capital Budgeting NPV IrrDocumento26 páginasCapital Budgeting NPV Irrkamarulz93_kzAinda não há avaliações

- Economic Profit Model and APV ModelDocumento16 páginasEconomic Profit Model and APV Modelsanket patilAinda não há avaliações

- Hafiz Mahmood Ul Hassan Cash Flow StatementDocumento3 páginasHafiz Mahmood Ul Hassan Cash Flow StatementHafiz Mahmood Ul HassanAinda não há avaliações

- Corporate Finance: Capital BudgetingDocumento29 páginasCorporate Finance: Capital BudgetingPigeons LoftAinda não há avaliações

- Practice Problems Ch12Documento57 páginasPractice Problems Ch12Kevin Baconga100% (2)

- Capital Budgeting Cash Flows: Solutions To ProblemsDocumento20 páginasCapital Budgeting Cash Flows: Solutions To ProblemsRau MohdAinda não há avaliações

- Ise 307Documento56 páginasIse 307Hussain Ali Al-HarthiAinda não há avaliações

- VebitdaDocumento24 páginasVebitdaAndr EiAinda não há avaliações

- 14 Jan 13Documento4 páginas14 Jan 13Sneh Toshniwal MaheswariAinda não há avaliações

- Corporate Finance Solution Chapter 6Documento9 páginasCorporate Finance Solution Chapter 6Kunal KumarAinda não há avaliações

- Capital Exp DecisionsDocumento24 páginasCapital Exp DecisionsGourav PandeyAinda não há avaliações

- Corporate Finance Tutorial 4 - SolutionsDocumento22 páginasCorporate Finance Tutorial 4 - Solutionsandy033003Ainda não há avaliações

- Activity - Capital Investment AnalysisDocumento4 páginasActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTEAinda não há avaliações

- Chapter 3 Depreciation - Declining and Double Declining MethodPart34Documento12 páginasChapter 3 Depreciation - Declining and Double Declining MethodPart34Tor GineAinda não há avaliações

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsAinda não há avaliações

- First Draft of The 2012 City of Brantford Budget DocumentsDocumento1.181 páginasFirst Draft of The 2012 City of Brantford Budget DocumentsHugo Rodrigues100% (1)

- National Seminar A ReportDocumento45 páginasNational Seminar A ReportSudhir Kumar SinghAinda não há avaliações

- 미국 회계 용어Documento20 páginas미국 회계 용어jenifferAinda não há avaliações

- Anta Tirta Kirana 1Documento1 páginaAnta Tirta Kirana 1yosi widianaAinda não há avaliações

- 10 Extinction DLPDocumento5 páginas10 Extinction DLPLouise Meara SeveroAinda não há avaliações

- Latin America Its Problems and Its Promise A Multi... - (Conclusion)Documento17 páginasLatin America Its Problems and Its Promise A Multi... - (Conclusion)Gabriel Aleman RodriguezAinda não há avaliações

- GTU Question BankDocumento3 páginasGTU Question Bankamit raningaAinda não há avaliações

- Skylark Skygondola PresentationDocumento87 páginasSkylark Skygondola PresentationrohanbagadiyaAinda não há avaliações

- Economics Perfectly Competitive MarketDocumento25 páginasEconomics Perfectly Competitive MarketEsha DivAinda não há avaliações

- Conversations in Colombia, S. Gudeman and A. RiveraDocumento217 páginasConversations in Colombia, S. Gudeman and A. RiveraAnonymous OeCloZYzAinda não há avaliações

- Apollo Tyres and BKTDocumento25 páginasApollo Tyres and BKTKoushik G Sai100% (1)

- Economics 1st Edition Acemoglu Solutions ManualDocumento17 páginasEconomics 1st Edition Acemoglu Solutions Manualkennethluongwetwu2100% (25)

- Brochure MisdevDocumento2 páginasBrochure MisdevyakubmindAinda não há avaliações

- GDP One of The Greatest Inventions in 20th Century-2Documento6 páginasGDP One of The Greatest Inventions in 20th Century-2Karina Permata SariAinda não há avaliações

- Overhead Analysis QuestionsDocumento9 páginasOverhead Analysis QuestionsKiri chrisAinda não há avaliações

- 6.1 Government of Pakistan's Treasury Bills: PeriodsDocumento13 páginas6.1 Government of Pakistan's Treasury Bills: PeriodsKidsAinda não há avaliações

- Economic Development Democratization and Environmental ProtectiDocumento33 páginasEconomic Development Democratization and Environmental Protectihaimi708Ainda não há avaliações

- Chapter 2 Activity 2 1Documento3 páginasChapter 2 Activity 2 1Wild RiftAinda não há avaliações

- Turismo Médico en Tijuana, B.C. EvimedDocumento2 páginasTurismo Médico en Tijuana, B.C. EvimedElizabethAinda não há avaliações

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocumento1 páginaIndian Income Tax Return Acknowledgement 2022-23: Assessment YearSagar GargAinda não há avaliações

- Records - POEA PDFDocumento1 páginaRecords - POEA PDFTimAinda não há avaliações

- Faisal, Napitupulu and Chariri (2019) Corporate Social and Environmental Responsibility Disclosure in Indonesian Companies Symbolic or SubstantiveDocumento20 páginasFaisal, Napitupulu and Chariri (2019) Corporate Social and Environmental Responsibility Disclosure in Indonesian Companies Symbolic or SubstantiveMuhamad Arif RohmanAinda não há avaliações

- Health TourismDocumento61 páginasHealth TourismT. Chang100% (1)

- Layman's Guide To Pair TradingDocumento9 páginasLayman's Guide To Pair TradingaporatAinda não há avaliações

- SBI PO Prelims 2020 2021 Questions Memory Based Paper 05 Jan 2021Documento23 páginasSBI PO Prelims 2020 2021 Questions Memory Based Paper 05 Jan 2021Suvid100% (1)

- Top 500 Taxpayers in The Philippines 2011Documento10 páginasTop 500 Taxpayers in The Philippines 2011Mykiru IsyuseroAinda não há avaliações

- Auto Title Loans and The Law BrochureDocumento2 páginasAuto Title Loans and The Law BrochureSC AppleseedAinda não há avaliações

- SABB Daily CommentaryDocumento2 páginasSABB Daily CommentaryClimaco EdwinAinda não há avaliações